Plus500 REVIEW 2025

Thinking about trading CFDs in 2025? Plus500 makes it simple. From forex and stocks to crypto and commodities, it packs a wide range of markets into a clean, easy-to-use platform. In this review, we’ll break down its fees, tools, security, and mobile experience, helping you see if Plus500 is the right fit for your trading style.

Broker Guide's Plus500 Review in 2025

When I first started looking into Plus500, I wanted to see if it was more than just another big name in CFD trading. On the surface, it looks simple—maybe even too simple compared to brokers that pack in endless features. But after digging deeper and actually testing the platform, I realized that its strength lies in that very simplicity. It’s fast, easy to use, and backed by serious regulation. The real question is whether that’s enough for traders in 2025. Let’s break it down.

About Plus500

Plus500 was founded in 2008 in Israel with one simple idea—make online trading accessible to anyone. What started as a small operation has grown into a global broker that now serves millions of clients. The company is publicly listed on the London Stock Exchange (FTSE 250), which means it operates with transparency and oversight that many private brokers can’t match.

Over the years, Plus500 has expanded into more than 70 countries. From Europe to Asia and beyond, it has become one of the most recognized names in retail trading. Its growth has been driven by a clear focus on offering a wide range of markets through CFD trading. With CFDs, traders can speculate on price moves without owning the actual asset. That means you can go long or short on forex, stocks, indices, commodities, ETFs, and even cryptocurrencies—all from the same account.

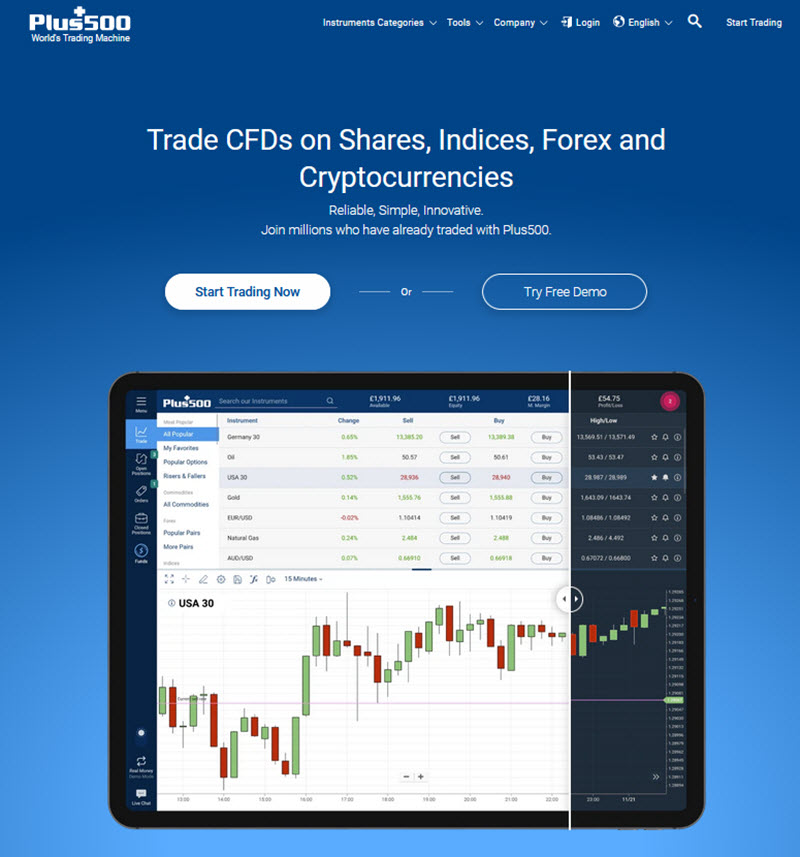

What really defines Plus500, though, is its platform. The interface is stripped back and straightforward. You don’t have to dig through menus or learn complicated tools just to place a trade. For beginners, that simplicity is a huge plus. You get a clear view of prices, easy order placement, and built-in risk management tools like stop losses and guaranteed stop orders.

That doesn’t mean it’s just for new traders. Many experienced users stick with Plus500 because of its reliability and speed. The platform works smoothly across desktop and mobile, with the app becoming a favorite for people who trade on the go.

In short, Plus500 isn’t trying to be everything for everyone. It doesn’t overload you with research reports or third-party platforms. Instead, it focuses on being a safe, regulated, and easy-to-use broker for trading CFDs worldwide.

My Quick Verdict: Who is Plus500 Best For?

After spending time with Plus500, I can say its biggest strength is its simplicity. The platform is built for traders who don’t want to wrestle with complicated menus or overly technical tools. Everything feels intuitive—placing a trade, checking your positions, or setting up a stop loss takes just a few clicks. Add in strong regulation across multiple regions and a wide range of CFDs covering forex, stocks, indices, commodities, ETFs, and crypto, and you’ve got a broker that delivers a solid, safe experience.

But that simplicity comes with trade-offs. If you’re the type of trader who thrives on in-depth research, detailed analytics, or advanced charting, you might find the platform limited. The absence of MT4 or MT5 means no automated trading or custom indicators, which could be a dealbreaker for experienced or algorithmic traders.

So who is Plus500 best for? I’d recommend it to beginners, casual traders, and anyone who values a clean interface over complex features. It’s also ideal for those who prefer mobile-first trading since the app is one of the smoothest I’ve used. If your style is quick, straightforward trades without the need for technical add-ons, Plus500 fits perfectly.

On the other hand, if you rely heavily on expert research, advanced chart setups, or third-party integrations, this broker probably won’t meet your needs. For me, the verdict is clear: Plus500 is trying to be simple, safe, and accessible. And for many traders in 2025, that’s exactly what they’re looking for.

Pros

Pros

- Simplicity – The platform is easy to use, with no clutter or confusing menus.

- No commission – Trading costs are built into the spread, making fees straightforward.

- Strong regulation – Supervised by multiple top-tier regulators and listed on the London Stock Exchange.

- Negative balance protection – You can’t lose more than the funds you deposit.

- Fast account setup – Verification is usually completed within a day.

- Mobile app – Clean, responsive, and great for trading on the go.

- Wide asset coverage – CFDs on forex, stocks, indices, commodities, ETFs, and cryptocurrencies.

Cons

- CFD-only – No option to own real stocks or cryptocurrencies.

- Inactivity fee – A monthly charge applies after three months of no trading.

- No advanced platforms – Lacks MT4/MT5 and support for automated trading.

- Limited research and education – Fewer market insights, learning tools, and analysis than some competitors.

Why You Should Choose Plus500 ?

One of the main reasons traders continue to choose Plus500 is trust. The broker is a publicly listed company on the London Stock Exchange and operates under the supervision of top-tier regulators such as the FCA, ASIC, and CySEC. With segregated client funds and negative balance protection, Plus500 provides safeguards that give retail traders a strong sense of security.

Simple and User-Friendly Platform

Plus500 has built its reputation on offering a platform that prioritizes simplicity. The interface is clean, straightforward, and free of unnecessary clutter. Traders can open or close positions quickly, access risk management tools like stop losses, and view real-time prices without navigating complex menus. This focus on usability makes it an attractive choice for beginners and casual traders who want a less overwhelming experience.

Mobile-First Trading Experience

In 2025, mobile trading continues to dominate, and Plus500’s app stands out as one of the most polished in the industry. It mirrors the web platform in both design and functionality, allowing traders to monitor charts, manage positions, and execute trades with ease. For those who prefer trading on the go, the app is a major advantage.

Clear Trade-Offs

Of course, Plus500 is not without its limitations. It remains a CFD-only broker, meaning traders cannot own physical shares or cryptocurrencies. The lack of MT4 and MT5 support will also deter those who rely on advanced trading strategies or automated systems. In addition, research and educational content is limited compared to more resource-heavy brokers.

The Bottom Line

For traders who value a secure, regulated, and straightforward broker with a strong mobile offering, Plus500 remains a top contender in 2025. While it may not satisfy advanced traders seeking complex tools, it delivers reliability and ease of use for the majority of retail clients.

Compare to Top Competitors

When looking at brokers in 2025, it helps to see how Plus500 stacks up against some of the industry’s biggest names. Each competitor brings a different strength to the table, catering to different types of traders. Here’s how Plus500 compares with FOREX.com, FP Markets, and eToro.

FOREX.com

FP Markets

eToro

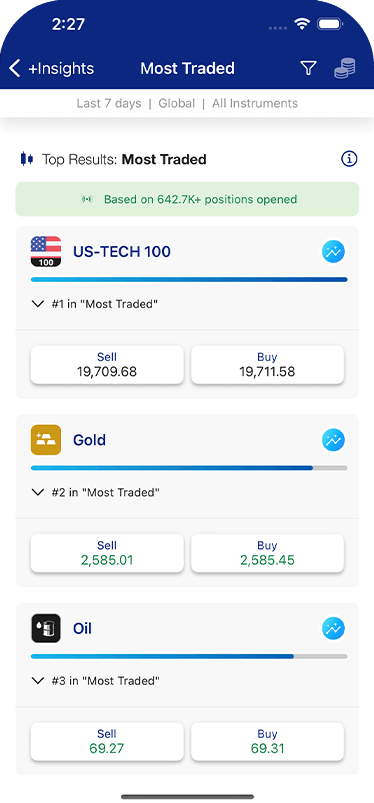

Exploring Plus500's Range of Tradable Instruments

One of the main attractions of Plus500 is the sheer variety of markets available to trade. The broker is entirely focused on CFDs (Contracts for Difference), which means traders can speculate on the price movements of different assets without owning them directly. From forex to stocks, indices, commodities, ETFs, and even cryptocurrencies, the range is broad enough to cover most trading interests.

Forex CFDs

Forex is at the heart of CFD trading, and Plus500 offers access to a wide selection of currency pairs. Traders can choose from major pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor pairs and more volatile exotics like USD/TRY or EUR/ZAR. The spreads are competitive, and the platform makes it easy to switch between pairs and track live exchange rates. Leverage on forex CFDs can be significant, depending on the regulatory region, but traders should be mindful that higher leverage also increases risk.

Stock CFDs

Plus500 also gives traders the ability to speculate on some of the world’s biggest companies without owning the shares outright. From global giants like Apple, Tesla, Amazon, and Microsoft to regional favorites in Europe, Asia, and Australia, the stock coverage is extensive. This allows traders to benefit from market moves in individual companies or diversify their strategies across multiple sectors. Unlike brokers that offer real share ownership, all trading here is CFD-based, which is better suited to short-term speculation rather than long-term investing.

Indices and Commodities

For those who prefer trading markets as a whole, Plus500 offers a strong lineup of index CFDs, including the S&P 500, FTSE 100, DAX 40, and Nikkei 225. These instruments are popular with traders who want broad exposure to economies rather than individual stocks. Commodities are also well covered, ranging from gold, silver, and oil to agricultural products like wheat and soybeans. With commodities, volatility often runs high, and leverage can magnify both opportunities and risks.

ETFs

Another useful feature of Plus500’s instrument list is access to ETF CFDs. These allow traders to speculate on baskets of assets—such as technology-focused ETFs or market index trackers—without having to buy into the fund directly. ETFs can provide diversification in a single trade, making them a flexible option for traders who want exposure to a broader theme or sector.

Cryptocurrency CFDs

For traders looking at digital assets, Plus500 offers crypto CFDs on popular coins such as Bitcoin, Ethereum, Litecoin, and Ripple. The advantage here is that there’s no need to set up a crypto wallet or deal with exchanges. However, it’s important to note that crypto CFDs are banned in certain jurisdictions like the UK, so availability will depend on the trader’s location. Spreads can also be wider compared to traditional markets due to the inherent volatility of cryptocurrencies.

| Asset | Plus500 |

|---|---|

| Forex Pairs | 65 |

| Tradeable Symbols | 5500 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | No |

| Cryptocurrency | Physical: No Derivative: Yes |

Depth of Choice and Comparisons

Compared to some competitors, Plus500’s instrument list is impressive for a CFD-focused broker. While it doesn’t provide real asset ownership like eToro or direct market access like FP Markets, it covers nearly every major asset class that retail traders look for. This makes it a versatile choice for those who want to switch between forex, stocks, commodities, and crypto without juggling multiple accounts.

Leverage and Risk Warnings

As with most CFD brokers, leverage is available but capped differently depending on the regulator. In the EU and UK, leverage is generally limited to 30:1 on major forex pairs and lower for stocks and crypto. Professional clients may qualify for higher ratios. While leverage can amplify profits, traders should remember that it also magnifies losses, which is why Plus500 highlights risk warnings throughout the platform.

Final Thoughts on Instruments

Overall, Plus500’s selection of tradable instruments strikes a good balance between variety and accessibility. The focus on CFDs keeps things simple while still giving traders exposure to global markets. Whether it’s currencies, global tech stocks, or commodities, Plus500 provides enough range to satisfy most retail traders—while reminding them of the risks that come with leveraged trading.

How Plus500 Instruments Compare to Competitors

While Plus500 offers a wide CFD lineup, it’s useful to see how it stacks up against other well-known brokers. Here’s a snapshot:

| Asset | Plus500 | FOREX.com | FP Markets | eToro |

|---|---|---|---|---|

| Forex CFDs | ||||

| Stock CFDs | ||||

| ETFs | ||||

| Indices | ||||

| Commodities | ||||

| Crypto CFDs | ||||

| Options | ||||

| Futures | Only for U.S. market |

Plus500 is one of the few brokers that offers options trading alongside CFDs, giving traders extra flexibility. However, it does not provide access to futures, which are available at some competitors like FP Markets and FOREX.com.

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | €50 |

| Average Spread EUR/USD (Standard) | 1.3 pips |

All-in Cost EUR/USD - Active | 1.3 pips |

Stock CFD Fees | High |

Index CFD Fees | Average |

| Forex CFD Fees | Low |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | An inactivity fee of $10 per month after 3 months of inactivity |

Understanding how a broker charges its clients is critical for any trader. Plus500 keeps things relatively straightforward by operating on a spread-only pricing model, meaning there are no direct trading commissions added to your orders. Instead, all costs are built into the bid-ask spread. This simplicity is appealing for beginners who want predictable pricing without hidden layers of fees. However, like any broker, Plus500 does have other costs such as overnight financing and non-trading charges that traders should be aware of. Below is a detailed breakdown of the fee structure in 2025.

Trading Fees

The most important cost for active traders is the spread, which is the difference between the buy and sell price. Plus500’s spreads vary depending on the asset class, and while they are competitive in some areas, they are slightly wider in others compared to brokers that specialize in raw-spread pricing.

Forex

Major currency pairs like EUR/USD typically start around 0.8–1.1 pips, which is reasonable but not as tight as what you might find with ECN brokers like FP Markets. Minor and exotic pairs naturally come with higher spreads due to lower liquidity.

Indices

From 0.02% to 0.20%+1.0 (markup x volume). Popular indices such as the S&P 500 and NASDAQ carry spreads that are generally in line with industry averages, though active day traders might notice they’re not the tightest in the market.

Stocks

When trading stock CFDs, spreads can vary significantly depending on the company. High-volume names like Apple or Tesla usually offer tighter spreads than smaller-cap stocks.

Cryptocurrencies

From 0.25% to 2.50%. Spreads here tend to be wider compared to forex or indices, which is common across most brokers due to crypto market volatility.

Another key point is the zero commission model. Unlike brokers that charge both spreads and commissions, Plus500 keeps pricing simple: traders only pay the spread. For beginners or casual traders, this approach is easier to understand, though professionals may prefer raw-spread accounts from brokers like FOREX.com or FP Markets.

In comparison to competitors, Plus500’s spreads are not the lowest, but the broker balances this with ease of use and transparency. The absence of commission charges makes it predictable, and for traders who value a straightforward approach over ultra-tight spreads, this model works well.

Other Trading Costs

Beyond spreads, traders should also account for overnight financing fees, also called swap rates. These are applied when positions are held open past market close and vary by instrument. For example, holding a forex or commodity CFD overnight may incur a small percentage-based fee, which can add up for long-term traders.

Another notable cost is the Guaranteed Stop Order (GSLO) fee. This optional feature ensures a position closes at your chosen level even during market gaps or volatility. While GSLOs add a small premium to the spread, they provide extra security for traders who want to lock in risk limits.

Overall, while these costs are standard across CFD brokers, it’s important for traders to factor them into longer-term strategies.

Non-Trading Fees

In addition to trading-related costs, Plus500 applies a few non-trading fees that are worth noting.

- Inactivity Fee: After three months of no login activity, Plus500 charges a $10 per month inactivity fee. This is a common practice among brokers, though it can catch out casual users who trade infrequently. Regular platform logins are enough to avoid the charge.

- Currency Conversion Fee: When you trade an asset denominated in a currency different from your account base currency, a conversion fee of around 0.7% is applied. This can add up if you frequently trade international markets.

- Payment-Related Costs: Deposits are generally free, but certain withdrawal methods may incur small processing fees, depending on the region or payment provider. Plus500 does not impose large flat withdrawal charges, making it relatively cost-efficient compared to brokers with higher transaction fees.

While none of these fees are excessive, they can impact returns over time if overlooked. Active traders will mainly notice spreads and financing rates, while casual traders should be mindful of inactivity charges.

Bottomline

Plus500’s pricing model is simple and transparent, with spreads forming the backbone of costs and no trading commissions. While competitors may offer tighter raw spreads, Plus500 appeals to those who prefer predictable pricing and a clean structure.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Plus500 Regulated ?

Yes, Plus500 is a highly regulated broker, operating under multiple top-tier authorities across the globe. It is authorized and supervised by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Monetary Authority of Singapore (MAS), the Financial Markets Authority (FMA) in New Zealand, and the Financial Sector Conduct Authority (FSCA) in South Africa. This broad regulatory footprint allows Plus500 to legally serve clients in more than 70 countries.

Each license requires the broker to comply with strict rules on capital adequacy, risk management, and client protection. For example, the FCA and ASIC are recognized for their rigorous oversight, often regarded as benchmarks of trust in the financial services industry. CySEC ensures compliance within the EU, while MAS and FMA expand the broker’s credibility in Asia-Pacific markets.

For traders, strong regulation means greater confidence in fund safety and fair dealing practices. It also means disputes can be escalated to independent financial ombudsmen, and brokers are required to keep transparent operational standards.

In short, Plus500’s multi-jurisdictional regulation shows it is not a fly-by-night broker but a stable, internationally recognized platform. This is one of the main reasons retail traders continue to trust it in 2025.

Understanding Regulatory Protections and Broker Stability

Regulation isn’t just a formality—it directly impacts how safe traders’ money is. With Plus500, several key protections are built into the structure of the business.

Client Fund Segregation

All client deposits are held in segregated bank accounts, separate from the company’s own funds. This ensures that trader money cannot be used for the broker’s operational expenses, and in the event of financial difficulties, client funds remain protected.

Negative Balance Protection

Plus500 also provides negative balance protection, meaning traders cannot lose more than their initial deposit. This is particularly important in volatile markets, where sudden price gaps could otherwise result in traders owing more than they invested.

Publicly Listed Transparency

Unlike many brokers, Plus500 is a publicly listed company on the London Stock Exchange (LSE). Being a listed entity means the firm must publish financial statements, undergo regular audits, and adhere to strict corporate governance rules. This level of transparency is rare among retail brokers and gives traders additional assurance of stability.

Investor Protection Schemes

Depending on jurisdiction, Plus500 clients may also benefit from compensation schemes. For example, traders under the UK’s FCA are covered by the Financial Services Compensation Scheme (FSCS), which protects eligible client funds up to £85,000 if the broker becomes insolvent. Similarly, CySEC-regulated clients may be covered by the Investor Compensation Fund (ICF) up to €20,000.

Taken together, these protections make Plus500 one of the more secure choices in the CFD space. While no broker is risk-free, the combination of multi-jurisdictional licenses, segregation of funds, negative balance protection, and the accountability of being publicly listed gives traders confidence that their broker is both stable and trustworthy.

How To Open an Account

Opening an account with Plus500 is designed to be quick and hassle-free, even for new traders. The process is fully digital and can be completed online or through the mobile app. Here’s what to expect:

Registration

Start by visiting the Plus500 website or downloading the app. You’ll need to provide some basic personal information such as your name, email address, phone number, and country of residence. A password is then created to secure your account.

You can also create an account using your Gmail, Facebook account or Apple account.

ID Verification (KYC)

Like all regulated brokers, Plus500 follows Know Your Customer (KYC) rules. You’ll be asked to upload a valid government-issued ID (such as a passport or driver’s license) and a proof of address (utility bill or bank statement). Documents are reviewed electronically, and in most cases, this process is completed within one business day.

Account Approval

Once your documents are verified, your account is activated. Approval is typically fast—many traders report being able to start trading within 24 hours of submitting their application.

Funding and Trading

After approval, you can make your first deposit using one of the supported payment methods and begin trading. Plus500 also provides a free demo account, which is available even before full verification. This demo mode comes with virtual funds and is an excellent way to practice strategies, explore the platform, and get comfortable before risking real money.

Overall, the process is straightforward, with most new clients able to open, verify, and start trading within a day. The addition of a demo account ensures that both beginners and experienced traders can ease into the platform at their own pace.

Account Types

Unlike some brokers that offer multiple tiers of accounts, Plus500 keeps things simple with a single live account type. Every trader gets access to the same features, pricing model, and instruments, regardless of their deposit size. This approach avoids confusion and ensures that all clients are treated equally.

There are, however, some distinctions worth noting:

Retail Account

This is the standard account type for most users. It includes features like negative balance protection and access to all CFDs on the platform. Leverage is capped according to regulatory rules in your jurisdiction (e.g., up to 1:30 in the EU and UK).

Professional Account

Experienced traders who meet certain criteria (such as large trading volume, financial instrument portfolio over €500,000, or relevant work experience) can apply for a professional status account. This offers higher leverage but removes some retail protections, such as compensation schemes.

Demo Account

Available for free, the demo account mirrors the live platform but uses virtual funds. It can be used indefinitely, making it an excellent tool for practice and learning.

What is the Minimum Deposit at Plus500

Plus500 keeps the minimum deposit requirement low, making it accessible to most retail traders. The typical minimum is $100 (or the equivalent in your account’s base currency), though this may vary slightly depending on the payment method and region. For example, certain countries such as the UK and Germany, the minimum deposit is €50.

This flexibility ensures that both casual traders and those looking to commit more capital can find a funding option that suits their needs. Importantly, deposits are free of broker fees, and the low entry point makes Plus500 attractive for beginners.

| Broker | Minimum Deposit |

|---|---|

Plus500 | €50 |

| FOREX.com | $100 |

FP Markets | $100 |

| eToro | $50 |

Deposit and Withdrawal

Managing funds on Plus500 is designed to be straightforward, with multiple methods supported for both deposits and withdrawals. The broker emphasizes transparency by keeping fees low and ensuring most transactions are processed quickly. Traders can choose from a variety of payment options, and while deposits are typically free, withdrawal rules are slightly more structured. Below is a closer look at how deposits and withdrawals work in 2025.

Deposit Fees & Options

Depositing money into your Plus500 account is simple and free of charge. The broker does not add fees on top of deposits, which makes funding your account cost-efficient compared to platforms that charge for incoming payments.

Available methods include:

The minimum deposit is $100, though for bank transfers the required amount may be higher in some regions. Most deposits appear instantly in your account when using cards or e-wallets, allowing traders to start trading without delay.

Overall, Plus500’s deposit process is efficient, free, and flexible, making it easy to fund your account whether you prefer traditional banking or digital wallets.

Withdrawal Fees & Options

Withdrawals at Plus500 are also straightforward, but they follow a more structured system. Traders benefit from five free withdrawals per month. After that, a small processing fee applies for additional withdrawals within the same month.

Available withdrawal methods include:

Each method has a minimum withdrawal amount, typically around $50 for cards and e-wallets, and $100 for bank transfers. Requests are usually processed within 1–3 business days, though the exact time may depend on your bank or payment provider.

Importantly, Plus500 does not add heavy fees on top of withdrawals, making it cost-effective compared to brokers that charge flat transaction fees. Still, traders should keep the minimum withdrawal requirements in mind, especially when using bank transfers.

In short, the system is designed to be transparent, reliable, and fair, giving traders predictable access to their funds without unnecessary costs.

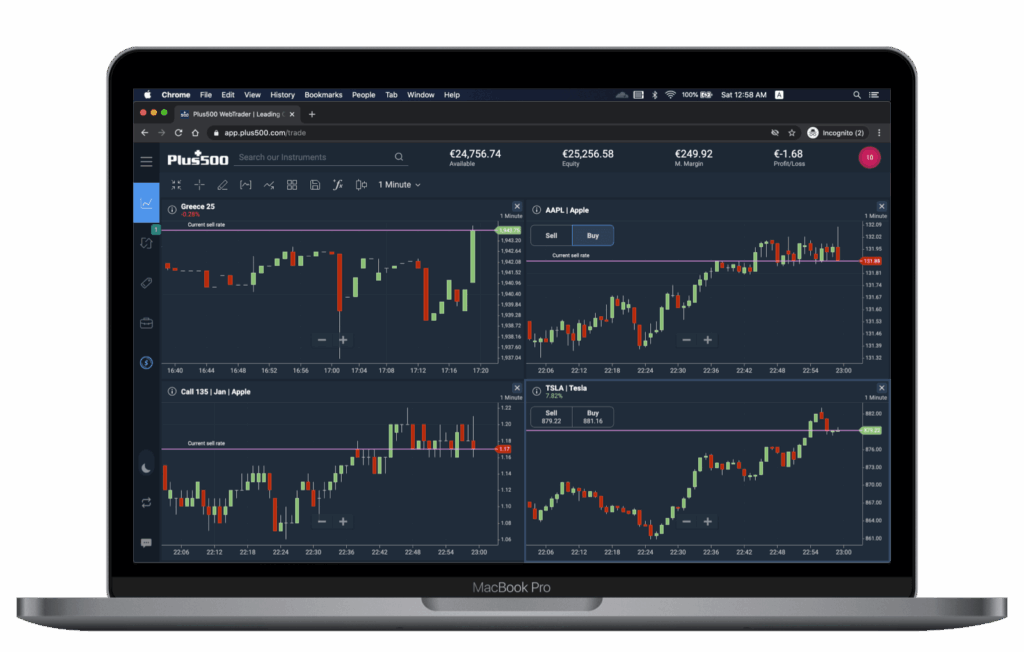

Web Trading Platform

The Plus500 WebTrader is designed for accessibility and ease of use. Unlike some brokers that focus on advanced platforms like MT4 or TWS, Plus500 keeps things streamlined, making it approachable for beginners while still offering enough features for casual traders. Below is a breakdown of the platform’s key functions.

Features and Functionality

Advanced Charting

Charts on Plus500 are clean and easy to navigate. Users can apply dozens of technical indicators, including moving averages, RSI, and Bollinger Bands. Basic drawing tools allow traders to mark trendlines or support and resistance zones, but the charting suite is not as extensive as professional platforms. Multi-timeframe analysis is available, but customization remains limited compared to specialist charting software.

Market Analysis Tools

Plus500 offers a selection of built-in analysis tools, though they are relatively light. Traders can view instrument-specific stats like daily highs and lows, percentage changes, and trading sentiment (the percentage of buyers vs sellers on the platform). However, it does not provide complex screeners or market scanners.

Real-time Information

The platform streams real-time quotes and pricing, ensuring that traders can make decisions based on up-to-date data. Market depth is not included, but price updates are fast and reliable, covering all asset classes offered.

Research Integration

Unlike some competitors, Plus500 does not directly integrate third-party research reports or analyst ratings into its platform. Research is limited to basic market commentary and price alerts, so traders who rely heavily on in-depth reports may find the platform lacking.

Educational Content Integration

Educational resources are not built into the WebTrader itself. Instead, Plus500 provides separate guides and tutorials on its website to help users understand the basics of CFD trading and risk management. These are sufficient for beginners but fall short of advanced learning materials.

Placing Orders

Order placement is straightforward. Traders can execute market, limit, and stop orders, as well as set Guaranteed Stop Orders (GSOs) for additional protection. The order ticket is easy to fill out and includes clear displays of margin requirements and potential risks.

Alerts & Notifications

The platform supports price alerts and push notifications. Traders can set alerts for specific price levels or percentage movements, and notifications can be delivered via web pop-ups, email, or directly to the mobile app.

Login and Security

Security is reinforced with two-factor authentication (2FA), alongside SSL encryption and standard account protection features. Traders can also enable account alerts to monitor any unusual login activity.

Search Functions

The search bar is simple but effective. Users can type a ticker symbol or instrument name to quickly locate stocks, forex pairs, indices, or commodities. Results load instantly, making navigation smooth even for beginners.

Pros & Cons of the Web Platform

Pros

- Simple and intuitive interface that makes trading accessible even for beginners.

- Browser-based access with no downloads, so you can trade from any device.

- Real-time quotes and fast execution, ensuring smooth order placement.

- Strong risk management tools like Stop Loss, Take Profit, and Guaranteed Stop Orders.

Cons

- Limited advanced charting compared to platforms like MT4 or TradingView.

- Lack of customization, with no support for custom indicators or automated trading.

- Restricted research tools, offering only basic market insights.

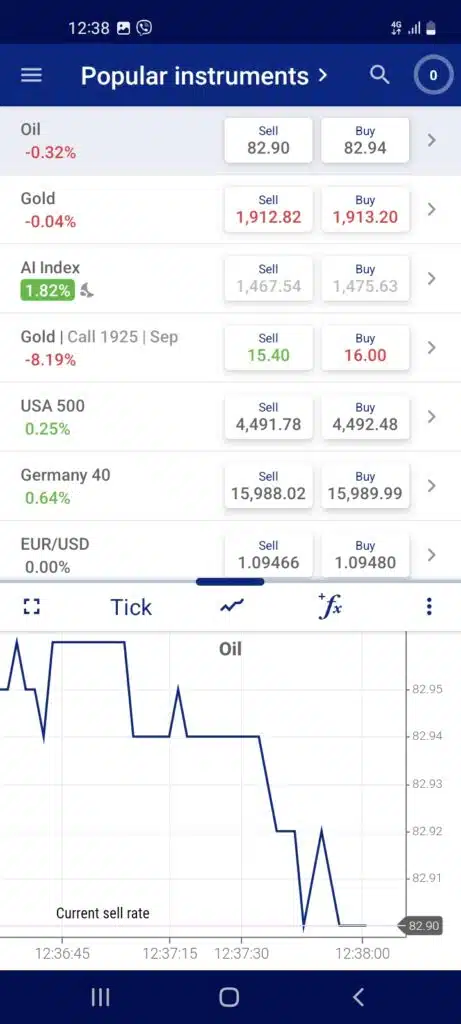

Mobile App

The Plus500 mobile app mirrors the WebTrader’s simplicity and is designed for traders who want to manage positions on the go. Available for iOS and Android, it delivers a smooth, intuitive interface that prioritizes usability while keeping all essential trading functions within reach.

Advanced Charting

Charts on the mobile app are responsive and include the same set of technical indicators and drawing tools as the web platform. Multi-timeframe views are available, though the smaller screen naturally limits advanced charting analysis. For quick technical checks, however, the app performs well.

Market Analysis Tools

The app provides traders with basic market insights, including daily performance data, percentage change, and client sentiment indicators. However, like the web version, it does not feature sophisticated screeners or multi-asset scanners.

Real-Time Information

Users receive real-time price updates and live quotes, ensuring that trading decisions are based on current market conditions. Execution speed is strong, with minimal delays even on mobile data connections.

Research Integration

There is no dedicated research integration within the mobile app. Traders won’t find third-party reports or analyst forecasts directly in the app, so those who rely on in-depth research may need external sources.

Educational Content Integration

Educational material is not directly embedded into the app. Instead, users can access guides and tutorials via Plus500’s website. The app is geared more toward trading execution than learning.

Placing Orders

The order process is fast and intuitive. Traders can place market, limit, stop, and Guaranteed Stop Orders (GSOs) directly from the app. Margin requirements and risk levels are clearly displayed before confirmation, helping traders avoid mistakes.

Login and Security

Security on the app includes two-factor authentication (2FA), biometric login options (fingerprint or Face ID), and strong data encryption. These features add convenience without compromising safety.

Search Functions

The mobile search function is quick and user-friendly. Traders can easily find instruments by typing either the ticker symbol or company/asset name, and results appear instantly.

Pros & Cons of the Mobile App

Pros

- Clean and easy-to-use design, perfect for traders who want simplicity on the go.

- Seamless syncing with the web platform, so trades and settings carry over smoothly.

- Push notifications and alerts, helping traders stay updated on price movements and account activity.

- Fast execution speed, ensuring orders are placed quickly even on mobile networks.

Cons

- Limited charting tools, with fewer indicators and less customization than desktop platforms.

- Small screen restrictions, which can make detailed analysis difficult.

- Basic research and education features, offering only market updates rather than in-depth insights.

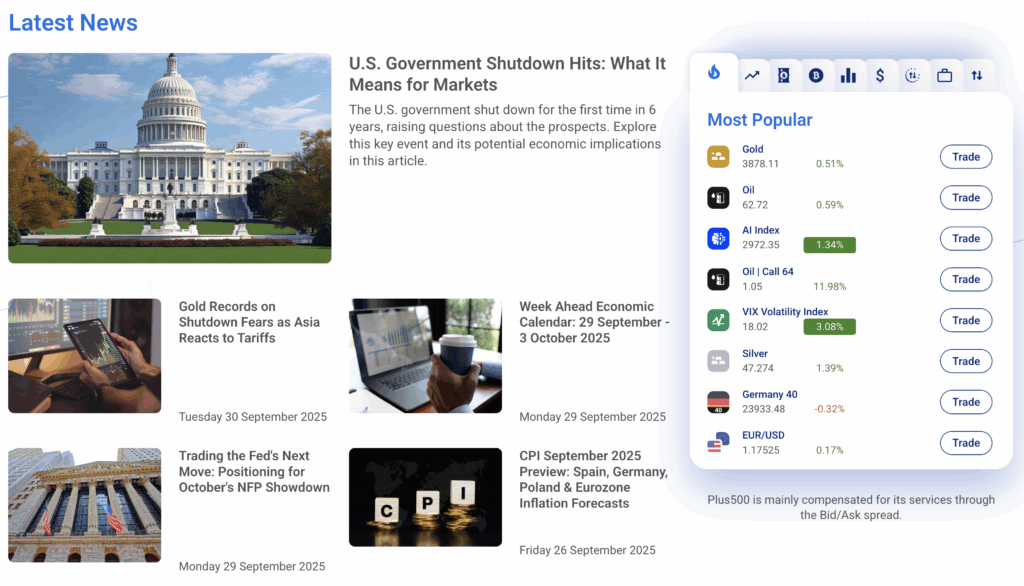

Market Research, Tools, and Education

Market research and educational resources can make or break a broker for certain types of traders. While some platforms provide a full suite of in-depth reports and advanced analysis tools, Plus500 takes a different approach—focusing on the basics that help users manage trades efficiently without overwhelming them.

Customer Support

Customer support plays a critical role in a trader’s overall experience. When issues arise—whether related to accounts, funding, or the platform—fast and reliable help can make all the difference. Plus500 provides support that prioritizes speed and accessibility, but with a narrower scope than some competitors.

Support Channels

Traders can reach Plus500’s support team 24/7 via live chat or email. Live chat is the standout option, usually resolving issues within minutes. Email responses vary but generally take a few hours to one business day. However, the absence of phone support is a limitation for users who prefer voice communication.

Service Quality

Feedback indicates that Plus500’s support agents are polite, professional, and effective at resolving most account-related issues. The platform also provides a Help Center with answers to common questions, reducing the need for direct contact. Compared to brokers like eToro or Forex.com, Plus500’s offering is narrower but sufficient for most traders.

Availability and Accessibility

Support is available around the clock, which is a major plus for traders across different time zones. This 24/7 coverage ensures assistance is never far away, even during busy trading sessions.

Verdict

Plus500’s support is efficient and reliable for most day-to-day issues, with live chat as the strongest channel. The lack of phone support may disappoint some, but for traders comfortable with digital communication, the 24/7 availability offers solid peace of mind.

FAQ

Is Plus500 good for beginners?

Yes. The platform is designed with simplicity in mind, making it easy for new traders to navigate. The unlimited demo account is also a great tool for practicing before trading with real money.

What is the minimum deposit at Plus500?

The minimum deposit varies by payment method but generally starts at $100. This makes it accessible to traders with a smaller budget who want to test the platform without committing too much capital.

Does Plus500 charge commissions?

No. Plus500 operates on a spread-only model, meaning traders don’t pay separate commissions. Costs are included in the difference between the buy and sell prices.

Can experienced traders use Plus500 effectively?

Yes, but with limitations. While the platform is reliable and regulated, it lacks advanced research tools, algorithmic trading, and third-party integrations that many professional traders expect.

What assets can I trade with Plus500?

Plus500 offers CFDs on forex, stocks, indices, commodities, ETFs, options, and cryptocurrencies. However, it does not provide direct ownership of the underlying assets.

Are there inactivity fees?

Yes. If you don’t log in for three months, Plus500 charges an inactivity fee of $10 per month until activity resumes.

Do I need to worry about taxes on my Plus500 trades?

Yes. Profits made on Plus500 may be subject to capital gains tax or income tax, depending on your country of residence. It’s recommended to consult a tax professional to understand your obligations.

Can I trade with a very small budget?

Yes. Since the minimum deposit is low and you can trade in small contract sizes, Plus500 is suitable for those starting with limited funds. However, because all instruments are CFDs, trading involves high leverage and risk, so careful money management is essential.

How are deposits and withdrawals handled?

Deposits are free, and withdrawals come with five free transactions per month. Processing typically takes 1–3 business days, depending on the method.