AvaTrade

Table of Contents

Broker

AvaTrade

Min Deposit

£100

Rating

AvaTrade Review: What to know in 2020

Launched in 2006, AvaTrade is an online broker based in Ireland. They have over 200,000 customers to date, and a total monthly trading volume of approximately USD 60 billion.

This international financial company offers CDFs on stocks, indices, commodities, cryptocurrencies, and Forex.

They have received a series of awards since 2009, their first prize awarded by Money Summit for the Best Alert System. In 2019 the company was granted The Best Forex Broker by Day Trading. From 2016 until 2020 they have obtained four prizes by The European.

They offer different account types, including Islamic accounts, and have intuitive platforms for all traders and their different needs and goals.

We invite you to learn more about this broker before you open an account.

AvaTrade Security

Offices and regulation

AvaTrade has clients in over 150 different countries and is regulated by the following jurisdictions:

- AVA Trade EU Ltd is regulated Central Bank of Ireland, their reference number being C53877.

- Ava Capital Markets Australia Pty Ltd is regulated by the Australian Securities and Investment Commission (ASIC), license number 406684.

- AVA Trade Japan K.K is regulated by the Financial Services Agency and the Financial Futures Association of Japan, license number 1574.

- Ava Trade Ltd B.V.I regulated by the British Virgin Islands Financial Services Commission, number SIBA/L/13/1049.

- It is regulated in Canada by the Investment Industry Regulatory Organization of Canada (IIROC) where it works in collaboration with another financial company named Friedberg Direct.

- AvaTrade Middle East Ltd. regulated by Abu Dhabi Global Markets (ADGM), Financial Regulatory Services Authority (FRSA).

- Ava Capital Markets Pty Ltd is regulated by the South African Financial Sector Conduct Authority, number 45984.

This financial services company has 10 offices around the world:

- Based in Ireland is their main headquarters, AvaTrade Financial Centre, in Five Lamps Place, Amiens Street, Dublin 1 Ireland.

- In Australia they are at Level 13 2 Park street, Sydney, NSW 2000.

- In South America they are present in Chile. Cerro el Plomo 5931, office 514, Las Condes, Santiago, Chile.

- AvaTrade China is located at SOHO Shangdu, Chaoyang District, Beijing.

- The company has offices in Italy in Viale Enrico Forlanini 23, 20134, Milano.

- AvaTrade Japan is at Minatoku Akasaka, 2-18-1, Tokyo.

- Their office in Mexico is in Park Plaza Santa Fe, Floor 5, CDMX Mexico.

- In Mongolia they are located in the MNTower- number 1402.

- In Poland they are in Ul. Postępu 15, 02-676 Warszawa.

- Their tenth office is in South Africa in Nelson Mandela Square, Office towers West, 2nd floor, Sandton. Johannesburg.

Main Features

For security, AvaTrade offers 256-bit SSL encryption on their website. They have segregated funds for all clients to keep your money untouched in case of bankruptcy or insolvency. To secure you from identity or card fraud, the company uses McAfee Secure.

As dictated by the American Institute of Certified Public Accountants, AvaTrade is WebTrust compliant. The company also has True- Site identity assurance for their website.

At the time of writing, AvaTrade was offering a welcome bonus if you deposit a minimum amount of 1,000 in USD, EUR, AUD and GBP base currency accounts. If you deposit more, the bonus rises, and you may calculate this.

Non Accepted Clients

AvaTrade is unable to accept customers from the United States, New Zealand or Belgium.

Account Types

AvaTrade offers a demo account for those who would like to practice before spending actual funds or for experienced traders that would like to try out a new strategy. Also known as “paper trading”, you can buy and sell virtual money with no value on this account.

If you have signed up directly to a demo account you can easily open an actual trading account. You may also choose between different account types such as retail, professional, options, spread betting, and standard. The availability will depend on the jurisdiction.

AvaTrade also offers Islamic accounts. This means that they accept the Islamic legal system or the Sharia law that rules that interest fees will not be charged to the client, therefore there will be no interest rate collected by the broker.

Fees and Commissions

Deposits

AvaTrade offers different deposit methods so clients may choose depending on their needs. First of all, you may use credit and debit cards. It is the fastest option because it is the only alternative that will be credited into your account instantly.

For e-payments such as Neteller, Skrill, Webmoney, you must wait at least 24 hours before your funds appear in your AvaTrade account. Australian and EU clients may not use e-payment methods.

Depending on your bank and country the last option is to wire transfer funds. This will take up to 7 business days to be credited to your account.

AvaTrade has minimum deposits, but it will all depend on your currency. For USD, EUR, GBP and AUD it should be 100 minimum, except for wire transfers that are at 500 minimum right now. It is important to note they do not charge deposit fees

Withdrawals

In order to withdraw money you must verify and confirm your account for security reasons and wait one to two business days to receive it. The company does not charge a fee for this.

Please note that your first withdrawal must be with the same deposit method and of a minimum amount of 200% of that initial funding. For the second withdrawal you are free to choose another method and amount.

The rules stated before are for non-EU customers.

Other fees on Ava Trade

AvaTrade will charge an inactivity fee if you have not used your account in three consecutive months. The amount depends on the currency, but for USD, EUR and GBP accounts it is 50 in the corresponding currency.

Trading features and platforms on AvaTrade

Position size

The platform has certain trading conditions. For cryptocurrencies you have a maximum amount of position limits that range from 10K to 600K.

The MetaTrader minimum nominal trade size is equal to 0.01. The minimum lot is 0.01, in other words, a micro lot. Spread is variable and depends on market conditions and the asset.

Techniques

AvaTrade allows swing trading, scalping, mirror trading and hedging.

Risk management

This platform has three different risk managements available to help you lower your trading risk: hedging strategies, budget-based approaches, and portfolio diversification.

AvaTrade has market orders, and it also offers negative balance protection. On the other hand, the company does not guarantee stop loss or trailing stops.

Markets and Assets

AvaTrade offers their clients Forex, stocks, margin trading, options, ETFs, bonds, cryptocurrencies and commodities.

Among the Forex offering, the platform supports over 50 currency pairs that include majors, minors, and exotics. They have 10 commodities such as crude oil, natural gas, soybeans, wheat, gold, corn, silver and platinum. Admiral Markets also offers Vanilla Options trading.

AvaTrade Leverage

AvaTrade leverage varies depending on the asset and it will be a maximum of 400:1, including Australia. For EU traders the maximum is only 30:1.

Platforms

AvaTrade offers various platforms to meet different needs. They have MT4, MT5, WebTrader, AvaOptions, DupliTrade, and their app called AvaTradeGO for both iOS and Android devices.

Social trading, education and support

Educational offering

AvaTrade offers a vast amount of educational resources for beginner and advanced traders. They have a premium educational platform called Sharp Trader for advanced and experienced traders.

You may also access their eBooks, and watch their videos that include tutorials, strategies and lessons.

On their website you can also find a blog, a section for beginners, order types, and economic indicators with educational information.

Research

AvaTrade has their own blog under the education section, where they write and inform users about their platform and international financial news. Some of their categories include trading history, advanced trading techniques, crypto, and public relations.

Social trading offering

This trading platform allows users to copy trade manually, automatically or semi-automatically. To access this mirror trading you must add a minimum amount of 500$ for Zulu, and 2,000$ for DupliTrade, the company’s platform partners for this technique.

Customer support

For customer support you may use their live chat which has attention hours because they are not available 24/7. You may also send an email and expect a reply in maximum one business day.

AvaTrade also offers different phone numbers you may call depending on your location. You also have 30 different languages to choose from to navigate on their website.

Pros and Cons

Pros

- They allow mirror trading.

- 30 different languages.

- Vast educational support.

- Live chat.

- They offer Islamic accounts.

Cons

- Minimum deposits.

- Inactivity fee.

- US and Belgian customers are not accepted.

How to open an AvaTrade account

If you would like to open an account, there are only a few simple details you must enter. We invite you to take a look at the step by step process we have provided for you below.

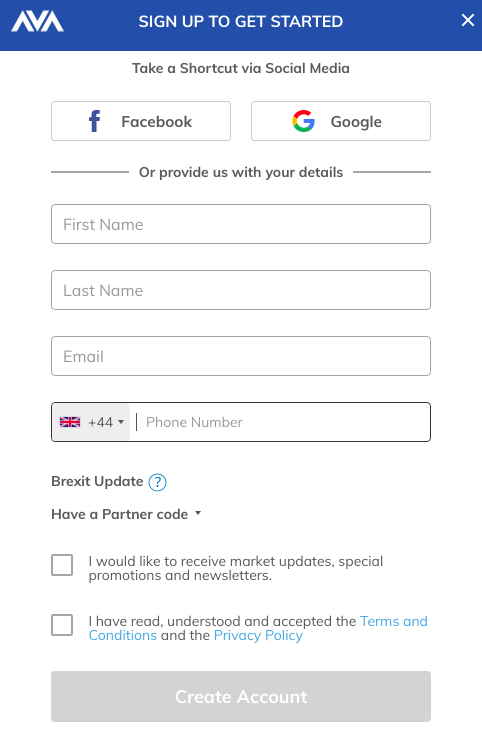

- First, click on the orange button that says “register now” in the middle of the main page or the top right corner. A rectangle will appear where you can fill in your name, email, phone number, and accept the Privacy Policy and Terms and Conditions.

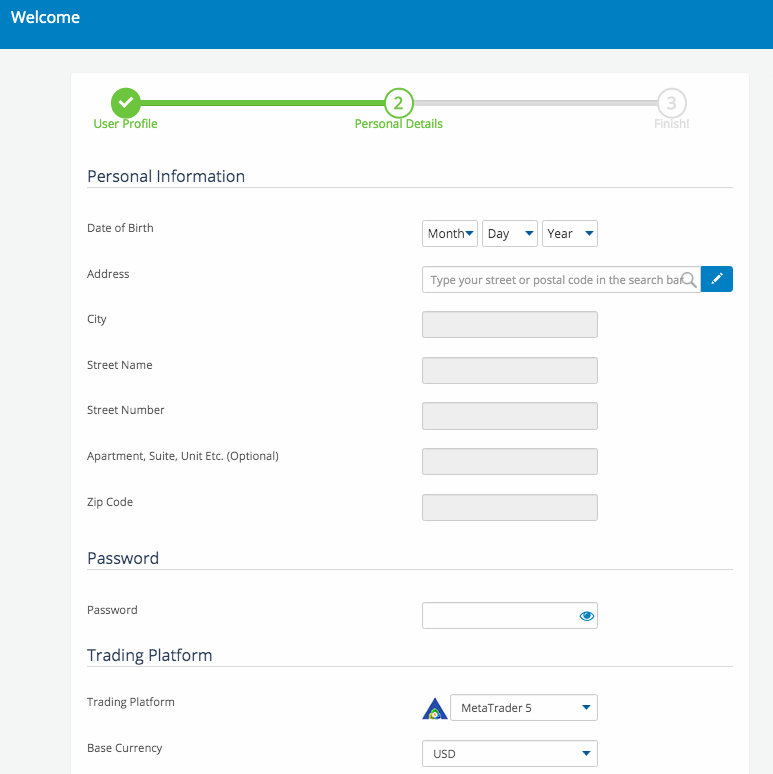

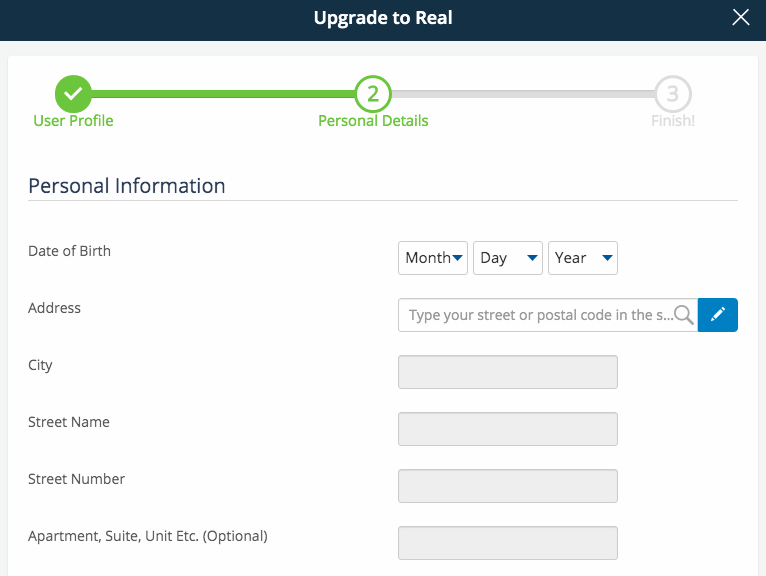

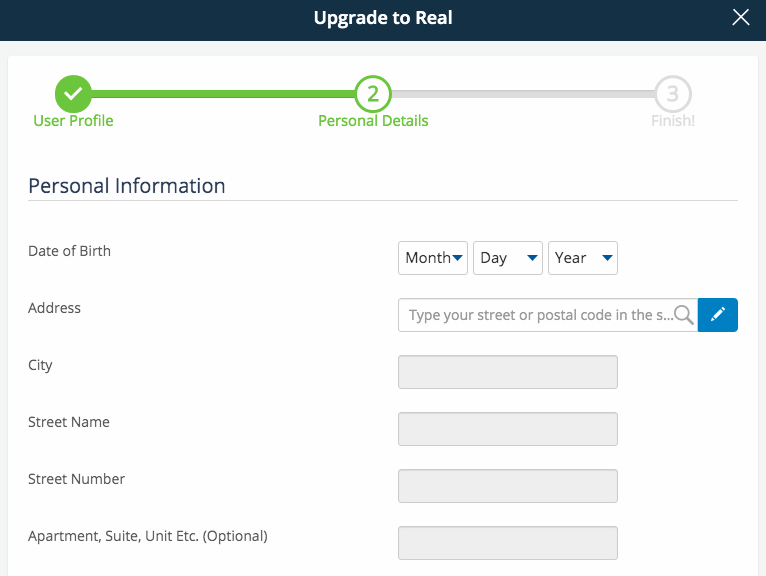

- Once you have completed your user profile and click on “create account”, you will be automatically taken to a new page to fill in your personal details. Remember to add a strong password and click on the eye icon to see if it’s correct.

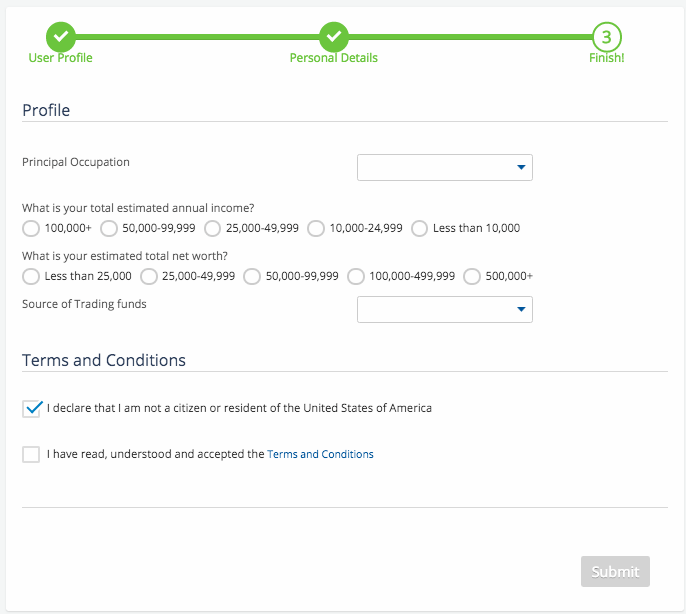

- Only one last step before you are ready! You must now choose the approximation of your estimated annual income, total net worth and the reason you’re trading. After you have once again accepted the terms, click on the bottom right button “submit”.

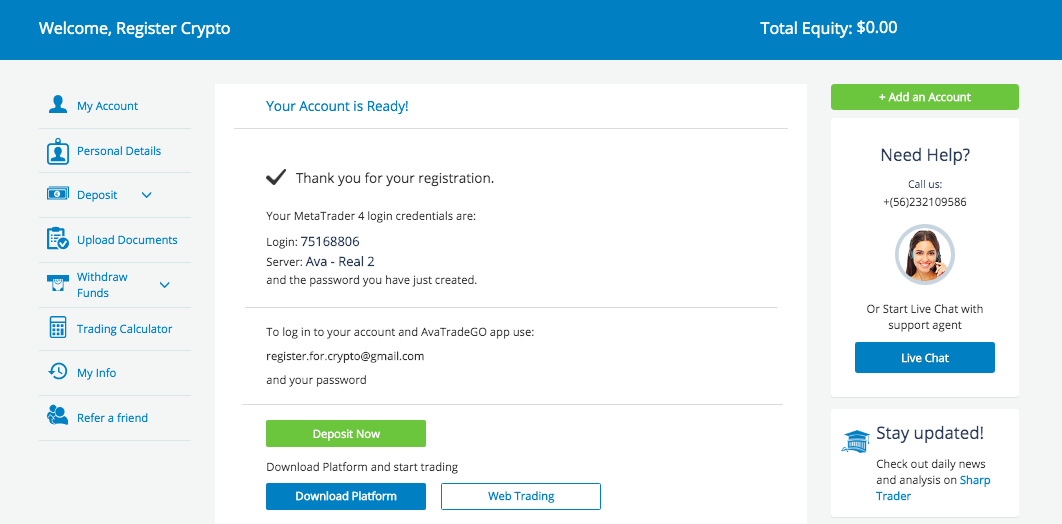

- You have signed up successfully once you see the welcome page below.

How to convert demo to real

If you have signed up for a demo account, the image below is what you should be looking at once you log in.

Whichever page you are looking at on your demo account you will see an orange button that says “upgrade to real”. If you click there, it should open a window that will ask for the same information as specified on the previous step by step.

You should be looking at the image below. Make sure it says “upgrade to real”.

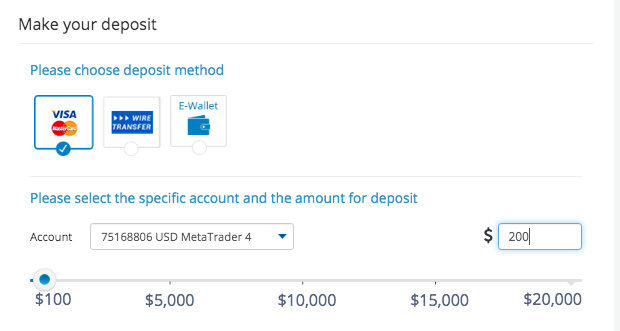

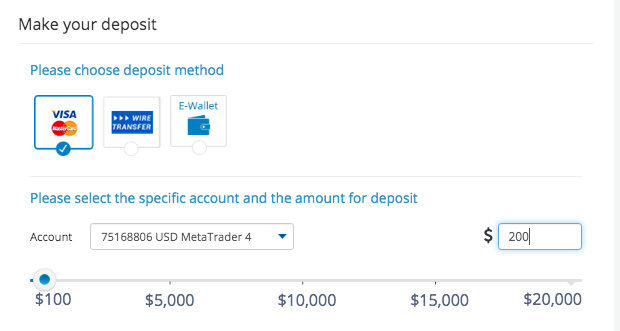

How to deposit money and start trading on Ava Trade

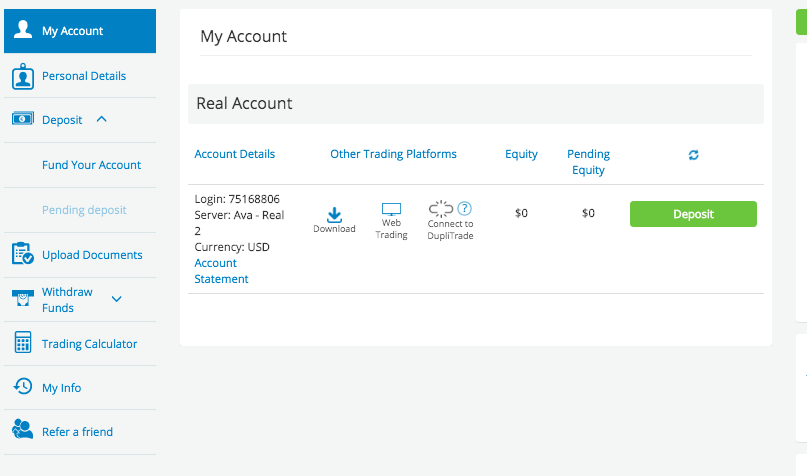

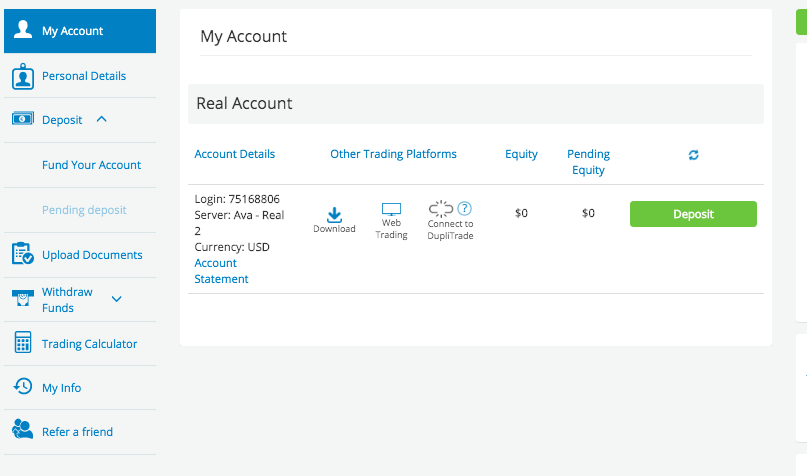

To make your first deposit you can either click on the green button that says “deposit” or on the menu to the right on the third option that says “deposit”. After clicking that you must go to where it says “fund your account”.

You should have been redirected to the page shown below. Choose your amount and fill in the details the platform will ask you for. If you deposit over 1,000 you get a session with an account manager.

Depending on the amount you deposit you may receive a welcome bonus. If you want to know more about the bonus or the deposit method we have included the information in the sections above.

Conclusion

AvaTrade offers traders many different assets. They have good customer support, and their platform is multi-language and user friendly.

This broker has a vast amount of educational support for different needs and experiences. Their many awards are proof of their excellent service, features, and regulations.

If you have any doubts on what they offer in your jurisdiction, please check out their website’s information to compare their global offerings.

Min deposit: £100

Regulation: CBI, ASIC, FSA & FFA, IIROC, FRSA, FSCA