EIGHTCAP REVIEW 2025

If you’re looking for a regulated, low-cost broker with modern trading platforms and one of the largest crypto CFD selections available, this 2025 Eightcap review has you covered. I personally tested the broker’s accounts, fees, and support to see if it still delivers the reliability and performance traders expect. This review breaks down everything you need to know to decide if Eightcap remains one of the most trusted and competitive brokers in today’s market.

Broker Guide's Eightcap Review in 2025

I decided to test Eightcap in 2025 to find out if it still lives up to its strong reputation for low fees, reliable regulation, and an impressive crypto offering. The trading industry changes quickly, and brokers that were once top-rated can easily fall behind.

My goal was to see if Eightcap continues to deliver the same value and trust it’s known for.

Founded in 2009 in Melbourne, Eightcap has earned global recognition for its transparent pricing, fast execution, and access to powerful trading platforms such as MetaTrader 4, MetaTrader 5, and TradingView.

It now provides access to more than 800 markets, covering forex, indices, commodities, shares, and over 200 crypto CFDs, making it one of the most diverse options among Australian brokers.

In this Eightcap review 2025, I opened a live account, tested its platforms, and evaluated customer support to see whether Eightcap still stands as one of the most affordable, secure, and beginner-friendly brokers available today.

About Eightcap

Eightcap was founded in 2009 in Melbourne, Australia, with a clear goal of making online trading simpler and more transparent. Over the years, it has grown into a global brokerage serving more than 80,000 clients across multiple regions. The company is known for its fast execution speeds, competitive pricing, and access to world-class platforms, giving traders the flexibility to trade how they prefer.

Eightcap operates under several regulated entities to serve clients around the world. Its Australian branch, Eightcap Pty Ltd, is licensed by the Australian Securities and Investments Commission (ASIC).

The UK arm, Eightcap Group Ltd, is regulated by the Financial Conduct Authority (FCA). For European traders, Eightcap EU Ltd holds a license from the Cyprus Securities and Exchange Commission (CySEC), while Eightcap Global Ltd in the Bahamas serves international clients under the Securities Commission of The Bahamas (SCB).

This multi-entity structure allows Eightcap to comply with strict financial standards while offering flexibility in leverage and product access depending on the client’s location.

In terms of credibility, Eightcap has received strong ratings across the industry. It holds a Trust Score of 85/99 from independent reviewers and a Trustpilot rating of 4.2/5 based on thousands of customer reviews. Together, these reflect Eightcap’s growing reputation as a safe, regulated, and trader-focused broker in 2025.

My Quick Verdict: Who is Eightcap Best For?

Rating: 4.5/5

Best for: Low-cost forex and crypto CFD trading.

Ideal for: Beginners, active traders, and anyone who values tight spreads and trusted regulation.

After testing Eightcap in 2025, I found it to be one of the better choices for traders seeking a balance between affordability and reliability. It shines in forex and crypto CFD trading, with consistently low spreads and competitive commissions on its Raw account.

Eightcap’s account setup is smooth and beginner-friendly, deposits and withdrawals are free, and traders can choose between MT4, MT5, or TradingView, depending on their preference. Being regulated by ASIC, FCA, and CySEC also gives traders an extra layer of confidence in the broker’s safety standards.

The downsides are relatively minor. Eightcap lacks a proprietary trading platform, doesn’t yet support Islamic (swap-free) accounts, and its education and research tools are fairly basic. Still, for cost-conscious traders, Eightcap remains a dependable, well-regulated choice in 2025.

Pros

- Regulated by top-tier authorities including ASIC, FCA, and CySEC

- Tight spreads starting from 0.0 pips on the Raw account

- Access to 200+ crypto CFDs, one of the largest selections among forex brokers

- Free deposits and most withdrawals with multiple payment options

- Supports MetaTrader 4, MetaTrader 5, and TradingView platforms

Cons

- No proprietary trading app or custom-built platform

- Limited research and educational materials compared to larger brokers

- Moderate range of non-crypto CFDs, fewer than some multi-asset competitors

Why You Should Choose Eightcap ?

One of the main reasons traders continue to choose Eightcap is its strong regulatory foundation. The broker is licensed in multiple top-tier jurisdictions, including ASIC (Australia), FCA (UK), and CySEC (EU), as well as the Securities Commission of The Bahamas (SCB) for global clients. This multi-layered regulation ensures a transparent, secure trading environment and strict adherence to international financial standards.

Expanding Market Access and Crypto Leadership

Eightcap has become a go-to broker for traders who want to diversify beyond traditional markets. It now offers access to over 800 CFDs, covering forex, indices, commodities, shares, and an impressive 200+ crypto CFDs — one of the broadest selections among regulated brokers. This makes Eightcap especially appealing to crypto enthusiasts who want to trade digital assets in a fully regulated environment.

Seamless Trading Experience with Leading Platforms

Another major strength is platform choice. Eightcap supports MetaTrader 4, MetaTrader 5, and TradingView, giving traders flexibility across both classic and modern interfaces. In fact, it’s one of the few Australian brokers officially partnered with TradingView, offering an integrated trading experience for chart-focused users. Advanced tools like Eightcap Labs and the FlashTrader EA (for MT5) further enhance trading precision and strategy automation.

Low Costs and Hassle-Free Setup

Eightcap continues to impress with its low-cost structure and easy account opening process. The minimum deposit is just $100, deposits and most withdrawals are fee-free, and there are no inactivity fees to worry about. Account approval is typically completed within one business day, allowing new traders to get started quickly.

Ideal For

- Traders focused on low fees and fast execution

- Crypto traders seeking a regulated environment

- Users of MetaTrader or TradingView who want platform flexibility

With ongoing improvements like expanded regulation in the UAE, enhanced tools, and continued transparency, Eightcap remains one of the most competitive and trusted brokers to trade with in 2025.

Compare to Top Competitors

To understand how Eightcap performs in today’s market, it’s worth comparing it with other top Australian brokers. Each competitor brings its own strengths to the table, whether that’s broader market coverage, stronger research tools, or enhanced trading conditions.

Blueberry Markets

Pepperstone

FP Markets

Exploring Eightcap’s Range of Tradable Instruments

Eightcap gives traders access to a well-balanced selection of over 803 CFDs across major asset classes, designed to suit both beginners and experienced traders. From forex and indices to commodities, shares, and cryptocurrencies, its lineup provides enough variety for most trading strategies without overwhelming users.

Cryptocurrencies

Crypto is where Eightcap truly excels. With over 200 crypto CFDs, it stands out as one of the largest regulated brokers in this space.

Traders can speculate on leading coins such as Bitcoin, Ethereum, Solana, and Ripple, as well as a wide range of altcoins. However, crypto CFDs are not available to UK retail clients due to local regulations.

Forex

Forex remains Eightcap’s core offering, with 56 currency pairs that include all major, minor, and exotic pairs. Spreads start from 0.0 pips on the Raw account and average around 0.2–0.8 pips for EUR/USD, making it one of the most competitive in its category.

Trade sizes start at 0.01 lots and can go up to 100 lots per trade, with leverage up to 1:30 for retail clients and 1:500 for offshore or professional clients.

Indices

Eightcap provides access to leading global indices such as the S&P 500, NASDAQ 100, DAX 40, FTSE 100, and ASX 200. These instruments come with tight spreads, reliable execution, and the ability to trade on both long and short positions.

Index trading is well-suited for traders looking to capture broader market movements without dealing with individual company stocks.

Commodities

For those interested in tangible assets, Eightcap offers CFDs on popular commodities including gold, silver, crude oil, natural gas, and coffee. Commodity trading benefits from stable spreads and smooth execution on both MT4 and MT5, making it ideal for diversification or hedging strategies.

Shares

Eightcap’s share CFDs cover major global markets, including U.S., European, and Australian companies. This gives traders exposure to popular names like Apple, Tesla, and Amazon, without needing direct ownership.

Share CFDs can be traded with leverage and short-selling options, offering flexibility for equity-focused strategies.

| Asset | Eightcap |

|---|---|

| Tradeable Symbols | 800+ |

| Cryptocurrencies | 200+ |

| Stocks | 800+ |

| Forex Pairs | 50+ |

| Commodities | 14 |

| Indices | 17 |

Bottom Line

While Eightcap’s overall range of 803+ markets is smaller than multi-asset competitors like Pepperstone or Fusion Markets, its crypto depth, tight spreads, and flexible leverage make it a standout choice for traders seeking low-cost access to both traditional and digital assets under strong regulatory oversight.

How Eightcap Instruments Compare to Competitors

| Asset | Eightcap | Blueberry Markets | Pepperstone | FP Markets |

|---|---|---|---|---|

| Forex | ||||

| Indices | ||||

| Commodities | ||||

| Stock CFDs | ||||

| Cryptocurrencies |

Further notes

Bottom-line

While all four brokers cover the major asset classes, Eightcap stands out in terms of its targeted crypto-CFD range and full integration (MT4/MT5/TradingView). The competitors — especially Pepperstone and FP Markets — offer a broader total number of instruments (shares/ETFs, etc). If you value deep crypto coverage and a regulated yet streamlined CFD selection, Eightcap holds strong; if you prioritise maximum breadth of markets (e.g., thousands of shares, ETFs, bonds), then FP Markets (or Pepperstone) may edge ahead.

Fees and Commission Structure

| Fees | |

|---|---|

| Average spread (EUR/USD) - Standard account | 1.0 pips |

| All-in Cost EUR/USD - Active | 0.76 pips |

Commissions | Standard Account – Spreads start from 1.0 pip with no commissions Raw Account – Start from 0.0 pips & a commission of $3.50 is charged per standard lot, per side |

Forex CFD fees | Low |

Index CFD fees | Low |

Stock CFD fees | Low |

| Deposit Fees | $0

|

| Withdrawal Fees | may be subject to a $/€8 fee under the CySEC-licensed entity |

| Inactivity Fee | $/€10 after three months of no trading activity |

Understanding a broker’s fees and commission structure is essential when choosing where to trade. Eightcap is known for being a low-cost broker, offering competitive spreads, transparent pricing, and no hidden charges. Whether you’re a beginner or an active trader, its pricing model is designed to keep trading costs predictable and fair.

Trading Fees

Eightcap offers two main account types, each tailored to different trading styles:

Standard Account - Commissions

The Standard Account is ideal for beginners and casual traders. It features zero commission and spreads that start from 1.0 pip on major forex pairs. This account keeps pricing simple by including all trading costs in the spread, making it easier for new traders to understand exactly what they’re paying.

Raw Account - Commissions

The Raw Account is built for experienced and high-volume traders. It charges a $3.50 commission per side per lot (or $7 per round trip) while offering spreads from as low as 0.0 pips on major pairs like EUR/USD. In practice, the average total round-trip cost on EUR/USD comes to about 0.76 pips, which is highly competitive compared to similar brokers.

Commissions on CFDs

Beyond forex, Eightcap also maintains transparent pricing across other CFD categories:

- Indices: Spreads typically start around 0.5 points for the S&P 500 and remain competitive for global indices such as the NASDAQ 100 and DAX 40.

- Stock CFDs: Commission is around $2 per 100 shares, allowing traders to access international equities without large overheads.

Swap / Overnight Fees

Like most CFD brokers, Eightcap charges or credits swap rates (overnight financing) for positions held overnight. These rates vary by instrument and market conditions, and traders can view the applicable swap rates directly on MT4, MT5, or TradingView. Swap fees represent interest rate differentials and are an important consideration for swing traders who hold positions for several days.

Other Trading Costs

Eightcap keeps additional costs minimal. There are no deposit fees, and most withdrawals are also free of charge. However, for clients registered under the CySEC entity, an $8 withdrawal fee may apply to certain international bank transfers. This minor charge helps cover processing costs and typically does not apply to card or e-wallet withdrawals.

Trading conditions remain consistent across all supported platforms (MT4, MT5, and TradingView), meaning there are no platform-specific surcharges or hidden markups. The broker’s pricing model is fully transparent, making it easier for traders to calculate expected costs before placing a trade.

No Inactivity or Maintenance Charges

One of the most trader-friendly features of Eightcap is its zero non-trading fees policy. Unlike many brokers that impose charges when your account sits idle, Eightcap does not charge inactivity or account maintenance fees—even if you take a break from trading for several months. This makes it a great option for traders who prefer to trade seasonally, test strategies over time, or hold funds in their account without worrying about penalties.

Transparent and Minimal Extra Costs

The only non-trading cost you might encounter comes from currency conversion fees. If you deposit, withdraw, or trade in a currency that differs from your account’s base currency, a small conversion charge may apply. For instance, if your account is in AUD but you trade USD pairs, your payment processor or bank may apply a minor exchange fee.

These conversion costs are standard across all brokers and are not specific to Eightcap. The key advantage here is transparency—Eightcap clearly discloses potential conversion charges, allowing traders to manage costs proactively.

Bottom Line

Eightcap’s low-cost, transparent pricing makes it one of the most affordable brokers in its class. Whether you choose the Standard Account for simplicity or the Raw Account for razor-thin spreads, you’ll benefit from institutional-grade pricing with no hidden fees. Add to that free deposits, no inactivity charges, and competitive swap rates, and it’s clear that Eightcap is an excellent choice for traders who want to minimize costs without compromising on performance or regulation.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Eightcap Regulated ?

Yes, Eightcap is a fully regulated global broker overseen by several top-tier financial authorities, giving traders strong confidence in its safety and reliability. The company operates under multiple licensed entities that ensure compliance with regional financial laws and client protection standards.

Global Licenses and Oversight

Eightcap’s regulatory structure is one of the most comprehensive among mid-size brokers:

- ASIC (Australia) – License No. 391441, through Eightcap Pty Ltd

- FCA (United Kingdom) – Reference No. 921296, through Eightcap Group Ltd

- CySEC (European Union) – License No. 246/14, through Eightcap EU Ltd

- SCB (The Bahamas) – License No. SIA-F220, through Eightcap Global Ltd

Each entity serves a specific client base, allowing Eightcap to maintain local compliance while offering different leverage levels and market access depending on the trader’s region.

Investor Protection and Security

Eightcap provides important investor safeguards through its regulated entities:

- UK clients are protected under the Financial Services Compensation Scheme (FSCS), covering up to £85,000 if the broker becomes insolvent.

- EU clients are covered by the Investor Compensation Fund (ICF), which protects up to €20,000 per eligible client.

- Negative balance protection is provided for clients registered under the EU, UK, and Australian entities, ensuring traders cannot lose more than their deposited funds.

However, clients trading under Eightcap Global Ltd (Bahamas) are not covered by an investor compensation scheme, although funds are held in segregated accounts with top-tier banks to ensure security.

Proven Stability and Reputation

With over 16 years of operation, Eightcap has established a stable and trustworthy reputation in the trading industry. It has maintained strong compliance records and consistently improved its regulatory coverage to reach more regions safely.

Overall, Eightcap’s multi-jurisdictional regulation, segregated funds policy, and long operational history make it a secure choice for traders who prioritize safety, transparency, and regulatory oversight.

Understanding Regulatory Protections and Broker Stability

When a broker is regulated by tier-1 authorities such as ASIC, FCA, and CySEC, it means traders benefit from some of the highest levels of financial protection in the industry. Tier-1 regulation requires brokers to segregate client funds from company capital, ensuring traders’ money is never used for operational purposes. These regulators also enforce regular financial audits, capital adequacy requirements, and transparent reporting, helping maintain financial integrity and accountability.

For traders, this translates into a more secure trading environment where funds are protected even if the broker faces financial difficulties. In addition, clients under the FCA (UK) and CySEC (EU) entities enjoy access to compensation schemes that can reimburse a portion of their funds in the unlikely event of insolvency.

Eightcap is a privately held company, not publicly traded, which allows it to remain independent and focused on maintaining consistent service quality rather than short-term shareholder targets. Despite its private ownership, the broker maintains a high degree of transparency, publishing clear legal documents, pricing policies, and regulatory details on its website.

With a presence across multiple regions and a growing client base exceeding 80,000 traders worldwide, Eightcap has built a reputation for stability and reliability. It also has a low complaint ratio compared to peers, which reflects strong compliance standards and responsive client support. For traders seeking a regulated and trustworthy partner, Eightcap offers a well-balanced mix of safety, transparency, and operational maturity.

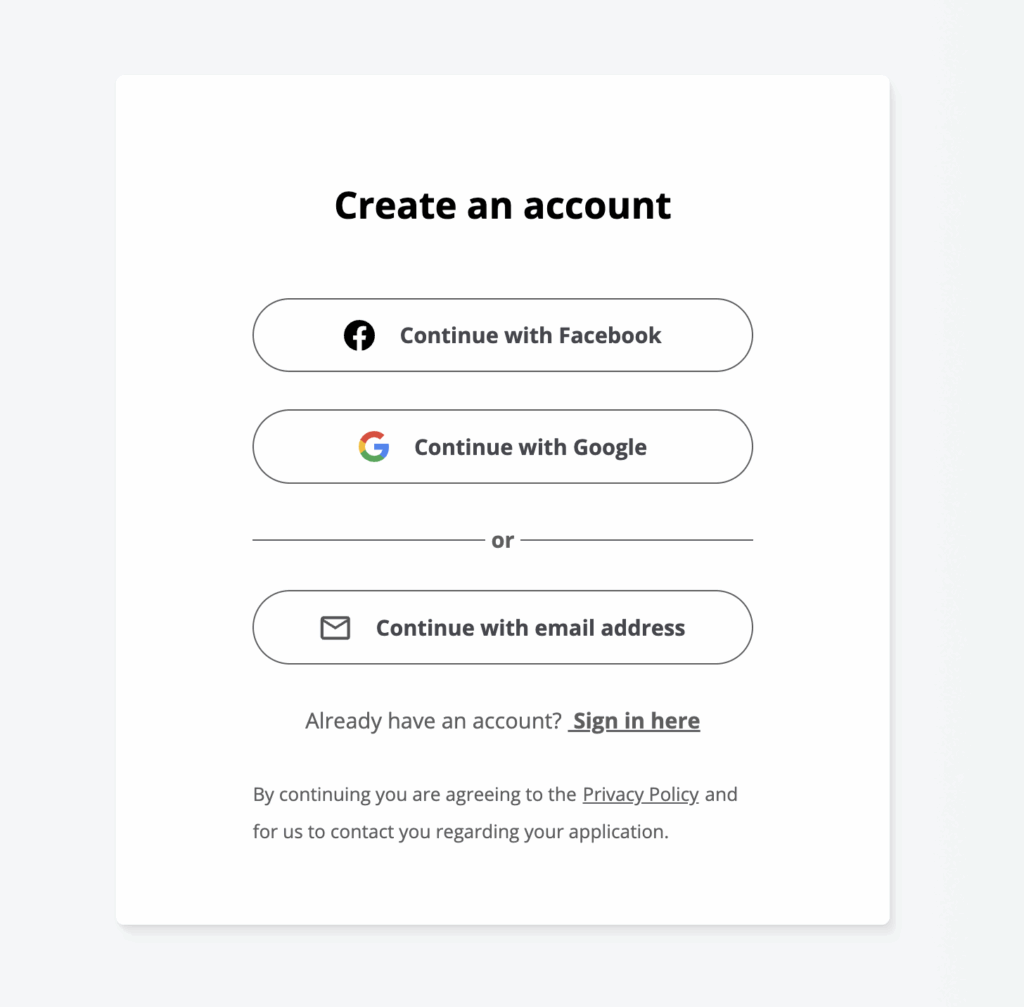

How To Open an Account

Opening an account with Eightcap is a quick and straightforward process designed to get traders up and running within a day. The broker has simplified the onboarding steps while keeping full compliance with international Know Your Customer (KYC) regulations to ensure security and transparency.

Step-by-Step Account Setup

- Sign Up: Visit the Eightcap website and click “Trade Now” You’ll be asked to provide your email address, country of residence, and password to begin the registration process. You can even use your Gmail or Facebook account to sign up.

- Personal Information: Enter your full name, date of birth, and address as they appear on your government-issued ID.

- Identity Verification (KYC): Upload a valid ID document such as a passport or driver’s license, along with a proof of address (utility bill or bank statement dated within the last three months).

- Account Preferences: Choose your account type (Standard or Raw), preferred base currency, and trading platform (MT4, MT5, or TradingView).

- Review and Submit: Confirm that your information is accurate and submit your application for review.

Verification and Approval

Eightcap typically verifies new accounts within one business day. Once approved, you’ll receive a confirmation email and can fund your account immediately using your preferred payment method.

Demo and Mobile Access

If you’re not ready to trade live, Eightcap also offers free demo accounts on MT4, MT5, and TradingView, allowing you to practice trading strategies in real market conditions. The signup process works seamlessly across both desktop and mobile, giving you the flexibility to open and manage your account from anywhere.

With its fast approval times and simple KYC steps, Eightcap makes it easy for traders to start trading confidently and securely.

Account Types

Eightcap offers a clear and flexible range of account types designed to suit different trading styles and levels of experience. Whether you’re a beginner, an active day trader, or a professional managing large volumes, the broker provides account options that balance pricing transparency, execution speed, and trading conditions.

Standard Account

The Standard Account is designed for simplicity and ease of use. It charges no commission, with spreads starting from 1.0 pip on major forex pairs. This account type is best for new or casual traders who prefer all-in-one pricing and straightforward cost management. It provides access to all supported platforms — MT4, MT5, and TradingView — and all available instruments.

Raw Account

The Raw Account is built for experienced and high-volume traders who prefer tighter spreads and direct market pricing. It features spreads from 0.0 pips and a $3.50 commission per side per lot, offering institutional-grade conditions. This account is ideal for scalpers, day traders, and algorithmic traders who value precision and low-cost execution.

Pro Account

The Pro Account caters to professional traders or high-net-worth clients who meet specific qualification criteria. These include demonstrating trading experience, portfolio size, or meeting a financial threshold set by regulatory standards.

The account provides higher leverage (up to 1:400) and access to the most competitive spreads available. It’s suitable for traders who manage larger capital and understand the associated risks of leveraged trading.

Demo Account

For beginners or strategy testers, Eightcap offers a free Demo Account that simulates live trading conditions using virtual funds. Traders can practice on MT4, MT5, or TradingView without financial risk, making it an excellent tool for learning and testing strategies.

Note

Eightcap does not currently offer Islamic (swap-free) accounts or managed account options. However, all accounts maintain the same execution speed, pricing transparency, and access to Eightcap’s full suite of trading tools and instruments.

What is the Minimum Deposit at Forex.com?

Managing your funds with Eightcap is simple and cost-effective, with low minimum requirements and fast processing times for both deposits and withdrawals. The broker focuses on transparency and convenience, ensuring traders can fund their accounts and access profits quickly, no matter where they are in the world.

Minimum Deposit

The minimum deposit to open a live trading account with Eightcap is $100. This relatively low entry point makes it accessible to beginners while still suitable for experienced traders looking to start with a manageable balance. The broker allows traders to choose their base currency from several major options: USD, EUR, GBP, AUD, CAD, NZD, and SGD, helping minimize currency conversion fees.

| Broker | Minimum Deposit |

|---|---|

Eightcap | $100 |

| Blueberry Markets | $100 |

Pepperstone | $0 |

| FP Markets | $100 |

Deposit and Withdrawal

Deposit Options and Fees

Eightcap supports a wide range of secure and instant funding options, including:

All deposits are free of charge, and funds are credited almost instantly when using cards or e-wallets. Bank transfers may take 1–3 business days depending on your location and banking institution.

Withdrawal Options and Processing Times

Withdrawals at Eightcap are typically processed the same business day if submitted before the daily cut-off time. Most withdrawal methods, including cards, PayPal, and e-wallets, are fee-free. However, bank wire withdrawals may incur a small processing charge, usually around $8, particularly for international transfers or clients under the CySEC entity.

Eightcap ensures all withdrawals are returned to the same source as the original deposit, in compliance with anti-money laundering regulations.

Eightcap allows traders to choose from a variety of account base currencies to suit their region and preferred trading setup. You can open an account in USD, EUR, GBP, AUD, CAD, NZD, or SGD, which helps reduce currency conversion costs when depositing, withdrawing, or trading instruments priced in your chosen currency. This flexibility is especially useful for traders who manage multi-currency portfolios or want to align their trading account with their local banking currency.

Bottom Line

With a low $100 minimum deposit, multiple funding options, and no deposit fees, Eightcap makes it easy for traders to start and manage their accounts. Add to that fast, same-day withdrawals and a transparent fee structure, and it’s clear why Eightcap remains a preferred broker for traders who value both flexibility and reliability in fund management.

Desktop Trading Platform

Eightcap delivers an impressive range of desktop trading platforms that cater to different styles and experience levels. Whether you prefer the classic MetaTrader setup or the modern look and feel of TradingView, each option provides a smooth trading experience with fast execution and dependable stability. I tested all three platforms, MT4, MT5, and TradingView, to see how they performed in real conditions, and the results were consistently solid.

MetaTrader 4 (MT4)

MetaTrader 4 remains a favorite for forex traders worldwide, and Eightcap’s version performs just as expected: fast, stable, and easy to customize. During my testing, trades executed almost instantly, even during major news events.

The interface may look a bit dated, but its reliability makes up for it. MT4 supports Expert Advisors (EAs) for automated trading, along with custom indicators and chart templates for personalized setups. It’s ideal for traders who value familiarity and proven performance.

MetaTrader 5 (MT5)

The MT5 platform takes things a step further with more technical indicators, additional timeframes, and a built-in economic calendar. I particularly enjoyed using Eightcap’s FlashTrader EA plugin, which made trade management faster and more precise.

The platform’s Depth of Market (DOM) feature and enhanced strategy testing tools give active traders a serious advantage. Compared to MT4, execution felt slightly quicker, and order handling was smoother, especially for multi-asset trading.

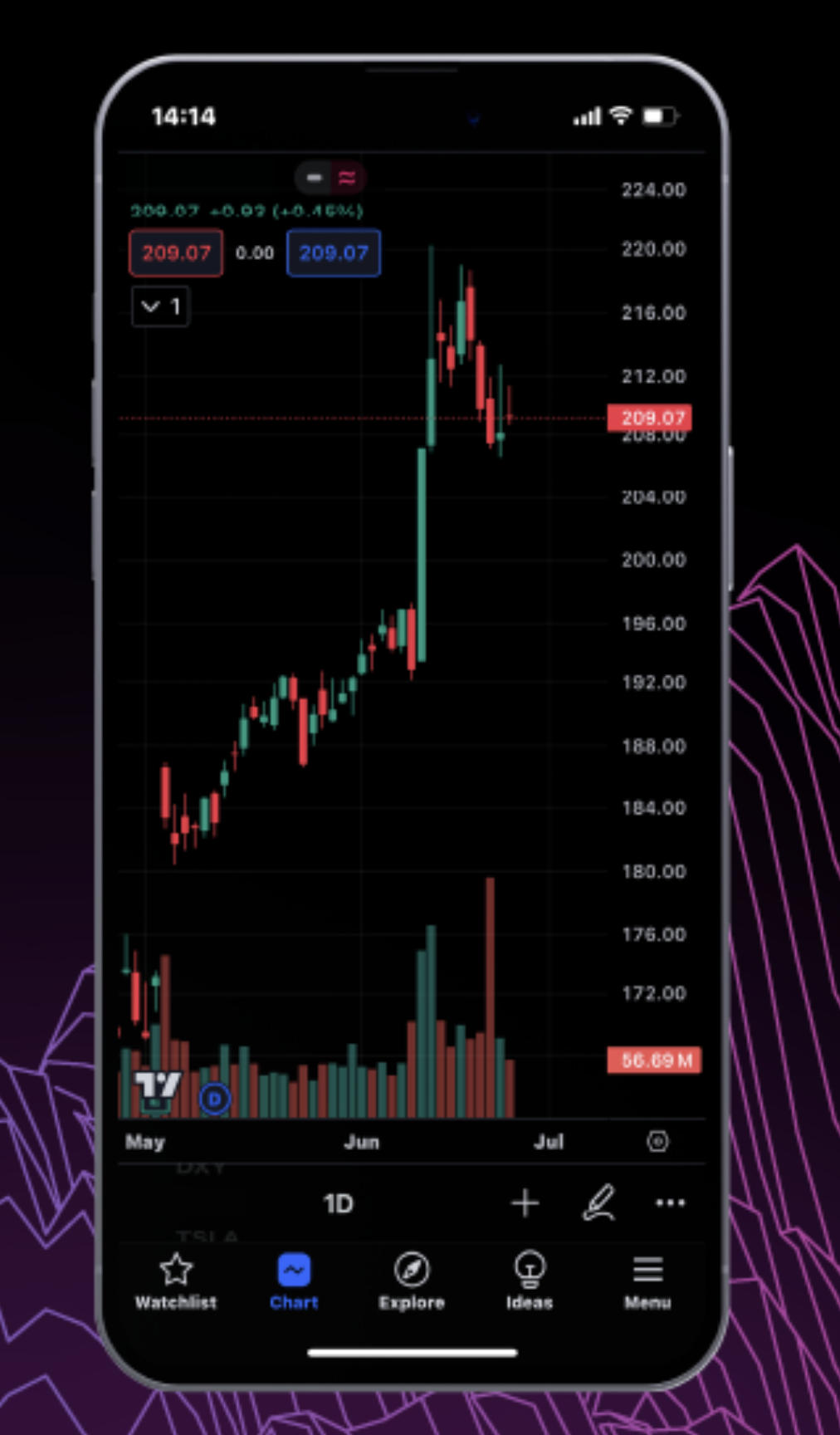

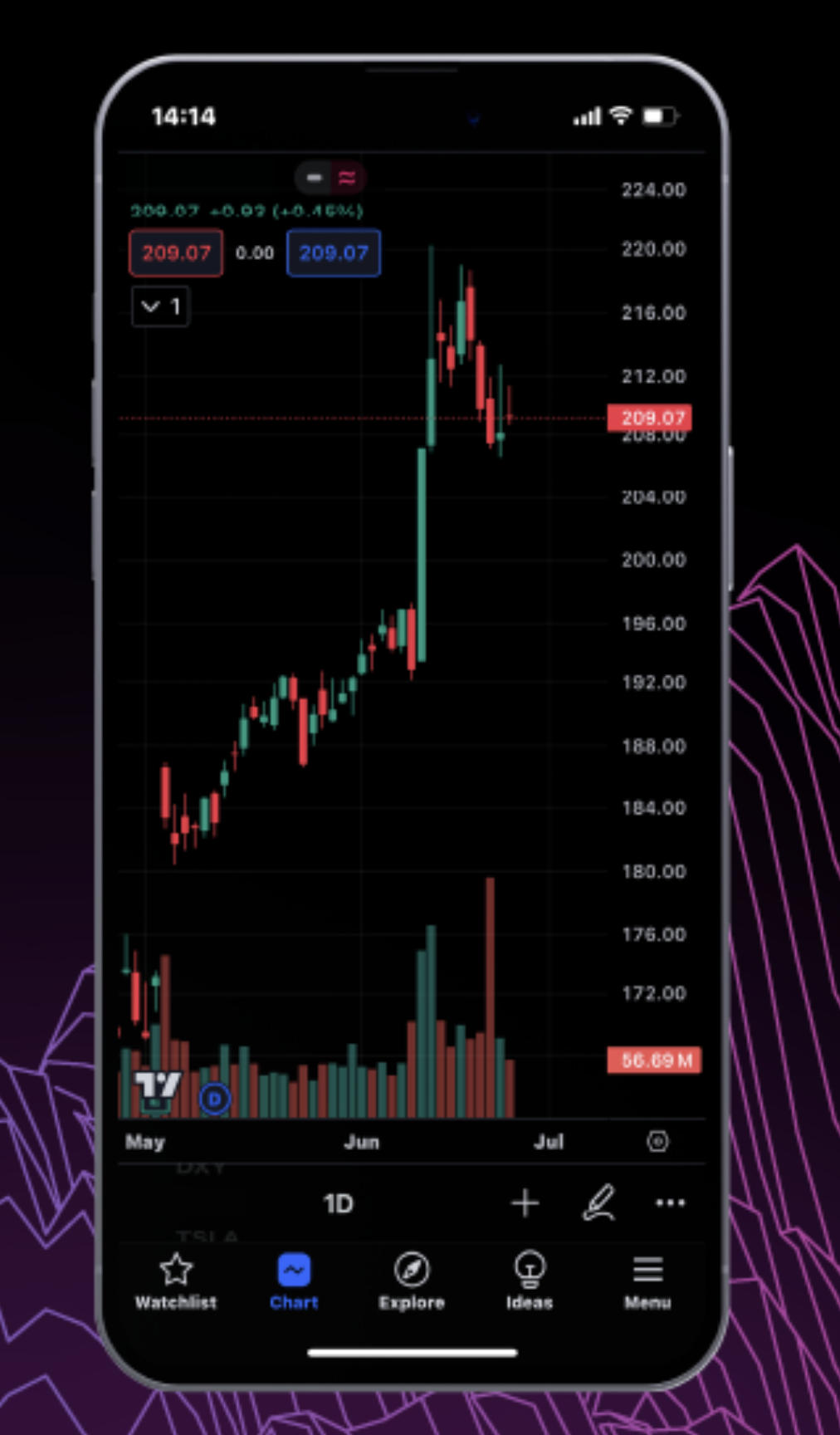

TradingView

Eightcap’s TradingView integration is one of its standout features. I connected my live account directly through TradingView and was able to trade straight from charts while using the platform’s professional-grade analytics and drawing tools.

The clean interface, interactive charts, and built-in social network made it easy to spot trade ideas and follow market trends. It’s perfect for visually oriented traders or anyone who prefers a modern web-based setup over MetaTrader’s traditional interface.

Copy Trading with Eightcap

Eightcap supports copy trading through several integrated third-party platforms, allowing traders to automatically replicate the strategies of experienced professionals. Using MetaTrader 4 and MetaTrader 5, you can connect to popular copy-trading services such as Signal Start or the MetaTrader Signals marketplace, where thousands of verified signal providers share their trades in real time.

VPS Hosting for Automated Trading

For traders who rely on automated strategies or Expert Advisors (EAs), Eightcap offers access to Virtual Private Server (VPS) hosting through several trusted partners. VPS hosting ensures your trading system runs continuously with low latency, even if your computer is turned off. This is crucial for maintaining consistent execution, especially for scalpers, algo traders, or high-frequency strategies.

Platform Stability and Execution

Across all platforms, Eightcap delivered low-latency execution and no platform downtime during testing. Orders were filled quickly, charts updated in real time, and I never experienced slippage beyond normal market conditions. While Eightcap doesn’t yet offer a proprietary web platform, its technical stability across MT4, MT5, and TradingView was consistently reliable.

Verdict

After extensive testing, I found Eightcap’s desktop trading experience to be efficient, intuitive, and highly stable. The combination of MetaTrader’s robustness and TradingView’s modern usability gives traders the best of both worlds. Even without a proprietary platform, Eightcap offers a professional and responsive setup that’s well-suited for everyone from casual traders to advanced algorithmic users.

Pros & Cons of the Web Platform

Pros

- Reliable execution across all platforms

- Full access to MT4, MT5, and TradingView

- One-click trading and automated strategy support

- FlashTrader EA enhances MT5 performance

Cons

- Outdated interface on MT4 compared to cTrader or modern web apps

- Platform access may vary by region (UK clients have TradingView only)

Mobile App

Eightcap gives traders full mobile access through the MT4, MT5, and TradingView apps, available on both iOS and Android. While the broker doesn’t yet have its own branded mobile platform, these three apps deliver everything you need for fast and efficient trading on the go. I tested each one to evaluate speed, usability, and stability — and found the experience consistently smooth across all devices.

MT4 Mobile Experience

The MetaTrader 4 mobile app offers a simple, reliable interface that’s perfect for quick trading and market monitoring. It runs smoothly on both iOS and Android, with real-time quotes, one-click trading, and customizable charts. In my testing, trades executed instantly and the app rarely lagged. While the interface feels a bit dated, it’s ideal for traders who prefer a no-frills, dependable setup.

MT5 Mobile

The MetaTrader 5 app adds more depth with advanced charting, additional indicators, and an integrated economic calendar. I found it noticeably faster than MT4, especially when managing multiple positions or switching between charts. Its multi-order management and improved trade history view make it a strong choice for active traders who need more control on mobile.

TradingView Mobile

The TradingView app stands out for its clean design, responsive charts, and social community features. I connected my Eightcap account easily and traded directly from the chart interface. The trendlines, drawing tools, and community insights make it perfect for traders who rely on technical analysis or want to follow shared market ideas. It’s modern, intuitive, and visually engaging.

Key Tools and Features

All three mobile apps include price alerts, interactive charting tools, trendlines, watchlists, and an economic calendar. They sync perfectly with the desktop versions, allowing you to start a trade on one device and manage it on another. During my testing, performance was stable, with no connection drops or order delays.

Verdict

Eightcap’s mobile trading experience is fast, flexible, and professional. While it doesn’t yet offer a proprietary app, the combination of MT4, MT5, and TradingView covers nearly every trader’s needs. Whether you prefer MetaTrader’s classic feel or TradingView’s modern interface, Eightcap’s mobile platforms deliver a powerful, well-rounded experience for trading anywhere, anytime.

Pros & Cons of the Mobile App

Pros

- Intuitive layouts with reliable execution

- Access to all order types and trading tools

- Excellent charting and customization

- Stable performance across platforms

Cons

- No proprietary mobile app yet

- Education and analytics not integrated

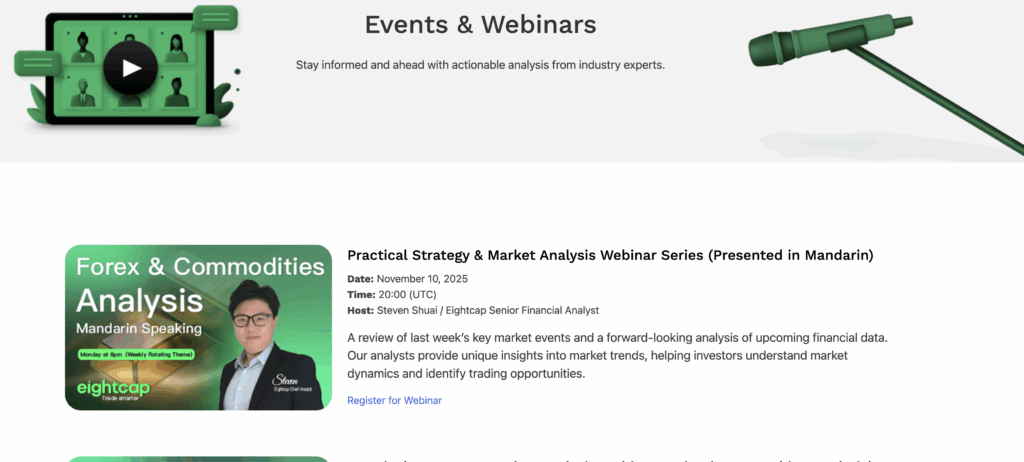

Market Research, Tools, and Education

The broker provides a growing set of research and trading resources that aim to support both new and experienced traders. While the offerings remain more limited than those of top-tier competitors, they cover the essentials and integrate well with the platforms.

The focus is on concise, actionable insights and smart tools rather than deep market analysis.

These features are helpful for short-term planning, though not as comprehensive as the research libraries at brokers like IG or CMC Markets.

Customer Support

Customer service plays a crucial role in a trader’s overall experience, and this broker delivers reliable and responsive assistance across several channels. Support is available 24 hours a day, five days a week, through live chat, email, and phone, ensuring that traders can reach help quickly during market hours.

Availability and Response Time

In testing, live chat proved to be the fastest option, with response times averaging under two minutes. The team was consistent in addressing questions accurately and professionally, from platform setup to account verification and withdrawal queries. Email replies usually arrived within a few hours, while phone support was efficient for more detailed discussions.

Multilingual Support

To accommodate traders from different regions, the support team offers multilingual assistance, including English and several other major languages. This accessibility is particularly beneficial for international clients who may prefer discussing technical topics in their native language.

Professionalism and Knowledge

All interactions during testing were polite and well-informed. Representatives demonstrated strong product knowledge and provided clear, step-by-step guidance when needed. The tone was professional but approachable, creating a positive and trustworthy impression throughout the conversation.

Limitations

The main drawback is the lack of weekend support, which could be inconvenient for traders who monitor markets or manage accounts outside of standard hours. However, since most financial markets are closed on weekends, this limitation is relatively minor.

Verdict

Overall, customer support is fast, professional, and reliable, with a team that understands both technical and account-related questions. Quick response times and multilingual service make it a dependable choice for traders who value efficiency and clear communication during their trading journey.

FAQ

Is Eightcap safe and reliable?

Yes. The broker is regulated by ASIC (Australia), FCA (UK), CySEC (EU), and SCB (Bahamas). These top-tier regulators ensure client fund protection through segregated accounts, regular audits, and strong compliance standards.

What is the minimum deposit to start trading?

The minimum deposit is $100, making it accessible to traders with smaller budgets. Deposits are free and can be made using bank transfers, cards, or e-wallets.

Does Eightcap offer a demo account?

Yes. You can open a free demo account on MT4, MT5, or TradingView. It allows you to practice trading in real market conditions using virtual funds, ideal for beginners testing strategies.

Is Eightcap good for beginners?

Yes. The broker’s simple account setup, low minimum deposit, and user-friendly platforms make it a great choice for new traders. Educational materials cover the basics, and the support team is helpful for first-time users.

Are my funds protected?

Yes. Client funds are kept in segregated trust accounts separate from company funds. Traders under the FCA and CySEC entities also benefit from compensation schemes of up to £85,000 and €20,000, respectively.

What trading platforms are available?

You can choose between MetaTrader 4, MetaTrader 5, and TradingView. Each platform supports full charting, automated trading, and mobile access.

What fees should I expect?

Eightcap charges no deposit or inactivity fees. Trading fees depend on the account type — Standard accounts have spreads from 1.0 pip, while Raw accounts charge a $3.50 commission per side with spreads from 0.0 pips.

Can I trade cryptocurrencies?

Yes. The broker offers over 200 crypto CFDs, one of the largest selections among regulated brokers. However, crypto CFDs are not available to UK retail clients due to local restrictions.

How fast are withdrawals processed?

Withdrawals are typically processed the same business day if requested before the daily cutoff. E-wallet and card withdrawals are usually completed within 24 hours, while bank transfers may take 1–3 business days.

Who is Eightcap best suited for?

Eightcap is ideal for beginners, traders with small budgets, and active traders who want tight spreads and reliable execution. It’s also suitable for crypto traders and anyone who values a regulated, low-cost trading environment.