FUSION MARKETS REVIEW 2025

Looking for a forex broker that combines ultra-low spreads, fast execution, and trusted regulation? In this in-depth Fusion Markets review, I put the platform to the test to see if it truly lives up to its reputation as one of the most affordable and transparent brokers in the world. From account setup and trading fees to platforms, regulation, and real trader feedback — here’s everything you need to know before opening an account in 2025.

Broker Guide's Fusion Markets Review in 2025

After seeing Fusion Markets rise in popularity among low-cost forex brokers, I decided to test it myself in 2025. Many traders have been talking about its tight spreads, low commissions, and reliable execution. I wanted to see if the hype matched the real trading experience.

I opened a live account, tested both the MT5 platform on desktop and the mobile app, and placed trades across major forex pairs and commodities.

The setup was quick, and the spreads were among the lowest I’ve seen. I paid close attention to execution speed, platform stability, and customer support during my test.

Fusion Markets has built a strong reputation for offering ultra-low fees without cutting corners on service quality. It is regulated by ASIC, giving traders confidence in its transparency and client fund protection.

The broker also supports multiple platforms, including MT4, MT5, cTrader, and TradingView, which makes it flexible for different trading styles.

Overall, my Fusion Markets trading experience confirmed that this broker is serious about cost efficiency and performance. For anyone looking for a low-cost broker that delivers strong execution and trusted regulation, Fusion Markets is worth testing in 2025.

About Fusion Markets

Fusion Markets is an Australian forex and CFD broker founded in 2017. The company is based in Melbourne and operates under Gleneagle Asset Management Pty Ltd. Its goal has always been simple: to make trading more affordable and transparent for everyone.

The broker is regulated by the Australian Securities and Investments Commission (ASIC), one of the most respected financial authorities in the world. It also holds additional licenses from the Vanuatu Financial Services Commission (VFSC) and the Financial Services Authority (FSA) in Seychelles. These multiple licenses allow Fusion Markets to serve traders around the globe while maintaining compliance with international standards.

Fusion Markets accepts clients from most countries, although traders from the United States, Japan, and a few restricted regions cannot open live accounts.

The company was founded by Phil Horner, who has decades of experience in the forex and derivatives industry. His vision was to create a broker that combines low trading costs, advanced technology, and honest service. Under his leadership, Fusion Markets has grown rapidly and earned a strong reputation among traders.

The broker has received several industry awards for its customer service, pricing, and platform range. It also boasts an excellent Trustpilot rating of 4.8 out of 5 stars from more than 4,800 reviews, showing high satisfaction among its clients.

Today, Fusion Markets stands out as a trusted ASIC regulated broker that offers some of the most competitive trading conditions in the industry.

My Quick Verdict: Who is Fusion Markets Best For?

Rating: 4.3

Best for: Traders who want low trading costs, fast execution, and transparent pricing.

Ideal for: Scalpers, algorithmic traders, and experienced investors who focus on performance and efficiency.

Not ideal for: Beginner traders looking for deep educational resources or long-term investors who prefer real stocks, ETFs, or bonds.

After testing Fusion Markets in 2025, I can confidently say it delivers on its promise of low-cost, transparent trading. The broker offers some of the tightest spreads and lowest commissions in the market, especially on major forex pairs like EUR/USD. Order execution is fast, and the trading experience feels smooth and stable across both desktop and mobile platforms.

Fusion Markets is fully regulated by ASIC, which adds a strong sense of trust and reliability. Its support for MT4, MT5, cTrader, and TradingView makes it flexible for traders who prefer different styles and strategies. Customer support is also a highlight, with fast and friendly assistance available 24/7.

Overall, Fusion Markets stands out as one of the most affordable and reliable brokers in 2025, combining cost efficiency with a professional trading environment.

Pros

- Tight spreads & low commissions

- Zero deposit/withdrawal/inactivity fees

- Supports MT4, MT5, cTrader & TradingView

- Fast account setup (under 10 mins)

- ASIC regulation adds strong credibility

Cons

- Limited educational content

- No ETFs or bonds

- Negative balance protection applies only under ASIC

- Swaps slightly higher than average

Why You Should Choose Fusion Markets ?

Fusion Markets is built for traders who care about value. Its ZERO account offers raw spreads starting from 0.0 pips with a $4.50 commission per lot, making it one of the cheapest brokers for forex and CFD trading. Compared to industry averages, Fusion Markets consistently ranks among the best forex brokers for low spreads, especially for high-volume or short-term strategies. There are no hidden fees, and deposits, withdrawals, and inactivity are all free.

Multi-Platform Flexibility

Traders can choose between MetaTrader 4, MetaTrader 5, cTrader, and TradingView — four of the most powerful and widely used platforms in the industry. This range of options makes Fusion Markets suitable for every trading style, from manual chart trading to automated systems. TradingView integration also appeals to traders who rely on advanced charting and social analysis.

Transparent and Trusted

Fusion Markets has earned a 4.8-star Trustpilot rating from thousands of reviews. Its clear fee structure, transparent pricing, and ASIC regulation build confidence among traders worldwide. The company also offers VPS hosting for high-frequency and algorithmic traders who need lightning-fast execution.

Ideal For

Fusion Markets is ideal for scalpers, algorithmic traders, and cost-conscious retail clients who want professional-grade trading conditions at a fraction of the usual cost.

Bottom Line

Fusion Markets combines low-cost trading, platform choice, and trusted regulation better than most of its peers. In 2025, it remains one of the most efficient and transparent brokers for serious traders looking to maximize value.

Compare to Top Competitors

The forex trading landscape is crowded, with many brokers claiming to offer the best spreads, platforms, and execution. To see how Fusion Markets really performs, it helps to compare it with a few of its biggest rivals. In 2025, three of the most notable competitors are IC Markets, OANDA, and XM — each respected in its own right but with key differences in cost, features, and user experience.

IC Markets

OANDA

XM

Exploring Fusion Markets’ Range of Tradable Instruments

Fusion Markets gives traders access to more than 250 tradable instruments, covering a wide selection of markets. The range includes forex, commodities, indices, share CFDs, and cryptocurrencies, offering plenty of opportunities for active traders. While the variety is broad enough for short-term strategies, the absence of ETFs and bonds means it may not fully satisfy long-term investors who prefer portfolio diversification.

Forex

Forex trading is at the heart of Fusion Markets. The broker offers over 90 major, minor, and exotic pairs, including EUR/USD, GBP/JPY, and AUD/CAD. Tight spreads and fast execution make it ideal for scalpers and algorithmic traders. With leverage up to 1:500 (outside ASIC jurisdiction), forex traders can take advantage of both high liquidity and low trading costs.

Commodities

Fusion Markets provides access to more than 20 commodities, including gold, silver, platinum, crude oil, and natural gas. Commodity spreads are highly competitive, with crude oil spreads starting from just 0.016 pips, one of the lowest in the industry. These assets are perfect for traders looking to hedge currency exposure or diversify their short-term strategies.

Share CFDs

The broker offers 100+ share CFDs from major global companies such as Apple, Tesla, Amazon, and Meta. These are available through MT5, cTrader, and TradingView platforms. Traders can speculate on price movements without owning the underlying shares, and benefit from both rising and falling markets.

Indices

Fusion Markets gives access to 15 major global indices, including the Dow Jones 30, Germany 40, UK 100, and Japan 225. Index trading provides exposure to broad market trends and is well-suited for day traders seeking volatility and liquidity.

Cryptocurrencies

Crypto traders can choose from 10+ digital assets, including Bitcoin, Ethereum, Solana, and Polygon. Spreads are tight, and trading is available 24/5 alongside traditional markets. This selection is smaller than some competitors but still covers the most popular coins.

| Asset | Fusion Markets |

|---|---|

| Share CFDs | 110 |

| Forex | 90+ |

| Commodities | 16 |

| Indices | 15 |

| Options | No |

| Cryptocurrencies | 13 |

| ETFs | 0 |

| Bonds | 0 |

Bottom Line

Fusion Markets offers a solid mix of 250+ instruments that cover all the essential asset classes for active traders. While it lacks ETFs and bonds, its focus on high-liquidity markets, tight spreads, and fast execution makes it a strong choice for those who trade frequently and value efficiency.

How Fusion Markets’ Instruments Compare to Competitors

When choosing a broker, the range of tradable instruments can make a big difference in how flexible your trading strategy can be. Fusion Markets offers over 250 assets, giving traders solid exposure to the most popular markets like forex, commodities, indices, shares, and crypto. However, compared to larger multi-asset brokers, it has a more focused lineup aimed at active traders rather than long-term investors.

Below is a comparison of Fusion Markets against three major competitors — IC Markets, OANDA, and XM — to see how their asset offerings stack up:

| Asset | Fusion Markets | IC Markets | Oanda | XM |

|---|---|---|---|---|

| Forex | ||||

| Commodities | ||||

| Share CFDs | ||||

| Indices | ||||

| Cryptocurrencies Futures | ||||

| Bonds CFDs | ||||

| ETFs |

Fees and Commission Structure

| Fees | |

|---|---|

| EUR/USD Spread (Raw) | 0.11 pips |

| GBP/USD Spread (Raw) | 0.24 pips |

Classic Account Spread | 0.9 pip markup |

| Commission (per round turn) | $4.50 per lot |

| Currency Conversion Fee | Applies when using non-base currency |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $0 |

Understanding a broker’s fee model is one of the most important steps before opening an account. Fusion Markets has built its reputation on low-cost and transparent pricing, offering some of the tightest spreads and lowest commissions in the industry. Below is a quick breakdown of its trading and non-trading fees, followed by a detailed analysis.

Trading Fees

Fusion Markets keeps trading costs simple and competitive. It offers two main account types — ZERO and Classic — each designed for a different trading style.

Spreads

The ZERO Account is built for traders who want the lowest possible spreads. On average, spreads start from 0.0 pips, with typical pricing around 0.11 pips on EUR/USD and 0.24 pips on GBP/USD.

The Classic Account adds a 0.9-pip markup, allowing commission-free trading while still keeping spreads tight compared to most brokers.

Commissions

The ZERO Account charges a $4.50 round-turn commission per standard lot, which is lower than XM ($7) and HF Markets ($6). This makes Fusion Markets one of the most cost-efficient brokers for high-frequency and scalping strategies.

The broker’s pricing is fully transparent, with no additional markups or hidden charges built into spreads.

Swaps

Swap fees (overnight financing) are slightly higher than the industry average. For example, holding a long position in gold may incur a swap cost of around $54 per lot.

These fees vary depending on the instrument, position type, and market interest rates. Despite this, swap rates are clearly listed on the platform, helping traders manage long-term costs.

Execution Model

Fusion Markets operates on a pure ECN (Electronic Communication Network) model. This means it does not act as a counterparty to client trades and instead connects traders directly to liquidity providers.

The result is fast execution, minimal slippage, and no dealing desk intervention — ideal for traders who rely on precision and speed.

Other Trading Costs

Fusion Markets is known for its transparency. There are no hidden markups, requotes, or execution delays. The broker does not offer Guaranteed Stop Loss Orders (GSLOs), which are available at some market maker brokers but usually come at an extra cost.

The broker also provides free access to advanced tools like TradingView integration, VPS hosting for high-frequency traders, and DupliTrade for copy trading, with no added platform fees.

Non-Trading Fees

Fusion Markets continues its low-cost approach outside of trading as well. It charges no deposit, withdrawal, or inactivity fees, setting it apart from many competitors that penalize inactive accounts.

The only additional cost traders may encounter is a currency conversion fee when depositing, withdrawing, or trading in a currency different from their account’s base currency. This is standard across most brokers and depends on prevailing exchange rates.

Bottom Line

Fusion Markets offers one of the most transparent and affordable pricing structures among global brokers. With spreads from 0.0 pips, a $4.50 round-turn commission, and no non-trading fees, it’s a top choice for scalpers, algorithmic traders, and cost-conscious investors. Its ECN model ensures efficient execution and fair pricing, making it one of the best forex brokers for low spreads in 2025.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Fusion Markets Regulated ?

Regulation plays a key role in determining how safe and trustworthy a broker is. Fusion Markets operates under a multi-entity structure, with different subsidiaries licensed by recognized regulators around the world. This setup allows the broker to serve a global client base while maintaining compliance in each region.

Regulatory Entities

- FMGP Trading Group Pty Ltd — Regulated by the Australian Securities and Investments Commission (ASIC), License No. 385620. ASIC is a Tier-1 regulator, widely respected for enforcing strict financial and operational standards. This entity covers clients based in Australia and ensures that client funds are held in segregated accounts with top-tier banks.

- Gleneagle Securities Pty Ltd — Licensed by the Vanuatu Financial Services Commission (VFSC), License No. 40256. The VFSC provides a lighter regulatory framework, mainly aimed at offering flexibility to international traders.

- Fusion Markets International Ltd — Registered and regulated by the Financial Services Authority (FSA) in Seychelles, License No. SD096. This entity allows Fusion Markets to serve clients from regions not covered by its Australian license.

Protection and Safety Measures

Under the ASIC license, clients benefit from negative balance protection, which prevents traders from losing more than their account balance. However, this protection does not apply under the VFSC or FSA entities.

Fusion Markets does not offer an investor compensation scheme, unlike brokers regulated in the EU or UK. This means that while the broker adheres to strict fund segregation and capital adequacy rules, there is no compensation fund in case of insolvency.

To further protect traders, Fusion Markets is also a member of The Financial Commission, an independent dispute resolution organization. This gives clients an additional layer of support in the event of a complaint or dispute.

Overall Assessment

Fusion Markets is considered a safe and well-regulated broker, especially for clients under the ASIC entity. Its compliance with multiple regulators and transparent operations inspire confidence. However, since it lacks EU or UK regulation and an investor compensation scheme, it is not classified as a top-tier global broker.

Understanding Regulatory Protections and Broker Stability

Segregated Client Funds

Fusion Markets takes client fund safety seriously. All client money is kept in segregated accounts with top-tier Australian banks, completely separate from the company’s own operating funds. This ensures that client deposits are protected and cannot be used for business expenses or trading activities. It’s a standard requirement under ASIC regulation, adding a strong layer of financial security.

Transparency and Track Record

Since its launch in 2017, Fusion Markets has maintained a transparent approach to operations. The broker publicly shares its company details, license numbers, and legal disclosures on its website. This open documentation helps traders verify its credentials easily. Over the years, it has built a reputation for reliability and honesty, earning positive reviews and industry recognition for consistent service quality.

Company Growth and Global Presence

Fusion Markets employs more than 100 professionals worldwide, with its main office located in Melbourne, Australia. The team has continued to expand its operations and platform offerings while maintaining lean operational costs to keep trading fees low.

Stability and Limitations

The broker is financially stable and continues to grow its client base each year. However, it does not hold licenses in the European Union or the United Kingdom, which limits access to investor compensation schemes available under those jurisdictions.

Bottom Line

Fusion Markets demonstrates strong safety practices, financial transparency, and operational stability, making it one of the more reliable regulated forex brokers in its category.

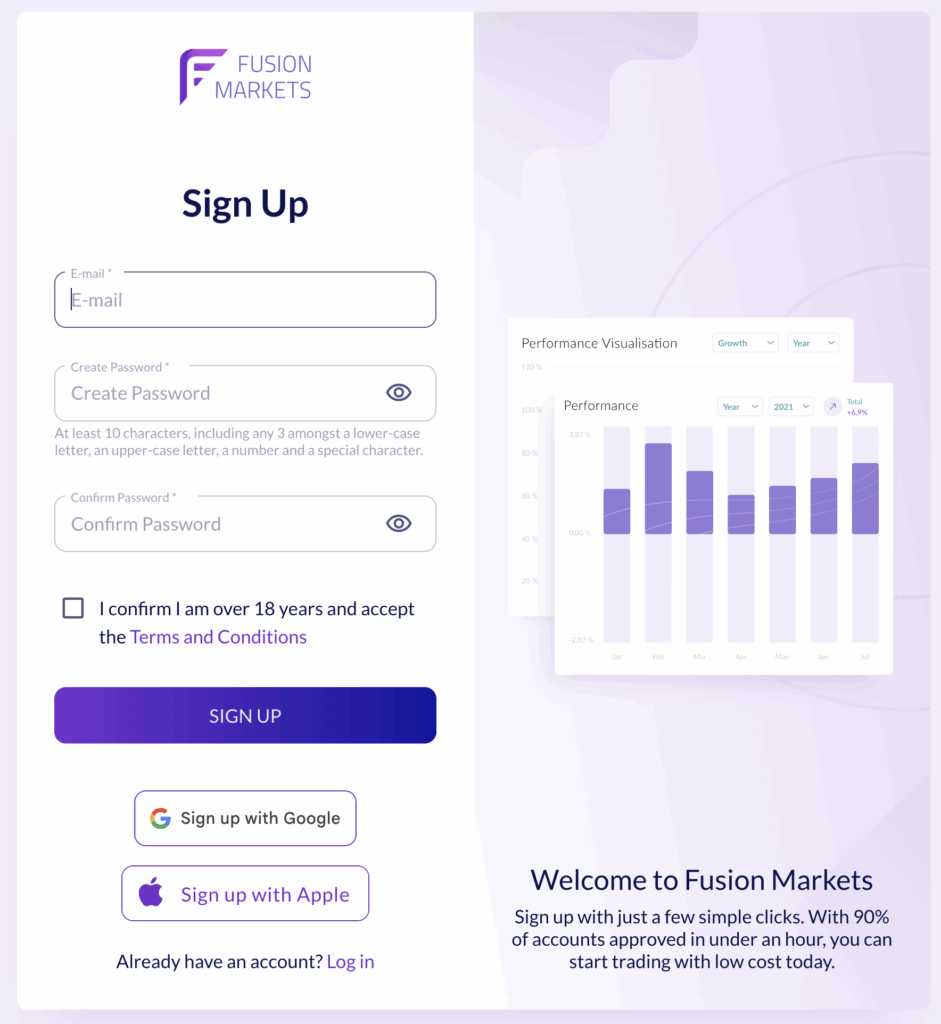

How To Open an Account

Opening an account with Fusion Markets is simple and fast. The whole process takes just a few minutes, and your account can be verified in a day.

Step 1: Register

Go to the Fusion Markets website and click “Create an Account.” Enter your email and password to create your profile.

Step 2: Add Personal Details

Fill in your basic information such as name, address, and country of residence. You’ll also choose your account type and base currency.

Step 3: Verify Your Identity

Upload your ID (passport or driver’s license) and proof of address (utility bill or bank statement). Verification is usually completed very quickly.

Step 4: Choose Platform

Select the platform you prefer — MT4, MT5, cTrader, or TradingView. Choose between a Classic or ZERO account depending on whether you prefer spread-only or commission-based pricing.

Step 5: Fund and Trade

Deposit money using your preferred payment method, and you’re ready to trade. Deposits are fast, and there are no setup or account maintenance fees.

If you’re outside Australia, there’s no suitability test required, so you can start trading right after approval.

Account Types

Fusion Markets offers a range of account types to suit different trading styles and experience levels. Whether you’re a beginner or a professional trader, there’s an option designed to match your goals and strategy.

Classic Account

The Classic Account uses a simple spread-only model with an average markup of 0.9 pips on major currency pairs. There are no commissions, which makes it easier for new traders to understand their costs.

This account is best for beginners and casual traders who prefer straightforward pricing without extra fees. Despite being commission-free, spreads remain tight compared to many competitors, making it an affordable choice for small-volume trading.

ZERO Account

The ZERO Account is designed for traders who want the lowest possible spreads and the fastest execution. Spreads start from 0.0 pips, and there’s a $4.50 round-turn commission per standard lot.

This account is ideal for scalpers, algorithmic traders, and experienced investors who rely on precision and high-frequency trading. It’s one of the most cost-efficient setups available among ECN brokers in 2025.

Pro Account (ASIC Clients Only)

Available only to ASIC-registered clients, the Pro Account offers higher leverage, rebates, and priority customer support. It’s built for professional or high-volume traders who meet ASIC’s eligibility criteria and need enhanced trading conditions.

MAM/PAMM Accounts

For fund managers or traders handling multiple clients, Fusion Markets offers MAM/PAMM account options. These accounts allow seamless management of multiple portfolios under one master account, with real-time performance tracking and allocation flexibility.

Islamic Account

Fusion Markets also provides a swap-free Islamic account that complies with Sharia principles, allowing traders to open positions without overnight interest charges.

Demo Account

New traders can start with a free demo account, which stays active for 30 days and can be renewed on request. It’s a safe way to test strategies or get familiar with the platforms before trading live.

What is the Minimum Deposit at Forex.com?

Funding your account at Fusion Markets is simple, fast, and cost-effective. The broker is known for its flexible payment options and transparent policy on deposits and withdrawals, making it easy for traders to manage funds without worrying about hidden charges.

Minimum Deposit

Fusion Markets has a $0 minimum deposit, allowing anyone to start trading with any amount they’re comfortable with. This flexibility is ideal for beginners who want to test the platform before committing larger funds. There are no setup or funding fees, and you can open an account instantly after completing verification.

| Broker | Minimum Deposit |

|---|---|

Fusion Markets | $0 |

| IC Markets | $200 |

| Oanda | $0 |

XM | $5 |

Deposit and Withdrawal

The broker supports a wide range of payment methods, including:

All deposits are processed quickly, and funds usually appear in your trading account within a few minutes (for cards and e-wallets) or up to one business day for bank transfers. Fusion Markets does not charge any deposit fees, although your bank or payment provider might apply small processing charges.

Withdrawal Fees & Options

Withdrawals are just as straightforward. Fusion Markets offers free withdrawals for most payment methods. However, international bank wire transfers incur a $20 fee, which is standard among global brokers. Withdrawal requests are processed within 1–3 business days, depending on the payment method and your bank’s processing time.

Traders can request withdrawals directly from their secure client portal. Fusion Markets processes transactions quickly, with most e-wallet and card withdrawals approved within the same business day.

Supported Currencies

Fusion Markets allows accounts in multiple base currencies, including USD, EUR, GBP, AUD, JPY, CAD, SGD, and THB. Choosing a base currency that matches your local bank helps you avoid unnecessary currency conversion fees, keeping costs low.

Bottom Line

With no minimum deposit, zero funding fees, and fast withdrawal processing, Fusion Markets makes funding and accessing your money smooth and stress-free. Its wide range of payment options and transparent policies make it one of the most convenient brokers for global traders.

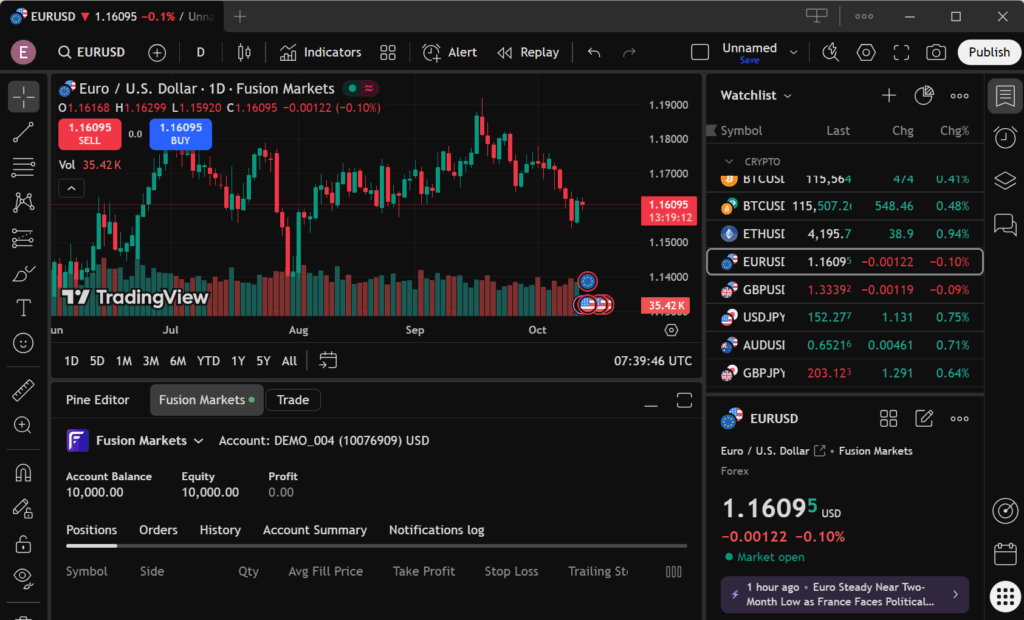

Desktop Trading Platform

Fusion Markets gives traders access to four professional-grade trading platforms — MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. Each platform is designed to meet different trading styles, from beginners and discretionary traders to professionals using automated systems. The broker’s focus on flexibility and technology ensures a seamless trading experience across all devices.

MetaTrader 5 (MT5) — Fast and Feature-Rich

MT5 is the most popular platform among Fusion Markets users. It’s fast, reliable, and packed with advanced tools, including 38 built-in indicators, 21 timeframes, and automated trading support through Expert Advisors (EAs).

The platform also offers an integrated economic calendar, customizable charts, and the ability to hedge or net positions. With low spreads and stable execution, MT5 is an excellent choice for both beginners and experienced traders.

cTrader — Built for Precision and Speed

cTrader is available for ZERO account holders who want the best possible execution speed and order control. It features depth of market visibility, advanced charting, and one-click trading, making it ideal for scalpers and high-frequency traders.

The clean interface and advanced order management tools give traders full control over their strategies, while also supporting custom indicators and algorithmic trading through cAlgo.

TradingView — Smart Charting and Social Insights

TradingView integration brings the power of community-driven analysis to Fusion Markets. Traders can access real-time charts, create custom indicators, and use Pine Script to automate strategies.

The platform also allows sharing ideas and insights with millions of users worldwide, making it a favorite for traders who value both advanced charting and market collaboration.

Copy Trading

Fusion Markets offers several copy trading options for traders who prefer an automated or social approach.

Fusion+ is the broker’s built-in copy trading platform. It lets users follow and automatically copy trades from experienced signal providers, making it ideal for beginners or investors who prefer hands-free trading.

DupliTrade allows clients to mirror professional strategies directly into their accounts, with full transparency and performance tracking.

Myfxbook AutoTrade offers another layer of automation by connecting traders to proven systems that execute trades in real time.

All three tools — Fusion+, DupliTrade, and AutoTrade — work seamlessly with Fusion Markets’ ECN pricing, ensuring fast execution and transparent results. These platforms make it easy to follow experts, diversify strategies, and trade smarter with minimal effort.

VPS Hosting for Automated Trading

To support advanced and high-frequency strategies, Fusion Markets provides free VPS hosting for clients who trade 20 or more lots per month. The VPS ensures low latency, stable connectivity, and uninterrupted trading, even when the user’s device is offline.

Verdict

Fusion Markets delivers a powerful combination of trading platforms that cater to every type of trader. From MT5’s reliability to cTrader’s precision, TradingView’s social power, and DupliTrade’s automation, the broker offers one of the most complete and flexible trading experiences available in 2025.

Pros & Cons of the Web Platform

Pros

- Multiple platforms to choose from

- Excellent order execution

- Algo and copy trading support

Cons

- Outdated MT interface

- No proprietary platform

Mobile App

Fusion Markets offers mobile trading across all its supported platforms — MT4, MT5, cTrader, and TradingView — giving traders full access to the markets wherever they are. The apps are available on iOS and Android devices and are optimized for speed, reliability, and ease of use.

MT4 and MT5 Mobile Apps

The MetaTrader apps remain the most popular choice among Fusion Markets traders. They provide fast order execution, real-time price alerts, and basic charting and analysis tools. Traders can open and close positions, manage orders, and monitor their accounts directly from their phones. While charting options are more limited than on desktop, the apps are ideal for managing trades on the go.

cTrader Mobile App

The cTrader app delivers a clean, modern interface with advanced order types and quick access to real-time depth of market data. It’s perfect for scalpers and active traders who need precise control over entries and exits. The app also syncs seamlessly with the desktop version, allowing smooth transitions between devices.

TradingView Mobile

For traders who love detailed charts, the TradingView mobile app offers advanced visual analysis tools, custom indicators, and access to the TradingView community. It’s great for staying connected to market trends and sharing ideas while away from the desk.

Verdict

The Fusion Markets mobile experience is best for managing open trades and monitoring markets, rather than doing deep analysis. It’s fast, reliable, and practical — perfect for trading on the go.

Pros & Cons of the Mobile App

Pros

- Fast Execution: Orders are processed quickly, allowing traders to react to market changes in real time.

- Easy to Use: Clean, intuitive interface on all platforms (MT4, MT5, cTrader, TradingView) makes navigation simple for beginners.

- Real-Time Alerts: Push notifications and price alerts help traders stay updated on key market movements.

- Multi-Platform Access: Syncs seamlessly with desktop versions, ensuring smooth transitions between devices.

- Reliable Performance: Stable connection and low latency make mobile trading efficient even on slower networks.

Cons

- Limited Charting Tools: Fewer technical indicators and customization options compared to desktop platforms.

- Smaller Screen Space: Charting and analysis can feel cramped on mobile devices.

- Not Ideal for In-Depth Analysis: Best for monitoring and managing trades rather than conducting full technical research.

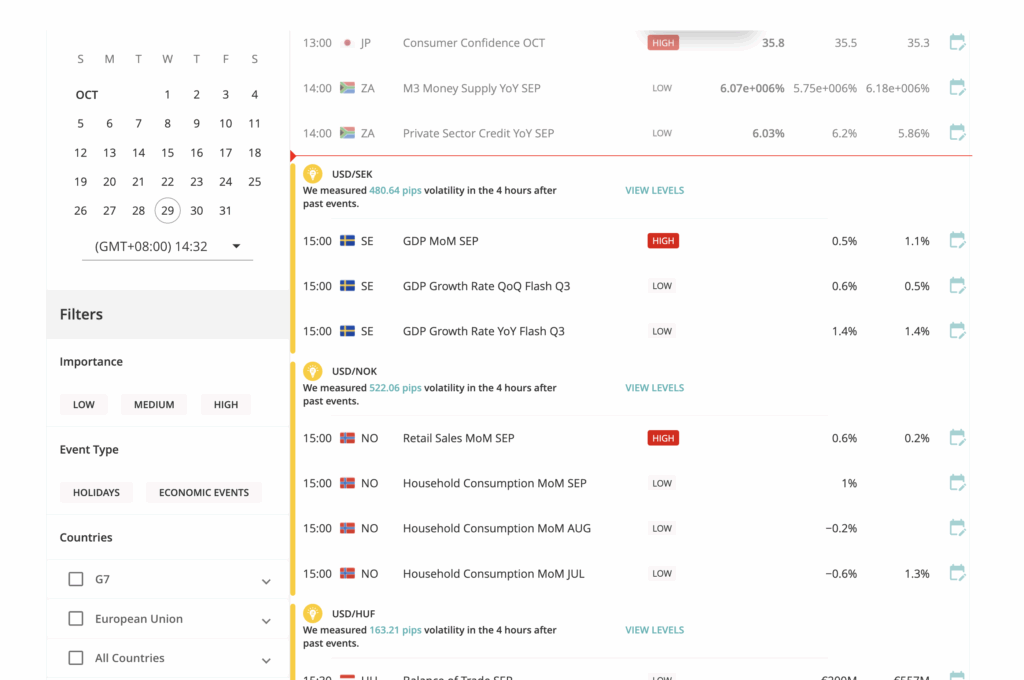

Market Research, Tools, and Education

Fusion Markets provides a well-rounded selection of research tools and trading resources designed to support traders of all experience levels.

While the broker’s research is practical and reliable, its educational materials are somewhat limited compared to larger competitors.

Customer Support

Fusion Markets provides 24/7 customer support through live chat, email, and phone, ensuring traders can get help whenever they need it. The team is known for being responsive, friendly, and knowledgeable, offering clear answers to both technical and account-related questions.

Traders can contact support via live chat directly on the website, which typically connects to an agent within a minute. For more detailed inquiries, users can email help@fusionmarkets.com, and responses usually arrive within a few hours. Phone support is also available during trading hours, making it easy to speak directly with a representative.

Fusion Markets has built a strong reputation for excellent customer service, reflected in its 4.8-star Trustpilot rating based on thousands of client reviews. Many traders praise the team for their professionalism, fast responses, and genuine willingness to help resolve issues.

Beyond general support, the broker also provides personal account managers for active traders, offering tailored guidance and faster assistance when needed. The help center and FAQ section on the website cover common questions about trading platforms, deposits, and withdrawals, allowing users to find answers instantly.

Verdict

Fusion Markets stands out for its quick, reliable, and friendly customer support. With around-the-clock live chat and consistently high customer satisfaction ratings, it’s one of the most responsive brokers in the industry.

FAQ

Is Fusion Markets safe and regulated in 2025?

Yes. Fusion Markets is regulated by ASIC (Australia), VFSC (Vanuatu), and FSA (Seychelles). ASIC oversight ensures strong client fund protection and transparent operations, making the broker safe and trustworthy for traders worldwide.

What platforms does Fusion Markets support?

Fusion Markets supports MT4, MT5, cTrader, and TradingView, giving traders access to a variety of interfaces for manual, automated, and social trading.

What are Fusion Markets spreads and commissions?

Spreads start from 0.0 pips on the ZERO account, with a $4.50 round-turn commission per lot. The Classic account has no commission but includes a 0.9-pip spread markup.

What is the minimum deposit?

The minimum deposit is $0, allowing traders to start with any amount they’re comfortable with.

Does Fusion Markets charge withdrawal or inactivity fees?

No. Fusion Markets charges no deposit, withdrawal, or inactivity fees. Only international bank wires may incur a $20 fee.

Can I trade crypto on Fusion Markets?

Yes. Fusion Markets offers 10+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Does it offer negative balance protection?

Yes, but only for ASIC-regulated clients. Other entities (VFSC and FSA) do not provide this protection.

How can I open a Fusion Markets account?

You can sign up online by providing your email, verifying your ID, and funding your account. The process takes less than an hour.

Is Fusion Markets good for beginners?

Yes. It’s beginner-friendly due to its simple setup and low costs, though educational resources are somewhat limited.

Is Fusion Markets good for beginners?

What countries are restricted?

Fusion Markets does not accept clients from the U.S., Japan, and a few restricted jurisdictions due to regulatory reasons.