CFI REVIEW 2025

Wondering if CFI is the right broker to trade with in 2025/2026? I put its platforms, pricing, regulation, and real-market performance under the microscope to see how it measures up. After testing CFI’s MT5 desktop setup, Multi-Asset platform, and advanced mobile app across thousands of markets, here’s what you can expect before opening your account.

Broker Guide's CFI Review in 2025

Known for its strong presence across the MENA region and its expanding global reach, CFI claims to offer traders access to over 15,000 tradable instruments across multiple asset classes, along with a range of advanced platforms designed for different trading styles.

Curious to see if those claims hold up, I decided to test CFI firsthand. I opened a live account and explored its MetaTrader 5 desktop platform, the CFI Multi-Asset platform, and its proprietary mobile app to evaluate how they perform in real market conditions.

My goal was to determine whether CFI’s technology, pricing, and overall trading experience truly stand out in 2026 or if it is simply another broker making big promises.

This review is based on my direct experience and detailed analysis of CFI’s fees, spreads, regulation, customer support, and platform usability. By the end, you will have a clear and honest picture of whether CFI is a trustworthy online trading broker worth considering for your next step in the markets.

About CFI

CFI (Credit Financier Invest) is a well-established UAE broker that has been serving traders since 1998. Headquartered in the United Arab Emirates, CFI has grown into one of the most recognized names in the global CFD trading industry, with a strong focus on transparency, regulation, and technological innovation.

Over the years, it has built a reputation for providing access to global financial markets through advanced trading platforms and a wide selection of products.

The CFI Group operates through 13 regulated entities across different regions, including the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Securities and Commodities Authority (SCA) in the UAE.

These licenses demonstrate the broker’s commitment to maintaining high regulatory standards and ensuring client fund protection across jurisdictions.

CFI gives traders access to over 15,000 financial instruments, covering forex, CFDs, global stocks, indices, cryptocurrencies, commodities, ETFs, and bonds. This extensive market coverage allows clients to diversify their portfolios and trade a wide range of assets from a single account.

With more than 500 professionals employed globally, CFI provides localized support and expertise to traders in both English and Arabic. The broker also stands out for offering no minimum deposit requirement, making it accessible to beginners while still providing advanced tools suitable for experienced traders.

As a regulated global CFD provider, CFI continues to strengthen its presence in the MENA region and beyond, combining 25 years of experience with modern trading technology to meet the evolving needs of today’s traders.

My Quick Verdict: Who is CFI Best For?

Our rating: 4.5/5

Best for: Traders who want access to a wide range of global markets, advanced trading platforms, and strong regulatory protection.

Not ideal for: Beginners seeking extensive educational support or those who prefer ultra-low spreads on forex pairs.

After testing CFI extensively, I found it to be a highly capable and well-regulated broker that strikes a strong balance between market access, platform choice, and trading innovation. Established in 1998, CFI has matured into one of the most trusted names in the MENA trading space, now expanding globally with a multi-licensed structure and a robust product lineup of more than 15,000 instruments.

In terms of trading experience, CFI performs exceptionally well. The broker’s platform offering is among the best in the industry, combining MetaTrader 5, TradingView, and its proprietary CFI Multi-Asset platform, along with a feature-rich mobile app. These platforms deliver smooth performance, reliable execution, and access to advanced tools such as Trading Central, Capitalise.ai, and Kaiana, CFI’s AI-powered trading assistant.

On the downside, spreads on major forex pairs are average rather than industry-leading, and customer support, while available 24/7, can sometimes be inconsistent in response detail. Educational content is also somewhat limited for absolute beginners.

That said, CFI’s overall offering remains very competitive, particularly for traders seeking flexibility, diverse assets, and trusted regulation. It’s an excellent fit for scalpers, algorithmic traders, and long-term investors alike.

Pros

- Multi-regulated by top authorities (FCA, CySEC, FSCA, SCA)

- Access to over 15,000+ tradable instruments

- Zero-commission account available

- Supports Capitalise.ai for code-free automated trading

- Advanced research tools powered by Trading Central

- Multiple platforms supported: TradingView, MT5, and the CFI App

Cons

- Customer support can be inconsistent

- Some features vary depending on region

- Higher spreads on certain forex pairs

- No weekend customer support available

Why You Should Choose CFI ?

In 2025, CFI (Credit Financier Invest) continues to strengthen its position as one of the best brokers in the MENA region and beyond. With over 15,000 tradable instruments, CFI gives traders and investors access to global and regional markets, including MENA stocks, U.S. equities, forex pairs, commodities, indices, ETFs, and cryptocurrencies.

This diversity allows clients to build balanced portfolios and explore multiple trading strategies without needing multiple accounts or brokers.

Global Expansion and Stronger Regulation

What sets CFI apart is its continued global expansion and multi-licensed framework. The broker is regulated by top-tier authorities such as the FCA (UK), CySEC (Cyprus), FSCA (South Africa), and SCA (UAE), ensuring traders operate under strict financial standards. These new and existing licenses enhance CFI’s reputation for transparency and investor protection, making it a reliable choice for traders seeking a regulated global broker with a proven record of trust and stability.

Smarter Trading Through AI and Automation

CFI is embracing innovation through AI trading tools and automation technology. Its proprietary mobile app integrates Kaiana, an AI-powered trading assistant that analyzes market conditions, highlights trading opportunities, and helps users make informed decisions. In addition, integration with Capitalise.ai allows for code-free algorithmic trading, making automation accessible even to those with no programming experience. These features demonstrate CFI’s focus on intelligent, tech-driven trading—an area where few brokers can truly compete.

Accessible for Every Type of Trader

Whether you’re a scalper, a long-term investor, or an algo trader, CFI offers a flexible trading environment tailored to your style. The Zero Commission Account delivers simple pricing and tight spreads, while the Dynamic Trader Account supports professional-level execution. With no minimum deposit, traders of all levels can start trading confidently.

Bottom Line

CFI’s combination of diverse markets, advanced technology, and strong regulation makes it one of the best brokers in 2026. It’s a broker that blends innovation with reliability, offering traders the tools, access, and protection they need to grow in today’s fast-moving financial markets.

Compare to Top Competitors

When evaluating CFI in 2026, it’s clear that the broker holds its own against some of the industry’s most established names. While competitors like Interactive Brokers, XTB, and CMC Markets each bring distinct advantages to the table, CFI competes through accessibility, technology, and a massive range of tradable instruments that few brokers can match.

Interactive Brokers

CMC Markets

XTB

Exploring CFI's Range of Tradable Instruments

One of CFI’s most significant advantages, and a core reason I tested the platform, is its sheer scale. The broker provides access to over 15,000 tradable and investment instruments, a number that dwarfs many of its global competitors.

This vast selection is not just for show; it offers genuine depth across nearly every conceivable asset class, catering to both focused CFD traders and long-term, multi-asset investors.

This offering is one of the most comprehensive I have encountered, particularly from a MENA-regulated broker.

The diversity allows traders to build complex strategies, hedge existing portfolios, or simply speculate on niche markets—all from a single platform.

Here is a detailed breakdown of what you can trade:

Forex: The platform features a robust list of 80+ forex pairs. This includes all major pairs, a wide array of minor crosses, and a significant collection of exotic pairs, making it a strong choice for dedicated CFI forex pair traders.

Share CFDs: This is a major strength for CFI. Traders get access to over 3,000 share CFDs from exchanges across the US, UK, Europe, and the MENA region. This deep liquidity in CFI stock CFDs is ideal for equity traders.

Indices: CFI provides 22 global indices, allowing you to trade the performance of entire economies. This includes major indices like the S&P 500, NASDAQ 100, DAX 40, and FTSE 100.

Cryptocurrencies: The CFI crypto trading offering is extensive, with 118 crypto assets available as CFDs. This goes far beyond Bitcoin and Ethereum, covering a wide range of altcoins and emerging tokens.

Commodities: The broker lists 19 commodities, including precious metals like gold and silver, as well as energy products such as Crude Oil and Natural Gas.

ETFs, Bonds, and Futures: Rounding out its CFD offering, CFI includes 676 ETFs, 3 bonds, and 25 futures contracts.

| Asset | CFI |

|---|---|

| Tradeable Symbols | 15,000+ |

| Cryptocurrencies | 118 |

| Stocks CFDs | 3040+ |

| Forex Pairs | 80 |

| Commodities | 19 |

| Indices | 22 |

| Futures | 25 |

| ETFs | 676 |

Bottom Line

What truly sets CFI apart in 2025/2026 is its dual offering. Beyond this massive list of CFDs, the broker also provides access to thousands of real MENA and US stocks and ETFs for investing (not as CFDs). Furthermore, for advanced traders, CFI supports trading vanilla options.

This commitment to multi-asset access makes CFI a powerful hub for traders managing diverse and sophisticated portfolios.

How CFI Instruments Compare to Competitors – CFI Review

CFI’s strength lies in its unique hybrid model. While it may not offer the sheer number of CFDs as CMC Markets or the vast universe of real assets as Interactive Brokers, it provides a powerful, curated blend of both.

The table below highlights that CFI is one of the few brokers that successfully bridges the gap, offering a massive list of CFDs alongside real stocks, real ETFs, and even vanilla options—a combination its direct competitors don’t fully match.

| Asset | CFI | Interactive Brokers | XTB | CMC Markets |

|---|---|---|---|---|

| Forex | ||||

| Indices | ||||

| Commodities | ||||

| Stock CFDs | ||||

| Cryptocurrencies | ||||

| ETFs | ||||

| Futures | ||||

| Bonds | ||||

| Index CFDs |

Fees and Commission Structure - CFI Review

| Fees | |

|---|---|

| Average Trading Cost (EUR/USD) | 0.4 pips |

| Average Trading Cost (GBP/USD) | 0.4 pips |

| Average Trading Cost Gold | $0.12 |

Forex fees | Average |

Stock CFD fees | Low |

Crypto spread | High |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $10 inactivity fee is charged if monthly paid commissions are below $10 |

CFI’s fee structure is transparent but presents a mix of highly competitive costs and some average-to-high spreads, depending on the asset and account type you choose.

Trading Fees

My analysis showed that CFI spreads and commissions are competitive for specific instruments like gold and stock CFDs. However, its costs for trading major forex pairs and cryptocurrencies were average-to-high compared to other market leaders.

Spreads

Spreads CFI’s primary commission-free account derives its costs from the spread. During my live testing, I recorded the average spread for EUR/USD at 1.4 pips. In contrast, I found the spread for Crude Oil to be very tight at 0.04 pips. Spreads on share CFDs were also consistently low.

Commissions

CFI commissions are structured around its two main account types:

Zero Commission Account: This account is ideal for most traders, as all trading costs are built into the spread. It starts from 0.4 pips.

Dynamic Trader Account: This account is designed for high-volume traders or scalpers, offering raw spreads (from 0.0 pips) in exchange for a "low, volume-based" commission.

However, the exact commission rate is not clearly disclosed on the website, which is a minor transparency concern.

Swaps (Overnight Fees)

CFI charges swap rates for holding CFD positions open overnight, which is standard practice. Based on my tests of major pairs like EUR/USD and GBP/JPY, I found CFI’s swap fees to be average to high compared to the industry benchmark. These rates fluctuate based on market conditions and are available within the trading platform.

Other Trading Costs

CFI operates as a market maker. In my testing, I did not experience any significant slippage beyond what is considered the industry norm.

Non-Trading Fees

Inactivity Fees

The only significant non-trading fee to be aware of is the $10 monthly inactivity fee.

However, based on my analysis, this fee is easily avoidable. It is only charged to accounts that fail to trade at least one standard lot (or its equivalent) within a given month. For moderately active traders, this policy should not be a concern.

Deposit and Withdrawal Fees

I found that CFI charges no deposit or withdrawal fees for its supported methods, which include bank wire transfers and credit/debit cards. This is a significant advantage, as it removes a common friction point for traders moving funds.

It is important to note, however, that while CFI does not charge a fee, third-party processor fees may still apply. For instance, your personal bank may charge a fee for sending a wire transfer, or a card processor might impose a currency conversion fee if you deposit in a currency different from your account’s base currency.

Verdict

The broker truly excels in its non-trading fees, where the $0 charge for deposits and withdrawals is a significant advantage for all traders. Furthermore, its $10 inactivity fee is reasonable and easily avoidable for even semi-active traders.

However, the trading fees are inconsistent. While the Zero Commission account is simple and attractive, the underlying CFI spreads on major forex pairs (like the 1.4 pips I observed on EUR/USD) and crypto are higher than many industry-leading competitors. This higher cost is partially offset by very tight, competitive spreads on assets like gold and share CFDs.

Ultimately, CFI’s fee structure is excellent for traders who value zero account-funding costs, but it may not be the cheapest option for high-volume forex specialists. CFI performs very well on non-trading CFI fees, standing out for its lack of charges on account funding and maintenance.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is CFI Regulated ?

Yes, CFI (Credit Financier Invest) is a heavily regulated and long-standing broker. Its safety framework is built on a multi-regulatory structure, meaning it holds licenses from several major financial authorities around the world.

These include top-tier regulators like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Europe.

For its operations in the Middle East and Africa, it is also regulated by the Securities and Commodities Authority (SCA) in the UAE and the Financial Sector Conduct Authority (FSCA) in South Africa.

This strong regulatory oversight ensures CFI adheres to strict client protection measures. These include maintaining segregated client funds, which separates customer money from the company’s operational capital, and providing negative balance protection to ensure you can never lose more than your account balance.

Furthermore, clients under specific entities are protected by compensation schemes, such as the FCA’s FSCS (up to £85,000) and CySEC’s ICF (up to €20,000). This robust licensing, combined with over 25 years of operational history since its establishment in 1998, solidifies CFI’s status as a safe and reliable broker.

Understanding Regulatory Protections and Broker Stability

A broker’s trustworthiness is the most critical factor in any review, and this is an area where CFI regulation demonstrates significant strength. My analysis found that CFI is not just regulated, but multi-regulated by some of the world’s most respected financial authorities.

This robust framework is a cornerstone of CFI safety and provides traders with substantial protections.

Key Regulators

CFI operates under a global structure with 13 different entities, ensuring compliance with local laws across its entire footprint. The most important of these licenses include:

- Tier 1 (FCA Broker): In the UK, Credit Financier Invest Limited is authorized and regulated by the Financial Conduct Authority (FCA). This is considered one of the strictest regulatory bodies globally.

- Tier 1 (CySEC Broker): In Europe, Credit Financier Invest (CFI) Limited is licensed by the Cyprus Securities and Exchange Commission (CySEC).

- Tier 2 (UAE): For its core MENA operations, CFI Financial Markets LLC is regulated by the Securities and Commodities Authority (SCA).

- Tier 2 (South Africa): The broker is also licensed by the Financial Sector Conduct Authority (FSCA) in South Africa.

Other key regulations include the FSC (Mauritius), CMA (Oman), and VFSC (Vanuatu), among others, showcasing a deep commitment to global compliance.

Client Fund Protections

Beyond its licenses, CFI implements essential safety mechanisms to protect client capital:

Segregated Funds

My research confirms that all CFI entities keep client funds in segregated funds, completely separate from the company’s own operational capital. This ensures that client money cannot be used for company business.

Negative Balance Protection

The broker provides negative balance protection across all its entities. This is a crucial guarantee that you can never lose more money than your account balance.

Compensation Schemes

Clients of specific CFI entities are covered by investor compensation funds.

- FCA (FSCS): Clients under the FCA-regulated entity are protected by the Financial Services Compensation Scheme (FSCS) for up to £85,000.

- CySEC (ICF): Clients under the CySEC-regulated entity are covered by the Investor Compensation Fund (ICF) for up to €20,000.

Broker Stability

CFI safety is further reinforced by its long-standing corporate stability. The group has over 25 years of experience in the financial markets, with its origins tracing back to 1998. With a global staff of over 500 employees, CFI has proven its longevity and resilience, solidifying its status as a reliable and stable brokerage for traders in 2026.

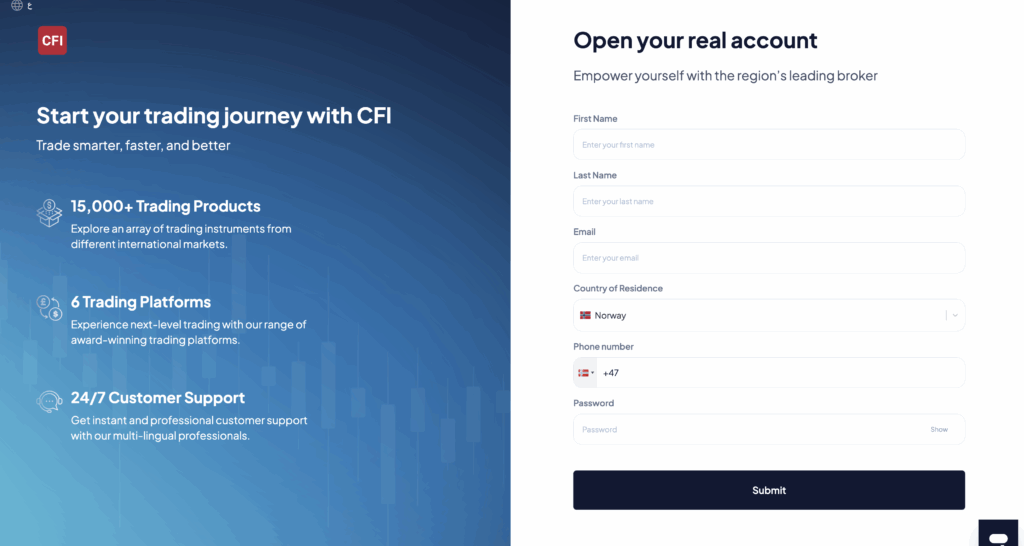

How To Open an Account - CFI Review

Opening a live account with CFI is a fully digital and straightforward process that I found to be clear and efficient. The broker’s onboarding is thorough, ensuring it complies with regulatory requirements by verifying every trader’s identity and financial background. This responsible approach ensures that clients are provided with access to services appropriate for their experience level.

Here are the simple steps to get your account set up:

- Initiate Application: Start by navigating to the cfi.trade website and clicking the “Get Started” or “Open Real Account” button.

- Fill in Personal Info: You will be prompted to fill out an online application form with your basic personal details, such as your name, email address, and country of residence.

- Submit Financial Background: You will need to provide details about your financial standing, employment status, and previous trading experience. This is a standard regulatory requirement for all reputable brokers.

- Choose Account & Currency: During the process, you will select your preferred account type (such as the Zero Commission or Dynamic Trader account) and choose your account’s base currency (e.g., USD, EUR, GBP, AED).

- Verify ID and Address: To finalize your account, you must upload verification documents. This typically includes a Proof of Identity (like a valid passport or national ID) and a Proof of Address (such as a recent utility bill or bank statement).

Once your documents are submitted and approved, your account will be activated, and you can proceed to fund it and begin trading.

Account Types

CFI keeps its account structure simple and accessible, focusing on two primary retail CFI account types and a $0 minimum deposit for both. This approach removes a significant barrier to entry and allows traders to choose an account based on their preferred fee structure rather than their initial capital.

The broker maintains standard margin policies to protect traders. The broker operates with a margin call level of 100% and a stop-out level of 50%. This means if your account equity falls to 100% of the required margin, you will receive a warning. If it continues to fall to 50%, the platform will begin to automatically close your positions to prevent further losses.

Zero Commission Account

This is the standard, all-in-one account suitable for most retail traders. All trading costs are built into the spread, which starts at a competitive 0.4 pips. It provides access to the full suite of platforms, including MT5, TradingView, and the CFI Multi-Asset platform.

Dynamic Trader Account

This account is designed for high-volume traders, scalpers, and those who use Expert Advisors (EAs). It offers raw spreads starting from 0.0 pips in exchange for a variable, volume-based commission. This model is often more cost-effective for frequent trading.

Other Account Types

CFI Demo Account: For those who want to test the platforms and strategies, a CFI demo account is available. This allows you to trade with virtual funds in a risk-free environment that mirrors live market conditions.

CFI Islamic Account: The broker also offers swap-free accounts for traders who cannot pay or receive overnight interest due to religious beliefs. These Islamic accounts are available upon request.

What is the Minimum Deposit at CFI?

CFI is one of the few regulated brokers that offer a true $0 minimum deposit, making it accessible to both beginners and experienced traders who want full flexibility when funding their accounts. Whether you’re testing the platform for the first time or planning to start with a larger balance, CFI allows you to deposit any amount that suits your trading strategy.

Both the Zero Commission Account and the Dynamic Trader Account come with no minimum funding requirement, which means you can open an account, explore the platform features, and begin trading without financial pressure. This setup is particularly beneficial for new traders who want to learn gradually, as well as advanced traders who prefer to scale their capital over time.

While CFI itself does not impose a minimum deposit, keep in mind that your bank or payment provider may have its own minimum transfer limits, depending on the method you choose. Overall, CFI’s flexible deposit policy makes it one of the most beginner-friendly regulated brokers in the market.

| Broker | Minimum Deposit |

|---|---|

CFI | $0 |

| Interactive Brokers | $0 |

XTB | $0 |

| CMC Markets | $0 |

Deposit and Withdrawal

I found the process of funding and withdrawing from CFI to be secure, professional, and refreshingly free of broker-side fees. The available CFI payment options are standard for the industry, ensuring most traders will have a convenient method.

Deposit Options

You can fund your account using several CFI deposit methods, including:

Deposits made via credit/debit card are processed almost instantly, while bank transfers can take a few business days to reflect in your account. One of the strongest points in CFI’s favor is its fee policy. CFI charges no deposit or withdrawal fees on its end. However, it is important to remember that third-party fees, such as those charged by your bank for a wire transfer, may still apply.

Withdrawal Fees & Options

For withdrawals, you must use the same method you used for your deposit. My research found the withdrawal time to be efficient. The broker processes withdrawal requests submitted during business hours within the same working day.

From there, the time it takes to receive your funds depends on the method: bank transfers are typically completed within 2 business days, while credit/debit card refunds can take from 1 to 5 business days to appear on your statement.

Fees and Base Currencies

One of CFI’s strongest advantages is its fee policy. CFI charges no deposit or withdrawal fees. This is a significant benefit that saves traders money on every transaction.

It is important to note that while CFI does not charge fees, third-party processors (like your bank) might still impose their own charges for services like wire transfers.

To help traders avoid currency conversion fees, accounts can be opened in several major base currencies, including USD, EUR, GBP, and AED.

Bottom Line

The bottom line is that CFI handles client funds exceptionally well. The process is straightforward, the processing times are fast, and the $0 fee policy for both deposits and withdrawals is a major plus that places it ahead of many competitors.

Desktop Trading Platforms

CFI’s platform offering is one of its greatest strengths. Rather than forcing traders into a single ecosystem, it provides a comprehensive suite of world-class platforms, each catering to a different trading style. This flexibility is a core part of its appeal, allowing you to use the industry standard for algo trading, the world’s best charting platform, or CFI’s all-in-one proprietary solution.

MetaTrader 5 (MT5)

I found this desktop platform to be a reliable and powerful workhorse. It is the top choice for traders focused on algorithmic trading, as it fully supports Expert Advisors (EAs) and includes a robust strategy tester.

The platform comes loaded with 38 technical indicators, 24 drawing tools, and 21 timeframes. Its main drawback is a dated interface that can feel cluttered compared to newer platforms.

TradingView

For technical analysts and chartists, CFI’s direct integration with TradingView is a standout feature. This allows you to trade CFI's full range of 15,000+ instruments directly from TradingView's advanced web and desktop charts.

You get the best of both worlds: CFI’s competitive trading conditions (like zero commissions) combined with TradingView's legendary charting, which includes over 100 built-in indicators, 50+ drawing tools, and access to a massive social community of over 50 million traders.

CFI Multi-Asset Platform

This is CFI's flagship proprietary platform, and it’s impressive. It’s the only platform in CFI's lineup where you can trade CFDs, real stocks, and options all in one place. I found it to be the true "all-in-one" solution for multi-asset investors.

It’s accessible via the web portal and a sleek mobile app. A key feature for equity traders is its support for Pre and Post-Market trading on US-listed shares, allowing you to react to news outside of standard market hours.

Capitalise.ai

CFI empowers traders who aren't coders with Capitalise.ai. This innovative tool allows you to automate your trading strategies using simple, plain English commands—no coding required.

You can backtest your strategies, set up smart notifications, and even use alerts from TradingView to trigger your automated trades. It’s a powerful way to remove emotion and execute strategies 24/7.

Copy Trading

For those who prefer to follow the experts, CFI offers a Social Trading feature. This service is powered by HokoCloud and is fully integrated with your CFI MT4/MT5 account.

You can browse a list of strategy providers, analyze their performance, risk levels, and trading history, and then choose to automatically replicate their trades in your own account. This is an excellent tool for beginners or for anyone looking to diversify their trading approach.

Order Execution

Trading on MT5 is fast and efficient. It supports all the core order types most traders need, including market, limit, and stop orders.

Key features like one-click trading are available, allowing scalpers and day traders to enter and exit the market with instant execution. You can also trade directly from the chart, which helps in managing entry points, stop-loss, and take-profit levels visually

Verdict

The bottom line is that CFI's platform suite is exceptional and caters to everyone.

Whether you are a technical purist who lives on TradingView, an algorithmic trader building EAs for MT5, a beginner who wants to use copy trading, or an investor who needs to trade stocks and options on a single platform, CFI has a best-in-class solution. This level of choice and integration is rare and is one of CFI’s most compelling advantages.

Pros & Cons

Pros

- Excellent Platform Choice: Offers MT5, TradingView, and a proprietary platform to fit any trading style.

- World-Class Charting: Provides top-tier, advanced charting tools across its entire platform suite.

- Powerful Automation: Supports both code-based EAs on MT5 and code-free automation with Capitalise.ai.

- Complete Market Access: Trade 15,000+ instruments, including real stocks and options, from the desktop platforms.

- Specialized Pro Tools: Access to a strategy tester, pre-market trading, and social trading communities.

Cons

- Fragmented Features: No single platform does everything; you must switch platforms to trade real stocks vs. use EAs.

- Steep Learning Curve: The number of platforms and MT5’s dated, cluttered interface can overwhelm beginners.

Mobile App

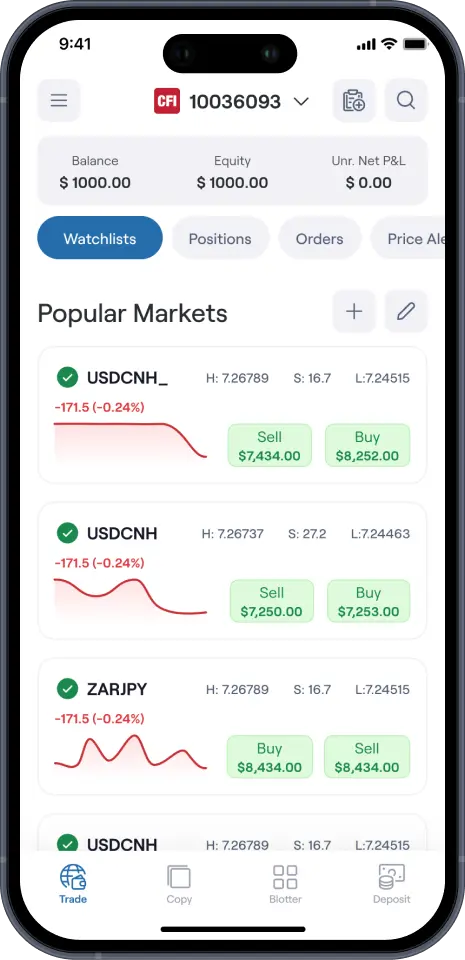

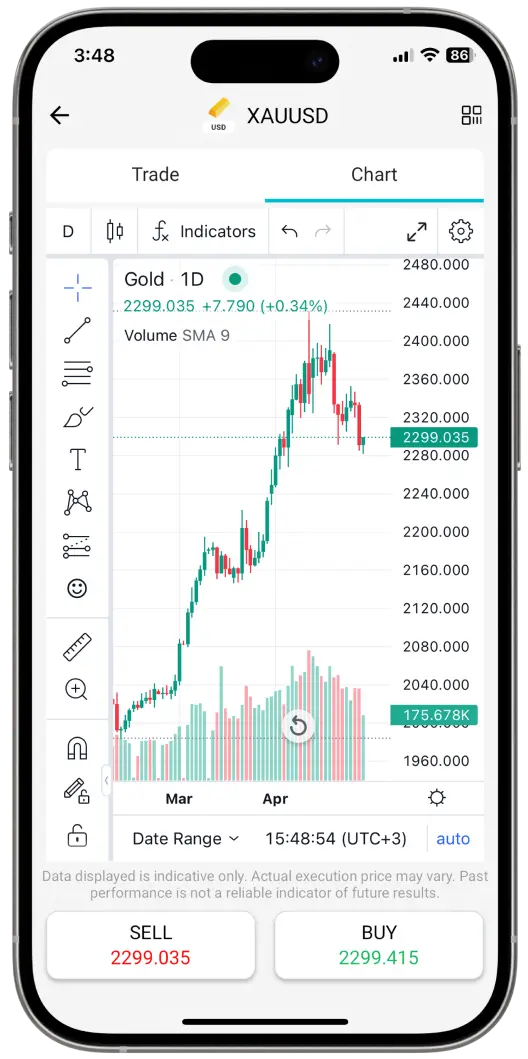

For this CFI app review, I tested the broker’s proprietary CFI Trading App. I found it to be a sleek, powerful, and feature-rich platform that stands well above the standard MT5 mobile app. It’s clear that CFI has invested heavily in creating a high-quality mobile trading 2025/2026 experience that serves as an all-in-one hub for trading, research, and account management.

A Sleek, Proprietary Experience

The app's interface is modern, intuitive, and clean. Unlike the cluttered feel of MT5, the CFI app is easy to navigate, allowing you to manage your portfolio, access watchlists, and execute trades smoothly. I was impressed by its smooth performance and fast execution, with no lag or stability issues during my testing.

Advanced Charting on the Go

The app's charting capabilities are its most impressive feature. It essentially embeds the power of TradingView into a mobile-native environment. It is packed with:

- 105 technical indicators

- 84 drawing tools

- 8 chart types

This is a massive arsenal for technical analysis, far exceeding what is available on most competing mobile apps.

Integrated Research and AI

This is where the app truly stands out. It's not just for trading; it's a complete research tool. Actionable trade ideas and technical analysis from Trading Central are integrated directly into the platform, giving you professional-grade insights in your pocket.

The most innovative feature is Kaiana, CFI's integrated AI trading assistant. Powered by OpenAI, Kaiana allows you to ask for market analysis, get summaries of earnings reports, or even ask educational questions in plain English.

For example, you can ask, "What is the market sentiment for gold?" or "Summarize Apple's latest earnings report," and Kaiana provides a concise, intelligent answer directly within the app.

Performance and Usability

The app's primary strengths are its sleek interface, smooth execution, and the seamless integration of research tools.

You can deposit, trade, and research all without leaving the app. The only real drawback is the inherent limitation of a mobile screen. While the charting is powerful, complex analysis and heavy platform customization are, as expected, easier to perform on a desktop.

Verdict

The bottom line is that the CFI Trading App is one of the best proprietary mobile platforms I have tested. It combines a user-friendly design with incredibly powerful charting, integrated Trading Central research, and the innovative Kaiana AI assistant. It is a perfect tool for traders who need to manage their portfolios and conduct serious analysis on the go.

Pros & Cons

Pros

- Powerful Proprietary App: A sleek, modern app built by CFI, not just a generic MetaTrader wrapper.

- Advanced Charting: Integrates TradingView charts, providing a massive library of 105 indicators and 84 drawing tools.

- Integrated AI Assistant: Features Kaiana AI, which can summarize reports, analyze sentiment, and answer market questions.

- Built-in Research: Actionable insights and trade signals from Trading Central are fed directly into the app.

- All-in-One Function: You can manage your account, deposit, withdraw, research, and trade all from one application.

Cons

- Limited Customization: As with any mobile app, deep customization and complex chart layouts are easier on the desktop version.

- Reported UI/UX Issues: Some users have reported finding the interface confusing or lacking, particularly around order placement when the market is closed.

- In-App Support Concerns: At least one user review noted difficulty in getting timely support directly through the app.

Market Research, Tools, and Education

CFI has built a powerful ecosystem for market analysis that skillfully combines premium third-party CFI research tools with its own in-house experts and advanced technology.

On top of these resources, traders gain access to actionable insights through Trading Central’s Market Buzz, featured trade setups, and detailed market breakdowns updated throughout the week.

The broker further enhances this with its own research team, which delivers weekly reports, technical outlooks, and stock reviews designed to keep traders informed and prepared for market movements.

Together, these tools create a comprehensive research environment that supports both beginners and experienced traders in making data-driven decisions.

Trading Central Signals: Actionable trade ideas and technical analysis reports.

Market Buzz: An advanced tool that uses AI for sentiment tracking, scanning news and social media to show what's driving market discussion.

Beyond this, CFI's in-house team produces a steady stream of high-quality proprietary research, including weekly market reports, in-depth stock reviews, and daily technical briefings. This content is practical and timely for active traders.

The most innovative tool is Kaiana AI, CFI's proprietary AI assistant built into the mobile app. This Kaiana AI tool allows you to ask for market analysis, get summaries of earnings reports, or even ask educational questions in plain English, making complex information accessible instantly.

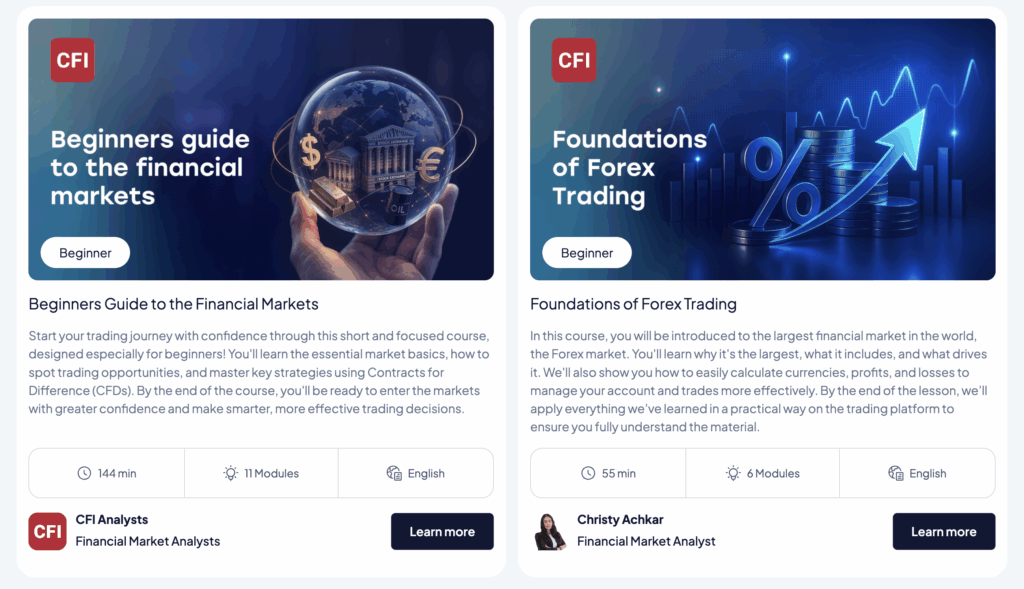

CFI Academy: This is a structured online learning portal offering full courses, such as "Foundations of Forex Trading" and "Introduction to Technical Analysis."

Recorded Webinars: For those who miss the live events, CFI maintains a "Webinars on-demand" library. I found this to be a great resource, with practical lessons on topics like "3 moving average setups every trader should know" and "Overcoming Fear and Greed in Trading."

Articles & Seminars: The site features an extensive library of educational articles, and the broker also hosts in-person seminars in various regions.

YouTube Lessons: CFI maintains an official YouTube channel (@cfigroup-en) with expert analysis and educational videos to support traders.

While the content is excellent, particularly for beginner and intermediate traders, I found it slightly limited for highly advanced, niche topics like complex options strategies.

Customer Support

I found it to be highly accessible, offering 24/7 assistance, which is a critical feature for a global broker operating across all market sessions. Support is provided in both English and Arabic, catering to its core client base in the MENA region and globally.

You can reach the broker help desk through several key channels:

- Live Chat: This is the quickest and most prominent option, available 24/7 directly from the website. CFI positions itself as a live chat forex broker, and its initial response speed reflects this.

- Email: For less urgent or more detailed inquiries, support is available at global@cfi.trade.

- Phone: Direct phone support is provided for various regions.

- Callback: Visitors can also request a callback from the website, a convenient feature that avoids wait times.

My live testing of the support showed a mixed experience. The good news is that the live chat connection time is excellent; I was connected to a live agent in less than one minute.

However, the quality of the support was inconsistent. The agent I spoke with was unable to answer a specific, technical question about the commission on the Dynamic Trader account and needed to transfer me to an expert.

On subsequent, less complex questions, the agent was correct but still somewhat slow to respond. This indicates that while CFI’s support is always available and quick to initiate contact, the first-line agents may not be equipped to handle all technical questions, leading to a varied and sometimes slow resolution process.

FAQ

Is CFI safe and regulated?

Yes, CFI is considered safe and is a heavily regulated broker. It operates with licenses from multiple major authorities, including top-tier regulators like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Europe. It is also regulated by the SCA in the UAE and the FSCA in South Africa, among others.

What is the minimum deposit for CFI?

The minimum deposit for CFI is $0. This makes it highly accessible for beginners who want to start trading with a small amount of capital.

Does CFI charge inactivity fees?

Yes, CFI charges a $10 monthly inactivity fee. However, this fee is only applied to accounts that have been inactive (i.e., no trading activity) for a specified period and is easily avoidable by placing at least one trade.

What platforms does CFI offer?

CFI offers a powerful suite of trading platforms, including the industry-standard MetaTrader 5 (MT5), the popular charting platform TradingView, and its own proprietary CFI Trading App and Multi-Asset platform. It also supports Capitalise.ai for code-free algo trading.

Can I use a demo account with CFI?

Yes, CFI provides a free demo account. This allows you to practice your trading strategies and get familiar with the platforms using virtual money in a real-time, risk-free market environment.

How do I withdraw funds from CFI?

You can withdraw funds by logging into your secure client portal and submitting a withdrawal request. For security, withdrawals are processed back to the original source of your deposit (e.g., the bank account or credit card you used to fund the account).

Does CFI support Islamic accounts?

Yes, CFI offers swap-free Islamic accounts upon request, subject to approval. These accounts are designed to comply with Sharia law by not charging or paying overnight swap fees. Note that certain instruments may be excluded from swap-free terms.

Is CFI good for beginners?

Yes, CFI is a strong choice for beginners. The $0 minimum deposit, free demo account, and user-friendly platforms like the CFI Trading App create a low-barrier entry. The broker also provides a solid library of educational articles and webinars to help new traders learn.

What is the maximum leverage at CFI?

Leverage at CFI depends on your regulatory jurisdiction and client status.

- For retail clients under stringent regulations like FCA and CySEC, leverage is capped at 1:30 for major forex pairs.

- For professional clients who meet specific criteria, leverage can be much higher, extending up to 1:500.

Does CFI offer social or copy trading?

Yes, CFI offers a Social Trading feature. This service is powered by HokoCloud and allows you to automatically copy the trades of experienced strategy providers, making it a valuable tool for both beginners and experienced traders.