FXCM REVIEW 2025

Thinking about trading with FXCM in 2025? In this review, we break down its fees, platforms, account types, regulation, and how it stacks up against rivals like Forex.com, Pepperstone, and FP Markets—so you know exactly if it’s the right broker for you.

Broker Guide's FXCM Review in 2025

If you’ve been around the forex and CFD trading world for a while, you’ve probably heard the name FXCM. With over 25 years in the industry, this broker has built a global presence that extends across multiple regions—and it’s especially recognized for its strong focus on algorithmic trading and advanced trading technology. But longevity alone doesn’t always mean reliability.

In this review, we’ll take an unbiased look at where the broker stands today. We’ll cover regulation, safety, and whether the platform is a solid choice for both beginners and experienced traders.

Expect a clear breakdown of its pros and cons, its trading platforms, and the overall trading experience. Hopefully, by the end, you’ll know whether FXCM is a safe and worthwhile option for your trading journey.

About FXCM

FXCM (Forex Capital Markets) was founded in 1999 and is headquartered in London. It is a subsidiary of the Jefferies Financial Group, a Fortune 500 company listed on the NYSE, which gives it strong financial backing.

The broker has a global presence with offices in London, Australia, South Africa, and Cyprus. It is regulated by several well-known authorities, including the FCA in the UK, ASIC in Australia, FSCA in South Africa, CySEC in Cyprus, and CIRO in Canada. This kind of multi-regulation gives traders higher levels of security and transparency.

The broker operates under a market maker model. What makes it stand out is its focus on algorithmic trading and the variety of trading platforms it offers. Traders can access different markets such as forex, CFDs on indices, commodities, shares, and cryptocurrencies, which allows for a well-rounded portfolio.

My Quick Verdict: Who is FXCM Best For?

After testing FXCM, I was impressed by how well it balances simplicity for beginners with powerful tools for more advanced traders. The broker’s focus on algorithmic trading is a real highlight, and its platform variety gives you flexibility whether you prefer manual setups or fully automated strategies. I also found the educational resources to be practical and beginner-friendly, but still detailed enough for traders moving into more complex strategies.

I see it working best for algo traders, active traders, and beginners who want both a safe and versatile platform.

The broker is best for algorithmic traders, active day traders, and beginners who want strong tools, easy onboarding, and room to grow with multiple platform choices.

Who is it best for

- Algo traders: Broad API access and automation options across Trading Station, MT4, TradingView, and third-party tools make it easy to build, test, and deploy strategies.

- Active traders: Competitive pricing for higher volumes, fast execution quality, and robust charting help with intraday decisions.

- Beginners: Clear education, practical tools like sentiment and volume, and an intuitive platform lineup reduce the learning curve.

- TradingView users: Native integration lets orders route directly from TradingView charts while keeping FXCM pricing and account features.

- Python and API users: Multiple APIs including FIX, Java, and Python support programmatic trading and data access.

Who might look elsewhere

- MT5-only traders: the platform does not offer MetaTrader 5, so MT5-focused workflows won’t fit here.

- Multi-asset hunters: The CFD lineup is under 500 symbols, which may feel limited versus multi-asset leaders.

- U.S.-based traders: FXCM does not accept U.S. residents, so regulated U.S. brokers will be required.

Why it stands out

- Platforms and tools: Best in Class recognition for Platforms & Tools, Algo Trading, Copy Trading, and Professional Trading in recent industry reviews.

- Automation-first approach: Ready-made and programmable routes to automation plus VPS and EA support on MT4.

- TradingView direct: Trade from TradingView with FXCM connectivity for a familiar

Pros

- Strong regulation from top-tier bodies like the FCA and ASIC, which boosts trust and safeguards client funds.

- Excellent algo trading support with Python, TradingView integration, multiple APIs, and ZuluTrade for copy trading.

- Platforms packed with 100+ indicators, giving plenty of room for strategy building and testing.

- Active trader program with rebates and discounts that rewards higher volumes.

- Great education and market research that help beginners get up to speed and give advanced traders fresh ideas.

Cons

- Narrow product range compared with multi-asset leaders like IG and Saxo.

- Pricing is only average on standard accounts, so costs may not be the lowest unless using active trader tiers.

- No MT5 support, which can be a dealbreaker for MT5-focused workflows.

- Not available in the U.S., so American traders will need alternatives.

Why You Should Choose FXCM in 2025?

Choosing the right broker can define your trading journey, and FXCM continues to prove why it remains a trusted option in 2025. From regulation and security to cutting-edge platforms and tools, here are the key reasons why this broker deserves attention this year.

1. High Trust and Strong Regulation

FXCM has earned a Trust Score of 95/99, ranking it among the most reliable brokers in the industry. With oversight from Tier-1 regulators such as the Financial Conduct Authority (FCA) in the U.K. and the Australian Securities & Investments Commission (ASIC), traders can rest assured their funds are protected under strict regulatory frameworks. They also maintains segregated client accounts and adheres to global compliance standards, reinforcing its reputation as a safe trading partner.

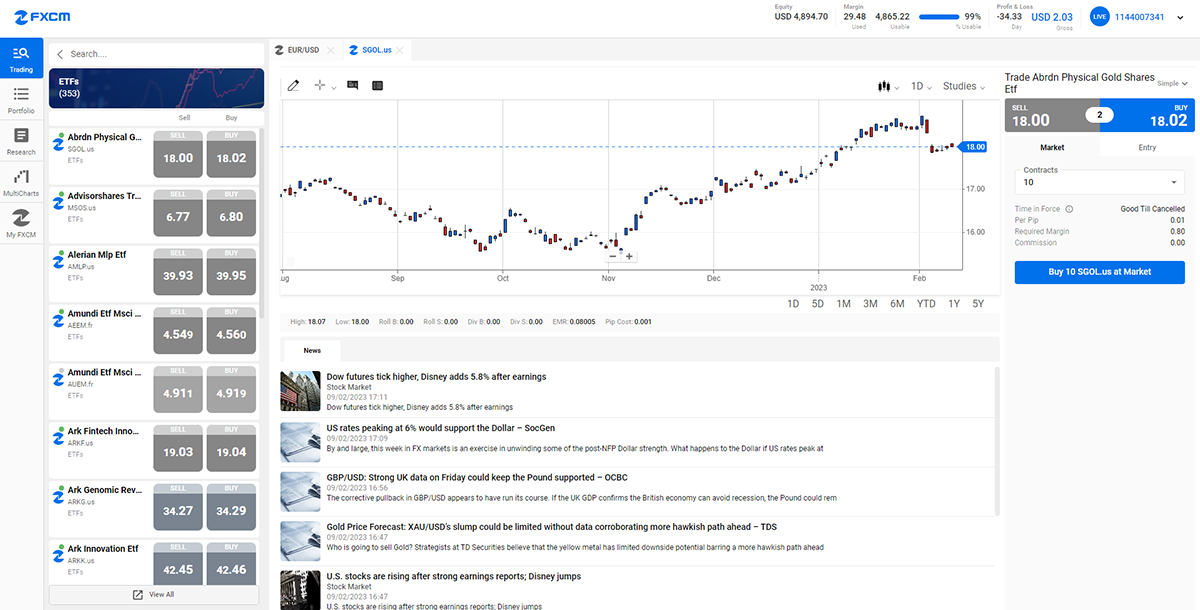

2. Wide Choice of Trading Platforms

One of the platform’s biggest advantages is its diverse platform offering. Traders can choose from:

- Trading Station – the flagship platform, designed for both beginners and pros.

- MetaTrader 4 (MT4) – the most widely used forex platform with strong EA (Expert Advisor) support.

- TradingView – modern charting and social trading tools for advanced analysis and community engagement.

- ZuluTrade (select regions) – for copy trading strategies.

This variety ensures that traders of all levels and styles, from manual discretionary traders to algorithmic quants, find the right fit.

3. Strong for Algorithmic and Professional Traders

The broker is recognized as a leader in algorithmic and professional trading. It supports:

- APIs for Python, REST, and FIX connectivity.

- Access to specialized algo platforms like QuantConnect, MotiveWave, and Capitalise.ai.

- An App Store full of trading robots, indicators, and add-ons.

For professionals, the Active Trader account unlocks rebates, dedicated support, and access to deep liquidity with tighter spreads, making FXCM highly competitive for high-volume strategies.

4. Accessible for Beginners and Low-Budget Traders

Not every broker caters equally to beginners and seasoned pros, but FXCM manages both. With a minimum deposit starting at just $50, new traders can explore live markets without overcommitting. The broker also offers:

- A free demo account with $20,000 virtual funds.

- A large library of educational articles, videos, and webinars.

- User-friendly mobile apps for learning and practicing on the go.

This balance of accessibility and sophistication makes FXCM attractive to traders at every stage of their journey.

5. Continuous Innovation and Upgrades

Unlike some brokers that stagnate, the platform is known for its continuous innovation. In recent years, it has:

- Integrated TradingView for seamless charting and community-driven strategies.

- Expanded its API support to allow advanced automation.

- Improved execution transparency with published slippage statistics.

- Enhanced research through partnerships with Trading Central, TipRanks, and eFX Data.

These upgrades show their long-term commitment to evolving alongside trader needs and technology.

The Bottom Line

In 2025, FXCM remains a highly trusted, well-regulated, and technology-forward broker. Whether you’re a beginner starting with $50, a professional seeking API connectivity, or an algo trader building strategies, the broker delivers the right mix of safety, flexibility, and innovation.

Compare to Top Competitors

To fully understand its strengths and weaknesses, it helps to see how it stacks up against other major players in the forex and CFD industry. In this section, I’ll compare FXCM with Forex.com, Pepperstone, and FP Markets—three brokers that often come up in the same conversation.

The focus will be on the areas traders care about most: fees, platforms, product range, and regulatory trust. By looking at FXCM side by side with its closest rivals, you’ll get a clearer sense of where it excels and where another broker might be the better fit for your trading goals.

Forex.com

Pepperstone

FP Markets

Exploring Oanda's Range of Tradable Instruments

FXCM provides traders with a well-structured selection of assets, though its range is narrower than some of the industry’s largest brokers. With around 440 instruments in total, FXCM’s focus is primarily on forex and CFDs. Here’s a closer look at what’s available.

Forex Trading

FXCM gives access to 46 currency pairs, including majors, minors, and selected exotics. For traders in the EU, U.K., and Australia, EUR/USD spreads average 0.78 pips, with lower rates possible through the Active Trader program. This makes FXCM a strong choice for those focused mainly on currency markets.

CFD Products

Beyond forex, FXCM offers a mix of CFDs on indices, commodities, and cryptocurrencies. Crypto trading is available only as derivatives, not as spot assets, which may be a drawback for traders seeking direct ownership. Still, the variety of CFDs provides opportunities to diversify across different asset classes.

Fractional Shares

Equity traders benefit from FXCM’s fractional share offering, which allows them to open smaller positions and gain exposure to global companies without needing significant capital. This feature is especially attractive to beginners and traders looking to diversify with limited budgets.

How FXCM Compares

With a total of ~440 tradable instruments, FXCM’s selection is respectable but limited compared to market leaders. For instance, IG offers more than 17,000 markets, spanning stocks, ETFs, and bonds. Traders who want niche products or extremely broad coverage may find FXCM restrictive, while those focused on forex and popular CFDs will find the lineup more than sufficient.

| Asset | FXCM |

|---|---|

| Forex Pairs | 46 |

| Tradeable Symbols | 440 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Cryptocurrency (Physical & Derivative) | Physical: No |

| Social Trading / Copy Trading | No |

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $50 |

| Average Spread EUR/USD (Standard) | 0.78 pips |

All-in Cost EUR/USD - Active | 0.78 pips |

Index CFD fees | Low |

Stock CFD fees | Low |

| Deposit Fees | $0 |

| Withdrawal Fees | $0 |

| Inactivity Fee | The fee is up to 50 units of the currency of your account after 12 months of no activity. |

When evaluating a broker, cost is one of the most important factors. FXCM offers a mix of spread-only pricing and commission-based accounts, which makes it flexible for both casual traders and professionals. While it may not always be the cheapest option on the market, FXCM combines competitive spreads with transparency, published execution stats, and rebate programs that can significantly reduce costs for high-volume traders.

Forex Trading Fees

FXCM provides two main account structures:

Standard Accounts:

Spreads on the popular EUR/USD pair typically range from 0.78 to 1.38 pips, depending on which FXCM entity you open an account with (EU, UK, or Australia). This is in line with many mid-tier brokers but slightly higher than ultra-competitive ECN accounts offered by Pepperstone or FP Markets.

Active Trader Program:

High-volume traders can qualify for FXCM’s Active Trader rebates, where the cost per million traded can be reduced by $5 to $25. This program rewards consistent activity and makes FXCM much more cost-efficient at scale.

Non-Trading Fees

Beyond spreads and commissions, traders should consider additional costs:

Deposits: FXCM charges no deposit fees, regardless of method.

Withdrawals: Some methods may incur third-party fees (e.g., bank transfers), but FXCM itself does not add extra charges for most withdrawal options.

Inactivity Fee: Accounts inactive for 12 months are subject to a $50 fee, which is fairly standard across the industry but worth noting.

Currency Conversion Fees: If you trade instruments quoted in a currency different from your account base, FXCM applies a conversion fee. Active traders dealing with multiple currencies should keep this in mind.

How FXCM’s Fees Compare

Versus Forex.com: Forex.com often has slightly higher spreads on standard accounts, but it competes well with commission-based pricing. FXCM’s Active Trader rebates give it an advantage for high-volume users.

Versus Pepperstone: Pepperstone tends to win on raw spreads and ultra-low commissions, especially for scalpers. FXCM counters with transparency and published slippage stats, which Pepperstone doesn’t provide in as much detail.

Versus FP Markets: FP Markets also offers very low spreads and commissions, making it a tough competitor. FXCM’s edge lies in its regulatory trust and execution reporting, which appeals to cautious traders.

Bottom line: FXCM’s fees are fair, transparent, and scalable. Standard accounts suit beginners, while professionals can benefit from commission accounts and rebates. Combined with published execution data, FXCM offers a strong balance of cost-effectiveness and credibility—though traders purely chasing the lowest spreads may find better raw pricing with Pepperstone or FP Markets.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is FXCM Regulated ?

Yes! As a matter of fact, FXCM is a well-regulated global broker with licenses from multiple top-tier financial authorities. This strong regulatory coverage is one of the main reasons it continues to hold a high Trust Score of 95/99, making it one of the most reliable brokers in the retail trading space.

Key Regulators Overseeing FXCM

- Financial Conduct Authority (FCA) – United Kingdom

- Australian Securities & Investments Commission (ASIC) – Australia

- Financial Sector Conduct Authority (FSCA) – South Africa

- Cyprus Securities and Exchange Commission (CySEC) – European Union

- Canadian Investment Regulatory Organization (CIRO) – Canada

Investor Protections

Being regulated across multiple jurisdictions means FXCM must comply with strict rules on client fund safety and operational transparency. These protections include:

- Segregated client funds – ensuring trader deposits are held separately from company funds.

- Negative balance protection (in most regions) – shielding clients from owing more than they deposit.

- Regular reporting and audits – maintaining compliance and financial stability under regulator oversight.

Why This Matters

For traders, regulation provides confidence that FXCM is operating fairly, securely, and with proper oversight. While some competitors operate under looser offshore licenses, FXCM’s global regulatory footprint puts it in the category of high-trust brokers, giving traders peace of mind that their funds and trading environment are well-protected.

Understanding Regulatory Protections and Broker Stability

One of FXCM’s strongest advantages is the stability and security it offers traders, thanks to both its ownership structure and its regulatory framework. These factors make FXCM not just a convenient broker, but also a trusted one.

Backing by Jefferies Financial Group

FXCM is owned by Jefferies Financial Group (NYSE: JEF), a publicly listed investment bank and Fortune 500 company. This backing provides significant financial strength and credibility, reassuring traders that FXCM has the resources and stability to operate sustainably, even during periods of market volatility.

Oversight by Tier-1 Regulators

FXCM operates under the supervision of multiple Tier-1 regulators, including the FCA in the UK and ASIC in Australia. These authorities impose strict requirements on:

- Capital adequacy – ensuring the broker maintains strong financial reserves.

- Segregation of client funds – keeping client deposits separate from company operating funds.

- Regular audits and reporting – verifying transparency and compliance.

Investor Protection Policies

To protect clients further, FXCM provides negative balance protection in certain jurisdictions, meaning traders cannot lose more than their account balance. This is particularly important in high-volatility markets where unexpected price gaps can occur.

Stability You Can Trust

With the combined strength of a Fortune 500 parent company, regulation from top-tier authorities, and client protection policies, FXCM demonstrates a high level of broker stability. For traders, this means the confidence to focus on markets without worrying about the safety of their funds.

How To Open an Account

Opening an account with FXCM is straightforward and fully digital, making it quick and convenient for new traders. In most cases, the process takes less than 15 minutes from start to finish.

Step-by-Step Process

- Go to FXCM’s official website

- Click “Open an Account”

- Enter your email and password

- Choose your platform

- Choose your currency

- Complete the online application form – provide basic personal details, financial background, and trading experience.

- Upload KYC documents – submit proof of identity (passport, driver’s license, or national ID) and proof of address (utility bill or bank statement).

- Application review and approval – FXCM usually verifies accounts in 1-2 days, though in some cases additional checks may be required.

- Fund your account

FXCM’s account-opening process is fast, user-friendly, and entirely online, making it easy for beginners and experienced traders alike to get started without unnecessary delays.

Account Types

FXCM offers a simple account structure designed to meet the needs of beginners, casual traders, and professionals. Each account type comes with its own features and benefits, making it easy to choose based on your trading style and budget.

Standard Account

The standard account requires a minimum deposit of just $50, making it highly accessible for new traders and those with smaller budgets. Spreads start from around 0.78 pips on EUR/USD, and clients get full access to FXCM’s platforms, research, and education tools.

Active Trader Account

Designed for high-volume and professional traders, the Active Trader account requires a $25,000 minimum deposit. In return, clients benefit from tighter spreads, lower commissions, and cash rebates ranging from $5 to $25 per million traded. Active Trader accounts also come with dedicated customer support and access to deeper liquidity.

Demo Account

For those who want to practice without risk, FXCM provides a free demo account preloaded with $20,000 in virtual funds. This is a great way for beginners to learn the platforms, test strategies, and get comfortable with order execution before switching to live trading.

| Account Type | Minimum Deposit | Key Features | Best for |

|---|---|---|---|

| Standard Account | $50 | EUR/USD ~0.78–1.38 pips, access to all platforms, education & research tools | Low-budget and casual traders |

| Active Trader Account | $25,000 | As low as 0.28 pips + $5 RT commission. Rebates of $5–$25 per million traded, tighter spreads, dedicated support | High-volume and professional traders |

| Demo Account | $0 (virtual only) | $20,000 virtual funds, risk-free practice, full access to platforms | Beginners testing strategies and platforms |

What is the Minimum Deposit at FXCM?

FXCM keeps entry requirements flexible, making it suitable for both beginners and professionals.

- Standard Account: The minimum deposit starts from just $50, making FXCM highly accessible for new traders or those who want to start with a smaller budget.

- Active Trader Account: For professionals and high-volume traders, the minimum deposit is $25,000, which unlocks tighter spreads, rebates, and premium support.

Whether you want to test strategies with a demo, begin live trading with as little as $50, or qualify for institutional-level pricing with $25,000, FXCM offers clear options for different trading needs.

| Broker | Minimum Deposit |

|---|---|

FXCM | $50 |

Pepperstone | $200 |

| Forex.com | $100 |

| FP Markets | $100 |

Deposit and Withdrawal

Managing deposits and withdrawals with FXCM is straightforward, with multiple funding options and mostly fee-free processing. The broker supports both traditional banking methods and modern e-wallets, giving traders flexibility based on convenience and location.

Deposit Fees & Options

This broker does not charge any deposit fees, which makes adding funds cost-effective for traders. Deposits are usually processed instantly with cards and e-wallets, while bank transfers can take a few business days depending on your region. Available payment methods include:

Withdrawal Fees & Options

Withdrawals are also flexible, with most methods free of charge. However, some bank wire transfers may incur fees depending on the client’s bank or location. E-wallet withdrawals such as PayPal, Skrill, and Neteller are generally processed faster and free of extra charges.

Desktop Trading Platform

When I tested FXCM’s Trading Station desktop platform, I found it to be surprisingly powerful and flexible—clearly designed with active traders in mind. It doesn’t feel cluttered or overwhelming, but the depth of tools becomes obvious the more you explore.

Features and Functionality

Advanced Charting

The charting package is one of the platform’s biggest strengths. I could open multiple charts at once, apply dozens of technical indicators, and even customize timeframes down to tick data. Drawing tools are responsive, and switching between chart types (candlestick, line, Renko, etc.) was seamless.

Market Analysis Tools

I appreciated the built-in market scanner, which made it easy to spot trading opportunities across forex, indices, and commodities. Economic calendar events are integrated directly, so I could line up trades with key releases without leaving the platform.

Real-time Information

Streaming real-time quotes were stable during my test, with no noticeable delays. Price movements updated instantly across all charts and watchlists, which gave me confidence when managing fast-moving trades.

Research Integration

Trading Station ties in neatly with FXCM’s market research reports and third-party providers. I was able to pull up daily insights, analyst commentary, and even quantitative data feeds—all without having to switch tabs or rely on an external browser.

Educational Content Integration

For beginners, I liked how FXCM integrates educational resources directly within the platform. Clicking through tutorials and webinars felt natural, especially when testing strategies in the demo environment.

Placing Orders

When I tested order execution on Trading Station, it felt fast and reliable. The platform offers a full range of order types, and here’s what stood out to me:

Market Orders – instant execution with minimal slippage during normal conditions.

:

Limit Orders – easy to set at preferred entry or exit levels.

:

Stop Orders – useful for managing risk automatically.

Trailing Stops – allowed me to lock in profits as the market moved in my favor.

One-Click Trading – enabled ultra-fast execution, ideal for scalping and high-frequency strategies.

Alerts & Notifications

Setting price alerts was simple—I could choose to be notified via pop-ups or sound alerts when my target levels were reached. This was useful when monitoring multiple pairs at the same time.

Login and Security

Login felt secure, with encryption and account session protection. I didn’t encounter any glitches, and reconnecting after being logged out was quick and straightforward.

Search Functions

The built-in search tool made navigation easier than I expected. Whether I was looking for a specific instrument, indicator, or research article, it pulled up results instantly.

Pros & Cons of the Web Platform

Pros

- Deep charting tools with multiple indicators and customizable layouts.

- Strong algorithmic trading support through APIs and automation add-ons.

- Wide variety of order types, including trailing stops and one-click trading.

- Integrated research and market insights, reducing the need for external platforms.

Cons

- No MT5 support, which some traders may prefer for multi-asset trading.

- Steeper learning curve for beginners compared to simpler web or mobile platforms.

Mobile App

FXCM’s mobile app brings most of the Trading Station experience to a smaller screen, and when I tested it, I found it intuitive for everyday trading. It’s designed to be lightweight and responsive, which makes it easy to monitor markets and execute trades on the go.

Look & Feel and Features

The app has a clean, modern design that doesn’t feel overwhelming. Charts load quickly, and I was able to add indicators, draw trendlines, and switch timeframes without lag. Watchlists sync seamlessly with the desktop platform, and push notifications keep you updated on price alerts or market events.

Login and Security

Logging in was straightforward, with support for biometric authentication (fingerprint/Face ID) depending on your device. Sessions timed out automatically for added security, and reconnection was quick if I closed the app.

Search Functions

The search tool was fast and effective. I could type in a symbol or keyword and instantly pull up instruments, charts, or order tickets without scrolling endlessly. For traders who follow multiple markets, this makes navigation smooth.

Placing Orders

Order placement on mobile was simple and reliable. During my test, I noticed:

Market and Limit Orders executed quickly with minimal taps.

Stop Orders were easy to set up directly from the chart view.

Trailing Stops were supported, which isn’t always common in mobile apps.

One-Tap Trading let me enter or exit positions instantly—ideal for fast-moving forex pairs.

Pros & Cons of the Mobile App

Pros

- Clean and intuitive design, easy to navigate for both beginners and active traders.

- Biometric login support (Face ID / fingerprint) for added security.

- Fast and accurate search functions, making it simple to find instruments.

- One-tap trading and multiple order types, including trailing stops.

- Seamless sync with desktop/watchlists, so you don’t lose track when switching devices.

Cons

- No MT5 support, unlike some competitors that include both MT4 and MT5 on mobile.

- Charting tools are more limited compared to the desktop version.

- Advanced traders may find it less customizable than cTrader or MetaTrader mobile apps.

Market Research, Tools, and Education

FXCM has built a strong ecosystem of research, trading tools, and educational resources, making it more than just a place to execute trades. When I tested these features, I found that they strike a good balance between catering to beginners who need guidance and professionals who demand advanced data and automation.

Trading Central – actionable technical signals and pattern recognition.

TipRanks – analyst ratings and sentiment data on global equities.

Investing.com feeds – real-time news and market commentary.

eFX Data – institutional-grade currency flow data for more advanced users.

This variety ensures traders can make decisions based on both technical and fundamental perspectives.

FXCM App Store – hundreds of add-ons, custom indicators, and automated strategies.

APIs – support for Python, REST, and FIX connections, making FXCM a favorite for algo traders.

Algo platforms – direct integrations with QuantConnect, MotiveWave, and Capitalise.ai, allowing traders to design, backtest, and deploy automated systems.

For systematic or professional traders, this toolkit is one of the most advanced among retail brokers.

200+ articles and guides covering forex basics through advanced strategies.

YouTube video tutorials that demonstrate platform features and market concepts.

Regular webinars hosted by market experts.

Step-by-step learning paths suitable for beginners and intermediate traders.

The content is well-organized, making it easy to progress from fundamentals to more complex topics.

Verdict

FXCM combines high-quality research, a powerful suite of trading tools, and extensive educational content. Beginners benefit from structured learning resources, while advanced traders gain access to APIs, algos, and institutional-grade data feeds—all of which elevate FXCM beyond a simple execution-only broker.

Customer Support

FXCM’s customer service is well-structured, professional, and easy to access. During my testing, I found responses to be timely and helpful, with staff knowledgeable about both technical issues and account-related queries. Support is available 24 hours a day, 5 days a week, which aligns with global market hours, though weekend coverage is not provided.

Availability and Languages

FXCM offers multilingual support in languages including English, Spanish, French, German, Arabic, Chinese, Italian, and Greek. This makes the service widely accessible for traders across different regions and markets.

Support Channels

Traders can reach FXCM through multiple channels:

- Live Chat – the fastest way to resolve most issues.

- Email Support – best for documents or detailed inquiries.

- Phone Support – direct access to staff for urgent problems.

Dedicated Account Managers

High-volume clients and Active Trader account holders receive dedicated account managers, providing more personalized support and quicker escalation when needed.

Response Times

In my experience, live chat replies came within minutes, while email responses were generally received within one business day. This lines up with most user reports of fast and reliable support.

Verdict

FXCM’s customer support is responsive, multilingual, and reliable, making it suitable for both beginners and professionals. The addition of account managers for premium accounts adds value for serious traders, though the lack of true 24/7 coverage is one of the few limitations. Overall, FXCM scores well in this area, providing the kind of support structure that inspires confidence.