cmc Markets review 2025

I put CMC Markets under the microscope, rigorously assessing its offerings, fee structure, trading platforms, and overall reliability. My hands-on testing provides critical insights for forex and CFD traders, active investors, and even beginners. Dive in to discover if CMC Markets is the ultimate partner for achieving your trading ambitions.

Why You Should Choose CMC Markets in 2025

I spent several weeks testing CMC Markets in 2025, diving into everything from its award-winning trading platform to its pricing, tools, and overall usability.

As someone who actively trades and compares brokers regularly, I wanted to see whether CMC still lives up to its long-standing reputation in such a competitive space.

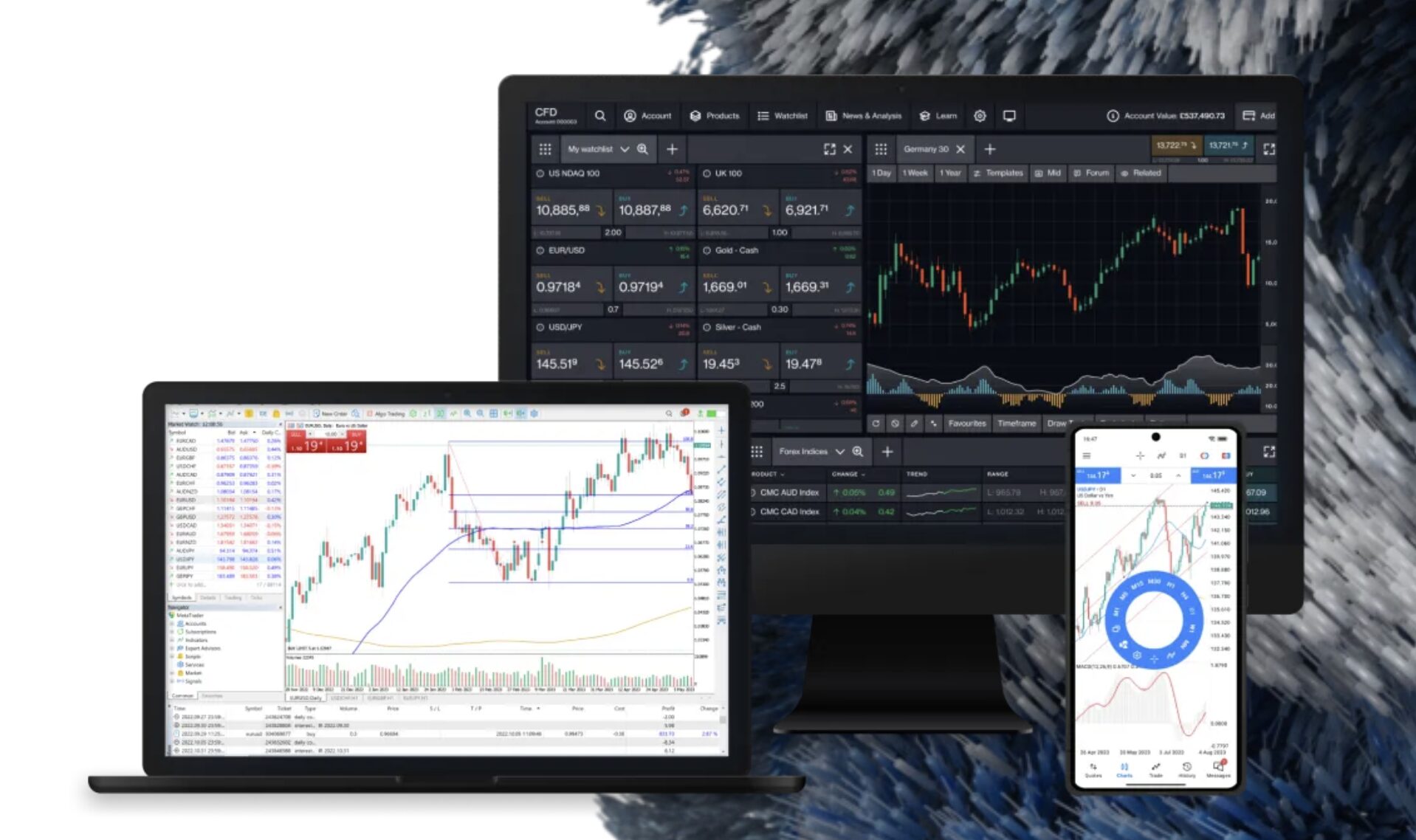

I opened a live account, placed real trades on both the Next Generation platform and MT4, explored its mobile app, and closely examined spreads, execution speed, and available markets.

This review is based on firsthand experience—not just specs and marketing claims—so if you’re considering CMC Markets this year, here’s what you need to know.

From our hands-on experience, CMC Markets stands out for several compelling reasons, offering a superb trading experience:

About CMC Markets

Founded in 1989, CMC Markets is a UK-based global CFD and forex broker that has grown into a formidable presence in the online trading landscape. As a publicly traded company (LSE: CMCX), CMC Markets has a long-standing history of innovation, consistently evolving its offerings to meet the demands of modern traders. Our examination confirms their commitment to providing advanced trading solutions and a vast array of instruments.

Summarizing the CMC Markets Experience

CMC Markets stands out as a highly reputable and powerful online broker, particularly for CFD and forex trading. Its proprietary Next Generation platform is a true highlight, offering an exceptional suite of advanced tools, charting capabilities, and research resources that cater to active traders.

The broker’s commitment to low forex fees, $0 minimum deposit, and free deposits and withdrawals makes it an attractive option for a broad spectrum of traders. Furthermore, its strong regulatory oversight across multiple Tier-1 jurisdictions provides a high level of trust and security.

However, be mindful of the higher stock CFD fees and the fact that it does not serve U.S. clients. While comprehensive, the platform’s advanced nature might present a learning curve for absolute beginners.

Our Verdict – Is CMC Markets the Right Broker for You?

Based on our thorough review, CMC Markets is an outstanding choice for experienced traders and those looking for a sophisticated platform with a vast array of tradable instruments. Its cutting-edge technology, competitive forex pricing, and strong regulatory standing position it as a leader in the online brokerage space.

If you are an active trader, particularly in forex and CFDs, and prioritize advanced tools, in-depth research, and robust platform performance, CMC Markets is undoubtedly one of the best options available. We highly recommend exploring their Next Generation platform and utilizing their free demo account to experience their offerings firsthand.

Pros & Cons

Pros

- Low Forex Fees. CMC Markets offers competitive forex fees, with typical spreads as low as 0.6 pips on EUR/USD.

- Superior Web and Mobile Platform. The Next Generation platform provides advanced charting, over 115 indicators, and 70 chart patterns, making it ideal for in-depth analysis and fast execution. Its mobile apps are equally well-designed.

- Advanced Research and Educational Tools. The platform integrates robust research tools, including Morningstar quantitative equity research reports and an extensive “Learn” portal with educational content.

- Vast Product Offering. Trade over 12,000 instruments, ensuring a broad spectrum of trading opportunities.

- No Minimum Deposit. You can open an account with a $0 minimum deposit, making it accessible for traders of all capital sizes.

- Free Deposits and Withdrawals. There are no charges for deposits and withdrawals, which is a significant advantage.

- Strong Regulatory Oversight. Regulated by five Tier-1 authorities and one Tier-2 authority, ensuring a secure trading environment.

- Demo Account Availability. A free demo account with £10,000 virtual funds allows you to practice strategies risk-free.

- 24/5 Customer Service. Customer service is available 24 hours a day, five days a week, providing timely support.

Cons

- High Stock CFD Fees. While forex fees are low, stock CFD fees can be high. For example, trading an Apple CFD could incur a cost of $10.10.

- Limited Cryptocurrency Offering. Cryptocurrency trading is only available through CFDs and is not available for direct underlying asset trading.

- Not Available in the U.S. CMC Markets does not accept U.S. clients due to regulatory constraints.

- Variability Between Platforms. The Next Generation platform offers more features and assets than the MetaTrader 4 (MT4) platform, which might create a learning curve for MT4 users.

- Inactivity Fee. A £10 monthly inactivity fee applies after 12 months, unless you hold no funds in your account.

- Minimum Trade Value for Global Markets. A $1,000 minimum trade value applies for all global markets outside of Australia, making diversification tricky for new investors with smaller capital. Trading outside Australia, the US, the UK, Canada, and Japan can also incur a commission of $59.95.

Explore CMC Markets Range of Tradable Instruments

CMC Markets truly excels in the breadth of its tradable instruments, providing you with ample opportunities to diversify your investment portfolio. From our testing, we found navigating this vast selection to be straightforward and intuitive.

Here’s a detailed breakdown of the instruments available:

| CMC Markets | MetaTrader 4 | |

|---|---|---|

| Number of instruments | 12,000+ | 220 |

| Forex | 330+ | 175+ |

| Indices | 80+ | 17+ |

| Commodities | 100+ | 15+ |

| Shares & ETFs | 10,000+ | Not Available |

| Fixed income | 50+ | Not Available |

- Forex: Access over 330+ forex pairs. CMC Markets even quotes its 158 currency pairs both ways, effectively doubling the available pairs to 316, and earning them an award for #1 Most Currency Pairs in 2025. You can trade major, minor, and exotic currency pairs.

- Indices: Trade CFDs on a wide range of global indices, allowing you to speculate on the performance of entire markets.

- Commodities: Access CFDs on popular commodities like gold, silver, oil, and natural gas, offering exposure to the raw materials market.

- Shares/Equities (CFDs): You can trade CFDs on thousands of global shares, allowing you to profit from price movements without owning the underlying asset.

- ETFs (CFDs): Trade CFDs on a variety of Exchange Traded Funds (ETFs), providing diversified exposure to different sectors or indices.

- Treasuries/Bonds: CMC Markets also offers trading on fixed income instruments, including treasuries.

- Cryptocurrencies (CFDs): While you cannot trade the underlying asset, CMC Markets offers CFDs on major cryptocurrencies. However, it’s important to note that crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents, except for Professional clients.

Leverage Explained: CMC Markets offers leverage on its CFD and forex products, which can significantly amplify your potential returns, but also your potential losses. It’s crucial to understand how leverage works and the associated risks before engaging in leveraged trading.

Against The Competitors

When comparing CMC Markets to its competitors like IG, XTB, IC Markets, Admirals (Admiral Markets), and Capital.com, CMC Markets consistently demonstrates strong performance across several key metrics.

| Broker | Minimum Deposit | Average Spread for EUR/USD | Forex Pairs | Available to U.S. |

|---|---|---|---|---|

| Forex.com | $100 | 1.0 | 87 | Yes |

| IG | $0 | 0.6 | 80 | Yes |

| CMC Markets | $0 | 0.7 | 175 | No |

- Spreads and Commissions: CMC Markets offers low forex fees and has been recognized for its low-cost offerings, winning awards for #1 Commissions & Fees. For example, the EUR/USD spread is typically 0.6 pips, on par with IG and XTB. While stock CFD fees can be high, their FX Active pricing structure, available in regions like Southeast Asia, Australia, New Zealand, Canada, and the U.K., provides even tighter spreads with commissions for high-volume traders.

- Platform Features: The Next Generation platform stands out as a “superb” offering, delivering best-in-class insights and analysis with extensive charting tools and a massive selection of instruments. While the MT4 offering has fewer symbols, it has been improved with Beeks VPS, Autochartist, and FX Blue plugins.

- Number of Instruments: CMC Markets boasts nearly 12,000 tradable instruments, which is a significant advantage over many competitors.

- Regulation and Safety: CMC Markets’ regulation by five Tier-1 jurisdictions and one Tier-2 jurisdiction places it among the most trusted brokers globally.

- Customer Support: With 24/5 customer service, CMC Markets offers extensive support, a significant win for users.

CMC Markets shines as a market maker broker with competitive pricing and a truly terrific trading experience.

Considering alternatives to CMC Markets? We can introduce you to our other trusted brokers here:

IG Review

FP Markets Review

interactive Brokers Review

XTB Review

Is CMC Markets Regulated?

One of the most critical aspects of choosing a broker is understanding its regulatory framework. We can confidently state that CMC Markets is a legitimate and highly regulated brokerage.

Is CMC Markets Safe to Trade With?

Beyond regulation, the safety of your funds and personal information is paramount. Our assessment indicates that CMC Markets is safe to trade with.

- Cybersecurity Protocols: While specific technical details on encryption and firewalls were not provided, the high level of regulatory oversight implies adherence to stringent security measures to protect client data and transactions.

- Track Record: We didn’t find any major security breaches or significant issues with CMC Markets’ security track record. Its high trust score and long operational history further bolster its reputation for security.

- Negative Balance Protection: CMC Markets offers negative balance protection. This crucial feature ensures that you cannot lose more than the funds in your account, providing a vital safeguard against market volatility, especially when trading leveraged products like CFDs.

Regulatory Bodies & Licenses

CMC Markets operates under the watchful eyes of several top-tier financial authorities globally. These include:

☑️ Financial Conduct Authority (FCA) in the UK.

☑️ Australian Securities & Investment Commission (ASIC).

☑️ Canadian Investment Regulatory Organization (CIRO).

☑️ Monetary Authority of Singapore (MAS).

☑️ Financial Markets Authority (FMA).

These five Tier-1 licenses, along with one Tier-2 license, contribute to CMC Markets' Trust Score of 99 out of 99, placing it firmly in the "Highly Trusted" category.

Client Fund Segregation

While the specific details on client fund segregation weren't explicitly detailed in the provided documents, it is a standard regulatory requirement for brokers operating under these top-tier authorities to segregate client funds from company operational funds.

This ensures that your money is protected, even if the company faces financial difficulties.

Investor Compensation Schemes

Depending on your jurisdiction, you may be covered by an investor compensation scheme.

For example, in the UK, clients might be protected by the Financial Services Compensation Scheme (FSCS) in the event of a firm's failure. This provides an additional layer of security for your investments.

Company Financial Stability

As a company that has been publicly traded (LSE: CMCX) since 1989, CMC Markets demonstrates significant financial stability and transparency. Its long operating history further reinforces its reliability.

Fees and Commission Structure

Understanding a broker’s fee structure is vital for managing your trading costs. We found CMC Markets to be largely transparent with its fees, offering competitive options for many traders, though with some key distinctions.

| Instrument | Min Spread | Standard CFD Account Min Spread | Margin Rate | Commision per $100,000 |

|---|---|---|---|---|

| AUD/USD | 0.0 | 0.7 | 5% | $2.50 |

| GBP/USD | 0.0 | 0.9 | 3.4% | $2.50 |

| EUR/USD | 0.0 | 0.7 | 3.4% | $2.50 |

| USD/CAD | 0.0 | 1.3 | 3.4% | $2.50 |

| USD/JPY | 0.0 | 0.7 | 3.4% | $2.50 |

Spreads

CMC Markets is known for its low forex fees and competitive spreads. For instance, the EUR/USD spread is typically 0.6 pips, which is competitive with industry leaders. All forex CFD fees are built into the spread, meaning there are no separate commissions charged for these trades. Similarly, average index CFD fees are built into the spread, with the S&P 500 index CFD having a spread of 0.5 pips.

Commissions

- Share CFDs: On the downside, stock CFD fees can be high. For example, the commission for an Apple CFD is $10.10.

- FX Active Account: For active forex traders, CMC Markets offers the FX Active pricing structure, which charges a commission per trade on top of highly competitive spreads. This results in an all-in cost of 0.5 pips for EUR/USD (including a $2.50 per side commission). This option is particularly beneficial for high-volume traders as it allows for discounts on trading costs based on collected Trading Points and monthly volumes.

Overnight Holding Costs (Swaps/Rollover)

Like most brokers, CMC Markets charges overnight financing costs (also known as swaps or rollover fees) for holding leveraged CFD positions open overnight. These are standard in the industry and reflect the cost of financing the leveraged portion of your trade.

Inactivity Fees

There is a £10 monthly inactivity fee that applies after 12 months, unless you hold no funds in your account.

Guaranteed Stop-Loss Order (GSLO) Premiums

You can use Guaranteed Stop-Loss Orders (GSLOs) to cap your maximum potential loss, but this comes with an additional charge or premium. This fee is only charged if the GSLO is triggered.

Deposit/Withdrawal Fees

Importantly, there are no charges for deposits or withdrawals. This is a significant advantage, as some brokers may levy fees for these transactions.

Overall, while stock CFD fees are a consideration, CMC Markets’ forex pricing is highly competitive, especially with the FX Active structure for active traders.

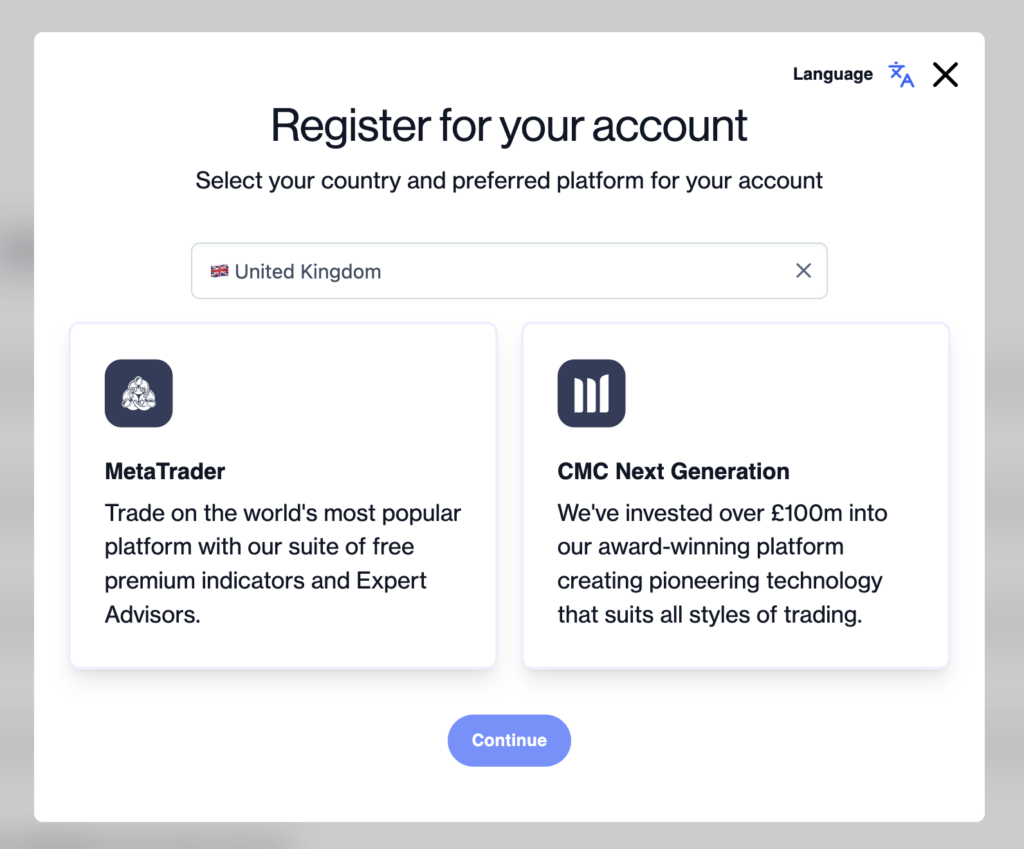

How To Open an Account with CMC Markets

Opening an account with CMC Markets is a straightforward and fully digital process, which we found to be quick and efficient.

The entire process typically takes 1-3 days.

Account Types

CFD Trading Account

This is the primary account type for speculating on the price movements of various financial assets using Contracts for Difference (CFDs). This account offers access to the vast majority of CMC Markets' tradable instruments.

FX Active Account

For high-volume forex traders, the FX Active account offers a commission-based pricing model with spreads from 0.0 pips on major FX pairs. This can lead to significant cost savings for active participants in the forex market. This option is available on both the Next Generation and MT4 platforms.

MetaTrader 4 (MT4) Account

CMC Markets provides access to the popular MetaTrader 4 platform, offering a robust and highly customizable environment for forex trading. This account type allows traders to utilize expert advisors (EAs), custom indicators, and advanced charting tools.

Professional Account

For clients who meet specific eligibility criteria (typically related to trading experience and financial portfolio size), CMC Markets offers Professional Accounts. These accounts often provide higher leverage but come with reduced regulatory protections compared to retail accounts.

Demo Account

An invaluable tool for beginners and experienced traders alike, the free demo account allows you to practice trading strategies with £10,000 in virtual funds in a risk-free environment. We highly recommend utilizing this to familiarize yourself with the platform and market dynamics before committing real capital.

CMC Markets offers a selection of account types designed to cater to different trading needs and experience levels.

What is the Minimum Deposit at CMC Markets

One of the most appealing aspects of CMC Markets, particularly for new traders or those with smaller capital, is its $0 minimum deposit requirement. This means you can start trading without a large initial capital commitment, making the platform highly accessible. This feature is particularly beneficial for those who prefer to add funds regularly, such as every pay cycle

Deposit and Withdrawal

CMC Markets makes funding your account and withdrawing your profits a hassle-free experience, a crucial aspect for any active trader. We found their processes to be efficient and transparent, reflecting a commitment to client convenience.

Deposits

Deposit Methods. You can fund your account using various methods, including credit/debit cards and bank transfers. The availability of multiple options provides flexibility.

Deposit Fees & Options. There are no fees charged by CMC Markets for deposits. This means the entire amount you deposit is available for trading.

Withdrawals

Withdrawal Methods. Similarly, you can withdraw your funds using methods like bank transfers or back to your credit/debit card.

Withdrawal Fees & Options. CMC Markets also levies no withdrawal fees. This commitment to free withdrawals is a significant benefit, ensuring you receive the full amount of your profits.

Processing Times. While specific processing times can vary based on the method and your bank, the digital nature of the process typically ensures efficient transactions.

Web Trading Platform

During our extensive testing, the CMC Markets Next Generation trading platform truly impressed us as a standout in the industry. It’s a proprietary, award-winning platform designed to provide a comprehensive and intuitive trading experience, whether you’re a novice or a seasoned professional.

From the moment we logged in, the platform’s clean interface and logical layout were immediately apparent. Navigating through different markets, accessing charts, and placing trades felt remarkably fluid.

The customization options were a significant plus; we were able to arrange our workspace with multiple layouts, tailoring it to our specific trading strategies and preferences. This flexibility is a big advantage for traders who like to monitor several instruments simultaneously or have different setups for various market conditions.

Key Features & Functionality

- Customizable Layouts & Workspaces: You can personalize your platform experience to suit your trading style, creating multiple layouts and saving workspaces. This allows for a highly tailored trading environment.

- Advanced Charting Tools: The platform boasts advanced charting capabilities with over 115 technical indicators and 70 chart patterns. You can trade directly from charts, a feature that significantly streamlines the trading process. We found the charting interface robust and responsive, allowing for in-depth technical analysis.

- Pattern Recognition Scanner: This innovative tool automatically identifies various chart patterns, helping you spot potential trading opportunities.

- Client Sentiment Tool: Gain unique insights into market sentiment with this proprietary tool, which can be valuable for gauging overall market mood.

- Advanced Order Types: The platform supports a wide range of order types, including market orders, limit orders, stop-loss orders, trailing stops, and Guaranteed Stop-Loss Orders (GSLOs). This flexibility allows for precise risk management and execution strategies.

- Watchlists & Alerts: Easily create and manage watchlists to monitor your preferred instruments. You can also set up price alerts to notify you of significant market movements.

- News & Analysis Integration: Stay informed with integrated Reuters news feeds, Morningstar quantitative equity research reports, and in-house market analysis. The economic calendar is also readily available.

- Performance Analytics: The platform includes tools to track and analyze your trading performance, helping you identify strengths and areas for improvement.

Our experience corroborated these facts. The Next Generation platform truly stands out for its comprehensive features, intuitive design, and robust performance, making it a powerful tool for traders of all levels.

Placing Orders

CMC Markets offers a comprehensive range of order types to help traders manage their risk and execute their strategies effectively, accessible through both the Next Generation and MetaTrader 4 (MT4) platforms.

Placing orders is intuitive. You simply select your instrument, choose an order type, specify the volume, and set your stop-loss and take-profit levels. The advanced order panel makes this process efficient.

Here’s a breakdown of the order types you can utilize:

- Market Order. This allows you to buy or sell an instrument immediately at the best available price.

- Limit Order. Set a specific price at which you want to buy or sell. Your order will only be executed if the market reaches your specified price or better.

- Stop-Entry Order. This order is used to open a new position once the market reaches a predetermined, less favorable price. It’s often used to enter a trend once a certain price level is broken.

- Stop-Loss Order. Crucial for risk management, a stop-loss order automatically closes your position when the market moves against you to a specified price, limiting potential losses.

- Take-Profit Order. This order automatically closes your position when the market moves in your favor to a predetermined profit target, helping you lock in gains.

- Trailing Stop-Loss. A dynamic stop-loss order that automatically adjusts as the market price moves in your favor, maintaining a set distance from the current price. This helps protect profits while allowing your position to benefit from continued favorable price movements.

Exclusive Features for Next Generations Users

While MT4 provides robust trading capabilities, the Next Generation platform offers advanced features designed to cater to more sophisticated trading strategies and enhance control over your trades. These include:

- Guaranteed Stop-Loss (GSLO). For complete peace of mind, a GSLO guarantees that your position will be closed at your specified price, regardless of market volatility or gapping. This comes with a small premium, but it eliminates slippage risk.

- Boundary Order. This unique order type allows you to set an upper and lower price limit. Your trade will only be executed if the market price falls within these boundaries, giving you precise control over your entry.

- Access Market Depth via Price Ladder. The price ladder provides a visual representation of market depth, showing the available liquidity at different price levels. This can offer valuable insights into market sentiment and potential price movements, aiding in more informed trading decisions.

The Next Generation platform’s exclusive features make it a powerful tool for traders seeking advanced control and detailed market insights.

Alerts & Notifications

Setting up alerts is straightforward, ensuring you don’t miss crucial market events or price levels.

Pros & Cons

Pros

- Advanced Risk Management Tools: Beyond basic stop-loss orders, the platform offers features like guaranteed stop-loss orders (GSLOs) for complete price certainty and boundary orders, which allow for highly specific entry and exit conditions. This empowers traders with granular control over their risk exposure.

- Economic Calendar Integration: A fully integrated and customizable economic calendar provides real-time updates on key economic events and data releases that can impact market prices. This helps traders stay informed and anticipate potential volatility.

- Pattern Recognition Scanner: The platform includes an intelligent pattern recognition tool that automatically identifies emerging and completed chart patterns across a wide range of instruments. This can significantly aid in identifying potential trading opportunities without manual searching.

- Client Sentiment Tool: A unique feature showing the real-time buy/sell sentiment of other CMC Markets clients. This can offer valuable insights into market positioning and act as a contrarian or confirming indicator for your own analysis.

- Extensive Educational Resources & Demos: While feature-rich, the platform is complemented by a wealth of educational materials, tutorials, and a highly functional demo account. This allows traders to thoroughly explore and practice with all the features in a risk-free environment before committing real capital.

Cons

- Potential for Information Overload: While the abundance of data and tools is a pro for experienced users, new traders might find themselves overwhelmed by the sheer amount of information presented on the screen, potentially leading to analysis paralysis or confusion.

- Reliance on Internet Connection: As a web-based platform, its performance and responsiveness are heavily dependent on a stable and fast internet connection. Users in areas with unreliable internet may experience lag or connectivity issues, impacting their trading execution.

Mobile App: Trading on the Go

CMC Markets understands the importance of mobile accessibility for traders. Their mobile trading apps, available for both iOS and Android, extend the robust capabilities of the Next Generation platform to your fingertips.

It offers a seamless user experience consistent with the web-based platform. The look & feel is intuitive and sleek, making it easy to navigate even on smaller screens.

Key Features

You’ll find a comprehensive set of features on the mobile app, including:

Login & Security

The app offers secure login options, including biometric authentication, for quick and safe access to your account.

Search Functions

We found the search functions to be efficient, allowing you to quickly locate instruments and markets.

Placing Orders

Placing orders on the mobile app is just as straightforward as on the web platform, optimized for touch interaction.

Pros & Cons

Pros

- Full functionality for trading and account management, highly convenient for on-the-go trading, responsive interface, secure login options.

- Push Notifications for Market Alerts. The app offers customizable push notifications for price alerts, economic events, and order fills. This ensures traders are immediately informed of significant market movements or when their orders are executed, even when they’re not actively watching the app.

- Intuitive and Streamlined User Experience. Despite offering full functionality, the app’s interface is thoughtfully designed for mobile use. Complex features are often presented in a simplified, tap-friendly manner, making it easy to navigate and execute trades quickly on a smaller screen.

- The mobile app often includes direct access to CMC Markets’ educational resources, market analysis, and news feeds. This allows traders to continue their learning and stay updated on market developments while on the go.

Cons

- Limited Multi-Charting Capabilities. Unlike the web platform which allows for multiple chart layouts and screens, the mobile app typically restricts users to viewing one chart at a time. This can make it challenging for traders who rely on monitoring several instruments or different timeframes simultaneously for their analysis.

- While convenient, trading on a mobile device can expose users to more distractions from other apps, notifications, and general mobile usage habits. This could potentially lead to less focused decision-making compared to trading in a dedicated desktop environment.

Market Research & Tools

CMC Markets provides a wealth of market research and tools to help you make informed trading decisions. Their offerings are sophisticated and designed to cater to various analytical approaches.

Integrated News & Analysis

Reuters news feed: Get real-time market news directly within the platform.

Morningstar quantitative equity research: Access in-depth reports and data from Morningstar for fundamental analysis.

In-house market analysts’ commentary: Benefit from insights and analysis provided by CMC Markets’ team of experts.

Economic Calendar: Stay updated on key economic events and data releases that can impact the markets.

Pattern Recognition Scanner: Automatically identifies popular chart patterns, saving you time and effort in technical analysis.

Client Sentiment Tool: Provides a unique look into what other CMC Markets traders are doing, offering a potential contrarian or confirming indicator.

Fundamental & Technical Analysis Resources: CMC Markets provides resources that support both fundamental analysis (through news and research reports) and technical analysis (through advanced charting and pattern recognition).

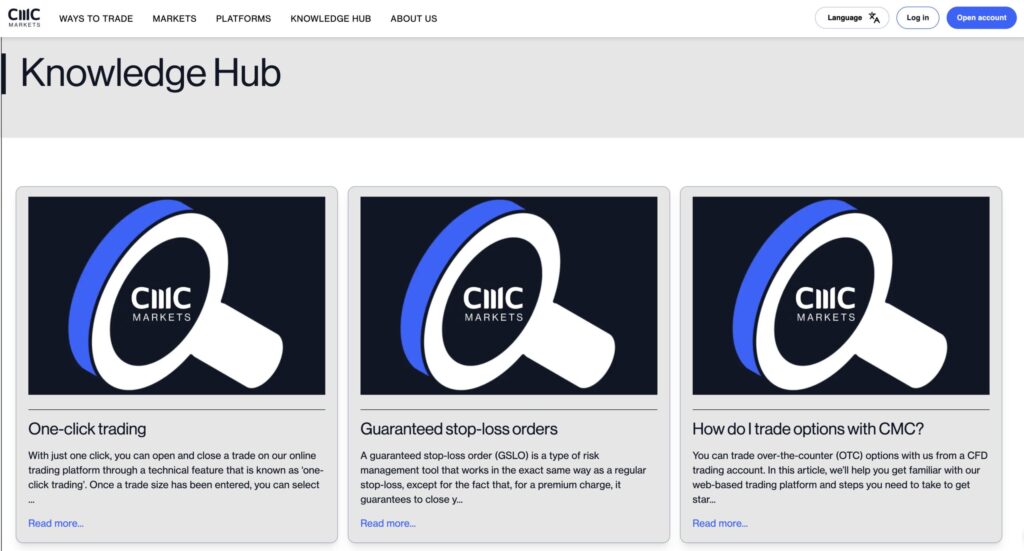

Learning and Developing Your Trading Skills

CMC Markets is committed to empowering its clients through education. Their educational content is robust, designed to help traders of all levels enhance their skills.

Educational Resource. The deep “Learn” portal offers a comprehensive suite of resources, including:

Beginner to Advanced Content. We found that their educational materials cater to a wide audience, from explaining basic trading concepts to delving into advanced strategies.

Demo Account for Practice. The availability of a free demo account cannot be overstated as an educational tool. It provides a safe space to apply what you learn without risking real capital.

CMC Markets’ educational offerings are a valuable asset, particularly for new traders looking to build a strong foundation and for experienced traders seeking to refine their strategies. While it might lack some interactive content or progress tracking, the depth of information is commendable.

Customer Support

Effective customer support is not merely an advantage, but a fundamental necessity. CMC Markets recognizes this imperative, providing a comprehensive customer service framework designed to assist clients whenever required.

Clients can readily connect with their dedicated support team through a variety of convenient contact channels, including telephone, email, and live chat. Notably, their customer service operates 24 hours a day, five days a week, ensuring timely assistance during active trading hours across diverse international time zones.

Our assessment indicates that their customer service is consistently responsive and highly capable, efficiently addressing a broad spectrum of inquiries. Furthermore, CMC Markets offers an extensive FAQ section and a comprehensive help center on their website, enabling clients to independently find answers to common questions with ease.

FAQS

Is CMC Markets good for beginners?

While CMC Markets offers a $0 minimum deposit and a free demo account, its advanced Next Generation platform might have a learning curve for absolute beginners. However, their extensive educational resources can help new traders get up to speed.

What is the minimum trade size on CMC Markets?

Specific minimum trade sizes can vary by instrument, but it’s important to note the $1,000 minimum trade value for all global markets outside of Australia.

Can I trade stocks directly on CMC Markets or only CFDs?

Primarily, CMC Markets offers CFDs on shares. However, if you are in the UK or Australia, you may access direct share dealing through the CMC Invest app.

Does CMC Markets offer MetaTrader 4 (MT4)?

Yes, CMC Markets offers the MetaTrader 4 (MT4) platform in addition to its proprietary Next Generation platform.

How long do withdrawals take on CMC Markets?

While specific processing times vary by method, CMC Markets generally processes withdrawals efficiently. Their account opening is 1-3 days, suggesting a quick turnaround for account services.

Is CMC Markets regulated?

CMC Markets is regulated by multiple top-tier authorities globally, including the FCA (UK), ASIC (Australia), CIRO (Canada), MAS (Singapore), and FMA (New Zealand).

Are my funds insured with CMC Markets?

CMC Markets operates under strong regulatory oversight, and in jurisdictions like the UK, client funds may be protected by investor compensation schemes like the FSCS. They also offer negative balance protection.

What instruments can I trade with CMC Markets?

You can trade nearly 12,000 instruments, including forex pairs, indices, commodities, share CFDs, ETFs, treasuries, and cryptocurrency CFDs.

Are there any hidden fees with CMC Markets?

CMC Markets is generally transparent with its fees. While there are spread costs, overnight financing costs, and potential premiums for guaranteed stops, as well as an inactivity fee, they clearly disclose these charges. They offer free deposits and withdrawals.