DOO PRIME REVIEW 2026

Is Doo Prime a reliable broker for active traders? Our review breaks down its account options, costs, and key strengths and limitations.

Broker Guide's Doo Prime Review in 2026

I decided to put Doo Prime to the test after observing its massive growth to 90,000+ active users across 40 countries.

There is significant industry curiosity surrounding their high leverage of up to 1:1000 and the bold claim of offering over 10,000 tradable instruments.

The primary goal of my evaluation was to determine if their multi-regulated status, spanning the FCA, ASIC, and SEC, actually translates into fund safety and a transparent trading environment for retail capital.

Beyond the marketing claims, I wanted to see how these features perform under real trading conditions, including execution quality and withdrawal reliability. This review focuses on separating genuine advantages from promotional hype, using hands-on testing and objective criteria.

About Doo Prime

Founded in 2014, Doo Prime has established itself as a significant player in the online brokerage space. Headquartered in Hong Kong, the firm maintains a strong international presence with strategic offices in Dallas, Sydney, Singapore, Dubai, and Kuala Lumpur.

The broker is a core part of the larger Doo Group ecosystem, a fintech powerhouse that employs over 750 people worldwide. This extensive network is bolstered by more than 250 institutional partners, allowing them to deliver advanced financial technology and deep liquidity to their retail clients.

By operating through multiple subsidiaries, the Doo Group manages a highly diversified portfolio of financial services, ranging from wealth management to clearing solutions. This robust corporate structure provides the foundation for their Doo Prime InTrade platform and allows them to serve over 90,000 users globally.

Their rapid expansion is further reflected in their collection of industry awards, including recognition for Excellent Customer Service and Financial Technology.

My Quick Verdict: Who is Doo Prime Best For?

Overall BrokerGuide Rating: 4.4/5

Doo Prime presents a compelling option for traders who prioritize high leverage and a massive asset selection, though it is not without its drawbacks. With an Overall Score of 4.4/5, the broker is categorized as a moderate-risk provider that excels in market coverage but lacks certain modern essentials like cryptocurrency trading.

The platform is particularly well-suited for active traders and those interested in social trading or PAMM/MAM accounts. However, the lack of transparency regarding real-time spreads and the high deposit requirement for a VPS are significant hurdles for smaller retail accounts.

Ultimately, if you are looking for a heavily regulated environment with access to over 10,000 instruments, Doo Prime is a strong contender. Just be prepared for a potentially complex fee structure and a strict onboarding process that requires extensive documentation.

Pros

- Market Depth: Access to an impressive range of 10,000+ instruments across six different asset classes, including Forex, Stocks, and Futures.

- High Leverage: Offers competitive purchasing power with leverage up to 1:1000 through certain entities for traders with high-risk appetites.

- Cost-Efficient Funding: There are no internal fees charged by the broker for deposits or withdrawals, helping to preserve your trading capital.

- Tier-1 Regulation: The Doo Group is regulated by top-tier global authorities including the FCA (UK), ASIC (Australia), and the SEC (US).

Cons

- No Real Cryptocurrency Trading: Unlike many modern competitors, Doo Prime does not currently support real cryptocurrency trading.

- Expensive VPS Access: Traders face a high entry barrier for automated trading, as a $5,000 deposit is required to access the virtual private server (VPS).

- Pricing Ambiguity: There is a notable lack of transparency regarding real-time spreads and commissions, which can make it difficult to gauge total trading costs upfront.

Why You Should Choose Doo Prime ?

For traders seeking a comprehensive all-in-one solution, Doo Prime offers unrivaled market access that stands out in the 2026 landscape. It is an ideal choice for investors who want to manage a diverse portfolio comprising Forex, Stocks, Futures, and CFDs from a single terminal.

With a massive library of over 10,000 instruments across six different asset classes, it provides the depth necessary for sophisticated diversification strategies.

The broker’s tech-forward infrastructure is a major draw for professionals who prioritize speed and precision. Doo Prime provides access to FIX API 4.4, a protocol that offers low-latency trading technology and high-frequency data transmission.

This system is capable of delivering up to 250 quotes updates per second, ensuring that active day traders can execute orders with institutional-grade efficiency.

Beyond core execution, the platform integrates institutional-grade tools to enhance market analysis. Traders benefit from the inclusion of Trading Central, which boasts over 8,000 trading tools and provides 24/7 coverage for real-time daily insights. Combined with the advanced charting capabilities of TradingView, these resources offer a powerful analytical suite for both technical and fundamental traders.

Verdict

Doo Prime is a robust option for experienced day traders and high-volume investors who require sophisticated technical tools and vast market reach under a multi-regulated framework. While it excels in technology and asset variety, it is best suited for those who can navigate its complex fee structure and do not require cryptocurrency access.

Compare to Top Competitors

Choosing the right brokerage in 2026 requires understanding how a provider stands against the industry's gold standard. While Doo Prime offers a high-leverage environment with vast market reach, it faces stiff competition from established global giants.

Interactive Brokers

Swissquote

IG

Exploring Doo Prime's Range of Tradable Instruments

Doo Prime offers an impressive selection of over 10,000 assets across six different classes, which provides traders with ample opportunity for portfolio diversification. This extensive range puts them in a strong position compared to other major brokers in the industry.

Forex

The broker provides access to over 100 currency pairs. This includes major pairs like GBP/USD and USD/JPY, as well as various crosses such as EUR/CAD.

Stocks

Traders can access over 300 stock CFDs, primarily focusing on high-liquidity US and Hong Kong securities. Featured options include major global brands such as Apple and Tesla.

Commodities & Energies

The commodities category includes popular metals such as Gold and Silver, which can be traded through CFDs, or futures contracts. Additionally, the platform offers a focused range of energy instruments including Crude Oil and Gas.

Futures

A standout feature of Doo Prime is its unique access to a variety of futures markets. Traders can speculate on NASDAQ100 futures, soybean futures, and gold CFD futures, offering a level of market depth not always found with standard retail brokers.

Indices

The broker offers more than 10 stock index CFDs, allowing for speculation on broader market movements. Key instruments available to traders include the US SPX 500 and the Russell 3000.

| Asset | Doo Prime |

|---|---|

| Tradeable Instruments | 10,000+ |

| Forex Pairs | 100+ |

| CFDs | Yes |

| Commodities | Yes |

| Indices | Yes |

| Cypto CFDs | Yes |

| Precious Metals | Yes |

How Doo Prime’s Instruments Compare to Competitors

When evaluating a broker’s asset library, it is important to distinguish between sheer volume and the variety of supported asset classes. Doo Prime excels in market depth with over 10,000 instruments, particularly in the Futures and HK stock sectors. However, as of early 2026, there are notable differences in the availability of certain assets like Cryptocurrency and Bonds when compared to established tier-1 competitors.

The following table provides a checklist of asset availability for Doo Prime compared to Interactive Brokers, Swissquote, and IG.

| Asset | Doo Prime | Interactive Brokers | Swissquote | IG |

|---|---|---|---|---|

| Forex | ||||

| Indices | ||||

| Stock CFDs | ||||

| Commodities | ||||

| Real Cryptocurrencies | ||||

| Bonds | ||||

| Options |

While Doo Prime offers a robust selection of 10,000+ products, it primarily focuses on CFDs, Forex, and Futures. Competitors like Interactive Brokers and Swissquote are better suited for investors requiring traditional banking products like Bonds or specialized derivatives like Options.

Fees and Commission Structure

Doo Prime maintains a fee structure that balances accessibility for beginners with professional tools for active traders. While the broker is generally competitive, our evaluation found that the lack of transparency regarding real-time pricing is a drawback for those who require precision in their cost analysis.

| Fees | |

|---|---|

| Minimum Standard Spreads | 1.0 pips |

| Minimum Raw Spreads | 0.0 pips |

| Commission | $3.50 commission per lot per trade |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $0 |

Trading Spreads

The broker advertises spreads as low as 0.1 pips. However, during live testing, the real-world costs were higher; we observed 0.7 pips on GBP/USD and 1.2 pips on EUR/AUD. These rates are reasonable but do not necessarily compete with the most aggressive discount brokers in the industry.

Commissions

The commission model depends heavily on the chosen account type:

Cent and STP Accounts: These profiles offer zero transaction fees, making them ideal for beginners and retail traders.

ECN Account: This account provides direct market access with tighter spreads, but it charges a commission per lot (typically $3.50).

Non-Trading Fees

A significant advantage for Doo Prime users is the absence of inactivity fees, which is superior to competitors like XTB or IG that charge monthly fees for dormant accounts. Furthermore, the broker does not charge internal fees for deposits or withdrawals, ensuring that more of your capital remains in your trading account.

Currency Conversion Fees

To minimize currency conversion costs, the broker supports several funding methods across 10+ different currencies. This allows global traders to fund their accounts in their local currency, effectively avoiding the high conversion markups often charged by banks or other financial institutions.

Verdict

The fee structure at Doo Prime is a “middle-of-the-road” offering that is particularly attractive for its lack of non-trading fees. It is an excellent choice for those who value the absence of deposit and withdrawal charges. However, the lack of transparency regarding spread fluctuations means high-volume traders should carefully monitor their execution costs.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Doo Prime Regulated ?

Doo Prime maintains a highly complex regulatory profile, operating through a global network of subsidiaries to provide services across various jurisdictions. This multi-layered approach allows them to offer a balance between high-tier security and flexible trading conditions.

Tier-1 Oversight

The Doo Group is overseen by some of the world’s most stringent financial authorities. This top-tier regulation is a primary factor in the broker’s high trust rating among institutional and retail investors.

- United States: Regulated by the SEC and FINRA via Elish & Elish Inc. (License SEC: 8-41551).

- United Kingdom: Regulated by the FCA through Doo Clearing Limited.

- Australia: Regulated by ASIC through Doo Financial Australia Limited (License 222650).

Offshore Entities

To facilitate high-leverage trading, Doo Prime utilizes several offshore licenses. These entities allow the broker to accept global clients who may fall outside the restrictive leverage caps of the UK or Australia.

- Seychelles: Licensed by the FSA (License SD090).

- Mauritius: Licensed by the FSC (License C119023907).

- Vanuatu: Licensed by the VFSC (License 700238).

Warning: It is critical to understand that client protection levels depend heavily on which specific entity holds your account. For example, while an FCA-regulated account may offer up to £85,000 in investor protection, offshore entities typically do not provide specific compensation funds. Always verify your jurisdiction and the governing license before depositing funds.

Verdict

Doo Prime is a legitimate and heavily regulated broker established in 2014. Its combination of Tier-1 and offshore licenses makes it an excellent choice for traders seeking a “best of both worlds” setup: the security of a major financial group with the flexibility of high-leverage offshore trading.

How To Open an Account

Opening an account with Doo Prime is a straightforward digital process designed to get you into the markets quickly. Based on our tests, the sign-up is efficient, though you should have your identification documents ready for the mandatory KYC (Know Your Customer) verification.

Initial Registration

Visit the official website and click on “Register”. You will need to provide your personal details such as name, country of residence, email address, phone number and create a secure password.

Account Verification

Check your inbox or messages for a verification link or code sent by the broker. Clicking this link activates your profile and allows you to access the client portal.

Complete Your Profile

Log in to your dashboard and you will be asked to fill out a brief questionnaire regarding your trading experience and financial background.

Submit Identity Documents

To comply with global anti-money laundering (AML) regulations, you must upload clear copies of your government-issued ID (such as a passport or driver’s license) and a proof of residence.

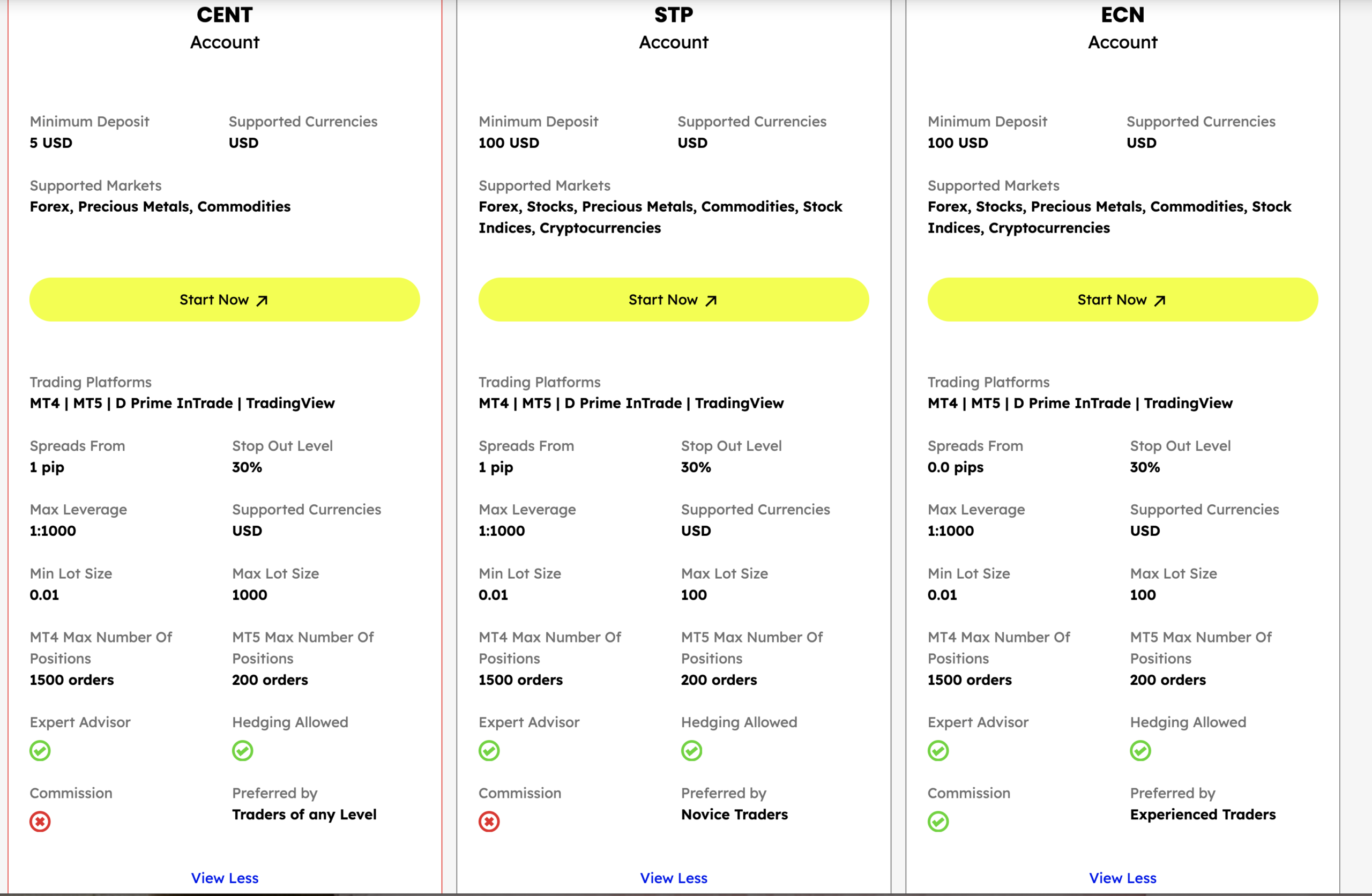

Doo Prime Account Types

Doo Prime offers three primary live account types: Cent, STP, and ECN. They are designed to serve traders ranging from absolute beginners to high-volume institutional professionals. All accounts provide access to the popular MT4 and MT5 terminals, as well as the proprietary Doo Prime InTrade mobile app and TradingView.

Cent Account

The Cent Account is the ideal entry point for those new to the markets or looking to test strategies with minimal financial commitment.

Minimum Deposit: Just $5 (or 5 USD) to get started.

Base Currency: The account is denominated in USC (US Cents), meaning a $10 deposit appears as 1,000 cents in your terminal.

Trading Costs: It features zero commissions, with spreads starting from 1 pip.

Tradable Assets: Access is focused on Forex, Precious Metals, and Commodities.

Execution: Supports a minimum lot size of 0.01 and allows for up to 1,000 lots per trade on MT4.

STP Account

The STP account is the most balanced option for retail traders who want broader market access without commission fees.

Minimum Deposit: A competitive $100 entry requirement.

Base Currency: Denominated in USD.

Trading Costs: Like the Cent account, there are no transaction commissions, and spreads typically start from 1 pip.

Tradable Assets: Offers the full range of 10,000+ instruments, including Stocks, Indices, and Futures.

Key Feature: This account type is eligible for Islamic swap-free options to accommodate Muslim traders.

ECN Account

The ECN account is engineered for professional day traders and scalpers who require direct market access and the lowest possible spreads.

Minimum Deposit: A higher threshold of $100 is required for this tier.

Trading Costs: Offers razor-thin spreads starting from 0.0 pips, but charges a standard commission (typically $3.50 per lot) to cover execution costs.

Premium Benefits: Includes free private hosting (VPS) to ensure uninterrupted trading and ultra-low latency for automated Expert Advisors (EAs).

Order Limits: Features unlimited limit and stop-limit orders, providing maximum flexibility for complex trading strategies.

What is the Minimum Deposit at Doo Prime?

When starting your journey with Doo Prime, one of the first considerations is the initial capital required to open a live account. The broker has designed a tiered entry system that caters to everyone from budget-conscious beginners to well-capitalized professional day traders.

The minimum deposit for a Doo Prime (D Prime) account in 2026 is categorized as follows:

Minimum Deposit by Account Type

- CENT Account: 5 USD. This account is preferred by traders of any level.

- STP Account: 100 USD. This account is noted as being preferred by novice traders.

- ECN Account: 100 USD. This account is preferred by experienced traders and features the tightest spreads starting from 0.0 pips.

By offering a low barrier to entry on its retail-focused accounts, Doo Prime ensures that the markets remain accessible while providing specialized environments for high-volume trading. In 2026, the minimum deposit levels are strategically set to align with the specific features and execution styles of their diverse account offerings.

| Broker | Minimum Deposit |

|---|---|

Doo Prime | $5 |

| Interactive Brokers | $0 |

Swissquote | $1000 |

| IG | $0 |

Deposit and Withdrawal

Managing your trading capital with Doo Prime is a streamlined process, offering a high degree of flexibility for global investors. The broker distinguishes itself by providing numerous localized funding channels and a commitment to zero internal fees for transaction processing.

Funding Options

Traders can choose from a robust selection of multiple funding methods supporting more than 10 different currencies. This diverse range helps users avoid unnecessary currency conversion fees.

Withdrawal Fees & Options

- Withdrawal Speed: Most requests are processed within 1 to 7 business days. E-wallets offer the fastest turnaround, often reflecting in your account in under 24 hours.

- No Internal Fees: Doo Prime does not charge deposit or withdrawal fees, though users should be mindful of potential third-party bank charges.

- Verification: To ensure security and compliance, a full KYC (Know Your Customer) verification is required before your first withdrawal.

Desktop Trading Platform

Doo Prime provides a robust suite of desktop trading platforms that cater to a wide range of trading styles, from high-frequency scalpers to long-term institutional investors. In 2026, the broker continues to leverage industry-standard technology alongside specialized tools to maintain a competitive edge in execution speed and market depth.

MetaTrader 4 (MT4)

The MT4 platform remains the go-to choice for traders focused on the Forex market. It is highly valued for its stability and lightweight performance, making it ideal for running on various hardware setups.

Core Features: Includes 30 built-in technical indicators, 31 graphical objects, and 9 different timeframes for precise chart analysis.

Order Management: Supports 4 pending order types—buy limit, buy stop, sell limit, and sell stop.

Algorithmic Trading: Fully compatible with Expert Advisors (EAs), allowing for the automation of complex trading strategies and historical backtesting.

MetaTrader 5 (MT5)

For those looking to diversify their portfolio beyond currencies, MT5 is the superior multi-asset choice. It offers enhanced analytical capabilities and faster processing speeds than its predecessor.

Advanced Analytics: Features 21 timeframes, 38 technical indicators, and 44 graphical objects such as Elliott Wave and Fibonacci Retracement.

Market Depth: Includes a Depth of Market (DOM) feature that allows traders to view bid and ask prices across various levels to gauge liquidity.

Fundamental Tools: Boasts a built-in economic calendar and a multi-threaded strategy tester for more efficient automated trading development.

TradingView Integration

Traders who prefer advanced visualization can use the TradingView integration directly with their Doo Prime accounts.

Visualization Tools: Access to 12 customizable chart types and 50 smart drawing tools for in-depth technical research.

Analytical Indicators: Includes over 100 technical indicators, such as Volume Distribution, and the ability to use Upper-End Pine Scripts for custom coding.

FIX API 4.4

Designed for institutional and high-volume professional traders, the FIX API 4.4 protocol offers ultra-low latency and direct market access.

High Performance: Capable of a high-frequency information transmission speed of up to 250 quotes updates per second.

Seamless Connectivity: Enables automatic exchange and hedging of currency pairs with complete reference information across all trading varieties.

Verdict

The desktop offering from Doo Prime is one of the most comprehensive in the industry for 2026. While MT4 serves the traditional Forex trader perfectly, the inclusion of MT5, TradingView, and FIX API ensures that professional and technical traders have all the tools necessary for high-stakes, multi-asset market participation.

Pros & Cons of the Web Platform

Pros

- Single-terminal access to over 10,000 instruments across MT4, MT5, and TradingView.

- Execution speeds as fast as 50 milliseconds through robust tech infrastructure.

- Advanced Automation: Strong support for EAs and high-frequency API trading.

Cons

- The complexity of MT5 and FIX API may be overwhelming for true beginners.

- Limited ETF/Bond Access: While vast, some markets like ETFs and Bonds are notably missing on the standard desktop setups.

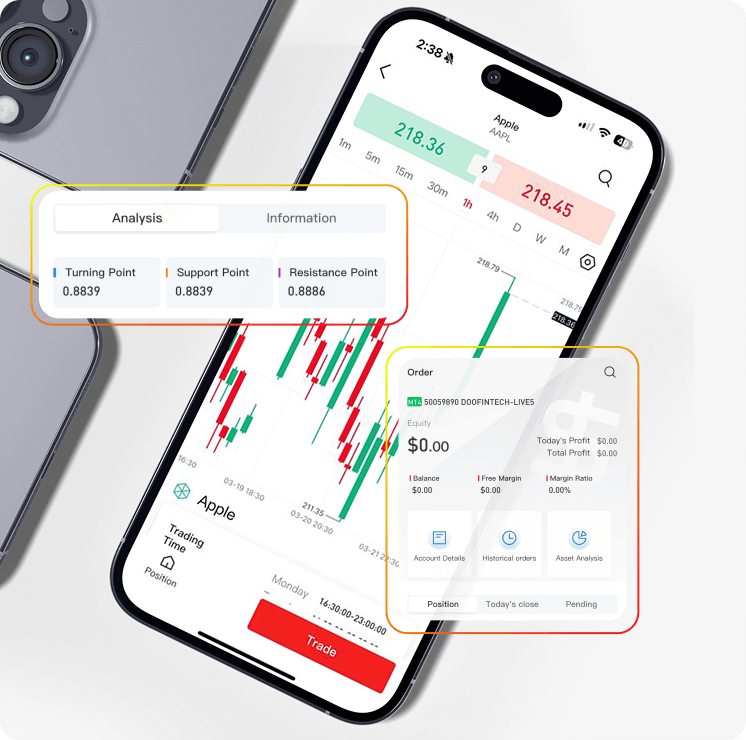

Doo Prime InTrade Mobile App

The Doo Prime InTrade app is a cutting-edge mobile trading terminal available for both iOS and Android. It provides traders with seamless access to a wide range of CFD instruments across seven asset classes, combining high-performance technology with an intuitive design optimized for mobile devices.

Professional Features and Versatility

The platform is a versatile solution that offers access to global financial products, including stocks, currencies, indices, and other CFDs. It allows users to trade international markets with ease, backed by robust technology and competitive features such as intuitive data displays and flexible leverage options up to 1:1000.

The app serves as a one-stop shop where traders can manage their accounts, track market trends, and execute trades with high efficiency.

Advanced Analytical Tools

Traders can explore rich charts and perform visual analysis using advanced indicators and professional drawing tools. The interface is highly customizable, allowing users to tailor their settings and view data in multiple languages for clearer, more precise analysis.

Furthermore, the app provides real-time trading data: including symbols, order types, volumes, and open prices, to help investors make informed decisions based on current market insights.

Stay Informed and Connected

To ensure no opportunity is missed, the app includes real-time news and in-depth market analysis directly within the terminal.

Users can set up real-time price notifications to get live updates from global markets, making it simple to track preferred assets while on the go. This focus on accessibility ensures that essential information is always at your fingertips, allowing for proactive portfolio management.

Security and Cloud Technology

Doo Prime InTrade utilizes cutting-edge cloud and network technology to provide a stable and secure trading environment with global connectivity. Its cloud-based system enables cross-device trading, offering enhanced flexibility for those who switch between mobile and desktop terminals.

Additionally, the platform prioritizes safety with industry-leading standards, including Two-Factor Authentication (2FA), ensuring that both your account details and assets remain protected at all times.

Verdict

The Doo Prime InTrade app is an outstanding choice for traders who demand institutional-grade tools in a mobile format. Its integration of real-time data, cloud synchronization, and robust security makes it a highly reliable terminal for managing a diverse global portfolio in 2026.

Pros & Cons of the Mobile App

Pros

- Market Access: Trade over 10,000 products including Forex, Stocks, and Futures through an intuitive, user-friendly interface.

- Easily manage deposits, withdrawals, and internal transfers while syncing seamlessly with your MT4/MT5 terminals.

- Experience fast and accurate millisecond order execution anchored by advanced network stability.

- Benefit from tailored settings, rich charting tools, and social trading features to follow successful portfolios.

Cons

- The depth of professional tools and advanced analytical features may carry a slight learning curve for absolute beginners.

- While highly capable, certain complex multi-threaded strategy testing remains more efficient on the desktop MT5 version.

Market Research, Tools, and Education

Doo Prime provides a suite of advanced resources designed to assist both technical and fundamental traders in navigating global markets. While the tools provided are professional-grade, the educational offering is often viewed as a solid foundation rather than an industry-leading academy.

For traders using Expert Advisors (EAs) or high-frequency strategies, Doo Prime offers a Virtual Private Server (VPS) to ensure uninterrupted execution and fast speeds. This allows your automated trades to run without downtime caused by local hardware or connectivity issues.

However, access requires a steep $5,000 deposit. Additionally, the Outrade platform offers a social trading network where users can access heatmaps and exposure tools to gauge real-time client sentiment on major assets.

Lessons in this section cover essential subjects such as an Introduction to ECN, Technical and Fundamental Analysis, and tutorials on the MetaTrader platforms. While these resources are beneficial for beginners to learn the basics, they are generally labeled as "useful but basic" and do not compete with the more immersive educational hubs provided by competitors like IBKR.

Customer Support

The customer support team at Doo Prime is available 24/7 to assist global traders across multiple time zones. Clients can reach out for help through several convenient channels, including Live Chat, Email, and Phone. Based on user feedback and testing, the support staff is generally described as polite and helpful for general inquiries. However, response times can become notably slow for complex technical queries that must be escalated to a specific “Account Manager”.

The broker maintains regional support centers to ensure coverage in major financial hubs, offering assistance in multiple languages, including English, Chinese, Vietnamese, Thai, and Korean.

While telephone support typically averages a response time of under 10 minutes, email inquiries can take anywhere from 2 to 24 hours to receive a comprehensive reply. This tiered support structure is effective for routine account issues but may test the patience of professional traders who require immediate technical resolutions during high-volatility sessions.

Verdict

In 2026, Doo Prime stands as a high-performance choice for active traders who prioritize execution speed and a massive asset variety. Its tech-heavy infrastructure and the proprietary InTrade app make it a formidable player for those who trade Forex, HK Stocks, and Futures under one roof.

While the broker provides excellent institutional tools like Trading Central and FIX API, it is less ideal for beginners who require a deep educational academy or for conservative investors who strictly demand local Tier-1 regulation.

FAQ

What is the minimum deposit for Doo Prime?

The entry point depends on the account type: Cent account require a minimum deposit of $5, while the professional ECN account requires a higher initial investment of $100.

Does Doo Prime offer a demo account?

Yes, Doo Prime offers free demo accounts for both the STP and ECN account types, allowing traders to practice in real-market conditions. Currently, the Cent account does not have a demo version as it is already designed for low-risk "micro" trading.

Can I trade Crypto on Doo Prime?

As of early 2026, Doo Prime has expanded its offerings to include Cryptocurrency CFDs, such as Bitcoin and Ethereum. This allows traders to speculate on price movements without needing a digital wallet, although availability may vary by your specific regulatory jurisdiction.

Is there an inactivity fee?

No, Doo Prime does not charge inactivity fees or account maintenance fees. This makes it an ideal choice for swing traders or long-term investors who may not execute trades every month.

What is the maximum leverage?

The maximum leverage offered by Doo Prime is 1:1000 for major currency pairs on accounts held under its offshore entities (Seychelles, Mauritius, or Vanuatu). Leverage for accounts under FCA or ASIC regulation is strictly capped at lower levels, such as 1:30.

Is Doo Prime regulated by the FCA?

Yes, the Doo Group operates Doo Clearing Limited, which is fully authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom (License No. 833414).

Does Doo Prime support MT4 and MT5?

Yes, Doo Prime fully supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) across desktop, web, and mobile devices. They also provide the proprietary InTrade app and TradingView integration for advanced charting.

Are there withdrawal fees?

Doo Prime does not charge internal fees for deposits or withdrawals. However, traders should be aware that third-party costs, such as intermediary bank fees or currency conversion charges from your provider, may still apply.

Does Doo Prime offer Islamic Accounts?

Yes, Doo Prime offers Islamic (Swap-Free) accounts for clients of the Muslim faith. These accounts eliminate overnight interest charges in compliance with Sharia law, though they may carry fixed administrative fees for positions held over a certain duration.