FXPRO REVIEW 2025

Looking for a broker that combines global trust, advanced platforms, and swift, no-dealing-desk execution? This 2025 FxPro review evaluates fees, platforms (MT4/MT5/cTrader), safety, and support to help you assess whether FxPro aligns with your strategy and risk profile.

Broker Guide's FXPro Review in 2025

Founded in 2006, FxPro is a UK-based multi-asset CFD and forex broker known for its transparency, global reach, and advanced technology. The company serves more than 11 million clients in over 170 countries and operates under strict top-tier regulation from the FCA (UK), CySEC (Cyprus), FSCA (South Africa), SCB (Bahamas), and FSA (Seychelles).

FxPro offers a wide selection of trading platforms including MT4, MT5, cTrader, and FxPro Edge, all supported by no-dealing-desk execution for fast and consistent order performance.

Suitable for both beginners and experienced traders, the broker stands out for its strong regulatory foundation, platform variety, and commitment to reliability.

This 2025 FxPro review explores its pricing, trading platforms, safety, and overall value for today’s traders.

About FXPro

Founded in 2006 and headquartered in London, United Kingdom, FxPro has evolved into one of the most established names in global online trading. The broker serves millions of retail and institutional clients worldwide and has executed hundreds of millions of orders since its inception. Recognized for excellence and transparency, it has earned over 125 international awards for trading innovation, reliability, and customer satisfaction.

Trading Offering and Key Facts

Traders can access 2,100+ tradable assets across forex, stocks, indices, metals, energies, and cryptocurrencies, all with a minimum deposit requirement of $100. The company’s emphasis on competitive trading conditions, advanced platforms, and fast order execution has contributed to its steady global growth.

Regulatory Structure

The FxPro Group operates multiple entities to comply with regional regulations:

- FxPro UK Ltd, regulated by the Financial Conduct Authority (FCA)

- FxPro Financial Services Ltd, licensed by both CySEC (Cyprus) and FSCA (South Africa)

- FxPro Global Markets Ltd, overseen by the Securities Commission of the Bahamas (SCB)

- Invemonde Trading Ltd, authorized by the Financial Services Authority (FSA) of Seychelles

Brand Partnerships

The company’s visibility extends beyond finance through high-profile sponsorships such as its partnership with the McLaren Formula 1 team, highlighting shared values of precision, performance, and innovation.

My Quick Verdict: Who is FXPro Best For?

Rating: 4.5/5

Best for: experienced traders who value deep liquidity, multiple platforms, and transparent execution.

FxPro maintains a strong reputation as one of the industry’s most reliable and well-regulated brokers. Backed by oversight from top-tier authorities such as the FCA and CySEC, it delivers a secure and professional trading environment. Its advanced technology and access to MT4, MT5, cTrader, and FxPro Edge make it ideal for those who prioritize flexibility and execution quality.

While trading costs are slightly higher than ultra-low-spread competitors like Pepperstone or IC Markets, the difference is offset by FxPro’s fast order processing, multi-asset range, and robust infrastructure. Overall, it stands out as a premium choice for traders who seek performance, trust, and choice over bare-minimum pricing.

Pros

- Wide platform selection, including MT4, MT5, cTrader, and FxPro Edge, giving traders flexibility across devices and strategies.

- Regulated in five major jurisdictions, ensuring strong client protection and operational transparency.

- Fast execution with a no-dealing-desk (NDD) model that supports fair and efficient order processing.

- Access to over 2,200 CFDs across forex, stocks, indices, metals, and more.

- Excellent customer support and a range of account types suited to both beginners and advanced traders.

Cons

- Spreads are slightly higher compared to low-cost brokers such as Pepperstone or IC Markets.

- Educational resources are adequate but limited when compared with larger competitors like IG or CMC Markets.

- No built-in social or copy trading options.

- Inactivity fees apply after six months without trading activity.

Why You Should Choose FXPro ?

With nearly 20 years of experience, FxPro has become one of the most reputable brokers in the global trading industry. Since its launch in 2006, it has grown to serve more than 11 million clients across 170 countries, operating under multiple top-tier regulators. This long-standing presence highlights its stability and consistent performance in a constantly evolving market.

Technological Advancements and Platform Updates

In 2025, FxPro continues to enhance its platforms and trading experience. The FxPro Edge Web platform has been upgraded for better performance, faster order execution, and improved layout customization.

Traders who use cTrader or MetaTrader 5 can take advantage of advanced algorithmic trading tools such as Expert Advisors (EAs) and cBots, allowing for automated and data-driven strategies. Meanwhile, rebate programs and tighter spreads make trading more cost-efficient for active users.

Reliable Execution and Transparency

FxPro’s no-dealing-desk execution model remains one of its strongest advantages, providing direct access to liquidity providers and ensuring trades are executed quickly and fairly. Compared to newer brokers that focus on aggressive promotions, FxPro emphasizes consistent performance, transparent pricing, and robust infrastructure backed by years of experience.

Bottom Line

FxPro stands out in 2025 as a trusted, technology-driven broker with a proven record of stability, innovation, and client satisfaction. It is best suited for traders who prioritize reliability, multi-platform access, and precise execution over the marketing promises of newer entrants in the market.

Compare to Top Competitors

When evaluating FxPro against other leading brokers, it’s clear that its strength lies in long-term reliability, diverse platform options, and strong global regulation. However, each competitor brings its own advantages, making them appealing to different types of traders. Here’s how FxPro stacks up against some of the industry’s best.

XM

Pepperstone

IG

Exploring FXPro’s Range of Tradable Instruments

FxPro gives traders access to a diverse portfolio of over 2,249 CFDs across global markets. The broker’s offerings vary slightly between MetaTrader 4, MetaTrader 5, cTrader, and FxPro Edge, allowing users to trade efficiently across multiple platforms depending on their strategy. From forex and commodities to shares and cryptocurrencies, the range is designed to support both active traders and long-term investors.

Forex

More than 70 currency pairs are available, including majors like EUR/USD and GBP/USD, minors such as EUR/JPY, and several exotic pairs. FxPro’s deep liquidity and rapid execution make it a strong choice for forex traders, particularly those using algorithmic strategies on cTrader.

Indices

Trade over 15 leading global indices, including the S&P 500, NASDAQ 100, FTSE 100, and DAX 40. These CFDs allow traders to speculate on broader market performance with transparent pricing and no hidden markups.

Metals

The broker offers CFDs on gold, silver, platinum, and palladium, providing opportunities to hedge against inflation or diversify portfolios with safe-haven assets.

Energies

Trade WTI and Brent Crude Oil as well as Natural Gas, all with competitive spreads and flexible leverage. Energies remain popular for those seeking exposure to global commodity trends.

Stocks

Access more than 1,800 stock CFDs from major US, UK, and European exchanges. These are available mainly on MT5, while BnkPro and Invest Web platforms allow real-share investing beyond CFD trading.

Futures and ETFs

FxPro provides CFDs on futures and ETFs, enabling traders to track global indices, commodities, and sector-based funds through a single account.

Cryptocurrencies

Trade Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash via CFDs. However, crypto CFDs are not available to UK retail clients due to regulatory restrictions.

Limitations

While the overall selection is strong, asset availability varies by platform, and MT4 users may find fewer stocks and ETFs compared to MT5. FxPro also does not currently offer real crypto ownership, only CFDs.

Bottom Line

FxPro’s wide range of tradable instruments, combined with its multi-platform accessibility, makes it an excellent choice for traders who want flexibility and market diversity. Despite minor platform-based limitations, it remains one of the most comprehensive and well-regulated brokers for multi-asset trading in 2025.

| Asset | FXPro |

|---|---|

| Forex Pairs | 75 |

| Tradeable Symbols | 2249+ |

| Stocks | 1,800+ |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency | 38 |

| Bonds | 6 |

| Indices | 19 |

| Metals | 8 |

| Futures | 40+ |

| Energies | 3 |

How FXPro’s Instruments Compare to Competitors

FxPro offers one of the most diverse selections of tradable assets among regulated global brokers. While competitors like XM, Pepperstone, and IG each excel in certain areas, FxPro’s multi-platform support and balanced market coverage make it a versatile choice for traders who value variety and depth.

Below is a comparison of available instruments across major brokers in 2025

| Asset | FXPro | XM | Pepperstone | IG |

|---|---|---|---|---|

| Forex | ||||

| Indices | ||||

| Stocks | ||||

| Commodities | ||||

| Cryptocurrencies | ||||

| Metals & Energies | ||||

| Futures CFDs | ||||

| ETFs |

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $100 |

| Average Spread EUR/USD (Standard) | 1.27 pips |

All-in Cost EUR/USD - Active | 0.61 pips |

| Commissions | $3.50 per side on cTrader and Raw accounts. $0 commission on other account types. |

| Forex CFD Fees | Average |

Index CFD Fees | Low |

Futures Fees | Low |

Stock CFD fees | Low |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | A $10 inactivity charge after 6 months |

FxPro offers a transparent and flexible pricing model tailored to suit various trading styles. Fees depend on the chosen platform and account type, giving traders the freedom to select between spread-only accounts and raw spread plus commission models.

Trading Fees by Account Type

On the MT4 and MT5 Standard accounts, pricing follows a spread-only structure, with an average spread of around 1.2 pips on major pairs such as EUR/USD. This option is ideal for traders who prefer simple, all-inclusive pricing without extra commission charges.

The Raw+ account provides spreads starting from 0.0 pips, combined with a $7 round-turn commission per lot. This model caters to active and high-volume traders who prioritize ultra-tight pricing. On the cTrader platform, the average effective spread is about 1.27 pips, including commissions.

Traders enrolled in FxPro’s VIP or Elite programs can earn rebates of up to 30% based on monthly trading volume, offering added value for frequent traders. The EUR/USD spread averages 1.4 pips, S&P 500 CFDs around 0.7, and Apple stock CFDs near 0.2—figures that remain competitive among top global brokers.

All accounts use a Market Execution model with no requotes, ensuring orders are filled at the best available market prices, even during periods of high volatility.

Other Trading Costs

FxPro applies overnight swap fees on leveraged positions held past the trading day’s close. The exact rate varies depending on the asset class and position direction. For Islamic swap-free accounts, these swaps are replaced by a small administration fee after a grace period.

Some markets may incur guaranteed stop-order fees, charged only if the guaranteed stop feature is used and triggered, protecting traders from slippage during extreme volatility.

Non-Trading Fees

Beyond trading activity, FxPro’s non-trading fees are relatively modest. The broker charges an inactivity fee of $10 after six months of account inactivity, followed by a monthly fee if the account remains dormant.

A currency conversion fee applies to trades or withdrawals made in currencies different from the account’s base currency.

Deposits and withdrawals are generally fee-free, though certain e-wallets may apply third-party transaction costs.

Final Thoughts on Costs

FxPro’s overall fee structure balances competitive spreads with flexibility and transparency. While its trading costs may be slightly higher than ultra-low-cost brokers, its rebate programs, platform diversity, and absence of deposit or withdrawal fees make it a cost-effective choice for traders seeking reliability and professional-grade execution

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is FXPro Regulated ?

FxPro operates under a robust regulatory framework that spans multiple respected financial authorities worldwide. Each entity of the FxPro Group is authorized and supervised by a regional regulator, ensuring compliance with strict financial standards and client protection measures.

Global Regulatory Oversight

- FxPro UK Ltd – Authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom (License No. 509956)

- FxPro Financial Services Ltd – Regulated by the Cyprus Securities and Exchange Commission (CySEC) (License No. 078/07) and the Financial Sector Conduct Authority (FSCA) in South Africa (License No. 45052)

- FxPro Global Markets Ltd – Supervised by the Securities Commission of the Bahamas (SCB) (License No. SIA-F184)

- Invemonde Trading Ltd – Authorized by the Financial Services Authority (FSA) of Seychelles (License No. SD120)

This multi-jurisdictional regulation provides traders with confidence that FxPro operates within well-defined legal and financial frameworks across different regions.

Investor Protection Measures

Clients under the FCA entity are covered by the Financial Services Compensation Scheme (FSCS), offering protection of up to £85,000 per eligible client in the event of broker insolvency. All FxPro entities maintain segregated client funds, meaning traders’ money is held separately from company operating accounts. Additionally, negative balance protection ensures that clients can never lose more than their deposited funds, even during periods of extreme market volatility.

Restrictions and Availability

Due to the absence of a CFTC (Commodity Futures Trading Commission) license, FxPro does not accept clients from the United States. This limitation is consistent with most global brokers not registered in the U.S.

Overall, FxPro’s adherence to strict international regulations and client protection standards reinforces its reputation as a secure and transparent global broker.

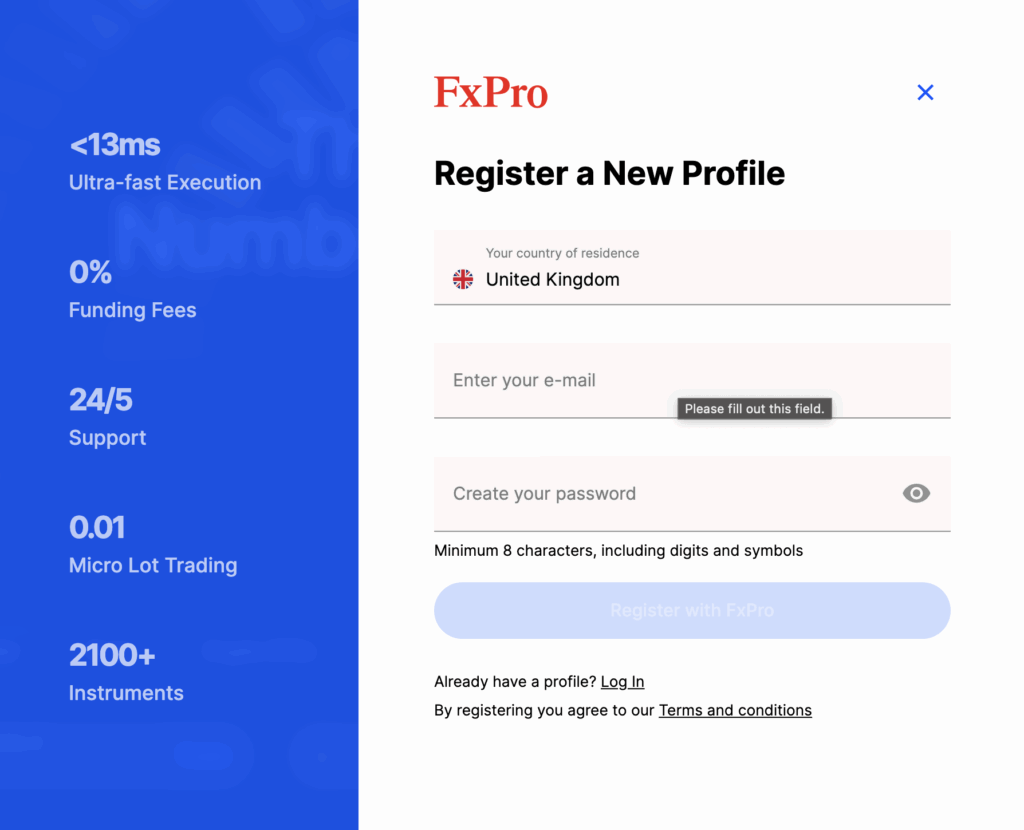

How To Open an Account

Opening an account with FxPro is a fully digital and straightforward process that can typically be completed within 24 hours. The broker’s onboarding system is designed to meet global regulatory standards while keeping the experience smooth for traders of all levels.

Here’s a step-by-step guide:

- Enter country of residence, full name, email, and password.

- Provide nationality, date of birth, phone number, and full residential address.

- Select employment status, industry, and highest education level.

- Add annual income, net worth, source of wealth, and reason for opening the account.

- Answer questions about trading experience and financial knowledge.

- Choose platform (MT4, MT5, FxPro Edge, or cTrader), default leverage, base currency, and email language.

- Upload a national ID, passport, or driver’s license and take a selfie.

- Submit a utility bill or bank statement issued within the last six months.

- Once your account is verified, you can fund it using your preferred payment method. The minimum deposit is $100.

Account Approval and Regional Differences

Account verification is typically completed within one business day, although processing times may vary depending on your location and the regulatory entity under which you register (for example, FCA, CySEC, or SCB).

FxPro’s onboarding process balances compliance with convenience, ensuring traders can start safely and efficiently while meeting all international standards.

Account Types

FxPro offers a variety of account types designed to meet the needs of different trading styles and experience levels. Each account comes with distinct pricing mo

MT4/MT5 Standard Account

The Standard Account on MetaTrader 4 and MetaTrader 5 is a spread-only account with average spreads around 1.2 pips on major currency pairs such as EUR/USD.

There are no commissions, making it ideal for beginners or casual traders who prefer a simple, transparent pricing structure. This account supports all major CFDs, including forex, metals, indices, and shares, depending on the platform.

Raw MT4/MT5 Account

The Raw Account provides spreads from 0.0 pips with a $7 round-turn commission per standard lot. This model is best suited for experienced or high-volume traders who prioritize tighter spreads and faster execution.

By combining institutional-grade liquidity with a no-dealing-desk model, this account ensures minimal slippage and direct access to the market.

cTrader Account

The cTrader Account features low variable spreads and a commission structure of $35 per $1 million traded (roughly $3.50 per side per standard lot). cTrader users benefit from advanced order management, in-depth market depth data, and algorithmic trading through cBots, making it a preferred choice for professionals and scalpers.

Elite Account

The Elite Account is tailored for high-volume traders with a minimum balance of $30,000. It offers rebates, lower commissions, and exclusive trading conditions, rewarding active users with up to 30% commission reductions based on monthly trading volume.

Edge Spread Betting (UK Only)

Available exclusively to UK residents, the Edge Spread Betting Account provides tax-free trading on a wide range of instruments. It combines the intuitive FxPro Edge platform with commission-free pricing and variable spreads, making it an efficient option for traders seeking flexibility and tax advantages.

Islamic Swap-Free and Demo Accounts

FxPro also offers Islamic swap-free accounts that comply with Sharia principles. Instead of overnight interest, a fixed administrative fee may apply after a grace period.

Additionally, demo accounts are available across all platforms, allowing users to practice strategies in a risk-free environment using real market conditions.

Each FxPro account type is designed to balance transparency, execution speed, and pricing efficiency, ensuring traders can choose the structure that best supports their trading goals.

What is the Minimum Deposit at FXPro

FxPro requires a minimum deposit of $100, making it accessible to both beginners and casual traders. This entry-level requirement applies across all account types and can be funded using various payment methods, including bank transfers, credit or debit cards, and popular e-wallets.

While $100 is sufficient to start trading, the broker recommends a minimum of $1,000 to maintain better margin management and risk control, especially for traders using leverage or holding multiple open positions. The flexible funding threshold allows users to start small and scale up as they gain confidence and experience.

| Broker | Minimum Deposit |

|---|---|

| FXPro | $100 |

XM | $5 |

| Pepperstone | $0 |

IG | $0 |

Deposit and Withdrawal

FxPro makes funding and withdrawing from your trading account simple, secure, and cost-efficient. The broker supports multiple payment options and maintains a no-fee policy on both deposits and withdrawals, ensuring traders can move funds easily without hidden charges.

The minimum deposit is $100, but the broker recommends maintaining at least $1,000 for better margin management and smoother trading operations. FxPro also supports multiple base currencies, helping reduce conversion costs when funding in the same currency as your account.

Deposit Fees & Options

All deposits are free of charge, and FxPro offers several convenient methods to fund your account. Most options provide instant processing, allowing you to begin trading right away. Bank transfers may take up to 1–3 business days depending on your region and bank.

Available Deposit Methods:

Withdrawal Fees & Options

Withdrawals are also free of charge and must be made using the same payment method used for deposit, in accordance with international anti-money-laundering (AML) regulations. This ensures funds are returned to the verified account originally used for funding.

Withdrawal requests are typically processed within one to two business days, though the time for funds to appear in your account may vary depending on the payment provider. E-wallet withdrawals are usually the fastest, while bank transfers may take slightly longer.

It’s important to note that third-party providers such as Skrill or Neteller may apply refund or transaction fees, which are beyond FxPro’s control.

Available Withdrawal Methods:

Bottom Line

FxPro’s deposit and withdrawal system is reliable, fast, and transparent. With broad payment coverage, instant funding for cards and e-wallets, and no internal fees, it delivers one of the most efficient funding experiences among regulated brokers.

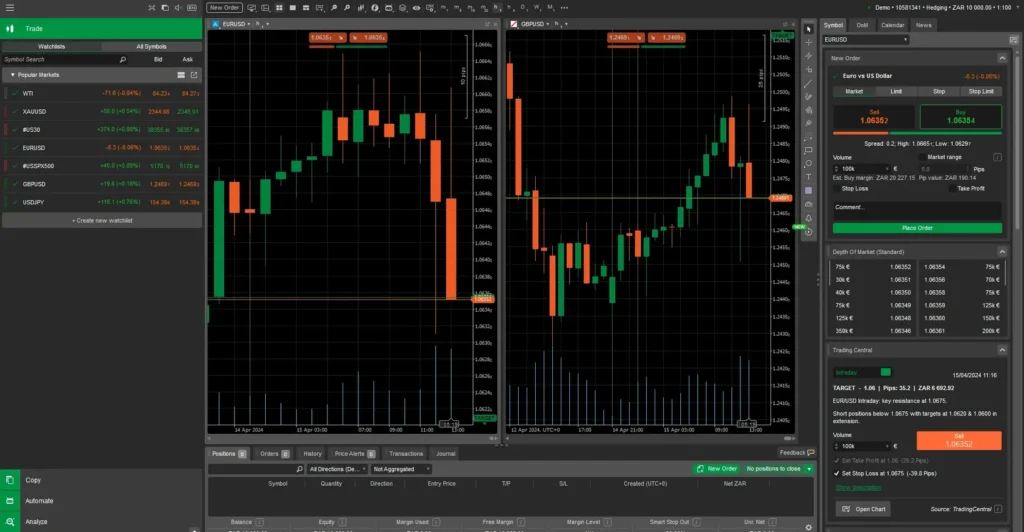

Desktop Trading Platform

FxPro offers four professional-grade trading platforms for desktop use — MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and FxPro Edge WebTrader. Each platform caters to different types of traders, from beginners to seasoned professionals, and all deliver fast execution with real-time market access.

During our testing, we selected and thoroughly tested the FxPro Edge WebTrader to evaluate its speed, functionality, and customization features, and it performed exceptionally well in terms of stability and user experience.

MetaTrader 4 and MetaTrader 5

MT4 remains the most popular choice among retail traders, offering a clean interface, 30+ built-in indicators, and compatibility with custom Expert Advisors (EAs) for automated trading.

MT5, the upgraded version, expands on these features with 80+ analytical tools, market depth display, and a multi-threaded strategy tester, making it ideal for traders who require faster processing and more analytical capabilities. Both platforms support one-click trading, multiple chart timeframes, and detailed order management tools, ensuring precision and control.

cTrader

The cTrader platform is built for advanced users seeking institutional-grade execution and in-depth control. It offers level II pricing, depth of market visibility, and custom order types, making it highly suitable for scalpers and algorithmic traders.

Through cAlgo, traders can code and deploy cBots for automated strategies using C# programming. The platform’s modern interface, responsive layout, and transparent execution model make it one of FxPro’s strongest offerings for professionals.

FxPro Edge WebTrader

The FxPro Edge WebTrader, which we tested extensively, stands out for its modular, drag-and-drop interface and browser-based accessibility — no installation required. It combines a sleek design with a customizable dashboard, allowing traders to organize multiple charts, watchlists, and news feeds according to their preferences.

Edge supports advanced charting tools, 50+ technical indicators, and a real-time trading journal, all integrated within an intuitive layout. It also delivers quick order execution and smooth performance even on high market volatility days.

Placing Orders

Order execution on FxPro’s platforms is seamless, with access to Market Execution and Instant Execution depending on the account type.

Traders can easily place market, limit, stop, and trailing stop orders, as well as OCO (One-Cancels-the-Other) orders on cTrader. The one-click trading function is available across all platforms, allowing quick entries and exits directly from the charts.

FxPro’s execution model ensures minimal slippage and no requotes, even during high-volatility periods, which is crucial for day traders and scalpers.

Charting and Analysis

FxPro’s desktop platforms excel in technical charting. MT4 and MT5 feature 30 to 80+ technical indicators, nine timeframes, and support for multiple chart types. cTrader and FxPro Edge WebTrader offer a more modern charting experience with detachable charts, multi-window layouts, and advanced drawing tools for precision analysis.

The Edge WebTrader, which we tested, allows traders to organize multiple charts side by side and customize them with preferred indicators and timeframes. Charts load quickly and maintain smooth performance, even when tracking several instruments simultaneously.

Tools and Automation

All FxPro platforms come equipped with tools designed to enhance strategy building and automation. MT4 and MT5 support Expert Advisors (EAs) for automated trading, while cTrader integrates cAlgo (now known as cTrader Automate) for running cBots coded in C#.

These tools enable traders to backtest and deploy algorithmic strategies with minimal manual intervention. The FxPro Edge platform also features customizable widgets, an economic calendar, real-time news, and price alerts, helping traders make informed decisions without leaving the trading dashboard.

Verdict

FxPro’s desktop platforms deliver a versatile trading experience across multiple interfaces. Whether you prefer the classic familiarity of MetaTrader, the analytical depth of cTrader, or the modern flexibility of FxPro Edge, all platforms offer advanced tools, automation options, and stable execution.

The Edge WebTrader, in particular, impressed during testing — proving fast, user-friendly, and well-suited for traders who want flexibility without sacrificing performance.

Pros & Cons of the Web Platform

Pros

- Multiple Platform Choices: Traders can choose from MT4, MT5, cTrader, and FxPro Edge WebTrader, offering flexibility for all trading styles and experience levels.

- Fast and Reliable Execution: Market Execution ensures no requotes and minimal slippage, even during high volatility.

- Advanced Charting Tools: Access to 50+ indicators, custom timeframes, and professional-grade analysis tools.

- Strong Automation Support: MT4/MT5 support Expert Advisors (EAs), while cTrader offers cBots for algorithmic trading.

- Customizable Interface: FxPro Edge WebTrader allows drag-and-drop layouts and modular workspaces tailored to user preferences.

- Smooth Performance: During testing, Edge WebTrader delivered fast order placement, stable connections, and responsive charting.

Cons

- Limited Add-Ons on Edge WebTrader: While intuitive, it lacks some third-party integrations and advanced scripting tools found in cTrader and MT5.

- Steeper Learning Curve: cTrader and MT5 can feel complex for beginners due to their advanced analytical features.

- No Integrated Social Trading: FxPro does not offer built-in copy or social trading functions within its desktop platforms.

- Design Inconsistencies Across Platforms: Visual and workflow differences between MT4, MT5, and Edge may require traders to adjust when switching between them.

Mobile App

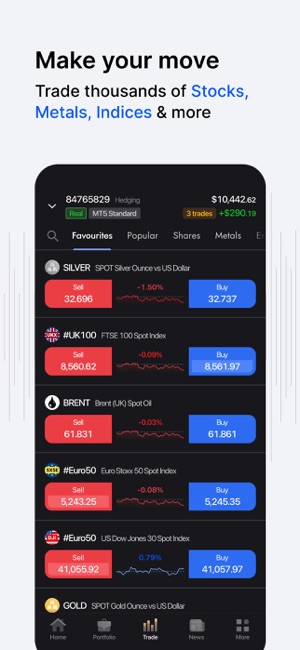

FxPro delivers a complete mobile trading solution through its dedicated FxPro App and the popular MT4 and MT5 mobile platforms. These apps are designed for traders who need full control of their accounts on the go, combining convenience, speed, and advanced functionality. Available for both iOS and Android, FxPro’s mobile experience bridges the gap between desktop-grade tools and portable trading flexibility.

FxPro App Features

The FxPro App serves as an all-in-one trading and account management hub, allowing users to monitor markets, open and close positions, fund accounts, and manage withdrawals directly from their mobile devices. It supports biometric authentication (Face ID and fingerprint login) for added security and convenience.

Traders can access real-time quotes across all asset classes, view interactive charts, and receive push notifications for price alerts, order executions, and market updates. The app’s clean, modern interface allows seamless navigation between trading, funds management, and market news without lag or clutter.

MT4 and MT5 Mobile Platforms

For traders who prefer MetaTrader, FxPro offers MT4 and MT5 mobile versions, fully compatible with their desktop counterparts.

These apps retain key functions such as one-tap trading, 30+ indicators, and multiple chart types, allowing users to analyze markets and execute trades directly from their phones or tablets. Chart layouts and account data automatically sync across devices, ensuring continuity for traders switching between desktop and mobile setups.

Charting and Tools on Mobile

Both the FxPro App and MetaTrader mobile platforms include powerful charting features, though naturally more compact than their desktop versions. Users can still perform technical analysis using multiple timeframes, zoom functions, and a solid range of drawing tools.

The FxPro App also integrates economic calendar updates and real-time market sentiment data, helping traders make informed decisions wherever they are.

Verdict

FxPro’s mobile trading experience is reliable, user-friendly, and secure, providing everything traders need to manage positions and monitor markets on the go. Whether using the FxPro App or MT4/MT5 mobile platforms, users benefit from fast execution, synchronized data, and strong functionality that make mobile trading both practical and professional.

Pros & Cons of the Mobile App

Pros:

- Intuitive, responsive interface suitable for traders of all experience levels

- Seamless synchronization with desktop platforms and web terminals

- Secure login options via biometric authentication

- Fast execution and real-time alerts for quick market responses

Cons:

- Smaller screen limits charting depth and analytical detail compared to desktop platforms

- No built-in copy or social trading features within the app

Market Research, Tools, and Education

FxPro provides a strong suite of research tools and market analysis features designed to help traders stay informed and make data-driven decisions.

Within the FxPro client portal and trading platforms, users gain access to real-time market news, an economic calendar, and a variety of in-depth analytical tools.

A key feature is the Fx Squawk headlines feed, available directly within the client portal and trading platforms.

This live audio and text news service delivers timely market updates, including the European Briefing, U.S. Briefing, and Closing Wrap—daily reports that summarize global market movements, major economic releases, and institutional insights. This continuous flow of information helps traders react quickly to breaking events without needing to switch platforms.

FxPro’s in-platform tools also include technical analysis features, offering 50+ indicators, trend overlays, and customizable chart setups.

These are complemented by an economic calendar that tracks major global data releases, helping traders anticipate market volatility and plan trades around key events.

While Trading Central integration is not officially listed for all regions, FxPro’s proprietary analytics and frequent updates provide comparable value.

The broker also provides regular market outlooks, price alerts, and event summaries that can be accessed via the platform’s research tab or directly from the FxPro website. Together, these features help create a cohesive and informed trading environment.

There are 36 cards in the Psychology section, while the four other learning categories each contain their own sets of mini cards. FxPro has also added a progress tracking feature, allowing traders to monitor their completed modules and measure their advancement through the material.

Customer Support

FxPro offers responsive and multilingual customer support designed to assist traders from around the world. Clients can reach the support team through live chat, email, and phone, with service available 24 hours a day, five days a week. Support is offered in over 20 languages, including English, Spanish, Arabic, Chinese, and German, making it accessible for traders across diverse regions.

The live chat function is the fastest way to get help, typically connecting users with an agent within a minute. Email support is equally reliable, with most queries answered within a few business hours. For more urgent issues, traders can contact FxPro’s regional offices by phone, where agents are trained to handle both technical and account-related inquiries.

Response Quality and Professionalism

During testing, FxPro’s support team proved to be fast, professional, and well-informed. Representatives were able to handle both general questions about account setup and more detailed topics like platform configurations and trading conditions. The quality of assistance reflected the company’s commitment to client satisfaction and transparency.

In addition to direct communication, FxPro provides an extensive FAQ section, along with platform tutorials and trading guides available through its website and client portal. These self-help materials are especially useful for new traders who prefer to troubleshoot issues or learn independently.

Room for Improvement

While FxPro’s customer service is efficient and courteous, there is room for improvement in two key areas. First, support is available only 24/5, leaving a gap over the weekend when markets like crypto remain active. Extending service to 24/7 availability would enhance accessibility for global traders operating in different time zones. Second, although the FAQ section is comprehensive, a searchable knowledge base or AI chatbot could make it easier for users to find answers instantly without waiting for an agent.

Verdict

Overall, FxPro’s customer support is reliable, multilingual, and well-organized, providing fast assistance and high-quality guidance. With extended coverage hours and more in

FAQ

Is FxPro safe and legit?

Yes. FxPro is a fully regulated and reputable broker licensed by top-tier authorities, including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), SCB (Bahamas), and FSA (Seychelles). The broker follows strict financial standards, offers negative balance protection, and keeps client funds segregated in trusted banks, ensuring safety and transparency.

What can I trade on FxPro?

You can trade over 2,200 CFDs across multiple asset classes, including forex, stocks, indices, metals, energies, futures, ETFs, and cryptocurrencies. Availability may vary by platform and regulatory jurisdiction.

What is the minimum deposit?

The minimum deposit is $100, though FxPro recommends starting with $1,000 for better margin management and flexibility when opening multiple positions.

Are there any fees for inactivity?

Yes. FxPro charges a $10 inactivity fee after six months of no trading activity, followed by a small monthly maintenance fee if the account remains inactive.

Which platforms does FxPro offer?

FxPro supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and its proprietary FxPro Edge WebTrader. All platforms feature advanced charting, technical indicators, and fast, no-dealing-desk execution.

Does FxPro allow crypto trading?

Yes. FxPro offers crypto CFDs on popular assets like Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash. However, crypto trading is not available to UK retail clients due to FCA restrictions.

Is FxPro good for beginners?

Yes. FxPro provides user-friendly platforms, educational resources, and demo accounts that allow beginners to practice risk-free. The broker’s transparent pricing and responsive customer support also make it beginner-friendly.

How can I withdraw funds?

Withdrawals can be made using the same method used for deposit, including bank transfers, cards, PayPal, Skrill, and Neteller. FxPro processes most requests within 1–2 business days, and no internal withdrawal fees apply.

Are there tax benefits for UK spread betting accounts?

Yes. UK residents trading via FxPro Edge Spread Betting Accounts may enjoy tax-free profits, as spread betting is exempt from capital gains and stamp duty tax in the UK.

Is FxPro suitable for professional traders?

Absolutely. FxPro caters to professionals through Raw and Elite accounts, tight spreads, algorithmic trading support, and rebate programs. Its institutional-grade liquidity and multiple platforms make it a strong choice for experienced and high-volume traders.