BLUEBERRY MARKETS REVIEW 2025

Thinking about opening a trading account with Blueberry Markets? In this detailed 2025 review, we put the popular Australian broker to the test to see if it still delivers on its promises of tight spreads, fast execution, and top-tier support. From regulation and fees to trading platforms, education, and customer service, we dig into every detail to help you decide if Blueberry Markets is the right fit for your trading goals.

Broker Guide's Blueberry Markets Review in 2025

I decided to test Blueberry Markets to find out if it still lives up to its strong reputation as one of Australia’s most trusted forex and CFD brokers in 2025.

The broker is known for its tight spreads, transparent pricing, solid regulation under ASIC and VFSC, and a setup that’s welcoming to beginners.

With so many brokers to choose from, I wanted to find out if Blueberry Markets still holds its ground as a reliable option.

About Blueberry Markets

Blueberry Markets was founded in 2016 by Dean Hyde, a former AxiTrader executive, and has grown into one of Australia’s most recognised forex and CFD brokers. The company is headquartered in North Sydney, Australia, and operates under the Blueberry Markets Group brand.

Traders have access to over 1,300 instruments, including forex pairs, indices, commodities, shares, and cryptocurrencies. The broker is dually regulated, holding licences from:

- ASIC (Tier 1) — Blueberry Australia Pty Ltd (AFSL 535887)

- VFSC (Tier 3) — Blueberry (V) Ltd

Blueberry Markets has built a reputation for transparency, reliable education resources, and responsive customer service, attracting thousands of traders worldwide. Client funds are held in segregated, AA-rated Australian bank accounts, and all accounts benefit from negative balance protection, offering an added layer of security.

Beyond its regulation and safety measures, Blueberry stands out for its customer-first approach. The broker combines competitive pricing with a personal touch, offering dedicated account managers, a rich library of trading tutorials, and 24/7 multilingual support. This balance of affordability, reliability, and human support makes it an appealing choice for both new and experienced traders looking for a trustworthy trading environment.

My Quick Verdict: Who is Blueberry Markets Best For?

Rating: 4.4/5

Best For: Day traders, scalpers, and learners who prefer MetaTrader platforms.

Not Ideal For: Long-term investors seeking real stocks, ETFs, or bonds.

Blueberry Markets remains an excellent choice for both beginners and active traders. It combines tight spreads, low fees, strong regulation, and intuitive platforms, making it easy to trade confidently across a wide range of markets. The broker’s educational resources, responsive support, and crypto-friendly features further enhance its appeal.

While the lack of a proprietary platform or investment products may limit long-term portfolio traders, Blueberry Markets excels at what it was built for: fast, affordable, and reliable CFD trading.

Pros

- Commission-free and raw spread account options

- Fast trade execution (1–3 ms with VPS hosting)

- 24/7 multilingual customer support

- 68 cryptocurrency pairs with multiple deposit methods

- Tight spreads and overall low trading fees

Cons

- No investor compensation fund

- No access to ETF or bond trading

- Offshore VFSC entity offers less protection than ASIC

Why You Should Choose Blueberry Markets ?

Blueberry Markets operates under dual regulation from ASIC and VFSC, giving traders the flexibility of higher leverage through its global entity while maintaining the security standards of a Tier-1 Australian regulator. Client funds are fully segregated in AA-rated Australian banks, ensuring transparency and safety.

Accessible for All Budgets

Whether you’re just starting out or refining advanced strategies, Blueberry makes trading accessible through micro-lot and demo accounts. New traders can practice in a risk-free environment, while experienced traders can scale confidently.

Low-Cost Trading Environment

The broker stands out for its tight spreads — around 1.1 pips on EUR/USD and 12¢ on gold — along with no inactivity, deposit, or withdrawal fees. These cost savings make a real difference for frequent and high-volume traders.

Professional Insights and Community

Blueberry’s VIP Trading Room connects clients with real-time market insights and strategy sessions from expert analysts such as Desmond Leong and Jon Kibbler. Traders can interact, learn, and stay ahead of key market movements.

Crypto-Friendly and Copy-Trading Ready

With 68 cryptocurrency pairs and deposit options in BTC, ETH, and USDT, Blueberry Markets caters to the growing crypto-trading community. It also supports copy trading via DupliTrade, allowing users to mirror the strategies of proven professional traders — ideal for those who want to learn or trade passively.

Bottom Line

Blueberry Markets continues to prove why it’s regarded as one of Australia’s most reliable brokers in 2025. With dual regulation, ultra-tight spreads, fast execution, and zero hidden fees, it strikes an excellent balance between safety, affordability, and performance. The broker’s VIP Trading Room, crypto support, and strong educational resources make it suitable for traders of all experience levels.

While it could improve by expanding its product range beyond CFDs and adding more frequent market analysis, Blueberry Markets remains a top choice for forex and CFD traders who value transparency, speed, and consistent support.

Compare to Top Competitors

When choosing a forex broker, it’s important to see how Blueberry Markets stacks up against other well-established names in the industry. Here’s a quick comparison with three of its closest competitors: Eightcap, OANDA, and IC Markets, to help you decide which platform best suits your trading style.

Eightcap

OANDA

IC Markets

Exploring Blueberry Markets’ Range of Tradable Instruments

Blueberry Markets offers an impressive selection of over 1,300 instruments, giving traders access to a diverse mix of global markets. Whether you prefer traditional forex trading, commodities, or digital assets, the broker’s range ensures plenty of opportunities to diversify your strategy and manage risk effectively.

Forex

Trade from a wide range of 63+ forex pairs, including major, minor, and exotic currencies. With spreads starting from 0.0 pips on the Direct Account, Blueberry is ideal for day traders and scalpers seeking precision and tight pricing.

Commodities

Access 21 popular commodities, including gold, silver, and crude oil. These assets allow traders to hedge inflation risks or speculate on global supply and demand trends.

Indices

Blueberry provides 15 global indices, such as the DAX30, DJ30, and GER30, giving traders exposure to entire stock markets through a single position. It’s a great option for those looking to trade macroeconomic events and global trends.

Global Shares

With over 1,100 share CFDs from major exchanges like NASDAQ, ASX, LSE, and Euronext, traders can speculate on leading companies across the US, Europe, and Australia. This broad access makes portfolio diversification simple and efficient.

Cryptocurrencies

Blueberry is a crypto-friendly broker, offering 68 cryptocurrency pairs, including Bitcoin, Ethereum, and emerging altcoins. Crypto traders can also fund their accounts using digital currencies such as BTC, ETH, or USDT for convenience and speed.

| Asset | Blueberry Markets |

|---|---|

| Tradeable Symbols | 1300+ |

| Forex Pairs | 63 |

| Commodities | 21 |

| Indices | 15 |

| Stocks | 1167 |

| Cryptocurrencies | 68 |

Key Takeaways

Blueberry Markets offers a well-balanced and diverse selection of instruments, making it suitable for both short-term traders and those seeking broad market exposure. The forex and crypto ranges are particularly strong, with tight spreads and reliable execution speed across MT4 and MT5 platforms.

Its variety of global shares and indices stands out, giving traders access to international markets without the need for multiple brokers. However, the absence of soft commodities, ETFs, and bonds may limit investors who prefer a more traditional or long-term portfolio mix.

Overall, Blueberry’s instrument lineup provides ample flexibility, low-cost access, and cross-market opportunities, especially for forex, commodities, and crypto enthusiasts.

How Blueberry Market’s Instruments Compare to Competitors

The table below shows how Blueberry Markets stacks up against other leading brokers — Eightcap, OANDA, and IC Markets — in terms of the range of tradable instruments offered.

| Asset | Blueberry Markets | Eightcap | Oanda | IC Markets |

|---|---|---|---|---|

| Forex | ||||

| Indices | ||||

| Commodities | ||||

| Stock CFDs | ||||

| Cryptocurrencies Futures | ||||

| Bonds | ||||

| ETFs |

Fees and Commission Structure

| Fees | |

|---|---|

| Average spread (EUR/USD) - Standard account | 1.2 pips |

Commissions | Standard Account – Spreads start from 1.1 pips with no commissions. Direct Account – Start from 0.0 pips and a commission of $7.0 per round lot |

Average Trading Cost EUR/USD | $9 |

Average Trading Cost GBP/USD | $9 |

Average Trading Cost Gold | $0.20 |

| Average Trading Cost Bitcoin | $22.70 |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $0 |

Blueberry Markets keeps its pricing structure simple and transparent with two main account types that cater to different trading styles:

Trading Fees

Standard Account: Spread-only pricing starting from 1.0 pip, with no commissions.

Standard Account: Direct Account: $7 per round-turn per lot (equivalent to $3.50 per side) with raw spreads from 0.0 pips.

Both account types feature no hidden markups and tight execution on the MT4 and MT5 platforms, ensuring fair pricing and reliability for all trading strategies.

Spreads & Swaps

Blueberry’s spreads are highly competitive across major and minor pairs:

EUR/USD: ~1.1 pips

GBP/JPY: ~2.4 pips

Gold: ~12¢ spread

BTC/USD: ~$29.78 (industry average: $35+)

Swap rates are moderate, averaging Long -$6.04 / Short +$2.82 on EUR/USD positions. These figures reflect typical overnight financing costs in line with other top-tier brokers.

Commissions by Asset Class

Forex: $7 per round-turn (Direct Account)

Indices: $0

Commodities: $0

US Shares: $2 per trade

AU Shares: $0.05 per share

Crypto: $0 commission (spreads only)

Other Trading Costs

Blueberry Markets charges no deposit, withdrawal, or account maintenance fees, helping traders retain more of their profits. There are also no inactivity charges, and swap rates remain competitive, making the broker a strong choice for both short-term and long-term traders.

Non-Trading Fees

Blueberry Markets keeps non-trading costs minimal, making it an attractive option for traders who value transparency and low overheads.

✅ No inactivity fee — your account won’t be charged for periods of non-use.

✅ No deposit or withdrawal fee — funding and withdrawing your account are completely free.

✅ No account maintenance cost — there are no hidden administrative charges.

⚠️ Currency conversion fees may apply if you trade or deposit in a currency different from your account’s base currency.

Overall, Blueberry Markets ensures traders keep more of their profits by eliminating unnecessary non-trading charges.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Blueberry Markets Regulated ?

Yes, Blueberry Markets is a regulated broker.

It operates under two regulatory authorities:

- ASIC (Tier-1) – Australia: Known for strict oversight and strong investor protection standards.

- VFSC (Tier-3) – Vanuatu: Allows global clients to access higher leverage and broader trading conditions.

While there is no compensation fund in place, Blueberry takes several important measures to safeguard traders:

- Segregated client funds held in AA-rated Australian banks

- Negative balance protection to prevent accounts from falling below zero

- 8-year operational track record with a reputation for transparency and compliance

Overall, Blueberry Markets is considered a safe and trustworthy choice for forex and CFD traders, especially under its ASIC-regulated entity.

Understanding Regulatory Protections and Broker Stability

Segregated Client Funds for Maximum Security

Blueberry Markets ensures that all client funds are fully segregated from company capital and stored in AA-rated Australian banks. This separation guarantees that traders’ money remains protected and untouched, even in the unlikely event of company insolvency.

Built-In Risk Protection Features

The broker provides negative balance protection, preventing traders from losing more than their initial deposit during volatile market conditions. This safeguard gives both beginners and professionals greater peace of mind when trading with leverage.

Proven Stability and Operational Strength

While Blueberry Markets does not participate in a formal investor compensation scheme, it maintains a strong reputation for transparency and financial integrity. With a team of over 100 employees and more than eight years of continuous operation, the broker demonstrates consistent growth, reliability, and commitment to client trust.

Bottom Line

Blueberry Markets delivers a strong balance between security, transparency, and long-term reliability. With segregated client funds, negative balance protection, and ASIC regulation, it offers traders a safe environment to operate in while maintaining flexible trading conditions under its global entity.

Although the absence of a compensation scheme is a minor limitation, Blueberry’s eight-year track record, steady growth, and well-established operations inspire confidence. Overall, it stands as a stable and trustworthy broker for traders who value both safety and performance.

How To Open an Account

Getting started with Blueberry Markets is quick and straightforward. The registration process is fully digital and designed to get you trading in just a few minutes.

- Sign Up: Visit the official Blueberry Markets website and click Open an Account.

- Enter Details: Fill out your personal information and trading preferences.

- Verify Identity: Upload a valid photo ID and proof of address for KYC verification.

- Account Approval: Your account is typically verified within minutes.

- Deposit Funds: Make your first deposit — the minimum requirement is $100.

- Start Trading: Choose between the Standard or Direct account, then download MT4 or MT5 to begin trading.

On average, the entire process takes less than 10 minutes from registration to platform access, making Blueberry Markets one of the fastest brokers to set up and start trading with.

Account Types

Blueberry Markets offers a variety of account options to suit different trading styles and experience levels. Each account provides access to the same platforms and trading instruments, but with different pricing structures and features designed for specific trader needs.

Standard Account

The Standard Account uses a spread-only pricing model, starting from 1.0 pip with no commissions. The minimum deposit is $100, and leverage goes up to 1:500. This account type is ideal for beginners and casual traders who prefer simple, transparent pricing without worrying about commission costs.

Direct Account

The Direct Account is built for active and professional traders seeking tighter spreads and faster execution. It offers raw spreads from 0.0 pips with a $7 commission per lot (round-turn). The minimum deposit remains $100, and leverage is available up to 1:500. This setup suits scalpers, day traders, and those using automated trading systems.

Islamic Account

For Muslim traders, Blueberry Markets provides a swap-free Islamic Account that complies with Sharia law. It eliminates overnight interest charges while maintaining the same market access, leverage up to 1:500, and trading conditions as other accounts.

Demo Account

The Demo Account offers a simulated live trading environment, allowing users to practice strategies and test the platform without risking real funds. It’s perfect for beginners or experienced traders looking to experiment with new systems or trading approaches before going live.

What is the Minimum Deposit at Blueberry Markets?

The minimum deposit at Blueberry Markets is $100 USD, which applies to both the Standard and Direct account types. This affordable entry point allows new traders to get started without needing a large initial investment.

Blueberry supports several base currencies, including USD, EUR, GBP, AUD, NZD, SGD, and CAD, giving traders the flexibility to fund their accounts in the currency they prefer.

Whether you are just beginning or expanding your trading activity, the $100 minimum deposit makes Blueberry Markets a practical and accessible choice for all experience levels.

| Broker | Minimum Deposit |

|---|---|

| Blueberry Markets | $100 |

Eightcap | $100 |

Oanda | $0 |

| IC Markets | $200 |

Deposit and Withdrawal

traders worldwide to manage their accounts efficiently. The process is fast, secure, and completely free of fees.

Deposit Options

You can fund your account using the following methods:

Withdrawal Fees & Options

When it’s time to access your funds, withdrawals are processed through:

Accepted Currencies

Blueberry Markets accepts multiple base currencies, including:

USD, EUR, GBP, AUD, NZD, SGD, and CAD.

Processing Time and Fees

All deposits and withdrawals are typically processed within 24 hours, which is faster than the industry average. Blueberry Markets charges no deposit or withdrawal fees, allowing traders to keep 100% of their capital for trading.

Bottom Line

Blueberry Markets makes deposits and withdrawals fast, flexible, and cost-free, ensuring traders can manage their funds without unnecessary delays or hidden charges. With a wide selection of payment options, support for major fiat and crypto currencies, and 24-hour processing times, the broker provides one of the most convenient funding systems in the industry.

Whether you’re trading locally or internationally, Blueberry Markets’ transparent and efficient payment process helps you focus more on your trading — and less on transaction hassles.

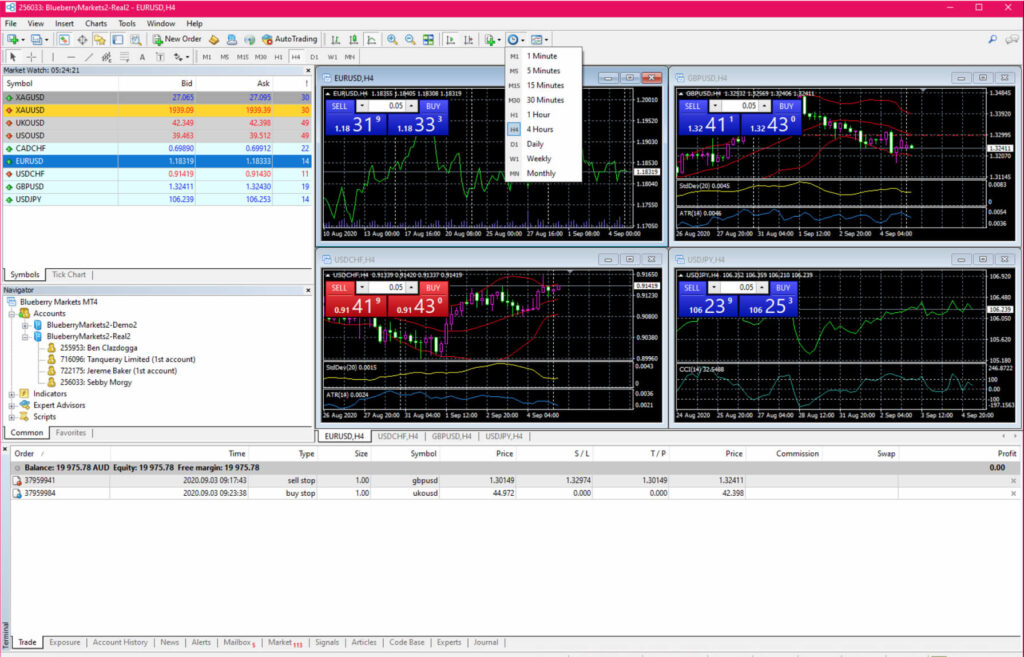

Desktop Trading Platform

Blueberry Markets provides access to the industry-standard MetaTrader 4 (MT4), MetaTrader 5 (MT5), Blueberry X, and WebTrader platforms, available on both Windows and Mac. These platforms are known for their reliability, speed, and wide range of professional-grade trading tools suitable for traders of all experience levels.

Platforms

Both MT4 and MT5 offer a clean, intuitive interface that supports advanced charting, one-click trading, and full customisation. MT5 includes several upgrades, such as more timeframes, built-in economic calendars, and additional order types, making it the preferred option for traders seeking more flexibility.

Blueberry X - A Modern, Flexible Trading Platform

Blueberry X delivers a clean, fast, and intuitive trading experience that blends simplicity with professional-grade tools. The platform gives traders full control, from customising layouts and running Expert Advisors (EAs) to tracking live sessions and managing funds seamlessly.

Whether you’re trading on desktop or mobile, Blueberry X stands out for its balance of flexibility, automation, and reliability, making it a strong choice for traders who want a streamlined, all-in-one setup.

Advanced Charting Tools

The desktop platforms come equipped with 38 built-in technical indicators and 44 analytical tools for precise chart analysis. Traders can overlay multiple charts, apply templates, and fine-tune strategies using historical data, ensuring every decision is backed by solid technical insight.

Automated and Copy Trading Features

Blueberry Markets supports Expert Advisors (EAs) for automated trading, allowing users to run complex strategies without manual input. The platform also integrates with VPS hosting for uninterrupted execution and supports copy trading and MAM/PAMM accounts, enabling professional traders to manage or mirror trades efficiently.

Depth of Market (DOM) Access

For scalpers and high-frequency traders, Depth of Market (DOM) visibility provides real-time order book data. This helps identify liquidity levels and execute trades with minimal slippage — a key advantage for those focused on precision and speed.

Verdict

Blueberry Markets’ desktop trading experience is robust, professional, and highly customizable, making it ideal for serious traders who rely on speed and analytical depth. While newcomers may need time to get familiar with MetaTrader’s interface, the platform’s flexibility and reliability make it a top choice for forex and CFD trading in 2025.

Pros & Cons of the Web Platform

Pros

Fast execution with minimal latency

Extensive range of custom indicators and analytical tools

Advanced strategy testing and automation support

Market depth visibility for improved trade accuracy

Cons

Slight learning curve for beginners due to advanced features

Mobile App

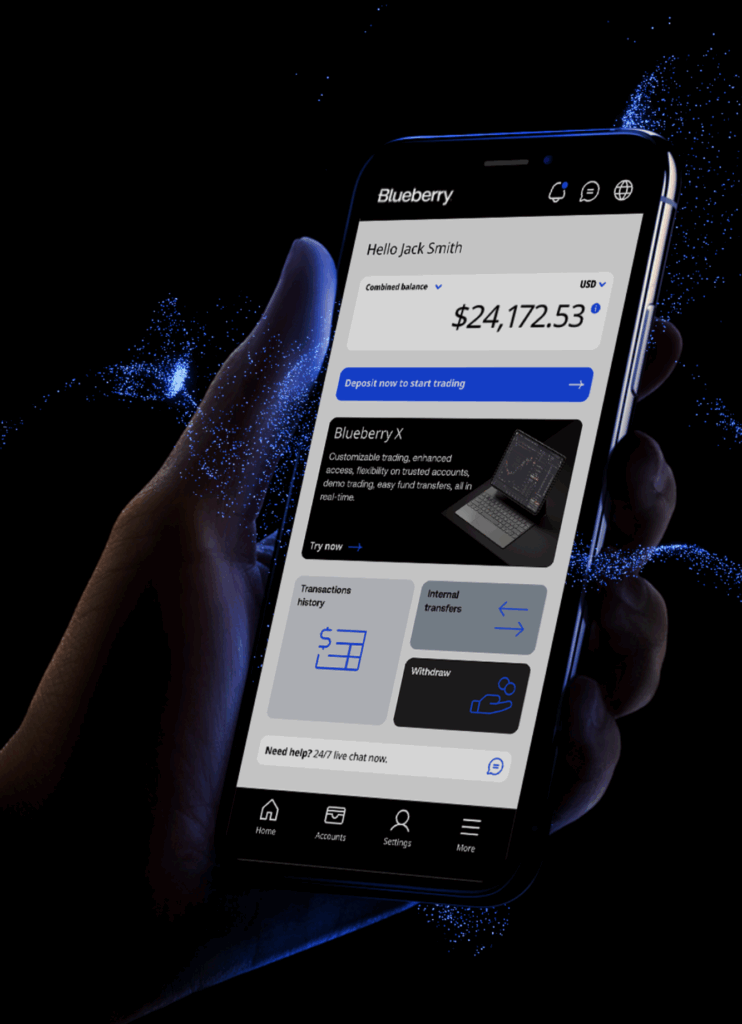

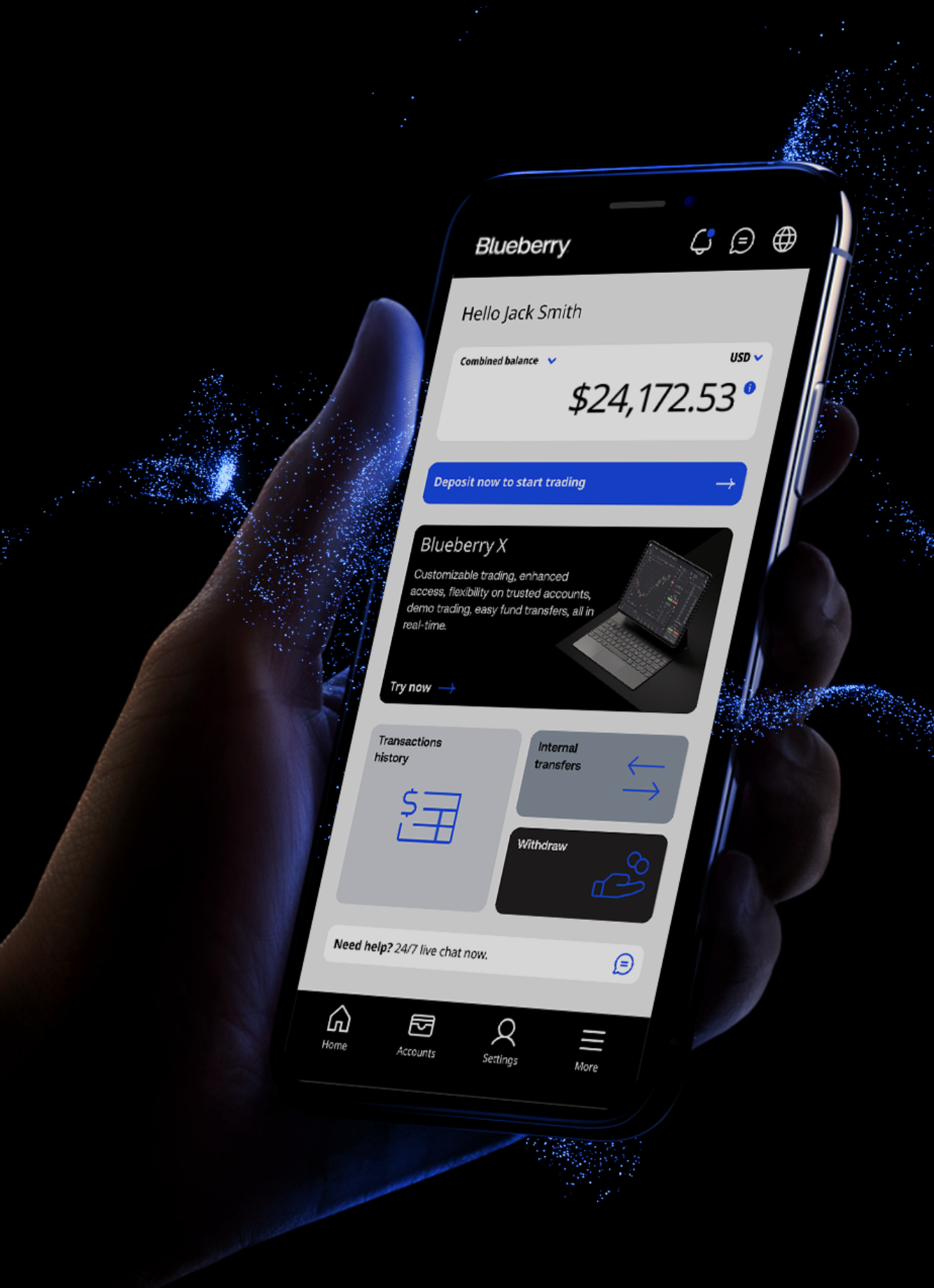

Blueberry Markets has recently introduced its new and improved mobile app, Blueberry X, designed to give traders a faster, smarter, and more intuitive trading experience on the go. Available on both Android and iOS, Blueberry X combines advanced trading functionality with a sleek, user-friendly interface that makes mobile trading smoother than ever.

Overview of Blueberry X

Unlike the standard MetaTrader apps, Blueberry X is a proprietary mobile platform developed specifically for Blueberry Markets traders. It offers full access to your trading account, real-time charts, and one-tap order execution, all wrapped in a modern design that’s easy to navigate.

The app allows traders to manage positions, view live market data, and analyze performance directly from their phones without switching between multiple platforms.

Key Features and Tools

The Blueberry X app includes:

- One-click trading for faster order execution

- Real-time price charts with multiple timeframes and technical indicators

- Custom alerts and notifications for price movements and trade updates

- Account management tools to monitor equity, balance, and open trades

- Seamless deposits and withdrawals directly within the app

It also syncs effortlessly with your desktop or web account, ensuring you can trade and monitor the markets from anywhere, anytime.

User Experience and Design

The app’s clean and intuitive design makes it ideal for both beginners and advanced traders. Navigation is smooth, trades execute instantly, and switching between charts and account views feels fluid.

Blueberry X also supports multiple languages, catering to the broker’s global client base. Performance remains stable even on mobile networks, providing a dependable experience for traders on the move.

Verdict

After using Blueberry X, it’s clear that Blueberry Markets has made significant progress in creating a modern, mobile-first trading experience. The app combines speed, reliability, and ease of use, making it ideal for traders who want to stay active without being tied to their desktops.

While it’s still building out advanced features, Blueberry X already feels like a major step forward for mobile traders looking for performance and convenience in one platform.

Pros & Cons of the Mobile App

Pros

Purpose-built trading app with an intuitive layout

Real-time alerts and lightning-fast trade execution

Easy access to deposits, withdrawals, and account management

Syncs seamlessly across devices

Cons

Still relatively new, so advanced customization options are limited compared to desktop MT5

Charting tools, while strong, may not yet match full desktop capability

Market Research, Tools, and Education

Blueberry Markets offers a comprehensive suite of research resources, trading tools, and educational materials designed to help traders improve their skills and make informed decisions.

While the broker’s on-site analysis has seen fewer updates recently, its other channels continue to provide high-quality, actionable insights.

- Economic Calendar for tracking global market events

- Trading Calculators for margin, pip, and position sizing

- VPS Hosting for uninterrupted automated trading

- DupliTrade Integration for copy trading and strategy mirroring

Customer Support

Blueberry Markets offers 24/7 customer support, ensuring traders can get assistance whenever they need it. The broker’s support team is known for its responsiveness, professionalism, and friendly approach, helping clients resolve issues quickly and efficiently.

You can reach the team through the following channels:

- Live Chat: The fastest way to get real-time help directly on the website or trading portal.

- Email: support@blueberrymarkets.com

- Phone: +61 2 7098 3946

Support is available in multiple languages, including English, Indonesian, Thai, Chinese, French, and Filipino, making it accessible to traders from around the world.

Blueberry’s team provides personalized assistance and reliable follow-ups, ensuring that every query—whether technical, account-related, or platform-based—is handled with care and attention. This commitment to customer experience helps set Blueberry Markets apart from many of its competitors.

FAQ

Is Blueberry Markets safe and regulated?

Yes. Blueberry Markets is regulated by ASIC (Australia) and VFSC (Vanuatu), ensuring trader protection through segregated client funds and negative balance protection.

What is the minimum deposit?

The minimum deposit is $100 USD for both the Standard and Direct accounts, making it accessible for new traders.

Does Blueberry Markets charge withdrawal or inactivity fees?

No. Blueberry Markets does not charge any withdrawal or inactivity fees, allowing traders to keep more of their funds.

What platforms can I trade on?

You can trade on MetaTrader 4, MetaTrader 5, and WebTrader, all available on desktop, mobile, and browser.

Can I trade crypto with Blueberry Markets?

Yes. Blueberry Markets offers over 68 cryptocurrency pairs, along with crypto deposit options such as Bitcoin, Ethereum, and USDT.

Is there a demo or Islamic account?

Yes. Traders can open a free demo account for practice or a swap-free Islamic account that complies with Sharia law.

Does Blueberry Markets offer copy trading?

Yes. Blueberry supports DupliTrade, which enables traders to automatically follow and copy professional trading strategies.

What are Blueberry’s spreads and commissions?

The Standard Account has spreads starting from 1.0 pip with no commission, while the Direct Account charges $7 per lot round-turn with raw spreads from 0.0 pips.

Is Blueberry good for beginners?

Yes. With demo accounts, micro-lot trading, and educational resources, Blueberry Markets is well-suited for beginners learning to trade.

How fast are deposits and withdrawals?

Deposits and withdrawals are typically processed within 24 hours on business days, which is faster than the industry average.