FP Markets review 2025

I objectively evaluated FP Markets‘ offerings, fees, platforms, and reliability in 2025. Based on my extensive hands-on testing, I provide key insights for forex and CFD traders, active investors, and beginners. Discover if FP Markets aligns with your trading goals.

Why You Should Choose FP Markets in 2025

In the fast-paced world of online trading, FP Markets has cemented its reputation as a trusted broker since 2005. Regulated by top-tier authorities and offering ultra-competitive pricing, it caters to both novice and professional traders.

In this review, I dissect FP Markets’ 2025 offerings, from fees and platforms to customer support and security, based on firsthand testing of its Standard MT4, Raw ECN, and Iress accounts. Whether you’re a scalper, swing trader, or long-term investor, this guide reveals whether FP Markets provides the optimal environment for your trading style, highlighting its strengths in low spreads, fast execution, and regulatory compliance, while also pointing out any potential drawbacks.

FP Markets stands out for several compelling reasons:

While a commission of $3 per standard lot per side applies, the effective all-in cost remains exceptionally low, averaging around 0.8 pips for EUR/USD based on my testing and available data. This pricing model is particularly attractive for high-frequency traders and scalpers. The Standard account, while spread-only, has significantly higher average spreads around 1.2 pips for EUR/USD.

This multi-platform access allows traders to choose the interface and tools that best suit their trading style, whether it’s algorithmic trading on MT4/MT5, using cTrader’s depth of market analysis, leveraging TradingView’s advanced charting and social features, or accessing a vast array of share CFDs via Iress.

These regulations ensure segregated client funds and offer negative balance protection. While they also operate under other regulatory bodies, including some offshore entities which may lack investor compensation schemes, the presence of top-tier licenses instills confidence.

FP Markets Pros and Cons

Pros:

- Ultra-tight spreads on forex and indices, especially on the Raw ECN account.

- No deposit or withdrawal fees in most cases.

- Extensive range of over 10,000 CFDs, including forex, cryptocurrencies, shares, indices, commodities, ETFs, and bonds.

- Support for multiple popular trading platforms: MT4, MT5, cTrader, TradingView, and Iress.

- Fast account opening process.

- Copy trading via Myfxbook

Cons:

- Limited research tools compared to some industry leaders like IG or Pepperstone. While they offer in-house analysis and third-party tools, the daily content flow could be more extensive.

- The interface of the MT4 mobile app feels somewhat outdated compared to newer proprietary apps. FP Markets’ own mobile app also lacks advanced charting and trading tools.

- Some educational content could be more advanced and better organized, with some outdated materials.

About FP Markets FP Markets

FP Markets, officially known as First Prudential Markets, was established in 2005 with its origins in Sydney, Australia. The company was founded by Matthew Murphie with the vision of creating a superior trading destination.

Since its inception, FP Markets has grown significantly and is now recognized as a global CFD and Forex broker with a presence in various regions and regulated by multiple financial authorities, including ASIC (Australian Securities and Investments Commission) and CySEC (Cyprus Securities and Exchange Commission).

The broker is known for pioneering the Direct Market Access (DMA) Contracts for Difference (CFD) model in Australia, emphasizing fair and transparent pricing.

This expansive range caters to both short-term speculators and long-term investors, ensuring flexibility across strategies and risk appetites.

Forex traders can choose from 90+ currency pairs, including majors like EUR/USD and exotics like USD/ZAR, with spreads starting at 0.6 pips for cost-effective execution. Equity enthusiasts gain exposure to 16+ global exchanges, trading shares in giants like Apple and Tesla or exploring niche markets like Singapore’s SGX.

For those drawn to commodities, IG provides direct access to spot gold, crude oil, and natural gas, alongside futures contracts for advanced hedging.

What truly distinguishes IG is its CFD ecosystem, covering nearly every asset class. CFDs allow traders to speculate on price movements without owning the underlying asset, profiting from both rising and falling markets.

For example, a trader can short the S&P 500 during a downturn or leverage volatility in Bitcoin with 24/7 crypto CFDs. The platform also curates thematic portfolios—pre-built baskets of stocks targeting trends like artificial intelligence or renewable energy—ideal for investors seeking focused exposure without stock-picking hassles.

Explore FP Markets Range of Tradable Instruments

FP Markets provides a 10,000+ selection of instruments via CFDs, catering to various trading preferences.

| Instrument | Number | Type | Industry Average |

|---|---|---|---|

| Forex Pairs | 72 | Major, Minor, Exotic | 33 - 70 |

| Commodities | 29 | Metals, Energies, Softs | 5 |

| Indices | 19 | Major Stock Indices, US Dollar Index | 7 |

| Stocks | 10,000+ | London, Paris, Frankfurt, Amsterdam, Hong Kong, Madrid, and New York | 200 |

| Bonds | 2 | US and European | 0 |

| Cryptocurrencies | 12 | Major and Minor | 15 |

FP Markets offers a broad spectrum of trading instruments via CFDs, encompassing a substantial range of forex pairs, global indices with competitive spreads, and popular cryptocurrencies.

Notably, their offering extends to a vast selection of share CFDs, primarily accessible through the Iress platform, alongside key commodities. This extensive variety allows traders to diversify their portfolios and capitalize on opportunities across different asset classes.

Against The Competitors

Comparing FP Markets to other brokers in the market highlights its strengths in specific areas.

| Feature | FP Markets | IC Markets | Pepperstone |

|---|---|---|---|

| Raw Forex Spread | 0.1 pips | 0.0 pips | 0.1 pips |

| Platforms | MT4, MT5, cTrader, TradingView, Iress, Mottai | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Minimum Deposit | $100 AUD for Standard and Raw accounts, $1000 AUD for Iress | $200 | $0 |

| CFD Instruments | 10,000+ | 2,000+ | 1,000+ |

FP Markets stands out with its extensive range of CFD instruments and the inclusion of the TradingView platform, in addition to the standard MT4/MT5 and cTrader offerings. While IC Markets may have slightly tighter raw spreads, FP Markets remains highly competitive, particularly when considering the commission.

Key Takeaways

Verdict: Is FP Markets Worth It in 2025?

Based on my comprehensive testing and analysis, I rate FP Markets highly, giving it a ★★★★☆ (4.3/5). It is undoubtedly a top choice for cost-sensitive forex and CFD traders who value tight spreads and access to multiple popular trading platforms.

While FP Markets excels in providing competitive pricing and a wide range of tradable instruments via CFDs, it falls slightly short in the depth of its educational content and the availability of physical stock trading. The Iress platform, while offering a vast selection of share CFDs, does come with potential inactivity fees.

Overall, FP Markets provides a robust trading environment with strong regulatory oversight from ASIC and CySEC, a wide variety of instruments, and excellent fee structure on its ECN account. The availability of platforms like MetaTrader, cTrader, and TradingView caters to diverse trading needs.

Considering alternatives to FP Markets? We can introduce you to our other trusted brokers here:

IG Review

Interactive Brokers Review

CMC Markets Review

XTB Review

Is FP Markets Regulated?

Yes, FP Markets is regulated by 6 financial authorities. The key regulators providing significant oversight include:

- ASIC (Australia): Australian Securities and Investments Commission.

- CySEC (EU): Cyprus Securities and Exchange Commission.

- FSCA (South Africa): Financial Sector Conduct Authority.

It is important to be aware that some of FP Markets’ entities are registered in offshore jurisdictions, such as the Seychelles (FSA). While these entities offer negative balance protection, they may not provide the same level of investor compensation schemes as those regulated by Tier-1 authorities like ASIC and CySEC

Understanding Regulatory Protections and Broker Stability at FP Markets

Understanding the regulatory environment and the operational stability of a broker is crucial for traders. Regulatory protections can vary significantly depending on the jurisdiction in which a broker’s entity is registered. Traders should be aware of the specific protections offered by the entity they choose to open an account with.

Regulatory Protections of Your Account

Stability and Transparency

Assessing a broker’s stability and transparency involves looking at its operational history, size, and how clearly it presents information.

Operating History and Size

Founded in 2005, FP Markets is a well-established CFD broker with nearly 20 years of experience. It is headquartered in Sydney, Australia, and has a substantial workforce.

Transparency

FP Markets demonstrates a positive level of transparency.

Is FP Markets Safe to Trade With?

Based on the evaluation of its regulatory framework and operational characteristics, FP Markets appears to offer a solid level of trust and stability.

Fees and Commission Structure

FP Markets offers a transparent and competitive fee structure, particularly for forex and index CFD trading on their Raw ECN account.

Forex. On the Raw ECN account, you benefit from raw spreads starting from 0.1 pips, with a commission of $3 per standard lot per side ($6 round turn). The Standard account is spread-only with average spreads around 1.2 pips for EUR/USD.

| Instrument | Live Spread (AM) | Live Spread (AM) | Industry Average |

|---|---|---|---|

| EURUSD | 1.1 pips | 1.1 pips | 1.08 pips |

| GBPJPY | 1.5 pips | 2.4 pips | 2.44 pips |

| Gold | 29 cents | 27 cents | 25 cents |

| WTI Oil | 2 cents | 2 cents | 3 cents |

| Apple | N/a | 9 cents | 33 cents |

| Dow Jones 30 | 1.4 pips | 0.9 pips | 3.3 pips |

| Bitcoin | $16.01 | $17.01 | $35 |

Shares. Trading share CFDs on the Iress platform involves commissions. For example, trading NASDAQ stocks incurs a commission of 2¢ per share with a minimum charge. UK stocks have a commission of 0.10% with a minimum charge.

| Exchange | Commission on CFDs on Shares |

|---|---|

| NYSE | 2 cents per share with a minimum charge of $2 per side |

| NASDAQ | 2 cents per share with a minimum charge of $2 per side |

| Hong Kong | 0.20% with a minimum charge of $2 |

| United Kingdom | 0.20% with a minimum charge of £2 |

| United Kingdom | 0.20% with a minimum charge of €2 |

Swap Fees. These are fees or credits applied for holding positions overnight. Based on my testing, the swap fees at FP Markets are generally in line with the industry average. For instance, holding a long EUR/USD position overnight incurred a charge of around $6.59 per standard lot.

| Instrument | Swap Long | Swap Short |

|---|---|---|

| EURUSD | Charge of $6.59 | Credit of $2.20 |

| GBPJPY | Credit of $15.54 | Charge of $30.72 |

Non-Trading Fees. A significant advantage is the absence of deposit and withdrawal fees in most cases. However, there is a monthly inactivity fee of AUD 55 for the IRESS Trader platform if commission generated is less than AUD 200 or the account balance is below AUD 50,000. Some withdrawal methods or international bank transfers might incur third-party fees.

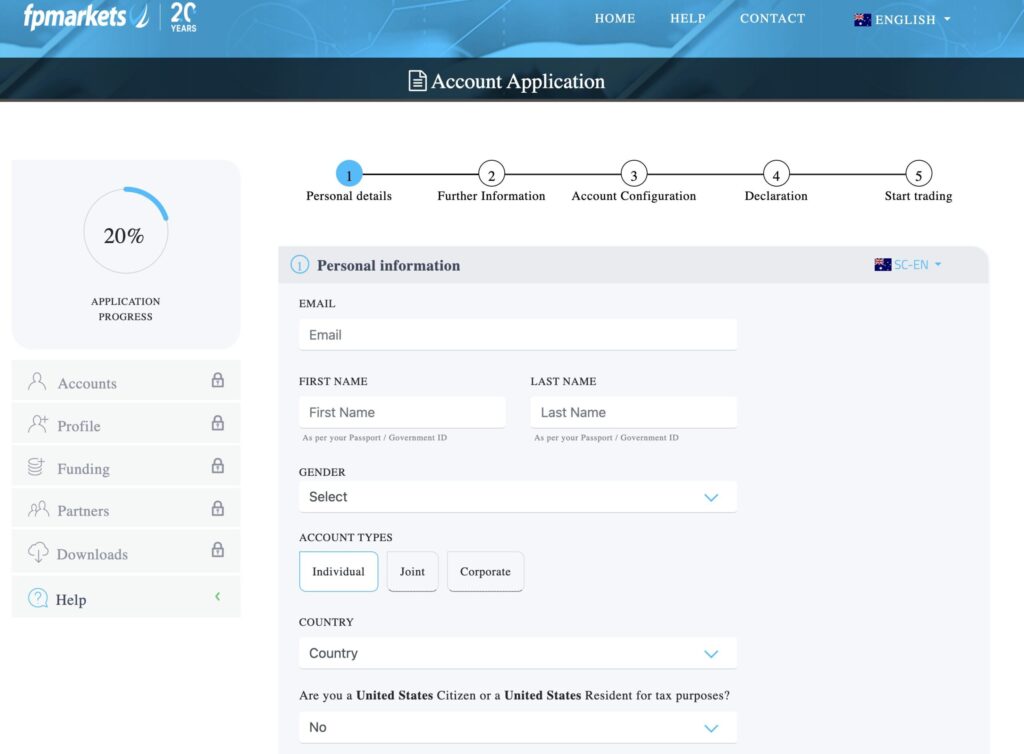

How To Open an Account with FP Markets

Opening a trading account with FP Markets is a straightforward and fully digital process. Here are the general steps involved:

The account opening process is generally fast, often completed within a business day.

FP Markets Account Types

FP Markets offers several account types designed to cater to different trading preferences and strategies:

MetaTrader Account Types

| Feature | Standard MT4/MT5 Account | Raw MT4/MT5 Account |

|---|---|---|

| Spreads | From 1.0 pips | From 0.0 pips |

| Commission | 0 | $3 per side |

| Minimum Deposit | $100 AUD or equivalent | $100 AUD or equivalent |

| Base Currencies | AUD, BRL, EUR, CAD, CHF, JPY, GBP, HKD, NZD, PLN, MXN | AUD, BRL, EUR, CAD, CHF, JPY, GBP, HKD, NZD, PLN, MXN |

| Islamic Account | Yes | Yes |

| Demo Account | Yes | Yes |

FP Markets offers two main account types accessible via the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms: the Standard Account and the Raw Account. The core distinction between them lies in how trading costs are applied.

Standard Account. This account features wider spreads, but with zero commission charged per trade.

- Best for: Beginners and those who prefer a simpler cost structure where all fees are included in the spread. It’s also suitable for traders who execute fewer trades or hold positions for longer periods, as the wider spread impact is less significant compared to high-frequency trading.

Raw Account. This account offers much tighter spreads, often starting from 0.0 pips, but a commission is charged for each trade executed.

- Best for: More experienced and active traders, including scalpers and day traders, who prioritize the tightest possible spreads for potentially better entry and exit prices. While there’s a commission, the significantly lower spreads can result in lower overall trading costs for high-volume traders.

Iress Account Type

| Feature | Retail Account | Professional Account |

|---|---|---|

| Minimum Balance | $1000 | $1000 |

| Brokerage Rate | $6 minimum, then 0.06% | 0.05%, no minimum |

| Financing | FP Markets base rate +3% | FP Markets base rate +2% |

| Iress Viewpoint | $75, GST fee is waived for commissions totaling $150 or more per month | $75, GST fee is waived for commissions totaling $150 or more per month |

| Viewpoint Essential | Free | Free |

| ASX Live Data fee | $25 ASX inc GST fee is waived for commissions totaling $50 or more per month | $25 ASX inc GST fee is waived for commissions totaling $50 or more per month |

| Telephone Trades | No additional charge | No additional charge |

A key benefit of FP Markets’ Iress account types is the provision of Direct Market Access (DMA), particularly for Share CFDs. This allows traders to place their orders directly onto the order books of global stock exchanges, offering greater transparency and control over order execution.

What is the Minimum Deposit at FP Markets

The minimum deposit required to open an account with FP Markets varies depending on the account type you choose:

- Standard and Raw ECN Accounts: The minimum deposit is $100 AUD or the equivalent in another supported currency.

- Iress Accounts: The minimum deposit for Iress accounts starts at $1,000 AUD.

Deposit and Withdrawal

Ensuring smooth and flexible fund management is a priority at FP Markets, which is why they offer a diverse range of deposit and withdrawal methods designed to make funding your trading account and accessing your profits as convenient and efficient as possible for clients globally.

Deposit Fees & Options

| Method | Currencies | Fees | Processing Time |

|---|---|---|---|

| Debit/Credit Card | AUD, EUR, GBP, USD, SGD, CAD, JPY, NZD | $0 | Instant to 1 day |

| Bank Transfer | AUD, EUR, GBP, USD, SGD, CAD, | No fees from FP Markets | 1 day |

| BPAY/PayID | AUD | $0 | 1 day |

| PayPal/Neteller | AUD, EUR, GBP, USD, SGD, CAD, JPY, NZD | $0 | 1 day |

| Skrill | USD, EUR, GBP | $0 | Instant to 1 day |

| Broker to Broker | AUD, CHF, EUR, GBP, USD, SGD, CAD, JPY, NZD | No fees from FP Markets | 1 day |

| Telephone Trades | No additional charge | No additional charge |

FP Markets provides fee-free deposits across most methods (cards, e-wallets, BPAY, PayID) and covers international fee for large bank transfers. Deposits are instant on MT4/5 platforms via cards, PayPal, Neteller, or Skrill, while Iress, bank transfers, and broker-to-broker take 1 business day. With support for 7+ currencies (AUD, USD, EUR, GBP, etc.), including niche options like PLN via Neteller, it caters to global traders seeking cost efficiency, speed (MT4/5 users), or flexibility for AUD-centric or high-value transactions.

Withdrawal Fees & Options

| Method | Currencies | Fees | Processing Time |

|---|---|---|---|

| Debit/Credit Card | AUD, EUR, GBP, USD, SGD, CHF, CAD, JPY, NZD, HKD | $0 | 2-10 days |

| Domestic Bank Wire | AUD | $0 | 1 day |

| International Bank Wire | Except AUD | $0 | 1 day |

| Neteller | AUD, EUR, GBP, USD, SGD, CAD, JPY, PLN, CHF | 1% up to 30 USD | 1 day |

| Skrill | USD, EUR, GBP | 1% + other fees | 1 day |

| PayPal | AUD, EUR, GBP, USD, SGD, CAD, JPY, NZD | $0 | 1 day |

FP Markets offers diverse withdrawal methods with most transactions processed within 1 business day (domestic/international bank wires, e-wallets, PayPal, etc.), significantly faster than typical industry timelines.

While zero fees apply to withdrawals via credit/debit cards, bank transfers, and PayPal, some methods incur charges: Neteller/Skrill (1% + potential country fees), PayTrust (1.5%), and OnlinePay (flat fees for RMB withdrawals).

Credit/debit card withdrawals take longer (2–10 days) due to bank processing, but the majority of options prioritize speed, supporting multiple currencies (AUD, USD, EUR, GBP, and niche options like PLN, MYR, RMB) for global accessibility.

Web Trading Platform

FP Markets’ web trading platform delivers a streamlined, no-download experience that caters to both casual and active traders. The broker offers access to MetaTrader 4, MetaTrader 5, TradingView, cTrader, and IRESS, all optimized for browser-based trading. They also provide Copy trading via Myfxbook.

During testing, I found MT4 WebTrader intuitive for executing one-click trades, setting alerts, and applying 30+ technical indicators (e.g., MACD, Bollinger Bands). Customizable dashboards allowed me to monitor multiple charts simultaneously, though the interface feels dated compared to modern rivals like TradingView. cTrader Web stood out with its Depth of Market (DoM) feature, providing transparency into liquidity for precise order execution.

The platform loads quickly, even during volatile sessions, and supports trailing stop-loss orders—ideal for risk management.

However, the web suite has limitations. MT4 WebTrader lacks advanced tools like backtesting or custom scripts available on the desktop version, forcing algo traders to switch platforms. The Iress web platform, while powerful for share CFDs, feels cluttered and unintuitive for forex traders.

Additionally, FP Markets’ proprietary web interface lacks an integrated economic calendar or news feed, requiring users to rely on third-party tools. While functional for basic trading, the web platform trails competitors like Pepperstone in features and design. For traders prioritizing simplicity and speed, it’s sufficient, but advanced users will prefer desktop or mobile apps.

Pros:

- Advanced automated trading (EAs).

- Supports 39 languages.

- Multiple order types (Market, Limit, Trailing Stop).

- Robust charting (30+ indicators, 9 timeframes).

- One-click trading & trade-from-chart functionality.

- WebTrader accessible via browser (no download).

Cons:

- Outdated, clunky interface.

- Steep learning curve for beginners.

- WebTrader lacks backtesting/EA scripting.

- No built-in news/economic calendar.

- Poor mobile-desktop synchronization.

- Limited customization compared to modern platforms.

Placing Orders

MetaTrader excels with its diverse order types, empowering traders to execute strategies with precision and flexibility. Here’s a streamlined breakdown of key options:

Market Order: Execute trades instantly at the current market price for immediate entry or exit.

Limit Order: Set predefined prices to buy below or sell above the market, capitalizing on optimal levels.

Stop Loss Order: Automatically close positions at a specified price to minimize losses during adverse moves.

Trailing Stop Order: Dynamically adjust stop-loss levels as the market trends, locking in profits while allowing room for growth.

The Trailing Stop shines in volatile markets, letting traders secure gains without prematurely exiting winning positions. Combined with MetaTrader’s automation capabilities, these tools streamline risk management and enhance strategic execution.

Alerts & Notifications

MetaTrader’s Alerts feature is a dynamic tool designed to keep traders informed and proactive in fast-moving markets. Far more than simple price notifications, this feature allows users to set customizable triggers for a wide range of market conditions, ensuring they never miss critical opportunities or risk thresholds.

Alarm Manager

Managing a trading account and staying on top of market movements can be demanding. FP Markets offers the Alarm Manager, a sophisticated tool designed to help you automate monitoring and responses to market and account events, effectively acting as your personalized trading assistant.

The Alarm Manager provides a flexible framework allowing you to define specific conditions or events and trigger automated actions or notifications in response. It essentially offers a set of building blocks to create a fully customized and automated trading companion.

With the Alarm Manager, you can:

- Receive timely notifications about crucial events impacting your account or the market.

- Configure automatic trading actions to be executed when specific conditions are met.

- Automatically share updates on your trading activity or market events with others via platforms like Twitter, email, or SMS.

This powerful tool enables you to set up a wide range of automated responses and alerts. For instance, you could use the Alarm Manager to:

- Get notified on screen, by email, or SMS if your account’s margin usage exceeds a set percentage (e.g., 20%).

- Automatically close all losing positions if the drawdown on your account reaches a certain threshold (e.g., 10%).

- Send an automatic message to your followers on social media (Twitter) or via email or SMS whenever you place a trade.

- Schedule automatic order placements or position closures at a specific future time (e.g., “at 2 pm” or “in 30 minutes”).

- Receive a warning if any of your open positions do not have a stop-loss order attached.

- Implement automated order placement or position closures based on signals from technical indicators like the Relative Strength Index (RSI) or moving average crosses.

- Alert followers on Twitter whenever an instrument reaches a new 30-day high.

- Display a congratulatory message after achieving a predefined number of consecutive winning trades (e.g., 3).

- Receive a reminder to cease trading if you experience a series of losing trades (e.g., 4 consecutive losses), if your account balance drops by a specified percentage (e.g., more than 3%), or if your win/loss ratio falls below a certain level (e.g., 30%).

- Receive a notification a set time before high-impact economic calendar events (e.g., 10 minutes prior).

- Automatically place a new order when a technical indicator like RSI is above a certain level (e.g., 70) on multiple timeframes.

- Initiate a new order if RSI crosses a specific level (e.g., above 70) or if a MACD cross of the signal line occurs.

Mobile App

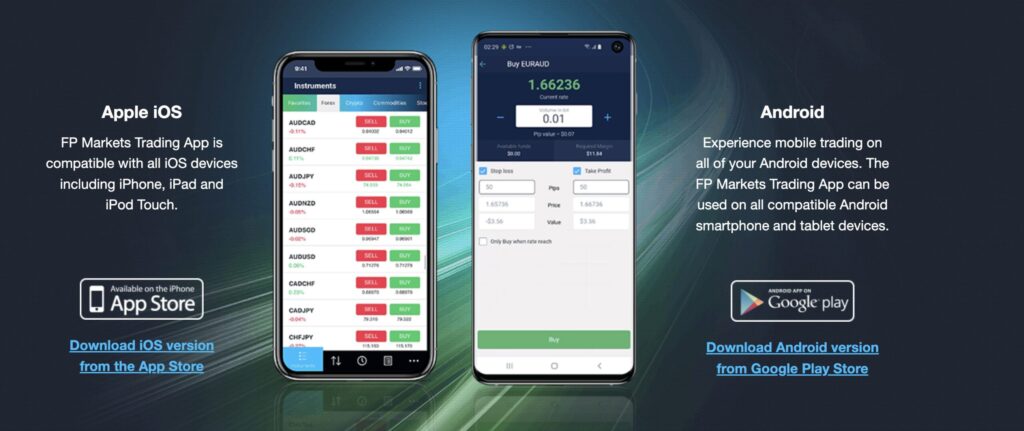

Mobile trading is essential for many traders, and FP Markets offers mobile applications for their supported platforms.

FP Markets extends its trading services to mobile users through a selection of popular platforms, ensuring traders can access the markets on the go.

FP Markets offers several mobile trading platforms for both iOS and Android devices, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, and IRESS Mobile. This review specifically focuses on the MetaTrader 4 mobile trading platform for Android.

Upon downloading the MT4 mobile app, users need to connect to the FP Markets-Live server to begin trading.

The mobile trading platform is available in numerous languages, offering accessibility to a global user base. However, changing the language on Android devices can be less straightforward, often requiring a change in the device’s default language.

Look and Feel

The FP Markets mobile trading platform is generally well-designed and user-friendly, making it easy for users to navigate and find features.

Login and Security

For mobile access, FP Markets primarily utilizes a one-step login process. While convenient, the absence of two-step authentication is a notable point regarding security. However, the platform does enhance security with a static pin created during account setup and the availability of biometric authentication (fingerprint) for a more convenient and secure login.

Search Functions

The mobile platform features good search functionality. Users can easily find trading instruments by typing the product’s name or Browse through categorized folders.

Placing Orders

Traders using the mobile platform have access to essential order types, including:

- Market orders

- Limit orders

- Stop orders

Additionally, the platform supports order time limits such as:

- Good ’til Canceled (GTC)

- Good ’til Time (GTT)

It is worth noting that while standard order types are available, trailing stop-loss orders can typically only be set from the desktop trading platform.

Pros

- User-friendly design

- Good search function

- Supports price alerts

- Biometric authentication available

Cons

- No two-step (safer) login

- Cannot set alerts and notifications directly in the mobile app

Despite the lack of two-step authentication and in-app alert setting, the FP Markets mobile offering, particularly the tested MT4 app, provides a well-designed and functional platform with good search capabilities and essential order types for traders on the move.

Market Research & Tools

FP Markets delivers high-quality market research through its Traders Hub, offering a balanced mix of fundamental and technical analysis that exceeds industry standards. In-house analysts produce timely reports on major market events, such as central bank meetings and economic releases, providing actionable insights for traders.

The broker enhances its research capabilities with third-party tools like Trading Central and Autochartist, integrated directly into the client portal. Trading Central’s Analyst Views, Featured Ideas, and Technical Insights enable traders to identify opportunities across forex, stocks, commodities, and indices using customizable criteria.

Autochartist complements this by auto-detecting chart patterns and key price levels. Additionally, FP Markets’ economic calendar ensures traders stay informed about upcoming market-moving events.

Education

FP Markets provides a comprehensive educational suite through its FP Markets Academy, featuring courses, live webinars, platform tutorials, and e-books. Content spans foundational topics like pips, margin, and technical indicators (e.g., MACD, RSI) to advanced strategies, available in both text and video formats.

The MetaTrader tutorials stand out, guiding users from platform basics to advanced tools like VPS installation and expert advisors (EAs). While the volume and quality of materials surpass industry averages, the education section requires modernization and better organization. Critically, the podcast series remains outdated, live webinars are limited, and some resources, like promised e-books, face delivery issues.

Key Takeaways

- FP Markets’ Traders Hub and third-party tools like Trading Central offer superior, actionable market insights.

- The FP Markets Academy provides versatile learning resources but needs structural updates and consistent content refreshes.

Customer Support

Access to reliable customer support is absolutely crucial when choosing a broker, and in my experience testing FP Markets, I found their support channels to be generally responsive and helpful.

They are available 7 days a week, ensuring assistance is available during key trading hours across different global sessions. Specifically, support is available Monday to Saturday from 07:00 to 07:00 AEDT and Sunday to Friday from 22:00 to 22:00 GMT. FP Markets provides support through multiple convenient channels: Live Chat, Email, and Phone.

During my testing, I specifically evaluated their Live Chat service and consistently experienced quick response times, typically connecting with an operator within a couple of minutes, which is quite efficient.

My inquiries via Email were also addressed promptly, usually receiving a response within a few hours. While I did encounter some longer wait times when utilizing the Phone support, the agents I interacted with were generally well-informed and polite.

Customer support is available in a variety of languages, including English, Spanish, Arabic, and Mandarin, catering to a diverse global client base.

Pros:

- Responsive Live Chat and Email support.

- Support offered in multiple languages.

Cons:

- Potential for longer wait times on Phone support.

FAQS

Can I trust FP Markets?

Yes, FP Markets is considered a trusted broker with regulation from Tier-1 authorities like ASIC and CySEC, offering segregated funds and negative balance protection. However, be aware that offshore entities may lack investor compensation schemes.

What are the disadvantages of using FP Markets?

Disadvantages include limited research tools compared to some competitors, potential fees on the Iress platform for inactive traders, an outdated MT4 mobile app interface, and no physical stock trading. Offshore entities also lack investor protection schemes.

How long does FP Market withdrawal take?

Withdrawal times vary, with e-wallets typically taking 24 hours and bank transfers ranging from 1 to 10 business days depending on the method and bank.

Who owns FP Markets?

FP Markets, or First Prudential Markets, was founded in 2005 and is headquartered in Sydney, Australia; it is not publicly traded.

Does FP Markets offer a demo account?

Yes, FP Markets offers free demo accounts on the MT4, MT5, cTrader, and TradingView platforms for practice trading.

What is FP Markets’ maximum leverage?

Maximum leverage for retail EU clients is 1:30 due to regulation, while professional accounts or those under offshore entities can access up to 1:500, varying by asset class.

What is the minimum deposit for FP Markets?

The minimum deposit is $100 AUD for Standard and Raw ECN accounts, and $1,000 AUD for Iress accounts.

Is FP Markets good for beginners?

FP Markets can be suitable for beginners due to demo accounts and available basic educational content, but awareness of CFD trading risks and the complexity of platforms like MT4 is important.

Is FP Markets good for experienced traders?

Yes, experienced traders often find FP Markets appealing due to its competitive low costs on the Raw ECN account, support for advanced platforms (MT4, cTrader, TradingView, Iress), and tools suitable for active trading and strategies like scalping

What type of broker is FP Markets?

FP Markets is primarily a CFD and forex broker. They operate as a market maker and offer ECN pricing through their Raw account.

Does FP Markets allow scalping?

Yes, FP Markets is suitable for scalping, offering features like competitive spreads, fast execution, and platforms like MetaTrader and cTrader which are often preferred by scalpers.

What assets can I trade with FP Markets?

You can trade a wide range of assets with FP Markets through CFDs, including forex pairs, indices, commodities, shares, ETFs, bonds, and cryptocurrencies.