BLACKBULL MARKETS REVIEW 2025

BlackBull Markets has grown from a small New Zealand broker into a global ECN provider trusted by traders in more than 180 countries. With low spreads, fast execution, and access to over 26,000 instruments, it promises an institutional-grade trading experience for retail traders. In this review, I tested BlackBull Markets to see how it performs in 2025 and whether it still delivers the value and reliability traders expect.

Broker Guide's BlackBull Markets Review in 2025

In 2025, I decided to test BlackBull Markets to see whether its growing reputation in the trading community is truly deserved. Over the past few years, the broker has made impressive progress, expanding its range of tradable assets to more than 26,000 markets and introducing new tools that appeal to both beginners and experienced traders.

Its focus on providing institutional-grade trading conditions and improving educational content has caught the attention of many traders looking for an alternative to traditional brokers.

At BrokerGuide.com, our goal is to deliver honest, data-driven insights that help traders choose brokers they can trust. We conduct hands-on testing, evaluate real trading conditions, and analyze platform performance from a trader’s point of view.

By reviewing BlackBull Markets in 2025/2026, I wanted to find out whether this New Zealand-based ECN broker truly offers the quality, transparency, and reliability it promises, or if its growing popularity is simply a result of clever marketing.

About BlackBull Markets

BlackBull Markets was founded in 2014 and is headquartered in Auckland, New Zealand. Since its launch, the company has grown from a local forex broker into a global ECN provider serving traders in more than 180 countries. The broker operates with a clear focus on delivering institutional-grade trading conditions, combining low spreads, fast execution, and deep liquidity across a wide range of markets.

BlackBull Markets is regulated by the Financial Markets Authority (FMA) in New Zealand and the Financial Services Authority (FSA) in Seychelles. This regulatory framework helps ensure a degree of security and transparency for traders while allowing the broker to maintain competitive conditions and flexible leverage.

Clients can trade more than 26,000 instruments, including forex, indices, shares, commodities, and cryptocurrencies, using advanced trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

With offices in New York, London, Jakarta, and Kuala Lumpur, BlackBull Markets continues to expand its global presence. In recent years, the company has achieved major milestones, including a significant private equity investment from Milford Private Equity Fund III and a 20 percent stake acquisition by LMAX Group in 2024.

These developments have strengthened the broker’s financial position and accelerated its growth into one of the most respected names in online trading.

My Quick Verdict: Who is BlackBull Markets Best For?

Overall impression: 4.5/5 – A fast-growing ECN broker ideal for traders seeking institutional conditions and global market access, but still improving in research and education.

Best for: Traders who want institutional-grade execution, access to a wide range of markets, and the flexibility to use multiple professional trading platforms.

Not ideal for: Beginners who prefer a broker with extensive research tools and step-by-step educational support.

After testing BlackBull Markets in 2025, I found it to be a strong performer in speed, pricing, and platform reliability. Trades executed almost instantly, averaging around 20 milliseconds on ECN servers, which is impressive for a retail broker. The platforms, including MT4, MT5, cTrader, and TradingView, all ran smoothly with consistent performance and excellent charting capabilities.

Pricing across account types is fair and transparent, especially on the ECN Prime and Institutional accounts, which deliver tight spreads and competitive commissions.

While BlackBull Markets continues to enhance its research tools and educational content, these areas still trail behind top-tier brokers such as IG or Pepperstone. However, its trading environment, low costs, and deep liquidity pools make it an excellent choice for active and professional traders.

Pros

- Tight ECN spreads, 26,000+ instruments

- Supports MT4, MT5, cTrader, TradingView

- Multiple copy trading tools (CopyTrader, ZuluTrade, Myfxbook)

- No deposit/withdrawal/inactivity fees

- Fast execution (20ms avg)

Cons

- Limited tier-1 regulation

- No proprietary trading app

- Education still improving

- High $2,000 minimum for Prime account

Why You Should Choose BlackBull Markets ?

BlackBull Markets has entered 2025 stronger than ever, with major upgrades to its platform lineup, educational resources, and research tools. The broker now supports an impressive range of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, TradingView, and its proprietary BlackBull Invest and CopyTrader solutions. These additions give traders more flexibility and control, whether they focus on forex, stocks, or CFD trading. The introduction of new analytical features and an expanded research hub shows that BlackBull is actively listening to client feedback and improving areas that once lagged behind.

Global Expansion and Recognition

From its headquarters in Auckland, New Zealand, BlackBull Markets has steadily built an international presence with offices in New York, London, Jakarta, and Kuala Lumpur. This global reach supports around-the-clock service and localized expertise for clients worldwide. Over the years, BlackBull has also earned recognition for its consistent growth and performance, featuring multiple times in Deloitte’s Fast 50 awards. These achievements underline the company’s strong trajectory and its ability to compete with leading global brokers.

Stability and Trusted Regulation

BlackBull Markets operates under the oversight of the Financial Markets Authority (FMA) in New Zealand and the Financial Services Authority (FSA) in Seychelles. This regulatory framework provides a solid foundation of trust and transparency while allowing the broker to offer competitive trading conditions. The company’s stability has been further reinforced by two key partnerships: a major private equity investment from Milford Private Equity Fund III and a 20 percent ownership stake acquired by LMAX Group in 2024. Both moves have strengthened BlackBull’s financial backing and boosted its institutional credibility.

Ideal for Serious ECN Traders

With its low-latency infrastructure, ECN execution, and access to over 26,000 tradable instruments, BlackBull Markets remains a top choice for serious traders. The broker’s direct connection to Equinix servers ensures lightning-fast order execution, making it suitable for scalpers, algorithmic traders, and professionals who require consistent precision. Combined with its growing ecosystem of platforms and enhanced client support, BlackBull Markets stands out in 2025 as a well-rounded, stable, and forward-thinking broker for global traders seeking institutional-level performance.

Bottom Line

BlackBull Markets has evolved from a regional broker into a trusted global name known for speed, reliability, and choice. It continues to deliver the kind of trading environment professionals expect while gradually becoming more accessible for everyday traders who value transparency and advanced tools.

Compare to Top Competitors

Before choosing a broker, it’s worth seeing how BlackBull Markets performs against other major players in the trading world. Each of the following competitors brings its own strengths and limitations. Here’s how they compare in terms of platforms, pricing, and overall trading experience.

IG

IC Markets

Fusion Markets

Exploring BlackBull Markets’ Range of Tradable Instruments

The broker offers an impressive selection of more than 26,000 tradable instruments, making it one of the most diverse brokers in its category. This wide market coverage gives traders the freedom to diversify across asset classes, hedge positions, or focus on specific sectors using their preferred trading platform.

Forex

Forex trading is at the heart of BlackBull’s offering, with more than 64 currency pairs available, including majors, minors, and exotics.

The ECN Prime account delivers ultra-tight spreads starting from 0.1 pips, supported by lightning-fast execution through Equinix servers. With leverage of up to 1:500 and deep liquidity, it’s a solid choice for both retail and professional traders.

Indices

BlackBull Markets provides access to major global indices such as the S&P 500, NASDAQ 100, FTSE 100, and DAX 40.

Traders can speculate on market trends or hedge portfolios through CFDs, with flexible leverage and tight pricing available on all platforms, including MetaTrader 5 and TradingView.

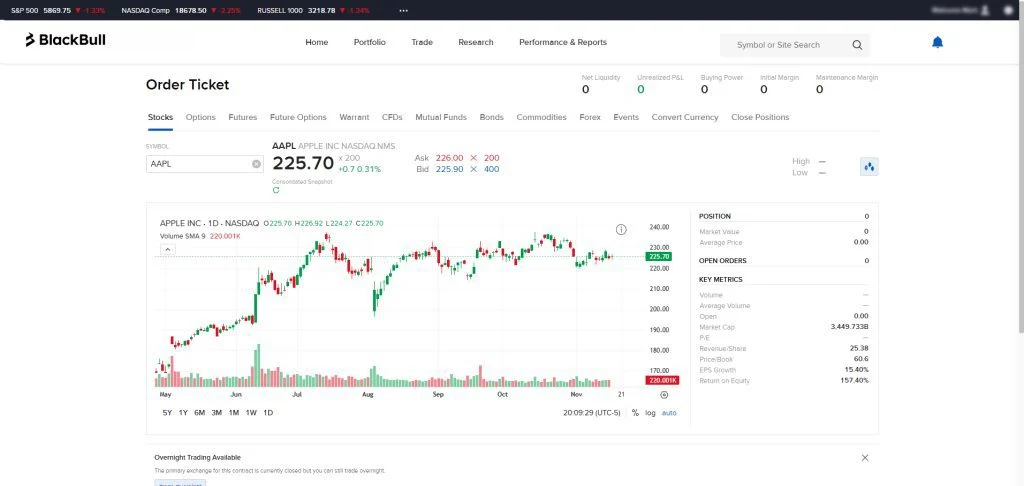

Stocks and CFDs

With over 1,800 global equities from the US, UK, Europe, and Asia, BlackBull allows traders to take advantage of stock price movements without owning the underlying shares.

Stock CFDs are available on MT4, MT5, and cTrader, while the BlackBull Invest platform enables direct stock ownership for long-term investors.

Commodities

BlackBull offers trading in key commodities such as gold, silver, crude oil, natural gas, and agricultural products. These assets are ideal for traders seeking diversification or inflation hedging opportunities. Competitive spreads and fast execution make commodity trading efficient and cost-effective.

Crypto CFDs

Cryptocurrency CFDs are available on leading digital assets like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Ripple (XRP), with leverage of up to 1:100. Traders can take long or short positions to capitalize on crypto volatility without directly owning the assets.

Futures

Futures CFDs are available through the MT5 platform, covering index and commodity markets. This feature appeals to advanced traders looking for exposure to broader global market trends.

| Asset | BlackBull Markets |

|---|---|

| Tradeable Symbols | 26,000+ |

| Cryptocurrencies | 20 |

| Stocks CFDs | 1800+ |

| Forex Pairs | 64+ |

| Commodities | 10+ |

| Indices | 16+ |

| Futures | 14+ |

| Energies | 2 |

Bottom Line

BlackBull Markets stands out for its exceptional range of tradable assets, catering to traders who value diversity and flexibility. While it doesn’t offer options trading, its broad market access, low spreads, and multi-platform support make it an outstanding all-in-one broker for active traders.

How BlackBull Markets’ Instruments Compare to Competitors

The table below highlights how BlackBull Markets’ range of tradable instruments stacks up against other leading brokers such as IG, IC Markets, and Fusion Markets. It shows at a glance which asset classes are available across each platform.

| Asset | Blueberry Markets | Eightcap | Pepperstone | FP Markets |

|---|---|---|---|---|

| Forex | ||||

| Indices | ||||

| Commodities | ||||

| Stock CFDs | ||||

| Cryptocurrencies | ||||

| Futures | ||||

| Precious Metals | ||||

| Options |

Fees and Commission Structure

| Fees | |

|---|---|

| Average spread (EUR/USD) - Standard account | 0.71 pips |

| All-in Cost EUR/USD - Active | 0.71 pips |

Commissions | ECN Standard account - $0 |

Forex CFD fees | Low |

Index CFD fees | Low |

Stock CFD fees | Average |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $0 |

Understanding a broker’s fee model is essential for managing your overall trading costs. BlackBull Markets is transparent in this area, offering a clear and competitive pricing structure designed to suit different types of traders — from beginners to professionals. Whether you prefer commission-free trading or raw ECN pricing, there’s an account option that fits your strategy and budget.

Trading Fees

BlackBull Markets operates on an ECN (Electronic Communication Network) model, which connects traders directly to liquidity providers without dealing-desk intervention. This results in tighter spreads and faster execution.

Spreads

BlackBull Markets is known for offering some of the most competitive spreads among ECN brokers.

On the ECN Standard account, spreads start from around 0.8 pips, making it a straightforward option for traders who prefer commission-free trading.

The ECN Prime account provides even tighter spreads starting from 0.1 pips, while the ECN Institutional account delivers raw spreads from 0.0 pips, ideal for high-volume or professional traders.

These consistently low spreads help minimize trading costs, particularly for scalpers and day traders who execute multiple positions daily.

Commissions

In addition to tight spreads, BlackBull Markets maintains transparent commission structures tailored to each account type. There are no additional hidden charges on trade execution, and all fees are clearly displayed before you place a trade. This clarity ensures that traders can accurately calculate total trading costs and plan strategies with confidence.

ECN Standard: This account type is ideal for newer traders or those who prefer a simple cost structure. Spreads start from 0.8 pips, and there are no additional commissions, making it straightforward and easy to manage.

ECN Prime: Designed for active traders, the Prime account offers spreads from 0.1 pips and a $6 round-trip commission per lot. The overall trading cost remains highly competitive compared to other ECN brokers.

ECN Institutional: Tailored for professional or high-volume traders, this account provides raw spreads from 0.0 pips with a $4 round-trip commission. Institutional clients also benefit from deeper liquidity and priority access to dedicated account management.

Swaps / Financing Charges

BlackBull Markets applies overnight financing (swap) rates to positions held beyond the trading day. These rates vary depending on the currency pair, instrument, and market conditions.

Traders can view the exact swap rates directly within the MT4 or MT5 platform specifications, ensuring full transparency before holding positions overnight. Islamic (swap-free) accounts are also available for traders who wish to comply with Sharia principles.

Other Trading Costs

BlackBull Markets offers a free VPS (Virtual Private Server) for eligible clients who maintain a minimum deposit of $2,000 and trade at least 20 lots per month. This is particularly useful for algorithmic traders who require uninterrupted connectivity and ultra-low latency. There are no hidden fees related to order execution, slippage, or deposit and withdrawal processing, giving traders confidence in predictable, fair-cost trading.

Non-Trading Fees

No Inactivity Fees

BlackBull Markets does not charge an inactivity fee, which sets it apart from many brokers that penalize dormant accounts. Traders can take a break from the markets for weeks or even months without worrying about maintenance or inactivity costs. This makes the broker a practical choice for part-time traders or those who trade seasonally.

Free Deposits and Withdrawals

Deposits and withdrawals are completely free of charge on BlackBull’s end, regardless of whether you use a bank transfer, credit or debit card, or an e-wallet. The broker also supports multiple base currencies, reducing the need for frequent conversions. This transparency allows traders to manage their funds without surprise deductions.

No Internal Conversion Charges

BlackBull Markets does not apply internal conversion fees when transferring between currencies within your account. This helps traders retain more of their capital, especially those who manage funds in different currencies.

Third-Party Processing Fees

While the broker itself does not charge funding fees, third-party or intermediary bank fees may apply depending on the payment provider or location. These charges are imposed externally and not controlled by the broker.

Verdict

With its blend of tight spreads, low commissions, and transparent cost structure, BlackBull Markets stands out as one of the most cost-effective ECN brokers in 2025. It offers excellent value for active traders seeking institutional-grade pricing without compromising execution quality.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Fusion Markets Regulated ?

BlackBull Markets operates under a dual regulatory framework that provides a balance between security and flexibility. The broker is regulated by the Financial Markets Authority (FMA) in New Zealand, which is considered a Tier 1 regulator known for its strict oversight and focus on client fund protection. This regulation ensures that BlackBull maintains segregated client accounts, proper capital adequacy, and transparent business practices.

In addition, BlackBull Markets holds a license from the Financial Services Authority (FSA) in Seychelles, an offshore jurisdiction that allows the broker to serve a broader international client base with more flexible trading conditions, such as higher leverage. While this combination offers accessibility to global traders, it’s worth noting that the FSA is not considered as stringent as regulators like the FCA (UK), ASIC (Australia), or CySEC (Cyprus), which provide stronger investor compensation schemes and stricter operational requirements.

The broker is also a member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution organization in New Zealand that offers additional protection to clients in case of conflicts or grievances.

Overall, it is regarded as safe for experienced traders, while beginners should be aware of the jurisdictional differences in regulatory protections when choosing their account location.

Understanding Regulatory Protections and Broker Stability

FMA Oversight and Transparency

The Financial Markets Authority (FMA) in New Zealand oversees BlackBull Markets’ operations, ensuring that the broker follows strict standards for transparency, financial reporting, and client fund protection. This supervision requires the company to maintain proper risk management practices and regularly report its financial standing, which helps build trust and accountability.

Investor Fund Segregation and Protection

Client funds are held in segregated accounts with top-tier banks, completely separate from the company’s operational funds. This means client money cannot be used for business expenses or trading purposes, offering an extra layer of security. BlackBull Markets also provides negative balance protection, ensuring traders cannot lose more than their deposited amount, even in volatile market conditions.

Financial Backing and Long-Term Stability

BlackBull Markets’ financial stability has been strengthened by significant investments from Milford Private Equity Fund III and the LMAX Group, which acquired a 20 percent stake in 2024. These partnerships reinforce the broker’s credibility, expand its institutional reach, and support continued growth in infrastructure and global operations.

How To Open an Account

Opening an account with BlackBull Markets is quick and straightforward, designed to take less than five minutes for most users. The process can be completed entirely online through the broker’s secure client portal.

Setting Your Login Details

Start by visiting the official BlackBull Markets website and selecting “Open Account.” Enter a valid email address and create your preferred password to set up your login credentials.

Filling in the Account Opening Form

Next, complete the registration form by providing your full name, residential address, city, postcode, phone number, and date of birth. Ensure that all information matches your legal identification documents.

Choosing a Preferred Account Type

Select your desired trading platform (MetaTrader 4, MetaTrader 5, cTrader, or TradingView) and choose an account type — ECN Standard, ECN Prime, or ECN Institutional — based on your trading needs and experience level.

Confirming Your Suitability Status

You’ll be asked to answer questions about your employment status, source of income, and trading experience. These details help the broker assess whether the products and leverage levels offered are suitable for you. Applications that don’t meet internal compliance requirements may be declined.

Getting Your Documents Verified

Upload clear photos of your proof of identity (passport, driver’s license, or national ID) and a proof of address (bank statement or utility bill issued within the last three months). Verification is typically completed within 24 hours.

Once your account is verified, you can fund it using your preferred payment method and begin trading on your selected platform.

Account Types

BlackBull Markets offers a range of account types tailored to different trading styles and experience levels. Each account provides access to the broker’s deep liquidity pool, low-latency execution, and multiple platform options, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView. Whether you’re a beginner testing strategies or a professional trader managing large volumes, there’s an option designed to fit your needs.

ECN Standard Account

The ECN Standard account is the most accessible option, requiring no minimum deposit. It features average spreads starting from 0.8 pips with no commission fees, making it ideal for new traders or those who prefer a simple cost structure.

Despite being entry-level, it still offers fast ECN execution and leverage of up to 1:500, giving traders competitive conditions without additional costs.

ECN Prime Account

For more experienced traders, the ECN Prime account offers tighter spreads starting from 0.1 pips and a $6 round-turn commission per lot. The minimum deposit is $2,000, which unlocks access to lower spreads, deeper liquidity, and faster execution.

This account type is best suited for active traders, scalpers, or algorithmic traders who prioritize pricing efficiency and execution speed.

ECN Institutional Account

Designed for professional and high-volume traders, the ECN Institutional account requires a $20,000 minimum deposit and offers raw spreads from 0.0 pips with a $4 round-turn commission. Institutional clients also receive enhanced liquidity, priority order routing, and dedicated account support.

Islamic and Demo Accounts

BlackBull Markets also provides Islamic (Swap-Free) accounts for traders who follow Sharia principles, as well as demo accounts for beginners who want to practice trading in a risk-free environment before going live.

What is the Minimum Deposit at BlackBull Markets?

BlackBull Markets keeps its account funding requirements flexible to accommodate different types of traders. The minimum deposit depends on the account type you choose:

- ECN Standard Account: $0 minimum deposit – ideal for beginners or traders who want to start small and explore the platform before committing more capital.

- ECN Prime Account: $2,000 minimum deposit – best suited for active or experienced traders who want access to tighter spreads and lower overall trading costs.

- ECN Institutional Account: $20,000 minimum deposit – designed for professional traders or institutions that require raw spreads, deep liquidity, and premium support.

BlackBull Markets accepts a wide range of funding methods, including bank transfers, credit/debit cards, and popular e-wallets, so deposits are quick and straightforward. Regardless of account type, traders can open an account in multiple base currencies such as USD, EUR, GBP, AUD, and NZD.

BlackBull Markets charges no deposit fees, and funds are usually credited instantly when using cards or e-wallets. Bank transfers may take between one and three business days to process, depending on the payment provider.

Verdict

The flexible deposit structure makes BlackBull Markets accessible to both new and professional traders. Whether you want to start small or trade with institutional-level conditions, the broker provides account options that match your goals and budget.

| Broker | Minimum Deposit |

|---|---|

BlackBull Markets | $0 |

| IG | $0 |

IC Markets | $200 |

| Fusion Markets | $0 |

Deposit and Withdrawal

BlackBull makes funding feel easy to live with. Cards and e‑wallets show up fast, bank wires take a bit longer, and the multi‑currency setup helps you avoid extra conversions when you just want to top up and trade.

Deposit

If you want speed, go with cards or e‑wallets since they usually credit almost instantly, while bank transfers typically clear within 1 to 3 business days, depending on your bank and region. Funding from an account in the same name keeps compliance smooth, and local rails like POLi can shorten wait times where available.

All deposits are processed quickly, and funds usually appear in your trading account within a few minutes (for cards and e-wallets) or up to one business day for bank transfers. Fusion Markets does not charge any deposit fees, although your bank or payment provider might apply small processing charges.

Withdrawal Fees & Options

You request payouts from the secure client area, approvals are quick, and timing depends on the method. Cards and e‑wallets are generally swift after approval, while bank wires usually land within 1 to 3 business days based on banking cut‑offs and intermediaries. Card refunds typically return up to the deposited amount before profits move via bank or an approved e‑wallet.

Currencies and Fees

Choosing a base currency like USD, EUR, GBP, or NZD helps cut down conversion friction when funding and withdrawing. While deposits are generally free on the broker’s side, international wires can still attract intermediary bank charges outside the broker’s control.

Verdict

For active traders, this setup just works. Instant top‑ups with cards and e‑wallets, dependable bank wires, sensible multi‑currency support, and no surprise deposit costs so you can focus on execution rather than moving money around.

Desktop Trading Platform

BlackBull’s desktop stack gives you breadth without forcing a one‑size‑fits‑all workflow. Pairing institutional connectivity with platforms traders already know and trust for day‑to‑day execution and analysis.

You can run MT4, MT5, cTrader, TradingView, and BlackBull Invest, so active CFD traders and longer‑term investors can keep everything under one roof while picking the workflow that fits their style and speed requirements. Each platform covers deep market access with advanced charting, order control, and optional social or copy integrations as your strategy matures over time.

MetaTrader 5 (MT5)

MT5 steps up with multi‑asset coverage, faster strategy testing, and 21 timeframes, which helps when you need more granular entries or want to manage diverse watchlists beyond MT4's limits. It supports advanced order types, hedging, and algorithmic trading, so discretionary and systematic traders can build and iterate without switching ecosystems.

cTrader Edge

cTrader delivers direct ECN pricing with full depth of market, precise order controls, and native algorithmic support. A strong fit if your edge depends on market depth, faster routing, and clean execution logs. The desktop experience is fast and modular, with detachable charts and layouts that scale well for multi‑monitor setups and complex workflows.

TradingView Integration

TradingView brings best‑in‑class charts, a large community for idea discovery, and Pine Script for custom studies. Experience all of this while you route orders through your BlackBull account from the same canvas to cut platform hopping.

If you collaborate, share screenshots, or like back‑testing ideas in a familiar visual environment, this integration feels natural on desktop.

BlackBull Invest

BlackBull Invest is the in‑house portfolio platform for real shares and ETFs across 80+ markets, which pairs nicely with your CFD stack. It is perfect when you want ownership alongside short‑term trading. Keeping investing and trading with one provider simplifies funding, statements, and tax reporting while still letting you segment strategies cleanly.

Copy‑trading with BlackBull Markets

If you prefer to follow proven profiles, BlackBull offers its own CopyTrader powered by Hokocloud and integrates with ZuluTrade, Myfxbook, and cTrader Copy for those running the cTrader desktop workflow.

You can browse leaders, review track records, set allocation and risk controls, and mirror trades automatically.

Verdict

For traders who value choice, BlackBull's desktop setup delivers institutional execution wrapped in familiar platforms without locking you into a single workflow.

The depth of copy integrations, algo support, and multi‑asset access through BlackBull Invest make it a serious contender for active traders. Though the thinner education means you'll need to lean on your own research and experience to make the most of the setup.

Pros & Cons

Pros

- Multiple choices across MT4, MT5, cTrader, TradingView, and BlackBull Invest to match different styles, from scalping and swing trading to long‑term investing.

- Advanced analysis, ECN depth, algorithmic support via MT4/MT5 Expert Advisors and cTrader cBots, plus FIX API access for institutional‑grade automated trading.

- Robust copy and social integrations covering native BlackBull CopyTrader, ZuluTrade, Myfxbook, and cTrader Copy for added flexibility across experience levels.

- Free VPS hosting for traders with a $2,000 balance and 20 lots monthly volume, which lowers latency for algorithmic strategies.

- WebTrader access for MT4 and MT5 means you can trade from any browser without installing software on desktop.

Cons

- Education and research features are still improving and lag behind top‑tier brokers like IG or Saxo, especially for macro and fundamental analysis.

Mobile App

BlackBull Markets gives traders full mobile access to the markets through industry-leading third-party apps rather than a proprietary one. The broker supports MetaTrader 4, MetaTrader 5, cTrader, and TradingView apps, all available on iOS and Android. Each app is designed to deliver fast execution, detailed charting, and reliable order management, ensuring a smooth experience for traders on the go.

Proprietary Apps

The broker offers several in-house applications tailored to specific trading and account management needs:

BlackBull SCA App: Secure Client Area app for managing accounts, deposits, and withdrawals.

BlackBull Invest: For long-term investing in real shares and ETFs.

BlackBull CopyTrader: Designed for copy trading and social trading, enabling users to follow and replicate successful strategies.

MetaTrader 4 and MetaTrader 5 Mobile

Both MT4 and MT5 mobile apps offer advanced charting tools, customizable layouts, and one-tap trading. Users can access over 65 technical indicators, manage open positions, and receive instant trade alerts. These apps are ideal for forex and CFD traders who rely on the MetaTrader ecosystem

cTrader Mobile

The cTrader mobile app is built for professional traders who value precision and usability. It features intuitive charting, order depth visibility, and fast execution speeds. The interface is clean, making it easy to analyze and place trades efficiently.

TradingView App

Through TradingView’s mobile app, traders gain access to powerful charting capabilities and social trading tools. It allows seamless syncing between mobile and desktop platforms for a consistent trading experience.

Verdict

BlackBull Markets delivers an excellent mobile trading experience through a combination of proprietary and third-party apps. Whether managing accounts, copying trades, or performing technical analysis, traders can enjoy institutional-grade tools and execution right from their smartphones or tablets.

Pros & Cons of the Mobile App

Pros

- Offers both proprietary and third-party mobile platforms (MT4, MT5, cTrader, TradingView).

- Full trading functionality with advanced charting and fast execution.

- Supports multiple order types and over 65 technical indicators.

- Seamless syncing between desktop and mobile platforms.

- Secure biometric login for added account protection.

- Proprietary apps for investing, account management, and copy trading.

- Optimized for both Android and iOS with stable performance.

Cons

- Requires switching between apps for trading, investing, and account management.

- Limited customization compared to desktop versions.

- Some third-party app updates may vary depending on platform providers.

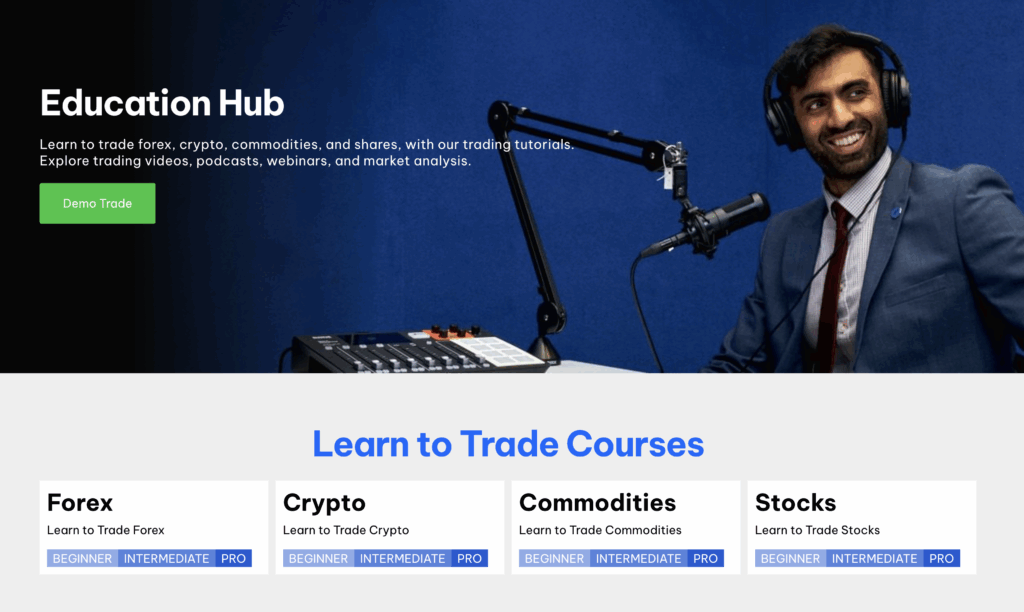

Market Research, Tools, and Education

BlackBull Markets has made steady improvements in its research and education resources, especially following its acquisition of ATM Strategy, a New Zealand-based research and analytics firm.

This partnership has strengthened the broker’s content quality and delivery, helping traders access more relevant insights and market analysis.

While still developing compared to industry leaders, BlackBull’s research and learning tools now offer a more structured experience for traders who want to improve their skills and decision-making

- The “Learn to Trade” podcast, which discusses trading psychology, market trends, and strategy development.

- YouTube playlists such as Elliot Wave Theory and Whiteboard Wizards, offering visual lessons that simplify complex topics.

- A structured Forex 101–303 series, guiding traders from foundational knowledge to advanced concepts like technical patterns and risk management.

Customer Support

The broker offers a strong customer support system designed to provide quick and reliable assistance for traders around the world. The broker’s support team is available 24/5 through live chat, email, and phone, ensuring that help is always within reach regardless of time zone or trading hours.

Availability and Response Time

During testing, BlackBull’s live chat support consistently responded within two minutes, offering prompt and accurate answers to both technical and account-related questions. The availability of round-the-clock service gives traders peace of mind, especially those trading in global markets.

Multilingual Assistance

Support is available in multiple languages, including English, Chinese, Arabic, Japanese, and Spanish, catering to BlackBull’s diverse international client base. This multilingual approach makes it easier for traders to get help in their preferred language and reduces communication barriers.

Professionalism and Quality

The support staff are knowledgeable and professional, handling queries with clarity and patience. Whether it’s help with platform setup, account verification, or funding, responses are detailed and solution-focused. BlackBull also offers a comprehensive Help Centre on its website, where traders can find quick answers to common questions.

Dispute Resolution

As a member of the Financial Services Complaints Limited (FSCL) in New Zealand, BlackBull Markets provides an independent dispute resolution process, ensuring clients have an extra layer of protection if issues arise.

Verdict

BlackBull Markets delivers reliable, fast, and multilingual customer support that stands out among ECN brokers. With responsive live chat, global accessibility, and professional service quality, it creates a positive and trustworthy experience for traders at every level.

FAQ

Is BlackBull Markets safe and regulated?

Yes! BlackBull Markets is regulated by the Financial Markets Authority (FMA) in New Zealand (a Tier-1 regulator) and also holds a licence with the Financial Services Authority (Seychelles) (FSA). However it is not regulated by the FCA, ASIC or CySEC.

What is the minimum deposit at BlackBull Markets?

The minimum deposit for the Standard account is US$0. The Prime account requires US$2,000 and the Institutional account US$20,000.

Does BlackBull Markets offer a demo account?

Yes, you can open a demo account to practise trading before depositing real money.

Are there fees for deposits or withdrawals?

Deposits are free of fees from the broker’s side. Third-party or intermediary bank fees may apply.

What trading platforms does BlackBull Markets support?

BlackBull supports major platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and TradingView, plus its own account-management apps.

Can beginners trade with BlackBull Markets?

Yes. Beginners can open an account (with US$0 deposit for Standard), use demo mode, and begin trading. But they should understand ECN conditions and costs.

Does BlackBull offer copy trading tools?

Yes. BlackBull offers copy-trading integration (e.g., via BlackBull CopyTrader) so traders can follow or replicate strategies.

What is the average spread for EUR/USD?

On their Prime account, spreads for EUR/USD can go as low as ~0.1 pips. On the Standard account the spread is higher (for example around ~0.8 pips or more).

Are swap-free Islamic accounts available?

Yes, swap-free (Islamic) accounts are available for eligible clients.

How long does it take to withdraw funds?

Withdrawals are usually processed very quickly once approved. Many methods show processing in under 24 hours, though bank transfers or certain methods may take 1-3 business days, depending on banks and jurisdictions.