COINBASE REVIEW 2026

Coinbase is one of the world’s most popular cryptocurrency exchanges because of its user-friendly design and strong focus on security. Read our honest breakdown to discover how its features and educational rewards can help you grow your digital portfolio.

Broker Guide's Coinbase Review in 2026

When researching cryptocurrency exchanges, I don’t rely solely on reputation; I prefer to test platforms myself to see how they actually perform in real-world use. That’s why I decided to personally try Coinbase, one of the most well-known crypto exchanges globally.

Coinbase has built a strong reputation for being beginner-friendly, highly regulated, and transparent, especially as a publicly listed company.

Those qualities naturally make it appealing to first-time crypto investors, but I wanted to see whether the platform truly lives up to its reputation once you start using it.

To do that, I went through the entire process from start to finish. I opened an account, completed identity verification, funded it using different payment methods, placed real trades, and tested withdrawals.

I also paid close attention to trading fees, since this is one of the most common concerns users have.

Beyond that, I compared the desktop platform and mobile app to assess the consistency and user-friendliness of the experience across devices, and I evaluated the responsiveness of customer support when help is needed.

This review is based on hands-on experience, not just research or feature lists. My aim is to share what actually matters when you’re using Coinbase day to day. The good and the not-so-good, so you can decide with confidence whether it’s the right platform for you.

About Coinbase

Before trusting any crypto exchange with your money, I always look closely at who’s behind the platform. Coinbase has one of the strongest backgrounds in the industry. Founded in 2012, Coinbase has grown from a small startup into one of the most established cryptocurrency companies in the world.

The company operates under Coinbase Global Inc, which became a publicly traded company in 2021 and now trades on the NASDAQ under the ticker COIN. This matters because public companies are held to higher standards of transparency, financial reporting, and regulatory compliance than private exchanges.

Coinbase is headquartered in the United States, which also places it under some of the strictest financial and consumer protection regulations globally.

Coinbase’s core mission has always been simple: to make cryptocurrency accessible to everyone. You can clearly see this focus in how the platform is designed. The standard Coinbase platform is built for everyday users who want an easy way to buy, sell, and hold crypto without dealing with complex trading tools or steep learning curves.

For more experienced traders, Coinbase also offers Coinbase Advanced, which replaced the former Coinbase Pro platform. While both platforms are part of the same ecosystem, they serve different types of users.

The platform is designed for simplicity and convenience, while Coinbase Advanced offers lower fees, more detailed charts, and advanced order types for active traders who want more control over their trades.

Today, Coinbase serves users in over 100 countries and supports hundreds of cryptocurrencies, making it one of the most globally accessible crypto exchanges available. The platform was co-founded by Brian Armstrong, who remains a key figure in shaping its long-term vision and regulatory-first approach to crypto adoption.

Overall, Coinbase’s long operating history, public company status, and global reach play a big role in why it’s often viewed as one of the more legitimate and trustworthy crypto exchanges on the market.

My Quick Verdict: Who is Coinbase Best For?

Overall BrokerGuide Rating: 4.6/5

Coinbase is best suited for beginners and long-term crypto investors who value security, regulation, and ease of use over the lowest possible fees. In my testing, the platform delivers a smooth, beginner-friendly experience with strong safety standards, but it comes at a higher cost compared to many competitors.

It is a good fit if you’re new to crypto, prefer a clean and simple interface, or want to trade on a platform that operates under strict regulatory oversight. It’s also a solid choice for users who plan to buy and hold cryptocurrencies rather than trade frequently.

On the other hand, active traders and fee-sensitive users may want to look elsewhere. Coinbase’s trading fees are higher than the industry average, especially on the standard platform, and advanced tools are more limited unless you switch to Coinbase Advanced.

If you’re chasing the lowest fees or need deep technical analysis tools, this may not be the best option.

From a safety standpoint, Coinbase scores highly. Its regulatory status, public company transparency, and strong security practices make it one of the more trustworthy crypto exchanges available today.

In short, Coinbase prioritizes trust and simplicity. You’ll pay more in fees, but for many users, especially beginners, that trade-off may be worth it.

Pros

- Highly regulated & publicly listed

- Beginner-friendly interface

- Strong security infrastructure

- Large selection of cryptocurrencies

- Excellent mobile app

Cons

- Higher fees than most competitors

- Limited advanced trading features vs pro platforms

- Customer support complaints during high-volume periods

Why You Should Choose Coinbase ?

As we move closer to 2026, the crypto industry is becoming more regulated, not less. This shift is exactly where Coinbase tends to perform best. While many loosely regulated exchanges struggle to adapt or exit certain markets altogether, Coinbase benefits from having taken a regulation-first approach from the beginning.

Because it already operates under strict U.S. and international compliance standards, Coinbase is far better positioned to handle tighter oversight without major disruptions to users.

A Platform Trusted by Institutions

Institutional adoption of crypto continues to grow, and large investors don’t take unnecessary risks with unregulated platforms. In my experience, Coinbase clearly caters to this shift. Its public company status, transparent financial reporting, and strong governance make it far more appealing to institutions than offshore exchanges that operate in regulatory gray areas.

This institutional trust often translates into greater platform stability, deeper liquidity, and long-term sustainability.

A Proven Track Record of Compliance and Security

One reason Coinbase stands out is its long-standing compliance history. Rather than reacting to regulation, the platform has consistently worked alongside regulators.

That proactive approach reduces the risk of sudden service interruptions, account freezes due to legal uncertainty, or forced market exits. These issues affected several less regulated exchanges in recent years.

For users, this means greater confidence that the platform will still be operating smoothly years down the line.

Continuous Platform Improvements, Not Gimmicks

Instead of chasing trends, the broker focuses on steady improvements. Over time, I’ve seen consistent upgrades to its trading experience, security features, supported assets, and platform performance. Both the desktop platform and mobile app continue to evolve, making the experience smoother for beginners while still offering advanced options for more experienced traders.

This long-term mindset is especially valuable in an industry where platforms can change or disappear quickly.

A Strong Fit for Long-Term Holders and Beginners

Coinbase works particularly well for long-term investors who want a simple, secure place to buy and hold crypto without unnecessary complexity. At the same time, beginners benefit from a clean interface, guided workflows, and clear explanations that reduce the learning curve.

While some exchanges may offer lower fees, they often come with added risk, limited transparency, or regulatory uncertainty. The broker trades ultra-low costs for stability and trust, a trade-off that becomes more attractive as the crypto market matures.

In a more regulated, institutionally driven crypto environment, Coinbase is positioned to remain one of the safer and more reliable choices in 2026.

Compare to Top Competitors

To help you decide whether Coinbase is the right platform for you, it’s useful to see how it stacks up against some of the most popular cryptocurrency exchanges in the market. Below is a quick comparison with Kraken, Binance, and Crypto.com based on fees, security, and overall user experience.

Kraken

Binance

Crypto.com

Exploring Coinbase’s Range of Tradable Instruments

When choosing a crypto exchange, I always look closely at what assets are actually available and just as importantly, what isn’t. Coinbase focuses almost entirely on cryptocurrencies and related digital assets, which keeps the platform simple and easy to understand.

Cryptocurrencies

Coinbase supports more than 350 cryptocurrencies, including major assets like Bitcoin, Ethereum, and Solana, as well as many popular altcoins.

The selection is large enough for most investors, especially beginners and long-term holders, without feeling cluttered by obscure or ultra-high-risk tokens. New assets are added carefully, often with an emphasis on compliance and legitimacy.

Stablecoins

Stablecoins are also well supported, with USDC playing a central role. USDC is closely associated with Coinbase and is commonly used across the platform for trading, transfers, and earning rewards where available. Tether (USDT) and Dai (DAI) are also available.

This makes it a convenient option for users who want to reduce volatility while staying within the crypto ecosystem.

Fiat-to-Crypto Pairs

Coinbase allows users to buy crypto directly using fiat currencies such as USD, EUR, and GBP, depending on location. This makes onboarding much easier compared to platforms that require crypto-to-crypto transfers. For beginners especially, being able to move straight from fiat to crypto is a major advantage.

Staking Options

In supported regions, Coinbase offers staking on select cryptocurrencies such as Ethereum 2.0 (ETH), Cosmos (ATOM), and Tezos (XTZ).

This allows users to earn rewards by holding certain assets directly on the platform without managing technical setups themselves. Availability, supported coins, and reward rates vary by country and regulation.

NFTs and Digital Collectibles

Coinbase has also explored NFTs and related digital assets, though this offering is more limited compared to dedicated NFT marketplaces. If available in your region, it provides a simple entry point for users who want exposure without leaving the Coinbase ecosystem.

Newly Launched Stock Trading

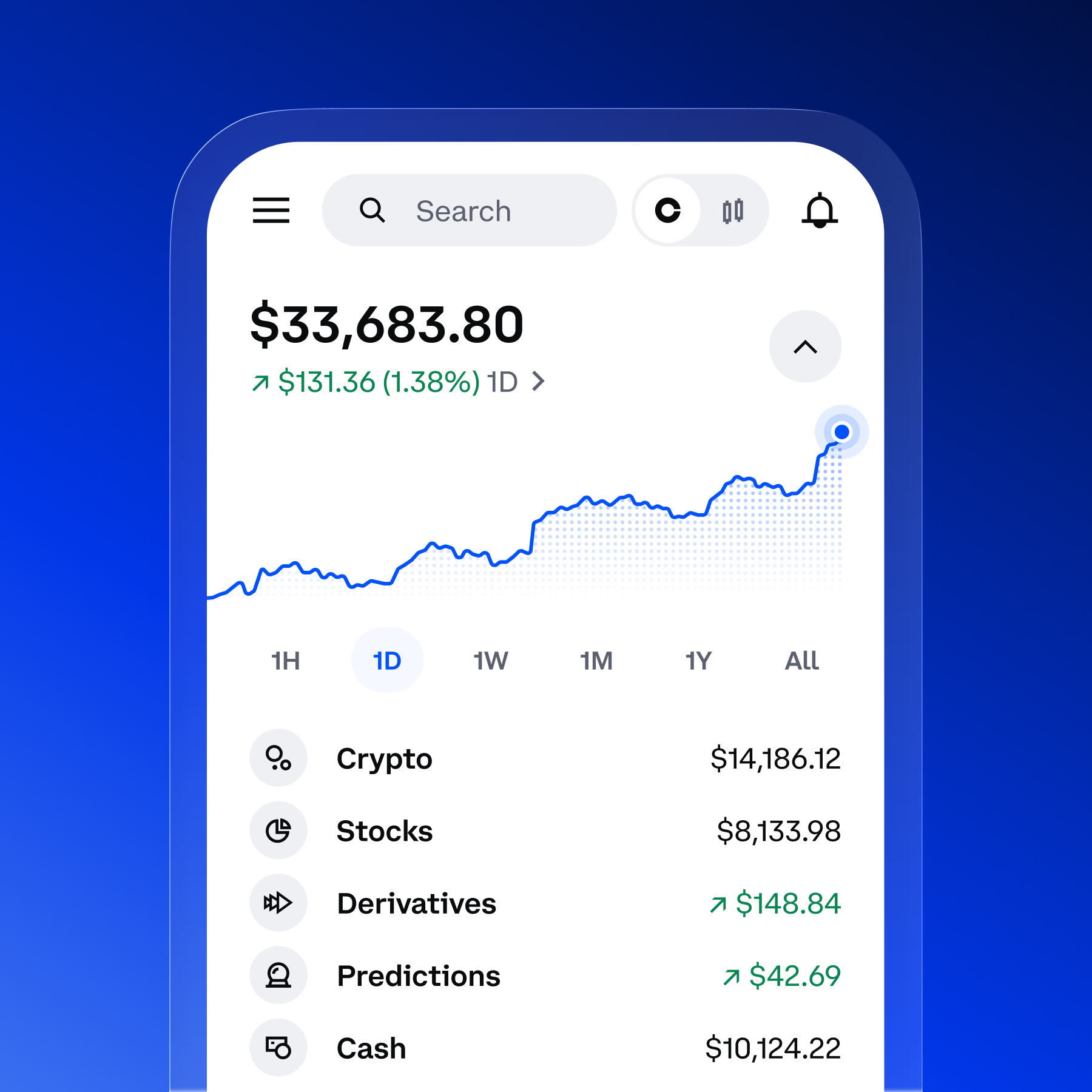

In a major expansion beyond crypto, Coinbase has recently introduced stock trading inside its app for U.S. users. This move lets you buy and sell traditional stocks and ETFs, initially hundreds of them, using USD or USDC, all under one account and wallet within the Coinbase ecosystem. The rollout includes commission-free trading available 24 hours a day, five days a week, with plans to add thousands more stocks over time.

This change marks a strategic shift as Coinbase evolves toward an “everything exchange,” combining crypto and equities in one place and blurring the lines between traditional brokerage services and digital asset trading.

How Coinbase ’s Instruments Compare to Competitors

| Asset | Coinbase | Kraken | Binance | Crypto.com |

|---|---|---|---|---|

| Bitcoin, Ethereum & Major Cryptos | ||||

| Wide Altcoin Selection | ||||

| Stablecoins (USDC, etc.) | ||||

| Fiat-to-Crypto Pairs | ||||

| Staking Options | ||||

| NFT Marketplace / Digital Collectibles | ||||

| Stocks, ETFs & Traditional Instruments |

Fees and Commission Structure

When I first started using the platform, the most confusing part was definitely the cost of trading. Transparency is critical for trust, and while Coinbase provides a lot of value in security, they are not the cheapest option on the market. Understanding the Coinbase fees structure requires looking at two different systems: the simple retail interface and the Advanced trading platform.

Trading Fees

For most casual users, the broker uses a spread-based model for simple buy and sell orders. When you use the “Simple” buy button, you aren’t just paying a flat fee. You are also paying a spread of about 0.50% to 1.00% depending on market volatility.

If you want to lower your costs, I highly recommend using the Advanced interface. It uses a maker-taker model which is much more competitive. Here is their latest pricing

| Level | Make/Taker Fee | Spot & Derivatives Volume | Asset Balance |

|---|---|---|---|

| VIP 8 | 0.000% / 0.020% | $250M | N/A |

| VIP 7 | 0.000% / 0.025% | $100M | N/A |

| VIP 6 | 0.000% / 0.035% | $50M | N/A |

| VIP 5 | 0.010% / 0.050% | $20M | N/A |

| VIP 4 | 0.025% / 0.065% | $10M | N/A |

| VIP 3 | 0.040% / 0.085% | $5M | N/A |

| VIP 2 | 0.050% / 0.100% | $1M | N/A |

| VIP 1 | 0.060% / 0.125% | $500K | N/A |

| Advanced 3 | 0.075% / 0.150% | $250K | $25M |

| Advanced 2 | 0.125% / 0.250% | $75K | $15M |

| Advanced 1 | 0.250% / 0.500% | $25K | $5M |

| Intro 2 | 0.400% / 0.800% | $10K | $10M |

| Intro 1 | 0.600% / 1.200% | ≥ $0 | ≥ $0 |

Commissions

It is important to clarify that Coinbase does not charge a traditional "flat commission" in the way an old-school stockbroker might. Instead, the fee is a percentage of the total trade.

On the standard platform, the "Coinbase Fee" is calculated at the time of the trade and is shown on the confirmation screen.

This fee varies based on your location, the payment method you use, and the size of the order. Generally, using a debit card or PayPal results in a much higher commission-like cost compared to using funds already sitting in your cash balance.

Spreads

As mentioned, the retail app adds a margin to the price. This means you are buying slightly above the market price and selling slightly below it. This spread can widen during times of extreme market stress.

Slippage

This happens when the market moves between the time you click "buy" and the time the trade is executed. Because Coinbase has deep liquidity, slippage is usually minimal for major coins like Bitcoin or Ethereum, but it can be more significant for smaller altcoins with lower trading volumes.

Verdict

My verdict is simple: you are paying for the “convenience factor.” While the standard interface is arguably the most user-friendly in the industry, the Coinbase fees are significantly higher than those of competitors like Binance or Kraken.

For most users, the standard retail app’s high spreads and transaction fees, ranging from 1.49% to 3.99% per trade, make it an expensive place for frequent trading.

However, if you are a long-term investor who values a secure, regulated environment and an intuitive experience, the added cost may be a justifiable trade-off for the peace of mind the platform provides. To keep costs manageable, I strongly recommend utilizing the Advanced platform for any significant trades to take advantage of much lower maker-taker fees.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Coinbase Regulated ?

When I evaluate a platform, regulatory compliance is my top priority because it directly impacts the safety of your funds. My research into Coinbase regulation confirmed that it is one of the most strictly overseen exchanges in the world.

Unlike many offshore platforms that operate in legal gray areas, Coinbase has a proactive approach to working with government authorities to ensure it meets high financial standards.

US Regulation and Oversight

In the United States, Coinbase is registered as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN). While the SEC does not regulate crypto exchanges in the same way it does traditional stock brokers, Coinbase’s status as a publicly traded company on the NASDAQ adds a significant layer of indirect oversight.

This public status requires a high degree of financial transparency and regular disclosures that private competitors simply do not have to provide.

UK and EU Compliance

For users in the United Kingdom, Coinbase operates through CB Payments Limited, which is authorized and regulated by the Financial Conduct Authority (FCA) to issue electronic money.

In the European Union, the platform maintains several key registrations:

- It is registered as a Virtual Asset Service Provider (VASP) by the Central Bank of Ireland.

- It is registered with the Dutch Central Bank (De Nederlandsche Bank) for crypto services.

- It holds licenses from the Bank of Spain and the Organismo Agenti e Mediatori (OAM) in Italy.

Public Company Audits

One of the biggest trust factors for me is that Coinbase must undergo rigorous annual audits. Because it is a public company, it must release audited financial statements that verify its holdings and corporate health.

This transparency ensures that the company is not engaging in the kind of risky accounting practices that led to the collapse of other major exchanges in the past.

Fund Segregation Practices

The broker follows strict rules regarding how it handles your money. I found that the exchange maintains customer assets on a one-to-one basis, meaning they do not lend out your funds without your explicit permission through specific programs.

- Custodial Accounts: For non-US users, fiat currency is held in custodial accounts that are separate from Coinbase’s own operating funds.

- No Corporate Use: This separation ensures the exchange cannot use your money to pay for its own business expenses or corporate debts.

- FDIC Insurance: For US-based customers, cash balances held in USD wallets are stored in pooled custodial accounts at banks covered by the FDIC, providing insurance up to $250,000.

Overall, this level of multi-jurisdictional regulation makes Coinbase a standout choice for anyone who prioritizes legal protection and corporate accountability.

Understanding Regulatory Protections and Broker Stability

Security is often the biggest concern for anyone entering the crypto market, and for good reason. During my time using the platform, I looked past the marketing to see exactly how Coinbase’s regulation and internal stability measures protect your assets. Because the exchange is a public company and highly regulated, it offers several layers of protection that are rarely found in the broader crypto space.

Cold Storage and Asset Security

One of the most important safety features I found is that the vast majority of digital assets are stored in cold storage. This means that the coins are kept in offline wallets that are disconnected from the internet, making them virtually immune to online hacking attempts. While the exact internal percentage can fluctuate with liquidity needs, the platform historically keeps approximately 98% of customer crypto in these secure offline environments.

Insurance and Account Protection

Coinbase provides a level of insurance coverage that adds a significant safety net for users:

- Crime Insurance: The platform maintains a commercial crime insurance policy that protects a portion of the digital assets held in their systems against theft or cybersecurity breaches.

- FDIC Insurance (USD): For US users, any cash balances held in USD wallets are stored in pooled custodial accounts at banks covered by the FDIC, providing protection up to $250,000.

- Coinbase One Protection: If you are a Coinbase One subscriber, you may be eligible for a one-time reimbursement of up to $1 million in the event of a security breach on your account.

Transparency of a Publicly Traded Company

Being a Nasdaq-listed company (Ticker: COIN) changes the stability of the broker entirely. Unlike private exchanges, Coinbase is required by law to provide high degrees of financial transparency.

They must release regular, audited financial reports that detail how they manage funds and the overall health of their balance sheet. This public accountability reduces the risk of the “black box” accounting that has caused other major crypto platforms to fail unexpectedly.

A Note on Market Risks

Despite these strong institutional protections, it is vital to remember that cryptocurrency remains an inherently volatile asset class. Regulatory protections and broker stability can protect you from platform-level theft or bankruptcy, but they cannot protect you from market price fluctuations. As with any investment, you should never invest money that you cannot afford to lose.

By combining strict regulatory oversight with advanced cold storage and public financial reporting, Coinbase provides one of the most stable and secure environments for crypto investors in 2026.

How To Open an Account

Setting up a new account can often feel like a hurdle, but in my experience, Coinbase has streamlined the process to make it as painless as possible.

Because it is a highly regulated exchange, you cannot simply trade anonymously; you will need to provide some personal details to satisfy legal requirements. When I tested the onboarding flow, the entire process took only a few minutes from start to finish.

Here is a simple, step-by-step guide to getting started:

Sign Up: Visit the official website or download the mobile app. Click the “Sign Up” button and enter your basic information, including your full name, email address, and a very secure password.

Email Verification: Coinbase will send a verification link to the email address you provided. You must click this link to confirm that you own the email account before you can move forward with the setup.

Identity Verification (KYC): To comply with Know Your Customer (KYC) regulations, you are required to verify your identity before you can access the trading platforms. During my test, I had to upload a clear photo of a government-issued ID, such as a passport or a driver’s license.

Secure Your Account (2FA): Security is paramount in crypto, so you must set up two-factor authentication (2FA). I recommend using an authenticator app rather than just SMS for an extra layer of protection against phone-based attacks.

Fund Your Account: Once verified, you can link a payment method to start trading. You can choose from several options:

Bank Transfer: Typically the most cost-effective way to move larger sums, though it can take a few business days.

Debit/Credit Card: These offer instant deposits, but be aware that they often come with much higher fees, usually around 3.99%.

E-wallets: Depending on your region, you may also be able to use Apple Pay or Google Pay for quick funding.

Account Types

Coinbase has intentionally designed different experiences to match your level of expertise, ranging from a simple retail app to a highly advanced trading interface. Understanding which one fits your needs is essential for both your user experience and your wallet.

Standard Coinbase Account

This is the default account most users start with. I found the interface to be remarkably intuitive, making it an excellent choice for those new to crypto trading.

It is primarily designed for simplicity, allowing you to buy, sell, and store over 350 cryptocurrencies with basic features. While it is very easy to use, be aware that this convenience comes with higher transaction fees, especially when using debit or credit cards.

Advanced Trade

If you find the standard fees too high, Coinbase Advanced is the solution I recommend switching to. It replaced the old "Coinbase Pro" in 2022 and is built for more active traders.

Lower Fees: It uses a maker-taker fee model that is significantly cheaper than the standard platform.

Professional Tools: You get access to advanced charting powered by TradingView, multiple order types (market, limit, stop), and full API access for algorithmic trading.

New Products: In 2025, Advanced Trade expanded into leveraged trading with a suite of new futures products, including Ripple (XRP) and Cardano (ADA).

Coinbase One (Subscription)

For investors who trade frequently, Coinbase offers a premium subscription service called Coinbase One, which starts at $4.99 per month. I found that this subscription completely changes the cost-benefit analysis for active users.

Zero Trading Fees: You get zero trading fees on a set amount of trades each month (for example, up to $10,000 in trades per month on the Preferred tier).

Enhanced Protection: It includes priority customer support and a one-time reimbursement of up to $1 million for security breaches.

Staking Boosts: Depending on your tier, you can receive a "staking boost" of up to 15%, increasing your passive rewards on held assets.

Wallet vs. Exchange Account Distinction

One of the most important things I learned during my testing is the difference between the Coinbase exchange account and the Coinbase Wallet. They are two separate products:

Exchange Account (Custodial): When you keep crypto on the main Coinbase platform, they hold the private keys for you. This is easier for beginners because if you lose your password, Coinbase can help you recover access to your funds.

Coinbase Wallet (Self-Custody): This is a standalone app where you have complete control over your private keys. It allows you to store your own crypto and NFTs and interact with decentralized applications (DApps).

The Trade-off: With the Wallet, you are your own bank. This provides more freedom and security, but if you lose your recovery phrase, your funds are gone forever.

What is the Minimum Deposit at Coinbase?

Technically, the minimum deposit on Coinbase is $0. This means you can open and verify your account without being forced to commit any funds immediately. However, to actually place a trade, you will need to move enough money to cover the minimum trade size, which is typically just $1.

One of the reasons I find Coinbase so accessible for new investors is that it has an incredibly low barrier to entry. While many traditional brokers require hundreds or even thousands of dollars to get started, Coinbase allows you to begin with almost nothing.

In my testing, I found that you can start building a portfolio with as little as $1 or $2, depending on your region and the specific asset you are buying.

| Broker | Minimum Deposit |

|---|---|

Coinbase | $0 |

| Kraken | $0 |

Binance | $0 |

| Crypto.com | $0 |

Deposit and Withdrawal

When it comes to moving your money, a platform’s practical usability is defined by how easily and quickly you can get funds in and out. During my testing of the Coinbase crypto exchange, I found that they offer a solid range of traditional payment methods, though the “speed vs. cost” trade-off is something every user should consider.

Deposit Fees & Options

Coinbase facilitates deposits using several familiar methods, each with its own fee structure and timeline:

Processing Times

Speed varies significantly based on the method you choose:

- Instant: Debit cards, credit cards, and e-wallets like Apple Pay provide immediate access to your funds.

- 1-3 Business Days: Standard bank transfers typically take a few days to clear and arrive in your Coinbase account.

Withdrawal Fees & Options

Getting your money out is relatively straightforward, but there are a few costs to keep in mind:

- Fiat Withdrawal Costs: If you are sending cash back to your bank, fees depend on the method. For example, a USD wire withdrawal carries a $25 fee. Standard ACH or Bacs transfers are often much cheaper or even free, depending on your account tier.

- Crypto Network Fees: When withdrawing crypto to an external wallet, you aren’t paying a Coinbase “fee” so much as a network (gas) fee. This cost goes to the blockchain miners/validators, not the exchange, and it fluctuates based on how busy the network is.

- Withdrawal Speed: One standout feature I found is that Coinbase allows for quick crypto withdrawals, sometimes immediately after a fiat purchase. For fiat, a bank withdrawal typically takes about three business days, while a debit card withdrawal can be slightly faster at around two business days.

Verdict

In summary, while the platform makes it very easy to move money, I recommend using bank transfers for larger sums to avoid the high percentage-based fees associated with instant card deposits.

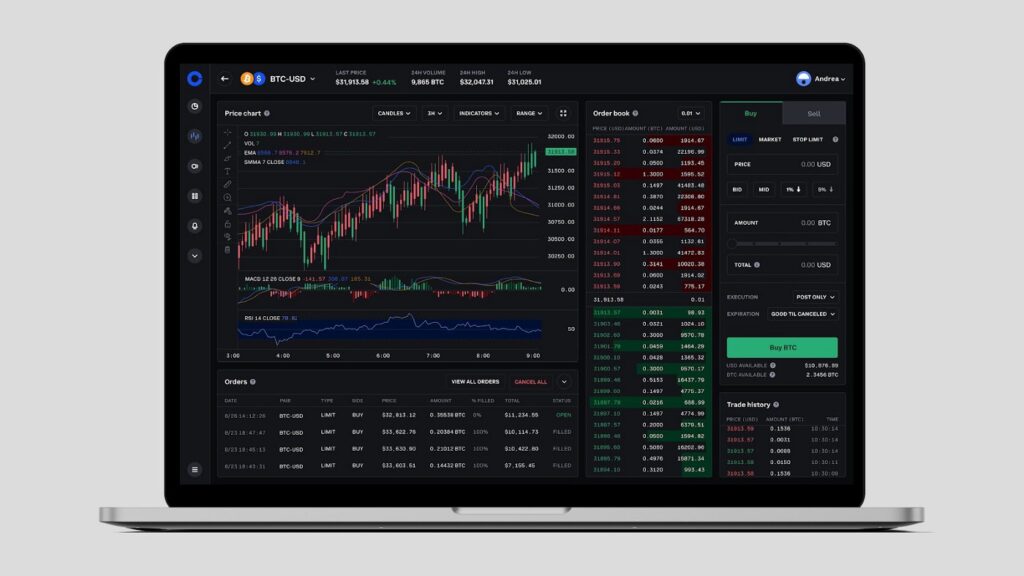

Desktop Trading Platform

While many people think of Coinbase primarily as a mobile-first app, the desktop experience is where you truly see the full power of the platform. I found that the desktop web interface is cleanly designed and provides a much more stable environment for technical analysis than the smaller screen of a smartphone.

Whether you are using the standard retail platform or the professional-grade Advanced Trade, the web-based experience is consistent and highly responsive.

Interface Design

The first thing I noticed when logging into the desktop platform is the TradingView-powered interface. It is remarkably intuitive, even for those who have never looked at a crypto chart before.

The navigation is simple: you have your main dashboard, your assets, and a clear "Buy/Sell" button that is accessible from almost every page. The layout feels spacious and uncluttered, avoiding the "data overload" that often plagues other exchanges like Binance.

Order Types

One of the major reasons I prefer the desktop version, specifically within Coinbase Advanced, is the granular control it gives you over your entries and exits. While the standard retail platform is limited to simple "market" buys and sells, switching to the Advanced interface unlocks professional tools.

Market Orders: For instant execution at the current price.:

Limit Orders: Which allow you to set a specific price at which you are willing to buy or sell.:

Stop Orders: Critical for risk management, allowing you to automatically exit a position if the market moves against you.

Portfolio Tracking

Keeping track of your performance is straightforward on the desktop dashboard. I found it very helpful that you can monitor price movements over multiple time frames, including 1 hour, 24 hours, 1 week, and 1 year.

Your total balance is displayed prominently in your local fiat currency (like USD or EUR), and the platform provides a clear breakdown of your individual asset holdings, their current market value, and your overall percentage gain or loss.

Security Features

Security on the desktop platform is robust, but it requires some manual setup to be truly effective. Coinbase uses industry-standard encryption, but I found that the real protection comes from the user-facing security tools.

The platform mandates two-factor authentication (2FA) for all sensitive actions, and I highly recommend using a physical security key or an authenticator app rather than SMS, as the desktop site makes it easy to manage these settings.

Additionally, you can "whitelist" specific wallet addresses, ensuring that crypto can only be sent to pre-approved locations, which is a vital safeguard against unauthorized withdrawals.

Verdict

The desktop platform is the "brain" of the Coinbase ecosystem and is where serious investors should spend most of their time. While the standard web interface is perfect for beginners who want a clean, simple layout, the real value lies in Coinbase Advanced.

By using the desktop site, you gain access to powerful TradingView charts and complex order types that aren't as easily managed on a phone.

Use the desktop version if you are making trades larger than a few hundred dollars. The access to Advanced Trade tools and lower maker-taker fees makes it the only way to trade cost-effectively on this platform

Pros & Cons of the Web Platform

Pros

- Intuitive Navigation: The TradingView integration makes charting and market analysis feel seamless.

- Advanced Functionality: Access to maker-taker fee models and professional order types through the Advanced interface.

- Detailed Tracking: Easier to view long-term trends and detailed portfolio history on a larger screen.

Cons

- Simple vs. Limited: The standard retail platform is almost too simple for experienced users, lacking the depth found in the Advanced version.

- Limited Research Tools: While the charting is excellent, I found that the platform still lacks built-in news feeds, economic calendars, and AI-driven market insights that are common on traditional brokerage sites

Mobile App

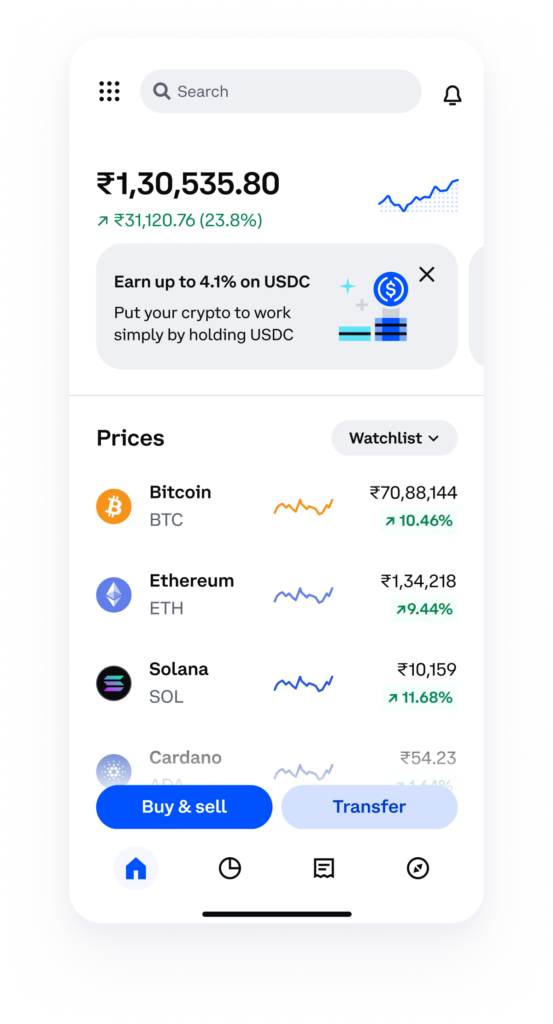

In 2026, most of us manage our lives through our smartphones, and crypto is no exception. During my testing, I spent a significant amount of time on the Coinbase app review to see if the mobile experience truly lived up to the desktop version. I found that the app is where Coinbase really shines, offering a remarkably smooth experience that makes complex crypto transactions feel as simple as sending a text message.

Look & Feel

The first thing I noticed is that the app is visually stunning and uncluttered. It uses a clean, modern design that prioritizes what you need most: your total balance and a clear list of your watchlisted coins.

Navigation is handled through a simple bottom menu that lets you jump between your portfolio, the "Buy/Sell" hub, and the educational "Learn" section with a single tap. Unlike some competing apps that feel like a cockpit full of flashing numbers, Coinbase’s mobile interface feels calm and accessible for beginners.

iOS & Android Performance

I tested the app on both high-end iOS and mid-range Android devices, and the performance was consistently high across both platforms. The app is fast to load, and I didn’t experience any significant lag even when the market was highly volatile.

iOS Integration: On iPhone, the integration with FaceID makes logging in and confirming trades incredibly fast.

Android Performance: The Android version is equally stable and supports biometric fingerprints for secure access.

Updates: The app receives regular updates, which in 2025 and 2026 have focused on integrating more advanced features from the "Advanced Trade" platform into the mobile experience.

Ease of Buying, Selling, and Notifications

The "Buy" process is the core of the mobile experience, and I found it to be remarkably seamless. You select your coin, enter the amount in fiat currency, and confirm the trade in just a few taps.

Instant Purchases: If you have a linked debit card or Apple/Google Pay, you can go from "thinking about buying" to "owning crypto" in under thirty seconds.

Price Alerts: I found the notification system to be one of the most useful features. You can set custom price alerts so the app pings your phone the moment Bitcoin or Ethereum hits your target price, ensuring you never miss a move while on the go.

Transaction Alerts: You also get immediate push notifications for any deposits, withdrawals, or successful trades, which provides a nice layer of real-time transparency.

Security Features

Despite its simplicity, the mobile app doesn't compromise on security. Because mobile devices are often lost or stolen, Coinbase has implemented several layers of "on-the-go" protection:

Biometric Locks: You can require FaceID, TouchID, or a PIN code every single time the app is opened.

Two-Factor Authentication (2FA): The app is fully compatible with 2FA apps like Google Authenticator, which I strongly recommend over SMS codes.

Address Whitelisting: Through the mobile settings, you can manage "whitelisted" addresses, ensuring that funds can only be sent to your pre-approved external wallets.

Verdict

It is exceptionally stable on both iOS and Android, offering a "one-tap" simplicity that is perfect for checking your portfolio or making a quick purchase while on the go. The integration of the "Learn & Earn" program directly into the app is a standout feature for beginners to build a small portfolio for free.

Pros & Cons of the Mobile App

Pros

- Industry-Leading UI: Arguably the most user-friendly crypto app available in 2026.

- Educational Integration: You can complete “Learn & Earn” lessons directly on your phone to get free crypto while you wait for the bus.

- Stable Performance: Highly optimized for both iOS and Android with very few crashes or bugs.

Cons

- High Fees on “Simple” Buy: The convenience of the one-tap buy button comes with the highest fees on the platform.

- Simplified Charts: While the app is great for quick trades, it lacks the deep technical analysis tools found on the desktop version.

Market Research, Tools, and Education

I was pleasantly surprised by how much effort Coinbase puts into educating its users. For beginners, the educational resources are a major highlight, though more experienced traders might find the research tools a bit lacking compared to full-service traditional brokers.

Customer Support

Customer support is an area where I found the experience can be a bit of a mixed bag. While Coinbase offers several ways to get in touch, actually reaching a human being can sometimes be a challenge.

Available Support Channels

In theory, Coinbase offers 24/7 support through several channels:

- Live Chat: Accessible through the web and mobile app.

- Email Support: For less urgent inquiries.

- Phone Support: Available for more complex account issues.

- Help Center: An extensive library of articles and FAQs that can solve most common problems.

The Chatbot Experience

During my testing, I noticed that the platform heavily relies on automated chatbots to route inquiries. While these bots are efficient at answering simple questions or directing you to help articles, it can be frustrating if you have a unique or complex problem that requires a person. I found that it often takes multiple prompts to get past the automated system and into a queue for a real representative.

Support for Non-Account Holders

A significant pain point I discovered is that most support options are hidden behind a login screen. This makes it particularly difficult for users who are locked out of their accounts or for prospective users who have questions before signing up to get the help they need.

Performance During High Volume

Like many large exchanges, Coinbase’s support responsiveness can slow down significantly during periods of high market activity. When crypto prices are moving rapidly and user activity spikes, wait times for chat and email responses have been reported to increase. For premium users, the Coinbase One subscription does offer “priority support,” which can be a valuable perk if you frequently need assistance.

Verdict

My hands-on testing confirms that while Coinbase provides the necessary support channels, the actual experience is often a “self-service” one that can be frustrating if you need immediate human intervention.

While the platform technically offers 24/7 assistance through chat, phone, and email, the heavy reliance on automated chatbots means you must often navigate multiple layers of generic responses before reaching a real representative.

A major drawback I discovered is that support for non-account holders or those locked out is significantly limited, as most help options are hidden behind a login screen.

Additionally, responsiveness tends to decline during high-market activity, leading to reported delays when users need help the most. For those who prioritize quick resolutions, the Coinbase One subscription, which offers priority support, is almost a necessity rather than an optional perk.

FAQ

Is Coinbase safe for beginners?

Yes, Coinbase is widely considered one of the safest platforms for beginners due to its heavy regulatory oversight and intuitive design. It uses two-factor authentication (2FA) and stores the vast majority of customer assets in offline cold storage to protect against hacking.

Are Coinbase fees high?

In my experience, yes, they are higher than the industry average. While the standard retail app is very easy to use, it carries fees and spreads that can range from 1.49% to nearly 4%, making it significantly more expensive than competitors like Kraken or Binance.

Can I withdraw crypto to my own wallet?

Absolutely. You can withdraw your purchased assets to any external wallet or use the self-custodial Coinbase Wallet for full control over your private keys. One standout feature is that Coinbase often allows you to withdraw crypto immediately after a fiat purchase.

Is Coinbase legal in my country?

Coinbase currently operates in over 100 countries and holds major licenses in the US (FinCEN), the UK (FCA), and throughout the European Union (Ireland, Spain, Italy, and the Netherlands). You should check their official supported countries list to confirm availability in your specific region.

Does Coinbase report to tax authorities?

As a highly regulated and publicly traded company, Coinbase complies with local tax laws. In many jurisdictions, they are required to report certain user activities to authorities like the IRS in the US. They also provide built-in tax reporting tools to help you calculate your gains and losses.

What is Coinbase Advanced?

Coinbase Advanced is a professional-grade trading interface that replaced Coinbase Pro. It offers significantly lower maker-taker fees, advanced charting powered by TradingView, and more complex order types like limit and stop-loss orders.

Is Coinbase better than Binance?

"Better" depends on your priorities. Coinbase is generally superior for ease of use, regulatory transparency, and security-first investors. Binance typically offers much lower fees and a far larger selection of niche altcoins, but it has faced more regulatory scrutiny in certain regions.

Can I stake crypto on Coinbase?

Yes, you can stake several assets including Ethereum (ETH), Solana (SOL), Cosmos (ATOM), and Cardano (ADA) to earn passive rewards. Be aware that Coinbase takes a commission from these rewards in exchange for managing the technical side of the staking process.

Does Coinbase have hidden fees?

While not exactly "hidden," the fees on the standard platform can be confusing. Beyond the visible transaction fee, there is a spread of approximately 0.50% added to the price of the crypto, meaning you buy slightly above the market rate.

What happens if Coinbase goes bankrupt?

Because Coinbase is a public company, user assets are held on a one-to-one basis and are legally segregated from the company’s operating funds. In a bankruptcy scenario, these custodial assets should theoretically be returned to users rather than used to pay corporate debts, though the legal process for crypto remains complex.