eTORO REVIEW 2025

Discover whether eToro is the right broker for you. We cover its social trading features, fees, regulation, platforms, tradable assets, and customer experience—everything you need to know before opening an account.

Broker Guide's eToro Review in 2025

eToro, founded in 2007 in Tel Aviv, is a global multi-asset investment platform best known for pioneering social trading, allowing users to copy the strategies of experienced investors. Its mission is to make investing simple, transparent, and accessible to everyone, bridging the gap between beginners and professionals.

Today, eToro serves around 40 million registered users worldwide, with operations in more than 75 countries, offering thousands of instruments across stocks, ETFs, forex, commodities, cryptocurrencies, and CFDs.

The broker is backed by strong regulatory oversight, holding licenses from the FCA (UK), CySEC (Cyprus/EU), and ASIC (Australia), among others.

With over 3.6 million funded accounts and nearly $17 billion in assets under administration, eToro has grown into one of the most recognizable names in online trading. Its combination of traditional investing, innovative crypto services, and community-driven features makes it a leading choice for retail traders worldwide.

About eToro

eToro was founded in 2007 in Tel Aviv by Yoni Assia, Ronen Assia, and David Ring, with the vision of making trading more accessible to everyone. It began as a straightforward online brokerage focused on forex and CFDs but quickly evolved into a pioneer of social trading, where investors could follow and copy others’ strategies. Over time, eToro expanded into stocks, ETFs, commodities, and cryptocurrencies, transforming into a multi-asset platform that caters to both casual investors and active traders worldwide.

Business Model

The platform operates on a dual-model structure. On one side, eToro offers real assets such as stocks, ETFs, and select cryptocurrencies, where users buy and hold the actual instruments. On the other hand, it provides CFDs (Contracts for Difference), allowing leveraged trading across forex, indices, commodities, and cryptocurrency pairs. This flexibility gives investors the option to choose between long-term ownership or short-term speculative trading, depending on their goals and risk profile.

Key Features

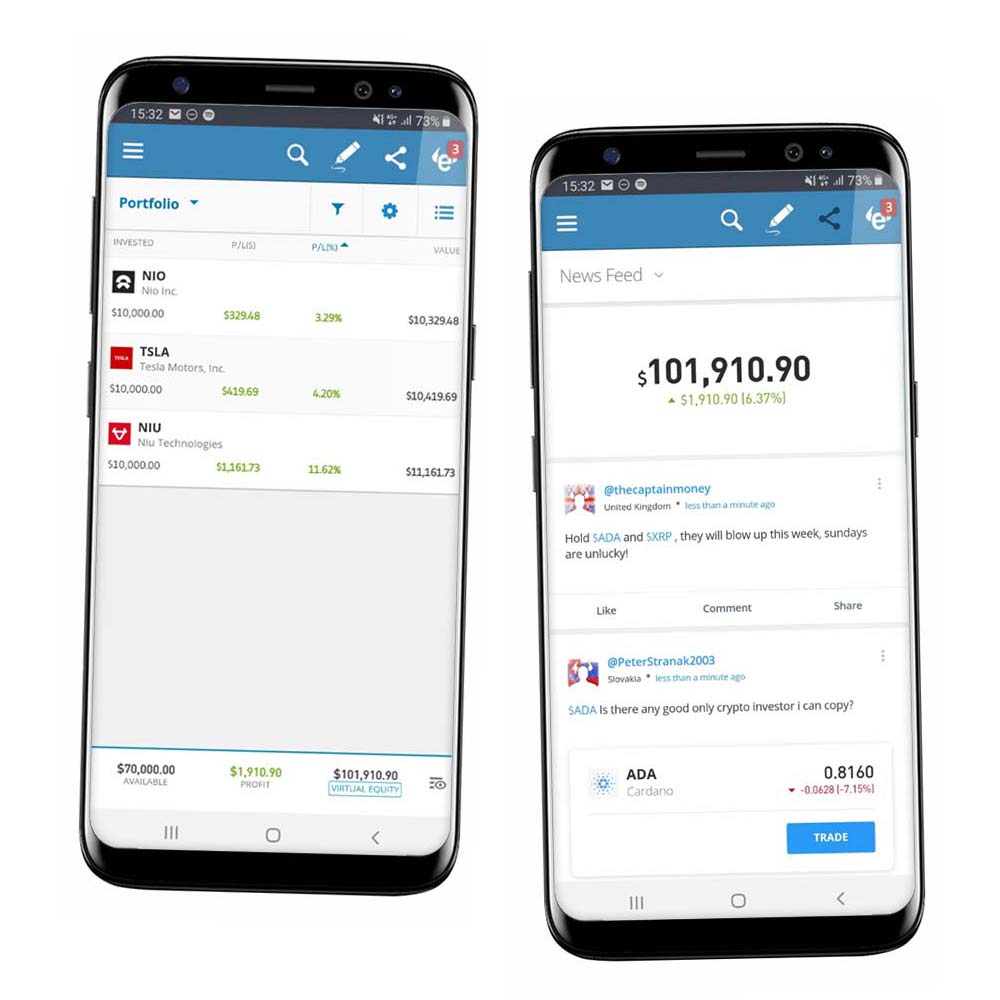

eToro is best known for its CopyTrader tool, which lets users automatically replicate the trades of experienced investors. For those looking for diversified strategies, Smart Portfolios offer curated, theme-based baskets of assets such as tech, renewable energy, or crypto. A demo account with virtual funds helps beginners practice risk-free, while features like interest on idle cash balances provide extra value for active account holders. Together, these tools create a platform that blends education, social engagement, and investing in a way few competitors match.

My Quick Verdict

eToro is one of the most beginner-friendly brokers in 2025, especially appealing to those who want an easy entry point into trading and investing. Its standout strength lies in social trading features like CopyTrader and Smart Portfolios, making it ideal for beginners who prefer to learn by following experienced traders, as well as for those who enjoy community-driven investing. The platform is intuitive, mobile-first, and offers access to a wide range of assets including stocks, ETFs, crypto, and forex.

However, readers should be aware that non-trading fees such as withdrawal charges, inactivity fees, and currency conversion costs can add up over time. Forex and CFD spreads are also not the lowest in the industry, making eToro less suitable for very active or cost-sensitive traders. Overall, eToro shines for ease of use, accessibility, and its unique social features, but those prioritizing ultra-low trading costs may want to compare alternatives.

Pros

- Ease of account opening & user-friendly platform – Setting up an account is fast and straightforward, and the platform is designed with beginners in mind.

- Unique social trading tools – eToro’s CopyTrader and Smart Portfolios make it easy to follow or mirror experienced traders, a major advantage for newcomers and community-driven investors.

- Wide asset selection – Trade and invest in a broad range of instruments, including stocks, ETFs, forex, cryptocurrencies, indices, and commodities, all from one account.

- Low stock & ETF commissions – In many regions, real stock and ETF investing comes with zero commission, making eToro competitive for casual investors.

Cons

- Non-trading fees – Withdrawal fees, inactivity charges, and currency conversion costs can reduce returns over time.

- Average forex & CFD spreads – Spreads on major pairs and CFDs are not the lowest in the market, which may discourage high-frequency or cost-sensitive traders.

- Customer support can be inconsistent – Response times vary, and some regions report delays or limited availability.

- Platform limitations – Fractional shares don’t come with voting rights, and investors cannot transfer stock positions to or from eToro.

Why You Should Choose eToro in 2025?

Social trading has become increasingly popular in recent years, and eToro remains the clear leader in this space. Its CopyTrader and Smart Portfolios allow users to mirror experienced traders or invest in ready-made thematic baskets. At the same time, the trend toward multi-asset brokers makes eToro’s offering particularly appealing. With access to stocks, ETFs, forex, cryptocurrencies, commodities, and indices under one account, investors no longer need to split funds across multiple platforms.

The platform has introduced interest on uninvested cash balances, offering up to 4.3% annually on idle USD funds. This feature is valuable for investors who prefer to wait for the right opportunity without losing potential earnings. eToro has also strengthened its regulatory framework, securing a MiCA permit under CySEC for crypto services across the EU, while also achieving SOC 2 Type II compliance for operational security. Combined with a solid financial position — including a $250 million revolving credit facility and nearly $740 million in cash reserves — these developments highlight eToro’s growing stability and reliability.

Another reason traders and investors may consider eToro in 2025 is the platform’s ongoing focus on feature expansion and accessibility. New tools such as recurring investments for stocks, ETFs, and cryptocurrencies, along with broader local market offerings and additional educational content, make it easier for users of all experience levels to engage.

Unique Selling Points

- CopyTrader & Smart Portfolios: Not just a gimmick — these tools are well-built and let users copy proven strategies or invest in thematic portfolios.

- Demo/Virtual Account Mode: Great for beginners or anyone testing strategies without financial risk.

- Interest on Cash Balance: Idle USD balances now earn competitive interest, turning downtime into earnings.

- Strong Regulation & Compliance: MiCA permit, SOC 2 Type II certification, and robust oversight across multiple jurisdictions.

- Growing Educational Resources & Tools: Expanded academy, webinars, AI-powered tools, and localized content.

What Types of Users Will Benefit Most

- Beginners who want a regulated, beginner-friendly platform with social trading tools and education.

- Occasional / Passive Investors looking for simple access to diversified portfolios across stocks, ETFs, and crypto.

- Investors with Idle Cash who can now earn meaningful interest while waiting to trade.

- Convenience-Seekers who value an intuitive mobile platform and easy account management.

Caveats / Who May Not Benefit as Much

- Cost-sensitive, high-volume traders may still find other brokers that beat eToro on spreads or commissions.

- In some regions, services may be restricted or some features unavailable (due to regulation).

- The “social / copy” model is great, but requires care: copied traders’ past performance is not a guarantee.

Compare to Top Competitors

When weighing eToro against other well-known brokers, it’s important to recognize both its unique strengths and where competitors may have an edge. While eToro dominates in social trading and beginner-friendly usability, other platforms excel in pricing, advanced tools, or market access. Here’s how three top competitors — XTB, Forex.com, and FP Markets — stack up against eToro in 2025.

XTB

Forex.com

FP Markets

Exploring eToro's Range of Tradable Instruments

eToro is widely recognized as a multi-asset broker, offering investors and traders access to a broad mix of financial instruments. Its product range is designed to serve beginners looking for long-term investments as well as traders interested in short-term opportunities. Below is a breakdown of what eToro offers in 2025, along with how it compares to competitors.

Stocks and ETFs

eToro gives users access to 3,000+ real stocks from major global exchanges, including the NYSE, NASDAQ, London Stock Exchange, and other European and international markets. This makes it a strong choice for investors who want geographic diversification in their portfolios. On top of that, eToro supports fractional share investing, allowing users to buy a portion of high-priced stocks such as Tesla or Amazon with a low minimum. ETFs are also available, covering sectors, indices, and themes — useful for passive or diversified investing.

Cryptocurrencies

One of eToro’s standout features is its large cryptocurrency offering, with more than 70 coins available. This includes popular options like Bitcoin, Ethereum, and XRP, along with smaller altcoins for more speculative opportunities. Users can either buy the real crypto asset (and withdraw it to the eToro Money wallet in supported regions) or trade them via CFDs depending on local regulations. This dual setup makes eToro especially attractive for traders who want both investment ownership and leveraged trading options.

Forex

eToro supports a solid list of forex pairs — covering majors, minors, and some exotics. While not as extensive as some specialist forex brokers, it still offers 40+ currency pairs, giving plenty of choice for retail traders. However, spreads can be slightly wider compared to forex-focused competitors like FP Markets or XTB, which could be a consideration for cost-conscious day traders.

Indices and Commodities

Beyond stocks and currencies, eToro gives traders access to global indices such as the S&P 500, NASDAQ 100, FTSE 100, and DAX, along with commodities including gold, silver, oil, and natural gas. These instruments are generally available as CFDs, allowing flexible speculation without owning the underlying asset. This adds portfolio diversification for traders who want exposure outside of equities and forex.

Options (Region-Specific)

In some jurisdictions, eToro has been gradually expanding into options trading, though this is not yet globally available. Where accessible, it gives traders additional flexibility to hedge or speculate, though it remains a secondary feature compared to stocks, ETFs, and crypto.

| Asset | eToro |

|---|---|

| Forex Pairs | 55 |

| Tradeable Symbols | 5461 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Cryptocurrency (Physical & Derivative) | Physical: Yes |

| Social Trading / Copy Trading | Yes |

Real Assets vs CFDs

A core distinction on eToro is between real assets and CFDs:

- Real assets: Stocks, ETFs, and many cryptocurrencies are directly owned by the investor. For example, buying Apple shares means you actually hold Apple stock.

- CFDs: Used for leveraged speculation on price movements in forex, indices, commodities, and some crypto. You don’t own the underlying asset but can profit from both rising and falling prices.

This setup gives traders the flexibility to choose between long-term investing and short-term leveraged trading, all on the same platform.

How eToro Compares

Compared to other brokers, eToro shines in its breadth of asset classes combined with its user-friendly access to both real assets and CFDs. Competitors like XTB and Forex.com tend to focus more on forex and CFD trading, with limited real stock or crypto access. Meanwhile, FP Markets offers professional-grade forex trading and low spreads but lacks eToro’s wide crypto offering and social trading features.

In short, while eToro may not always be the cheapest on spreads, its multi-asset coverage, fractional investing, and unique social features make it a top choice for investors and traders who value variety and accessibility.

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $50 |

| Average Spread EUR/USD (Standard) | 1.0 pips |

All-in Cost EUR/USD - Active | Not Available |

| Cryptocurrency Trading | 1% flat rate commission |

Index CFD fees | Average |

Stock CFD fees | Low |

| Deposit Fees | $0 |

| Withdrawal Fees | $5 |

| Inactivity Fee | $10 per month after 12 months of inactivity |

eToro’s pricing model is designed to be simple and beginner-friendly, but it’s important to understand all the individual charges that make up its fee structure. The broker primarily relies on spreads for revenue, with additional costs on specific transactions and account activities. Below is a detailed breakdown of the main fees traders can expect in 2025.

Spreads

Most of eToro’s trading costs come from variable spreads, which represent the difference between the buy and sell price of an asset. On major forex pairs like EUR/USD, the average spread is around 1 pip, which is higher than what low-cost brokers such as FP Markets (as low as 0.0 pips + commission) or XTB typically offer.

While this makes eToro less appealing for high-frequency traders who prioritize razor-thin spreads, the platform was never designed to compete solely on pricing. Instead, people choose eToro for its social trading ecosystem and CopyTrader feature, which adds value beyond the raw spread costs.

Overnight Fees (Swaps)

Traders holding leveraged CFD positions overnight incur overnight financing charges. These vary by asset, leverage, and market conditions. For example:

Forex CFDs: typically around $0.00001–$0.00003 of the notional value per night, depending on the pair.

Non-leveraged positions on real stocks and ETFs are not subject to overnight financing costs, which is a key advantage for long-term investors.

Currency Conversion Fees

Since all eToro accounts are denominated in USD, any deposits or withdrawals in other currencies are subject to a currency conversion fee. These start from 150 pips depending on the currency and payment method. For non-USD users, this is one of the more significant costs to consider.

Withdrawal Fees

eToro applies a flat $5 withdrawal fee, regardless of the amount withdrawn. While this is not excessive, it does stand out compared to brokers like XTB, which often charge no withdrawal fees. Processing times usually take 1–5 business days, depending on the payment provider.

Inactivity Fees

If an account remains inactive for 12 months, eToro charges a $10 monthly inactivity fee. This is deducted from the available balance and does not affect open positions. While avoidable, it can reduce funds for users who leave accounts dormant.

Slippage and Minimum Trade Sizes

Like all brokers, eToro is subject to slippage, particularly during times of low liquidity or high volatility, such as major news events. This can result in execution prices being slightly different from expected. In terms of accessibility, eToro keeps things beginner-friendly with low minimum trade sizes (as little as $10 for stocks and ETFs, and $200 for copy trading portfolios). While this lowers barriers for new investors, it may not appeal to advanced traders who value raw pricing and faster execution

Final Thoughts on Costs

eToro is not the cheapest broker on the market, especially when it comes to spreads on forex and CFDs, as well as currency conversion and withdrawal fees. However, for long-term stock and ETF investors, the zero-commission structure makes it highly attractive, and its transparency ensures that traders know exactly what they’re paying. In short, while cost-conscious scalpers or professional forex traders may find better pricing elsewhere, eToro’s fee structure balances accessibility and simplicity, making it well-suited for beginners and social traders who prioritize convenience over rock-bottom costs.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Forex.com Regulated ?

When choosing a broker, regulation is one of the most important factors to consider. eToro operates under a multi-jurisdictional regulatory framework, giving clients reassurance that their funds and trades are overseen by respected financial authorities worldwide.

Global Regulatory Coverage

eToro is regulated by several top-tier financial watchdogs, including:

- FCA (UK) – ensuring strong oversight and access to the FSCS compensation scheme, covering eligible clients up to £85,000.

- CySEC (Cyprus) – providing EU-wide passporting and compliance with ESMA standards.

- ASIC (Australia) – adding further investor protection under strict Australian financial laws.

- FinCEN (US) – overseeing eToro’s crypto and securities operations in the United States.

This broad regulatory reach means that clients are protected differently depending on their region, but all benefit from clear standards of transparency, client fund segregation, and operational oversight.

Public Company Status – NASDAQ Listing in 2025

In 2025, eToro successfully completed its IPO on the NASDAQ, becoming a publicly traded company. This not only boosts its financial transparency—since it must now publish audited financial reports—but also enhances its stability and reputation in a competitive broker landscape. For traders, this milestone strengthens confidence that eToro is here for the long haul.

Investor Protections by Region

Depending on where you register your account, you may have access to different investor protection schemes:

- United Kingdom – FSCS protection up to £85,000.

- European Union – ICF protection under CySEC, up to €20,000.

- United States – Eligible securities accounts may fall under SIPC protection up to $500,000, though this does not apply to crypto or CFD trading.

- Australia and Other Regions – While compensation schemes may be more limited, regulatory oversight from ASIC ensures compliance with best practices.

Risks and Limitations

Despite its strong regulatory position, there are some important risks to consider:

- CFDs remain high-risk products with leverage that can amplify both gains and losses.

- Crypto assets offered on eToro are less consistently regulated, and protections may not extend to digital currencies in the same way as stocks or ETFs.

- Investor compensation schemes vary by region, so it’s important to understand what coverage applies to your specific account.

eToro stands out as a well-regulated, publicly listed broker, offering strong stability and oversight compared to many competitors. However, traders must remain aware of the risks tied to crypto volatility and leveraged CFDs, where protections may be limited

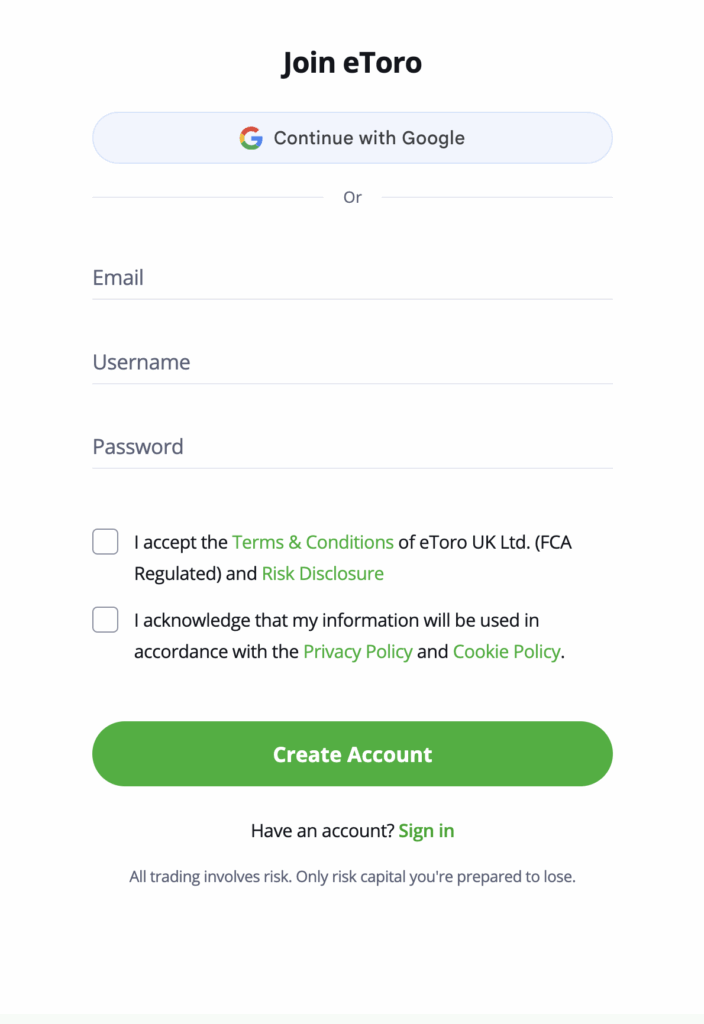

How To Open an Account

Opening an account with eToro is designed to be quick and beginner-friendly, making it accessible to traders across different experience levels. The process is fully digital and can often be completed within a single day, provided that all documents are submitted correctly.

Registration

- Start by visiting eToro’s website or mobile app and clicking “Join eToro.”

- Enter your personal details including email, username, and create a secure password.

* Alternatively, you can register using your Google account.

KYC (Know Your Customer) Verification

eToro is a regulated broker and requires compliance with anti-money laundering (AML) laws.

You’ll need to provide:

- Proof of identity (e.g., passport, driver’s license, or government-issued ID).

- Proof of address (e.g., utility bill, bank statement, or official government correspondence not older than 3 months).

Deposit Funds

Once verified, you can make your first deposit using supported payment methods (credit/debit card, bank transfer, PayPal, Skrill, etc.). Deposits are typically instant for cards and e-wallets, while bank transfers may take a few days.

How Long Does It Take?

Most eToro accounts are verified within 24 hours if documents are clear and valid. In some cases, manual reviews or regional compliance requirements may extend this timeframe, but the overall process is faster compared to many traditional brokers.

Opening an eToro account is fast, fully online, and straightforward. With verification often completed in a single day, new traders can quickly move from sign-up to their first trade with minimal hassle.

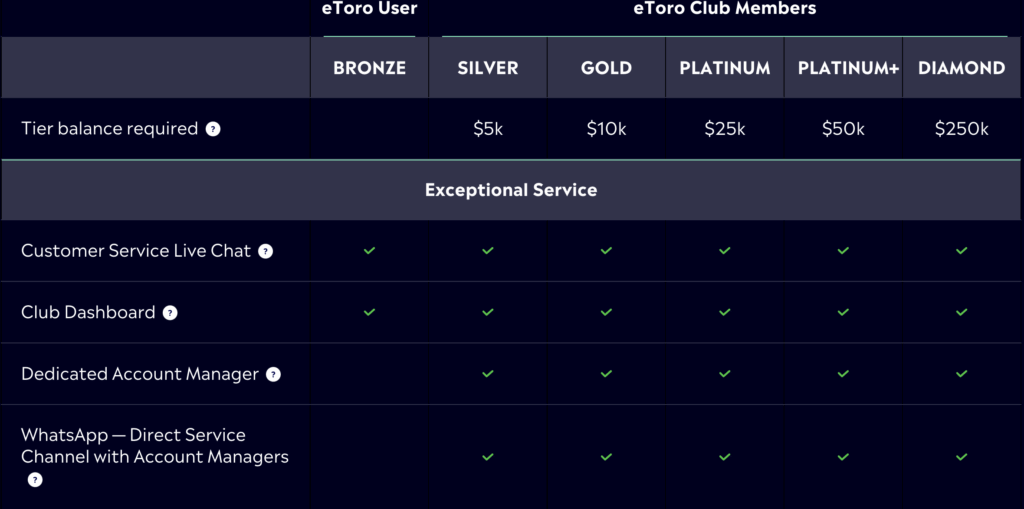

Account Types

When I opened an account with eToro, I noticed right away that they keep things simple but flexible. There aren’t dozens of account tiers to choose from like some brokers—just two core options that cover most traders’ needs.

Live Account (Real Money)

The Live account is the standard option for trading with real funds. Once I completed verification and made my first deposit, I was able to access the full range of assets, from stocks and ETFs to crypto and forex. This is the account most users will trade with day to day.

Demo Account (Virtual Trading)

Before risking any money, I tested strategies using eToro’s Demo account, which comes pre-loaded with $100,000 in virtual funds. The demo mirrors the live platform exactly, so it’s ideal for beginners learning the ropes or for experienced traders experimenting with new strategies without risk.

eToro Club Tiers (VIP Program)

In addition to the standard Live and Demo accounts, eToro offers a VIP-style membership program called the eToro Club. This tiered system rewards traders based on their account equity, unlocking exclusive perks the higher you go.

It’s designed for active or high-balance investors who want reduced fees, premium services, and VIP treatment. Each tier offering benefits like:

Lower withdrawal and deposit fees

Access to private market signals and research

Priority customer support

Invitations to exclusive events

What is the Minimum Deposit at eToro?

eToro keeps the entry barrier relatively low, making it accessible to beginners as well as more experienced traders. The general minimum deposit is $50 in most countries when funding by debit/credit card, PayPal, or other instant payment methods. However, this amount can vary depending on your region and funding option.

- United States: $1 minimum deposit.

- UK: $10

- Most countries: $50 minimum deposit.

- Wire transfers: $500

| Broker | Minimum Deposit |

|---|---|

eToro | $50 |

XTB | $0 |

| Forex.com | $100 |

| FP Markets | $100 |

Bottom line: With minimum deposits as low as $1 and $10 in the US and UK, eToro is one of the more beginner-friendly brokers. That said, check your local requirements before signing up, since deposit rules vary by region and payment method.

Deposit and Withdrawal

The broker does not charge deposit fees regardless of the method used. Traders can fund their accounts with credit/debit cards, PayPal, Skrill, Neteller, or bank transfers without extra charges from the broker.

That said, some banks or card issuers may add their own charges, particularly on international transactions. Bank transfers can take longer—up to 3–5 business days—while cards and e-wallets are usually instant.

Minimum deposit requirements vary (as covered earlier), with the lowest thresholds available in the US ($1) and UK ($10), while many other regions require $50–$200.

Withdrawal Fees & Options

Unlike deposits, eToro does apply a flat withdrawal fee of $5 per transaction. The minimum withdrawal amount is $30, which means smaller amounts cannot be withdrawn.

Withdrawals are usually processed within 1–3 business days, though the actual time until funds appear depends on the method:

Deposits are free and straightforward, with plenty of options across regions. Withdrawals, however, come with a $5 fee and USD-only processing, which can add costs for non-USD traders. eToro is convenient for funding, but withdrawal fees and delays are worth factoring in if you trade actively.

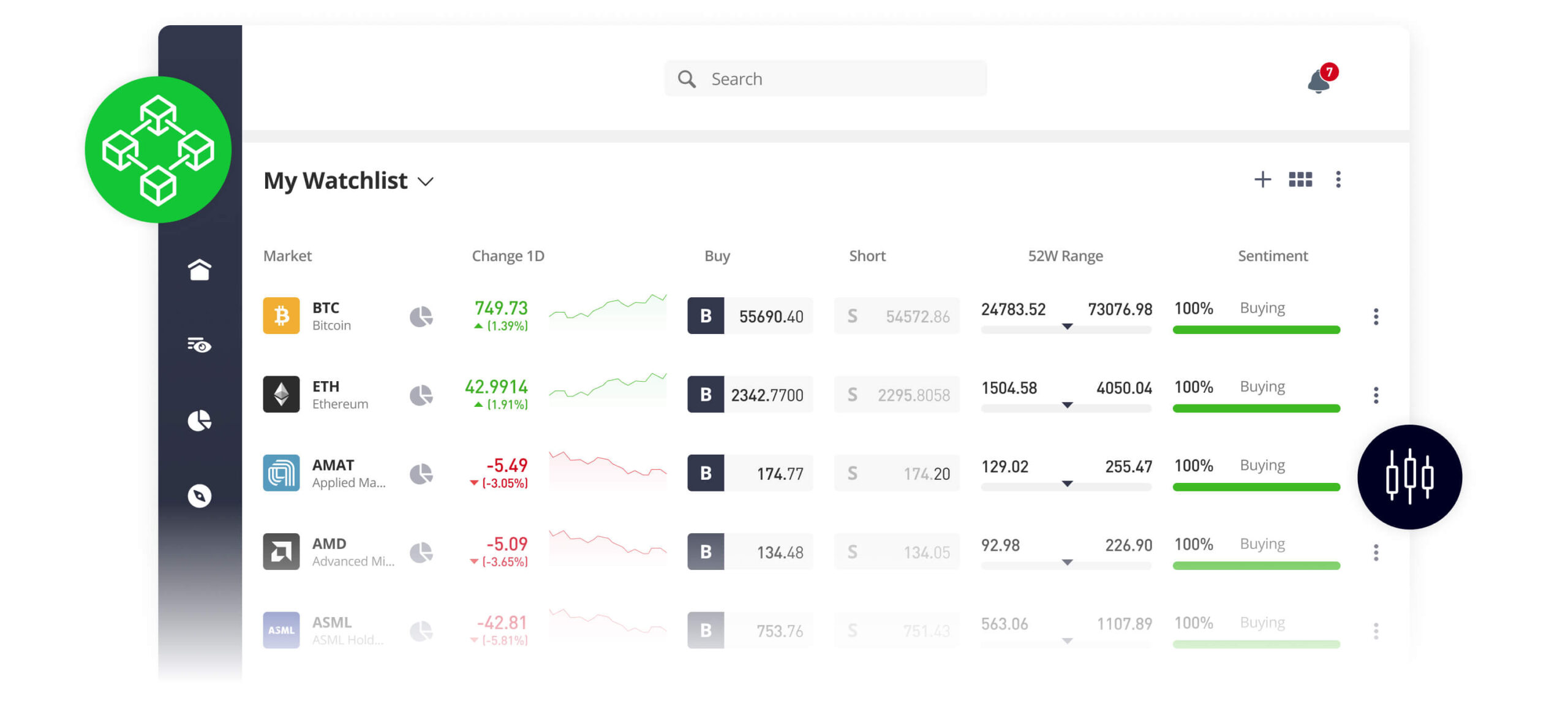

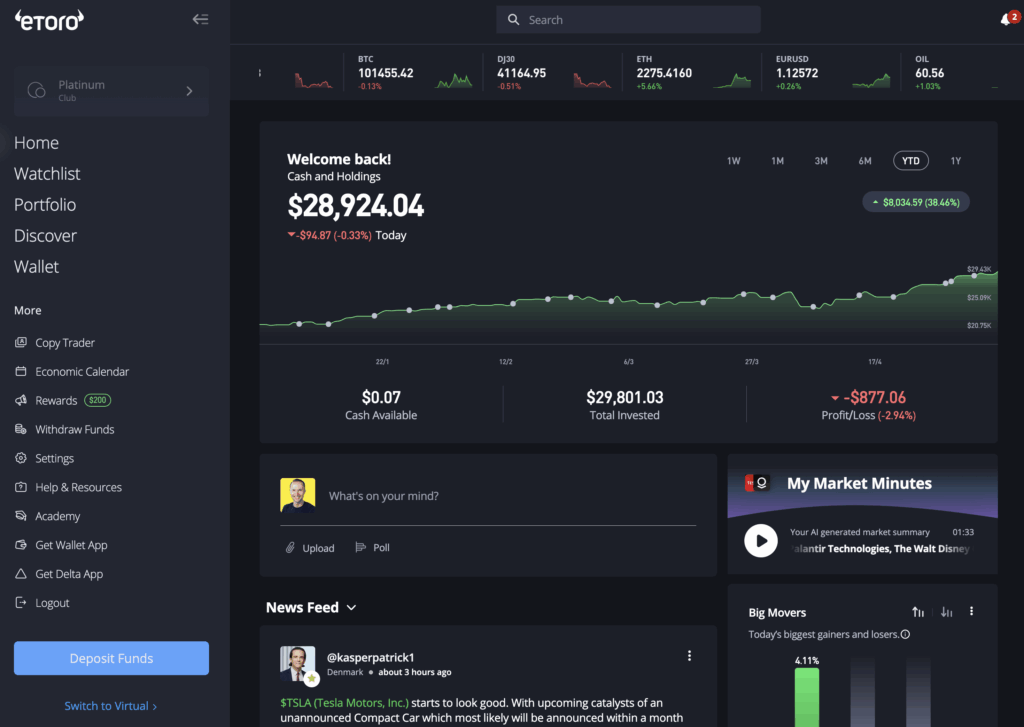

Desktop Trading Platform

When I tested eToro’s desktop trading platform, the first thing that stood out was its clean and modern layout. It’s clearly designed with usability in mind, which makes it approachable for beginners while still offering enough depth for more experienced traders.

Features and Functionality

Charting

The platform’s charting tools are intuitive but not overly advanced compared to specialist platforms like MetaTrader or TradingView. I was able to switch between multiple chart types (candlesticks, bars, line), apply dozens of indicators, and even use drawing tools for technical analysis. For everyday charting, it’s more than enough, but power users may find the customisation options limited.

Market Analysis Tools

Market sentiment plays a big role on eToro, and I found the community-driven insights integrated directly into the platform useful. Each asset page shows buy/sell percentages, analyst ratings, and fundamental metrics like P/E ratios for stocks. It feels like a blend of social feed and research hub, which is different from the traditional broker approach.

Real-time Information

Prices update smoothly with real-time streaming quotes. I tested opening and closing positions on forex and stocks, and execution was fast, with no noticeable lag. Market depth isn’t as detailed as on professional platforms, but for retail traders, the data feels reliable.

Research Integration

One thing I appreciated was the integration of third-party research alongside eToro’s own analysis. For example, when checking Tesla stock, I could see professional analyst ratings, hedge fund activity, and even insider trading sentiment. This makes it easy to combine market data with external perspectives in one place.

eToro also offers Trading Central, but it’s not available to everyone—it’s reserved for eToro Club members who reach certain tier levels. On top of that, funded account holders gain access to stock research reports, which add an institutional-grade layer of analysis.

What really stood out to me is that eToro was one of the first brokers to integrate TipRanks, a leading resource for stock research and broader asset class coverage beyond forex. Having TipRanks inside the platform makes it simple to check analyst consensus, target prices, and hedge fund sentiment without leaving eToro.

Educational Content Integration

As I browsed through assets, I noticed eToro also surfaces educational explainers and guides. For beginners, this helps bridge the gap between just looking at a chart and actually understanding what’s driving the price. It’s not as advanced as a full learning academy, but the contextual integration is useful.

Placing Orders

Placing a trade on eToro’s desktop platform felt smooth and beginner-friendly, but with enough flexibility for more advanced use. The order ticket is cleanly laid out, and I was able to go from search to execution in just a few clicks. Here’s how it works in practice:

- Select an asset and hit the “Trade” button.

- Choose whether to Buy (long) or Sell (short).

- Enter the amount in dollars (not lots), which makes it simpler for beginners to size positions.

- Set Stop Loss and Take Profit levels either as dollar amounts or percentages.

- Adjust leverage (where available) if trading CFDs.

- Preview the trade, then click “Open Trade” to execute instantly, or set it as a pending order with your chosen entry price.

I found it easy to modify trades after execution—dragging stop-loss and take-profit lines directly on the chart was a big plus. For stock and ETF investing, there’s also the option to buy the real underlying asset with no leverage, making eToro feel more like a hybrid between a broker and an investment app

Alerts & Notifications

I was able to set price alerts for key assets, and the notifications popped up instantly both on the platform and via email. For active traders, this feature helps keep track of movements without staring at the screen all day.

Login and Security

Logging in felt secure. eToro supports two-factor authentication (2FA), and I enabled it via my phone for extra protection. Sessions time out automatically if idle, which adds another security layer.

Search Functions

The search bar is one of my favourite parts of the desktop platform. I could type in a company name, ticker symbol, or even a keyword like “tech,” and it instantly suggested relevant stocks, ETFs, and even other traders to copy. It’s faster and smarter than many platforms I’ve used.

Pros & Cons of the Web Platform

Pros

- User-friendly interface – Clean, modern layout makes it easy to navigate even for beginners.

- Fractional investing – Buy stocks or ETFs from as little as $10, ideal for small accounts.

- Integrated research – Analyst ratings, TipRanks data, and stock reports available directly on the platform.

- Social trading features – Community sentiment, CopyTrader, and Smart Portfolios embedded into the platform.

- Smooth order execution – Fast trade placement with drag-and-drop stop-loss and take-profit adjustments.

- Secure login – 2FA and auto timeouts add an extra layer of protection.

Cons

- Limited advanced charting – Fewer technical indicators and customization options compared to MT4, MT5, or TradingView.

- No downloadable software – Web-based only; some professional traders prefer standalone desktop platforms.

- Execution depth – Market depth and order book views aren’t as detailed as on institutional platforms.

- Heavy reliance on USD – All accounts are in USD, so traders from other regions may face conversion costs.

eToro’s web platform is perfect for beginners and social traders who value usability and research integration, but advanced or algorithmic traders may find it lacking compared to specialist platforms.

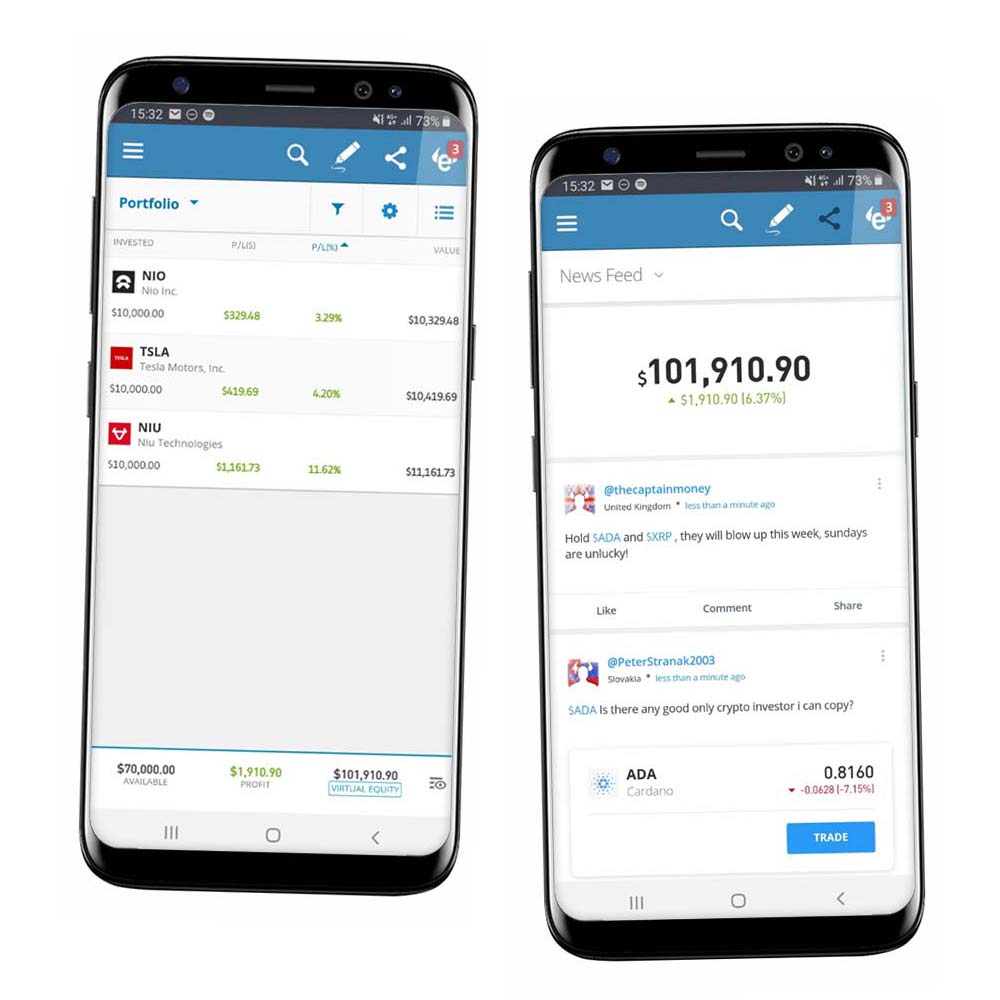

Mobile App

I use the mobile app daily for quick checks and fast entries. It feels smooth, loads charts quickly, and keeps watchlists in sync with desktop. Research, news, and the calendar are a tap away, so I can act without switching apps.

Look & Feel and Features

The eToro mobile app mirrors the web platform’s clean and modern design, making it intuitive even for first-time users. Navigation is smooth, with tabs for Watchlists, Portfolio, Discover, and Social Feed always just a tap away. I found it easy to switch between monitoring markets, reading community insights, and placing trades, all within a single streamlined app.

Login and Security

Logging in is straightforward with email and password, and I was able to enable biometric login (fingerprint/Face ID) for quicker access. The app also supports two-factor authentication (2FA), which added reassurance whenever I logged in or attempted withdrawals.

Search Functions

The search bar is prominent and responsive, letting me find assets by name or ticker symbol instantly. Results are categorized by asset class (stocks, crypto, forex, ETFs, commodities), and tapping on an asset immediately opens its chart, stats, and trading options.

Placing Orders

Placing trades on the app felt just as smooth as on the web platform:

Select the asset from Watchlist, Portfolio, or Search.

Tap “Trade” to open the order ticket.

Enter amount (supports fractional investing).

Set Stop-Loss, Take-Profit, and leverage level directly from the same screen.

Confirm trade with a swipe or tap.

Execution was fast, and the order screen clearly showed fees and exposure before I confirmed, which is very beginner-friendly.

Pros & Cons of the Mobile App

Pros

- Sleek, user-friendly design that mirrors the web platform.

- Supports fractional investing and quick order execution.

- Biometric login (Face ID/fingerprint) plus 2FA for strong security.

- Integrated social feed for copy trading and community insights.

- Search is fast, accurate, and organized by asset class.

Cons

- Advanced charting features are more limited than on desktop.

- No customizable layout or multi-window trading view.

- Can feel cluttered when switching between trading and social features.

- Some research tools (e.g., Trading Central, TipRanks) are easier to use on desktop.

eToro’s mobile app shines for everyday traders who want a seamless, social-driven trading experience on the go. While it lacks the depth of advanced charting and customization found on desktop platforms, its sleek design, intuitive order placement, and strong security make it one of the best options for casual and copy traders in 2025.

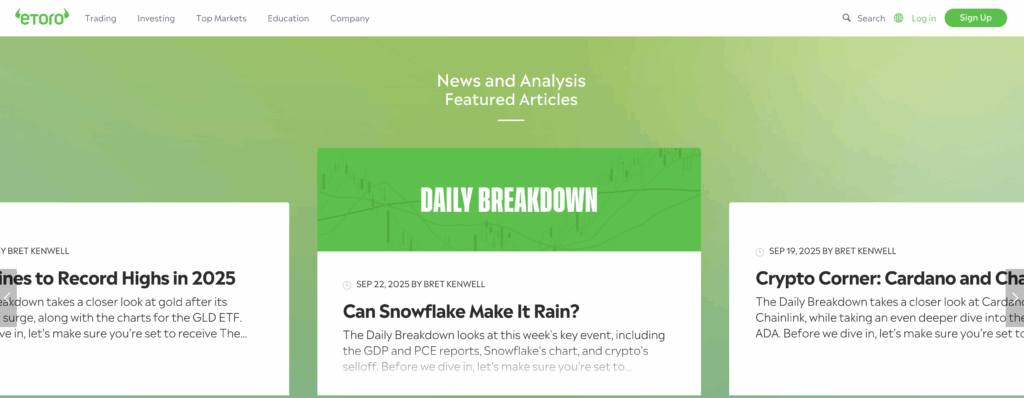

Market Research, Tools, and Education

Staying ahead in trading requires more than just access to markets—it depends on the quality of research, analysis tools, and educational resources a broker provides. eToro positions itself as more than just a trading platform by combining market insights, third-party research integrations, and learning materials designed to support both beginners and experienced traders. In this section, we explore how eToro equips its users to make informed decisions and how its resources compare to those of traditional brokers.

On top of this, Trading Central is available, but only for higher-tier eToro Club members, giving them access to advanced technical analysis and market insights. While the research coverage is broad, it leans more towards stocks and general market sentiment than deep forex or commodity analysis.

Market sentiment indicators show what percentage of eToro’s community is buying or selling a particular asset, which ties directly into the broker’s social trading ethos. There are also built-in economic calendars, earnings reports, and market news feeds to keep traders updated in real time. Together, these tools make eToro better suited for social investors and multi-asset traders, rather than hardcore technical analysts who need advanced strategy-building tools.

Customer Support

Availability and Channels

eToro provides 24/5 customer support, accessible through live chat, support tickets, and email. Unlike some top competitors, the broker does not currently offer direct phone support, which may be a drawback for traders who prefer voice interaction.

Response Times

In my testing, live chat proved responsive, though wait times can vary depending on traffic. Some traders report that response quality and speed are not always consistent across regions, with delays more common during peak trading hours.

Languages Supported

Support is available in multiple languages, including English, Spanish, German, French, Italian, Mandarin, and Japanese, catering to its diverse international client base. This multilingual coverage is a strong point for eToro, especially for new traders who prefer native-language assistance.

Help Center and Self-Service

The eToro Help Center is well-structured, with FAQs, guides, and troubleshooting resources covering account setup, fees, deposits/withdrawals, and trading features. For many queries, users can find solutions without needing to contact an agent.

Verdict

eToro’s customer support is adequate but not outstanding. The multilingual coverage and live chat availability are positives, but the lack of phone support and occasional delays can frustrate some users. Overall, support is functional and reliable enough for most traders, but those who demand round-the-clock, highly responsive service may find eToro less competitive compared to certain rivals.

FAQ

Is social trading a good strategy for beginners?

Yes, social trading can help beginners learn by observing experienced investors’ strategies. On eToro, the CopyTrader feature makes this especially accessible, but it should be paired with personal research.

What is the minimum deposit required to start trading?

The minimum deposit depends on the broker and region. On eToro, it generally starts at $50 in the U.S. and U.K., though it may be higher in some countries.

How do brokers make money if they don’t charge commissions?

Most commission-free brokers earn revenue through spreads, overnight financing (swap fees), and conversion charges. eToro follows this model, meaning you don’t pay commissions on stocks, but you may face spreads and non-trading fees.

Can I trade real stocks or only CFDs?

On eToro, traders can access both real stocks and ETFs (commission-free in many regions) as well as CFDs on forex, indices, and commodities. This mix makes it suitable for both long-term investors and short-term traders.

How safe is my money with online brokers?

Safety depends on regulation. Choosing a broker licensed by top-tier regulators such as the FCA, ASIC, or CySEC provides strong protection and compensation schemes.

What are the risks of trading cryptocurrencies on brokers?

Crypto is highly volatile, and depending on the jurisdiction, it may not be covered by investor protection schemes. This is true for eToro too, where crypto CFDs are high risk and not available in all regions.

How fast can I open and verify a trading account?

Most brokers now offer quick onboarding, often within 1 business day. On eToro, the process is usually fast if your documents are uploaded correctly.

Are mobile trading apps as good as desktop platforms?

Mobile apps are optimized for ease of use and convenience, making them excellent for monitoring and quick trades. Desktop platforms, however, usually provide more advanced charting and analysis.

What fees should I watch out for besides spreads?

Traders should be aware of withdrawal fees, inactivity charges, overnight financing costs, and currency conversion fees, which can add up over time

Can I practice trading before using real money?

Yes, most brokers offer a demo account with virtual funds. eToro provides a free $100,000 virtual portfolio so users can test strategies before going live.