NINJATRADER REVIEW 2025

Thinking about trading futures in 2025? We put NinjaTrader to the test — live trading, platform performance, real fees, and all. Known for its low-cost futures trading and professional-grade tools, the broker has long been a favorite among serious traders.

But is it still the best choice after its 2025 acquisition by Kraken? In this in-depth review, we break down everything — from commissions and regulation to platform pros and cons — so you’ll know exactly whether NinjaTrader deserves a spot in your trading setup.

Broker Guide's NinjaTrader Review in 2025

For this NinjaTrader Review 2025, our team opened a live account, placed real trades, and carefully analyzed everything from fees and platform usability to regulation, safety, and customer support.

The goal is to provide traders with a clear and unbiased view of how NinjaTrader performs in real market conditions.

In May 2025, it became part of the Kraken Group, one of the world’s leading crypto exchanges — yet it continues to operate independently as a regulated U.S. futures broker under the CFTC and NFA.

This combination of institutional backing and autonomy makes it one of the most stable and trusted futures platforms available today.

In this comprehensive review, we break down NinjaTrader’s performance, pricing, tradable instruments, and user experience, so you’ll know exactly what to expect before opening an account.

Whether you’re a seasoned futures trader or someone exploring professional tools for the first time, this guide will help you decide if it is the right fit for your trading goals.

About NinjaTrader

Founded in 2003, NinjaTrader has evolved into one of the most respected U.S.-based futures-only brokers, serving both retail and institutional traders worldwide. Today, it supports a community of over 1 million users who rely on its professional-grade tools, flexible pricing, and deep market access.

Regulated and Secure Under CFTC and NFA

NinjaTrader operates under the oversight of two top-tier U.S. regulators — the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

These agencies enforce strict compliance standards and segregated client fund policies, ensuring trader protection and operational transparency. This makes them a trusted name for those who prioritize safety in futures trading.

Built for Serious Futures Traders

Unlike multi-asset brokers, NinjaTrader is specialized in futures trading, offering more than 100 contracts across major markets — from commodities and stock indices to treasuries and crypto futures. This focus makes it an ideal platform for traders who want direct, low-cost access to futures products and professional-level analytics.

Powerful Platforms and Customization

NinjaTrader is available across desktop, web, and mobile, giving traders complete flexibility in how they trade. The desktop platform remains its flagship, offering advanced charting, strategy automation, and backtesting tools. While the web and mobile apps provide seamless access to markets on the go. Traders can also use simulated trading to practice strategies risk-free and enhance their setups with thousands of third-party add-ons from NinjaTrader’s ecosystem.

With its combination of regulatory strength, professional functionality, and community-driven innovation, NinjaTrader continues to set the standard for futures brokers and trading platforms in 2025.

My Quick Verdict: Who is NinjaTrader Best For?

Rating: 4.4/5

Best for: Advanced futures traders seeking low costs, professional tools, and customizable strategies.

Not ideal for: Traders seeking a beginner-friendly interface or those looking to trade stocks, ETFs, or spot forex, as NinjaTrader focuses exclusively on the futures market.

NinjaTrader continues to be one of the most cost-efficient and feature-rich futures trading platforms in 2025. Designed for serious and experienced traders, it combines low commissions, advanced analytics, and robust automation tools within a professional-grade ecosystem. With commissions as low as $0.09 per contract, deep customization options, and reliable execution, it stands out as a top choice for those who trade futures actively or build custom trading strategies.

Its platform is built to handle complex trading environments, offering a wide range of features for both discretionary and automated trading.

For experienced traders who prioritize performance, reliability, and regulatory trust, the broker remains a top-tier choice for futures trading in 2025.

Pros

- Regulated by CFTC & NFA

- Low futures commissions ($0.09–$1.29 per contract)

- No deposit minimum

- Free ACH withdrawals

- Award-winning desktop platform

- Simulated trading & customizable tools

- Strong research & education resources

Cons

- Futures-only (no stocks/forex)

- Inactivity fee: $25/month

- Wire withdrawal fee: $30

- Desktop only for Windows

- Market data subscriptions are required for most contracts

Why You Should Choose NinjaTrader ?

In May 2025, NinjaTrader officially became part of the Kraken Group, one of the world’s largest and most trusted cryptocurrency exchanges. This acquisition brought NinjaTrader under the umbrella of a major financial technology powerhouse — giving it greater stability, security, and innovation resources while still allowing it to operate independently as a regulated U.S. futures broker. For traders, that means a stronger infrastructure, improved integrations, and continued confidence in NinjaTrader’s long-term reliability.

Transparent Pricing and Low-Cost Futures Trading

The broker appeal lies in its transparent, tiered pricing model. Traders can choose from Free, Monthly, or Lifetime plans, with commissions starting as low as $0.09 per contract for lifetime license holders. There are no deposit minimums, and ACH transactions are free, keeping overall costs predictable and competitive. This clarity in pricing makes them particularly attractive compared to brokers that bury their charges in complex spreads or platform fees.

Built for Serious Futures Traders

Whether you’re a short-term futures scalper or a professional running automated trading strategies, the broker provides the performance tools you need. The desktop platform is designed for deep market analysis, advanced charting, and strategy automation, while the web and mobile platforms extend flexibility to trade anywhere. Thousands of third-party add-ons and indicators make it easy to customize your setup — from algorithmic systems to personalized chart layouts.

Supported by a Large Community and Learning Hub

NinjaTrader also stands out for its vibrant trading community and extensive educational ecosystem. Through their Learn portal, traders gain access to tutorials, webinars, and platform guides. Its simulated trading mode helps new users practice without risk, while the community forum and developer marketplace create an environment where ideas, strategies, and scripts are constantly shared and refined.

Compared with Other Futures Brokers

When compared to brokers like Interactive Brokers, AMP Futures, and Optimus Futures, NinjaTrader holds its ground in both pricing and functionality. While Interactive Brokers offers broader asset classes, NinjaTrader outperforms in usability, charting depth, and automation for dedicated futures traders. AMP and Optimus may offer slightly lower commissions, but NinjaTrader’s advanced tools, community support, and regulatory track record make it the more complete trading ecosystem overall.

Verdict

With its strong regulatory foundation, Kraken-backed stability, and professional-grade trading environment, the broker continues to be one of the most compelling choices for futures traders in 2025. It’s an ideal platform for those who want low-cost, high-performance trading with the flexibility to automate, customize, and continuously grow their trading skills.

Compare to Top Competitors

Choosing the right futures broker often comes down to finding the best balance between cost, performance, and platform usability. While NinjaTrader shines for its low fees, automation tools, and futures-only focus, it’s helpful to see how it stacks up against other leading brokers in the same space — Optimus Futures, Interactive Brokers, and TradeStation.

Optimus Futures

Interactive Brokers

TradeStation

Exploring NinjaTrader's Range of Tradable Instruments

When it comes to market access, NinjaTrader takes a focused, futures-only approach — offering more than 100 tradable futures contracts across global markets.

Instead of spreading thin across multiple asset types, NinjaTrader invests heavily in building a deep, reliable infrastructure for professional futures trading. This focus gives traders access to some of the most liquid and cost-efficient markets in the world.

Stock Index Futures

NinjaTrader provides a broad selection of U.S. and global stock index futures, including the E-mini S&P 500 (ES), Micro E-mini Nasdaq 100 (MNQ), Dow Jones (YM), and Russell 2000 (RTY). These contracts are among the most traded globally, offering tight spreads and strong liquidity for day traders and institutions alike.

Commodity and Energy Futures

For traders focused on raw materials and energy markets, NinjaTrader supports a diverse range of commodity and energy futures, covering crude oil (CL), natural gas (NG), gasoline (RB), and agricultural staples like corn (ZC), soybeans (ZS), and wheat (ZW). These markets are highly volatile and favored by active traders looking for momentum opportunities.

Metal Futures

NinjaTrader offers key precious and industrial metals, including gold (GC), silver (SI), platinum (PL), and copper (HG). These contracts are widely used for inflation hedging and portfolio diversification, supported by NinjaTrader’s precise charting and analytical tools.

Cryptocurrency Futures

Leveraging its connection to Kraken, NinjaTrader now includes access to regulated crypto futures, such as Bitcoin (BTC) and Ethereum (ETH) contracts. This gives traders a secure, compliant way to gain exposure to digital assets without needing a crypto exchange account.

Treasury and Financial Futures

For those trading interest rates or government debt instruments, NinjaTrader provides U.S. Treasury futures including the 10-Year Note (ZN), 30-Year Bond (ZB), and 2-Year Note (ZT). These contracts are ideal for macro traders and institutional participants managing yield curve exposure.

| Asset | NinjaTrader |

|---|---|

| Stocks | No |

| Options | No |

| Futures Trading | Yes |

| Forex | No |

| Crypto Trading | Yes |

| Commodities | Yes |

| ETFs | No |

| Indices | Yes |

| Bonds | No |

Broker Connectivity and Market Expansion

While NinjaTrader’s core brokerage specializes in futures, the platform also connects with Interactive Brokers, OANDA, FXCM, and Forex.com, enabling access to additional markets such as stocks and forex through linked accounts. This flexibility allows traders to stay within the NinjaTrader environment while diversifying their strategies.

Bottomline

Overall, NinjaTrader’s 100+ futures products span every major sector — from U.S. indices and commodities to metals, crypto, and treasuries. For active traders who demand depth, speed, and precision, NinjaTrader remains one of the most comprehensive futures trading platforms in 2025.

How NinjaTrader’s Instruments Compare to Competitors

While NinjaTrader focuses exclusively on futures trading, many traders want to know how its product range stacks up against other major brokers. To help you see the differences at a glance, here’s a comparison of tradable instruments between NinjaTrader, Interactive Brokers, Optimus Futures, and TradeStation.

| Asset | NinjaTrader | Interactive Brokers | Optimus Futures | TradeStation |

|---|---|---|---|---|

| Futures | ||||

| Stocks | ||||

| ETFs | ||||

| Forex | ||||

| Commodities | ||||

| Cryptocurrencies Futures | ||||

| Options | ||||

| CFDs |

Fees and Commission Structure

| Fee Type | Fees | Notes |

|---|---|---|

| Micro Futures Commissions | $0.09 – $0.35 per contract | Varies by plan (Free, Monthly, Lifetime ) |

| Commissions Per Contract | $0.09 - $0.35 | Lower with paid plans |

| Exchange + NFA Fees | $0.37 | |

| Clearing Fee | $0.15 | Applied to all trades |

| Intraday Margin | As low as $50 | Depends on product and account type |

| Market Data Subscription | Starts at $48 per year | Required for live data access |

| Inactivity Fee | $25 per month | Charged if no trades occu |

| Withdrawal Fee (Wire) | $30 | ACH withdrawals are free |

| Platform License (Optional) | $99/month or $1,499 lifetime | Unlocks lowest commission rates |

Before choosing any broker, understanding the full fee breakdown is essential — and NinjaTrader’s structure is refreshingly transparent. Whether you’re trading micro contracts or standard futures, the platform offers tiered pricing that rewards active and long-term traders. Below is a summary of NinjaTrader’s key trading and non-trading fees for 2025.

Trading Fees

NinjaTrader’s tiered pricing model lets traders choose between three plans:

Free Plan: No monthly fee, but higher trade commissions.

Monthly Plan ($99/month): Mid-tier commissions, ideal for active traders.

Lifetime Plan ($1,499 one-time):Unlocks the lowest commissions, starting at $0.09 per micro contract or $0.59 per standard contract.

This flexibility allows traders to align costs with their trading frequency. Those who trade high volumes or rely on automation typically find the Lifetime plan pays for itself over time.

In addition to commissions, traders pay exchange and NFA fees (around $1.37–$1.40 per contract) and a clearing fee of $0.15, which are standard across U.S. futures brokers. Margins can be as low as $50 intraday, giving short-term traders access to leveraged opportunities with minimal capital requirements.

Other Trading Costs

To access real-time data, a market data subscription is required, starting at roughly $48 per year. This covers key exchanges such as CME, NYMEX, COMEX, and CBOT. Traders can also purchase additional feeds for specific markets or premium analytics.

NinjaTrader also offers an optional platform license, which can be paid monthly, quarterly, or as a one-time lifetime purchase. This license not only reduces commissions but also unlocks advanced platform customization and automation features.

Non-Trading Fees

NinjaTrader keeps most non-trading costs low, but a few charges apply for inactive or wire-heavy accounts. An inactivity fee of $25 per month applies if no trades are placed, and wire withdrawals cost $30, while ACH transfers remain free.

For users depositing or withdrawing in non-USD currencies, a 1% currency conversion fee (minimum $10) may apply.

Verdict

Overall, NinjaTrader’s fee structure is one of the most transparent and cost-effective among U.S. futures brokers. With competitive per-contract pricing, free ACH transactions, and flexible licensing options, traders can easily manage their costs. Combined with ultra-low intraday margins and scalable account plans, NinjaTrader stands out as a top choice for active and professional futures traders in 2025.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is NinjaTrader Regulated ?

Yes. NinjaTrader is a fully regulated U.S. futures broker. It operates under the supervision of the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

These two agencies are among the most trusted regulators in global finance. They ensure that NinjaTrader follows strict rules on transparency, client protection, and financial reporting.

All client funds are held in segregated accounts. This means your money is kept separate from the company’s operating funds. If anything were to happen to the broker, your deposits would remain protected. However, there is no investor compensation scheme like those found in Europe or the U.K.

NinjaTrader is not a publicly listed company, but it has been operating since 2003 and has built a strong reputation for reliability and compliance. In 2025, NinjaTrader became part of Kraken’s financial group, adding more credibility and stability to its operations. Kraken’s global presence and resources further strengthen NinjaTrader’s long-term outlook.

It is important to note that NinjaTrader does not offer negative balance protection. This means that in extreme market conditions, traders can lose more than their initial deposit. Futures trading involves leverage, so proper risk management is essential.

Overall, NinjaTrader meets high U.S. regulatory standards and offers a transparent, secure environment for trading futures. With CFTC and NFA oversight, a long operational history, and Kraken’s ownership, it stands among the most trustworthy futures brokers for active traders in 2025.

Understanding Regulatory Protections and Broker Stability

Segregated Client Funds

NinjaTrader keeps all client funds in segregated accounts, completely separate from its own operating capital. This is a key protection under CFTC and NFA regulations, ensuring that customer deposits cannot be used for company expenses or trading activities. If the broker were ever to face financial issues, client money would remain secure and recoverable. This segregation of funds is one of the strongest safeguards available to U.S. traders.

CFTC Audits and NFA Oversight

As a CFTC-registered Futures Commission Merchant (FCM) and a member of the National Futures Association (NFA), NinjaTrader is subject to regular compliance audits and financial reviews. These regulators monitor the broker’s capital reserves, operational procedures, and reporting standards to ensure transparency and investor protection. Both the CFTC and NFA enforce some of the world’s strictest oversight requirements for futures brokers, giving traders peace of mind that NinjaTrader operates under consistent scrutiny.

Institutional Backing Through Kraken

In 2025, NinjaTrader became part of the Kraken Group, one of the most established names in global finance and digital asset trading. This acquisition provides NinjaTrader with institutional support, stronger financial stability, and advanced technological infrastructure. Despite being part of a larger group, NinjaTrader continues to operate independently, maintaining its focus on regulated futures trading in the U.S.

Proven Track Record and Risk Awareness

With over 20 years of continuous operation, NinjaTrader has built a reputation for reliability and innovation in futures trading. However, it’s important to recognize that futures trading carries a high level of risk. Leveraged positions can lead to losses exceeding the initial deposit, making experience and risk management essential for long-term success.

Bottom Line

NinjaTrader’s combination of segregated funds, strict U.S. regulatory oversight, and Kraken-backed stability makes it one of the safest environments for futures traders. Its long operational record demonstrates resilience, while its transparent practices reflect a continued commitment to trader protection and responsible brokerage operations.

How To Open an Account

Opening an account with NinjaTrader is quick and straightforward. The entire process can be completed online through the official website, and most accounts are approved within one to three business days. Here’s a step-by-step overview of what to expect.

1. Register on NinjaTrader.com

Start by visiting ninjatrader.com and selecting “Open Account.” Provide your email address and verify it. Then, you’ll be asked to create a username, password, and Once registered, you can access the onboarding dashboard to begin the verification process.

2. Verify Your Identity

Like all regulated U.S. brokers, NinjaTrader requires you to complete a Know Your Customer (KYC) verification. You’ll need to upload a valid ID (passport or driver’s license) and proof of address (such as a utility bill or bank statement). This step ensures full compliance with CFTC and NFA regulations.

3. Fund Your Account

Once approved, you can fund your account via ACH transfer, debit card, or bank wire. ACH deposits are free, while wire transfers may incur a small fee. There is no minimum deposit required, so traders can start with any amount that suits their comfort level.

4. Start Simulated or Live Trading

After funding, you can begin with simulated trading to practice in a real-market environment or switch directly to live trading once ready. The account dashboard and trading platform are fully integrated, making it easy to manage your funds, trades, and settings in one place.

NinjaTrader’s streamlined onboarding process, flexible funding options, and no minimum deposit requirement make it simple for both new and experienced traders to get started quickly and confidently.

Account Types

NinjaTrader offers several account types designed to meet the needs of both individual and professional traders. Each account provides access to the platform’s powerful trading tools and competitive pricing, with differences mainly in ownership structure and purpose.

Individual

The Individual Account is designed for trading futures and options on futures. This account type gives traders full access to real-time market execution, margin trading, and all available contract types. It’s ideal for both active day traders and long-term futures investors who want direct access to regulated U.S. markets.

Demo Account (Simulated Trading)

For new or developing traders, NinjaTrader offers a free Demo Account, also known as a Simulated Trading Account. This feature allows users to test strategies, practice order execution, and explore platform tools without risking real money. It mirrors live market conditions, making it perfect for training or strategy development before going live.

IRA Accounts

NinjaTrader also supports Individual Retirement Accounts (IRAs) for eligible U.S. clients. These accounts allow traders to participate in futures markets while maintaining the tax advantages of an IRA. They are available through approved custodians and meet all U.S. retirement trading requirements.

Corporate and Joint Accounts

Professional entities and multiple owners can open Corporate or Joint Accounts, offering flexibility for trading businesses, partnerships, or family trading setups.

No Islamic Account Option

Currently, NinjaTrader does not offer Islamic or swap-free accounts, as its focus remains on futures trading, which naturally involves overnight financing and settlement costs.

What is the Minimum Deposit at NinjaTrader?

One of the biggest advantages of NinjaTrader is that it has no fixed minimum deposit requirement. Traders can open and maintain an account with any amount that suits their budget or trading strategy.

This makes the platform accessible to both beginners testing the waters and experienced traders managing larger portfolios.

While there’s no official minimum to start, it’s important to consider the margin requirements for the futures contracts you plan to trade. For example, intraday margins can start as low as $50 per micro contract, but standard contracts may require a few hundred dollars per position. To trade comfortably and manage risk, most users begin with at least $400 to $1,000 in starting capital.

Deposits can be made via ACH transfer, wire transfer, or debit card, with ACH deposits free of charge. Funds are typically available within one to two business days, allowing traders to start quickly.

Because NinjaTrader caters to futures traders, it’s recommended to maintain sufficient capital not just for margin, but also for market volatility and potential drawdowns.

In short, NinjaTrader’s no minimum deposit policy offers great flexibility — giving traders full control over how much they commit to their account while keeping entry barriers low for anyone interested in futures trading in 2025.

| Broker | Minimum Deposit |

|---|---|

| NinjaTrader | $0 |

Optimus Futures | $500 |

| Interactive Brokers | $0 |

TradeStation | $0 |

Deposit and Withdrawal

Managing funds with NinjaTrader is simple and efficient, with several options available for both deposits and withdrawals. The platform aims to make account funding convenient while keeping fees low and processing times fast.

Deposit Options

NinjaTrader supports a variety of deposit methods, allowing traders to fund their accounts in a way that suits them best.

All deposit methods are free of charge on NinjaTrader’s side. Funds are credited once cleared, and traders can start simulated or live trading immediately after the balance appears in their account.

Withdrawal Fees & Options

Withdrawing funds is just as straightforward. NinjaTrader offers one withdrawal method:

Other Fees and Supported Currencies

Currency conversions incur a 1% fee (minimum $10) when transferring non-USD funds. NinjaTrader supports multiple currencies, including USD, EUR, GBP, AUD, and CAD, giving international traders flexibility when funding their accounts.

Bottomline

NinjaTrader offers a smooth and transparent funding process, with free ACH and debit deposits, low-cost withdrawals, and fast turnaround times. For both U.S. and global traders, the platform’s banking options provide reliability, simplicity, and cost efficiency — key advantages for active futures trading in 2025.

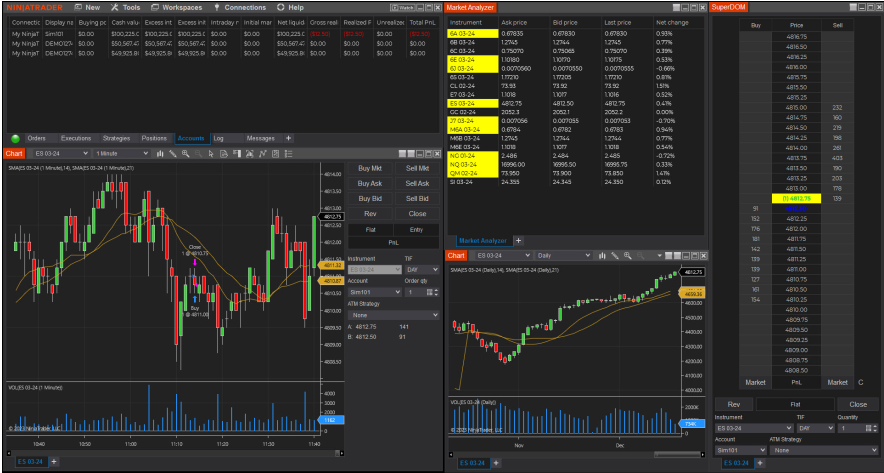

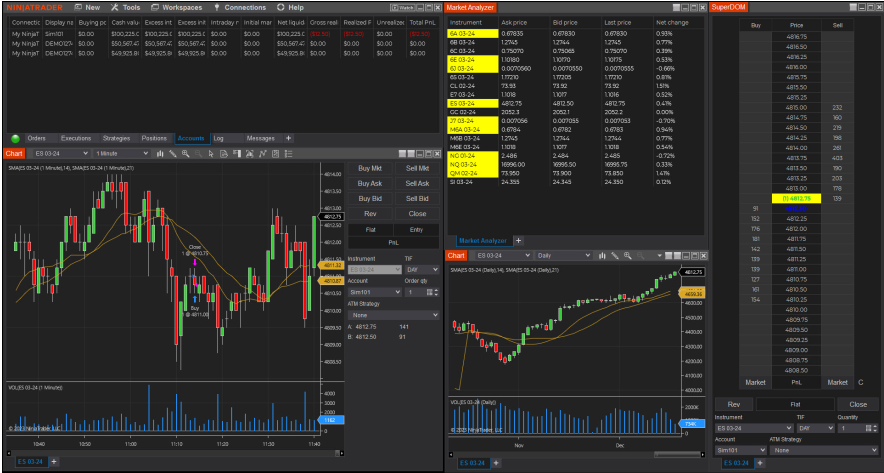

Desktop Trading Platform

After spending several days testing the NinjaTrader desktop platform, it’s clear why it’s considered one of the most advanced and respected platforms for futures trading. It’s not just a trading interface—it’s a full analytical and strategic environment built for professionals.

The layout is highly customizable, allowing you to design your workspace with precision, from advanced charts and data windows to automated strategy modules.

Advanced Charting and Analysis

NinjaTrader’s charting engine is one of the best I’ve tested. Charts are clean, fast, and fully interactive, with over 100 built-in technical indicators and drawing tools.

You can overlay multiple markets, build multi-timeframe analyses, and create alerts based on price or indicator signals. For strategy-focused traders, the Market Analyzer and Order Flow + suite provide granular insights into volume, liquidity, and order book dynamics—crucial for intraday futures trading.

Automation and Backtesting

One of the strongest features is NinjaTrader’s strategy automation and backtesting tools. Using the built-in Strategy Builder, I was able to create and test custom strategies without writing a single line of code.

For developers, the platform supports C# scripting, allowing complex algorithmic strategies and integration with third-party applications. Backtesting performance is robust, with detailed metrics on drawdown, profit factor, and execution timing.

Integration and Compatibility

The desktop platform supports connections with external brokers like Interactive Brokers, OANDA, and FXCM, giving traders more flexibility to manage positions across multiple markets.

It also integrates with a wide range of third-party add-ons, from custom indicators to trade management tools. Data feeds are easily configured, and execution speed is excellent, even during high-volume sessions.

Accessibility and Performance

The desktop platform is now available for both Windows and macOS, offering more flexibility than before. Installation is straightforward, and system performance remains smooth even with multiple charts and indicators running. However, the interface can feel dense at first, especially for traders used to simpler layouts.

Verdict

Overall, NinjaTrader’s desktop platform delivers a professional-grade experience that few brokers can match. It’s ideal for traders who value data precision, automation, and flexibility. For futures professionals and strategy developers, this is one of the most powerful trading environments available in 2025.

Pros & Cons of the Web Platform

Pros

- Deep analytics and advanced charting tools

- Fast, reliable order execution

- Powerful automation and backtesting capabilities

- Supports 3rd-party add-ons and external brokers

- Includes a free simulated trading environment

Cons

- Complex interface for beginners

- Requires time to customize and optimize settings

- Heavy resource usage on older computers

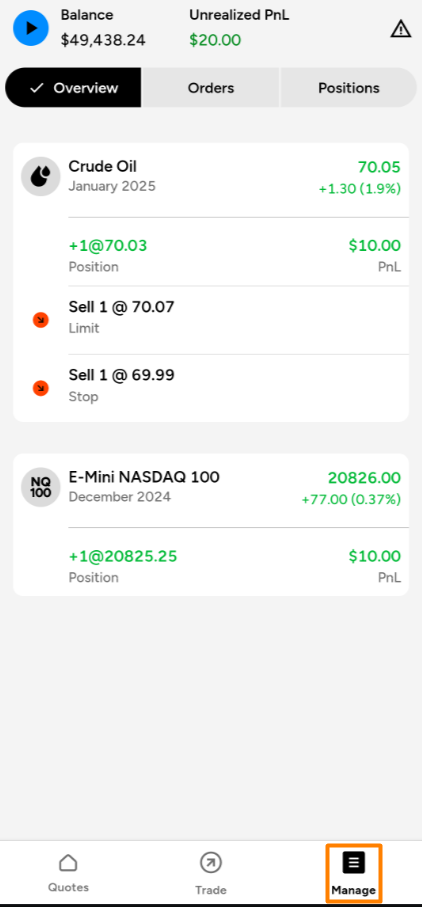

Mobile App

The NinjaTrader mobile app extends the power of the desktop and web platforms into a compact, on-the-go trading experience. Available for iOS and Android, it allows traders to monitor markets, manage open positions, and place trades in real time. The app automatically syncs with your desktop and web accounts, ensuring all trade activity, watchlists, and order details remain consistent across devices.

Look and Interface

At first glance, the NinjaTrader mobile app feels modern, clean, and professional. The dark mode layout is easy on the eyes, and key details like account balance, open positions, and order history are clearly displayed.

The interface is streamlined yet powerful, giving you everything you need without unnecessary clutter. Buttons are responsive, and menus are logically organized, making navigation smooth even on smaller screens.

Ease of Use

During testing, the app proved to be fast, stable, and intuitive. Market data loads instantly, and switching between charts, positions, and account details is seamless.

New traders might need a bit of time to get comfortable with futures-specific terms and margin details, but overall, the learning curve is manageable. Once familiar, it becomes a highly efficient tool for managing trades on the go.

Placing and Managing Orders

Placing orders on the NinjaTrader mobile app is quick and straightforward. You can choose between market, limit, and stop orders, adjust position sizes, and set take-profit or stop-loss levels with a few taps.

Order confirmations are clear, and execution is nearly instantaneous. Managing existing trades is just as easy—you can modify or close positions, view margin requirements, and monitor live P/L in real time.

Charting and Market Data

Charts are fast-loading and interactive, supporting pinch-to-zoom, indicator overlays, and multiple timeframes. While not as detailed as the desktop version, the mobile charts are well-suited for quick analysis and trade monitoring. Live market data updates smoothly, ensuring you never miss key price movements.

Verdict

The NinjaTrader mobile app delivers a powerful, reliable companion to the full desktop experience. It’s perfect for traders who want to stay in control of their positions and monitor markets anytime, anywhere.

While advanced chartists may prefer the desktop platform for deeper analysis, the mobile version strikes an excellent balance between simplicity, performance, and professional functionality—making it one of the best futures trading apps available today.

Pros & Cons of the Mobile App

Pros

- Available on iOS and Android

- Real-time quotes, alerts, and order notifications

- Clean and user-friendly interface

- Instant trade execution and seamless syncing with desktop/web

- Optimized for speed and reliability

Cons

- Limited chart customization and indicators compared to desktop

- Mild learning curve for those new to futures trading

Market Research, Tools, and Education

NinjaTrader stands out for its wide range of research tools, charting capabilities, and educational resources that cater to both new and advanced futures traders. Everything you need to analyze the market, test strategies, and improve performance is built directly into the platform.

During testing, the tools felt professional, data-rich, and customizable, offering the kind of flexibility that serious traders expect from a premium platform.

Traders can also create their own custom indicators or import thousands of third-party add-ons from NinjaTrader’s extensive marketplace. The charting system supports features like multi-chart linking, order flow visualization, and depth of market (DOM) analysis, giving you a clear picture of liquidity and order activity. The combination of flexibility and depth makes NinjaTrader a strong platform for technical analysis and active trade management.

This makes it easier to evaluate how a strategy would have performed under real market conditions without risking capital.

Whether you are backtesting complex strategies or refining your chart setups, NinjaTrader’s tools and learning resources make it an excellent choice for informed, data-driven trading.

Customer Support

NinjaTrader offers dedicated 24/5 customer support through multiple channels, ensuring that traders get timely assistance whenever they need it. During testing, the support team was responsive, knowledgeable, and professional, making it easy to resolve technical or account-related questions quickly.

Support Channels

Traders can contact the support team via live chat, phone, or email. The live chat option is the fastest, with typical response times of under one minute. This is especially useful during active trading sessions when quick answers are essential.

Phone support is also available for more complex issues, while email is best for non-urgent inquiries or documentation requests. The quality of responses was consistent across all channels, and agents provided clear, step-by-step guidance for both technical and account-related topics.

Help Center and Documentation

For self-service users, NinjaTrader maintains a detailed Help Center filled with articles, guides, and FAQs that cover everything from platform setup to troubleshooting and strategy development. The content is well-organized and written in plain language, making it easy for both beginners and experienced traders to find solutions independently.

Community and Events

NinjaTrader also has an active community forum, where traders share strategies, custom indicators, and platform tips. In addition, the company hosts educational webinars and live events to help users stay updated on new tools and trading techniques. These resources foster a strong sense of community and support continuous learning.

Bottomline

Overall, NinjaTrader’s customer support and educational ecosystem are among the best in the industry. With quick live chat response times, comprehensive documentation, and an engaged user community, traders have multiple ways to get help fast.

Whether you are troubleshooting a technical issue or learning a new feature, NinjaTrader provides a reliable and supportive environment for its users.

FAQ

Is NinjaTrader safe and regulated in 2025?

Yes. NinjaTrader is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), ensuring strict compliance, fund segregation, and transparent operations.

What can I trade on NinjaTrader?

You can trade futures and options on futures, including contracts for stock indices, commodities, metals, treasuries, and cryptocurrencies.

Does NinjaTrader charge inactivity or withdrawal fees?

Yes. There’s an inactivity fee of $25 per month if no trades are placed, and wire withdrawals cost $30. ACH withdrawals are free.

What is the minimum deposit to start trading?

There is no minimum deposit requirement. However, you should maintain enough funds to meet margin requirements, which start from $50 per micro contract.

Can I open a demo account on NinjaTrader?

Yes. NinjaTrader offers a free demo account (simulated trading) where you can test strategies and practice in real market conditions.

Can I trade crypto futures on NinjaTrader?

Yes. Through its integration with Kraken, NinjaTrader offers access to regulated cryptocurrency futures such as Bitcoin and Ethereum.

Does NinjaTrader support automated trading strategies?

Yes. The platform includes a Strategy Builder for no-code automation and supports C# scripting for custom algorithmic strategies.

How can I withdraw funds from NinjaTrader?

You can withdraw via ACH (free) or wire transfer ($30 fee). Processing usually takes 1–2 business days.

Is NinjaTrader suitable for professional traders?

Absolutely. With advanced charting, low commissions, automation tools, and institutional-grade analytics, NinjaTrader is ideal for professional and high-volume futures traders.

Is NinjaTrader good for beginners?

It’s best suited for intermediate and advanced traders, but beginners can still learn effectively using the demo account and educational resources before going live.