AXI REVIEW 2025

Searching for a trusted broker with low spreads, solid regulation, and advanced trading tools? After hands-on testing of Axi’s MT4, MT5, and mobile platforms, here’s a complete look at how it performs in 2025 — covering its fees, safety, features, and overall trading experience.

Broker Guide's Axi Review in 2025

Choosing a reliable forex broker can make a big difference in your trading results, and that’s exactly why I decided to test Axi firsthand.

Over several weeks, I opened a live account, placed real trades on both the MetaTrader 4 desktop and mobile platforms, and evaluated key areas such as execution speed, spreads, and customer support.

My goal was to find out if Axi still holds up as one of the most trusted brokers in 2025.

In this detailed review, I’ll walk you through everything I found, including Axi’s fees, trading platforms, regulation, available instruments, customer service, and overall verdict.

After testing Axi’s MT4 and mobile platforms, here’s everything you need to know before opening an account in 2025.

About Axi

Quick Facts:

- Founded: 2007

- Headquarters: NSW, Australia

- Offices: London, Limassol, Dubai

- Regulated by: ASIC, FCA, CySEC, DFSA, FMA, FSA

- Tradable Instruments: 290+

- Trustpilot Score: 4.2 / 5

Axi is a globally recognized online forex and CFD broker that has been serving traders since 2007. Headquartered in NSW, Australia, the company has expanded its international footprint with offices in London, Limassol, and Dubai, catering to over 60,000 clients across 100+ countries. Over the years, Axi has built a strong reputation for transparency, reliability, and competitive trading conditions tailored to both retail and professional traders.

Axi offers access to more than 290 tradable instruments, including forex, indices, commodities, cryptocurrencies, and stock CFDs. The broker operates under a multi-entity structure, each authorized and regulated by respected financial authorities.

These include the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) for EU clients, the Dubai Financial Services Authority (DFSA), the Financial Markets Authority (FMA) in New Zealand, and the Financial Services Authority (FSA) in Saint Vincent and the Grenadines.

This broad regulatory coverage ensures client fund protection, segregation of accounts, and adherence to strict compliance standards. Axi’s trustworthiness is further reflected in its Trustpilot rating of 4.2 out of 5, based on thousands of verified customer reviews.

In recognition of its commitment to excellence, Axi received multiple honors at the 2025 Global Business & Finance Magazine Awards, including Best Financial Institution in the UK, Latin America, and the Middle East. These achievements highlight Axi’s consistent efforts to maintain high standards in service, technology, and global accessibility.

My Quick Verdict: Who is Axi Best For?

Rating: 4.5/5

Best for: Traders who value strong regulation, tight spreads, and a powerful MT4 trading experience.

After testing Axi’s live account, platforms, and customer support, it’s clear why this broker continues to rank among the most trusted names in the industry. Axi stands out for its top-tier regulation under ASIC and the FCA, low trading fees, and a seamless MetaTrader 4 ecosystem enhanced by tools like Autochartist, PsyQuation, and Axi Copy. Execution speed was consistently fast during testing, and deposits or withdrawals were processed smoothly without hidden fees.

On the downside, Axi’s product range is narrower compared to large multi-asset brokers like IG or IC Markets, and MetaTrader 5 is still not available in all regions. The broker also doesn’t accept clients from the United States, which limits accessibility for some traders.

Even so, Axi offers a well-rounded experience that balances affordability, performance, and safety. It’s particularly well-suited to forex and CFD traders who prefer the reliability of MetaTrader 4 and the backing of trusted global regulation.

It remains a solid choice for traders who want reliability, regulation, and advanced MT4 tools without excessive costs.

Pros

- Regulated by ASIC and the FCA, offering strong investor protection

- Ultra-low spreads starting from 0.0 pips on Pro and Elite accounts

- No deposit or withdrawal fees across most payment methods

- Supports MT4 and MT5, with access to VPS hosting and copy trading via the Axi Copy app

- Comprehensive educational content through Axi Academy, webinars, and tutorials

- 24/7 multilingual customer support available through live chat, email, and phone

Cons

- No clients accepted from the United States, New Zealand, or Australia under certain entities

- MT5 platform available only to clients of offshore divisions

- Slightly higher spreads on the Standard account compared to top-tier competitors

- No CFDs on options or bonds, limiting advanced diversification opportunities

Why You Should Choose Axi ?

Axi has entered 2025 with several important upgrades designed to improve the trading experience for both new and experienced traders. The rollout of MetaTrader 5 (MT5) across more regions gives clients access to advanced charting, additional timeframes, and deeper market insights.

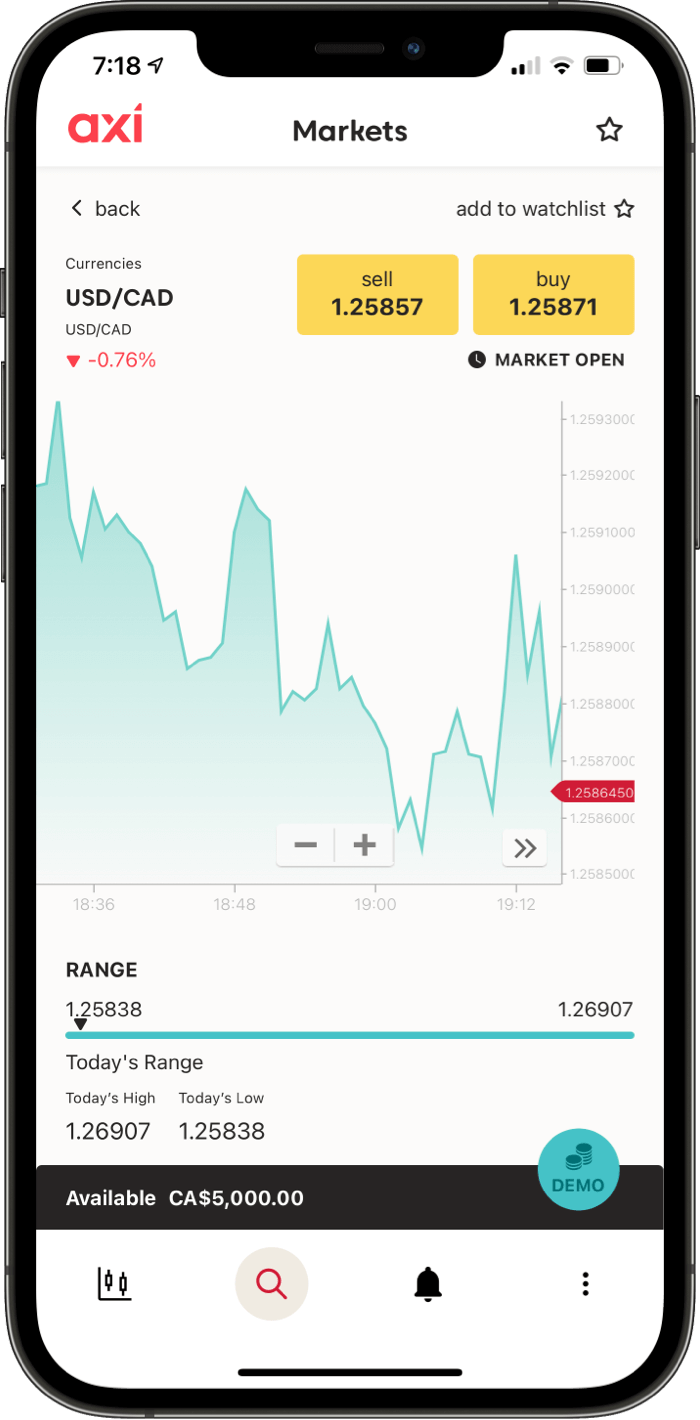

Meanwhile, the Axi App and Axi Copy app have made trading more accessible, allowing users to open accounts, analyze markets, and mirror top-performing traders directly from their smartphones. Spreads have also tightened across major forex pairs, further enhancing trading efficiency for high-volume and cost-conscious clients.

Commitment to Transparency and Regulation

Axi continues to strengthen its reputation as one of the most transparent and well-regulated brokers in the industry. The company operates under the supervision of multiple authorities, including ASIC, FCA, CySEC, and DFSA, ensuring compliance with strict financial standards. This broad regulatory coverage not only provides client protection and fund segregation but also reinforces Axi’s long-term credibility in global markets.

Awards and Global Growth

In recognition of its consistent performance, Axi earned several accolades at the 2025 Global Business & Finance Magazine Awards, including Best Financial Institution in the UK, Latin America, and the Middle East. The broker now serves over 60,000 clients in more than 100 countries, with steady growth driven by its expanding product range and technology-first approach.

Verdict

In 2025, Axi stands out as a tech-driven broker blending institutional liquidity with retail accessibility. With a growing suite of tools, stronger regulatory backing, and a focus on transparent pricing, Axi continues to evolve in step with trader needs. Whether you’re a beginner exploring forex or a professional seeking low-cost execution, Axi offers a dependable and innovative trading environment built for long-term success.

Compare to Top Competitors

When choosing a forex broker, it’s important to understand how Axi stacks up against other major names in the industry. While Axi focuses on regulation, cost efficiency, and advanced MetaTrader tools, its competitors bring their own strengths to the table. Here’s how Axi compares with FxPro, AvaTrade, and Fusion Markets in 2025.

FXPro

Avatrade

Fusion Markets

Exploring Axi’s Range of Tradable Instruments

Axi provides access to a diverse selection of over 290 CFDs across multiple asset classes, offering opportunities for traders to diversify and manage risk within a single platform.

You can trade Forex, Indices, Commodities, Stocks, Cryptocurrencies, IPOs, and Futures, with flexible leverage depending on your region and account type.

While Axi’s market coverage is solid, it doesn’t yet include options or bond CFDs, which are available with a few larger competitors such as IG and Saxo Bank.

Forex

Forex trading is Axi’s strongest offering, featuring 70+ currency pairs covering majors, minors, and exotics. Traders can access leverage of up to 1:1000 through offshore entities and 1:30 under FCA and ASIC regulation.

Spreads start from 0.0 pips on Pro and Elite accounts, and all trades benefit from ECN-style execution with access to more than 20 top-tier liquidity providers.

Compared to competitors like IC Markets and Fusion Markets, Axi’s spreads are slightly higher on Standard accounts but still competitive overall.

Stock CFDs

Axi allows trading on more than 100 global stocks from markets including the US, UK, Europe, and Hong Kong.

You can trade popular companies like Tesla, Meta, Disney, and Microsoft, with leverage up to 1:20 for professional clients and 1:5 for retail traders under FCA or ASIC supervision.

All stock CFDs are commission-free on Standard accounts, making them ideal for traders who want to speculate on share movements without owning the underlying assets.

Indices

With over 30 major indices available, Axi provides exposure to some of the world’s leading markets, such as the S&P 500, NASDAQ 100, DAX 30, and FTSE 100.

Index CFDs can be traded with leverage up to 1:500 (offshore) or 1:20 (FCA and ASIC), and spreads start from as low as 0.2 points. These instruments are particularly suited to traders looking to capture broader market trends rather than focusing on individual stocks.

Commodities

Axi offers trading in 13+ commodities, including crude oil, natural gas, wheat, corn, and precious metals.

With leverage of up to 1:1000 offshore and 1:10 under regulated entities, commodity CFDs allow traders to speculate on global supply and demand shifts without physically holding the assets.

Cryptocurrencies

Axi supports over 30 cryptocurrency CFDs, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Chainlink (LINK).

Traders can speculate on both rising and falling prices without needing a crypto wallet. Leverage reaches 1:200 offshore and 1:2 in the UK and EU, aligning with regulatory requirements.

| Asset | Axi |

|---|---|

| Forex Pairs | 70 |

| Tradeable Symbols | 290 |

| Stocks | 100+ |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency | 30 |

| Commodities | 13 |

| Indices | 30 |

| Futures | 150+ |

How Axi’s Instruments Compare to Competitors

| Asset | Axi | FXPro | Avatrade | Fusion Markets |

|---|---|---|---|---|

| Forex | ||||

| Indices | ||||

| Stock CFDs | ||||

| Commodities | ||||

| Cryptocurrencies | ||||

| Futures CFDs | ||||

| Options CFDs | ||||

| ETFs | ||||

| Bond CFDs |

Bottom Line

Axi covers all the essential markets most traders need, including forex, indices, commodities, stocks, and cryptocurrencies. While it doesn’t offer options, bonds, or ETFs like some larger multi-asset brokers such as FxPro or AvaTrade, it maintains a strong and focused selection ideal for forex and CFD traders who value simplicity, speed, and competitive pricing.

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD (Standard) | 1.2 pips |

Average Spread EUR/USD (Pro) | 0.2 pips |

| Commissions | $3.50 per side on Pro accounts. $0 commission on Standard. |

| Forex CFD Fees | Low |

Index CFD Fees | Low |

Stock CFD fees | Low |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | A $10 inactivity charge after 12 months of no trading activity |

The broker offers a simple and transparent pricing model tailored to different trading styles. Whether you’re a beginner or a high-volume professional, the cost structure is designed to keep trading affordable while maintaining competitive execution.

Spreads and Commissions by Account Type

Each account type has its own fee model, combining spreads and commissions in different ways:

Standard Account

- Average spread: 1.2 pips (EUR/USD)

- No commission

- Best for beginners or casual traders who prefer an all-inclusive cost structure

Pro Account

- Average spread: 0.2 pips (EUR/USD)

- $7 round-trip commission per standard lot

- Designed for active traders who value lower spreads and faster execution

Elite Account

- Raw spreads from 0.0 pips

- $3.50 round-trip commission

- Ideal for professional traders managing larger volumes

Financing Charges (Swaps)

When positions are held overnight, swap fees apply based on interbank rates. These charges can be easily viewed within the MT4 platform under the “Properties” section of each instrument. There’s no additional markup beyond the standard swap rate, ensuring transparent overnight funding costs.

Other Trading Costs

Additional expenses are minimal but worth noting:

- VPS hosting is free for those trading more than 20 lots per month; otherwise, a small monthly fee applies.

- No hidden execution or administrative costs are added to trades.

Non-Trading Fees

Outside of actual trading activity, the broker keeps costs low:

- No deposit or withdrawal fees (excluding possible third-party bank charges).

- $10 inactivity fee after 12 months of no trading activity.

- Currency conversion fee when funding or withdrawing in a non-base currency.

Verdict

Overall, the fee structure is transparent and cost-efficient. With low spreads, minimal commissions, and no surprise charges, this broker offers a fair balance between affordability and high-quality execution — suitable for both beginners and seasoned traders.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Axi Regulated ?

Regulation is one of the strongest indicators of a broker’s credibility and commitment to client safety. Axi operates under a multi-jurisdictional regulatory framework, ensuring compliance with some of the world’s most respected financial authorities. This broad oversight provides traders with a secure trading environment, fund protection, and transparent business practices.

Global Regulatory Coverage

Axi is regulated by several tier-1 and tier-2 regulators around the world, each responsible for enforcing strict operational and financial standards:

- Australia – ASIC (Australian Securities and Investments Commission)

- AFSL License No.: 318232

- AxiCorp Financial Services Pty Ltd operates under ASIC, ensuring capital adequacy, segregation of funds, and transparent reporting.

- AFSL License No.: 318232

- United Kingdom – FCA (Financial Conduct Authority)

- Firm Reference No.: 466201

- Axi Financial Services (UK) Ltd complies with FCA rules, which include participation in compensation schemes and strict client fund segregation.

- Firm Reference No.: 466201

- European Union – CySEC (Cyprus Securities and Exchange Commission)

- License No.: 433/23

- Oversees operations through Solaris EMEA Ltd, ensuring Axi meets EU-wide MiFID II requirements and investor protection standards.

- License No.: 433/23

- United Arab Emirates – DFSA (Dubai Financial Services Authority)

- License No.: F003742

- Regulates AxiCorp Financial Services Pty Ltd’s Dubai branch, maintaining high compliance standards in the Middle East region.

- License No.: F003742

- New Zealand – FMA (Financial Markets Authority)

- License No.: 518226

- Supervises Axi’s operations for New Zealand clients, ensuring transparent and ethical trading practices.

- License No.: 518226

- Saint Vincent and the Grenadines – FSA (Financial Services Authority)

- Registration No.: 25417 BC 2019

- Oversees AxiTrader Ltd, which provides services to international clients and offers higher leverage options (up to 1:1000).

- Registration No.: 25417 BC 2019

Investor Protection and Fund Security

Clients trading under FCA regulation are protected by the Financial Services Compensation Scheme (FSCS), which covers up to £85,000 in the event of broker insolvency. Those under CySEC regulation benefit from the Investor Compensation Fund (ICF), providing coverage of up to €20,000.

Across all jurisdictions, client funds are held in segregated accounts at top-tier banks, ensuring they remain separate from the broker’s operational capital. Additionally, negative balance protection ensures that clients cannot lose more than their deposited amount, even in cases of extreme market volatility.

It’s important to note that Axi cannot onboard clients from the United States due to local financial regulations.

Understanding Regulatory Protections and Broker Stability

Regulation is more than a formality—it’s the foundation of trust between a broker and its clients. Being supervised by top-tier regulators such as the ASIC in Australia and the FCA in the United Kingdom provides strong safeguards that enhance financial stability and investor protection. These authorities require strict compliance with capital adequacy, risk management, and operational transparency, ensuring that client funds and trading activities are managed responsibly.

A key component of this protection is client fund segregation. All customer deposits are held in separate trust accounts at reputable banks, completely isolated from the broker’s own operating funds. This means that even in the unlikely event of insolvency, client money remains protected and cannot be used to cover company expenses or debts.

Additionally, Axi’s regulated entities participate in compensation schemes that offer an extra layer of security. Traders under the FCA are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000, while those under CySEC benefit from the Investor Compensation Fund (ICF), covering up to €20,000. These programs ensure clients have financial recourse in the rare case of broker default.

Beyond regulation, Axi’s financial transparency and consistent performance have earned industry recognition, including awards at the 2025 Global Business & Finance Magazine Awards for Best Financial Institution in multiple regions. The broker also enjoys a strong reputation among users, reflected in its Trustpilot rating of 4.4 out of 5, based on thousands of verified reviews.

With multiple top-tier licenses, robust fund protection policies, and a proven record of reliability, Axi demonstrates both regulatory strength and operational stability. It’s a broker built on transparency and long-term trust—qualities that continue to attract traders worldwide.

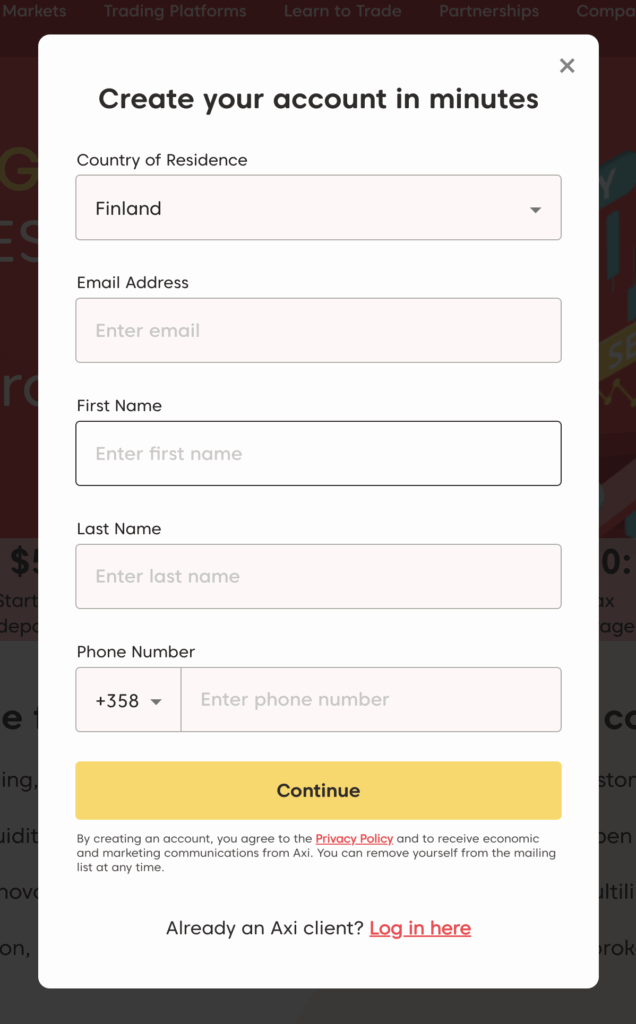

How To Open an Account

Opening a trading account is straightforward and takes about 10 minutes from start to finish. The process is fully digital, and most traders can begin trading within 24 hours once verification is complete. Here’s a quick step-by-step guide to get started:

Step 1: Sign Up

Visit the broker’s official website and click “Create Account.” You’ll be asked to provide basic personal details such as your name, email address, country of residence, and phone number. You’ll also need to choose your preferred account type (Standard, Pro, or Elite) and base currency.

Step 2: Verify Your Identity

As part of the Know Your Customer (KYC) requirements, you’ll need to verify your identity and address. This involves uploading a valid photo ID (such as a passport or driver’s license) and a proof of address document (like a recent utility bill or bank statement). The verification process typically takes under 24 hours once your documents are submitted.

Step 3: Fund Your Account

Once verified, you can make your first deposit through one of the supported payment methods, including bank transfer, credit/debit card, or e-wallets. There are no deposit fees, and funds are usually credited instantly for most methods.

All account setup and funding activities are protected by SSL encryption, ensuring your personal data and financial transactions remain secure.

Account Types

This broker offers a well-structured range of account types designed to meet the needs of all kinds of traders—from complete beginners to high-volume professionals. Each account provides access to the same trading platforms (MT4 and MT5), strong regulatory protection, and competitive pricing. The main differences lie in spreads, commissions, and deposit requirements.

Below is an in-depth look at each account type and who it’s best suited for.

Standard Account

The Standard Account is designed for beginners and casual traders who prefer simplicity and low entry barriers. It combines competitive spreads with zero commissions, making it easy to manage trading costs without complex fee structures.

Spreads: From 1.2 pips (EUR/USD)

Commission: None

Minimum Deposit: $0–$200

Leverage: Up to 1:500 (depending on region)

Best for: Beginners and part-time traders

Key Benefits:

- No commission fees—costs are included in the spread

- Easy to open and ideal for traders learning the basics

- Full access to all trading instruments and platforms

Pro Account

The Pro Account caters to experienced traders who need tighter spreads and faster execution. It uses a raw pricing model that directly connects traders to liquidity providers, making it suitable for scalping and algorithmic trading.

Spreads: From 0.0 pips (EUR/USD)

Commission: $7 round-trip per lot

Minimum Deposit: $5–$500

Leverage: Up to 1:500 (offshore) / 1:30 (FCA, ASIC)

Best for: Experienced and active traders

Key Benefits:

- Access to raw spreads for greater cost efficiency

- Lower overall trading costs compared to Standard accounts

- Excellent for strategies requiring precise execution and tight spreads

Elite Account

The Elite Account is built for professional and high-volume traders who prioritize execution speed and the lowest possible trading costs. It offers access to institutional-grade liquidity and personalized account support.

Spreads: From 0.0 pips

Commission: $3.50 round-trip per lot

Minimum Deposit: $25,000

Leverage: Up to 1:500 (offshore) / 1:30 (FCA, ASIC)

Best for: Professional and institutional traders

Key Benefits:

- Ultra-low trading costs with minimal commission

- Priority customer service and premium VPS hosting

- Tailored account management for large-scale trading operations

Other Account Types

Islamic (Swap-Free) Account:

The Islamic Account is designed for Muslim traders who wish to trade in accordance with Sharia law. It removes all overnight swap or interest charges while keeping the same spreads and commissions as other account types.

Key Benefits:

- Fully compliant with Islamic finance principles

- No interest or swap fees on overnight positions

- Available on Standard, Pro, or Elite structures

Demo Account:

The Demo Account is a risk-free way to explore the platform and test strategies using virtual funds. It mirrors real market conditions and allows traders to gain experience before committing real capital.

.

Key Benefits:

- Free and unlimited use

- Real-time market pricing and order execution

- Ideal for both beginners and strategy testing

Verdict

The account lineup is well-balanced and transparent. Standard is perfect for beginners getting started, Pro offers great value for active traders seeking tighter spreads, and Elite caters to professionals who want the lowest commissions and premium execution.

What is the Minimum Deposit at Axi?

FxPro requires a minimum deposit of $100, making it accessible to both beginners and casual traders. This entry-level requirement applies across all account types and can be funded using various payment methods, including bank transfers, credit or debit cards, and popular e-wallets.

While $100 is sufficient to start trading, the broker recommends a minimum of $1,000 to maintain better margin management and risk control, especially for traders using leverage or holding multiple open positions. The flexible funding threshold allows users to start small and scale up as they gain confidence and experience.

| Broker | Minimum Deposit |

|---|---|

| Avi | $0 |

FXPro | $100 |

| Avatrade | $100 |

Fusion Markets | $0 |

Deposit and Withdrawal

Managing your funds is simple and secure, with a wide range of payment options available to suit traders from different regions. The broker’s funding process is designed for speed and transparency, with no hidden fees and multiple currencies supported to minimize conversion costs.

Deposit Fees & Options

There are no deposit fees regardless of the payment method used, making it easy to fund your trading account without unnecessary costs. With more than 15 supported payment options, clients can choose the method that best fits their location and convenience.

Processing times:

- Instant for e-wallets and cards

- 1–3 business days for bank wire transfers

Deposits are automatically credited in your account’s base currency to avoid conversion costs, and all transactions are protected by SSL encryption for maximum security.

Withdrawal Fees & Options

Like deposits, there are no withdrawal fees, except for possible charges from your receiving bank (especially for international wires). The withdrawal process is straightforward and compliant with anti-money laundering (AML) regulations, meaning funds can only be sent back to an account in your own name.

Processing times:

- 1–2 business days for most methods

- Up to 3 days for international bank transfers

The broker does not allow third-party transfers, ensuring full compliance with AML and KYC standards. This helps protect client accounts and maintain secure fund management.

Verdict

Funding and withdrawals are efficient, secure, and cost-free on the broker’s side. With over 15 payment options, instant processing for most deposits, and transparent withdrawal rules, traders benefit from one of the most user-friendly and flexible payment systems in the industry.

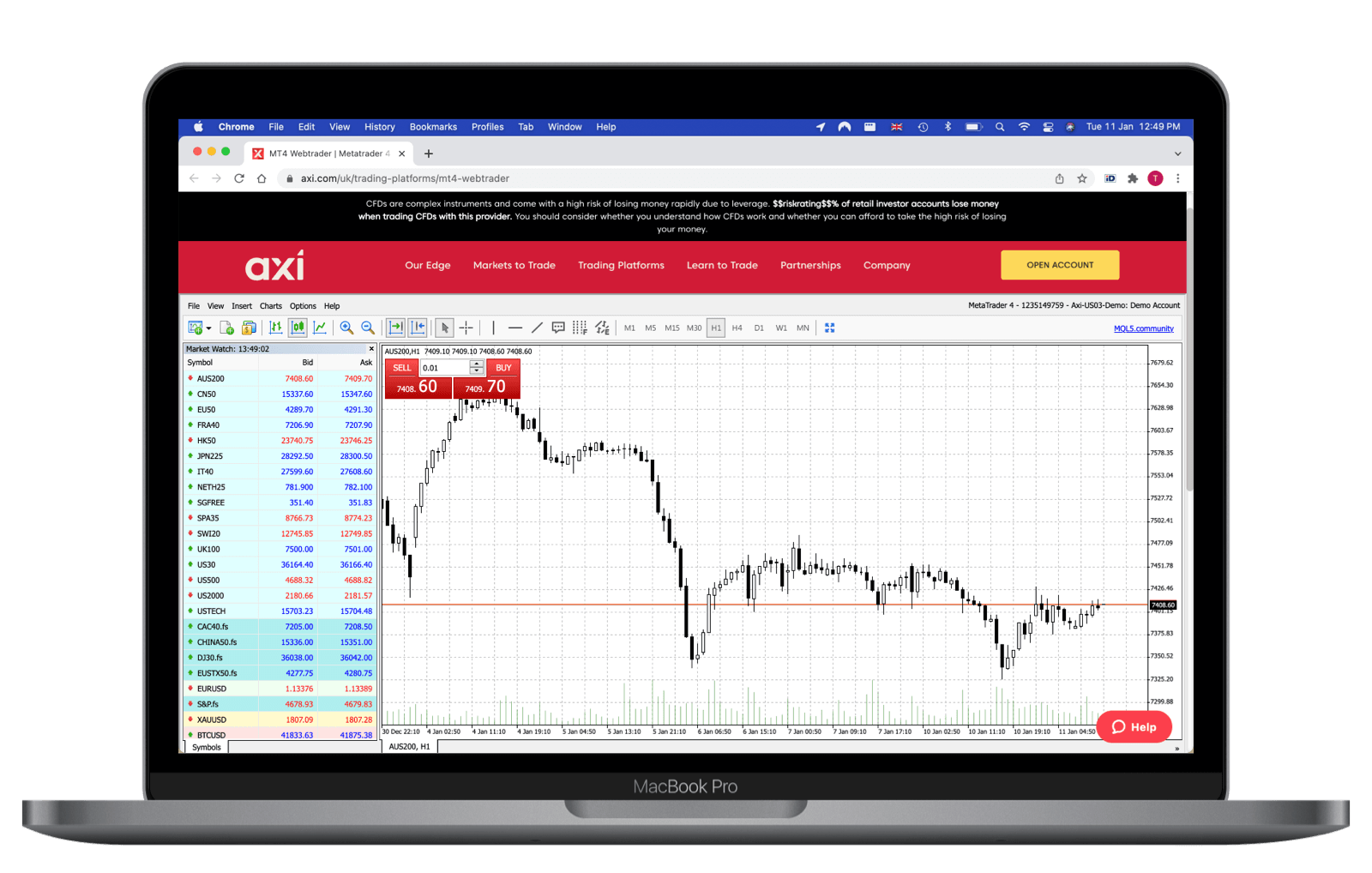

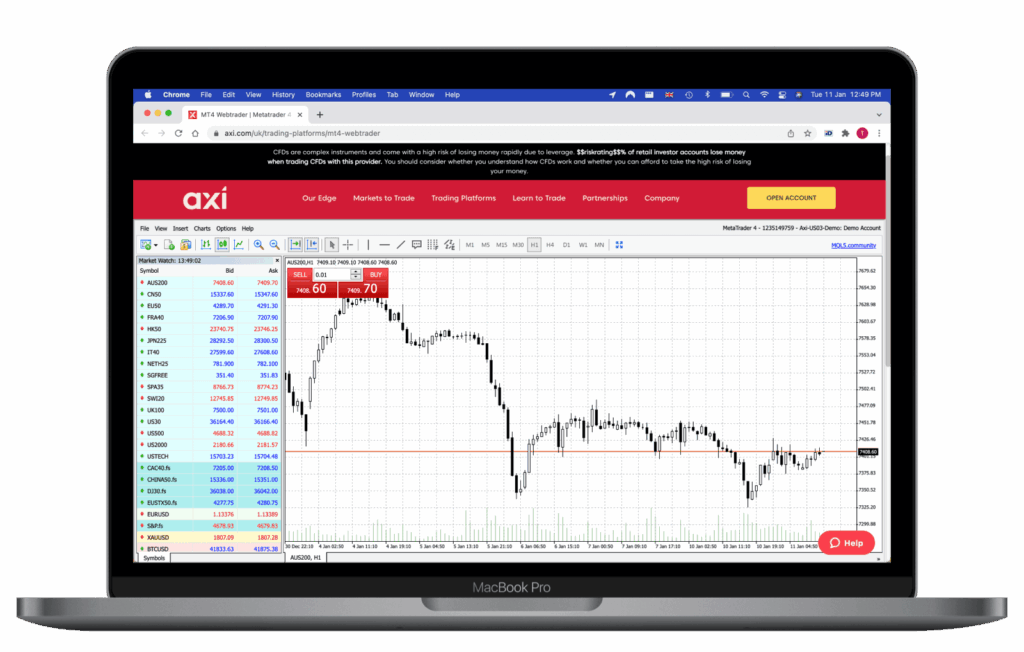

Desktop Trading Platform

Axi provides traders with access to the world’s most trusted and feature-rich trading platforms — MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their reliability, speed, and flexibility, making them ideal for traders who rely on advanced tools and automated strategies.

MetaTrader 4 (MT4)

MT4 remains the broker’s core desktop trading platform, trusted by thousands of traders worldwide. It’s designed for both beginners and advanced users who want precise execution and powerful analysis tools.

Key Features:

Live Interactive Charts: Real-time market data with customizable indicators and drawing tools.

Expert Advisors (EAs): Support for automated trading strategies and algorithmic systems.

Autochartist Integration: Pattern recognition software that identifies trade opportunities automatically.

PsyQuation: An AI-powered analytics tool that helps traders understand their performance and optimize their strategies.

MT4 NexGen Add-On: Provides enhanced trade management, sentiment indicators, and correlation tools.

VPS Hosting: Ensures uninterrupted automated trading with reduced latency and faster execution.

MT4 is also fully integrated with the Axi Copy App, allowing traders to copy the trades of experienced investors directly within the platform. This feature is especially useful for those who want to learn or trade passively while leveraging the expertise of top-performing traders.

MetaTrader 5 (MT5)

MT5 is available primarily for offshore clients and offers an upgraded experience with enhanced charting, a broader range of instruments, and improved order management. It includes an integrated economic calendar, more timeframes, and additional pending order types, making it suitable for traders who want a more versatile and modern trading environment.

MT5 Advantages:

- More instruments and markets compared to MT4

- Built-in calendar and market depth view

- Enhanced analytical tools and 64-bit processing for faster performance

Verdict

Both MT4 and MT5 offer a professional-grade trading experience backed by speed, stability, and deep analytical features. While MT5 expands possibilities for offshore users, MT4 remains the platform of choice for most traders who value custom tools, copy trading, and proven reliability.

Pros & Cons of the Web Platform

Pros:

- Access to the industry-standard MT4 ecosystem

- Comprehensive toolset including Autochartist, PsyQuation, and NexGen

- Fast ECN execution with low latency and high stability

- VPS and copy trading support for advanced users

Cons:

- MT5 is not yet available in all regions

- No fully proprietary web platform for traders who prefer browser-based solutions

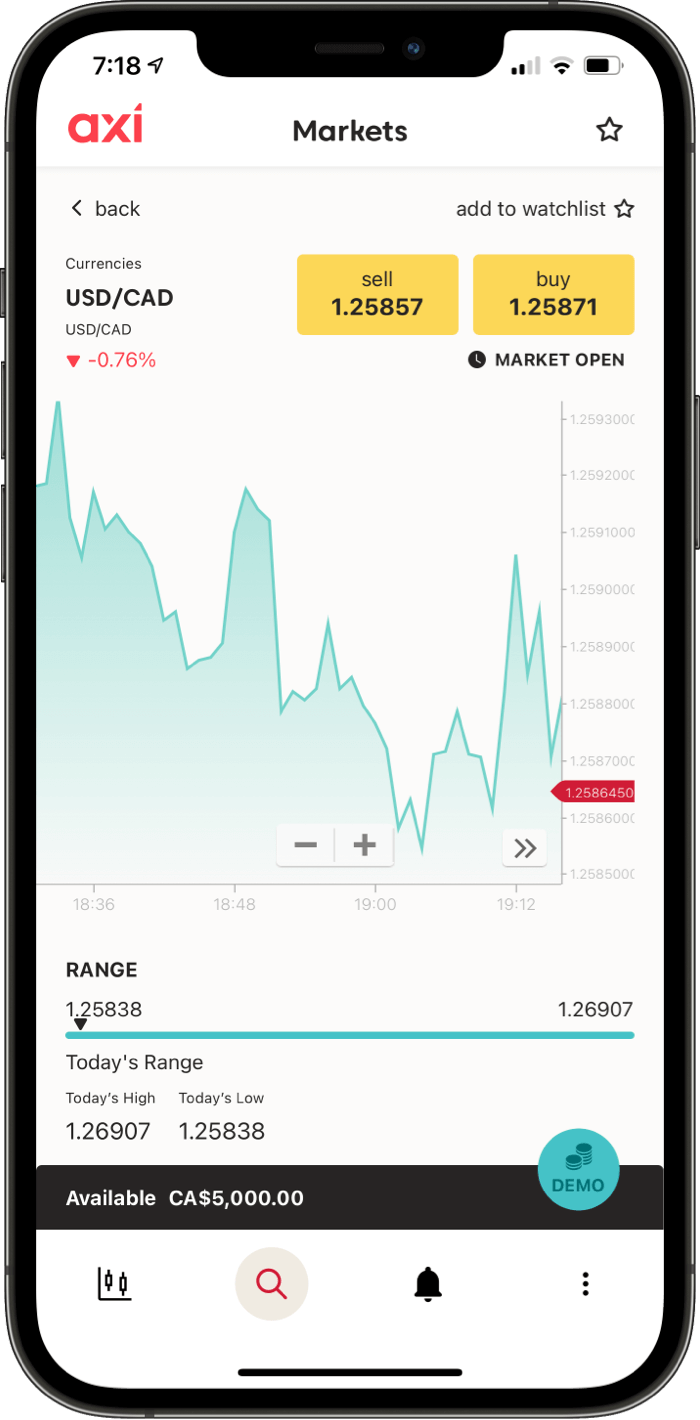

Mobile App

Trading on the go is seamless with the combination of the MetaTrader 4 mobile app and the Axi App, the broker’s proprietary platform designed to complement the desktop experience. Together, they provide full access to live markets, advanced charting tools, and quick order execution right from your smartphone or tablet.

MetaTrader 4 Mobile App

The MT4 mobile app delivers all the core trading features you’d expect from the world’s most popular trading platform. Available on both iOS and Android, it allows traders to monitor markets, execute trades, and manage positions with ease.

Key Features:

- Real-time charts and market quotes across all major instruments

- One-click trading for fast order execution

- Full access to pending and market order types

- Custom watchlists to track favorite assets

- Integrated economic calendar for key market updates

Axi App (Proprietary Platform)

The Axi App is an all-in-one solution for account management and mobile trading. Traders can open new accounts, fund them instantly, and access key market insights directly from the app. It’s also fully integrated with the Axi Copy App, enabling users to copy trades from professional traders in real time — an excellent option for beginners or passive investors who want to learn by following expert strategies.

Highlights:

- Clean, intuitive interface with advanced charting

- Fast deposits and withdrawals from within the app

- Access to educational content and market news

- Biometric login for added security

Verdict

Both the MT4 and Axi mobile apps deliver a flexible and feature-rich experience for traders who prefer to stay active on the move. With copy trading, built-in analytics, and secure login options, the apps combine convenience with performance — though MT5 mobile availability remains restricted in some regions.

Pros & Cons of the Mobile App

Pros:

- Smooth, easy-to-navigate interface

- One-click trading and full account management

- Axi Copy App integration for social trading

- Secure biometric login and demo account access

Cons:

- Not available in all jurisdictions

- MT5 mobile functionality is limited to offshore clients

Market Research, Tools, and Education

Axi places a strong emphasis on trader development and research, providing a comprehensive suite of educational resources and analytical tools.

Whether you’re a beginner learning the basics or an intermediate trader looking to sharpen your strategy, the broker’s learning ecosystem combines technology, insights, and professional guidance to support every stage of your trading journey.

Key Learning Resources: eBooks: Cover essential topics like technical analysis, risk management, and trading psychology.

Webinars: Conducted by experienced analysts who explain current market trends and strategy development in real time.

Video Tutorials: Step-by-step guides for mastering trading platforms, indicators, and automated strategies.

Blog Insights: Regular articles offering commentary on global markets, trading tips, and economic events.

All materials are presented in clear, practical language, making Axi Academy a useful starting point for new traders and a handy reference for those refining their approach.

Top Tools Include:

Autochartist: Automatically scans markets for chart patterns and technical setups, saving traders time and improving accuracy.

PsyQuation: A data-driven performance analytics tool that helps traders understand their behavior, identify weaknesses, and optimize strategies.

MT4 NexGen: Adds advanced features like sentiment analysis, trade management widgets, and correlation monitoring to the standard MT4 platform.

Together, these tools transform the traditional MT4 platform into a professional-grade workspace, bridging the gap between retail and institutional trading.

Customer Support

Strong customer support is a key factor in evaluating any broker, and this one performs well across accessibility, speed, and overall service quality. Whether you’re facing a technical issue, a trading query, or simply need account assistance, help is always close at hand.

Support Channels

Traders can reach the support team through multiple communication channels, including:

- Live Chat – Instant responses directly on the website or trading platform.

- Email – Ideal for more detailed inquiries or document submissions.

- Phone Support – Available during market hours for direct, real-time assistance.

- WhatsApp Support – Convenient for quick updates and regional support access.

This multi-channel approach ensures clients can get the help they need quickly, using whichever method suits them best.

Availability and Response Times

Customer support operates 24/5 for most regions and 24/7 under certain offshore entities, ensuring that traders across time zones can connect with an agent when needed. During testing, response times were among the fastest in the industry:

- Live Chat: Typically under 30 seconds

- Phone: Usually within 3 minutes

- Email: Replies received within a few hours on average

Such benchmarks indicate a well-trained, responsive team equipped to handle both technical and account-related issues efficiently.

Multilingual Coverage

Axi’s support is multilingual, catering to a global client base with service available in English, Spanish, Arabic, Portuguese, Chinese, Vietnamese, and several other languages. This accessibility makes it easier for traders worldwide to communicate clearly and receive accurate assistance.

Awards and Recognition

The company has received multiple industry awards for customer satisfaction and service excellence, further validating its commitment to client care.

Verdict

Customer support is reliable, responsive, and globally accessible. While it’s not 24/7 for all regions, response times and professionalism are consistently strong, making the overall experience smooth and dependable for traders of all levels.

FAQ

Is Axi safe and regulated?

Yes. Axi is regulated by several top-tier authorities, including ASIC (Australia), FCA (UK), CySEC (EU), and DFSA (UAE). These licenses ensure that client funds are protected, accounts are segregated, and strict financial standards are maintained.

What can I trade on Axi?

You can trade over 290 instruments, including Forex, Indices, Commodities, Stocks, Cryptocurrencies, Futures, and IPOs. While the range is comprehensive, it does not currently include options or bond CFDs.

What is the minimum deposit to start trading?

The minimum deposit depends on your region and account type: $0 for certain Axi entities; $5 for Standard and Pro accounts; $25,000 for Elite Account.

Does Axi offer a demo account?

Yes. Axi provides a free, unlimited demo account that mirrors real market conditions using virtual funds. It’s a great way for beginners to practice trading or for experienced traders to test new strategies risk-free.

Can I trade with a small budget?

Absolutely. Axi’s Standard Account can be opened with as little as $0–$200, depending on your region. You can also trade micro-lots, making it suitable for those who prefer to start small while learning the ropes.

Is Axi suitable for professional traders?

Yes. Professional and high-volume traders can benefit from Pro and Elite Accounts, offering raw spreads from 0.0 pips, ultra-fast ECN execution, and low commissions as little as $3.50 per round trip.

What tools are available for market analysis?

Axi offers several advanced tools, including Autochartist, PsyQuation, and MT4 NexGen, plus access to regular market updates, webinars, and the Axi Academy for continuous education.

Does Axi support long-term investing?

Yes, while primarily a CFD broker, Axi’s stock CFDs allow traders to hold positions for the long term. Competitive swap rates and robust execution make it possible for investors to manage medium- to long-term strategies effectively.

How can I deposit or withdraw funds?

You can fund your account using 15+ methods, including cards, bank transfer, PayPal, Skrill, Neteller, POLi, and crypto (offshore). There are no deposit or withdrawal fees, and most transactions are processed within 1–2 business days.

Is Axi good for beginners?

Yes. Axi’s user-friendly MT4 platform, Axi Academy, and copy trading tools make it ideal for beginners. The broker’s low-cost entry, demo account, and educational resources provide a safe and supportive environment for new traders to start confidently.