forex.com REVIEW 2025

Here’s what to expect in this FOREX.com Review 2025: a quick look at safety and regulation, real‑world platform testing, fees and the $100 minimum, plus funding with no broker fees. You’ll also see account types explained, customer support availability, and a clear verdict on who FOREX.com is best for.

Broker Guide's Forex.com Review in 2025

In the competitive landscape of forex and CFD trading, professional investors demand brokers that deliver not just execution speed but also institutional-grade stability and advanced risk management tools. With over 15 years of experience managing portfolios across global markets, including high-frequency trading and hedging strategies, I’ve rigorously evaluated Forex.com‘s platform through live trades, stress-testing it during major economic events, such as central bank announcements.

From my firsthand use, it stands out for its seamless integration of proprietary analytics and multi-asset capabilities, making it a reliable choice for scaling operations.

Established in 2001 as part of the NASDAQ-listed StoneX Group, Forex.com maintains an exemplary Trust Score of 96 out of 99, underscoring its robust regulatory framework and financial resilience. Yet, in a 2025 market shaped by evolving regulations and volatility, does it align with your institutional needs? This in-depth review examines its strengths to inform your strategy

About Forex.com

When you’re evaluating a forex broker, it’s essential to start with the fundamentals, who they are, and what gives them staying power in this fast-paced industry. Let me introduce you to Forex.com, a broker I’ve come to appreciate for its solid foundation and global reach. Founded in 2001, Forex.com has built a reputation as a leading global forex and CFD broker, offering traders access to a vast array of markets without unnecessary complications.

What really sets Forex.com apart and builds that immediate layer of trust is its backing by StoneX Group Inc., a publicly traded financial services powerhouse listed on NASDAQ under the ticker SNEX. StoneX itself has roots dating back to 1924, evolving from a commodity hedging firm into a Fortune 500 company with a century of experience in financial markets.

This isn’t just corporate fluff; it translates to high reliability, as evidenced by Forex.com‘s impressive Trust Score of 96 out of 99 from industry evaluators, signaling top-tier stability and client protection.

Today, Forex.com serves traders worldwide, from beginners scaling up to institutional players managing complex portfolios, with a wide range of offerings including over 80 currency pairs, CFDs on indices, commodities, and cryptocurrencies. Whether you’re trading from New York, London, or Singapore, their global infrastructure ensures you’re connected to opportunities around the clock. In my experience, this kind of heritage and scale make Forex.com a broker you can rely on for the long haul.

My Quick Verdict: Who is Forex.com Best For?

After thoroughly testing Forex.com across multiple accounts and market conditions, here’s my balanced take on this broker. I’ve executed live trades using their Web Trader, MetaTrader 5, and mobile app during volatile sessions.

The results highlight a broker that excels in key areas, but it’s not perfect for everyone.

Let me break it down step by step for easy reading.

What Stands Out Positively:

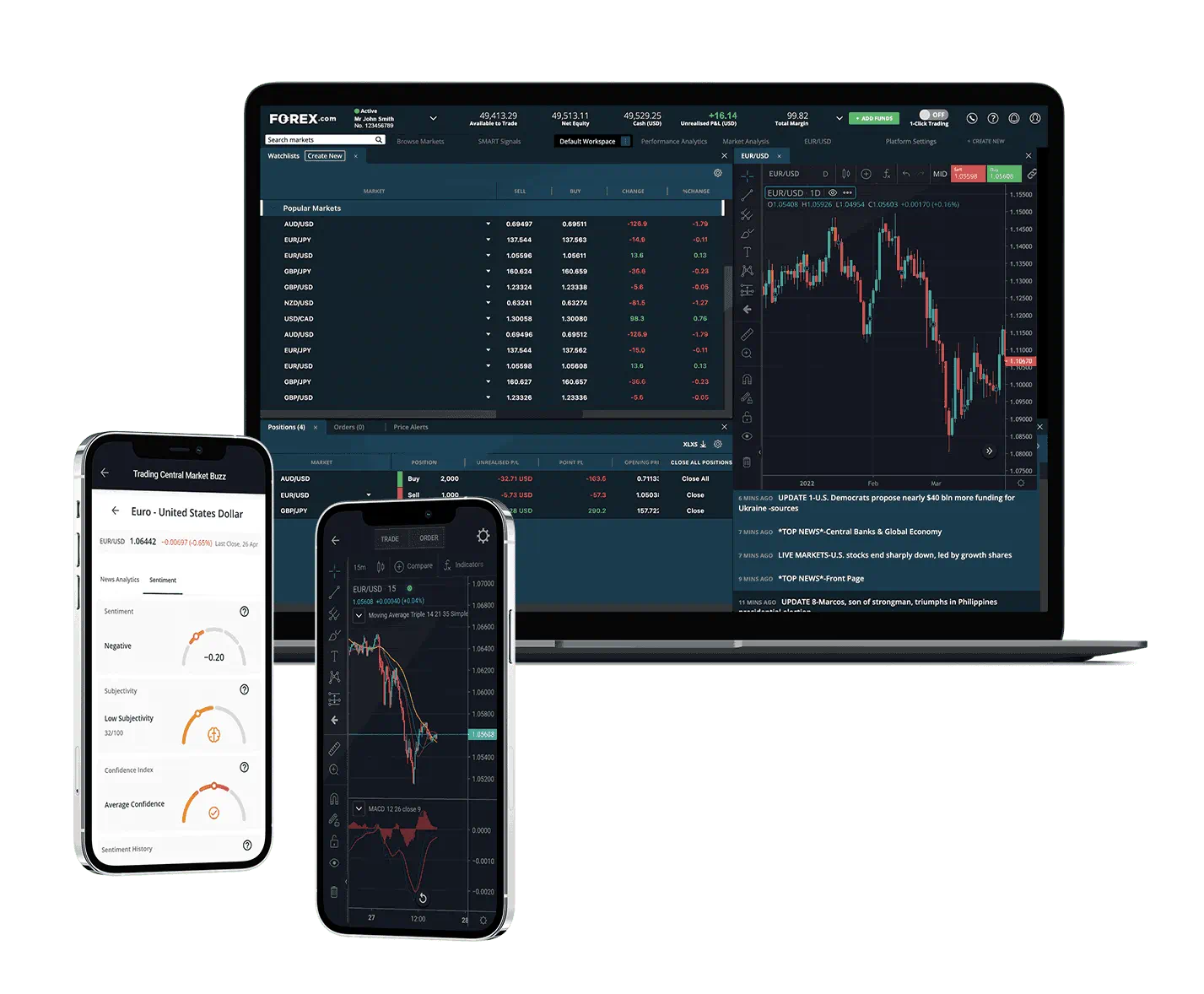

- Platforms Deliver Real Power. You’ll get institutional-grade tools with integrated TradingView charts and access to over 5,500 tradable symbols, making analysis smooth and efficient.

- Research Tools Are Comprehensive. Expect daily market updates from an in-house team, plus weekly outlooks and actionable trade ideas that suit various trading styles.

- Education Resources Shine. The award-winning Trading Academy offers interactive courses, webinars, and guides—ideal if you’re building skills or refining strategies.

- Asset Variety Impresses. Trade more than 80 forex pairs, plus CFDs on indices, commodities, cryptocurrencies, and even prediction markets through their Kalshi partnership.

Who Should Consider Forex.com?

- It’s a strong fit for traders who prioritize high-quality platforms for seamless execution.

- Perfect if you rely on extensive market research to inform your decisions.

- Well-suited for those seeking robust educational support to grow as traders.

- Especially rewarding for high-volume traders who can access Active Trader rebates and lower costs.

A Closer Look at Pricing:

- On the Standard Account, spreads start at 0.8 pips, which is competitive but around the industry average.

- Costs improve significantly with the Commission (RAW) account—think spreads from 0.0 pips plus a $5 commission per lot

- The Active Trader program offers rebates up to 15% for larger volumes, making it more affordable for serious players.

- However, if you’re a casual trader with low volumes, fees might feel higher compared to some budget-focused brokers.

Areas That Could Improve:

- Fees on stock CFDs tend to run higher than forex trades.

- You’ll need a separate account for U.S. stocks or futures, which adds a layer of complexity.

- The desktop platform is feature-packed but comes with a steeper learning curve for newcomers.

Wrapping It Up:

Forex.com holds a top Trust Score of 96, backed by global regulation from bodies like the FCA and CFTC. It’s a feature-rich broker that works well for beginners gaining confidence, and experts scaling strategies.

If reliability, advanced tools, and strong support are your priorities, this broker is a solid choice. For those focused strictly on the lowest fees for small trades, you might want to compare alternatives. And in the 2025 landscape, Forex.com positions itself as a reliable partner for traders aiming to level up their game.

Pros

- Excellent Regulation: Backed by multiple top-tier authorities like the FCA in the UK, CFTC and NFA in the US, ASIC in Australia, and more, ensuring strong investor protection and fund segregation.

- Advanced Platforms: Provides a powerful proprietary web platform and desktop platform with integrated TradingView charts, plus full support for MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for algorithmic trading and customization.

- Superior Research & Education: Features an award-winning Trading Academy with interactive courses, plus high-quality market analysis, daily insights, and tools like performance analytics to boost your trading edge.

- Wide Range of Instruments: Access to over 5,500 tradable symbols, including 80+ forex pairs, CFDs on indices, commodities, cryptocurrencies, and even prediction markets.

Cons

- Average Spreads on Standard Accounts: Not the most competitive for casual or low-volume traders, with spreads starting around 0.8 pips—better deals exist elsewhere for beginners.

- Inactivity Fee: Charges a $15 monthly fee (or equivalent) after 12 months of no trading activity, which can add up if you’re not consistently active.

- Separate Accounts for Some Assets: Requires a distinct StoneX One account for trading U.S. stocks and futures, adding complexity if you want a one-stop shop.

Why You Should Choose Forex.com ?

The forex and CFD trading landscape is evolving rapidly—with tighter regulations, AI-driven tools, and a push for diversified assets. If you’re wondering why Forex.com stands out amid the competition, it’s because they’ve been innovating smartly while leaning on their rock-solid foundation. Drawing from my own experience trading on their platforms and recent industry updates, here are the key reasons this broker could be your go-to choice this year.

First off, their platform innovation is a game-changer. Forex.com has rolled out full support for MetaTrader 5 (MT5) to clients in the U.S., Canada, and the EU, a move that brings advanced features like enhanced charting, more timeframes, and superior backtesting to a broader audience.

If you’re into algorithmic trading or need robust technical analysis, this upgrade makes their ecosystem even more powerful, aligning perfectly with 2025’s tech-forward trading trends.

Adding to that, they’ve enhanced their analytics game through the acquisition of Chasing Returns, now offering free performance analytics tools. This means you get detailed insights into your trading habits. Think win/loss ratios, emotional bias detection, and strategy optimization, all at no extra cost. In a year where data-driven decisions are key to staying ahead, these tools help you refine your approach without shelling out for third-party software.

Forex.com has also expanded its offerings via a strategic partnership with Kalshi, opening up prediction markets for trading on events like political outcomes or economic indicators. This isn’t just niche; it’s a forward-thinking addition that lets you diversify beyond traditional forex pairs and CFDs.

Underpinning all this is their unwavering trust factor. As part of the publicly traded StoneX Group Inc. (NASDAQ: SNEX), Forex.com is overseen by some of the world’s strictest regulators, including the FCA, CFTC, and ASIC. This setup ensures segregated client funds, negative balance protection, and transparency, which are crucial factors in 2025 as regulatory scrutiny ramps up globally.

In essence, if you’re seeking a broker that’s innovating without compromising on security, Forex.com delivers a compelling package for 2025.

Compare to Top Competitors

Finding the right fit often comes down to trust, pricing flexibility, platform depth, and breadth of markets. Here is a clear, natural comparison to help decision-making, followed by a short conclusion favoring the broker that checks the most boxes for 2025.

OANDA

Pepperstone

FXCM

Exploring Oanda's Range of Tradable Instruments

Forex.com offers a deep multi-asset lineup designed to support both focused forex strategies and broader macro or event-driven approaches, with clear numbers that speak to its scale and flexibility.

Forex

Traders can access over 80 currency pairs spanning majors, minors, and exotics, which is more than enough to build diversified FX strategies while keeping spreads and liquidity in view. Pairs like EUR/USD, GBP/JPY, and emerging-market crosses are all available, making it suitable for both day trading and carry strategies.- Indices (CFDs)

The platform lists major global equity benchmarks such as the S&P 500, Nasdaq 100, Dow Jones, FTSE 100, and DAX, plus select regional indices. This range supports hedging, macro positioning, and correlation plays alongside core FX exposure. - Commodities (CFDs)

Coverage includes metals like gold and silver, energy contracts such as WTI and Brent, and agricultural products where available. These instruments enable inflation hedges, risk-off pivots, and thematic trades tied to supply-demand dynamics. - Cryptocurrencies (CFDs)

Popular names such as Bitcoin, Ethereum, and additional large-cap coins are typically available as CFDs in eligible regions. This gives traders a way to express crypto views within the same account ecosystem, subject to local regulations. - Total symbols

Across markets, there are over 5,500 instruments available for trading, which is a standout figure for a broker centered on forex and CFDs. The breadth makes multi-asset portfolio building practical without juggling multiple providers.

| Asset | Forex.com |

|---|---|

| Forex Pairs | 80+ |

| Tradeable Symbols | 5500 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Cryptocurrency (Physical & Derivative) | Physical: No |

| Social Trading / Copy Trading | No |

Limitations and Exclusions I’ve Noticed

Even with a strong overall package, a few practical limits are worth flagging for planning and compliance.

Regional product gaps

- CFDs are not available to U.S. residents due to local regulation, so the multi-asset CFD lineup seen overseas will not mirror the U.S. experience.

- Crypto CFDs are restricted in some jurisdictions, including a ban for retail traders in the UK, which narrows digital asset exposure depending on location.

Protection and features vary by entity

- Negative balance protection and guaranteed stop-loss orders are available in the UK/EU under ESMA rules, but these protections are not offered to all non‑UK/EU clients, including many U.S. accounts.

- Investor compensation schemes differ by region, so coverage like FSCS in the UK does not apply globally, and U.S. clients typically lack equivalent insurance from the broker side.

Fees to watch

- An inactivity fee of $15 per month applies after 12 months without trading activity, which can surprise infrequent users returning after a long break.

- U.S. and Canadian clients may face bank withdrawal fees for smaller transfers under certain thresholds, while other regions might not, so it pays to check the fee table before funding or withdrawing.

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $100 |

| Average Spread EUR/USD | 1.4 pips |

Average Spread EUR/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.035 |

| Average Trading Cost Gold | $0.63 |

| Average Trading Cost Bitcoin | $60 |

| Minimum Raw Spread | 0.0 pips |

| Minimum Standard Spread | 0.8 pips |

| Minimum Commission for Forex | $5 per $100K |

| Deposit Fees | $0 |

| Withdrawal Fees | $0 |

| Inactivity Fee | $15 per month after 12 months of no activity |

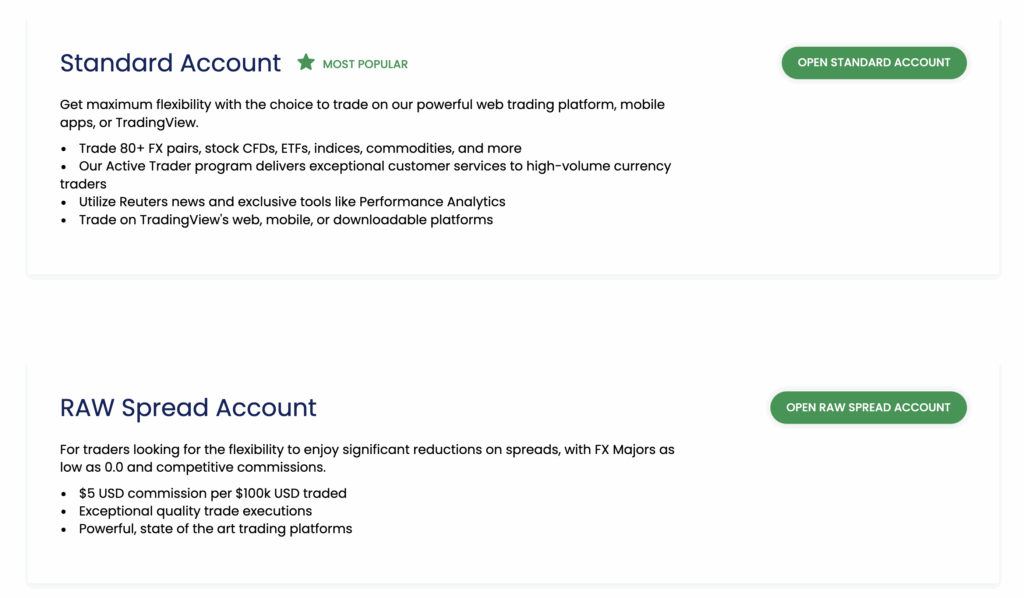

Costs at FOREX.com depend on the account type selected, trading volume, and platform choice, so it’s important to match pricing to strategy and frequency. The two core account setups are the commission-free Standard and the Commission (RAW) pricing model with tighter spreads plus a flat fee.

Trading Account Fees

Standard Account:

Commission-free pricing with minimum spreads from 0.8 pips on popular pairs, though real-world averages are typically higher during most sessions. This is the most straightforward model for learning the platform and keeping costs predictable.

Raw Spread Account:

Spreads from 0.0 pips during peak liquidity plus a fixed commission, commonly around $5 per standard lot round turn. This setup often lowers all-in costs for frequent traders and those who value tighter spreads for precision entries.

Non-Trading Fees

Non-trading costs at FOREX.com are straightforward to plan for. Transparency matters here, so below are the key items to watch, along with what they mean in practice.

Inactivity fee:

A $15 monthly charge (or local currency equivalent) applies after 12 consecutive months with no trading activity on the account. Logging in alone may not qualify as activity, so plan a small trade or close the account if it will sit unused long term.

Deposit and withdrawal fees:

FOREX.com does not charge internal fees for deposits or withdrawals. Third-party or bank charges can still apply depending on the payment method, so check with the card issuer or bank before moving funds.

Currency conversion fee:

A 0.50% conversion fee applies if funding or withdrawing in a currency different from the account’s base currency. This also applies to internal conversions tied to transfers that require FX conversion.

Final Thoughts on Costs

For most traders, picking the right pricing at FOREX.com matters more than any headline spread, since real costs depend on account type, volume, and trading hours.

The Standard account is the simplest, but averages are higher outside peak liquidity. The Commission (RAW) setup usually lowers all-in costs for active strategies that need tight spreads.

Non-trading fees are straightforward, with no internal deposit or withdrawal charges, a transparent $15 inactivity fee after 12 months, and a modest 0.50% currency conversion fee when funding or withdrawing in a non-base currency. If volume is set to scale, combining RAW pricing with rebates and trading during the London–New York overlap can materially tighten effective costs, while beginners may prefer the predictability of Standard until consistency justifies a switch.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Forex.com Regulated ?

Yes. Forex.com operates under multiple top‑tier regulators, which signals strong oversight and robust operational standards for client protection. In the UK, it is authorized by the FCA; in the U.S., it is overseen by the CFTC and is a member of the NFA; in Canada, it falls under CIRO; in Australia, under ASIC; across the EEA, under CySEC; and in Singapore, under MAS. This multi‑jurisdiction framework helps ensure stringent compliance, transparent conduct, and consistent supervision across major markets.

Client funds are held in segregated accounts, meaning customer money is kept separate from the broker’s operating capital to reduce counterparty risk in case of financial distress. Investor protection schemes also apply by region and entity.

For example, UK clients of the FCA‑regulated entity may be eligible for compensation up to £85,000 via the FSCS, while coverage in other regions varies based on local rules. Together, segregation, strong licensing, and jurisdiction‑specific compensation frameworks make Forex.com a safe, credibility‑rich option for both retail and professional traders.

Understanding Regulatory Protections and Broker Stability

What “regulated” means

Being under top‑tier regulators sets rules for capital, audits, disclosures, and conduct, which reduces misuse of funds and abusive practices while enforcing consistent standards.

Who oversees Forex.com

- FCA in the UK for strict conduct and client‑money rules.

- CFTC and NFA in the U.S. for dealer oversight and reporting.

- CIRO in Canada for national supervision of investment dealers.

- ASIC in Australia for licensing, leverage, and product governance.

- CySEC across the EEA under MiFID II for best execution and disclosures.

- MAS in Singapore for high bars on capital and compliance.

Segregated client funds

Client money sits in segregated accounts, separate from operating capital, to lower counterparty risk if the firm faces stress or insolvency.

Compensation schemes by region

Coverage varies by entity and jurisdiction; in the UK, eligible clients may claim up to £85,000 via the FSCS, while other regions apply their own limits and rules.

Negative balance protection and leverage caps

Retail clients in the UK/EU typically have negative balance protection, while protections and leverage limits differ elsewhere, so policies should be confirmed for the exact account.

Operational stability and parent backing

A publicly listed parent with diversified revenues, audited reporting, and market scrutiny generally enhances broker stability and resilience through cycles.

Mandatory transparency

Regulated brokers publish pricing, execution, conflict‑of‑interest, and complaints data, helping traders assess execution quality, slippage patterns, and true all‑in costs.

Pre‑funding checklist

- Verify the legal entity and its regulator.

- Confirm segregation of client funds and banking partners.

- Check negative balance protection for the account type.

- Review compensation scheme eligibility and limits.

- Read the order‑execution policy and historical metrics.

- Align leverage and margin rules to the strategy’s risk.

Why this matters

Strong oversight, segregation, and clear disclosures reduce operational and counterparty risks, while regional protections and escalation paths improve outcomes if issues arise.

How To Open an Account

Getting started is simple, fully digital, and quick. Here’s a clear step‑by‑step so setup is smooth from first click to first trade.

Start online

Visit the FOREX.com website and select an account that you want to open. The application is entirely online and typically takes only minutes to submit.

Enter basic details

Provide personal information and a short financial profile. Expect fields for contact info, employment, income range, and trading experience.

Verify identity and address

Upload a valid government ID for identity verification and a recent utility bill or bank statement for proof of address. Clear scans speed approval.

Fund the account

The minimum deposit is $100, which enables live trading once verification is complete. Match funding currency to the base currency when possible to avoid conversion costs.

Start trading

After verification and funding, log in, customize the workspace, and place the first trade. Most applicants are ready to go shortly after approval.

Standard Account

The Standard account is best for beginners and casual traders. It uses simple, spread-only pricing with no commission, which keeps costs predictable and setup straightforward. It works well for learning the platform, testing strategies, and lower-frequency trading. The minimum to start is $100, but a recommended deposit of $1,000 offers healthier margin and position sizing.

RAW Spread Account

The RAW Spread account is built for active traders who want near‑zero spreads on major FX pairs, paying a transparent commission of $5 per $100k traded instead of a marked‑up spread. It shines when precise entries matter, combining exceptional execution quality with ultra‑competitive pricing and reliable fills during fast markets. Traders get access to powerful, state‑of‑the‑art platforms that support advanced charting, one‑click tickets, and robust risk controls. It’s best for scalpers, day traders, and systematic strategies that benefit from tight, predictable all‑in costs.

How To Choose

Pick Standard if simplicity and learning are top priorities. Choose RAW if tight spreads matter and a commission model is acceptable. Match the deposit to the strategy’s risk, drawdown tolerance, and position‑sizing needs.

What is the Minimum Deposit at Forex.com?

The minimum deposit at FOREX.com is $100 for Standard and RAW spread accounts. In practice, the broker suggests about $1,000 for Standard and $2,500 for RAW to trade effectively.

| Broker | Minimum Deposit | Notes |

|---|---|---|

| Forex.com | $100 | Standard requirement for most accounts. |

| OANDA | $0 | No barriers; fund what you want, when you want. |

Pepperstone | $200 | Recommended starting deposit; varies by funding method. |

FXCM | $50 | Lower than many, but not as flexible as OANDA. |

Key Takeaway

- FOREX.com’s $100 entry is modest, but higher deposits help with margin headroom and stable sizing under live volatility.

- OANDA is the most flexible for testing and gradual scaling thanks to a $0 minimum across many entities.

- Pepperstone often allows starting small, though $200 is widely advised to cover margin and costs meaningfully.

- FXCM sets a low $50 threshold that is easy to meet, with regional pages confirming the same baseline in multiple markets.

Deposit and Withdrawal

Funding and withdrawals are fully digital, quick, and straightforward. There are multiple methods, and the broker does not charge fees for moving money in or out.

Deposit Fees & Options

The broker supports a variety of popular deposit methods to ensure convenience for its global client base:

Withdrawal Fees & Options

OANDA’s withdrawal policy is straightforward:

Fees and processing

- No deposit fees from the broker.

- No withdrawal fees.

- Third‑party or bank charges may apply, depending on card issuer, bank, or e‑wallet.

- Processing times vary by method and region; cards and e‑wallets are usually faster than bank transfers.

Practical tips

- Use the same method for deposit and withdrawal to speed up verification.

- Match funding currency to the account’s base currency to avoid conversion costs.

- Ensure KYC is complete before requesting a withdrawal to prevent delays.

Desktop Trading Platform

Forex.com offers two desktop options: Advanced Trading Platform (Desktop) and MetaTrader. For this review, the focus is on the flagship Advanced Trading Platform (Desktop). It feels fast, stable under load, and easy to shape into a multi‑monitor workflow. MetaTrader is still available for EAs and custom indicators, but the native desktop shines for integrated research, smoother navigation, and tighter execution flow.

Features and Functionality

Advanced Charting

Charts load quickly and stay responsive during volatile moves. Indicator depth is strong, drawing tools are snappy, and templates make repeat setups simple.

Market Analysis Tools

Screeners, heatmaps, and sentiment live next to watchlists. Idea discovery is quick and avoids extra tabs.

Real-time Information

Prices, spreads, and depth update with low lag. Fill feedback lands instantly in the ticket and blotter.

Research Integration

Broker research, technical notes, and market overviews open in side panels. It is easy to compare a note with a live chart before placing an order.

Educational Content Integration

Inline tips appear where needed. Short explainers help new users move from reading to placing a trade without leaving the platform.

Placing Orders

Tickets support market, limit, stop, trailing stop, and OCO with time‑in‑force choices. One‑click trading and price tolerance help during news.

Alerts & Notifications

Price, indicator, and news alerts are fast to set and reliable. Order and fill notifications pop in real time.

Login and Security

Login is straightforward with session controls and device trust options. Security settings are simple to manage in the profile.

Search Functions

Search finds symbols by name or ticker and shows spreads, hours, and margin at a glance. Filters narrow by asset class and volatility for faster symbol picks.

Pros & Cons of the Web Platform

Pros

- Advanced Trading is fast, stable, and easy to customize for multi‑monitor workflows.

- Charting depth is strong with many indicators, quick drawing tools, templates, and trade‑from‑chart.

- Integrated research, news, and calendar sit beside charts and tickets for tight analysis‑to‑execution flow.

- One‑click trading, OCO, trailing stops, and price tolerance help during volatile news spikes.

- Performance analytics (PlayMaker/Trading Analytics) surface habits, overtrading, and time‑of‑day weaknesses.

- Clean watchlists, reliable alerts, and instant fill feedback improve situational awareness.

Cons

- Charts feel less smooth than the broker’s web platform with TradingView, especially for rapid markups.

- Window management can get busy when building complex layouts without predefined templates.

- No native social/copy trading in the flagship desktop; requires external ecosystems.

- Learning curve exists for first‑time users setting advanced order preferences and analytics.

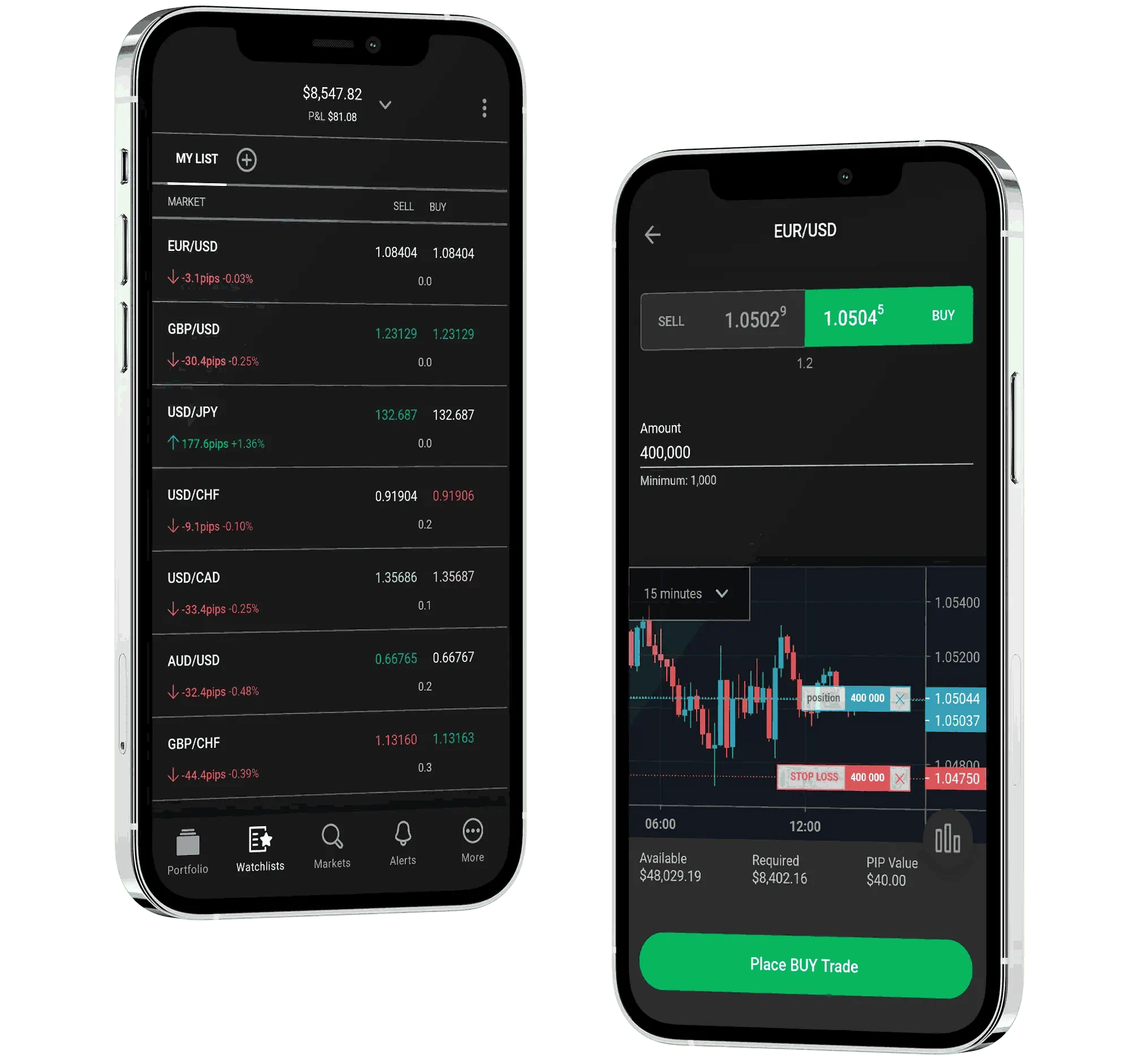

Mobile App

I use the mobile app daily for quick checks and fast entries. It feels smooth, loads charts quickly, and keeps watchlists in sync with desktop. Research, news, and the calendar are a tap away, so I can act without switching apps.

Look & Feel and Features

I like the clean layout and readable charts. Indicators and drawing tools are easy to apply, and templates save time. Watchlists, positions, and the ticket are always close, which keeps decisions quick.

Login and Security

I sign in with biometrics/Face ID. Device trust and basic security controls work as expected. It’s simple to manage from the profile screen.

Search Functions

I can find symbols by name or ticker fast. Results show spreads, hours, and margin at a glance. Filters help me narrow by asset class and popularity.

Placing Orders

I place market, limit, stop, trailing stop, and OCO orders with a few taps. One‑tap trading speeds up entries. Price tolerance helps during fast moves.

Pros & Cons of the Mobile App

Pros

- Smooth performance with a tidy UI.

- Solid charting for a phone, with useful indicators and drawings.

- Fast tickets, synced watchlists, biometrics, and reliable alerts.

Cons

- Limited screen space for multi‑chart views.

- Analytics are lighter than desktop.

- Complex layouts are harder to build on small screens.

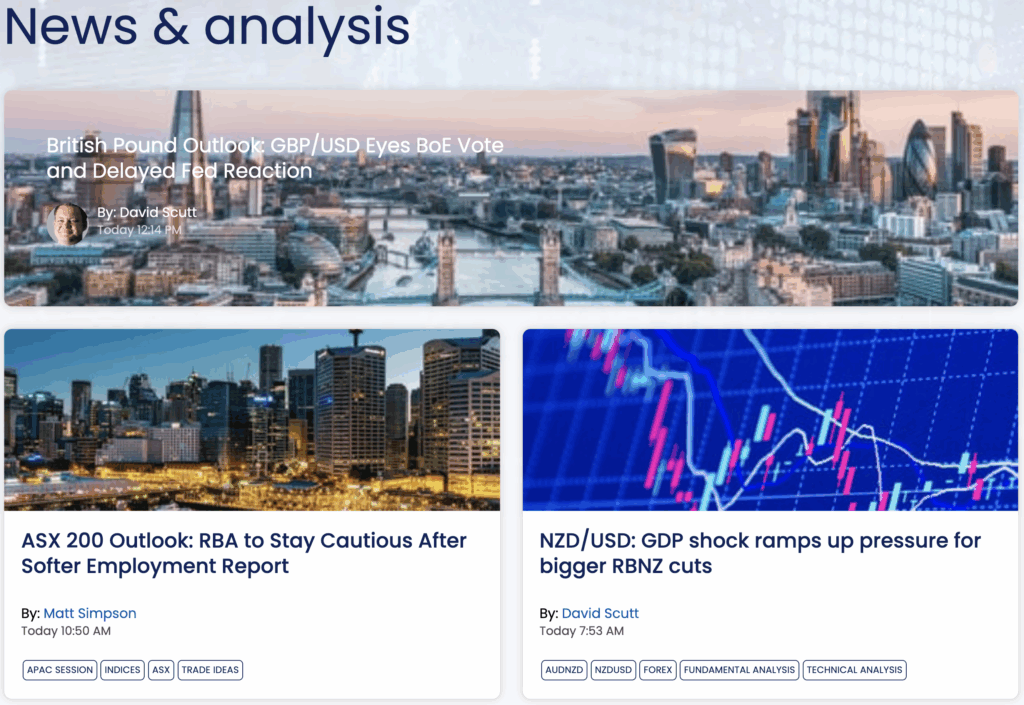

Market Research, Tools, and Education

Forex.com’s strongest edge is research depth, integrated tools, and structured education that connects directly to trading decisions. The in-house global team delivers timely analysis, actionable trade ideas, and event-driven updates that slot neatly into daily prep, while Trading Central adds independent signals and pattern recognition to validate setups from multiple angles.

Together with advanced charts, a rich economic calendar, exclusive performance analytics, and a robust Trading Academy, the stack shortens the path from insight to execution and helps traders improve over time.

Customer Support

Availability

Support operates 24 hours a day, 7 days a week, including weekends and market holidays, so help is always reachable regardless of time zone or trading session.

Quality

Service quality is consistently strong, with helpful agents who respond quickly and resolve most platform, funding, and account queries efficiently; complex issues are escalated cleanly with clear follow‑ups.

Channels

- Phone for urgent, trade‑impacting issues that require immediate action

- Live chat for quick troubleshooting, navigation help, and status updates

- Email for detailed requests, document submissions, and a written audit trail

What to expect

Wait times are generally short, identity verification is straightforward, and guidance covers platform features, order tickets, and common funding steps; if an investigation is needed, next actions and timelines are communicated clearly.

Verdict

Customer support is a clear strength: always‑on availability, responsive agents, and multiple channels provide dependable coverage for both routine questions and urgent trade matters.

FAQ

Is Forex.com a trustworthy broker?

Yes. It’s regulated in major jurisdictions, offers segregated client funds, and has a long operating history with strong oversight and transparent policies.

What is the minimum deposit for Forex.com?

$100 to open a Standard or RAW account, though higher deposits help with margin and position sizing.

Does Forex.com charge withdrawal fees?

No. The broker does not charge deposit or withdrawal fees, though banks or payment processors may.

What trading platforms does Forex.com offer?

Advanced Trading Platform (Desktop, Web, Mobile) and MetaTrader, covering discretionary, indicator‑heavy, and EA workflows.

Is Forex.com good for beginners?

Yes. The Standard account is simple, education is strong, and the platforms are intuitive with embedded tips and research.

How does Forex.com make money?

Primarily from spreads and commissions, plus ancillary services like financing and exchange/conversion where applicable.

Can I trade stocks on Forex.com?

Core offering is forex and CFDs; stock access depends on region and product availability via CFDs rather than direct share dealing in many cases.

Does Forex.com have an inactivity fee?

Policies can vary by region; check the entity’s fee schedule in the account documents to confirm current terms.

Is my money safe with Forex.com?

Client funds are held in segregated accounts, with protections depending on the regulator and entity; this reduces counterparty risk.