The Bank of Japan started its two-day monetary policy meeting Monday, and the bank is expected to announce any decision later on Tuesday in Tokyo. The decision will be followed by a press conference by the 31st and current Governor of the BoJ, Haruhiko Kuroda.

According to market expectations, the most likely scenario would be a wait-and-see mode from the bank while attempting to assess COVID-19 impact and the bank’s response. So, the Boj will leave interest rates and assets purchased unchanged.

Be aware of what Kuroda has to say

Everybody remembers last week’s Fed aftermath when the markets were trading inside a powerful rally. Last Wednesday, the Fed came out with a grim forecast for the United States economy regarding COVID-19 impact. The market started a period of selling, and the risk aversion took the financial world.

However, the Fed announced Monday it would buy a broad and diversified portfolio of corporate bonds as a tool to support the economy and provide liquidity to medium and big companies.

Wall Street reacted positively, and markets started to recover initial losses and closed up on the day. However, any sense of risk if contained by the BoJ meeting.

Markets are worried about a Fed meeting aftermath replication just ahead of the Bank of Japan announcement. According to the Rabobank FX analysis team, the Bank of Japan is expected to deliver a dovish message that would push the Japanese yen down.

Although Rabobank doesn’t expect the meeting to provide much direction for the JPY, Kuroda’s comments may be sufficient “to cause a modest softening in the currency.”

“Even though the worst of the COVID-19 related crisis may be passed, it is very unlikely that BoJ Governor Kuroda will provide an outlook much brighter to that offered by Powell,” Rabobank said in a recent note.

In that framework, Japanese Prime Minister, Shinzo Abe said Monday that official’s “priority now is to do everything to put the economy on the recovery path.” Abe also commented that “the debt balloon can be maintained forever.”

USD/JPY potential reaction

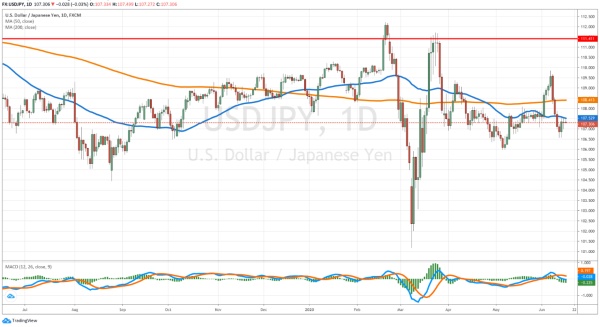

The Japanese yen is currently trading sideways against the US dollar. With the USD/JPY being contained by the 50-day moving average at the 107.50-60 area, a bearish BoJ would spur risk aversion and push the pair down to the 106.55, June 11 and 12 minimums.

On the other hand, if the Bank of Japan announces additional stimulus, the JPY would be under pressure, lifting the USD/JPY to higher levels and enough stamina to break above the 108.00 area.