OANDA REVIEW 2025

In this review, you’ll get a clear, hands-on look at everything this broker offers—from account types and trading platforms to fees, regulation, and customer support. Whether you’re a beginner starting with a small budget or an experienced trader looking for advanced tools and competitive pricing, this review breaks down OANDA’s strengths, weaknesses.

Why You Should Choose OANDA in 2025

I’ve traded with OANDA long enough to see why it has built such a strong reputation. Founded in 1996, it grew from a small forex data service into a global broker trusted by millions. What sets OANDA apart is its robust regulatory footprint, being licensed in multiple Tier-1 jurisdictions, including the FCA in the UK and the CFTC in the US. That kind of oversight gives me confidence every time I place a trade.

This review is for anyone considering OANDA in 2025—whether you’re just starting out, already trading actively, or managing high volumes. Personally, I appreciate that the broker caters to different styles, ranging from micro-lot beginners to elite-level traders, with rebate programs.

In terms of markets, OANDA offers an impressive range of instruments. Depending on your region, you can access from 69 forex pairs to over 4,000 tradable instruments, including CFDs on indices, metals, commodities, bonds, ETFs, and even cryptocurrencies. For UK traders, this means spread betting and CFDs; for US traders, it means spot forex and crypto through Paxos. Either way, the coverage is wide enough to build a flexible portfolio under one account.

About OANDA

Back in the late 1990s, Oanda was known mainly for its online currency converter. Since then, they’ve grown into a powerhouse in online trading. Founded in 1996, OANDA now operates as a global broker with offices in the US, UK, Canada, Singapore, Australia, Japan, and Europe. What I like about this broker is that it hasn’t lost its data-driven roots—its platforms and tools still feel built for traders who value transparency and accuracy.

Regulation is another area where OANDA stands tall. In the UK, they’re regulated by the FCA; in the US, they’re overseen by the CFTC and are a member of the NFA. Add in ASIC in Australia, CIRO in Canada, MAS in Singapore, and the JFSA in Japan, and you’ve got a broker covered by some of the toughest financial watchdogs in the world. That level of oversight makes me comfortable trading larger amounts, knowing client funds are protected.

As for their product range, OANDA adapts to regional regulations. In the US, the focus is spot forex and crypto (through Paxos), while in the UK and Europe, traders can access forex, indices, metals, commodities, bonds, ETFs, and stock CFDs. Depending on your region, the lineup can expand to more than 4,000 tradable instruments. That’s more than enough for me to diversify without needing a second broker.

Whether you’re a beginner testing your first micro lot or an experienced trader running algorithmic strategies, OANDA has built an ecosystem that works. From regulation and safety to instruments and platforms, they’ve earned their spot as one of the most recognizable names in the industry.

My Quick Verdict - Do I Recommend OANDA?

After trading with OANDA and comparing it against other top brokers, I see it as a solid choice in 2025 for most traders. If you’re in the UK or EU, you’ll enjoy access to a wide range of instruments, competitive spreads, and flexible platforms. If you’re in the US, OANDA remains one of the safest forex brokers available, though the product lineup is more limited.

The biggest advantages are clear: strong regulation across multiple Tier-1 authorities, low fees for forex and CFDs, and user-friendly platforms that make both web and mobile trading smooth. I find their research tools especially handy, whether it’s MarketPulse analysis or Algo Labs for automated trading.

That said, there are drawbacks. In the US, you’re limited mostly to forex, and spreads can run higher than the cheapest brokers unless you qualify for Elite or Core Pricing tiers. High-volume traders will appreciate those discounts, but casual traders may feel the costs more.

Overall, I’d give OANDA a 4.6/5 rating. Oanda is best for beginners who want safety, everyday traders who value reliability, and professionals who can unlock Elite-level pricing.

Pros

- Strong global regulation — licensed by Tier-1 authorities including the FCA (UK), CFTC (US), ASIC (Australia), MAS (Singapore), and CIRO (Canada).

- $0 minimum deposit — you can open an account without worrying about upfront funding barriers.

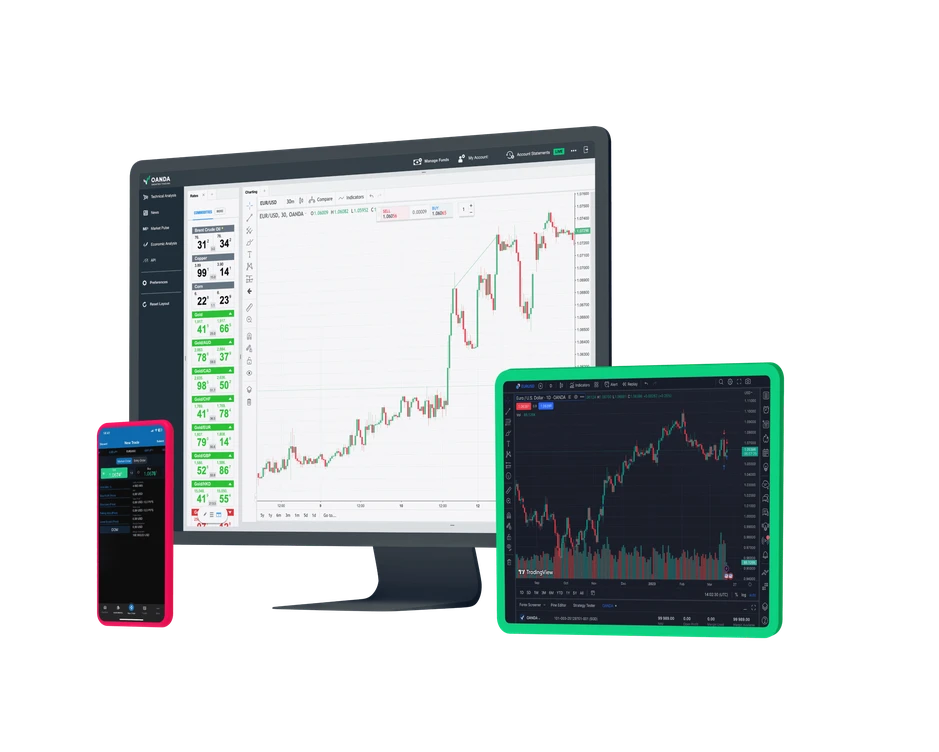

- Multiple trading platforms — OANDA Trade, MT4/MT5, and TradingView support a wide range of strategies.

- Powerful research tools — MarketPulse, Algo Labs, and Autochartist provide market insights and support algo trading.

- User-friendly mobile and web apps — simple layouts and smooth functionality for trading on the go.

- Low forex CFD fees vs some competitors — competitive spreads on forex and CFDs when compared with similar brokers.

Cons

- Limited product range in the US — American clients are restricted to forex (and crypto via Paxos), unlike EU/UK traders who get access to CFDs and more.

- Spreads are higher than top competitors unless you qualify for Elite/Core pricing tiers.

- Customer support is limited to 24/6 — no Saturday availability, which can be a drawback for global traders.

- Not a publicly traded company— this can affect perceived transparency and stability compared to brokers tied to banks.

Why OANDA is Right for You in 2025

When I look at brokers for long-term reliability, OANDA consistently makes the shortlist. The company has been around since 1996 and is backed by seven Tier-1 regulators, including the FCA, CFTC, ASIC, MAS, CIRO, and JFSA. That level of oversight has earned OANDA a Trust Score of 93, putting it among the most secure brokers in the world.

Another reason I keep OANDA in my toolkit is their approach to transparency. Unlike some brokers that advertise “from 0.0 pips” but rarely deliver, OANDA publishes the average spreads its clients actually pay.

For example, EUR/USD spreads averaged around 1.69 pips in 2025, with detailed breakdowns by time frame, so you know exactly what trading costs look like.

OANDA also balances its offerings between beginners and advanced traders. If you’re new, you can start small with micro-lots—literally as low as 1 unit of currency. For experienced traders, the broker supports API access through Algo Labs, advanced charting on TradingView, and algorithmic strategies with MT4/MT5. This flexibility means you don’t outgrow OANDA as your trading skills improve.

Finally, OANDA’s global access sets it apart. The broker is available across multiple regions, including the UK, US, EU, Canada, Singapore, Japan, Australia, and even the Philippines. Wherever you are, there’s usually an OANDA entity regulated to serve your market.

In short, OANDA in 2025 remains a broker you can trust, with transparent pricing, versatile tools, and worldwide availability.

Compare to Top Competitors

When weighing OANDA against other well-known brokers, three names often come up: FOREX.com, Pepperstone, and FXCM. Each has its strengths, but OANDA stands out in key areas.

Forex.com

Pepperstone

FXCM

Exploring Oanda's Range of Tradable Instruments

One of the first things I check with any broker is the product lineup, and OANDA doesn’t disappoint—though what you can trade depends heavily on where you live.

- Forex: OANDA offers between 48 and 69 currency pairs depending on the entity you register under. This covers all the majors, minors, and a good selection of exotics.

- CFDs: Outside the US, you’ll find a wide mix of contracts for difference, including indices, commodities, metals, bonds, ETFs, and stock CFDs. US traders don’t get access to CFDs due to local regulations.

- Stocks: If you’re in the EU, OANDA also provides access to US and international stocks, either as real shares or stock CFDs.

- Cryptocurrencies: Availability varies by region. In the US, you can trade actual crypto through Paxos, a regulated partner. In other regions, OANDA offers crypto CFDs on popular assets like Bitcoin and Ethereum.

When you put it all together, OANDA clients can trade up to 4,172 instruments across its global entities. That’s a solid range—broad enough for me to diversify across forex, commodities, and even crypto, without needing multiple brokers.

| Asset | OANDA |

|---|---|

| Tradeable Symbols | 4172 |

| Forex Pairs | 69 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Cryptocurrency (Physical & Derivative) | Yes |

| Social Trading / Copy Trading | Yes |

Limitations and Exclusions I’ve Noticed

As much as I value OANDA, there are some limits and exclusions worth pointing out before you sign up.

First, if you’re a US trader, your options are restricted to forex and spot crypto (through Paxos). That means no CFDs on indices, metals, commodities, or stocks—products that are widely available in the UK, EU, and other regions.

Second, access to cryptocurrency CFDs depends heavily on where you live. For example, they’re available in certain global entities but not for UK retail clients due to FCA rules.

Third, OANDA does not operate in some countries at all. Traders from places like Afghanistan, Cuba, Iran, North Korea, and several others are excluded from opening accounts.

Finally, I’ve noticed that while OANDA’s platforms are reliable, they don’t always offer the same depth of features as best-in-class competitors. You get strong charting and order execution, but advanced traders may find limitations compared to platforms like SaxoTrader or IG’s proprietary suite..

These exclusions don’t break the deal for me, but they are important to keep in mind. If you need full multi-asset access or ultra-tight spreads without Core/Elite pricing, you may feel constrained.

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD - Standard | 1.69 |

Index CFD Fees | Low |

Stock CFD Fees | Low |

| Inactivity Fee | $10 per month after 12 months of no activity |

| Credit/Debit Card Deposit Fees | £0 for most regions, up to 2% for certain countries. |

| Deposit Fees | $0 |

| Withdrawal Fees | $0 |

When you trade with OANDA, understanding the fee structure is key because it can directly affect your bottom line. OANDA is known for its transparency, and unlike some brokers, they publish their average spreads and clearly outline what you’ll pay depending on your account type and trading activity. Let’s break it down.

Forex Trading Fees

OANDA offers different pricing models, each suited to different types of traders:

Spread-only pricing (Standard account):

This is the most common setup for everyday traders. The cost of trading is built directly into the spread, so there are no extra commissions added on top. On major currency pairs such as EUR/USD, spreads usually range between 1.2 and 1.7 pips, while minors and exotics are slightly higher. For new traders or those who prefer simplicity, this model makes it easy to understand exactly what you’re paying.

Core Pricing account: This model caters to more active and experienced traders who want tighter spreads and are comfortable paying a commission. Spreads start from as low as 0.4 pips, but you’ll pay $5 per 100,000 units traded, per side. In practice, this often works out cheaper if you trade high volumes or scalp small moves in the market. However, access requires a $10,000 minimum deposit, which may be a barrier for smaller accounts.

Elite Trader Program: For professionals and high-volume clients, OANDA offers rebates and further cost reductions through this program. Once you reach certain monthly trading volumes, you can qualify for cashback rebates ranging from $5 to $17 per million traded. This makes OANDA far more competitive for serious traders, especially those executing large or frequent trades.

Other Trading Costs

In addition to forex, OANDA charges different rates for other markets:

Share CFDs: Available in certain regions, these come with a commission of around 0.06% per trade, plus the spread. For example, trading $10,000 worth of stock CFDs would incur a $6 commission.

Guaranteed Stop-Loss Orders (GSLOs): In some regions, OANDA provides GSLOs, which ensure your trade is closed at the set price even during volatility. If triggered, they come with a small premium, usually equivalent to around 1 pip.

Rollover/financing fees: Like all brokers, OANDA applies overnight financing charges when you hold positions past the market close. The exact rate depends on the instrument and whether you are long or short, but it’s something to keep in mind if you plan to swing trade or hold positions for weeks at a time.

Non-Trading Fees

While OANDA’s trading fees are competitive, you should also be aware of their non-trading charges:

Inactivity fee: If you leave your account dormant for 12 months, OANDA begins charging a monthly inactivity fee of $10 (or £10 in the UK). This doesn’t apply if you simply have open trades, but it will kick in if you neither trade nor log in.

Deposit fees: OANDA doesn’t charge anything for deposits, but depending on your payment method, your bank or e-wallet provider may apply their own fees.

Withdrawal fees: The first withdrawal to your debit or credit card each month is free. Additional withdrawals or bank transfers come with fixed charges, usually between $10–$20, depending on the region and method. PayPal and other e-wallet withdrawals may also carry small fees.

Currency conversion fees: If you deposit, trade, or withdraw in a currency different from your account’s base currency, OANDA applies a conversion fee. This is fairly standard across the industry, but worth noting if you plan to fund in a currency like GBP and trade in USD.

Final Thoughts on Costs

Overall, OANDA’s fee structure is competitive and transparent. Casual traders will find the spread-only model simple and easy to manage, while professionals can unlock serious cost savings through Core Pricing or the Elite Trader program. The non-trading fees, while present, are manageable if you remain active and plan withdrawals strategically. In short, OANDA provides a balance of flexibility and fairness that works across different trader profiles

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is OANDA Regulated ?

Regulation is one of OANDA’s biggest strengths, and it’s a key reason I feel comfortable trading with them. Unlike many offshore brokers, OANDA holds licenses across multiple Tier-1 jurisdictions, which gives traders worldwide a strong layer of protection.

OANDA is licensed and supervised by:

☑️ United States: Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA)

☑️ United Kingdom: Financial Conduct Authority (FCA)

☑️ Australia: Australian Securities and Investments Commission (ASIC)

☑️ Canada: Canadian Investment Regulatory Organization (CIRO)

☑️ Singapore: Monetary Authority of Singapore (MAS)

☑️ Japan: Japan Financial Services Agency (JFSA)

☑️ British Virgin Islands: BVI Financial Services Commission (BVIFSC)

☑️ Poland: Komisja Nadzoru Finansowego (KNF)

In practice, these licenses mean OANDA must follow strict rules around how it handles client money. Traders benefit from segregated funds, so client deposits are kept separate from the broker’s operating capital. There are also client money rules ensuring transparency and negative balance protection in certain regions to prevent clients from owing more than their deposits.

All this regulatory oversight has earned OANDA a Trust Score of 93/99, placing it among the most secure and reliable brokers in the industry. For me, that high trust rating makes a big difference—especially when trading larger positions or holding accounts across multiple currencies.

Understanding Regulatory Protections and Broker Stability

One of the main reasons I’ve stuck with OANDA is the peace of mind that comes with trading under a heavily regulated broker. With licenses in the US, UK, Canada, Australia, Singapore, Japan, and Europe, OANDA operates under some of the toughest financial watchdogs in the world. That translates into concrete protections for everyday traders like you and me.

- Segregated client funds: Your money is held separately from OANDA’s operational funds, so it cannot be used for company expenses or liabilities. In the rare case of financial trouble, your deposits remain ring-fenced.

- Negative balance protection: In regions such as the UK and EU, OANDA guarantees you won’t lose more than your account balance. This matters during volatile events when prices can gap, helping prevent unexpected debt.

- Client money rules: Regulators require OANDA to follow strict auditing and reporting practices, so there’s ongoing oversight on how funds are handled.

- Dispute resolution mechanisms: Being licensed in multiple Tier-1 jurisdictions means clients can escalate unresolved complaints to independent financial authorities, an option not available with offshore brokers.

Beyond regulation, I also look at stability. OANDA has been in business since 1996, survived multiple financial crises, and continues to expand globally. It isn’t a publicly traded company, but its longevity and consistent compliance track record add weight to its reliability. Combine that with a Trust Score of 93/99, and you get one of the safest trading environments in the retail forex and CFD space.

In short, OANDA’s regulatory protections and two decades of proven stability make it a broker I feel confident using, whether I’m trading micro lots or managing larger accounts.

How To Open an Account

Opening an account with OANDA is straightforward, though the speed can vary depending on where you live. In the UK and EU, digital verification usually takes less than 24 hours, while in the US, the process can take a bit longer due to stricter regulatory checks.

The steps are simple:

Registration: Start by filling out the online application form with your personal details, trading experience, and financial background.

KYC (Know Your Customer): Upload proof of identity (like a passport or driver’s license) and proof of address (such as a utility bill or bank statement). OANDA’s system verifies these documents before activating your account.

Funding: Once approved, you can deposit funds using debit/credit cards, bank transfers, or e-wallets (options vary by region). The best part is there’s no minimum deposit, so you can start with as little or as much as you’re comfortable with.

Trading: After your account is funded, you can log into OANDA Trade, TradingView, or MT4/MT5 and place your first trade.

For me, the smooth digital sign-up is one of the reasons I recommend OANDA to new traders. You don’t need to mail forms or wait weeks for approval—the process is fully online and designed to get you trading quickly and securely.

Account Types

OANDA keeps its account structure simple but flexible, giving traders options that match their region and trading style.

Standard Account

The most common choice, giving you access to all asset classes available in your region with no minimum deposit. Pricing is spread-only, making costs easy to understand.

Spread Betting Account (UK only)

Exclusive to UK residents, this account offers tax-free trading on forex and CFDs, also using a spread-only pricing model.

Sub-Accounts

OANDA allows you to create multiple accounts under a single profile. Through the dashboard, you can easily switch between sub-accounts, which is useful for separating strategies, portfolios, or base currencies.

- v20 Account: The default account type that works seamlessly with OANDA’s proprietary web platform, mobile app, and TradingView.

- v20 MT4 Account: Built for traders who prefer MetaTrader, this account also connects with OANDA’s web and mobile platforms, plus TradingView.

Elite Trader Account

Designed for higher-volume traders, this account unlocks tighter spreads, rebate programs, and the added benefit of a dedicated Relationship Manager.

What is the Minimum Deposit at OANDA?

One of the things I appreciate most about OANDA is that it has no minimum deposit requirement. You can open a live account with $0, which makes it easy for beginners to get started without committing a large amount of capital upfront.

This flexibility also benefits experienced traders who want to test OANDA’s platforms or execution before moving larger sums over. Whether you’re funding with a small amount to practice or depositing more for active trading, OANDA doesn’t impose barriers at the entry point.

In short, the minimum deposit is as low as you want it to be—making OANDA one of the most accessible brokers in the market today.

One of OANDA’s standout features is its $0 minimum deposit requirement. You can open an account and start trading without having to commit any upfront capital. This makes OANDA especially attractive to beginners testing the waters, as well as experienced traders who want to trial the platform before moving larger funds.

By contrast, many of OANDA’s competitors set minimum deposit levels, which can create a barrier to entry for smaller accounts.

| Broker | Minimum Deposit | Notes |

|---|---|---|

| OANDA | $0 | No barriers; fund what you want, when you want. |

| Forex.com | $100 | Standard requirement for most accounts. |

Pepperstone | $200 | Recommended starting deposit; varies by funding method. |

FXCM | $50 | Lower than many, but not as flexible as OANDA. |

Key Takeaway

If you’re just starting out, OANDA offers the most accessible entry point with zero minimum deposit, while competitors like Pepperstone and FOREX.com expect at least $100–$200 to get started. FXCM sits in the middle at $50, but OANDA still wins for flexibility.

Deposit and Withdrawal

OANDA makes it relatively easy to fund and withdraw from your account, with a variety of payment methods available depending on your region.

Deposit Fees & Options

The broker supports a variety of popular deposit methods to ensure convenience for its global client base:

Withdrawal Fees & Options

OANDA’s withdrawal policy is straightforward:

Processing Times

- Cards and e-wallets: Usually processed within 1 business day.

- Bank wires: Can take 1–5 business days, depending on your bank and location.

I like that OANDA doesn’t charge for deposits, and the free first card withdrawal each month is a nice touch. That said, if you rely heavily on bank transfers or multiple withdrawals per month, the costs can add up. Planning your withdrawals strategically is the best way to minimize fees.

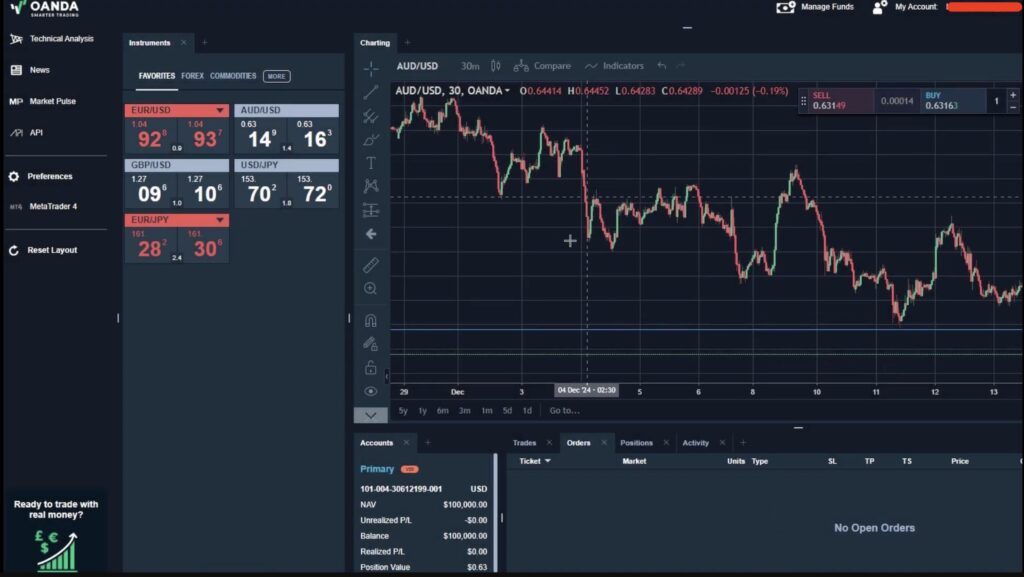

Web Trading Platform

I’ve used OANDA’s platforms across web, mobile, and desktop, and the web trading platform is where the broker really finds a balance between simplicity and functionality.

Features and Functionality

Advanced Charting

OANDA’s integration with TradingView gives traders access to professional-grade charting, complete with dozens of indicators, drawing tools, and customizable layouts.

Market Analysis Tools

The web platform includes built-in tools like Autochartist, economic calendars, and sentiment data to help identify trade setups and market trends.

Real-time Information

Traders get live pricing, streaming news feeds, and instant execution updates, ensuring decisions are made with the latest market data.

Research Integration

OANDA’s proprietary analysis from MarketPulse is seamlessly integrated, giving direct access to expert insights and daily commentary without leaving the platform.

Educational Content Integration

For beginners, the platform links to guides, webinars, and Smart Videos, letting traders learn while they trade, making it easier to improve skills in real time.

Placing Orders

OANDA’s web platform makes order placement quick and flexible. You can choose from multiple order types including:

Market

Limit

Stop

Trailing stop orders.

The interface allows you to set stop-loss and take-profit levels directly on the chart, making risk management seamless.

Alerts & Notifications

Custom alerts can be set based on price levels, technical indicators, or market events. Notifications are delivered in-platform and can also be sent to email or mobile, so you never miss important moves even when you’re away from the screen.

Login and Security

Account security is a priority with OANDA. The platform supports secure login protocols, two-factor authentication (2FA), and encrypted data transfers, ensuring your personal and financial information stays protected.

Search Functions

The search function is straightforward and responsive, letting you quickly find instruments, indicators, or account features. This is particularly useful when navigating across hundreds—or even thousands—of tradable products.

Pros & Cons of the Web Platform

Pros

- Clean and intuitive design — easy to navigate even for beginners.

- Advanced charting through TradingView integration with dozens of indicators and drawing tools.

- Multiple order types including market, limit, stop, and trailing stop, with the ability to set stop-loss and take-profit directly from the chart.

- Seamless research integration — MarketPulse analysis, Autochartist, and economic calendar built into the platform.

- Fast execution with reliable trade placement and real-time price updates.

Cons

- Limited advanced features compared to premium platforms like SaxoTrader or IG’s proprietary suite.

- Customization is basic — while layouts can be adjusted, it lacks the deep personalization some professional traders expect.

- No depth-of-market (DOM) trading or advanced order book features for scalpers.

- Web-only environment can feel less powerful than full desktop platforms for heavy algorithmic or high-frequency trading.

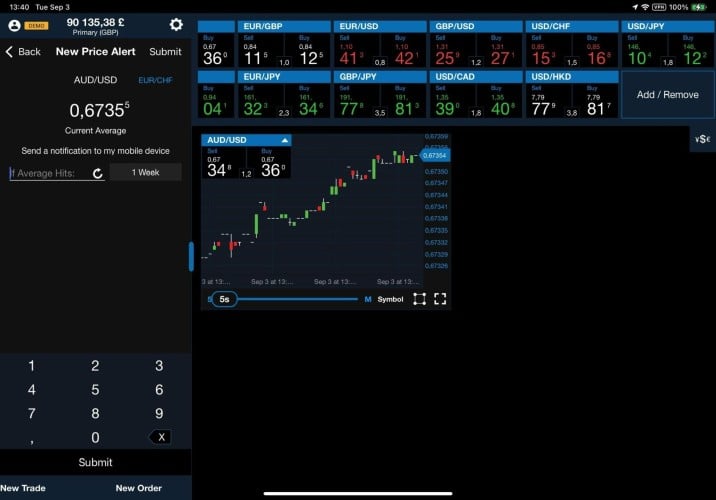

Mobile App

For me, OANDA’s mobile app is one of the broker’s strongest features. Built for both iOS and Android, it delivers a trading experience that feels just as reliable as the web platform but optimized for smaller screens. Whether you’re checking charts on the train, placing quick orders during a lunch break, or monitoring positions overnight, the app gives you the flexibility to stay connected to the markets at all times.

The design is clean and responsive, with intuitive navigation that makes it easy to switch between watchlists, charts, and order tickets. I also like that it supports advanced features like customizable indicators, drawing tools, and even price alerts—so you’re not sacrificing functionality for convenience.

In short, OANDA’s mobile app combines ease of use with serious trading tools, making it a solid choice for both casual traders who like to monitor the markets on the go and active traders who need full control outside their desktop setup.

Look & Feel and Features

The OANDA mobile app has a clean, modern design that makes it easy to navigate even for first-time traders. The interface balances simplicity with depth, offering customizable watchlists, interactive charts, and quick access to account details. Features like one-touch trading, economic calendar integration, and news updates mean you don’t miss out on important market moves while on the go.

Login and Security

Security is taken seriously on the mobile app. You can log in using secure protocols, with support for biometric authentication such as fingerprint or facial recognition on supported devices. All transactions and data are encrypted, giving you peace of mind when managing your funds and trades away from your desktop.

Search Functions

Finding instruments is straightforward with the app’s responsive search function. You can quickly filter by forex pairs, indices, commodities, or other asset classes. The app also lets you favorite or bookmark instruments, so your most-traded markets are always one tap away.

Placing Orders

Order placement on the mobile app is fast and flexible. You can open positions directly from charts or watchlists, with multiple order types available including market, limit, stop, and trailing stop. Stop-loss and take-profit levels can be added in a few taps, and the app provides real-time pricing to ensure trades are executed accurately.

Pros & Cons of the Mobile App

Pros

- Clean, intuitive design that’s easy to navigate for both beginners and experienced traders.

- Biometric login options (fingerprint or face ID) add convenience and security.

- Advanced charting tools with multiple indicators and drawing features, optimized for mobile screens.

- Fast and flexible order placement directly from charts or watchlists.

- Customizable alerts and push notifications to keep track of price moves and market events.

- Seamless integration with OANDA Trade, MT4, and TradingView accounts.

Cons

- Limited customization compared to desktop platforms—layouts and indicators are not as robust.

- Fewer research and education features than the web platform, with less in-depth content available in-app.

- No depth-of-market or advanced order book tools, which may frustrate professional scalpers.

- Occasional syncing issues when switching between devices (e.g., saved chart settings).

Market Research, Tools, and Education

OANDA provides a solid mix of market insights, trading tools, and educational resources. While the depth may not rival premium research-driven brokers, the content is reliable, timely, and well-integrated into the trading platforms.

Webinars covering trading strategies and market outlooks.

Guides on forex basics, risk management, and platform use.

Smart Videos, short and focused tutorials that help you understand core trading concepts and platform features.

Verdict

While OANDA doesn’t have the deepest institutional-grade research compared to brokers like IG or Saxo, it provides enough tools and insights to support most retail traders. Beginners will find the education resources practical, while advanced traders can leverage Algo Labs and API access for a more technical edge.

Customer Support

OANDA provides 24/6 multilingual support, which covers the main trading week but not weekends. For most traders, this is enough, though the lack of 24/7 availability may be limiting if you trade global markets across different time zones.

Support Channels

☑️ Live chat for quick problem-solving directly on the platform or website.

☑️ Email support for detailed queries or account-specific issues.

☑️ Phone support in select regions for traders who prefer speaking directly with an agent.

Languages

OANDA’s support team offers help in several major languages, including English, Spanish, Mandarin, Japanese, and more. This multilingual coverage is a plus for traders in Asia and Europe who prefer support in their native language.

User Experience

From my experience, response times are generally fast on live chat and phone. The agents are knowledgeable and can resolve most platform or account issues without long delays. That said, reviews are mixed—some traders report excellent service, while others find it less responsive during peak hours.

Overall, OANDA’s customer support is reliable during the trading week, with solid multilingual coverage and multiple contact channels. However, if round-the-clock support is a must for you, the limited hours may feel restrictive.

FAQ

Is OANDA safe to trade with in 2025?

Yes. OANDA is regulated by multiple Tier-1 authorities including the FCA, CFTC, ASIC, MAS, and others. With a Trust Score of 93/99, it’s considered one of the safest brokers for both beginners and professionals.

What is the minimum deposit at OANDA?

There’s no minimum deposit. You can open an account and start trading with as little as $1, which makes it ideal for low-budget and first-time traders.

Is OANDA good for beginners?

Yes. The $0 minimum deposit, user-friendly platforms, and simple spread-only pricing make OANDA beginner-friendly. New traders also benefit from its educational resources like Smart Videos, webinars, and guides.

Is OANDA suitable for experienced traders?

Definitely. OANDA offers Core Pricing with tighter spreads, the Elite Trader program with rebates, and advanced tools like Algo Labs and API access, which cater to experienced and high-volume traders.

What are OANDA’s forex spreads?

On the Standard account, average spreads on majors are around 1.2–1.7 pips. With Core Pricing, spreads can go as low as 0.4 pips plus commission—more appealing for active or professional traders.

Can US traders use OANDA?

Yes. OANDA is fully licensed in the US by the CFTC and NFA. US traders can trade forex and crypto (via Paxos), but not CFDs.

Do they charge withdrawal fees?

The first debit or credit card withdrawal per month is free. Additional withdrawals or bank transfers may incur fees, so planning withdrawals is especially useful for budget-conscious traders.

How long do deposits and withdrawals take?

Card and e-wallet transactions usually process within 1 business day, while bank transfers can take 1–5 business days. Beginners with smaller accounts often prefer card or PayPal for speed.

What education and research tools do they provide?

OANDA offers MarketPulse daily analysis, Autochartist, Algo Labs, and an economic calendar for insights. For beginners, there are Smart Videos, trading guides, and webinars. Experienced traders can dive into API tools and advanced strategy resources.