Interactive Brokers Review 2025

As a serious investor, I’m always looking for platforms that can keep up. For 2025, Interactive Brokers continues to impress me with its vast asset selection, powerful trading tools, and genuinely competitive pricing.

Why You Should Choose Interactive Brokers in 2025

Interactive Brokers (IBKR) has long been the gold standard for serious traders, but does its reputation hold up in 2025?

It remains a top choice for serious traders in 2025 because it gives you access to a huge range of investments from all over the world. This includes stocks, options, futures, currencies, bonds, and funds. Having this variety is very useful for building a diverse investment portfolio and using advanced trading techniques, especially when the global economy is changing quickly.

Also, IBKR keeps its costs low, which is a big plus. If you trade a lot or want to save money on fees, IBKR is a good option. While other brokers might try to make money in different ways, IBKR focuses on keeping costs down for its customers.

Their trading platform, called Trader Workstation (TWS), is still very powerful for experienced traders. It offers many tools for looking at charts, analyzing data, and managing your orders. IBKR keeps updating the platform with new features, so you always have access to the latest technology. This is especially important as artificial intelligence and computer-driven trading become more common.

IBKR is also financially stable and follows all the rules, which gives you peace of mind, especially when markets are unpredictable. They also offer good rates if you need to borrow money for trading, which is helpful for certain trading strategies.

Plus, IBKR provides many educational resources to help you learn more about investing and how to use their platform. While some newer platforms might look simpler, IBKR’s wide range of features and reliable service are still the best choice for traders and investors who want good performance, access to many markets, and low costs.

Simply put, Interactive Brokers is our top-rated broker at Broker Guide, outperforming all others in our evaluations.

Pros and Cons

Pros:

- Low fees (Free stock trades on IBKR Lite)

- Wide market range

- 90+ technical indicators for charting nerds

- No inactivity fees

- Great for experienced or professional traders

Cons:

- Trader Workstation (TWS) feels like piloting a spaceship

- Customer support delays

- Might be too complex for beginners

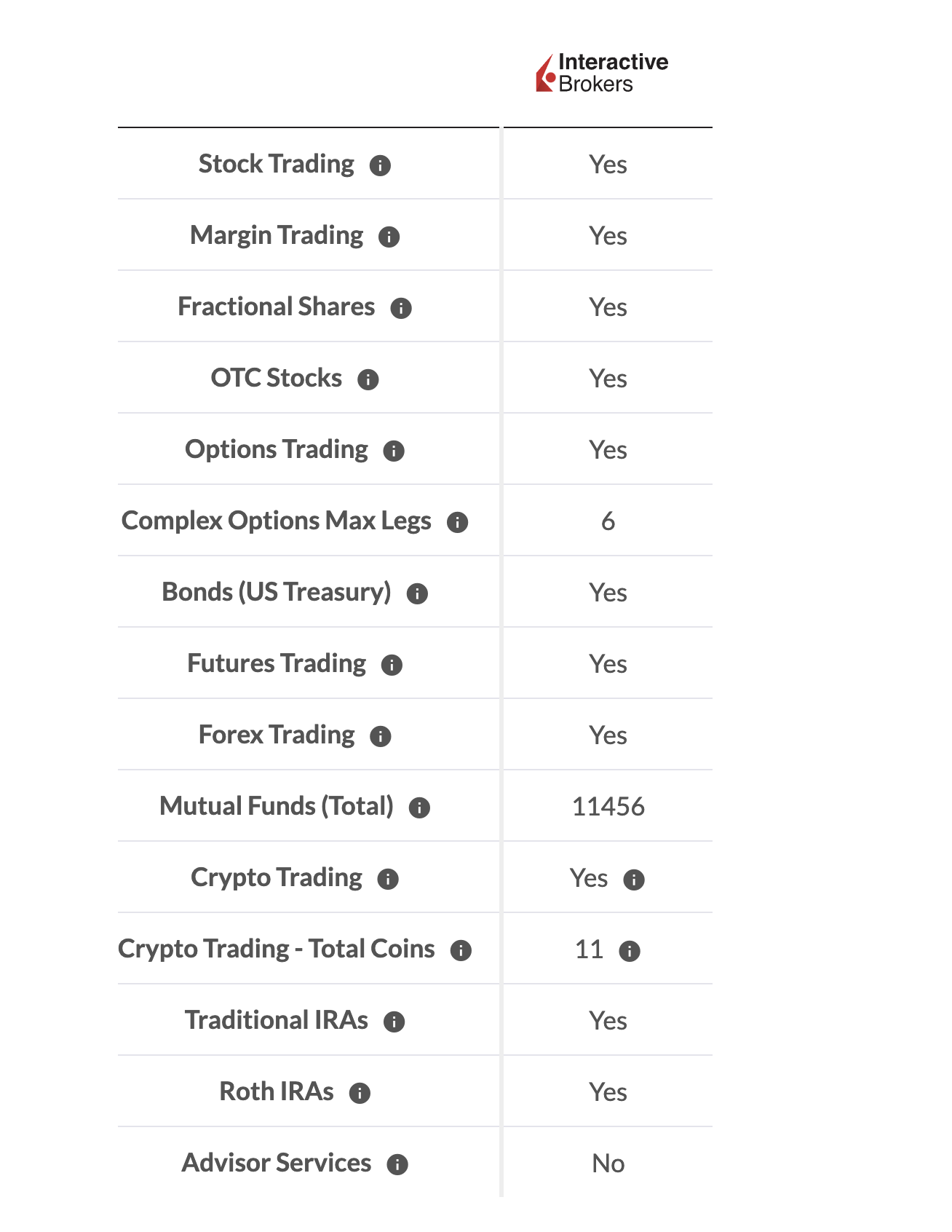

Explore Interactive Brokers Range of Tradable Instruments

Interactive Brokers (IBKR) stands out for its exceptional diversity of tradable instruments, catering to both casual investors and sophisticated traders.

The platform provides access to over 150 global markets across 33 countries, making it one of the most comprehensive brokers for international trading.

Whether you’re interested in traditional assets like stocks and bonds or niche products like cryptocurrency futures and warrants, IBKR’s offerings are designed to meet varied investment strategies.

Against the Competitors

| Asset | Interactive Brokers | Saxo | Degiro |

|---|---|---|---|

| Stocks | |||

| ETFs | |||

| Forex | |||

| Funds | |||

| Bonds | |||

| Options | |||

| CFDs | |||

| Crypto | |||

| Futures |

Key Takeaways

While Saxo and DEGIRO also support all core asset classes (see table above), IBKR distinguishes itself with:

Verdict:

Interactive Brokers is the best choice for advanced traders and globally minded investors seeking unparalleled variety and institutional-grade tools. Its vast instrument range—from fractional shares to crypto futures—outshines DEGIRO’s simplicity and Saxo’s premium pricing.

Choose IBKR if:

- You prioritize global market access, low-cost margin trading, or niche products.

- You need retirement accounts or complex options strategies.

Consider competitors if:

- You prefer simplicity (DEGIRO for basic investing).

- You want direct spot crypto trading (Saxo offers crypto CFDs, but alternatives like Coinbase may suit better).

While IBKR’s platform complexity may overwhelm beginners, its flexibility and depth make it a powerhouse for serious traders.

Considering alternatives to Interactive Brokers? We can introduce you to our other trusted brokers here:

IG Review

FP Markets Review

CMC Markets Review

XTB Review

Is Interactive Brokers Regulated?

Interactive Brokers stands out as one of the most secure platforms available today, backed by an impressive array of regulatory licenses and investor protections. The firm operates under the supervision of more than 10 financial authorities worldwide, including heavyweight regulators like the U.S. SEC, UK’s FCA, and Australia’s ASIC. This multi-jurisdictional oversight ensures IBKR adheres to strict anti-money laundering rules, maintains adequate capital reserves, and keeps client funds segregated from company assets.

Your money receives multiple layers of protection at Interactive Brokers. All U.S. accounts benefit from standard SIPC insurance covering up to $500,000. There’s also an additional protection from Lloyd’s of London for your peace of mind.

The brokerage’s financial stability is further demonstrated by its $16.6 billion in equity capital and its status as a publicly traded company on Nasdaq. While IBKR did face a $20 million CFTC penalty in 2023 for record-keeping issues, this incident didn’t impact client funds or the firm’s overall financial health.

For institutional clients and risk-conscious traders, IBKR offers valuable compliance tools including pre-trade restrictions and real-time monitoring alerts. However, cryptocurrency investors should note that digital assets held with IBKR don’t qualify for SIPC protection, as they’re custodied through Paxos Trust.

When compared to competitors, IBKR’s global regulatory footprint and enhanced insurance coverage give it a clear advantage, particularly for international investors. With a 4.8/5 safety rating, Interactive Brokers remains one of the most trustworthy platforms in the industry, though crypto traders may want to consider additional security measures for their digital assets.

Fees & Commission Structure

Interactive Brokers offers two distinct pricing tiers, IBKR Pro for professionals and IBKR Lite for casual investors—each designed to align with specific trading styles and priorities. Here’s a breakdown of their features, costs, and unique advantages:

IBKR Lite: Simplicity & Zero Commissions

IBKR Lite is ideal for cost-conscious investors seeking straightforward pricing. This plan offers $0 commission on U.S. stocks and ETFs, while they charge $0.65 per contract for options trades.

To offset these low fees, IBKR Lite utilizes payment for order flow (PFOF), which may marginally affect trade execution quality—though the impact is minimal, typically amounting to just a few cents per $1,000 traded.

Retail investors focused on long-term strategies or occasional trading will appreciate the simplicity and predictability of this plan, making it a strong choice for those prioritizing affordability over advanced features.

IBKR Pro: Precision & Value for Active Traders

Designed for high-volume and professional traders, IBKR Pro emphasizes transparent pricing and superior order execution. Stock trades start a $0.0035 per share (with a $0.35 minimum), with volume discounts reducing costs to as low as $0.0005 per shar for frequent traders.

Options contracts are priced tieredly, ranging from $0.65 to $0.25 per contract based on the premium size.

Unlike IBKR Lite, this plan avoids payment for order flow entirely, ensuring trades are routed for optimal execution—a rare feature shared only with Fidelity among major brokers. IBKR Pro is tailored for traders who demand precision, scalability, and institutional-grade tools.

Margin Rates: Industry-Leading Affordability

Interactive Brokers distinguishes itself in the brokerage industry by providing some of the most competitive margin rates available to traders.

The specific rate applied to a margin loan depends on several factors, including the currency involved, the type of account (IBKR Lite or IBKR Pro), and the total loan amount.

For U.S. dollar-denominated loans, IBKR Lite simplifies its pricing with a margin rate calculated as the benchmark rate plus 2.5%. On the other hand, IBKR Pro adopts a tiered approach tailored to the loan size.

The rate starts at the benchmark plus 1.5% for the first $100,000 borrowed and progressively decreases, reaching as low as the benchmark plus 0.5% on amounts over $50 million.

As of January 2025, this structure results in a rate of 6.830% for IBKR Lite and 5.830% for IBKR Pro on loans under $100,000. These figures are notably lower than the rates offered by leading competitors such as Fidelity and Charles Schwab, positioning Interactive Brokers as a cost-efficient option for traders leveraging margin to enhance their investment strategies.

This combination of flexibility and affordability underscores its appeal to both casual and high-volume investors.

Mutual Funds & Penny Stocks

IBKR provides access to over 48,000 mutual funds globally, including more than 11,000 in the U.S. Over 4,000 of these funds are fee-free, while others cost the lesser of 1.5% of the trade value or $14.95—a cost-effective model compared to industry averages.

However, penny stock traders may find IBKR Pro less ideal due to its per-share commission structure, which can accumulate quickly with low-priced, high-volume trades.

For U.S. dollar-denominated loans, IBKR Lite simplifies its pricing with a margin rate calculated as the benchmark rate plus 2.5%.

On the other hand, IBKR Pro adopts a tiered approach tailored to the loan size. The rate starts at the benchmark plus 1.5% for the first $100,000 borrowed and progressively decreases, reaching as low as the benchmark plus 0.5% on amounts over $50 million.

As of January 2025, this structure results in a rate of 6.830% for IBKR Lite and 5.830% for IBKR Pro on loans under $100,000.

These figures are notably lower than the rates offered by leading competitors such as Fidelity and Charles Schwab, positioning Interactive Brokers as a cost-efficient option for traders leveraging margin to enhance their investment strategies. This combination of flexibility and affordability underscores its appeal to both casual and high-volume investors.

Key Considerations

Choose IBKR Lite if you prioritize commission-free trades, simplicity, and don’t require advanced execution tools. It’s well-suited for passive investors or those with smaller portfolios. Opt for IBKR Pro if you’re an active trader seeking top-tier execution, volume-based discounts, or low-cost margin borrowing. Its lack of PFOF and institutional-grade features make it a powerhouse for professionals.

Final Verdict

Interactive Brokers’ dual pricing model successfully caters to a broad spectrum of investors. IBKR Lite excels for casual users with its zero-commission structure, while IBKR Pro dominates as a cost-efficient, execution-focused platform for serious traders. Though penny stock enthusiasts might explore alternatives, IBKR’s global reach, vast mutual fund selection, and industry-low margin rates solidify its position as a premier choice for diversified and active trading strategies.

Interactive Brokers Fee Structure: A Comprehensive Breakdown

Interactive Brokers offers a flexible fee model with tiered and fixed pricing options, tailored to different trading volumes and strategies. While the structure may seem complex initially, fees vary by market and product, making it essential to evaluate your trading habits to choose the most cost-effective plan. Below is a snapshot of fees for the UK market, highlighting key products and commission ranges.

For most individual investors, minimum fees often apply for stock and ETF trades. For example, under the fixed fee structure, a single trade exceeding £6,000 would incur fees above £3. The table below provides an overview of select products and their associated costs. Note that fees can differ significantly across global markets, so always review IBKR’s official resources for full details.

| Product | Monthly Amounts | Tiered Fees | Fixed Fees (IB Smart Routing) |

|---|---|---|---|

| Stocks or ETFs | Trade value of £40,000,000 and below | 0.05% of trade value + Third Party Fees Minimum fee per order £1 | 0.05% of Trade Value (No Third Party Fees) Minimum fee per order £3 |

| Index Options | Contract volume of 1,000 and below | £0.65 per contract + Third Party Fees | £1.70 per contract (No Third Party Fees) |

| Index Options | Contract volume of 1,001 to 10,000 | £0.45 per contract + Third Party Fees | £1.70 per contract (No Third Party Fees) |

| Stock Options | Contract volume of 8,000 and below | £1 per contract + Third Party Fees | £1.70 per contract (No Third Party Fees) |

| Stock Options | Contract volume of 8,001 to 40,000 | £0.70 per contract + Third Party Fees | £1.70 per contract (No Third Party Fees) |

| Futures | Contract volume of 1,000 and below | £0.65 per contract + Third Party Fees | £1.70 per contract (No Third Party Fees) |

| Futures | Contract volume of 1,001 to 10,000 | £0.45 per contract + Third Party Fees | £1.70 per contract (No Third Party Fees) |

| Single Stock Futures | All | Not applicable | £1.70 per contract (No Third Party Fees) |

Always verify fees directly on Interactive Brokers’ platform, as structures may vary by region and trading activity.

How To Open an Account with Interactive Brokers

Opening an Interactive Brokers (IBKR) account can be done online via their website or mobile app. While the platform claims the process takes “just a few minutes,” expect to spend closer to an hour due to the detailed information required. Below is a breakdown of the steps involved.

- Individual (standard account)

- Stocks and Shares ISA (UK tax-efficient account)

- Junior Stocks and Shares ISA

- Joint Account

- Retirement Account (exclusive to U.S. tax residents)

Example: For this guide, we selected the Stocks and Shares ISA option.

- Full name, address, and contact information.

- Marital status, employment status, and number of dependents.

- National Insurance number (UK applicants).

- Tax residency

- Source of wealth

Note: Additional questions may appear based on your responses. For instance, if you’re employed or self-employed, you’ll need to provide your employer’s name, country, and address.

Then, you need to provide your investment objectives and purpose of trading:

- Preservation of capital and income generation (low risk).

- Growth (lower risk).

- Hedging (higher risk).

- Profits from active trading/speculation (high risk).

After that, you need to provide your trading experience. Specify your familiarity with stocks and estimated annual trade volume.

- A government-issued photo ID (e.g., passport, driver’s license).

- A recent utility bill or bank statement (for address confirmation).

- Fund your account via bank transfer or other supported methods.

- Begin trading on the platform.

By following these steps, you’ll navigate IBKR’s thorough onboarding process and gain access to its global trading platform.

What is the Minimum Deposit at Interactive Brokers?

Interactive Brokers prioritizes accessibility by imposing no mandatory minimum deposit for standard cash accounts, making it an attractive option for investors of all sizes. However, specific trading activities and account types come with funding requirements:

$0 Minimum for Cash Accounts

You can open and fund a cash account with any amount, even as low as $1. This flexibility is ideal for beginners, passive investors, or those testing the platform with smaller sums. For example, you can purchase fractional shares of U.S. stocks or ETFs with minimal capital.

$2,000 Minimum for Margin Trading and Short Selling

If you want to trade on margin (borrowing funds to amplify positions) or engage in short selling, IBKR requires a minimum equity of $2000 in your account.

Account Types

Interactive Brokers provides a diverse range of account types tailored to different ownership structures and user needs. These accounts are broadly categorized into individual and institutional offerings, with some options—such as retirement or custodial accounts—exclusively available to U.S.-based clients. Below is a detailed breakdown of the available account types and their purposes.

Account Types by Ownership

| Account Type | Description |

|---|---|

| Individuals | Owned and operated by a single person. |

| Joint | Shared ownership between two individuals. |

| Trust | Managed by a trustee as a separate legal entity for the beneficiary’s benefit. |

| IRA | Individual Retirement Account (U.S. clients only). |

| Stock UGMA/UTMA | Custodial accounts for minors (U.S. clients only). |

| Friends and Family | Designed for groups of up to 15 members. |

| Family Office | For individuals acting as Family Office Managers. |

| Small Business | Tailored for small corporations or business entities. |

| Advisor | For professionals managing both client administration and investments. |

| Money Manager | For advisors hired to manage investments on behalf of other advisors. |

Deposit and Withdrawal

Interactive Brokers provides a streamlined process for funding and withdrawing from your account, supporting a wide range of methods tailored to global and regional needs. Below is a detailed overview of how deposits and withdrawals work, including key considerations for fees, processing times, and currency management.

Base currencies: 27 (GBP, EUR, USD, AUD, CAD, JPY)

Deposit Fees & Options

IBKR supports multiple funding options, and the good news is that they don’t have deposit fees, though availability varies by region. Once again, they don’t have a minimum deposit to start trading with them.

☑️ Bank Transfers: Direct wire transfers or electronic funds transfers (EFT) from a linked bank account.

☑️ ACH (U.S. Clients)

☑️ Check

☑️ Direct Rollover (IRA accounts only)

☑️ Trustee-to-Trustee (IRA accounts only)

When funding your Interactive Brokers account via bank transfer, you should anticipate a processing period of 1-5 business days, depending on your bank’s policies and whether the transfer is domestic or international. This delay accounts for standard banking procedures, including verification and settlement periods.

Withdrawal Fees & Options

They also offer flexible withdrawal methods with transparent fee structures, though costs and processing times vary depending on the chosen option. Below is a detailed breakdown of withdrawal policies, fees, and key considerations

Withdrawal fee: Free for the first withdrawal of each month.

Withdrawal method: Bank wire transfers, ACH, Check

Transfers to accounts not in your name are blocked for compliance reasons. Following the first complimentary withdrawal, fees for any additional withdrawals are determined by both the currency being withdrawn and the chosen withdrawal method.

Web Trading Platform

Interactive Brokers offers two desktop trading platforms: IBKR Desktop, a streamlined, user-friendly interface, and Trader Workstation (TWS), a feature-rich platform for advanced traders. Below is a detailed breakdown of their capabilities, tools, and user experience.

IBKR Desktop – Modern and Intuitive

IBKR Desktop replaces the legacy Trader Workstation (TWS) with a faster, sleeker interface while retaining core functionalities like charting, screening, and order execution. Designed for both beginners and seasoned traders, it balances simplicity with depth.

Pros:

- User-friendly interface

- Streamlined design with drag-and-drop customization.

- Multi-timeframe analysis (similar to TradingView Premium) without extra fees.

- 15+ order types, including trailing stops and algo-driven “IB SmartRouting.”

- Two-step login via mobile app push notification.

- Available in 9 languages, including English, Spanish, Chinese, and Japanese.

Cons:

- Limited advanced tools

- Algo trading and niche portfolio management features remain exclusive to TWS.

Appearance & Ease of Use

The IBKR Desktop platform distinguishes itself through its exceptional balance of comprehensive functionality and user-friendly design. Despite the abundance of features, the platform maintains a clean and intuitive interface, making it accessible to both novice and experienced traders.

This thoughtful approach to user experience ensures that even with complex analytical tools at their fingertips, users can navigate the platform with ease. The visual clarity of the interface, coupled with well-organized menus, facilitates efficient multitasking, a crucial aspect for active traders who need to monitor multiple market variables simultaneously.

A significant enhancement in the recent update is the introduction of customizable layouts. Users now possess the ability to resize tabs and arrange various components, such as charts, watchlists, and news feeds, onto a single screen.

This level of personalization allows traders to tailor their workspace to their specific needs and trading strategies. For instance, a trader can create a layout that displays real-time charts alongside fundamental analysis data for a particular stock, providing a holistic view of the asset.

Login & Security

Interactive Brokers implements a robust two-factor authentication system to ensure the utmost security for its users. Upon initiating a login to the IBKR Desktop platform, a push notification is promptly dispatched to the user’s registered IBKR mobile application. This notification requires a simple confirmation, thereby verifying the user’s identity and authorizing access.

This streamlined process provides a secure and efficient login experience, balancing stringent security measures with user convenience. We understand the importance of safeguarding your financial information, and this two-step verification process is a testament to our commitment to providing a secure trading environment.

Placing Orders

When it comes to executing trades, precision and flexibility are paramount. The IBKR Desktop platform offers a comprehensive suite of order types, designed to cater to a wide spectrum of trading strategies and risk management preferences. We aim to provide you with the tools necessary to execute your trades with confidence and efficiency.

Basic Orders:

Market: Execute immediately at the best available price.

Limit: Buy/sell at a specific price or better.

Stop: Trigger a market order once a price threshold is reached.

Stop Limit: Combine stop and limit orders to control execution price post-trigger.

Advanced Orders:

Market-to-Limit: Converts to a limit order if immediate execution isn’t possible.

Trailing Stop: Adjusts the stop price as the market moves by a defined margin.

Trailing Stop Limit: Adds a limit price to trailing stops for tighter control.

Relative: Pegs orders to a reference price (e.g., bid/ask midpoint).

Snap Market/Midpoint/Primary: Quickly execute at the current market, midpoint, or primary exchange price.

Market/Limit on Close: Execute at the closing auction price.

IB SmartRouting & Order Time Limits

IB SmartRouting enhances trade execution by automatically directing orders to the optimal exchange or liquidity pool, ensuring the best possible pricing and faster fills. This feature is particularly valuable for equities, options, and other assets, as it minimizes slippage and reduces trading costs by prioritizing venues with the tightest spreads or deepest liquidity.

Order Time Limits provide flexibility in managing trade duration, catering to both short-term tactics and long-term strategies:

- Good until end of day (Day)

- Good ’til Canceled (GTC)

- Good-Til-Date (GTD)

- Immediate-or-cancel (IOC)

- Day ‘Til Canceled (DTC)

- Market/limit on open (OPG)

Alerts & Notifications

You can set up alerts for any asset you’re watching and get notified when it hits your price targets. Want a buzz when a stock goes above or below a certain price? No problem. You can even choose how often you want to get pinged – just once or until a specific date. It’s like having your own personal market watchdog.

Portfolio Management

Interactive Brokers offers transparent and accessible portfolio and fee reports. Users can quickly view monthly fees and interest within the “Balances” tab of the portfolio section, while more detailed analyses are available through the Client Portal’s comprehensive reporting tools.

Mobile App

Interactive Brokers offers three mobile apps—IBKR GlobalTrader, IBKR Mobile, and IMPACT—each tailored to different investor needs.

IBKR GlobalTrader is a user-friendly mobile app ideal for new investors and those interested in global markets, offering fractional shares, foreign stocks, and options in a simplified interface. For us, this would be the easiest to learn and perfect for new traders.

IBKR Mobile is a highly comprehensive mobile trading app, mirroring much of the desktop platform’s functionality, including advanced order tickets, recurring investments, and robust options trading tools, making it exceptionally powerful for experienced traders.

The Impact app simplifies ESG investing by allowing users to select their values, curating aligned companies, and providing a portfolio grading system, making it a valuable tool for socially conscious investors.

Below, we tested IBKR GlobalTrader, the platform’s most user-friendly option for casual and intermediate traders.

Pros:

- Intuitive layout with easy navigation.

- Secure Touch ID/Face ID authentication.

- Find assets quickly by name or browse pre-built lists (e.g., ESG stocks, value ETFs).

- Available in 10+ languages, including English, Spanish, Arabic, Japanese, and Simplified Chinese.

Cons:

- Only basic orders (Market, Limit, Stop) and a “Swap” feature to exchange positions.

- Cannot set custom price notifications.

- Excludes forex, bonds, futures, and CFDs.

Appearance & Ease of Use

The IBKR GlobalTrader app boasts a clean and modern interface, providing a significantly improved user experience compared to the more complex IBKR Mobile. We can definitely say that the app is made for beginners.

Login & Security

Interactive Brokers prioritizes account safety with a two-step login process on its mobile platform, requiring both your password and a confirmation via the IBKR mobile app for enhanced protection. For added convenience, you can also log in using biometric authentication, such as fingerprint or facial recognition, streamlining access without compromising security.

This multi-layered approach ensures your account remains secure while making the login process quick and hassle-free. Additionally, all sensitive data is encrypted to safeguard your personal and financial information from unauthorized access.

Searching Assets

Interactive Brokers offers an intuitive and efficient search system that makes finding assets effortless. Simply begin typing the name of any stock, ETF, or other security, and the platform will instantly display relevant matches

Upon selecting an asset, users are presented with a comprehensive information window, including price history charts, relevant calendar events, fundamental data, company profiles, analyst ratings, related news, and direct access to trading functions via “Swap,” “Buy,” “Sell,” and “Options” buttons.

Placing Orders

The mobile trading platform provides essential order types to accommodate different trading strategies:

Market Orders – Execute immediately at the best available price

Limit Orders – Set your desired entry/exit price

Stop Orders – Trigger trades when reaching specified price levels

A unique ‘Swap’ order function allows seamless position replacement, enabling you to exchange one holding for another in a single transaction.

For trade duration control, the platform offers these time-in-force options:

Day – Active until market close

Good Till Canceled (GTC) – Remains open until filled or manually canceled

Outside Regular Trading Hours – Executes in pre-market or after-hours sessions

These streamlined order options provide flexibility while maintaining an intuitive mobile trading experience. The ‘Swap’ feature is particularly valuable for portfolio rebalancing, eliminating the need for separate buy/sell transactions.

Alerts & Notifications

Unfortunately, the IBKR GlobalTrader mobile platform does not currently offer alert or notification functionalities. This means users must actively monitor market conditions within the app itself.

Market Research and Tools

Interactive Brokers offers one of the most complete research suites we’ve tested, effectively serving both beginners and professionals.

The platform thoughtfully segments its tools – casual investors will appreciate the straightforward Fundamentals Explorer in the Client Portal, while active traders can dive deep with Trader Workstation’s advanced analytics.

What impressed us most was how IBKR bridges the gap between fundamental and technical analysis.

While its charting tools and technical indicators meet professional standards, we found its fundamental research capabilities equally robust. This dual strength allowed us to validate technical patterns with hard financial data, creating more informed trading decisions.

The research library’s depth is staggering. IBKR aggregates insights from nearly every major provider, creating what might be the most comprehensive collection of third-party reports available at any brokerage.

When testing during a CPI data release, we appreciated having immediate access to multiple expert analyses, though navigating the wealth of information required some acclimation.

Features like saved research folders and the Trader’s Insights community discussion threads helped organize this abundance of information.

For market context, IBKR’s overview pages deliver concise snapshots of major indices and movers, enhanced by explanatory “why is it moving” commentary.

But the true standout is PortfolioAnalyst, which brings institutional-grade portfolio analytics to retail investors.

This free tool lets users benchmark performance, analyze attribution factors, and even aggregate external accounts – functionality we’ve typically only seen in premium services like Bloomberg Terminal.

Education

Interactive Brokers delivers one of the most comprehensive investor education programs we’ve tested across brokerage platforms. Their Trader’s Academy stands out for its institutional-quality content presented in an accessible format suitable for all experience levels.

During our evaluation, we were particularly impressed by the multi-format approach combining video tutorials and helpful study materials. The curriculum progresses logically from market fundamentals to advanced derivatives strategies, though we noted some beginner concepts could use more explicit explanation for true novices.

What truly differentiates IBKR’s educational offering is its seamless integration with actual trading tools. Each lesson includes practical exercises using the platform’s real features, effectively bridging the gap between theory and application. We found this hands-on approach significantly improved knowledge retention compared to passive learning formats.

Overall, Interactive Brokers has created an educational resource that rivals many paid services, combining professional-grade content with practical trading applications. The program’s strongest asset is its ability to scale from basic investing principles to institutional trading strategies within a unified learning environment.

Customer Support

Interactive Brokers offers multiple support channels, but our experience reveals inconsistencies in quality and responsiveness. While the platform provides professional-grade trading tools, its customer service doesn’t always match this standard.

Available Support Channels:

We found phone support generally competent for basic account inquiries during testing, though wait times varied significantly. The live chat proved helpful for quick questions during business hours, while email responses typically took 24-48 hours.

The knowledge base stands out as particularly robust, with detailed guides covering everything from account setup to complex trading strategies. However, we noticed technical or margin-related questions often required escalation, resulting in delayed resolutions.

Overall, while the support system functions adequately, it represents one of the weaker aspects of the IBKR experience compared to its exceptional trading tools.

FAQ

Is my money safe with Interactive Brokers?

Yes, Interactive Brokers is regulated by top-tier authorities (including the SEC, FCA, and FINRA) and provides SIPC protection up to $500,000, additional insurance through Lloyd’s of London and Segregated accounts to separate client funds from company assets.

Is IBKR good for beginners?

While powerful, IBKR’s platforms have a steep learning curve. Beginners may prefer IBKR GlobalTrader (simplified mobile app) or IBKR Lite (no commissions on U.S. stocks). However, educational resources like Trader’s Academy help bridge the gap.

Does Interactive Brokers trade crypto?

Interactive Brokers does offer cryptocurrency trading through multiple avenues. Clients can directly trade popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), and Litecoin (LTC) through IBKR's partnerships with regulated crypto firms Paxos and Zero Hash. The platform has expanded its offerings to include additional altcoins such as Solana (SOL), Cardano (ADA), Ripple (XRP), Dogecoin (DOGE), Chainlink (LINK), Avalanche (AVAX), and Sui (SUI).

What is the difference between IBKR Pro and Lite?

Interactive Brokers offers two distinct pricing plans tailored to different types of investors. IBKR Lite is designed for casual investors, featuring commission-free trading on U.S. stocks and ETFs with simpler pricing. However, it uses Payment for Order Flow (PFOF), which may slightly impact trade execution quality. Margin rates are also higher at Benchmark + 2.5%. IBKR Pro, on the other hand, caters to active traders and professionals. It employs a tiered commission structure starting at $0.0035 per share and avoids PFOF for potentially better trade execution. The platform offers significantly lower margin rates (as low as Benchmark + 0.5% for large balances) and provides more advanced trading tools.

What is the minimum balance for IBKR?

$0 for cash accounts, $2,000 for margin trading (U.S. regulations), No minimums for most non-U.S. accounts.

Do professionals use IBKR?

Yes. IBKR is widely used by active traders, financial advisors (portfolio management features) and Institutions (high-volume pricing, global access).

Who owns Interactive Brokers?

Founded by Thomas Peterffy, IBKR is a publicly traded company (NASDAQ: IBKR) with no majority owner.

How long does it take to withdraw money from Interactive Brokers?

Based on our hands-on testing, withdrawals from Interactive Brokers typically take 2-4 business days to reach your bank account. The exact timing depends on, your bank's processing speed, whether the transfer is domestic or international. IBKR offers one free withdrawal per calendar month, with subsequent withdrawals potentially incurring fees.

Does Interactive Brokers have instant deposits?

No, Interactive Brokers doesn’t offer instant deposits.