ACTIVTRADES REVIEW 2026

With $0 minimum deposits, lightning-fast 4ms execution, and an industry-leading $1M insurance policy, ActivTrades is built for security-conscious traders. Access 1,500+ markets commission-free through ActivTrader, MetaTrader, or TradingView. It’s the perfect blend of elite technology and a user-friendly experience.

Broker Guide's ActivTrades Review in 2026

Choosing an online broker in today’s saturated market is no small feat, especially when you are looking for a partner that balances historical reliability with modern technology.

To provide a truly comprehensive ActivTrades review, I went beyond the marketing brochures and conducted an extensive hands-on test.

What makes this broker a compelling case study is its longevity. Originally founded in 2001 in Switzerland, ActivTrades has managed to stay at the forefront of the industry for nearly 25 years.

In this review, I’ll break down whether their award-winning safety standards and IBM Cloud-based infrastructure actually translate into a superior experience for the modern trader.

About ActivTrades

ActivTrades is a distinguished online broker with a deep-rooted history in the financial world. Founded in 2001 in Switzerland, the company has matured into a global powerhouse, eventually moving its main operations to become London-headquartered.

Over nearly 25 years of experience, the broker has successfully scaled its operations to service a massive user base of over 100,000 customers across 170 jurisdictions.

To maintain its global reach, ActivTrades operates through several highly regulated entities, including offices in London, Milan, Nassau, Sofia, Lisbon, Port Louis, and Florianópolis.

Their commitment to infrastructure is evident in their IBM Cloud-based trading infrastructure, which is designed to handle over 100,000 orders per second, ensuring they can provide lightning-fast order execution with an average speed of 0.004 seconds for both retail and high-volume traders.

Beyond its technical prowess, the broker has established a culture of excellence that has earned it over 60 prestigious international accolades. By undergoing regular financial audits by PricewaterhouseCoopers (PwC) and maintaining segregated accounts at top-tier banks like Barclays and Lloyd’s, ActivTrades ensures that its operational integrity remains as high as its performance.

My Quick Verdict: Who is ActivTrades Best For?

Overall BrokerGuide Rating: 4.6/5

In my assessment, ActivTrades stands out as a high-performance Market Maker that prioritizes trader security and execution quality.

While it offers a slightly smaller selection of tradable symbols (approximately 1,200 to 1,532+ instruments) compared to some industry mega-brokers, it compensates with some of the most robust consumer protection mechanisms available.

The broker’s most compelling feature is its enhanced funds insurance, which protects client capital up to $1 million—a figure that vastly exceeds standard regulatory requirements for SCB and FSC-regulated entities.

When you combine this generous insurance with negative balance protection for all account holders and competitive spreads starting at 0.5 pips, ActivTrades proves to be a reliable and cost-effective choice for those who value broker stability above all else.

Pros

- Founded in 2001, ActivTrades has over two decades of industry experience and a long-standing reputation for reliability.

- The broker advertises lightning-fast order execution with average speeds as low as 0.004 seconds (4ms).

- Customers registered under the SCB (Bahamas) and FSC (Mauritius) entities are eligible for enhanced investor compensation of up to $1 million at no additional cost.

- All account holders, including professional traders, are safeguarded by negative balance protection, ensuring they never lose more than their account balance.

- ActivTrades offers a $0 minimum deposit for customers in most regions, making it highly accessible for beginners.

Cons

- Customer support is unavailable on Saturdays and Sundays, which may be a drawback for traders who prepare their strategies over the weekend.

- The broker charges a $12.50 fee for bank transfer withdrawals in US dollars for certain entities.

- Inactivity Fees: Inactive customers incur a $10 monthly fee after 52 weeks (one year) of no trading activity, provided the account has a positive balance.

- Due to FCA regulation, cryptocurrency CFDs are not available to retail traders from the U.K. entity or U.K. residents.

Why You Should Choose ActivTrades ?

As the trading landscape becomes increasingly dominated by algorithmic trading and high-frequency execution, choosing a broker that can keep pace with technological shifts is vital. ActivTrades has positioned itself as a future-proof partner by prioritizing institutional-grade infrastructure for the everyday retail trader.

The Power of IBM Cloud Infrastructure

One of the most compelling reasons to choose ActivTrades in 2026 is its massive investment in a highly scalable proprietary trading infrastructure built on the IBM Cloud. This sophisticated setup allows the broker to deliver lightning-fast order execution with ultra-low latency, which is critical for those navigating volatile markets. By utilizing cloud-based technology, the broker ensures that its systems are always optimized, reducing the risk of downtime during peak market hours.

Scalability: 100,000+ Orders Per Second

Reliability in 2026 isn’t just about staying online; it’s about handling massive throughput without slippage. ActivTrades boasts a trading system with the capacity to process over 100,000 client orders per second. This immense order processing capacity means that even during major global economic events—where volume spikes—the platform can handle the load without experiencing significant delays or bottlenecks. For the user, this translates to a minimal risk of requotes, with over 93.60% of orders executed at the requested price.

A Gateway for Beginners

Despite its high-tech backbone, ActivTrades remains one of the most accessible entry points for novice traders. The broker is a good choice for beginners due to its minimalist design, easy-to-use ActivTrader platform, and well-laid-out website. Beginners can “test the waters” risk-free using a demo account that closely replicates live market conditions. Furthermore, the $0 minimum deposit requirement in most regions removes the initial financial barrier, allowing new users to start their journey at their own pace.

A Legacy of Security and Trust

Longevity is the ultimate indicator of broker stability. Having operated since 2001, ActivTrades has navigated every major financial crisis of the 21st century. In 2026, their commitment to safety remains unmatched, featuring investor compensation of up to $1 million for specific entities and regular financial audits conducted by PricewaterhouseCoopers (PwC).

Verdict: Is ActivTrades Ready for 2026?

Yes. While many brokers struggle to update legacy systems, ActivTrades has already embraced the cloud revolution. Their combination of IBM Cloud scalability, 4ms execution speeds, and a quarter-century track record makes them an exceptionally reliable choice for traders who require a platform that is both technologically advanced and financially secure.

Compare to Top Competitors

While ActivTrades offers an impressive suite of tools and security features, it is helpful to see how it stacks up against other industry leaders to ensure it aligns with your specific trading goals. Here is a brief comparison with three of its primary rivals.

OANDA

Pepperstone

Fusion Markets

Exploring ActivTrades’ Range of Tradable Instruments

ActivTrades offers a versatile selection of over 1,500 financial markets, providing ample opportunities for portfolio diversification across multiple asset classes. While the total count of 1,532 tradable symbols is slightly lower than some “mega-brokers,” the quality and variety of the instruments cater to both traditional and niche trading strategies.

Forex Trading

The broker provides a robust selection of 56 currency pairs, encompassing Major, Minor, and Exotic markets. Retail clients in the UK and EU are restricted to a maximum leverage of 1:30, while those under the Mauritius (FSC) entity can access dynamic leverage reaching as high as 1:1000 depending on the position size. Trading is highly flexible, allowing for standard, mini, and micro lots starting at just 0.01 lots, which corresponds to 1,000 units of the base currency.

Indices (Cash and Futures)

Traders can speculate on the price fluctuations of 44 indices measuring the performance of major companies in the US, UK, Europe, Japan, China, Brazil, and Australia. Key examples include the S&P 500, DAX 40, and Nikkei 225. Exposure is available through both cash indices and futures contracts, with leverage capped at 1:20 for major indices in the UK and EU, while reaching up to 1:1000 for clients under the Mauritius division.

Stock CFDs

Stocks represent the most substantial portion of the ActivTrades product lineup, accounting for a staggering 81% of available instruments. Traders can access over 1,240 share CFDs from companies across the US, UK, and Europe, including markets in Germany, Spain, and Italy. The minimum trading volume for shares is set at 0.01 lots, ensuring that large-cap equities are accessible to traders with various budget sizes.

Commodities Spot and Futures

ActivTrades stands out by offering 35 commodities through both spot and futures markets. Traditional assets like Gold, Silver, and Crude Oil are readily available for speculation. Additionally, the broker offers less common markets such as Cocoa, Coffee, Sugar, and even Carbon Emissions, giving it a definitive edge over many rival brokers.

Exchange Traded Funds (ETFs)

Traders looking for broader market exposure can utilize over 135 Exchange-Traded Funds (ETFs). These are neatly categorized into US, UK, and European regions to help users navigate their options. The selection also includes specialized thematic funds, such as the iShares Bitcoin Trust ETF and the ProShares Bitcoin Strategy ETF, alongside ETFs for energies and treasury bonds.

Bond CFDs

The inclusion of 7 bond CFDs is a notable advantage, as these are often unavailable at certain rival brokerages. Seasoned traders can speculate on debt securities such as the US T-Bond, Euro Bund, Euro BTP, and Euro Schatz. Leverage for these instruments is capped at 1:5 in Europe and the UK, but can reach 1:500 under the Mauritius entity.

Important Note on Cryptocurrency

While ActivTrades offers a selection of 15 popular digital coins including Bitcoin, Ethereum, and Solana, availability is strictly subject to local regulation. Notably, cryptocurrency CFDs are not available to retail traders registered under the FCA (UK) entity or to UK residents.

| Asset | ActivTrades |

|---|---|

| Tradeable Symbols | 1500+ |

| Forex | 56 |

| Cryptocurrencies | 15 |

| Commodities | 35 |

| Indices | 44 |

| Bonds | 7 |

| ETFs | 135 |

How ActivTrades’ Instruments Compare to Competitors

| Asset | ActivTrades | OANDA | Pepperstone | Fusion Markets |

|---|---|---|---|---|

| Forex | ||||

| Indices | ||||

| Stock CFDs | ||||

| Commodities | ||||

| Cryptocurrencies | ||||

| ETFs | ||||

| Bonds |

Fees and Commission Structure

ActivTrades is widely recognized for its transparent pricing model, which primarily utilizes a spread-based structure for most of its financial markets. This approach allows the broker to offer commission-free trading across almost all major asset classes, including forex, indices, and commodities. Because the broker acts as a market maker and the sole execution venue for client trades, they profit primarily from the bid-ask spread rather than hidden transaction fees.

| Fees | |

|---|---|

| Average Spread (EUR/USD) | 0.50 pips |

| Average Spread (GBP/USD) | 0.80 pips |

| Commission | $0 except stocks |

| Financing Charges (Swap Fees) | Yes |

| Deposit Fees | $0

|

| Withdrawal Fees | $12.50 for USD bank withdrawals |

| Inactivity Fee | $/€10 monthly fee |

Trading Fees and Spreads

The trading fees at ActivTrades are highly competitive, with average spreads often outperforming those of its closest industry rivals.

For highly liquid currency pairs like the EUR/USD, the average spread typically hovers around 0.5 pips, though live data from some reviews has shown it can reach 1.08 pips depending on market conditions and account type.

These narrow spreads generally start at 0.5 pips across all account types, ensuring that retail traders receive high-quality pricing. For a standard lot of EUR/USD, the average spread cost is approximately $5.

Commissions and Asset-Specific Costs

While most instruments are commission-free, stock CFDs are the notable exception to this rule. For these assets, traders incur a fixed or percentage-based fee depending on the region; for example, US shares are charged at $0.02 per share with a $1 minimum, while UK shares attract a 0.10% commission with a £1 minimum.

For positions held overnight, traders are subject to financing charges or swap rates, which fluctuate based on global interest rate differentials. It is worth noting that short positions can sometimes result in positive swaps, allowing traders to earn interest rather than paying it.

Non-Trading Fees: Inactivity and Conversion

Beyond the direct costs of executing a trade, ActivTrades maintains a few non-trading fees that users should monitor to avoid unnecessary expenses. The broker imposes an inactivity fee of $10 per month (or the equivalent in other currencies) but only after an account has been dormant for 52 weeks.

Additionally, a 0.5% currency conversion fee is applied when a trader opens a position in a currency different from their base account currency. While deposits are generally free of charge, certain withdrawal methods may attract fees, such as a $12.50 charge for bank transfer withdrawals in US dollars through the European entity.

Verdict

ActivTrades offers a highly transparent and competitive pricing model that is particularly attractive for casual and low-volume traders.

By providing fully commission-free trading across nearly all asset classes, with stock CFDs being the only exception, the broker ensures that trading costs are easy to calculate and built directly into the narrow average spreads.

While non-trading fees like the 0.5% currency conversion charge and specific withdrawal fees require attention, the overall all-in cost remains among the best in the industry.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is ActivTrades Regulated ?

When choosing a trading partner, regulatory oversight is the most critical factor in ensuring your capital is handled with integrity. ActivTrades maintains an exceptionally high standard of security and stability, backed by licenses from several of the world’s most respected financial watchdogs. This multi-jurisdictional approach allows the broker to offer tailored services while adhering to strict regulatory compliance standards.

Global Regulators and Licenses

ActivTrades operates under the supervision of five distinct regulatory bodies across the globe:

- Their UK division, ActivTrades Plc, is authorized and regulated by the FCA (License No. 434413), which is widely considered one of the strictest Tier-1 regulators globally.

- This Tier-1 license enables the broker to onboard customers from across the European Union under MiFID guidelines.

- This license allows the broker to service international clients through ActivTrades Corp.

- Regulates ActivTrades Markets, providing a framework for global operations outside of the UK and EU.

- ActivTrades CCTVM is authorized by the Brazilian Central Bank and overseen by the CVM, strengthening their presence in Latin America.

Understanding Regulatory Protections

Beyond simple registration, ActivTrades implements several high-level consumer protection mechanisms to ensure broker stability and fund safety:

- All client funds are strictly ring-fenced from the broker’s operational capital. These funds are stored in segregated accounts at reputable Tier-1 banks, including Barclays, Lloyd’s, Citibank, and RBS.

- To ensure total transparency and accuracy in their financial reporting, the broker undergoes regular financial audits by PricewaterhouseCoopers (PwC), one of the prestigious Big Four accounting firms.

- ActivTrades provides negative balance protection to all account holders, including professional traders, ensuring that no client can ever lose more than their initial investment.

- In addition to standard protections, the broker provides enhanced insurance of up to $1 million for clients under the SCB and FSC entities, far exceeding the minimum requirements of most regulators.

Verdict

ActivTrades earns a top-tier reputation for safety. By combining FCA and CMVM regulation with Tier-1 bank segregation and an unprecedented $1 million insurance policy, they provide a level of investor protection that is a rarity in the industry.

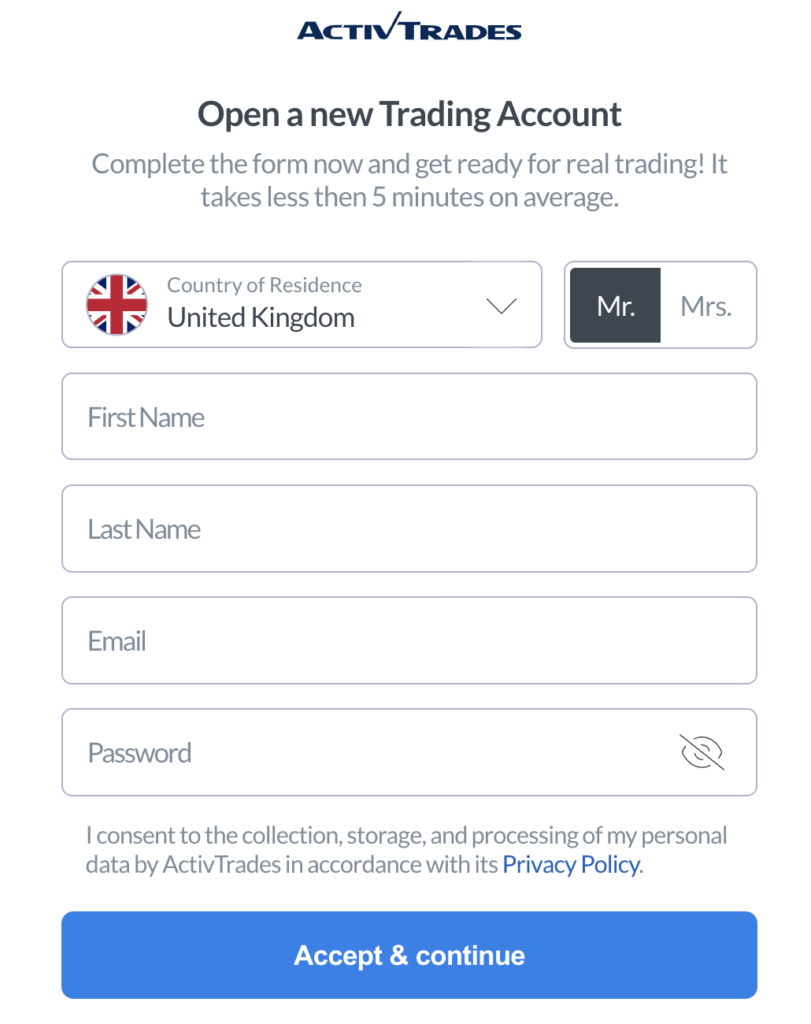

How To Open an Account

The account opening process at ActivTrades is designed to be as efficient as possible, utilizing a streamlined registration system that allows users to set up their profile in a matter of minutes. Based on my testing, the entire digital onboarding experience can be completed in approximately 7 minutes if you have your documentation ready.

To begin, you simply navigate to the broker’s website and click the Sign Up button. The process follows these specific steps:

- Personal Information: Select your country of residence and provide your name and email address.

- Contact Details: Enter a current phone number for urgent account matters.

- Identify Details: Provide your birth date, nationality, and Tax Identification Number (TIN) if required by your jurisdiction.

- Residential Address: Fill in your full current address, including postcode and city.

- Employment Info: Specify your current employment status and professional details.

- Financial Profile: Enter your annual income, savings value, and intended initial deposit.

- Source of Funds: Declare how you obtained your trading capital (e.g., salary, investments, or inheritance).

- Document Upload: Provide digital copies of your ID and Proof of Address to complete the KYC procedure.

- Eligibility Questionnaire: Answer a series of questions to help the broker evaluate your experience with derivative trading.

- Platform Selection: Choose your preferred trading platform (ActivTrader, MT4, or MT5) and base account currency.

Verification and Activation

Once you have submitted your application, the relevant department typically evaluates and verifies your documents within one business day. In many cases, verification can be completed in just a few hours depending on the current workload.

To satisfy KYC requirements, you will need to upload high-quality photos or scans of the following:

- Proof of Identity: A valid passport, national ID card, or residence permit.

- Proof of Address: A recent utility bill or bank statement.

After the broker confirms your identity, you are free to add funds to your live balance and begin trading. Verified customers have the flexibility to register up to 10 live accounts under a single profile.

Account Types

ActivTrades provides a versatile range of account types designed to accommodate the diverse needs of its global clientele, ensuring there is a specific structure tailored to every strategy, from beginners practicing risk-free to professionals requiring high leverage.

Individual Account

The Individual (Retail) Account is the primary option for most users, offering commission-free trading across nearly all asset classes except for stocks. Traders benefit from market execution with no requotes and can utilize micro lot trading starting at 0.01 lots for precise risk management.

This account supports over 10 base currencies, including EUR, USD, GBP, and CHF, which helps users avoid unnecessary currency conversion fees.

Professional Account

Experienced traders who meet specific eligibility criteria can upgrade to a Professional Account, which allows access to significantly higher leverage of up to 1:400 for forex CFDs.

This tier includes premium perks such as a dedicated account manager, access to invitation-only seminars, and a cashback program. Notably, ActivTrades is a rarity in the industry as it extends negative balance protection and investor compensation to professional clients.

Islamic Account

For those who adhere to Shariah law, the broker offers a specialized Islamic Account that facilitates swap-free trading. Positions held overnight in this account do not incur interest or rollover fees, though administrative fees may apply after a certain grace period. This account type is currently available to customers onboarding from 13 specific countries, including the UAE, Saudi Arabia, Kuwait, and Qatar.

Demo Account

The Demo Account serves as an essential tool for all skill levels to test new strategies in a risk-free environment that closely replicates live trading conditions.

Users can customize their setup by selecting a preferred trading platform, leverage ratio, and base currency, with virtual credits available from 250 to 200,000. While designed for long-term testing, these accounts typically expire after 30 days.

What is the Minimum Deposit at ActivTrades?

One of the most attractive features for beginner traders is that ActivTrades has no minimum deposit requirement for customers registering through the UK (FCA), European (CMVM), Bahamas (SCB), and Mauritius (FSC) entities.

This $0 minimum deposit allows you to open an account and explore the platform’s features without an immediate financial commitment. However, there are regional exceptions to this rule: customers residing in China must start with at least $500, while those in Brazil have a significantly higher requirement of R$100,000.

| Broker | Minimum Deposit |

|---|---|

ActivTrades | $0 |

| OANDA | $0 |

Pepperstone | $0 |

| Fusion Markets | $0 |

Deposit and Withdrawal

Managing your live trading balance at ActivTrades is designed to be a streamlined and highly accessible experience. The broker offers a diverse range of payment options and maintains some of the fastest processing times in the industry, ensuring that your capital is always where you need it.

Deposit Fees & Options

ActivTrades prides itself on being an accessible entry point for all traders, which is why deposits are free of charge across all supported methods. You can fund your account using a wide variety of deposit methods such as

For most methods like cards and e-wallets, funds typically reflect in your balance within 30 minutes. Additionally, traders registered under the offshore divisions (Bahamas and Mauritius) have the option to deposit using cryptocurrencies such as Bitcoin, Ethereum, and Tether.

Withdrawal Fees & Options

Cashing out your profits is a hassle-free process, with most requests being processed within the same working day. While withdrawals via debit and credit cards, PayPal, Skrill, and Neteller are free, there are specific costs associated with bank transfers depending on your location and currency:

- European (CMVM) entity: A $12.50 fee applies specifically to USD bank transfer withdrawals.

- Bahamas and Mauritius entities: Requesting a bank transfer withdrawal will incur a £9 fee.

- Crypto withdrawals: These are generally free but require a minimum withdrawal of $25.

Supported Base Account Currencies

To help you avoid the 0.5% currency conversion fee, ActivTrades supports a robust selection of 11 base account currencies. This allows most traders to manage their funds in their native currency:

- Primary Currencies: EUR, USD, GBP, and CHF.

- Additional Options: BRL, INR, KWD, ARS, QAR, SEK, and AED.

Verdict

The ActivTrades funding model is a standout feature for its speed and flexibility. By offering fully free deposits and same-day withdrawal processing, the broker provides the high level of liquidity that modern traders demand. While you should be mindful of the specific bank transfer fees for USD and UK-based accounts, the ability to choose from 11 base currencies makes it incredibly easy to keep your trading costs low by avoiding conversion charges.

Desktop Trading Platform

ActivTrades provides a versatile suite of desktop trading platforms designed to accommodate both beginner and seasoned traders. While they offer the industry-standard MetaTrader software, their proprietary ActivTrader platform is engineered to offer a more intuitive and high-performance experience through the IBM Cloud.

ActivTrader: The Proprietary Edge

The ActivTrader platform is the broker's flagship browser-based solution that requires no software downloads. One of its most distinctive features is the integration of TradingView charts, providing users with 14 chart types and over 30 technical indicators.

A standout tool unique to this platform is the Progressive Trailing Stop, which allows traders to set two price tiers for more dynamic risk management. It also features market sentiment indicators, allowing users to harness the "wisdom of the crowd" when making decisions.

MetaTrader 4 (MT4): The Forex Standard

For those who prefer a traditional environment, ActivTrades fully supports MetaTrader 4, the world’s most popular platform for forex trading. It features 9 timeframes, 3 chart types, and over 50 preinstalled indicators.

A significant draw for MT4 users is the ability to use Expert Advisors (EAs) for algorithmic trading, allowing for the full automation of strategies. However, it is important to note that stock CFDs are currently unavailable on the MT4 version offered by this broker.

MetaTrader 5 (MT5): Advanced Multi-Asset Trading

MetaTrader 5 is the improved, more powerful successor to MT4, designed for multi-asset trading including shares, ETFs, and cryptocurrencies. It offers enhanced capabilities such as 21 timeframes, 8 order types, and a multi-threaded strategy tester for faster backtesting.

ActivTrades enhances the standard MT5 experience with a suite of custom add-ons and indicators that provide Level II pricing and Depth of Market (DOM) insights.

TradingView Integration

For traders who demand the highest level of charting capabilities, ActivTrades allows users to link their accounts directly to the TradingView platform. This integration supports chart trading, allows for up to 8 charts in a single tab, and provides access to advanced chart types like Renko and Kagi.

It serves as a bridge for those who want the technical power of TradingView combined with ActivTrades’ lightning-fast execution.

Copy Trading and Automated Solutions

While ActivTrades does not offer a built-in, proprietary social or copy trading platform, users can still implement copy trading strategies through the MetaTrader ecosystem.

By utilizing the Signals tab in MT4 or MT5, traders can subscribe to professional signal providers to have trades automatically replicated in their own accounts. Additionally, the broker's support for Expert Advisors (EAs) allows for a high degree of automated trading, enabling users to execute complex strategies without constant manual monitoring.

Verdict

ActivTrades offers one of the most well-rounded platform selections in the industry. While MetaTrader remains the gold standard for algorithmic traders and those seeking third-party copy signals, the ActivTrader proprietary platform is a superior choice for those who want a modern, browser-based interface with unique risk-management tools like the Progressive Trailing Stop.

The addition of TradingView integration ensures that even the most demanding technical analysts have the tools they need.

Pros & Cons of Desktop Platform

Pros

- Choice between the user-friendly ActivTrader, powerful MetaTrader suite, or TradingView.

- Access to the Progressive Trailing Stop and Market Sentiment tools on ActivTrader.

- All platforms benefit from the IBM Cloud infrastructure, offering 0.004s execution speeds.

- MetaTrader platforms are bolstered by a “good variety” of proprietary indicators and custom tools.

Cons

- Does not support stock CFDs.

- Learning Curve: MT5 and TradingView may be intimidating for complete beginners.

- Proprietary software does not support EAs or automated bots.

Mobile App

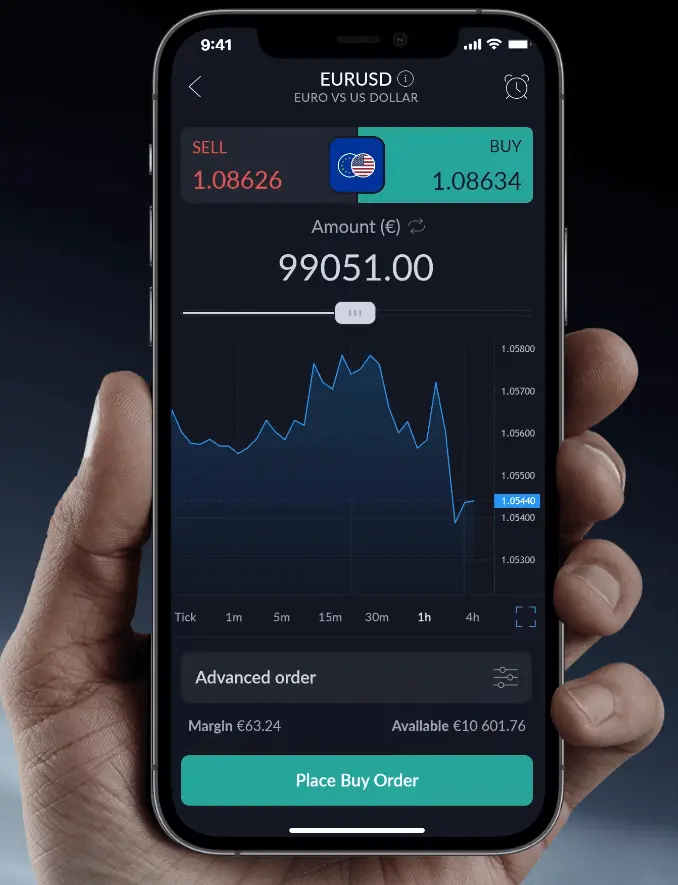

The ActivTrades mobile experience is built around the philosophy of providing institutional-grade power in a user-friendly, portable format. By offering a choice between their high-performance proprietary software and industry-standard third-party apps, the broker ensures that traders can manage their portfolios with ultra-low latency from anywhere in the world.

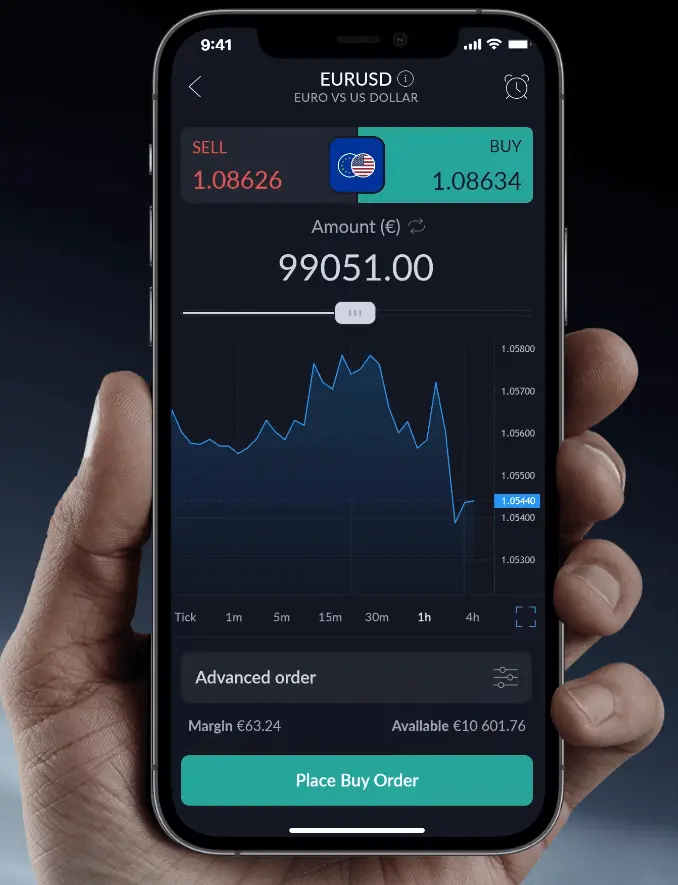

ActivTrader: The Flagship Native App

The ActivTrader mobile app is the crown jewel of their mobile offering, boasting impressive user ratings of 4.1/5 on Android and 4.9/5 on iOS. It is designed with a minimalist interface that doesn't sacrifice depth, incorporating TradingView charts and unique features like market sentiment data.

One of its most powerful mobile-specific tools is the Progressive Trailing Stop, which allows for more sophisticated risk management than standard mobile platforms.

MetaTrader 4 & 5 Integration

For traders who rely on algorithmic strategies or custom indicators, ActivTrades provides full access to the MT4 and MT5 mobile apps.

These apps serve as a reliable bridge for those already accustomed to the MetaTrader ecosystem, offering 30+ technical indicators, multiple timeframes, and real-time price alerts. The MT5 mobile version is particularly useful for multi-asset traders who need to manage stock CFDs and ETFs on the go.

Advanced Functionality & Security

The mobile experience is bolstered by advanced order types such as Partial Close, Buy/Sell Entry Stops, and Limit Orders. To ensure a safe trading environment, all mobile platforms are protected by two-factor authentication (2FA) and provide negative balance protection to all retail users.

The apps also feature a dark and light mode, personalized watchlists, and a live newsfeed from FxStreet to keep traders informed of market-moving events.

Verdict

ActivTrades offers one of the most reliable and future-proof mobile experiences in the forex and CFD industry. The ActivTrader app is a standout for its minimalist design that remains powerful enough for professional use.

While there is minor room for improvement regarding biometric logins, the combination of TradingView charting, high user ratings, and ultra-fast execution makes it an elite choice for traders who need a mobile platform they can trust in 2026.

Pros & Cons of the Mobile App

Pros

The native ActivTrader app is frequently praised for its smooth navigation and intuitive trade ticket window.

Sophisticated Risk Tools: Mobile access to Trailing Stops and Progressive Stops gives traders an edge in protecting profits.

Real-time market sentiment data is built directly into the app, helping traders gauge the “wisdom of the crowd”.

The apps are designed to be lightweight, running efficiently on Android 6.0 or iOS 16.4 and higher.

Cons

Some advanced order types like One-Cancels-Other (OCO) are currently unavailable on the mobile interface.

While secure with 2FA, the app currently lacks integrated biometric authentication (fingerprint/face ID).

The mobile version offers fewer chart customization options compared to the full desktop proprietary suite.

Market Research, Tools, and Education

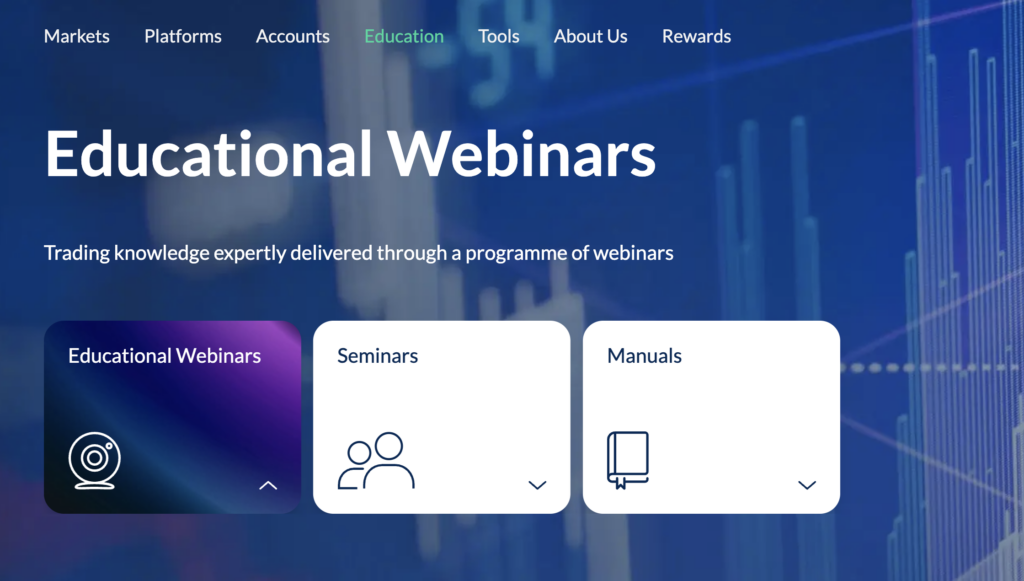

ActivTrades empowers its clients by providing a high-performance environment for decision-making, combining sophisticated market research with institutional-grade analysis tools and an expansive educational library.

This integrated ecosystem is designed to help traders of all levels transition from basic market understanding to executing complex, data-driven strategies.

The in-house analysis team provides a regular "Global Markets Weekly Outlook" that breaks down major trends in forex, stocks, commodities, and cryptocurrencies.

A fully customizable economic calendar is also available to track high-impact global events, such as central bank interest rate decisions or employment data, allowing traders to plan for potential market volatility. For those focused on long-term trends, the broker offers a library of over 70 macro analysis articles covering essential topics like oil benchmarks and global inflation.

One key tool is Market Buzz®, an AI-driven tool that uses natural language processing to scan thousands of news sources and social media platforms. It provides a visual "buzz" indicator for specific assets to gauge market sentiment in real-time. The suite also includes Technical Views®, which delivers actionable analysis for over 1,000 instruments, identifying key support and resistance levels and pinpointing potential entry or exit points.

Additionally, Economic Insight® is an advanced tool that maps historical price movements to specific economic events, helping traders understand how certain data releases might influence future prices.

Webinar Series: The broker hosts the "Monday Market Matters" webinar series, led by industry experts, covering diverse topics from basic trading to risk management.

Step-by-Step Manuals: For those new to the platforms, a series of how-to manuals for ActivTrader, MT4, and MT5 are available to ensure users can navigate the software's full feature set.

Trading Seminars: In addition to digital content, the broker occasionally hosts in-person trading seminars in various global locations, allowing for direct networking and learning from professional traders.

Although the organization of their educational articles could be improved, the quality of the expert-led webinars and professional analysis tools ensures that every client has the resources to make informed, data-driven decisions in 2026.

Customer Support

Providing timely and efficient customer support is one of the biggest strengths of ActivTrades. The support department is at customers’ disposal round-the-clock on weekdays, delivering quick assistance via multiple communication channels. While staff are off duty on weekends, the broker compensates with a high level of expertise and multilingual support available in 14 languages, including English, German, Italian, and Chinese.

Support Channels and Responsiveness

Traders can choose from several efficient ways to get in touch with a representative. The live chat is undoubtedly the quickest method, with agents typically responding within two minutes. For those on mobile, WhatsApp support provides an instant, familiar way to resolve queries on the go. Alternatively, clients can request a free callback over the phone or send a message via the online contact form for less urgent issues. Email support is also highly reliable, with response times generally ranging from a few hours to a single working day.

Self-Service and Educational Help

For traders who prefer to find answers independently, ActivTrades maintains a comprehensive Help Center and a detailed FAQ section. This digital library covers a wide range of topics, from account set-up and two-step verification to specific trading conditions for Islamic accounts. The site also features platform manuals and archived video tutorials, ensuring that users can troubleshoot common technical or administrative issues without needing to contact a live agent.

Verdict

ActivTrades offers an exemplary support ecosystem that ranks among the best in the industry for responsiveness and reliability. By providing multilingual assistance across modern channels like WhatsApp and maintaining a sub-two-minute response time for live chat, the broker ensures that traders are never left without guidance during market hours.

While the lack of weekend support is a minor limitation, the sheer variety of self-service tools and the high quality of their award-winning service make them a top-tier choice for both beginners and professionals in 2026.

FAQ

What is the minimum deposit for an ActivTrades account?

There is a $0 minimum deposit for most regions, including the UK and Europe. However, customers in China and Brazil must start with at least $500.

Is ActivTrades a safe and regulated broker?

Yes, the broker is authorized by top-tier regulators like the FCA (UK) and CMVM (Portugal), maintains segregated accounts at Tier-1 banks, and offers up to $1 million in enhanced insurance.

What are the average spreads for the EUR/USD?

The target spread for major pairs like EUR/USD is exceptionally tight at 0.5 pips, with all-in costs typically remaining around $5 per standard lot.

Does ActivTrades charge a commission on forex trades?

No, forex and most CFD trading is fully commission-free. Commissions only apply to stock CFDs, such as $0.02 per share for US stocks.

Which trading platforms are available?

Traders can choose between the proprietary ActivTrader platform, the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5), or integrate directly with TradingView.

Can I trade cryptocurrencies at ActivTrades?

Yes, the broker offers CFDs on 15 popular digital coins including Bitcoin and Ethereum. However, these are not available to retail traders in the UK due to FCA regulations.

What is the maximum leverage available for retail traders?

Retail leverage is capped at 1:30 in the UK and EU to ensure trader safety, while international clients under the Mauritius entity can access leverage up to 1:1000.

Are there any inactivity fees?

A monthly inactivity fee of $10 (or equivalent) is applied only after an account has been dormant for 52 weeks, provided there is a positive balance.

How fast is order execution at ActivTrades?

The broker uses IBM Cloud infrastructure to deliver an average execution speed of just 0.004 seconds (4ms), with over 93% of orders filled at the requested price.

Does ActivTrades offer a demo account?

Yes, a customizable demo account is available with up to $200,000 in virtual funds. It does not expire as long as it is used at least once every 30 days.