AVATRADE REVIEW 2025

Curious if AvaTrade finally nails that “easy to start, serious to scale” balance in 2025? Picture a clean WebTrader for quick entries, MT4/MT5 when the setup gets technical, and extras like AvaProtect and Trading Central to keep risk and research tight. Add AvaOptions for defined‑risk plays, AvaFutures for listed markets, and AvaSocial if copy trading is on the roadmap. It’s not trying to undercut raw‑spread ECNs or win a pro charting arms race—but if predictable costs, solid guardrails, and a real learning path matter, this one’s worth a closer look.

Broker Guide's Forex.com Review in 2025

If a broker that’s been around since 2006 with global regulation and a packed toolkit sounds appealing, AvaTrade fits that bill. It lets traders access forex, indices, stocks, commodities, crypto, ETFs, options, and even exchange‑traded futures, with platforms for every style—WebTrader and AvaTradeGO for simplicity, MT4/MT5 for depth and automation, and AvaOptions if options are on the roadmap; copy trading is covered via popular integrations and a native social layer.

On costs and safety, AvaTrade keeps it straightforward: fixed spreads instead of per‑trade commissions, a low $100 minimum to get started, and negative balance protection to help guard against the worst‑case scenario. There’s also AvaProtect—an optional loss‑protection add‑on on select platforms—so a trade can be insured for a chosen window in exchange for a quoted fee, adding an extra layer of risk control for cautious traders.

About Avatrade

Headquartered in Dublin, AvaTrade is regulated in the EU by the Central Bank of Ireland (C53877) and operates a multi‑entity structure that includes CySEC, ASIC, FSCA, BVI, JFSA/FFAJ, ADGM FRSA, and ISA oversight.

That footprint helps the broker serve 400k+ clients worldwide with multi‑language support, local phone lines in many markets, and localized funding options that align with regional payment habits and compliance standards. Beyond the regulatory breadth, the brand’s long operating history (since 2006) and multi‑region office network contribute to operational resilience, faster support routing, and region‑aware onboarding.

Traders benefit from a consistent, fixed‑spread model and a toolset that spans education, Trading Central integrations, and copy‑trading connectivity—features that align well with beginners and intermediate users building confidence while scaling strategies.

Product access and leverage at AvaTrade depend on the client’s onboarding entity, country of residence, and chosen platform—key factors that determine what instruments are enabled and at what margin levels.

MT5 and WebTrader typically surface the broadest symbol lists for CFDs across FX, indices, stocks, commodities, ETFs, and crypto‑CFDs, making them the default for traders who want maximum coverage in one place. For specialized workflows, AvaOptions is required to trade vanilla FX options with a full strategy interface, while AvaFutures is needed for exchange‑traded futures on venues like CME/Eurex; both are separate account environments tailored to their products.

Practically, that means traders can start broad on MT5/WebTrader, then add dedicated options or futures accounts as strategies evolve—retaining a single brand relationship while expanding into more advanced instruments under consistent support, funding, and risk controls.

My Quick Verdict: Who is Avatrade Best For?

Our rating: 4.4/5

Best for: beginners, social/copy traders, and options‑curious users who want an all‑in‑one setup with platform choice, structured education, and predictable fixed‑spread pricing.

Ideal for: traders who value commission‑free CFDs, negative balance protection, and the option to add AvaProtect for defined downside—while having room to grow into MT4/MT5 automation, AvaOptions, and AvaFutures as strategies mature.

Why it stands out

- Breadth without overwhelm: the lineup spans WebTrader/AvaTradeGO for ease, MT4/MT5 for custom indicators and automation, plus dedicated environments for options and exchange‑traded futures—so scaling from basics to advanced feels natural.

- Predictable costs and guardrails: fixed spreads and no trade commissions simplify comparisons, while negative balance protection and optional AvaProtect add clear risk‑control levers for newer and risk‑aware traders.

- Education and copy trading: a strong educational library, Trading Central integrations, and social/copy access (AvaSocial, ZuluTrade, DupliTrade) help shorten the learning curve and provide idea flow when building a routine.

Who gets the most value

- New and intermediate traders wanting a “learn‑by‑doing” path with built‑in education, simple pricing, and easy‑to‑use mobile/web platforms.

- Multi‑strategy testers who might start with CFDs and later branch into options (via AvaOptions) or listed futures (via AvaFutures) without switching brokers.

- Copy‑trade explorers who prefer to follow and mirror strategies while gradually developing their own playbook.

Trade‑offs to note

- Inactivity and administration fees apply on dormant accounts, so active use is encouraged to avoid those charges.

- FCA coverage is limited; regulation is solid elsewhere, but UK‑specific expectations may require entity checks before onboarding.

- Some platform constraints exist—mobile charting has fewer drawing tools than top tier apps, and a number of stock/ETF CFDs are best accessed on MT5, which adds a small learning curve.

If the priority is user‑friendly platforms, consistent fixed‑spread pricing, and strong education—with the flexibility to expand into copy trading, options, and futures—AvaTrade delivers a well‑rounded experience. Traders who demand ultra‑low raw spreads, the most advanced native research suite, or deep FCA alignment may prefer alternatives, but for most beginners and strategy‑curious traders, the overall balance of features, protections, and growth paths is compelling.

Pros

- Wide platform selection: WebTrader, AvaTradeGO, AvaOptions, MT4/MT5, ZuluTrade/DupliTrade/AvaSocial.

- Fixed spreads with zero trading commissions on CFDs; negative balance protection; AvaProtect loss insurance on WebTrader/AvaTradeGO.

- Strong beginner education (AvaAcademy), Trading Central integrations, and broad instrument coverage including futures and FX options.

Cons

- Inactivity fee after 3 months plus annual administration fee after 12 months; relatively high versus peers.

- Research depth lags top brokers; proprietary platforms lack some advanced features/drawing tools.

- No STP/ECN accounts with raw spreads; no FCA license; regional restrictions on e‑wallets.

Why You Should Choose Avatrade ?

Fixed‑spread transparency, strong platform variety (including options and futures), and comprehensive education make AvaTrade compelling for guided learning and multi‑strategy trading without commissions on CFDs. It suits traders who want predictable pricing, easy on‑ramp platforms, and a clear path to grow into MT4/MT5 automation, AvaOptions for FX options, and AvaFutures for listed markets as skills evolve.

Pricing and predictability

Fixed spreads simplify cost planning compared with fluctuating variable spreads, and commission‑free CFD pricing keeps calculations straightforward for newer traders building consistency. For traders who favor clarity over chasing the tightest raw spreads, this structure reduces decision friction and helps with journaling and post‑trade reviews.

Platforms and scalability

AvaTrade’s platform stack is designed to scale with experience. WebTrader and AvaTradeGO prioritize usability for day‑to‑day trading, while MT4/MT5 unlock custom indicators, EAs, and multi‑timeframe analysis. AvaOptions adds a visual, strategy‑centric options interface, and AvaFutures opens access to CME/Eurex products for those moving into exchange‑traded instruments. This progression lets strategies mature without switching brokers.

Education and signals

A structured education hub, beginner‑friendly tutorials, and Trading Central integrations support continuous learning. For idea flow and validation, built‑in signals and social options provide starting points that can be adapted into personal playbooks as confidence grows.

Risk controls and safeguards

Risk features like negative balance protection and AvaProtect add structured downside management not always found at competitors. Negative balance protection helps prevent catastrophic losses in extreme volatility. AvaProtect allows pre‑defined protection windows on eligible trades for a quoted fee, which is useful when navigating events or uncertain catalysts.

Who benefits most

- New and intermediate traders who want clear costs, supportive education, and an approachable mobile/web experience.

- Strategy‑curious traders who plan to start with CFDs, then branch into automation on MT4/MT5, experiment with FX options, or step into futures without changing providers.

- Copy/social traders who prefer to learn through following and mirroring, then gradually take more control as skills improve.

Considerations before choosing

- Staying active matters, since dormant accounts can incur inactivity and administration fees over time.

- Some advanced charting and drawing tools are stronger on third‑party platforms than on the proprietary apps, so platform selection should match the analysis style.

- Market and feature availability can vary by region and entity, so it’s wise to confirm instrument lists, leverage, and funding options during signup.

Bottom line

If the priority is a friendly platform experience, predictable fixed‑spread pricing, and strong education—with room to expand into copy trading, options, and futures—AvaTrade offers a balanced path for building skills and diversifying strategies. Traders who require ultra‑low raw spreads or top‑tier native research may prefer specialized alternatives, but for most beginners and strategy‑builders, the overall mix of features and risk safeguards is compelling.

Compare to Top Competitors

AvaTrade competes with several established brands, and the right choice often comes down to pricing preferences, platform depth, and the balance between education and research tools. Each broker below offers a distinct proposition for different trader profiles and stages of the learning curve. Here is how it compares to FOREX.com, XM, and Admirals.

FOREX.COM

XM

Admirals

Exploring Avatrade's Range of Tradable Instruments

AvaTrade offers a broad lineup that helps build simple and advanced strategies in one account. The catalog includes 53+ FX pairs, 600+ stocks focused on U.S. names plus major EU and UK listings, 36 indices, 19 commodities, 60+ ETFs, 25+ cryptos (CFDs), 44+ FX options, and CME/Eurex futures on AvaFutures. Availability can change based on the platform and the entity, so it is smart to confirm access on MT5, WebTrader, AvaOptions, and AvaFutures during signup.

Forex (FX pairs)

AvaTrade lists 53+ FX pairs across majors, minors, and select exotics to support day trading and swing strategies. Traders can use MT4/MT5 for custom indicators and EAs or WebTrader for a simpler setup with integrated signals. Fixed spreads help make FX costs predictable for planning and journaling.

Stocks

With 600+ stocks, coverage leans toward large and mid‑cap U.S. companies with a meaningful set of EU/UK names. Most stock CFDs are best accessed on MT5, which typically shows the broadest symbol list and market details. This range fits earnings plays, sector rotation, and news‑driven strategies.

Indices

There are 36 indices that include popular benchmarks like the S&P 500, NASDAQ‑100, and leading European and Asian indices. Index CFDs offer diversified exposure with a single trade and are often used for momentum, hedging, and macro views. Execution is available on WebTrader and MT5 for flexible workflows.

Commodities

AvaTrade provides 19 commodities covering energies, precious metals, and select softs. These markets suit inflation hedges, event‑driven trades, and seasonal themes. Spreads and trading hours vary by product, so checking each contract’s details on WebTrader or MT5 is helpful.

ETFs

With 60+ ETFs, traders can target sectors, factors, and themes without building baskets from scratch. ETF CFDs are useful for tactical plays on volatility, sectors like energy or tech, and alternatives like gold miners. Most ETF access is optimized on MT5 for broader availability.

Cryptocurrencies (CFDs)

AvaTrade offers 25+ cryptos (CFDs), which are derivatives, not the actual coins. This means positions track price moves without owning the asset. Access can be limited for UK retail and other regions, so it is important to check local rules before funding.

FX options

There are 44+ FX options available on AvaOptions with a visual strategy interface for calls, puts, and multi‑leg structures. Options can define risk, shape payoff profiles, and hedge spot positions. A separate AvaOptions account setup is required to trade these instruments.

Futures

Exchange‑traded CME/Eurex futures are available through AvaFutures for traders moving into listed markets. This includes index, commodity, currency, and rates contracts with standardized specs and central clearing. A dedicated AvaFutures account is needed for access and proper margin handling.

| Asset | Swissquote |

|---|---|

| Forex Pairs | 53 |

| Tradeable Symbols | 1260 |

| Stocks and ETFs | 20,000 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency | Physical: No Derivative: Yes |

| Bonds | 2 |

Platform Notes

Instrument lists and leverage depend on the client’s onboarding entity and the chosen platform. MT5 and WebTrader usually provide the widest symbol coverage for CFDs, while AvaOptions and AvaFutures are required for FX options and listed futures. Confirm product access, leverage, and funding options during onboarding to avoid surprises later.

How Avatrade’s Instruments Compare to Competitors

Below is a simple availability matrix using check marks for offered assets and x for not offered. This is a generalized view based on typical product lineups and is intended as a quick scannable guide.

| Asset | Avatrade | Forex.com | XM | Admirals |

|---|---|---|---|---|

| Forex CFDs | ||||

| Index CFDs | ||||

| Stocks/Shares CFDs | ||||

| Commodities | ||||

| ETFs CFDs | ||||

| Cryptocurrency CFDs |

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $100 |

| Average Spread EUR/USD (Standard) | 0.93 pips |

All-in Cost EUR/USD - Active | 0.61 pips |

| Forex CFD Fees | Low |

Index CFD Fees | Average |

Futures Fees | Low |

Stock CFD fees | Low |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $10 per month after 2 consecutive months of inactivity |

AvaTrade does not charge trading commissions on standard CFD accounts, and the main cost is the spread built into the buy and sell price. Spreads are fixed on most markets, which makes trade costs more predictable for planning and journaling. Standard overnight financing (swaps) applies when positions are held past the platform’s daily cutoff, so longer holds should factor this cost into expected returns.

Here are the key fee figures organized for quick use. Numbers can vary by entity, platform, and market conditions, so they should be treated as typical ranges and examples for planning rather than guaranteed quotes.

CFD Trading Costs

Spreads on majors: EUR/USD typically from 0.8–1.3 pips on fixed‑spread accounts, with 1.0–2.0 pips common on other popular pairs depending on liquidity.

Indices: Major index CFDs (for example S&P 500, NASDAQ‑100, FTSE 100) often show all‑in fixed spreads in the 0.5–2.0 index‑point range during liquid hours.

Commodities: Gold commonly 20–30 cents, WTI crude oil often 3–6 cents, varying by session and volatility.

Stocks and ETFs (CFDs): Pricing is spread‑only on most regions; typical all‑in spreads often equate to 0.10%–0.30% of notional on liquid U.S. names during peak hours.

Cryptos (CFDs): Wider spreads than FX or indices are normal; majors like BTC and ETH often sit in low single‑digit bps relative to price during liquid periods but can widen significantly in off‑hours or volatile moves.

Overnight Financing (Swaps)

FX swaps: Commonly quoted in points per day and converted to currency based on position size; as a planning proxy, majors often equate to roughly ±0.5%–3.0% annualized depending on rate differentials, day of week, and direction.

Indices and commodities: Frequently float in a ~1.5%–3.5% annualized window in normal conditions; special events can push rates outside this range.

Stocks and ETFs: Long positions typically incur a benchmark rate plus a markup (for example reference rate + 2.0%–3.0% annualized), while shorts can be higher due to borrow costs on hard‑to‑borrow names.

Non‑trading fees

Inactivity fee: Charged after 3 months of no trading activity; a common figure is $50 per quarter of inactivity, applied periodically until activity resumes.

Administration fee: Applied after 12 months of inactivity; a representative example is $100 annually while the account remains dormant.

Conversion fee: If trading or funding in a currency different from the account base, expect a typical 0.5%–1.0% conversion spread.

Deposit and withdrawal: Broker‑side fees are usually $0 for standard methods; third‑party bank or processor fees may apply, and wires can carry bank charges (often $15–$30 outbound depending on bank).

AvaFutures pricing

- Per‑contract commission: Typical examples include $1.75 per standard or E‑mini contract and $0.75 per micro contract on U.S. index futures.

- Exchange and regulatory fees: Passed through at cost and depend on the specific exchange and product (for example CME, CBOT, NYMEX, COMEX, Eurex), commonly a few cents to a couple of dollars per side.

- Market data: Real‑time professional and non‑professional data packages are billed according to exchange rules, with non‑pro bundles for U.S. equities and futures often in the $5–$20 per month tier per venue.

Professional account notes

- Pricing: Qualified professional clients may see tighter spreads on FX and indices compared with retail accounts.

- Leverage: Higher maximum leverage is available at the cost of reduced retail protections; confirm exact limits with the assigned entity during onboarding.

Verdict

AvaTrade offers a clear, commission‑free CFD pricing model built around fixed spreads, which makes trade costs easy to plan even if headline spreads are not the very lowest in the market. Typical FX costs starting around 0.8–1.3 pips on major pairs are competitive for casual and swing traders, and the structure pairs well with standard overnight swaps for those who hold positions beyond the cutoff. On AvaFutures, the per‑contract approach with transparent exchange and regulatory fees is straightforward for listed products and works well for traders stepping into micros or e‑minis.

Where costs can creep up is with inactivity and administration fees, so staying active or closing unused accounts is wise, and choosing a matching base currency helps avoid unnecessary conversion charges. Overall, fees land near the industry average for a commission‑free model, delivering predictability and simplicity for most beginners and intermediate traders, while high‑frequency or raw‑spread seekers may prefer a broker that offers STP/ECN style pricing.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Avatrade Regulated ?

Yes, AvaTrade is regulated in the EU by the Central Bank of Ireland (CBI C53877), in Cyprus by CySEC (347/17), in Australia by ASIC, in South Africa by the FSCA, in the BVI by the FSC, in Japan by the FSA/FFAJ, in Abu Dhabi by the ADGM FSRA, and in Israel by the ISA, among other jurisdictions, while FCA authorization in the UK is not present.

The CBI public register confirms the Irish entity’s authorization, and investor protection rules and leverage limits vary by entity, so it is important to verify which regional company will hold the account during onboarding.

Understanding Regulatory Protections and Broker Stability

EU clients benefit from ICCL compensation up to 90% capped at €20,000, client fund segregation, and MiFID oversight, and negative balance protection applies for retail clients. These safeguards aim to ring-fence client money from company funds, provide recourse in the event of an authorized firm’s failure, and enforce conduct rules regarding leverage, disclosures, and best execution.

AvaTrade is a well-established (since 2006) multi-licensed broker that utilizes external audits and segregation controls, which enhance operational resilience and oversight. It is not a bank and not publicly listed, so stability rests on regulatory supervision, capital adequacy, and internal risk controls rather than deposit insurance or public market scrutiny.

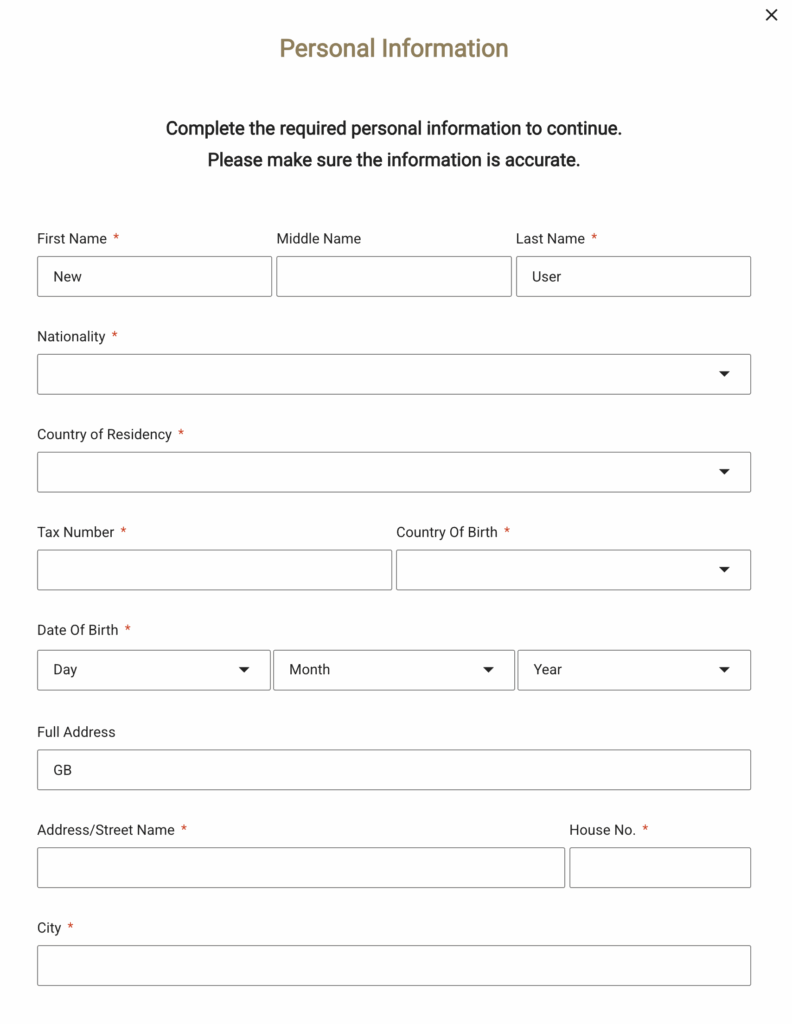

How To Open an Account

Getting started is straightforward and fully digital, and most applicants can complete the first step in just a few minutes.

Start registration. Go to the broker’s signup page, enter an email, create a strong password, and choose the country of residence.

Provide personal details. Add full name, date of birth, home address, and a valid mobile number to complete the profile.

Complete the financial profile. Disclose employment status, income range, savings, and source of funds to meet AML requirements.

Answer the experience questionnaire. Confirm basic knowledge of leveraged products, risk, margin, and order types.

Upload KYC documents. Submit a clear photo ID (passport, driver’s license, or national ID) and a recent proof of address (utility bill or bank statement).

Wait for verification. Approval typically completes within one business day if documents are legible and match the form details.

Fund the account. Deposit at least $100 via the available method in the region, confirm payment details, and wait for funds to reflect.

Account Types

AvaTrade offers a straightforward lineup designed to cover beginner, intermediate, and advanced needs while keeping setup simple. Live trading runs on a dealing‑desk model with fixed spreads, and there are no STP/ECN raw‑spread accounts. Leverage and product access vary by region and client classification, so it is best to confirm the specific entity limits during signup. A free demo is available for practice and platform testing.

Retail/Standard

This is the default live account for most traders and supports the full CFD lineup with fixed spreads and no trading commissions. It suits day trading and swing trading on WebTrader, AvaTradeGO, and MT4/MT5, with access to education and Trading Central tools.

Premium

This account is designed for experienced traders who meet regulatory criteria for activity, experience, and portfolio size. It typically offers tighter pricing and higher leverage than retail, but it comes with reduced regulatory protections, so it is intended for seasoned users who understand the risks.

Corporate

A legal‑entity account for companies that want centralized control over trading, funding, and reporting. Documentation requirements are more extensive than for individuals, and availability can vary by region.

Islamic (swap‑free)

A Sharia‑compliant option that removes overnight swap interest from qualifying instruments. In place of swaps, alternative fees or adjusted spreads may apply on extended holds, and product availability can vary by region.

Spread betting (UK/IE)

Available to eligible clients in the UK and Ireland, spread betting mirrors CFD exposure but settles in stake‑per‑point terms and may have different tax treatment. It runs on the same platform stack and uses fixed spreads without commissions.

AvaOptions

A dedicated account for vanilla FX options with a visual strategy interface, risk metrics, and multi‑leg construction. It is ideal for hedging spot FX or shaping defined payoff profiles, separate from the standard CFD account.

AvaFutures

A dedicated account for exchange‑traded futures on venues like CME and Eurex, using a per‑contract fee model and exchange‑level margining. It suits traders who want standardized, centrally cleared products beyond CFDs.

What is the Minimum Deposit at Forex.com?

AvaTrade sets a minimum deposit of $100 or 100 units of the selected base currency, which keeps the first funding hurdle low for new accounts. For a smoother experience across more products and to maintain healthier margin buffers, the broker generally suggests starting with $1,000–$2,000, especially if planning to hold multiple positions or test several platforms. This guidance helps reduce the risk of margin stress during volatile sessions and gives more flexibility for diversification and risk management.

How it compares to competitors:

| Broker | Minimum Deposit |

|---|---|

| Avatrade | $100 |

| FOREX.COM | $100 |

XM | $5 |

Admirals | $100 |

Takeaway

AvaTrade’s $100 minimum is competitive for getting started, while the suggested $1,000–$2,000 range is practical if the goal is to access more symbols comfortably, withstand routine volatility, and avoid frequent top‑ups. Compared to peers, XM tends to be the friendliest for ultra‑low initial deposits, FOREX.com is broadly comparable to AvaTrade at the entry level, and Admirals usually sits close by with a slightly higher threshold in some regions.

Deposit and Withdrawal

Funding is available via cards and bank wires globally, with e‑wallets such as PayPal, Skrill, Neteller, and WebMoney supported in select regions subject to local rules. First‑time card deposits may take a few hours for extra verification, while subsequent card top‑ups are typically faster once the card is confirmed. Internal withdrawal processing usually completes within 24–48 hours, and the final arrival time depends on the payment method and the client’s region.

Deposit Fees & Options

There are no internal deposit fees. Card deposits are typically instant after the first verification cycle, while bank wires can take several business days to arrive depending on the sending bank and corridor.

E‑wallet availability and processing times vary by jurisdiction, with many regions seeing same‑day or next‑day clearing. Supported base currencies include EUR, GBP, USD, CHF, AUD, ZAR, and JPY, though some are limited to clients in their home regions. Choosing a base currency that matches the main funding and trading currencies helps minimize conversion costs.

Withdrawal Fees & Options

There are no internal withdrawal fees, and cards, bank wires, and region‑dependent e‑wallets are supported. Third‑party provider charges and FX conversion costs can apply, especially on international bank wires or when withdrawing to a currency different from the account base currency.

Standard AML routing applies, so withdrawals must first match the original deposit path up to 100% of deposited funds. Typical internal processing takes 24–48 hours, with additional time to receipt depending on the card network, bank, or e‑wallet processor and the client’s location.

Bottom line

For most regions, funding and withdrawals are straightforward, fast, and fee‑friendly on the broker’s side, with cards and bank wires covering the basics and e‑wallets available where supported.

First‑time deposits can take a few hours due to verification, and withdrawals typically clear internally within 24–48 hours, after which processor and regional timelines apply. To keep costs down and avoid delays, match the base currency to typical deposits, use the same method for withdrawals to satisfy AML routing, and plan ahead for wire transfer times and any third‑party or conversion charges.

Web Trading Platform

I tested AvaTrade’s WebTrader in the browser to see how it handles real, day‑to‑day CFD trading, from setting up watchlists to placing and managing orders with risk controls. I wanted something quick to learn, stable during busy sessions, and clear enough that I could manage multiple positions without getting lost in menus. After a few sessions, I had a good feel for what WebTrader does best and when I’d switch to MetaTrader or a specialist app.

What’s available on desktop

On desktop, I can choose MT4, MT5, AvaOptions on Windows, and WebTrader in the browser, and I can also use AvaFutures for exchange‑traded products. WebTrader includes Trading Central for ideas and analytics right in the interface, and the order ticket supports AvaProtect on eligible markets for defined downside during a chosen window. MT4/MT5 give me deeper charting, custom indicators, and automation, AvaOptions is for visual FX options strategy building, and AvaFutures is set up for listed futures with per‑contract pricing and exchange margining.

My experience on WebTrader

WebTrader felt fast and simple to navigate, so I was able to build watchlists, pull up instrument details, and place orders without hunting through tabs. Charting covered my essentials with multiple timeframes, common indicators, and clean drawing tools, though it is not as deep as MetaTrader or a pro charting suite. I liked how the ticket made it easy to add stops and limits and toggle AvaProtect when I wanted extra cover around events, and the open positions panel made real‑time P/L and exposure clear at a glance.

When I would use MetaTrader

If I need expert advisors, custom indicators, or tighter control over multi‑timeframe charting, I switch to MT4/MT5. MT5 in particular tends to list more symbols for CFDs like stocks and ETFs, which helps when I’m scanning sectors. Strategy testing and automation just feel better on MetaTrader, so that is where I build and refine rule‑based systems before taking them live.

My take on AvaOptions

AvaOptions is powerful for vanilla FX options, with a visual payoff chart, Greeks, and templates that make multi‑leg structures easier to build. It took me a little time to get comfortable, and the Windows‑only limitation means I need a workaround on a Mac. Once I settled in, I liked pairing defined‑risk option structures with spot FX views to shape risk more precisely.

AvaFutures

For listed markets, AvaFutures gives me standardized contracts, exchange clearing, and a familiar per‑contract fee model. I use it when I want CME or Eurex products and tighter market structure than CFDs, but it does require a separate account and comfort with contract specs and margin. If I am planning to hold through major events, the transparency on exchange fees and margins is a plus.

Verdict

If I want the fastest route to trading with a gentle learning curve, I open WebTrader and get to work with Trading Central and AvaProtect right where I place orders. When I need heavyweight charting, automation, or a larger symbol set, I move to MT4/MT5. If I’m building risk‑defined FX option strategies, I launch AvaOptions, and for standardized contracts I go to AvaFutures. In practice, I start on the web for speed and then level up to the specialist platforms as my strategy needs more depth.

Pros & Cons of the Web Platform

Pros

- Clean, beginner‑friendly layout that makes it easy to build watchlists, view contract specs, and place orders without digging through menus.

- Integrated Trading Central and sentiment help with quick idea generation and basic validation inside the platform.

- AvaProtect is available in the order ticket on eligible markets for time‑boxed downside protection, which is rare among web platforms.

- Fast to launch in any modern browser with no installs, and syncs well with the mobile app for on‑the‑go checks.

- Core charting is solid for day‑to‑day use, with multiple timeframes, common indicators, and essential drawing tools that cover most routines.

Cons

- Charting depth and drawing tools are lighter than what power users get on MetaTrader or premium third‑party charting suites.

- Fewer customization options for layouts, alerts, and multi‑monitor workflows compared to advanced desktop platforms.

- Limited automation and no native support for custom indicators or EAs, which pushes algorithmic users toward MT4/MT5.

- Power features like detailed backtesting or advanced order types are basic, making WebTrader better for straightforward execution than complex strategy development.

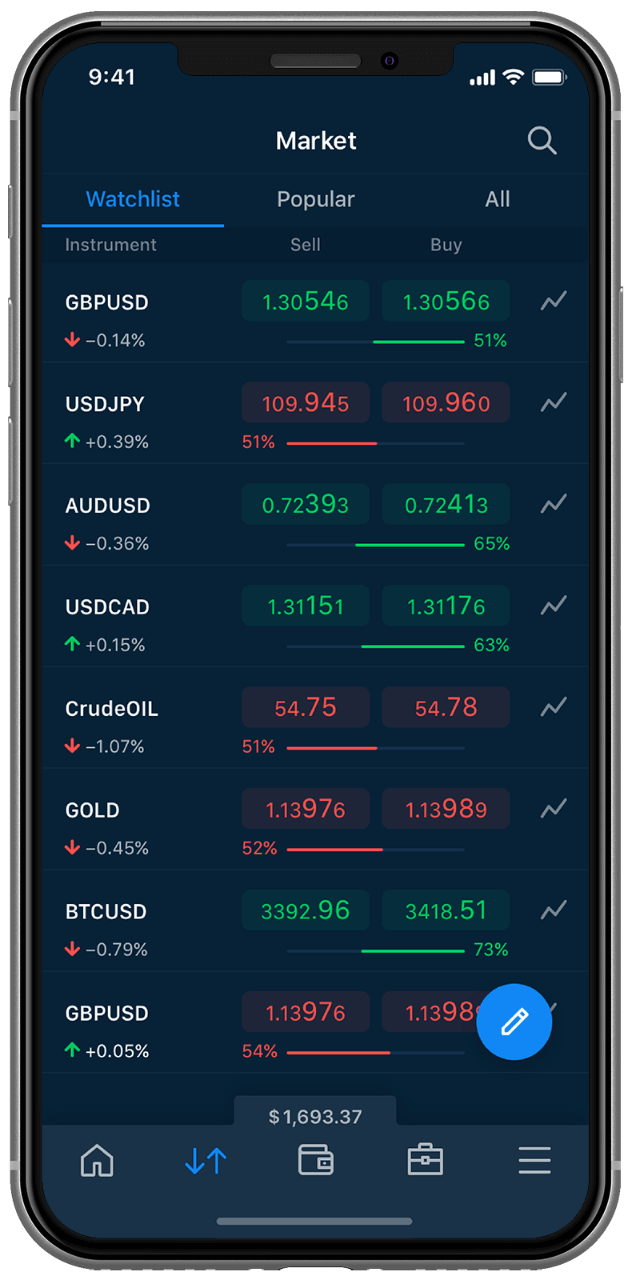

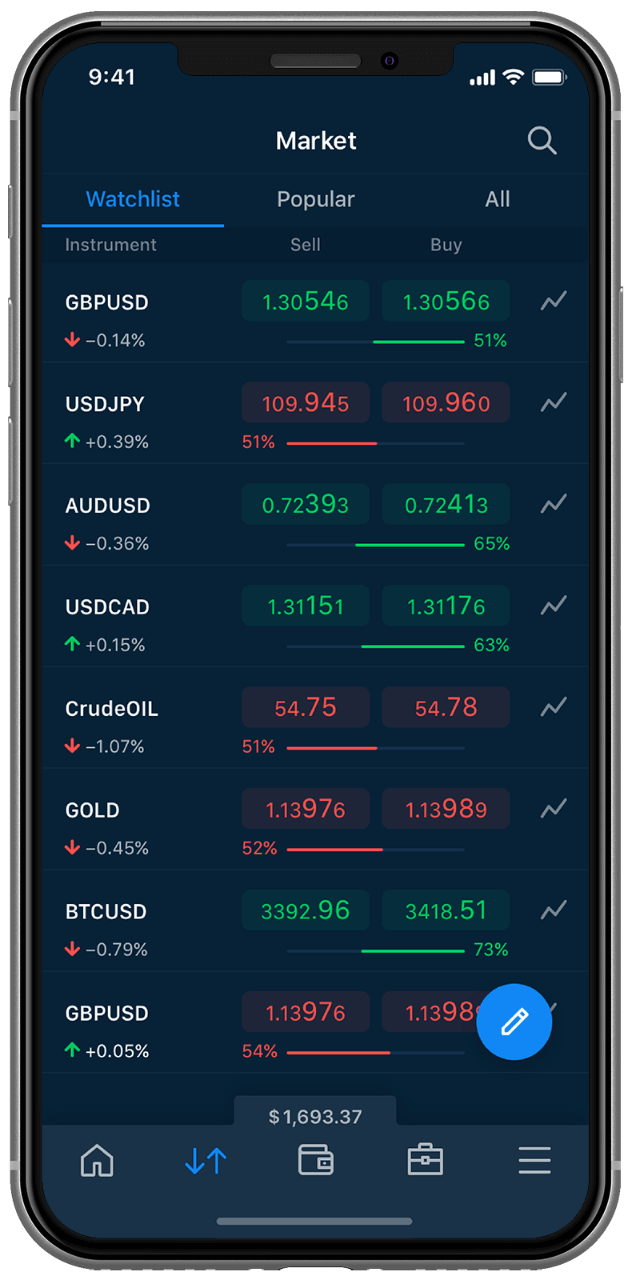

Mobile App

I use AvaTradeGO when I want the WebTrader experience on my phone, since my watchlists sync and I still get Trading Central ideas and the AvaProtect toggle in the ticket. The interface feels familiar, so moving from desktop to mobile is quick, and I can check specs, session hours, and sentiment without digging through extra screens.

Placing orders on mobile

Order entry is straightforward for market, limit, and stop orders, and I can set stop‑loss and take‑profit at the same time or adjust them later from the positions tab. When AvaProtect is available for an instrument, I can turn it on during ticket preview, pick the protection window, and see the cost before I confirm. Partial closes and quick modifications are easy, so managing positions on the go feels predictable.

Look and feel

The layout is clean with big, readable text and a simple bottom navigation that keeps watchlists, charts, and portfolio close at hand. I like that key stats and contract info sit near the chart, which reduces tapping around, and alerts arrive fast enough that I do not feel tied to the screen. Overall, the design favors clarity and speed, which is what I want on a phone.

Charting and tools

Mobile charts load quickly and include plenty of popular indicators and multiple timeframes, which covers most checks I make away from the desk. Drawing tools are more limited than desktop, so fine trendline work and multi‑chart layouts are better left for later on the computer. For quick reads, moving averages, RSI, and levels are easy to set up and reuse.

AvaOptions and MetaTrader on mobile

When I want to model FX options, the AvaOptions app helps me see payoff shapes and Greeks as I choose strikes and expiries, which makes multi‑leg building less error‑prone on a small screen.

If I am running MetaTrader accounts, the MT4/MT5 apps do a good job for monitoring and trade management, even though building or editing automated strategies is still a desktop task. In practice, I monitor risk and handle simple entries on mobile, then do deeper work back at the desk.

Copy trading with AvaSocial

When I want a social layer, I open AvaSocial to discover, follow, and copy experienced traders from a dedicated app. I can review profiles, check performance and risk, allocate a budget per expert, and start or stop copying with a couple of taps. It works well as a learning aid too, since I can compare approaches, chat, and adapt ideas while keeping control over allocation and limits.

Verdict

AvaTrade’s mobile stack covers the essentials with a friendly feel, quick syncing from web to phone, and helpful touches like Trading Central and AvaProtect right in the ticket, so day-to-day checks and orders are smooth even when away from the desk.

For deeper analysis, automation, and fine chart work, desktop still wins, but on balance the combination of AvaTradeGO, AvaOptions, MetaTrader, and AvaSocial gives a flexible toolkit that scales from quick trade management to strategy learning and copy trading without feeling clunky on a small screen.

Pros & Cons of the Mobile App

Pros

- User-friendly interface with synced watchlists from web for a seamless handoff between devices.

- AvaProtect access directly in the order ticket on eligible markets for time-boxed downside protection.

- Integrated signals and economic calendar for quick idea checks without leaving the app.

- AvaOptions mobile includes preset strategies with draggable strikes for faster multi-leg setup.

Cons

- Limited drawing tools compared to desktop, so precise annotations are harder on mobile.

- Some AvaOptions features work best or only in landscape, which can be awkward on smaller phones.

- Fewer advanced research integrations than category leaders, so deep analysis often requires desktop or third-party tools.

Market Research, Tools, and Education

The platform integrates the full Trading Central suite, including Market Buzz, Analyst Views, and Featured Ideas, plus an economic calendar and regular video updates for quick market context. Copy trading is available through ZuluTrade and DupliTrade, while AvaSocial adds a native social layer to discover, follow, and copy traders with in‑app risk controls. This setup helps scan opportunities, validate bias, and execute with clearer stops and targets linked to each idea.

Built‑in sentiment, contract specs, and session hours reduce context switching, while the calendar highlights high‑impact events to time entries and manage risk. For listed markets, AvaFutures provides exchange‑grade transparency on margins and fees, complementing CFD workflows for standardized contracts.

Customer Support

After testing support during live sessions, the mix of channels felt practical and easy to navigate, and getting a real person didn’t take long. I bounced between phone, live chat, WhatsApp, and the help center to see how each behaved, and the language localization made the whole process smoother and less formal.

Channels and Availability

Support runs 24/5 with regional phone lines, live chat that quickly hands off from a bot to an agent, WhatsApp for quick follow‑ups, and a detailed FAQ/help center for self‑service. The site is localized in 20+ languages, so onboarding, funding, and platform setup are easier to resolve without confusion. For non‑urgent questions, the web email form doubles as a ticketing system where it’s simple to attach screenshots and add context.

Responsiveness and Experience

In testing, phone and chat responses were prompt and solved most routine issues on the first try, which is crucial when markets are moving. WhatsApp was handy for status updates without staying on hold, and ticket replies landed within about 24 hours with clear, threaded context. Agents spoke plainly, linked to the right guides, and escalated when needed without runaround, which kept resolution time tight.

Self‑service Resources

The help center covers verification, deposits/withdrawals, platform walkthroughs, and common troubleshooting with step‑by‑step articles and screenshots. I liked that many guides link straight into platform tutorials, so it’s easy to go from reading to doing in a couple of clicks. For quick answers, pairing FAQs with chat makes self‑resolution and light assistance feel seamless.

Verdict

Support feels reliable and pragmatic for weekday trading, with fast live channels for urgent issues and a solid ticket flow for detailed cases. Broad language coverage and regional lines are standout strengths, and typical 24‑hour ticket turnarounds meet expectations for non‑urgent requests. A true 24/7 live option would help weekend crypto activity, but as it stands, the coverage, speed, and clarity check the boxes for most trading scenarios.

FAQ

What is the minimum deposit at AvaTrade for small budgets?

The typical minimum is $100 or 100 units of the chosen base currency, though the broker suggests $1,000–$2,000 for smoother product access and healthier margin buffers when running multiple positions.

Does AvaTrade offer a demo account for beginners?

Yes, a free demo mirrors live pricing and lets beginners practice order entry, risk controls, and platform workflows on WebTrader, AvaTradeGO, MT4/MT5, and AvaOptions without risking real funds.

Which AvaTrade account is best for active traders?

Most active traders use the Retail/Standard CFD account with fixed spreads for predictable costs, pairing it with MT4/MT5 for advanced charting, custom indicators, faster layouts, and strategy testers.

How do I qualify for an AvaTrade Professional account?

Professional status requires meeting regional regulatory criteria (experience, activity, portfolio thresholds); it can offer higher leverage but with reduced retail protections, so it suits seasoned traders.

Is there an Islamic (swap‑free) option at AvaTrade?

Yes, the Islamic account removes overnight interest on qualifying instruments; alternative fees or adjusted spreads may apply depending on region and holding period.

What platforms does AvaTrade support for advanced strategies?

AvaTrade supports WebTrader and AvaTradeGO for simplicity, MT4/MT5 for EAs and deep charting, AvaOptions for vanilla FX options, AvaFutures for listed futures, and AvaSocial for copy trading.

How does copy trading work at AvaTrade?

AvaTrade supports ZuluTrade and DupliTrade for strategy mirroring and offers AvaSocial to discover, follow, and copy traders with allocation controls, performance stats, and in‑app risk limits.

What education does AvaTrade provide for beginners?

AvaAcademy offers structured courses, quizzes, progress tracking, and many videos/articles, plus Trading Central integrations and tutorials that connect learning directly to platform execution.

How are taxes handled on AvaTrade accounts?

Tax treatment depends on jurisdiction, instrument, and account entity; maintain detailed trade and funding records and consult a licensed tax professional to classify gains, losses, and deductible costs.