BINANCE REVIEW 2026

Our Binance crypto exchange review for brokerguide.com delivers a definitive, hands-on look at the world’s largest trading platform in 2026. In an era of shifting global regulations, we separate the facts from the marketing jargon by reporting on our real-world tests involving real-money deposits and the execution of high-leverage futures contracts.

Broker Guide's Binance Review in 2026

I approach this Binance crypto exchange review for brokerguide.com with a commitment to transparency because your capital is on the line.

As the industry evolves through shifting global regulations, there is a critical need for a definitive guide to help you separate stable giants from risky newcomers.

To provide this assessment, I performed a hands-on test involving real-money deposits and the execution of both spot trades and futures contracts.

I specifically waited for periods of high volatility to push the Binance mobile app to its limits and verify that order execution remained stable under pressure.

This deep dive allowed me to experience the platform exactly as you would so that you can trade with total confidence.

About Binance

The Binance crypto exchange has maintained its position as a titan of the industry since it was founded in 2017 by Changpeng Zhao and Yi He. Originally based in China, the company has navigated a complex path of global expansion.

This journey has transformed Binance from a simple crypto-to-crypto portal into a massive Web3 ecosystem that combines the roles of an international stock exchange, a brokerage, a bank, and an asset manager into one powerful interface.

Today, they are widely recognized as the largest cryptocurrency exchange in the world by trading volume. Its market position is supported by a massive user base that exceeded 297 million users by late 2025.

The platform offers an unparalleled selection of digital assets, supporting over 400 cryptocurrencies and more than 1,500 trading pairs. This extensive range ensures that users have access to everything from major cryptocurrencies like Bitcoin and Ethereum to niche altcoins and leveraged tokens.

However, the company has faced significant hurdles regarding its leadership and regulatory compliance. In a landmark 2023 settlement, Changpeng Zhao pleaded guilty to violating the Bank Secrecy Act and resigned as CEO.

As part of a $4.3 billion settlement with the U.S. Department of Justice, Binance agreed to years of independent monitoring to ensure it maintains robust anti-money laundering (AML) and Know Your Customer (KYC) standards.

Under the new leadership of Richard Teng, the exchange has pivoted toward a “compliance-first” era, significantly expanding its board and working to secure licenses in jurisdictions like the Abu Dhabi Global Market (ADGM) to restore institutional trust.

My Quick Verdict: Who is Binance Best For?

Overall BrokerGuide Rating: 4.5/5

My quick verdict is that Binance remains the “Swiss Army Knife” of the crypto world. It is an unrivaled destination for experienced traders who require a wide variety of trading types, such as margin trading, options, and advanced trading bots.

The low fee structure, especially when utilizing the 25% BNB discount, makes it one of the most cost-effective choices for high-volume users.

The platform presents a steeper learning curve for absolute beginners despite the improvements. While the “Lite” mode on the Binance mobile app offers a more user-friendly experience, the sheer volume of features and professional trading tools in the “Pro” version can be intimidating.

If you are looking for a platform that you can grow into as your skills evolve, Binance is a leading choice that offers every tool you will ever need.

Pros

- Unmatched liquidity and massive selection of assets.

- Highly competitive fee structure (0.1% standard) with BNB discounts.

- Robust ecosystem: staking, NFT marketplace, and Web3 wallet.

Cons

- Complex interface can be intimidating for novices.

- Customer support can be slow during peak market events.

Why You Should Choose Binance ?

As we move into 2026, the Binance crypto exchange continues to dominate the market by evolving from a simple trading hub into a highly sophisticated Web3 ecosystem. Choosing a platform in this era requires more than just looking at a list of available coins; it requires finding an institution that offers a blend of innovation, rigorous security, and long-term sustainability.

Pioneering Innovation through Real-World Assets and AI

The most compelling reason to choose Binance in 2026 is its aggressive transition toward “Utility Value.” Binance has become a leader in integrating Real-World Assets (RWA), allowing users to interact with tokenized versions of traditional financial instruments directly on the Binance Smart Chain.

This innovation bridges the gap between decentralized finance and traditional markets, providing traders with unprecedented diversity.

Furthermore, the platform has integrated advanced AI compliance tools to streamline the user experience. These tools help manage the complex regulatory compliance requirements of different jurisdictions, ensuring that your trading remains uninterrupted regardless of shifting global standards.

By utilizing AI to monitor real-time monitoring and fraud detection, Binance provides a smoother, faster interface that remains responsive even during periods of high volatility.

A New Standard for Security Evolution

Security remains a primary concern for any trader, and Binance has responded by evolving its protection layers. The exchange continues to rely on the Secure Asset Fund for Users (SAFU), an emergency insurance fund that was established to protect users’ capital in the event of unforeseen security breaches.

By allocating a percentage of all trading fees to this fund, Binance ensures it has the capital necessary to keep users whole.

Transparency has also reached a new peak with the implementation of real-time Proof of Reserves using zk-SNARKs. This zero-knowledge proof technology allows the exchange to prove it holds user assets at a 1:1 ratio without compromising individual privacy.

This level of cryptographic verification gives you the peace of mind that your digital assets are backed by physical reserves at all times.

Institutional Sustainability and Stability

Perhaps the strongest argument for Binance in 2026 is its proven sustainability. The exchange has successfully navigated a period of intense scrutiny, emerging as a more mature institution following its $4.3 billion settlement with the U.S. Department of Justice. This settlement was not just a financial penalty but a turning point that led to the implementation of industry-leading anti-money laundering (AML) and KYC standards.

Under its new leadership, the company has prioritized a “compliance-first” strategy, which has stabilized its market position and restored the trust of institutional investors.

By choosing Binance, you are aligning yourself with a platform that has survived the ultimate stress tests of the legal and financial worlds, proving that it has the infrastructure and the will to remain the world’s largest cryptocurrency exchange for the long haul. Whether you are utilizing Binance Earn for passive income or executing complex futures contracts, you are doing so on a platform built for permanent stability.

Compare to Top Competitors

Choosing the right platform is a critical step in your trading journey, so it is helpful to see how the Binance crypto exchange stacks up against other industry leaders.

While Binance offers the most extensive liquidity and asset variety, these top competitors focus on different strengths like regulatory clarity or user simplicity to attract their specific audiences.

Kraken

Crypto.com

Coinbase

Exploring Binance’s Range of Tradable Instruments

Binance offers an expansive market range that caters to every type of investor, from casual hobbyists to high-frequency institutional traders. With over 400+ supported coins and a staggering 1,500+ trading pairs, the platform provides deep liquidity and a variety of ways to interact with digital assets.

Cryptocurrencies

Binance supports a massive selection of major cryptocurrencies and niche altcoins, allowing users to build highly diversified portfolios.

Core Assets: High-volume trading is available for top coins like Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and Solana (SOL).

Emerging Tokens: The platform frequently lists new projects through its Launchpad and Launchpool, giving users early access to innovative Web3 tokens.

Stablecoins: Traders rely on a wide variety of stablecoins such as USDT, USDC, and FDUSD to manage volatility and maintain purchasing power within the ecosystem.

Fiat to Crypto Pairs

For many users, Binance serves as a primary gateway to the crypto world by offering extensive fiat-to-crypto trading pairs.

Supported Currencies: The exchange supports more than 50 fiat currencies, including the USD, EUR, GBP, and AED.

Funding Options: Users can purchase crypto directly using credit/debit cards, bank transfers (like SEPA or Faster Payments), and even third-party providers.

P2P Trading: The peer-to-peer (P2P) marketplace allows for even greater flexibility, supporting local bank transfers and cash payments in over 100 countries.

NFT Marketplace

The Binance NFT Marketplace has matured into a core pillar of its Web3 ecosystem, connecting creators with a global audience of collectors.

Digital Ownership: Users can mint, buy, and sell unique digital assets across several blockchains, including the Binance Smart Chain (BSC) and Ethereum.

Interactive Features: The platform is known for its Mystery Boxes, which contain surprise NFTs of varying rarity, and its Initial Game Offerings (IGOs) for limited edition gaming assets.

Low Costs: Binance charges a competitive 1% platform fee on sales, which is significantly lower than many other major NFT marketplaces.

Spot & Margin Trading

At its core, Binance excels in spot trading, which remains the simplest method for buying and selling real assets that you own.

Deep Liquidity: With daily trade volumes often exceeding $217 billion, traders can execute large orders with minimal slippage.

Borrowed Capital: For those seeking to increase exposure, margin trading offers up to 5:1 leverage. Users can choose between cross margin for overall balance protection or isolated margin to limit risk to specific trades.

Derivatives: Futures and Specialty Contracts

Binance is a global leader in derivatives, allowing traders to speculate on price movements without owning the underlying asset.

High Leverage: The platform offers up to 125x leverage on certain perpetual and quarterly futures contracts.

Advanced Options: European-style vanilla options provide sophisticated tools for hedging and volatility trading.

Binance Battle: This feature gamifies trading by allowing users to compete in short-term price prediction challenges for rewards.

How Binance ’s Instruments Compare to Competitors

| Asset | Binance | Coinbase | Kraken | Crypto.com |

|---|---|---|---|---|

| Bitcoin, Ethereum & Major Cryptos | ||||

| Wide Altcoin Selection | ||||

| Stablecoins (USDC, etc.) | ||||

| Fiat-to-Crypto Pairs | ||||

| Staking Options | ||||

| NFT Marketplace / Digital Collectibles | ||||

| Stocks, ETFs & Traditional Instruments |

Fees and Commission Structure

Understanding the fee structure is essential for any trader looking to maximize their returns on the Binance crypto exchange. Binance is widely recognized as one of the lowest fee crypto exchanges in the industry, offering a transparent and highly competitive pricing model that rewards active market participants. By utilizing a combination of trading volume and native token integration, the platform allows you to drive your costs down significantly as your portfolio grows.

Trading Fees and the VIP Tier System

For the vast majority of users at the VIP 0 level, Binance applies a standard 0.1% maker fee and a 0.1% taker fee for spot trading. A maker fee is charged when you place an order that goes onto the order book, providing liquidity to the market, while a taker fee is applied when your order is filled immediately by “taking” an existing order from the book.

As your activity increases, you can move through a series of VIP tiers ranging from VIP 1 to VIP 9. Your tier is determined by two primary factors: your 30-day trading volume measured in Bitcoin and your average daily holdings of Binance Coin (BNB).

For instance, reaching VIP 1 requires a 30-day volume of at least 50 BTC and a balance of 50 BNB, which reduces your maker fee to 0.09%. At the highest institutional level of VIP 9, fees can drop as low as 0.02% for makers and 0.04% for takers.

| Level | Make/Taker Fee | 30d Trade Volume (BTC) | BNB Balance |

|---|---|---|---|

| VIP 9 | 0.0200% / 0.0400% | ≥ 150000 BTC | ≥ 11000 BNB |

| VIP 8 | 0.0300% / 0.0500% | ≥ 80000 BTC | ≥ 9000 BNB |

| VIP 7 | 0.0400% / 0.0600% | ≥ 40000 BTC | ≥ 6000 BNB |

| VIP 6 | 0.0500% / 0.0700% | ≥ 20000 BTC | ≥ 3500 BNB |

| VIP 5 | 0.0600% / 0.0800% | ≥ 10000 BTC | ≥ 2000 BNB |

| VIP 4 | 0.0700% / 0.0900% | ≥ 4500 BTC | ≥ 1000 BNB |

| VIP 3 | 0.0700% / 0.1000% | ≥ 1500 BTC | ≥ 500 BNB |

| VIP 2 | 0.0800% / 0.1000% | ≥ 500 BTC | ≥ 200 BNB |

| VIP 1 | 0.0900% / 0.1000% | ≥ 50 BTC | ≥ 50 BNB |

| VIP 0 | 0.1000% / 0.1000% | ≥ 50 BTC | ≥ 0 BNB |

The 25% BNB Discount

One of the most effective ways to lower your costs immediately is the BNB fee discount. If you hold Binance Coin in your spot wallet and enable the option to pay your fees with it, Binance provides an automatic 25% reduction on all spot trading fees.

This simple step effectively brings the standard 0.1% fee down to just 0.075%, making it an essential strategy for both casual and professional traders.

Non-Trading Fees: Deposits and Withdrawals

Beyond the act of trading, you should be aware of the costs associated with moving your capital in and out of the ecosystem.

Deposit Fees

Depositing cryptocurrencies is generally free, although you will still be responsible for the network/chain fees required by the specific blockchain to send funds from an external wallet. For fiat deposits, costs vary by provider and region; for example, debit card deposits may carry a 2% fee, while certain bank transfers can be free of charge.

Withdrawal Fees

When moving digital assets off the exchange, Binance charges flat fees per coin to cover the cost of moving them on the blockchain. For fiat withdrawals, the cost depends on the method; using Faster Payments for GBP incurs a flat fee of 1.5 GBP, while SEPA transfers for EUR cost approximately 0.8 EUR.

Currency Conversion

For users who prefer a simpler experience, the Binance conversion portal allows you to swap assets with 0% trading fees, though it is important to note that a spread is still applied to the market rate.

No Inactivity Fees

A significant advantage of the Binance crypto exchange compared to many traditional brokerages is the lack of hidden maintenance costs. There are no inactivity fees mentioned in the official fee schedules or documentation, meaning you will not be penalized if you decide to take a break from the market and leave your funds in your account. This makes Binance a viable option for long-term “HODLers” who do not intend to execute frequent transactions.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Binance Regulated ?

As we move into 2026, the Binance crypto exchange has significantly matured its regulatory status by pivoting toward a “compliance-first” global model. While it previously operated under a more decentralized and often criticized framework, Binance has now secured a landmark global license from the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSRA).

Under this framework, which becomes fully operational on January 5, 2026, Binance functions through three separate licensed entities such as Nest Exchange Limited, Nest Clearing and Custody Limited, and Nest Trading Limited.

Mirroring the rigorous oversight structure of traditional financial institutions. In addition to this unified global anchor, the exchange maintains a wide array of local registrations and authorizations in key jurisdictions such as France, Japan, Bahrain, and El Salvador, while continuing to navigate complex compliance landscapes in the USA and UK through dedicated, separate entities or strict local standards.

This transition, following a major $4.3 billion settlement and independent monitoring, positions Binance as a pioneer in adopting the “gold-standard” regulatory frameworks that are now defining the digital asset industry in 2026.

Understanding Regulatory Protections and Broker Stability

Navigating the complex world of cryptocurrency requires a deep understanding of how a platform protects your capital and what legal frameworks govern its operations. For the Binance crypto exchange, the story of its regulatory status and user protections is one of rapid evolution from a decentralized startup to a global financial powerhouse that has recently pivoted toward a “compliance-first” model.

Understanding Regulatory Status

Binance has historically operated with a unique, decentralized structure that has occasionally drawn the attention of global regulators. The company is currently headquartered in Malta, a jurisdiction known for being a hub of blockchain innovation, while its primary web servers are located in Japan to ensure operational stability away from restrictive regions.

While it previously functioned without traditional financial industry oversight, the exchange has recently faced significant legal milestones that have reshaped its stability.

Following a landmark $4.3 billion settlement with the U.S. Department of Justice, Binance agreed to years of independent monitoring to ensure it maintains the highest anti-money laundering (AML) and KYC standards.

In 2026, the platform has further matured by securing high-tier licenses in major financial hubs like the Abu Dhabi Global Market (ADGM), signaling its commitment to a transparent and stable future.

Broker Stability and the SAFU Fund

Because cryptocurrency exchanges are not members of the Securities Investor Protection Corp. (SIPC), they do not offer the same government-backed insurance found in traditional stock brokerages.

To counter this, Binance established the Secure Asset Fund for Users (SAFU) in 2018. This emergency insurance fund is comprised of a portion of all trading fees, creating a billion-dollar reserve designed to protect users in the event of extreme security breaches or hacks.

This internal protection layer ensures that the exchange remains stable even during periods of intense market stress.

Protective Self-Custody and Web3 Integration

In addition to centralized safeguards, Binance empowers you to take control of your own digital assets through its integrated Web3 Wallet. This self-custody solution, built directly into the Binance mobile app, allows you to move funds from the custodial exchange into a private environment where you hold the keys.

By utilizing Multi-Party Computation (MPC) technology, the wallet offers a modern alternative to traditional seed phrases, providing a bridge between the convenience of an exchange and the ultimate security of self-sovereignty. These combined layers of institutional oversight, emergency insurance, and personal custody tools make Binance one of the most robustly protected environments in the Web3 ecosystem today.

How To Open an Account

Getting started on the Binance crypto exchange in 2026 is a streamlined journey designed to move you from a visitor to a verified trader in a matter of minutes. The platform utilizes a structured onboarding process that prioritizes both ease of use and institutional-grade security and protection.

The Three-Step Registration Process

To open your account, you simply follow these essential steps:

Registration: Visit the official website or download the app and sign up using your email address or phone number. You will receive a verification code via SMS or email to confirm your primary contact method.

Identity Verification (KYC): To comply with global regulations and unlock full features, you must complete Know Your Customer (KYC) verification. This involves providing your full legal name, a government-issued photo ID, and completing a brief facial recognition scan. Verified status typically grants you higher withdrawal limits and access to fiat currency deposits.

2FA Setup: Security is paramount, so the final step is enabling Two-Factor Authentication (2FA). Binance supports several methods, including passkeys, authenticator apps, and SMS authentication, adding a critical layer of defense against unauthorized access.

Account Types

Binance offers two distinct account categories to serve different market needs:

- Personal Accounts: These are designed for individual traders and are the standard choice for most users. They are easier to set up and provide full access to the Web3 ecosystem.

- Enterprise Accounts: For businesses and organizations, corporate accounts offer enhanced transaction limits and multi-user governance controls. These require additional documentation, such as proof of business registration, but unlock institutional-grade tools and dedicated account management.

Lite vs. Pro Account

Within the Binance mobile app, you can switch between two specialized viewing modes at any time:

Binance Lite

This mode is the perfect choice for crypto novices or those who want a simplified experience. It features a clean dashboard focused on buying and selling the most popular assets without the complexity of deep order books.

Binance Pro

Aimed at experienced traders, the Pro version provides the full suite of professional trading tools. This includes advanced charting features, futures contracts, margin trading, and the comprehensive Binance Earn portal for generating yield.

What is the Minimum Deposit at Binance?

The minimum deposit for most standard funding methods on the Binance cryptocurrency exchange, such as credit cards or debit cards, is typically $10.

While there is no minimum requirement for direct cryptocurrency deposits beyond covering the necessary network fees, most fiat gateways and the Binance conversion portal enforce this $10 floor to execute a transaction.

Furthermore, once your account is funded, the minimum trade amount on the spot market is also generally set at $10.

| Broker | Minimum Deposit |

|---|---|

Binance | $0 |

| Kraken | $0 |

Coinbase | $0 |

| Crypto.com | $0 |

Deposit and Withdrawal

The Binance crypto exchange provides one of the most versatile fiat gateways in the industry, ensuring that you can move capital into the ecosystem using the methods that best suit your local needs. By supporting over 50 fiat currencies and offering more than 100 payment methods, Binance acts as a global bridge between traditional finance and the world of digital assets.

Multiple Funding Methods

Traders have access to several primary channels for funding their accounts:

Withdrawal Fees & Options

To successfully move your earnings off the Binance crypto exchange, you can choose from several digital and traditional channels depending on your location and account verification status. While the platform provides high flexibility for global users, it is important to note that most methods involve a flat fee to cover processing and network costs.

Verdict

Binance offers an industry-leading range of deposit and withdrawal options that cater to both local and global needs. Its tiered limit system ensures that as your trading volume grows, the platform scales with you to provide the necessary liquidity and freedom.

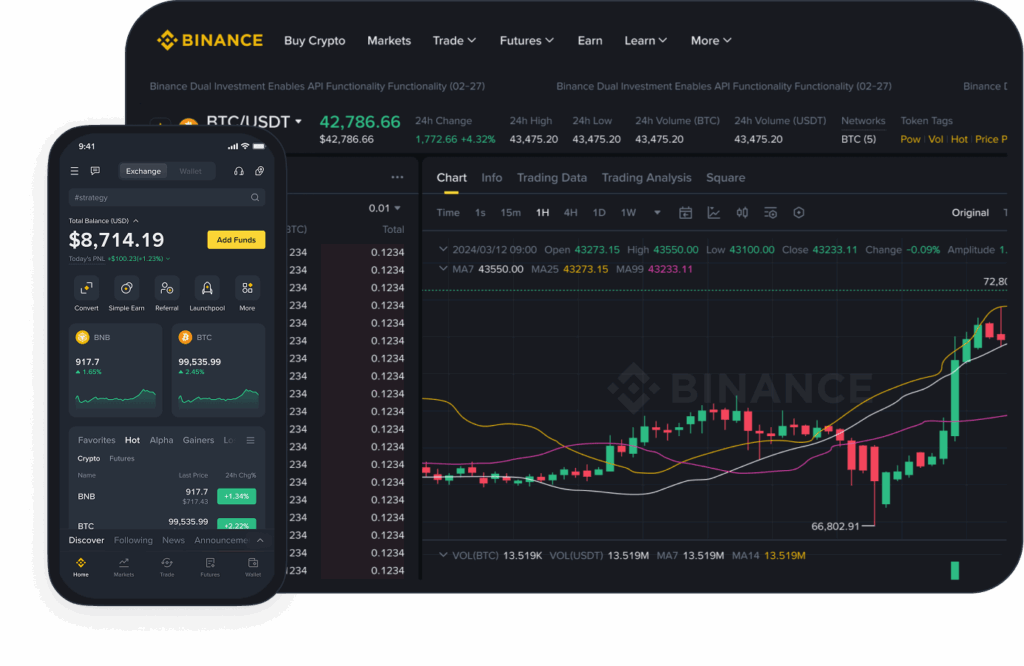

Desktop Trading Platform

The Binance desktop app is the definitive choice for professional traders who require high-level analytical power within the Web3 ecosystem. While the web version is convenient for quick checks, the dedicated desktop application provides a purpose-built environment that eliminates performance bottlenecks.

It remains highly responsive even during periods of high volatility, supporting the rapid order execution necessary for professional-grade trading.

Advanced Charting and Analytics

The centerpiece of the desktop experience is the sophisticated charting and analytics suite that integrates seamlessly with industry-standard tools. Traders can deploy over 100 technical indicators, such as moving averages (MA) and Relative Strength Index (RSI), to identify market trends and precise entry points.

This interface supports high-precision technical analysis by offering dozens of drawing tools and real-time responsiveness that surpasses standard browser-based platforms.

Multi-Window and Workspace Customization

Professional efficiency is at the heart of the desktop design, featuring robust multi-window support and synchronized layouts. You can detach charts and order books into separate windows, allowing you to spread your workspace across multiple monitors for a comprehensive view of the market range.

The application allows for deep personalization, where users can save various workspace layouts and switch instantly between a light or dark theme based on their preference.

API Solutions for Algorithmic Trading

For those moving beyond manual execution, the platform provides advanced API solutions to facilitate algorithmic trading. Developers can build custom trading bots that interact directly with the Binance crypto exchange via a high-speed interface.

This functionality is managed through secure account settings where you can restrict permissions and whitelist specific IP addresses to maintain the highest levels of security and protection.

Verdict

The Binance desktop platform is an essential command center for serious participants in the digital asset market. Its combination of advanced charting, multi-monitor flexibility, and robust API support creates a professional environment that is currently unrivaled among global crypto exchanges in 2026.

Pros & Cons of the Dekstop Platform

Pros

- Offers industry-leading technical analysis tools and seamless TradingView integration.

- Optimized for professional setups with multi-window support and detachable charts.

- High-Speed Execution: Provides the low latency required for active spot trading and complex futures contracts.

Cons

- Steep Learning Curve: The high density of professional trading tools can be intimidating or overwhelming for beginners.

- Requires a stable desktop setup, making it less flexible than the portable Binance mobile app.

Mobile App

The Binance mobile app is a powerful, all-in-one trading tool that allows you to manage your entire digital asset portfolio from your smartphone. While the interface is highly functional, it is also notably “dense,” packed with features that cater to both simple buyers and complex futures traders.

User Interface and Experience

To accommodate different skill levels, the app offers two primary modes: Binance Lite and Binance Pro. Binance Lite provides a simplified, clean interface focused on basic buying, selling, and asset conversion, making it ideal for crypto novices. Conversely, the Pro version unlocks the full Web3 ecosystem, including advanced charting, margin trading, and depth-of-market data.

Built-in Web3 Wallet

A standout feature in 2026 is the integrated Binance Web3 Wallet, a self-custody solution accessible directly within the main app. T

This wallet uses Multi-Party Computation (MPC) technology, which enhances security by removing the need for traditional, easily lost seed phrases. It supports over 130 different chains, allowing you to move funds seamlessly between the exchange and decentralized applications (dApps).

One-Click Convert Portal

For those who want to avoid the complexity of order books, the Convert portal offers a "one-click" solution for swapping assets. This feature allows for instant trades between hundreds of major cryptocurrencies and stablecoins with 0% trading fees, though it is important to note that a small spread is applied to the market rate.

Mobile Security and Alerts

The app prioritizes security and protection through integrated Two-Factor Authentication (2FA) and biometric login options. You can also set custom price alerts that send push notifications to your device, ensuring you never miss a significant market move while you are away from your desktop.

Verdict

The Binance mobile app is arguably the most feature-rich crypto trading application available in 2026, serving as a portable command center for serious investors. While its density requires some time to master, its integration of self-custody and instant conversion tools makes it an essential asset for any mobile trader.

Pros & Cons of the Mobile App

Pros

- Access to spot trading, futures contracts, and the NFT marketplace in a single application.

- The built-in Web3 Wallet allows users to manage their own private keys with modern MPC security.

- Exceptional Asset Range: Supports over 600 cryptocurrencies and 1,500 trading pairs on the go.

Cons

- The “dense” and complex interface can be intimidating for absolute beginners.

- Some users report occasional slow responsiveness or lag during major high volatility market events.

Market Research, Tools, and Education

Binance sets itself apart from traditional brokerages by offering a robust suite of educational and analytical resources. These tools are designed to move you beyond simple speculation by providing the high-level data and foundational knowledge necessary for long-term digital asset management.

By 2026, the Academy has expanded its curriculum to include specialized blockchain engineering and compliance courses, while continuing its popular "Learn & Earn" program which rewards users with major cryptocurrencies for completing educational quizzes

By combining these with Binance Academy’s foundational articles, the platform ensures that its users are some of the most well-informed in the cryptocurrency market.

Customer Support

The Binance crypto exchange operates a massive, global support infrastructure designed to assist its base of over 200 million users across multiple time zones and languages. While the platform has historically relied on automated systems to manage its high volume of inquiries, it has significantly expanded its human support capabilities heading into 2026 to provide a more empathetic and effective service.

Support Channels and Accessibility

Traders can access assistance through several primary channels:

- 24/7 Live Chat (Bot Bibi): This is the first line of defense, powered by an advanced AI chatbot named Bibi. It is designed to handle common requests such as 2FA resets, password changes, and transaction status checks instantly.

- Human Agent Transfer: If the AI cannot resolve your issue, you can request a transfer to a live Customer Service (CS) agent. These agents are available around the clock and support 17 different languages, ensuring that global users can communicate in their preferred tongue.

- Self-Service Help Center: Binance maintains a massive repository of FAQs, video tutorials, and step-by-step guides. This Help Center is essential for users who prefer to troubleshoot issues independently or learn about specific platform features like Binance Earn or API management.

- Social Channels: For general updates and quick queries, the exchange is active on platforms like X (formerly Twitter) through the @BinanceHelpDesk handle and has an official presence on Discord.

Verdict

While the lack of phone support may be a drawback for some, Binance’s 24/7 live chat and extensive self-service resources provide a robust safety net. The transition to a “user-first” culture has noticeably improved response times and the quality of assistance for complex issues in 2026.

FAQ

Is Binance safe in 2026?

Binance is considered one of the safest crypto exchanges because it utilizes advanced security systems like Two-Factor Authentication (2FA), keeps the majority of funds in cold storage, and employs real-time monitoring. Additionally, the platform maintains the Secure Asset Fund for Users (SAFU), an emergency insurance fund designed to protect users against losses from potential hacks.

How do I reduce my Binance trading fees?

You can reduce your costs by holding Binance Coin (BNB) to receive an automatic 25% fee discount. Furthermore, you can lower your rates by climbing VIP tiers through increased 30-day trading volume or by using limit orders (maker) instead of market orders (taker).

Does Binance work in the USA?

The main international platform, Binance.com, does not provide services to US residents due to regulatory compliance issues. Instead, US-based customers must use Binance.US, a separate regulated entity with different features and supported coins.

What is the minimum deposit on Binance?

The minimum deposit for most standard funding methods, such as credit or debit cards, is typically $10. While there is no minimum requirement for direct cryptocurrency deposits beyond covering network fees, most fiat gateways enforce this small $10 floor to execute a transaction.

Can I earn interest on my crypto at Binance?

Yes, you can earn passive income through Binance Earn, which offers a variety of yield-generation products. Options include flexible savings for instant redemptions, fixed-term staking for higher rewards, and liquidity farming.

What is the 25% BNB fee discount?

Traders who hold BNB in their exchange wallet and choose to pay their trading fees using the token receive an automatic 25% reduction in cost. This discount applies to spot trading and is a primary way for users to lower their transaction overhead.

How long do Binance withdrawals take?

The time required for withdrawals depends on the method; cryptocurrency withdrawals are subject to network confirmation speeds on the specific blockchain used. Fiat withdrawals via bank transfer or card can vary based on the provider, though some methods like Faster Payments are relatively fast.

How do I complete Binance KYC?

To complete Know Your Customer (KYC) verification, you must upload a government-issued photo ID and perform a brief facial recognition scan. For higher withdrawal limits, you may also need to provide proof of address, such as a utility bill or bank statement.