KRAKEN REVIEW 2026

Is Kraken still just a crypto exchange? In 2026, the answer is a resounding no. From commission-free stocks to a 50x futures market, we’ve spent months testing the new ‘everything app’ to see if it’s truly the safest place for your money. Here is our unfiltered verdict.

Broker Guide's Kraken Review in 2026

Kraken launched in 2011 as one of the first cryptocurrency exchanges. It built a reputation as a leader in security over the last decade. I tested the platform again in early 2026 to see how it has changed. This review focuses on Kraken’s move away from being a crypto-only exchange.

The platform now functions as a full-service brokerage. It offers over 11,000 different stocks and ETFs to eligible users in the United States. This expansion allows traders to manage multiple asset classes in one place.

I also wanted to evaluate the company ahead of its IPO filing. Kraken recently updated its interface to better serve both beginners and professionals.

My testing involved a hands-on look at the new features and fee structures. This introduction explains why Kraken remains a top choice for investors in 2026.

About Kraken

Jesse Powell founded Kraken in 2011 to build a secure bridge between traditional finance and the emerging digital economy. Based in San Francisco, the company has grown from a pioneer exchange into a global powerhouse now led by Co-CEOs Dave Ripley and Arjun Sethi.

This leadership team remains committed to the original mission of accelerating global crypto adoption to provide financial freedom for all. Today, Kraken operates at a massive scale, serving more than 15 million clients across 190 countries.

The platform supports over 500 cryptocurrencies and has recently expanded its reach by offering thousands of traditional equities.

My Quick Verdict: Who is Kraken Best For?

Overall BrokerGuide Rating: 4.6/5

Kraken stands out as the safest bet in the industry because it is the only major exchange that has never suffered a platform-wide hack. This impeccable security record provides peace of mind that few competitors can match.

The platform has evolved into the ultimate all-in-one solution for modern investors. You can now trade Apple stocks and Bitcoin within the same seamless interface. This integration makes Kraken the most versatile brokerage available in 2026 for those who want to manage a diverse portfolio in one place.

Pros

- Flawless Security: Kraken remains a “security first” leader and is the only major exchange that has never lost user funds to a platform-wide hack since its founding in 2011.

- Unrivaled Asset Variety: Users can trade a massive selection of over 550 cryptocurrencies alongside more than 11,000 U.S. stocks and ETFs.

- High Staking Rewards: The platform offers competitive passive income opportunities, with staking rewards reaching up to 22% APY on eligible digital assets.

- Transparent Fee Structure: Kraken provides low, clearly displayed trading fees, including a flat 1% for instant purchases and even lower maker/taker rates on Kraken Pro.

Cons

- Strict U.S. Restrictions: Due to regulatory requirements, many U.S. clients cannot access on-chain staking, “Opt-in” rewards, or futures trading.

- Withdrawal Minimums: Some assets, such as Bitcoin, have relatively high withdrawal minimums and flat fees that can be costly for those moving small amounts.

Why You Should Choose Kraken ?

Kraken has spent years building a reputation for security, but 2026 marks its transition into a dominant global financial hub. The platform now offers unique advantages that appeal to both traditional stock investors and dedicated crypto traders.

The 2026 IPO and Enhanced Transparency

Kraken is currently preparing for its highly anticipated IPO in the first half of 2026. This public listing marks a major milestone for the firm as it targets a valuation of $150 billion.

To prepare for this move, Kraken has increased its financial transparency by moving to a quarterly cadence for its Proof of Reserves audits. These cryptographic audits confirm that Kraken holds at least 100% of all client assets, with recent reports showing a 114.9% reserve ratio for Bitcoin.

This makes Kraken a “clean” and highly regulated alternative for those wary of less transparent competitors.

New Opportunities in Prediction Markets

Kraken will launch its own prediction market by 2026 to expand beyond traditional trading services. This feature allows you to trade on the outcomes of real-world events, such as elections or major sporting results.

These markets act as a powerful tool for hedging risk or gaining insight from the “wisdom of the crowd”. By integrating these markets directly into its interface, Kraken provides a new level of utility for your digital assets.

True Portfolio Diversification

Kraken is now the only major crypto-native exchange that offers commission-free trading for over 11,000 U.S. stocks and ETFs. This allows you to manage Apple stocks and Bitcoin side-by-side without paying a single cent in commissions on your equities.

The platform even supports extended trading hours for stocks on Kraken Pro, giving you 24/5 access to the markets. This all-in-one approach eliminates the need for multiple brokerage accounts and simplifies your financial life.

Compare to Top Competitors

While Kraken is a top-tier choice for security and multi-asset trading, comparing it to other industry leaders helps you find the best fit for your specific strategy. Here is how Kraken stacks up against its three biggest rivals in 2026.

Coinbase

Binance

Crypto.com

Exploring Kraken's Range of Tradable Instruments

Kraken has evolved into a comprehensive financial hub, allowing users to manage a diverse portfolio of digital and traditional assets from a single interface.

Cryptocurrency

Kraken remains a powerhouse in the digital asset space, supporting over 550 cryptocurrencies. This extensive list includes market leaders like Bitcoin (BTC) and Ethereum (ETH), as well as trending memecoins such as DOGE, SHIB, and PEPE. The platform continuously adds new tokens to its spot market, maintaining one of the highest liquidity scores in the industry.

Stocks & ETFs

Eligible users in the United States can now trade more than 11,000 U.S.-listed stocks and ETFs. This selection covers major listings across the NYSE, NASDAQ, and AMEX, including popular equities like Tesla (TSLA) and NVIDIA (NVDA). These brokerage services are commission-free and available in most states, excluding Maine and New York.

Derivatives

For experienced traders outside the U.S., Kraken Pro offers a high-performance derivatives platform. Users can access up to 50x leverage on hundreds of different crypto futures contracts. The platform supports perpetual and dated futures, allowing for advanced hedging and directional strategies with competitive taker and maker fees.

xStocks

International retail clients in select regions can access xStocks, which are tokenized representations of real-world U.S. equities. These assets are backed 1:1 by the underlying stock or ETF and are issued as SPL tokens on the Solana blockchain.

xStocks offer unique benefits like 24/7 trading on Kraken Pro and the ability to hold the tokens in a self-custodial wallet.

How Coinbase ’s Instruments Compare to Competitors

| Asset | Kraken | Coinbase | Binance | Crypto.com |

|---|---|---|---|---|

| Bitcoin, Ethereum & Major Cryptos | ||||

| Wide Altcoin Selection | ||||

| Stablecoins (USDC, etc.) | ||||

| Fiat-to-Crypto Pairs | ||||

| Staking Options | ||||

| NFT Marketplace / Digital Collectibles | ||||

| Stocks, ETFs & Traditional Instruments |

Fees and Commission Structure

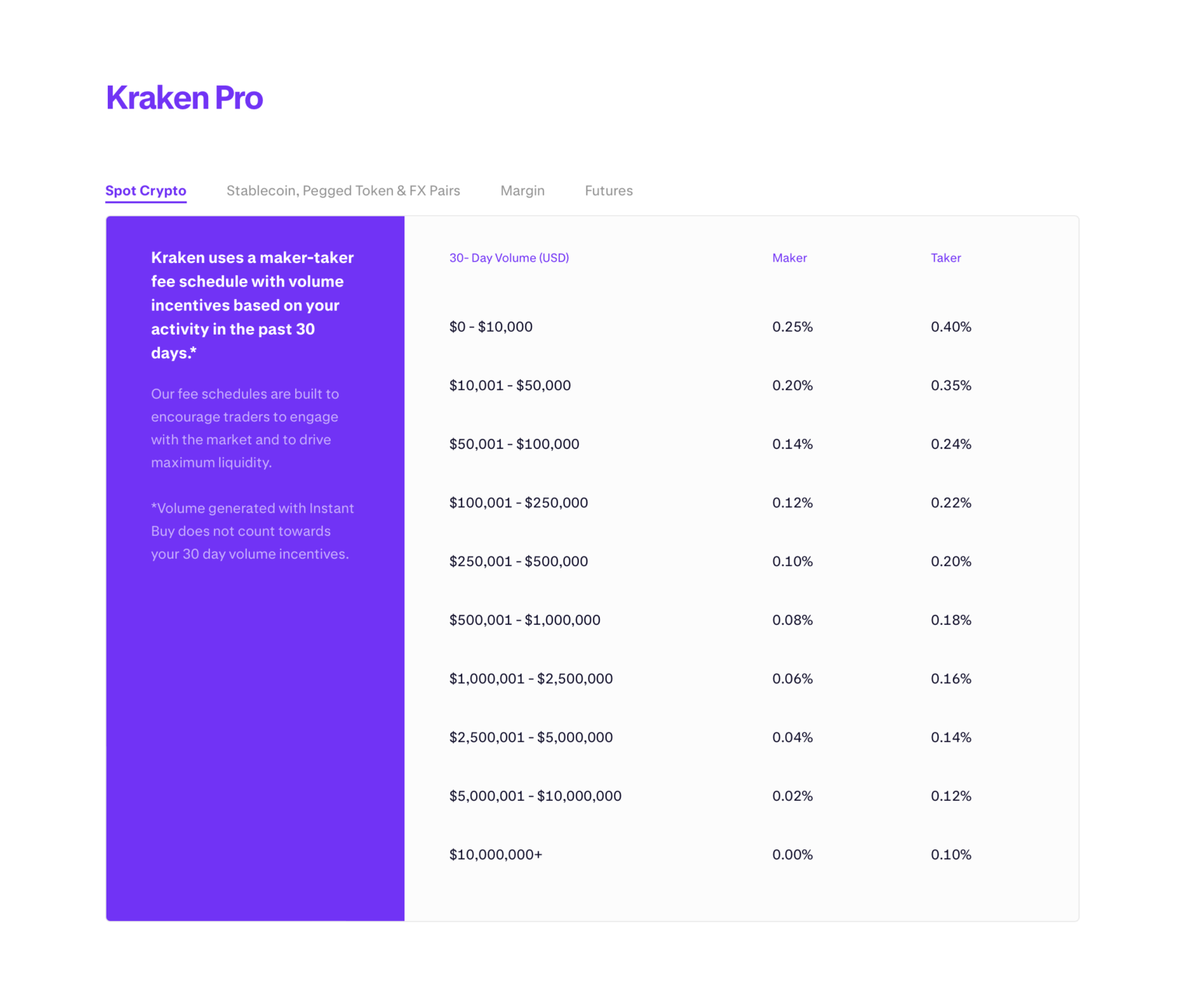

Kraken offers a tiered pricing model that rewards active traders while providing straightforward options for beginners. Understanding where you trade on the platform is the key to minimizing your costs.

| Tier | Maker/Taker Fee |

|---|---|

| Up to $10k | 0.25% / 0.40% |

| Up to $100k | 0.14% / 0.24% |

| Up to $500k | 0.1% / 0.2% |

Standard Trading Fees

For casual investors using the "Instant Buy" feature on the main Kraken app, the platform charges a 1% fee per transaction. This provides speed and simplicity but is more expensive than the professional interface. Additional processing fees may apply if you use a credit card or digital wallet for these purchases.

Kraken Pro: Taker and Maker Fees

Active traders should use Kraken Pro to access significantly lower costs. This interface uses a maker-taker model based on your 30-day trading volume.

Maker Fees: Start at 0.25% and can drop to 0.00% as your volume increases.

Taker Fees: Start at 0.40% and scale down to 0.10% for high-volume users. These rates make Kraken one of the most competitive professional exchanges for both spot and margin trading.

Stock and ETF Commissions

Kraken has disrupted traditional finance by offering $0 commissions on over 11,000 U.S.-listed stocks and ETFs. This allows you to diversify your portfolio into equities like Tesla or Apple without the typical brokerage fees. While Kraken does not charge a fee, small regulatory costs from the SEC or FINRA may still be passed through on sell orders.

Kraken+ Membership

For frequent traders, the Kraken+ subscription offers a way to eliminate standard fees entirely. For a monthly fee of $4.99, members receive zero trading fees on their first $10,000 of monthly volume. This membership also unlocks exclusive perks, such as boosted staking rewards and early access to "Kraken Drops" airdrops.

Futures Trading Fees

Kraken Pro offers a separate, highly competitive fee structure for futures trading that differs from its spot market rates. These fees are based on a maker-taker model and are designed to accommodate the larger position sizes made possible by higher leverage.

Entry-Level Tier: For traders with a 30-day volume between $0 and $100,000, the fees start at 0.02% for makers and 0.05% for takers.

Volume Incentives: As your trading activity increases, these rates scale down significantly.

High-Volume Trading: For those exceeding $100 million in monthly volume, the maker fee drops to 0.00%, while the taker fee reduces to 0.01%

Non-Trading Fees

One of Kraken’s biggest advantages is the lack of “hidden” costs. The platform does not charge any inactivity fees or account maintenance fees. You can leave your account idle for years without worrying about a balance drain. Additionally, there are no currency conversion fees when you trade between supported fiat pairs like USD and EUR on the Pro order books.

Verdict

Kraken’s fee structure in 2026 is widely considered the most transparent in the industry, though it requires users to choose their interface wisely. The “bottom line” is that while the standard app is built for convenience, the professional platform is built for cost-efficiency.

- For Beginners: The flat 1% fee on the standard app is simple and displays clearly before you buy, but it is significantly more expensive than using the Pro interface.

- For Active Traders: Kraken Pro is the clear winner with maker fees starting at 0.25% and taker fees at 0.40%. These rates are highly competitive and are lower than the entry-level tiers at rivals like Coinbase and Gemini.

- For Stock Investors: The introduction of commission-free U.S. stock trading makes Kraken a powerful “all-in-one” brokerage, as you pay $0 in commissions on traditional equities.

- For High-Volume Users: The maker-taker model rewards activity; fees scale down to 0% for those trading over $10 million monthly.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Kraken Regulated ?

Kraken prioritizes compliance to build long-term trust with its global user base. The company maintains active registrations with several of the world’s most stringent financial authorities to ensure it meets high standards for transparency and anti-money laundering.

Global Licensing

Kraken is registered as a Money Services Business (MSB) with FinCEN in the United States. Internationally, the firm holds licenses with the FCA in the United Kingdom and FINTRAC in Canada. In the Asia-Pacific region, the platform follows strict AUSTRAC regulations in Australia. These global licenses confirm that Kraken operates under constant regulatory oversight and adheres to regional financial laws.

Security Standards

The platform is a “security first” leader with advanced internal controls. Kraken is fully certified with ISO/IEC 27001 and SOC 2 Type 1 standards. These certifications are the gold standard for cybersecurity and data protection in the financial industry. By maintaining these audits, Kraken ensures its systems are robust enough to prevent unauthorized access and protect user data.

Protection and Broker Stability

It is important to note that most cryptocurrency assets are not covered by traditional FDIC or SIPC insurance. However, Kraken Financial operates as a Wyoming-chartered Special Purpose Depository Institution (SPDI). This status adds a significant layer of stability and credibility to Kraken’s financial operations compared to offshore exchanges. To further protect investors, Kraken uses audited Proof of Reserves to prove it holds a 1:1 backing of all client funds.

How To Open an Account

Setting up an account on Kraken is a streamlined process designed for security and speed. By 2026, the platform has optimized its onboarding to allow new users to go from registration to their first trade in just a few minutes.

Step-by-Step Account Opening

Sign Up: Create an account using your email address and a strong password on the official Kraken website or mobile app.

Email Verification: Activate your account by clicking the link or entering the code sent to your registered email.

Complete KYC: Provide your legal name, date of birth, and address to initiate the identity verification process.

Submit Documents: Upload a high-quality photo of your Photo ID (Passport, Driver’s License, or National ID) and a Proof of Residence document, such as a utility bill or bank statement.

Finalize Verification: Once the Kraken team reviews your documents, often within an hour, your account will be ready for full funding and trading.

Account Types

Kraken offers a streamlined account structure in 2026, primarily differentiated by the level of identity verification and the specific features you wish to access.

Standard Account

This is the base level for retail investors. It allows you to buy and sell over 550 cryptocurrencies and 11,000 U.S. stocks and ETFs. Standard accounts feature the "Instant Buy" interface, which is ideal for beginners seeking a simple, banking-like experience.

Kraken Pro Account

Every Kraken user can access the Pro interface at no additional cost. This account type is built for active traders who require advanced order types, TradingView charting, and lower maker-taker fees.

Kraken Financial Account

Through its Wyoming-chartered SPDI, Kraken offers integrated banking services. This allows eligible users to earn interest on USD deposits and enjoy seamless fiat-to-crypto transitions within a regulated banking framework.

What is the Minimum Deposit at Kraken?

Kraken maintains one of the lowest entry barriers in the financial industry, making it accessible for both beginner and seasoned investors. For most users, you can get started with as little as $1, although the exact requirement may fluctuate based on your specific payment provider.

The broker offers a diverse range of cash deposit methods, and you will find that most of these options do not incur any service fees. Depending on the funding route you select, your capital may be credited to your account instantly or could take up to five business days to settle.

| Broker | Minimum Deposit |

|---|---|

| Kraken | $0 |

Coinbase | $0 |

Binance | $0 |

| Crypto.com | $0 |

Deposit and Withdrawal

Kraken offers a highly flexible funding ecosystem that bridges the gap between traditional banking and the digital economy. Whether you are moving small amounts or managing institutional-level capital, the platform provides specific channels tailored to your speed and cost requirements.

Deposit Options

Kraken supports a wide array of fiat and cryptocurrency funding methods. Most crypto deposits are free and credited as soon as they reach the required network confirmations. For cash, the options include:

Withdrawal Fees & Options

Kraken uses a transparent, flat-fee structure for withdrawals, meaning you pay the same amount regardless of the transaction size.

Supported Currencies

Kraken functions as a global gateway by supporting a wide range of national currencies and digital assets. This allows users from diverse regions to trade and fund their accounts without the need for complex currency conversions.

National (Fiat) Currencies

Kraken supports seven major national currencies for funding and trading. These include:

- USD: United States Dollar

- EUR: Euro

- GBP: Great British Pound

- CAD: Canadian Dollar

- AUD: Australian Dollar

- CHF: Swiss Franc

- JPY: Japanese Yen

The platform provides dedicated trading pairs for each of these currencies, allowing you to buy assets like Bitcoin or Ethereum directly with your local cash.

Digital Assets & Stablecoins

Kraken’s selection of cryptocurrencies has grown to over 550 assets, ensuring deep liquidity across all major sectors of the market.

- Major Coins: Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Cardano (ADA).

- Stablecoins: Extensive support for fiat-pegged tokens like USDC, USDT, and DAI, which are available on multiple networks including Ethereum, Solana, and Arbitrum.

- Traditional Equities: Through its brokerage expansion, users in eligible regions can also trade over 11,000 U.S. stocks and ETFs.

Network Support

To lower transaction costs, Kraken supports deposits and withdrawals across various blockchain networks beyond the mainnet. These include Lightning Network for Bitcoin, as well as Layer 2 solutions like Arbitrum, Base, and Optimism for Ethereum-based assets.

Verdict

Kraken provides one of the most robust and transparent funding systems in the industry. The $1 minimums and commission-free ACH are massive wins for retail users. While the 7-day withdrawal hold on ACH can be a minor hurdle for those in a rush, it is a necessary standard for security and fraud prevention.

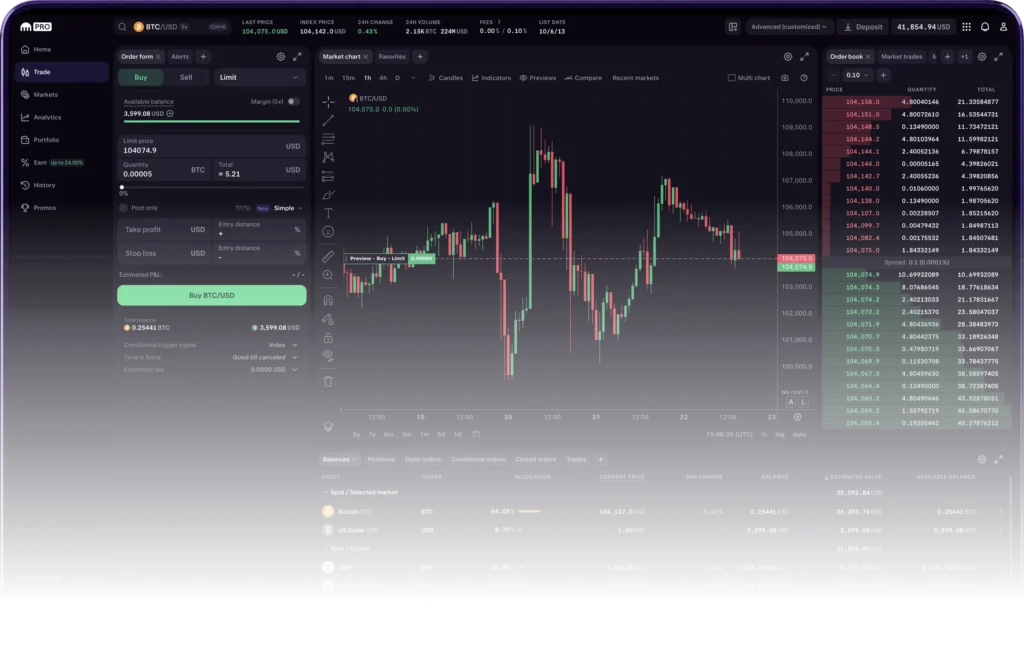

Desktop Trading Platform

The Kraken Desktop application is a high-performance, installable software designed for professional traders who require more stability and speed than a standard web browser can provide. In 2026, it serves as the flagship environment for active market participants, offering a “command center” experience that synchronizes seamlessly with the Kraken Pro web and mobile ecosystems.

Unrivaled Customization with "Boards"

The standout feature of Kraken Desktop is its modular interface built around "Boards." A Board is a fully customizable workspace where you can arrange over 25 different trading and data widgets to fit your specific strategy.

You can create, save, and switch between up to 100 different board layouts, such as a "Scalping Board" with a vertical ladder or a "Technical Analysis Board" focused on large-scale charting. The platform even supports multi-monitor setups, allowing you to pop out individual boards into separate windows to maximize your screen real estate.

Advanced Technical Analysis and Charting

Kraken Desktop integrates full-featured TradingView charts, providing access to hundreds of technical indicators like Moving Averages, RSI, and Bollinger Bands. Traders can perform detailed analysis and even modify orders directly on the chart by dragging and dropping price lines.

The platform also allows you to compare up to four different markets simultaneously in a single view, which is essential for identifying correlations between Bitcoin and traditional stocks.

High-Speed Execution and One-Click Trading

To cater to day traders, the desktop app includes the "Ladder" module for rapid execution. This tool displays price action in a vertical sequence, allowing for one-click trading at specific price levels with pre-set quantity shortcuts.

Because the app runs natively on Windows, macOS, or Linux, it offers superior speed and lower latency compared to the web-based Pro interface, reducing the risk of browser crashes during periods of extreme market volatility.

Consolidated Portfolio Tracking

While the app is built for trading, it provides a comprehensive view of your entire financial standing. The all-in-one interface allows you to switch instantly between spot, margin, and derivatives trading. You can monitor your "Margin Health" in real-time and track your consolidated portfolio performance across all asset classes, including traditional equities and staked digital assets, without leaving the application.

Verdict

Kraken Desktop is arguably the most powerful installable trading platform provided by any major crypto-native exchange. It successfully bridges the gap between professional TradFi terminals and the fast-moving crypto markets. While its complexity may intimidate total beginners, it is an essential tool for any serious investor who values stability, speed, and deep customization.

Pros & Cons

Pros

- Superior Speed: Enjoy native app performance with significantly lower latency than standard web browsers.

- Infinite Customization: Create a personalized workspace by saving up to 100 custom layouts and utilizing multi-monitor setups.

- Advanced Tools: Access professional-grade features, including one-click ladder trading and in-depth margin health modules.

Cons

- Steep Learning Curve: The modular “Board” system provides great power but can be overwhelming for new users to navigate.

- No Direct Funding: You cannot process deposits or withdrawals directly within the desktop app; these must be managed via the web or mobile versions.

Mobile App

Kraken provides a robust mobile experience by offering several specialized applications. In 2026, the company continues to separate its services into distinct apps to avoid clutter and provide a more focused experience for different types of users. All official apps synchronize with your primary account, allowing you to manage your portfolio across all devices seamlessly.

Two-Tiered Trading Experience

Kraken maintains two primary apps for market participants: the standard "Kraken" app and "Kraken Pro." The main Kraken app features a vibrant, intuitive design focused on accessibility, making it the perfect choice for beginners who want to buy, sell, and stake with a few taps.

In contrast, Kraken Pro is a high-performance tool for experienced traders, offering a sleek mobile-first design that includes advanced charting, deep liquidity, and professional-grade order execution.

Advanced Functionality on the Go

The mobile suite does not compromise on power. On Kraken Pro, users can access sophisticated trading instruments including margin with up to 5x leverage and futures with up to 50x leverage, provided they meet regional eligibility.

The app also supports conditional orders like stop-loss and take-profit, ensuring you can manage your risk even when away from your desk. For those seeking passive income, both apps allow you to manage and track your staking rewards in real-time.

The "Krak" Money App

A major addition to the ecosystem is Krak, a global money app that functions as a bridge between crypto and traditional banking. This app allows you to send money instantly to over 160 countries using personalized "Kraktags," eliminating the need for complex bank details or wallet addresses.

Krak also offers specialized "Spend and Earn" accounts where you can hold over 300 currencies and automatically earn rewards on your idle balances.

Secure Self-Custody with Kraken Wallet

For users who want full control over their assets, the Kraken Wallet provides a secure, non-custodial gateway to the Web3 world. This open-source, multi-chain wallet supports major networks like Bitcoin, Ethereum, Solana, and various Layer 2 solutions. It allows for seamless interaction with dApps via WalletConnect and even features a built-in NFT gallery to view and manage your digital collectibles across different blockchains.

Verdict

Kraken’s mobile ecosystem is arguably the most comprehensive in the industry. While having multiple apps can be slightly confusing for newcomers, it ensures that each tool remains fast and perfectly tailored to its specific purpose. The addition of the Krak app and a high-quality self-custody wallet makes Kraken a truly complete "all-in-one" financial platform for 2026.

Pros & Cons of the Mobile App

Pros

- Tailored Interfaces: Separate apps for beginners and pros prevent the cluttered “everything app” feel and ensure high performance.

- Feature Rich: Access to advanced tools like 50x futures leverage, professional analytics, and even tokenized stocks from your phone.

- Global Utility: The Krak app provides unique global remittance features that rival traditional banking services.

Cons

- App Fragmentation: Managing 4-5 different apps can be a hassle for users who want everything in a single interface.

- Device Intensity: High-volume traders report that the Pro app can be slow on older hardware during periods of extreme market volatility.

- Learning Curve: While the standard app is simple, mastering the full mobile suite and its different fee structures takes time.

Market Research, Tools, and Education

Kraken provides a robust ecosystem for both learning and analysis, ensuring that users have the data they need to navigate the 2026 financial markets effectively. By blending crypto-native insights with traditional market tools, the platform caters to everyone from first-time buyers to institutional professionals.

For high-level outlooks, Kraken partners with firms like CF Benchmarks to provide long-term price projections and risk-adjusted return models for various asset classes.

Charting: Full integration with TradingView provides hundreds of technical indicators, drawing tools, and the ability to compare up to four markets simultaneously.

Proprietary Analytics: Unique modules like Aggressor Differential (measuring buy/sell pressure) and Rolling Volatility give traders a look at the "hidden" mechanics of the order book.

Execution Tools: Professional traders can utilize a Ladder Trading module for rapid, one-click order entry, which is essential for high-frequency strategies.

Guided Walkthroughs: Step-by-step videos and articles on how to buy, stake, and secure your first assets.

Security Best Practices: Dedicated modules on protecting your digital identity and using advanced security features like Master Keys.

Institutional Resources: Specialized guides for corporate clients on qualified custody and regulatory compliance rails.

Customer Support

Kraken provides global, 24/7 customer support through a variety of channels to ensure traders can get help whenever they need it. The core of their service is a live chat feature that aims to respond to 90% of messages within 30 seconds, providing near-instant assistance for common issues.

For more complex inquiries, you can submit a support ticket via email, which typically receives a response within 24 to 48 hours. The platform also offers voice support directly within its mobile apps for clients in specific situations, ensuring you can speak to a real person when a more personal touch is required.

The support team is distributed globally and is fluent in 13 different languages, reflecting Kraken’s status as an international brokerage. For high-net-worth individuals and institutional clients, the Kraken VIP program provides a dedicated account manager and priority support with even faster resolution times.

This “white-glove” service is reserved for users who maintain an average balance of $10 million or exceed $80 million in annual trading volume.

Beyond direct contact, Kraken maintains an extensive Support Center loaded with hundreds of in-depth articles, tutorials, and troubleshooting guides. These self-service resources cover everything from account verification to advanced margin trading documentation.

While the platform has a high client satisfaction score, users should note that during periods of extreme market volatility, response times for email tickets may extend beyond the usual window.

Overall, the multi-layered support system remains one of Kraken’s strongest competitive advantages in the 2026 financial landscape.

FAQ

Is Kraken safe to use in 2026?

Yes. Kraken is widely considered one of the most secure exchanges globally. It has maintained a spotless record since 2011, having never lost user funds to a platform-wide hack. It also uses audited Proof of Reserves to confirm it holds 1:1 backing of all client assets.

Can I buy stocks on Kraken?

Yes. Eligible users in the United States (excluding Maine and New York) can trade over 11,000 stocks and ETFs with $0 commission. This service allows you to manage traditional equities and crypto within the same interface.

What are the trading fees?

Kraken uses a two-tier fee system. The standard app charges a flat 1% fee for instant buys and sells. Kraken Pro uses a maker-taker model with fees starting as low as 0.25% maker / 0.40% taker, which scale down based on your 30-day trading volume.

Is there a minimum deposit?

Kraken is very accessible, with a minimum deposit of just $1 for ACH transfers and most crypto assets. Other methods like Apple Pay or wire transfers may have higher minimums, typically around $10 to $150.

When is the Kraken IPO?

Kraken has confidentially filed for an IPO and is targeting a public debut in the first half of 2026. Analysts expect the company to be valued at approximately $15 billion to $20 billion.

Does Kraken offer staking rewards?

Yes. Kraken offers on-chain staking for 21 different cryptocurrencies, with rewards reaching up to 22% APY. Note that staking is currently restricted for most retail users in the U.S. due to regulatory requirements.

How many apps does Kraken have?

Kraken offers five specialized apps: Kraken (for beginners), Kraken Pro (for active traders), Krak (a global money/remittance app), Kraken Wallet (self-custody), and Inky.

Is Kraken regulated?

Yes. Kraken is highly compliant and registered with several global authorities, including FinCEN (US), FCA (UK), FINTRAC (Canada), and AUSTRAC (Australia).

Can I trade futures on Kraken?

Yes. Non-U.S. users can access over 350 perpetual futures with up to 50x leverage. U.S. users can trade regulated crypto futures through Kraken Derivatives US.

How fast is customer support?

Kraken offers 24/7 support via live chat and email in 13+ languages. Live chat typically connects you to an agent within 2–3 minutes, while email responses can take 24–48 hours depending on market activity.