IC Markets Review 2025

Curious if IC Markets is still worth trading with in 2025? I decided to find out. In this in-depth review, I’ll walk you through my firsthand experience, from fees and platforms to speed and support, & see how it compares to other top brokers like IG, Pepperstone, and Vantage.

Broker Guide's IC Markets Review in 2025

I decided to test IC Markets to see if its “True ECN” claim still holds up in 2025. Many brokers promise low spreads and fast execution, but few deliver on both.

To find out, I opened a live account and compared IC Markets with top rivals like Pepperstone, Fusion Markets, and IG.

I focused on what really matters for traders: pricing, speed, regulation, and overall user experience.

My goal was simple, to see if IC Markets still deserves its reputation as one of the best ECN forex brokers for low-cost, high-performance trading.

About IC Markets

IC Markets was founded in 2007 and is headquartered in Sydney, Australia. Over the years, it has built a strong reputation as a reliable ECN forex broker that caters to both beginners and professional traders.

The company was created with a clear goal — to provide fair and transparent access to the global financial markets. Today, IC Markets is known as one of the world’s most established brokers, offering a trading environment that closely mirrors institutional-grade conditions.

Fast Execution and Deep Liquidity

One of the biggest reasons traders choose IC Markets is its unmatched execution speed and deep liquidity. The broker connects to multiple top-tier liquidity providers to ensure low latency and minimal slippage. This setup gives traders access to raw spreads starting from 0.0 pips on major currency pairs.

Combined with its True ECN model, orders are filled quickly and transparently, without dealing desk intervention. These features make IC Markets a favorite among scalpers, day traders, and algorithmic traders who depend on precision and speed.

A Massive Client Base and Global Reach

IC Markets has grown from a regional brokerage into a global trading powerhouse. It now serves more than 200,000 active clients across over 160 countries. IC Markets reached an impressive $1.6 trillion in global trading volume in 2024, ranking among the largest forex and CFD brokers by volume. This scale speaks to the broker’s strong reputation, reliable infrastructure, and ability to handle high trading demand from retail and institutional clients alike.

Multiple Trading Platforms for Every Style

IC Markets offers a wide range of industry-leading trading platforms, giving users the freedom to choose what best fits their trading style. Clients can trade using MetaTrader 4 (MT4) and MetaTrader 5 (MT5) — both well-known for their advanced charting tools and automated trading capabilities.

The cTrader platform is ideal for traders who prefer an intuitive interface and fast order execution, while TradingView provides a seamless experience for those who value powerful charting and social trading features. Together, these platforms make IC Markets one of the most flexible brokers in the industry.

Why Traders Trust IC Markets

From its Australian roots, IC Markets has maintained a reputation for transparency, regulatory compliance, and consistent performance. Its combination of fast execution, raw pricing, and strong global regulation positions it as a leading choice for traders in 2025. Whether you trade manually, use Expert Advisors, or follow social strategies, IC Markets provides the technology and reliability to trade with confidence.

My Quick Verdict: Who is IC Markets Best For?

Rating: 4.4/5

Best for: Experienced traders, scalpers, and algorithmic traders who use MT4, MT5, or cTrader.

Not ideal for: Beginners or long-term investors who prefer simpler, proprietary platforms and a more hands-off approach.

IC Markets remains one of the most reliable choices for serious traders in 2025. It continues to deliver on its promise of raw spreads, fast execution, and a true ECN trading environment.

During testing, trade orders were executed almost instantly, and spreads on major pairs like EUR/USD often hovered near zero. The broker’s combination of advanced platforms, deep liquidity, and stable performance makes it ideal for active traders who want institutional-grade conditions without paying high costs.

Pros:

- True ECN execution & raw spreads from 0.0 pips

- Over 3,500+ tradable instruments

- Free deposits, withdrawals, and no inactivity fees

- Multiple regulations (ASIC, CySEC, FSA Seychelles, CMA Kenya, SCB Bahamas)

- Advanced platforms + copy trading options (IC Social, Signal Start)

- Excellent for scalping and algorithmic trading

Cons:

- No FCA regulation

- No proprietary platform

- Limited stock CFD range (mostly Aussie shares)

- Research tools could be more robust

Why You Should Choose IC Markets ?

This broker continues to stand out for its exceptionally low trading costs. Spreads start from 0.0 pips, and commissions remain among the most competitive in the market. There are no hidden charges for deposits, withdrawals, or inactivity, helping traders keep their profits intact.

Fast Execution and Deep Liquidity

Speed is a major advantage. With execution times averaging under 40 milliseconds, trades go through almost instantly via deep interbank liquidity pools. This reliability and precision make it a strong choice for scalpers and traders who depend on fast order execution.

Flexible Trading Options

IC Markets supports a wide range of trading styles. You can automate your strategies, copy other traders, or manage multiple accounts if you trade professionally. The setup is designed to give users flexibility, control, and access to advanced tools without unnecessary complexity.

Transparent and Easy to Use

With ten available base currencies, it’s easy to manage funds and avoid conversion fees. The pricing model is simple, transparent, and fair, so traders always know what to expect.

Competes With Industry Leaders

When compared with well-known names like IG, Pepperstone, and Fusion Markets, this broker continues to perform at a high level. It offers a balance of cost, speed, and platform quality that appeals to serious traders looking for consistent results in 2025.

The Bottom Line

If you’re looking for a fast, low-cost, and transparent trading experience, IC Markets delivers on all fronts. It’s built for traders who value performance and flexibility over flashy extras, making it a dependable choice for those who want professional-grade conditions in 2025.

Compare to Top Competitors

When evaluating this broker, it’s worth seeing how it compares with other major names in the industry. Each of these competitors brings its own strengths — from platform innovation to research tools — but the focus here is on pricing, performance, and overall trading experience.

IG

Pepperstone

Vantage

Exploring IC Markets’ Range of Tradable Instruments

IC Markets provides access to a broad and diverse selection of markets, offering over 3,583 tradable instruments across multiple asset classes. From forex and commodities to crypto and futures, traders can build strategies that fit any market condition or risk profile.

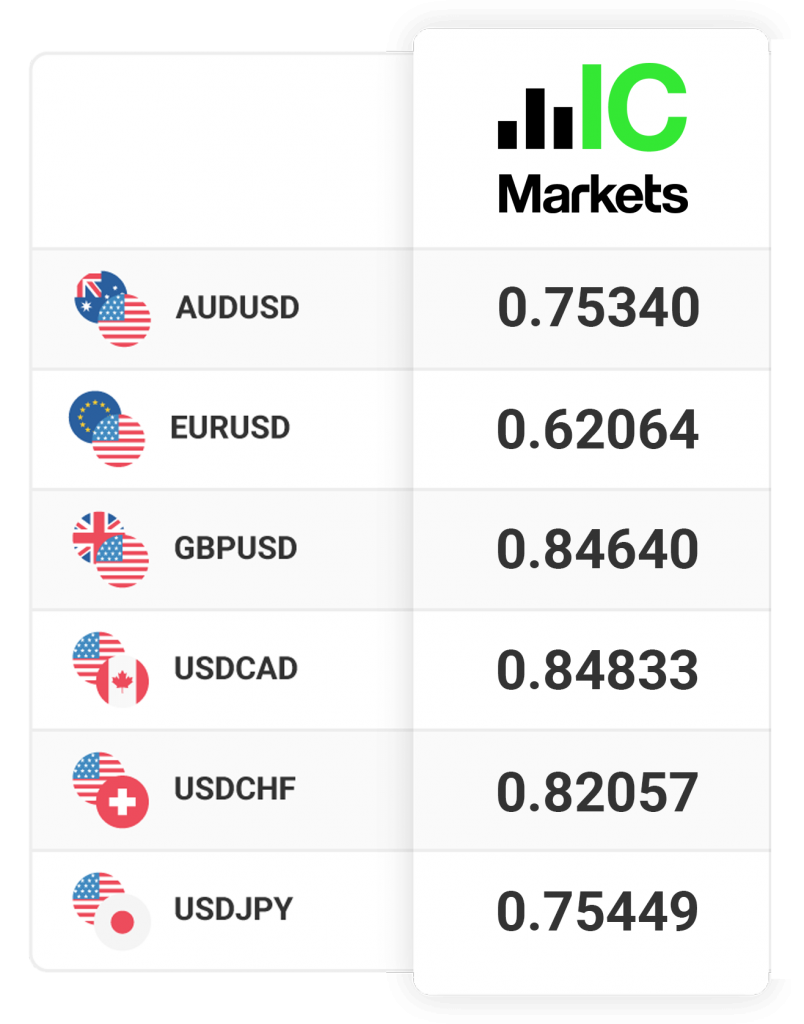

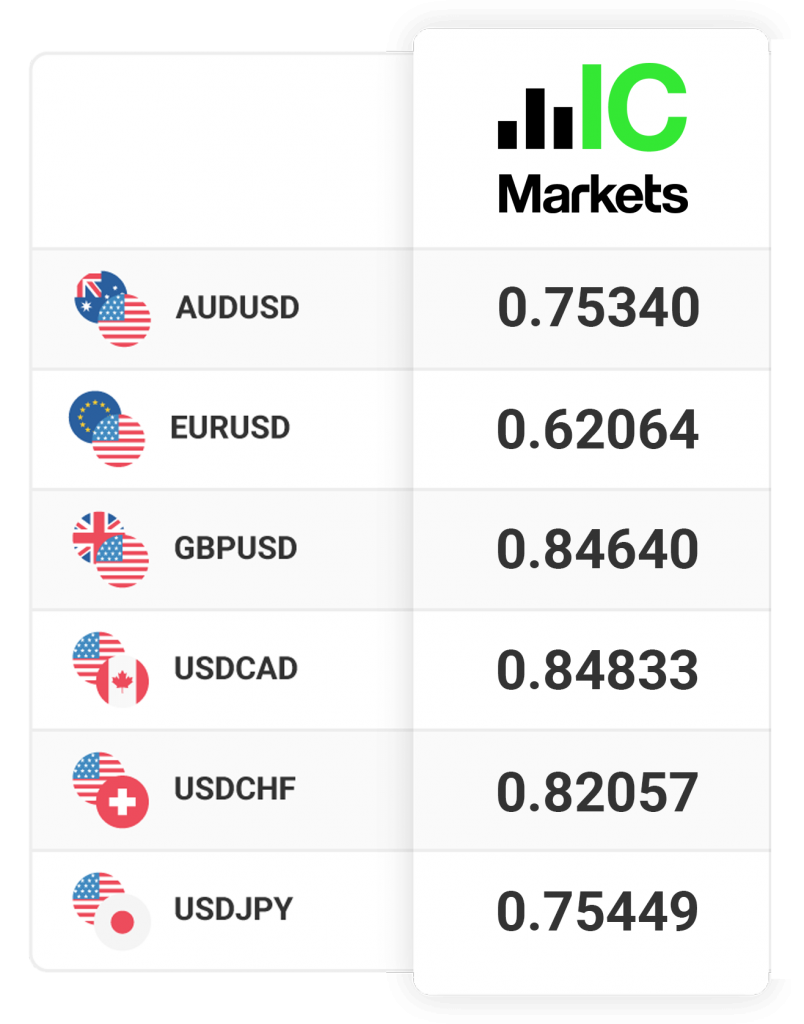

Forex

Trade from 61 forex pairs, including majors, minors, and exotics. With spreads starting from 0.0 pips and fast execution, it’s designed for traders who demand precision and liquidity. Popular pairs like EUR/USD, GBP/USD, and USD/JPY consistently show some of the lowest average spreads in the market, making this setup especially attractive for scalpers and algorithmic traders.

Commodities — Metals and Energy

The commodities range covers popular assets such as gold, silver, platinum, WTI oil, and Brent crude. These markets offer opportunities to hedge inflation, trade global trends, or diversify beyond currencies. With tight spreads and strong liquidity, it’s a straightforward way to access both metals and energy products.

Indices — Global Market Access

Trade the world’s major indices including the S&P 500, FTSE 100, NASDAQ 100, DAX 40, and Nikkei 225. These CFDs allow traders to speculate on entire markets rather than single companies. With low margin requirements and competitive pricing, they’re popular for short-term traders and swing traders alike.

Cryptocurrency CFDs

The crypto CFD lineup features leading coins like Bitcoin, Ethereum, Litecoin, and Ripple, among others. You can trade both rising and falling prices without owning the underlying asset. Note that crypto CFDs are for speculative trading only and aren’t available to retail clients in certain regions, such as the UK and EU.

Bonds and Stocks

Traders can access Australian share CFDs and global bond markets through a smaller but useful selection. Stock CFDs include large-cap companies listed on the ASX, allowing short-term speculation or hedging. Bond CFDs let traders position around global interest rate changes, adding another layer of diversification.

Futures

The broker also offers futures CFDs on commodities, indices, and currencies. These instruments mirror the price movements of real futures contracts but can be traded with lower capital requirements. They’re suitable for traders looking to capture longer-term trends or manage exposure to global markets without owning the physical asset.

| Asset | IC Markets |

|---|---|

| Stocks CFDs | 2100+ |

| Options | No |

| Futures | 4 |

| Forex | 61 |

| Crypto Trading | 21 |

| Commodities | 24 |

| ETFs | No |

| Indices | 24 |

| Bonds | 9 |

The Bottom Line

With thousands of markets available — including forex, commodities, indices, crypto, stocks, bonds, and futures — this broker gives traders exceptional flexibility and reach. Whether you prefer short-term trading or diversified long-term strategies, the range of instruments ensures you’ll find opportunities across all major markets.

How IC Markets’ Instruments Compare to Competitors

This broker offers one of the widest selections of tradable markets among leading forex and CFD providers. With more than 3,500 instruments across forex, commodities, indices, crypto, stocks, bonds, and futures, it provides traders with plenty of options to diversify or focus on specific markets. To see how it measures up, here’s a quick comparison against three major competitors — IG, Pepperstone, and Vantage — each known for their own market reach and platform strengths.

| Asset | IC Markets | IG | Pepperstone | Vantage |

|---|---|---|---|---|

| Forex | ||||

| Commodities | ||||

| Indices | ||||

| Cryptocurrencies Futures | ||||

| Stocks | ||||

| Bonds CFDs | ||||

| Futures CFDs |

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $200 |

| Average Spread EUR/USD (Standard) | 0.62 pips |

All-in Cost EUR/USD - Active | 0.62 pips |

| Commissions | Standard Account: $0 Raw Spread Account: $7.0 per lot |

| Forex CFD Fees | Low |

Index CFD Fees | Low |

Stock CFD fees | Low |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $0 |

IC Markets is known for its low-cost trading model and clear pricing. It offers institutional-grade spreads and execution without unnecessary markups or hidden charges. Whether you’re trading manually or using automated strategies, the fee structure is designed to keep trading costs predictable and fair.

Trading Account Fees

Trading Fees

There are three main account options — Standard, Raw Spread (MT4/MT5), and cTrader Raw — each catering to different trading preferences and experience levels.

Standard Account

- Average Spread (EUR/USD):> ~0.82 pips

- Commission: None

Raw Spread (MT4/MT5) Account

- Average Spread (EUR/USD): From 0.0 pips

- Commission: $7 per round turn (1 lot)

cTrader Raw Account

- Average Spread (EUR/USD): From 0.0 pips

- Commission: $6 per round turn (1 lot)

Other Trading Costs

Beyond spreads and commissions, this broker keeps additional costs minimal:

Deposit Fees: None

Withdrawal Fees: None (only minor third-party bank charges may apply)

Inactivity Fees: None

Account Maintenance Fees: None

This fee-free policy gives traders peace of mind and helps protect profits, especially for those who trade less frequently.

Non-Trading Fees

Inactivity Fee: None

Currency Conversion Fee: Applies only when funding or trading in a non-base currency

Final Thoughts on Costs

This broker remains one of the most competitively priced options in 2025. With raw spreads from 0.0 pips, commissions as low as $6 per lot, and zero non-trading fees, it consistently ranks among the best for cost efficiency. Whether you’re a scalper, algorithmic trader, or long-term investor, the transparent pricing model ensures you trade under some of the fairest and most reliable conditions in the market.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is IC Markets Regulated ?

Yes. IC Markets operates under several respected financial regulators, giving traders confidence that their funds and trading activities are well protected. Each entity follows strict compliance standards designed to ensure transparency, segregation of client funds, and fair trading practices.

Regulatory Licenses

- ASIC (Australia): Tier-1 regulator, License No. 335692

- CySEC (European Union): License No. 362/18

- FSA (Seychelles): License No. SD018

- CMA (Kenya): License No. 199

- SCB (Bahamas): License No. SIA-F214

These licenses allow the broker to serve traders globally while maintaining compliance with international financial laws and oversight standards.

Investor Protection

- EU Clients: Protected up to €20,000 through the Investor Compensation Fund (ICF) under the CySEC-regulated entity.

- Negative Balance Protection: Offered to clients under ASIC and CySEC, ensuring that traders cannot lose more than their deposited funds.

- Client Fund Security: All customer funds are held in segregated trust accounts at top-tier banks.

While the broker is not publicly listed and does not hold a banking license, its strong multi-jurisdictional regulation and operational history make it a secure and trustworthy choice for traders worldwide.

Understanding Regulatory Protections and Broker Stability

With more than 15 years in operation, IC Markets has built a reputation for reliability and transparency. It has consistently maintained a Trust Score of 88/99 according to some independent reviews, reflecting its strong compliance record, client protection measures, and global regulatory coverage. Longevity in the market is a key indicator of stability, and this broker’s long track record reinforces its credibility.

Financial Strength and Capital Position

The company maintains a solid capital base, ensuring it can meet its financial obligations even during periods of market volatility. Its focus on financial health and risk management allows it to operate confidently across multiple jurisdictions while protecting traders from potential liquidity risks.

Client Fund Protection

All client funds are kept in segregated accounts at top-tier banks, separate from the broker’s operational capital. This structure ensures that traders’ money cannot be used for company expenses or investments. Additionally, negative balance protection is in place under key regulated entities, ensuring clients cannot lose more than their deposited amount — a vital safeguard during volatile market conditions.

The Bottom Line

This broker’s long-standing regulatory record, capital stability, and client protection policies make it a dependable choice for traders who prioritize safety as much as performance. It combines experience with strong oversight, giving traders peace of mind that their funds are handled securely.

How To Open an Account

Opening an account is quick, secure, and fully online. Most applicants finish the form in minutes and get verified within one business day after documents are submitted. The minimum deposit is 200.

Step-by-step:

- Fill out the online registration form. Enter your contact details and personal information accurately.

- Choose your platform, account type, and base currency. Pick MT4, MT5, cTrader, or TradingView with Standard or Raw pricing.

- Providing information about your trading experience and selecting a security question.

- Upload a valid government ID and a recent proof of residence. Ensure the images are clear and readable.

- Complete KYC and a short suitability test. Typical approval is completed within 24 hours.

- Deposit funds. The minimum is 200 with multiple supported payment methods and no deposit fee.

Time to open: around 10 minutes to apply. Verification: about 1 business day.

Account Types

Picking the right account should feel straightforward. IC Markets keeps pricing clear and platforms flexible, so you can align costs with how you trade and scale as you grow. Each option below highlights who it suits and why.

Standard Account

The Standard Account uses a spread-only model with no commissions, making cost tracking simple for discretionary traders on MT4 or MT5. Typical majors start around 0.8 pips, which suits lower-frequency or beginner workflows.

RAW Spread Account

The Raw Spread Account offers spreads from 0.0 pips plus 7 per lot round turn on MT4 or MT5, favoring scalpers, EA users, and spread-sensitive strategies. It delivers raw pricing and fast execution for active trading styles.

cTrader Raw Spread Account

The cTrader Raw Spread Account provides 0.0 pips plus 6 per lot round turn on cTrader, with a higher order limit that’s well-suited to heavy day trading and algos. It is ideal if you prefer cTrader’s interface and depth-of-market tools.

Islamic Account

The Islamic Account is swap-free and available on main account types for clients who require interest-free overnight conditions. Certain instruments may carry a fixed overnight fee instead of swaps.

MAM/PAMM Accounts

MAM/PAMM accounts are built for money managers who need flexible allocation and real-time reporting across client sub-accounts. They also support expert advisors for systematic management.

What is the Minimum Deposit at IC Markets?

The minimum deposit is 200 across all live accounts, which keeps onboarding consistent whether you prefer Standard, Raw Spread, or cTrader Raw pricing. You can also trade in micro-lot size 0.01 lots, which is helpful for fine-tuning risk and scaling positions gradually as you validate a strategy or EA. Flexible lot sizing is supported on the broker’s platforms, letting you start small and adjust sizing as your balance and confidence grow.

| Broker | Minimum Deposit |

|---|---|

| IC Markets | $200 |

IG | $0 |

| Pepperstone | $0 |

Vantage | $50 |

Deposit and Withdrawal

IC Markets makes funding straightforward, fast, and low cost, with a wide range of supported methods and clear timelines. Deposits are generally instant with cards and e-wallets, while withdrawals are typically processed the same or next business day, subject to banking networks and cut-off times.

Deposit Options

Fund your account via bank transfer or credit/debit cards (Visa, Mastercard) with no broker deposit fee; cards are typically instant once approved, while bank transfers follow your bank’s timelines.

You can also use e-wallets such as PayPal, Skrill, Neteller, POLi, BPay, and FasaPay for quick funding; these are generally instant once processed in the client area.

Additional processors include Visa Direct, SafeCharge, Transact365, Klarna, CardPay, eCommPay, and RapidPay, subject to regional availability and your selected base currency.

No broker deposit fee; cards and most e-wallets are instant once approved.

Withdrawal Options

Withdraw with no broker fee via the same method used to deposit, wherever possible; note that international bank wires may attract intermediary bank charges outside the broker’s control.

Requests are typically processed the same or next business day after submission; cards often arrive in 3–5 business days post-processing, e-wallets are commonly near-instant once processed, and bank transfers take 2–5 business days domestically and longer for international wires.

No broker withdrawal fee; international bank wires may incur intermediary bank charges.

Desktop Trading Platform

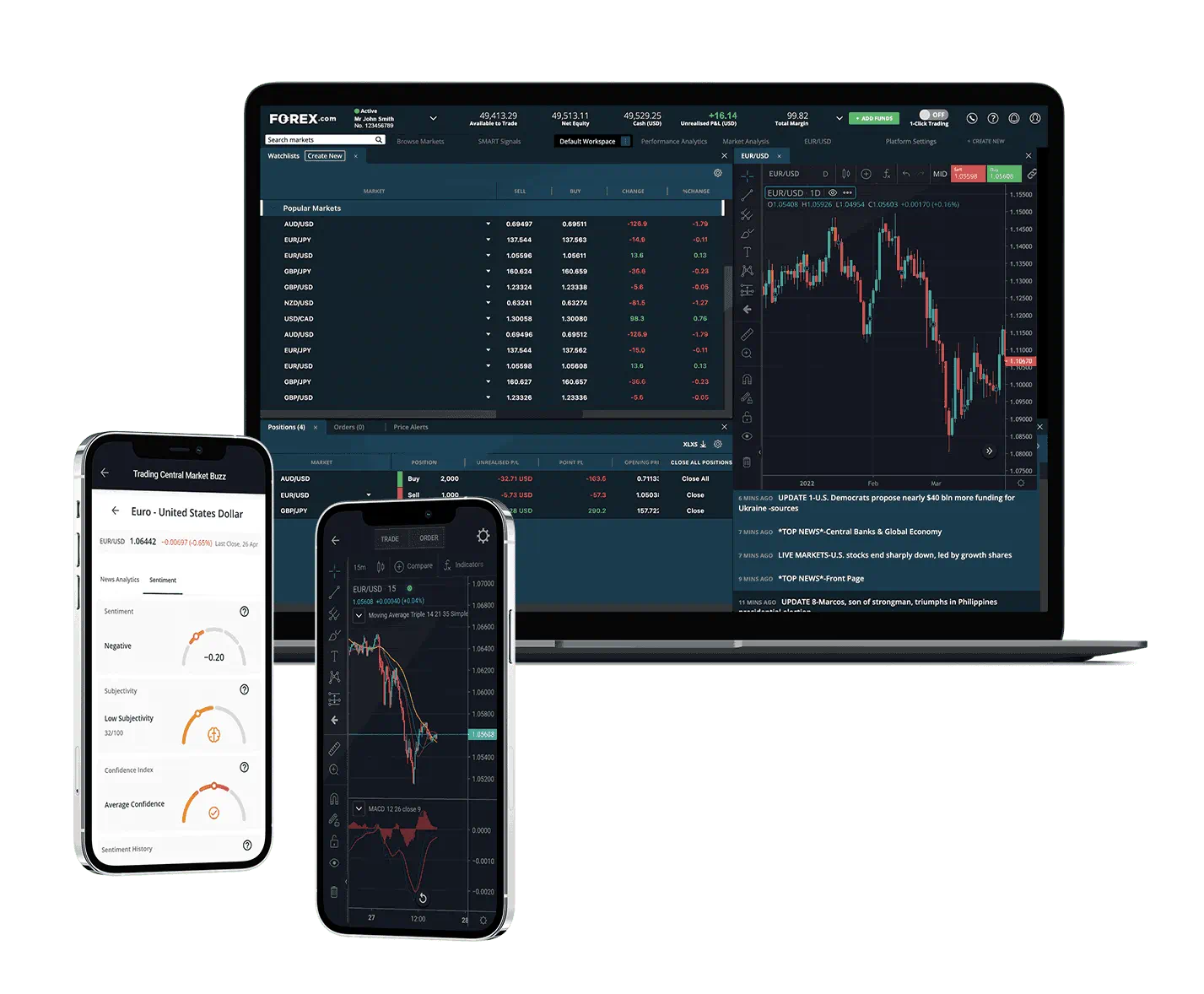

The desktop trading experience here is designed for performance, flexibility, and speed. Traders can choose from a suite of industry-leading platforms — MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView — all optimized for different trading styles. Whether you’re running automated strategies, analyzing complex charts, or executing high-frequency trades, the desktop setup delivers institutional-grade performance for retail traders.

Multiple Platforms, One Goal: Precision

Each available platform offers a unique trading experience. MT4 remains the most popular choice for forex traders, supporting thousands of Expert Advisors (EAs) and custom indicators.

MT5 adds more advanced order types and analytical tools, ideal for multi-asset traders. cTrader stands out for its sleek design, improved market depth view, and faster order execution. Meanwhile, TradingView provides modern web-based trading with powerful charting, social sharing, and easy strategy integration.

Seamless Execution and Trading Tools

All platforms deliver one-click trading, tight spreads, and deep liquidity, allowing for near-instant order execution. The trading environment supports multiple order types, market depth, and advanced risk management tools.

Traders can easily set up automated systems, copy strategies, or use manual analysis tools depending on their preferred workflow.

Advanced Charting and Customization

Charting capabilities are a standout feature across all platforms. Users can apply custom indicators, draw tools, and templates to create a personalized trading workspace.

Both MetaTrader and cTrader allow the use of third-party plugins, while TradingView enhances the experience with cloud-based chart syncing and community-driven analysis.

Integration with Copy and Algorithmic Trading

For traders who prefer automation or signal following, the desktop platforms integrate with multiple copy trading services and strategy automation tools.

MT4 and MT5 support Expert Advisors (EAs), cTrader uses cAlgo for custom strategies, and TradingView allows Pine Script-based automation and alerts. This flexibility ensures traders can combine manual and automated methods without compromise.

Verdict

The desktop trading suite is built for serious traders who demand speed, flexibility, and advanced functionality. While there’s no proprietary platform, the inclusion of MT4, MT5, cTrader, and TradingView provides everything most traders could need — from algorithmic execution to advanced charting.

Combined with deep liquidity and reliable execution, it stands out as one of the most complete and professional desktop trading environments available in 2025.

Pros & Cons of the Web Platform

Pros

- Access to four major platforms: MT4, MT5, cTrader, and TradingView

- Fast and reliable execution with deep liquidity

- Supports algorithmic and copy trading across all major platforms

- Highly customizable interface with advanced charting tools

- One-click trading and multiple order types for fast execution

- Compatible with third-party plugins and strategy automation tools

- Cross-platform synchronization for seamless trading between desktop and web

- Tight spreads and minimal latency for professional-grade performance

Cons

- No proprietary platform, unlike some competitors such as IG

- Platform features vary, meaning some tools are exclusive to specific platforms (e.g., cTrader vs MT5)

- Requires setup and learning curve for beginners unfamiliar with multi-platform systems

- Limited stock CFD tools compared to brokers focused on equities

Mobile App

The mobile experience is built for traders who want flexibility without losing performance. Available on MT4, MT5, cTrader, and IC Social, the apps work smoothly on both iOS and Android devices. They’re ideal for checking charts, managing open positions, or copying trades while on the move.

Platform Choices

Each app offers something slightly different. The MT4 and MT5 mobile apps provide all the essentials — full trade execution, live pricing, and chart analysis tools.

cTrader Mobile has a cleaner interface and faster order handling, perfect for traders who value precision. IC Social is more community-focused, letting you follow and copy successful traders directly from your phone.

Performance and Ease of Use

The mobile apps are fast, reliable, and easy to navigate. Execution times are quick, charts load instantly, and syncing between devices is seamless. You can start a trade on desktop and monitor or close it from your phone without missing a beat.

The layout is simple and functional, making it easy for both beginners and experienced traders to manage positions confidently.

Copy Trading on the Go

The IC Social app adds an extra layer of convenience for those who enjoy following proven strategies. You can browse top-performing traders, copy their positions instantly, and monitor performance in real time. It’s a hands-on way to stay connected to market movements without needing to execute every trade yourself.

Design and Security

The design is clean and intuitive, with enough charting tools and indicators to make quick analysis easy. While it’s not as advanced or visually refined as IG’s or CMC Markets’ mobile platforms, it still gets the job done effectively.

All apps include secure logins, encryption, and two-factor authentication, ensuring your trading and personal data remain protected.

Verdict

The mobile apps deliver a smooth, dependable trading experience for users who want to stay active away from their computer. Between MT4, MT5, cTrader, and IC Social, you have the freedom to trade, analyze, and copy strategies whenever you want.

While they may not be the most advanced apps in the market, their reliability, speed, and ease of use make them a solid choice for everyday mobile trading.

Pros & Cons of the Mobile App

Pros

- Available on MT4, MT5, cTrader, and IC Social for both iOS and Android

- Fast execution speeds and stable performance

- Seamless syncing between desktop and mobile accounts

- Supports copy trading and social trading via IC Social

- User-friendly interface that’s easy to navigate

- Secure login with two-factor authentication and encryption

- Real-time quotes and charting with multiple timeframes and indicators

- Quick trade execution and position management on the go

- Lightweight design that runs smoothly even on older devices

Cons

- Less advanced interface compared to IG or CMC Markets apps

- Limited charting tools and customization options

- Some platform features are missing on mobile versions (vs desktop)

- Copy trading tools are not as in-depth as dedicated platforms

Market Research, Tools, and Education

IC Markets provides a good range of research tools aimed at helping traders make more informed decisions. Among these are Trading Central and Autochartist, both popular for their chart pattern recognition and market analysis features.

These tools scan the markets automatically to highlight potential trade setups, saving traders time and helping them spot opportunities more efficiently.

In addition to these, traders can use a variety of third-party plugins for technical analysis and trade management, which integrate seamlessly with MT4, MT5, and cTrader.

While the built-in research tools are useful, they are not as extensive as what’s offered by top-tier brokers like IG or Saxo, who provide in-house analytics and detailed market commentary.

For traders who prefer independent research, the broker also provides economic calendars, market news feeds, and live price updates. The overall setup ensures you have the essentials needed to stay informed, though it’s more focused on efficiency than depth.

- Beginner guides and platform tutorials

- Webinars hosted by trading professionals

- Articles covering strategy, risk management, and technical analysis

These materials are well-organized and easy to follow, but they’re not as extensive or interactive as the offerings from larger brokers with dedicated education hubs.

Customer Support

IC Markets offers 24/7 customer support through live chat, email, and phone. Whether you’re dealing with a technical issue, a platform question, or an account-related concern, help is always available. The support team operates across all time zones, making it easy for traders worldwide to get assistance whenever needed.

Multilingual and Responsive Team

The IC Markets support team is multilingual and highly responsive, catering to traders from different regions and language backgrounds. During testing, most inquiries were answered within a few minutes via live chat. Email responses typically arrived within a few hours, even during busy trading periods. The staff are knowledgeable about both technical and trading-related topics, providing accurate and practical solutions.

Weekend Availability for Funding Issues

One of the standout features of IC Markets’ customer service is its weekend availability for urgent account and funding issues. While trading support is limited to market hours, traders can still get assistance with deposits, withdrawals, and account access even on Saturdays and Sundays — something few brokers offer.

Communication Channels

Traders can reach IC Markets via:

- Live Chat: Available 24/7 with near-instant response times

- Email Support: support@icmarkets.com

- Phone Support: Global and regional numbers provided on the official website

- Help Center: Detailed FAQs, guides, and troubleshooting tips

This multi-channel setup ensures that traders can find answers quickly, whether they prefer direct communication or self-service options.

Verdict

IC Markets delivers excellent customer support that matches its reputation as a trader-focused broker. The 24/7 live chat, multilingual assistance, and weekend help for funding issues set it apart from many competitors. While the lack of a dedicated account manager may be a drawback for high-volume traders, the overall service quality is fast, reliable, and highly professional — making IC Markets a dependable choice for global clients.

FAQ

Is IC Markets safe and regulated in 2025?

Yes. IC Markets is regulated by multiple top-tier authorities, including ASIC (Australia), CySEC (EU), FSA (Seychelles), CMA (Kenya), and SCB (Bahamas). It also offers negative balance protection and segregated client funds for added safety.

What is the minimum deposit?

The minimum deposit to open an account with IC Markets is $200 across all account types.

Does IC Markets charge withdrawal or inactivity fees?

No. IC Markets does not charge any withdrawal or inactivity fees, although small third-party bank charges may apply for wire transfers.

Which platforms does IC Markets offer?

IC Markets supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView, giving traders flexibility to choose their preferred trading environment.

Can I trade crypto CFDs?

Yes. IC Markets offers cryptocurrency CFDs on major coins like Bitcoin, Ethereum, Litecoin, and Ripple. However, crypto CFDs are not available to retail traders in certain jurisdictions such as the UK.

Does IC Markets support copy trading?

Yes. IC Markets supports copy trading through IC Social, Signal Start, and Myfxbook AutoTrade, allowing traders to follow or replicate strategies from experienced traders.

Is IC Markets good for beginners?

IC Markets can be suitable for beginners due to its low fees, simple account setup, and solid educational content. However, its advanced platforms and tools may require some learning time for new traders.

What’s the average IC Markets spread on EUR/USD?

The average spread on the EUR/USD pair is around 0.82 pips on the Standard Account and 0.0–0.1 pips on the Raw Spread Account.

Can I use MT5 for automated trading?

Yes. IC Markets fully supports automated trading on MT5, allowing you to use Expert Advisors (EAs) and custom indicators for algorithmic strategies.

How long do withdrawals take?

Withdrawals from IC Markets are typically processed within one business day. E-wallet and card withdrawals are usually faster, while international bank transfers may take 2–5 business days to reflect in your account.