Lightyear REVIEW 2025

Looking for a smarter, simpler way to invest in 2025? In this in-depth Lightyear review, we break down everything that makes the platform stand out — from its transparent low fees and FCA regulation to its sleek, beginner-friendly design. See why Lightyear is quickly becoming a favorite among investors who value clarity, control, and confidence.

Broker Guide's Lightyear Review in 2025

We test and review the world’s most transparent and cost-efficient brokers to help investors make smarter choices. For our Lightyear review 2025, we wanted to see whether this fast-growing platform truly lives up to the hype as one of the UK and EU’s most user-friendly investing apps.

Launched in 2021 by former Wise (TransferWise) employees, Lightyear has quickly become a favourite among beginner and cost-conscious investors thanks to its simple interface, low fees, and clear pricing.

The platform offers access to global stocks and ETFs, fractional shares, and even interest on uninvested cash — all while being fully regulated in both the UK and EU.

In this Lightyear broker review, we’ll explore how it performs across pricing, platform usability, product range, and safety. We’ll also look at who it’s best suited for — and where it still falls short for more advanced traders seeking wider asset classes or deeper analytics.

By the end, you’ll know whether the Lightyear investing app deserves a place in your 2025 trading toolkit.

About Lightyear

Founded in 2020 by former Wise (TransferWise) employees, Lightyear was built on a mission to make global investing simple, transparent, and affordable for everyone. Headquartered in Tallinn, Estonia, the platform combines the founders’ fintech expertise with a clear focus on reducing unnecessary complexity and fees — values that have made it one of Europe’s fastest-growing investment platforms.

Lightyear operates under strong regulatory oversight, holding licenses from both the Financial Conduct Authority (FCA) in the UK and the Estonian Financial Supervision and Resolution Authority (EFSA). This dual regulation gives investors peace of mind, ensuring their funds are held securely in segregated accounts and covered by investor protection schemes across both regions.

Now available in 22 European countries, Lightyear Europe caters to a wide audience of retail investors seeking low-cost access to global markets. Users can trade thousands of US, UK, and EU-listed stocks, a growing range of ETFs, and even Baltic bonds — a unique offering among modern investing apps.

The platform also partners with BlackRock to provide Money Market Funds (MMFs) that earn interest on idle cash, allowing users to make their uninvested funds work harder.

Another standout feature is Lightyear’s multi-currency account, which supports GBP, EUR, USD, and HUF balances. This enables investors to buy foreign stocks without excessive currency conversion fees, making it especially attractive for those managing a diversified global portfolio.

In short, Lightyear is a transparent, regulation-backed platform designed for modern investors who value simplicity, flexibility, and control over their money — without the hidden costs and clutter of traditional brokers.

My Quick Verdict: Who is Lightyear Best For?

Rating: 4.6/5

Best for: Beginners and long-term investors

After testing the platform extensively, it’s clear that Lightyear delivers on its promise of making investing simple, transparent, and affordable. It’s an excellent choice for beginners and long-term investors who value ease of use, regulated protection, and low ongoing costs.

Lightyear’s biggest strengths lie in its clean interface, clear pricing, and dual regulation under the FCA (UK) and EFSA (Estonia). Investors can trade global stocks, ETFs, and Baltic bonds without worrying about hidden fees, while the platform’s Money Market Funds provide attractive interest rates on uninvested cash — a rare advantage in today’s brokerage landscape.

That said, Lightyear isn’t designed for advanced traders. There’s no support for crypto, CFDs, or advanced charting tools, so active or high-frequency traders may find the platform too limited.

Still, for anyone seeking a trustworthy, beginner-friendly way to grow their wealth with minimal friction and full transparency, Lightyear stands out as one of 2025’s most accessible and well-regulated investment platforms.

Pros:

- Fully regulated by the FCA (UK) and EFSA (Estonia) for enhanced investor protection

- Supports fractional shares and a multi-currency account (GBP, EUR, USD) to reduce FX costs

- Earns high interest on uninvested cash through BlackRock Money Market Funds (MMFs)

- 0% Lightyear execution fees on ETF trades

- No deposit, withdrawal, or inactivity fees, keeping overall costs extremely low

Cons:

- Limited asset range — no crypto, CFDs, or options available

- No demo account or SIPP, restricting flexibility for some investors

- Customer support only available during business hours (no 24/7 service)

- Basic research tools and charting, less suitable for advanced traders

Why You Should Choose Lightyear ?

In 2025, Lightyear continues to set the standard for simplicity, transparency, and accessibility in online investing. Designed for today’s investors who value clarity over complexity, it combines low fees, intuitive design, and regulatory strength to make global markets easy to access — whether you’re investing £10 or £10,000.

Post-Brexit Confidence Through Dual Regulation

Lightyear’s strongest advantage lies in its dual regulation under the Financial Conduct Authority (FCA) in the UK and the Estonian Financial Supervision and Resolution Authority (EFSA). This dual framework provides a safety net for both UK and EU investors, ensuring that client funds are fully segregated and protected under the FSCS (£85,000) or the Estonian Investor Protection Scheme. For cross-border investors, this offers rare continuity and peace of mind in the post-Brexit landscape.

High-Yield Cash Management with MMFs

Through its partnership with BlackRock, Lightyear offers Money Market Funds (MMFs) that allow users to earn interest on uninvested cash — currently reaching up to around 5%, depending on the currency. This means your money continues working for you even when it’s not actively invested in stocks or ETFs, giving Lightyear an edge over “idle cash” accounts on other platforms.

Transparent, Low-Cost Investing

Unlike “zero-commission” brokers that disguise costs through wider spreads or FX markups, Lightyear keeps its pricing straightforward. You pay a clear, flat trading fee — £1 for UK shares, €1 for EU stocks, or 0.10% (max $1) for US trades — with no hidden extras. There are no deposit, withdrawal, or inactivity fees, and ETF trades are free of Lightyear execution charges.

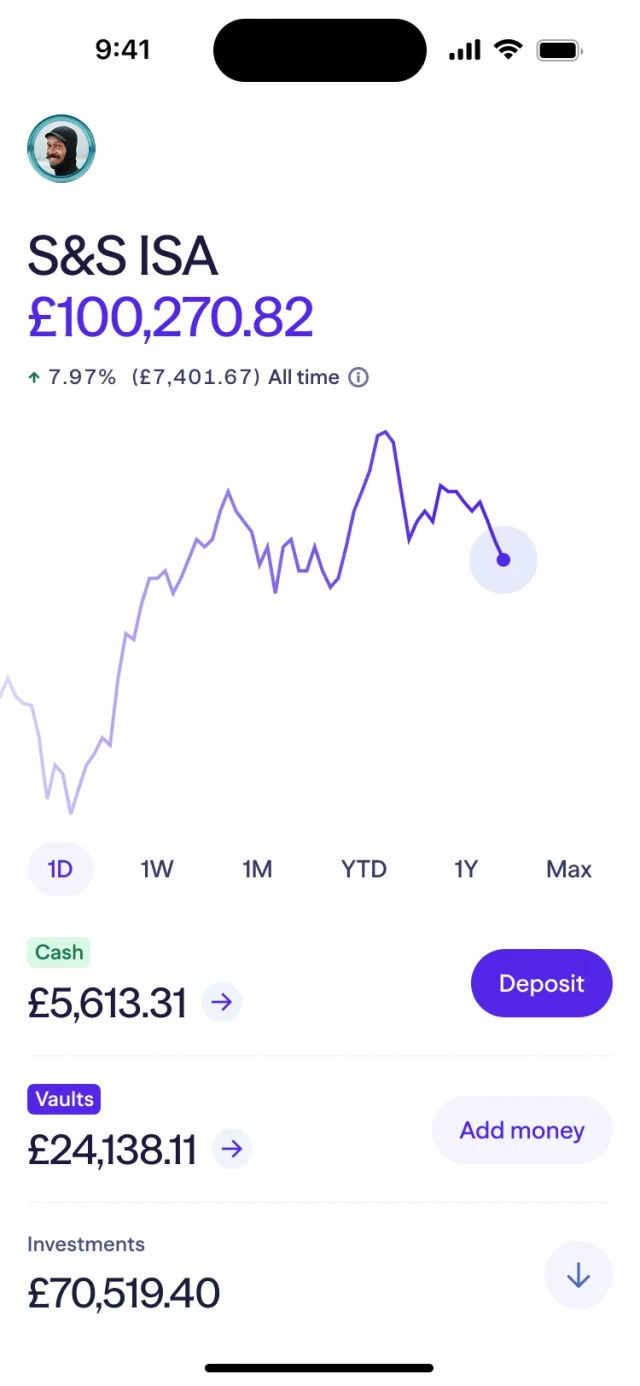

Tax-Free and Cross-Border Flexibility

UK users benefit from tax-free investing via Stocks & Shares ISA and Cash ISA options, both with competitive rates and zero account fees. Meanwhile, the multi-currency account (GBP, EUR, USD, HUF) allows European investors to trade across borders without incurring costly conversion charges.

Smooth, Intuitive Experience

Whether on mobile or web, Lightyear’s minimalist interface makes investing easy and engaging. It’s fast, secure, and designed for all experience levels — a rare blend of simplicity and sophistication that solidifies Lightyear as one of 2025’s most forward-thinking investing platforms.

Compare to Top Competitors

Before deciding if Lightyear is the right fit, it helps to see how it stacks up against other major European brokers. While several platforms promise low-cost trading and user-friendly apps, few combine regulation, transparency, and interest-bearing accounts quite like Lightyear does. Here’s how it compares to some of its closest rivals in 2025:

Trading 212

eToro

DEGIRO

Exploring Lightyear’s Range of Tradable Instruments

Lightyear keeps its investment offering focused, transparent, and practical — catering primarily to investors who prefer regulated, low-risk products over speculative trading. While it doesn’t offer crypto, CFDs, or derivatives, its curated range of assets gives users broad access to major global markets with minimal fees and maximum simplicity.

Here’s a closer look at what you can trade on Lightyear:

Stocks

Lightyear offers access to over 3,000 US stocks, more than 100 EU-listed equities, and around 50 UK companies. This includes global giants such as Apple, Tesla, and HSBC, as well as leading firms from France, Germany, and the Netherlands. Investors can build diversified portfolios across multiple regions and sectors directly from one platform. The platform’s stock range continues to grow, making it ideal for those who want exposure to both established blue chips and emerging European opportunities.

ETFs (Exchange-Traded Funds)

For those who prefer a hands-off approach, Lightyear’s 200+ ETFs provide instant diversification. You can invest in popular index funds like the S&P 500, FTSE 100, or MSCI World, along with thematic ETFs focused on technology, clean energy, or dividend-paying companies. Lightyear charges 0% execution fees on ETF trades, making them one of the most cost-efficient options for long-term investors seeking to track major market indices.

Baltic Bonds

A unique feature that sets Lightyear apart is its access to Baltic bonds — corporate and government bonds from Estonia, Latvia, and Lithuania. These bonds offer investors exposure to a growing regional market while maintaining transparency and low entry costs. With bonds starting from as little as €1 per trade, they’re a compelling addition for those seeking modest fixed-income exposure alongside equities and ETFs.

Money Market Funds (MMFs)

Lightyear’s Money Market Funds, powered by BlackRock, allow users to earn competitive interest on their idle cash — currently up to around 4–5%, depending on the currency (USD, GBP, or EUR). These MMFs invest in short-term, high-quality debt instruments, giving investors liquidity, stability, and daily accrual of returns. It’s an innovative way to keep your uninvested balance working passively while maintaining easy access to funds.

Fractional Shares

With fractional investing, users can buy a portion of high-priced shares like Netflix or Amazon with as little as £1. Available for both US and EU stocks and ETFs, this feature makes global investing more inclusive and budget-friendly, especially for beginners.

Overall, Lightyear’s asset selection is intentionally streamlined — prioritizing clarity, safety, and accessibility over speculative trading. It’s a balanced suite designed for investors who want steady, long-term exposure to global markets without unnecessary risk.

| Asset | Lightyear |

|---|---|

| US Stocks | 3000+ |

| ETFs | 200+ |

| Canada Stocks | 100+ |

| Asian Stocks | 40+ |

| EU Stocks | 100+ |

| UK Stocks | 50+ |

How Lightyear’s Instruments Compare to Competitors

| Asset | Lightyear | Trading 212 | eToro | DEGIRO |

|---|---|---|---|---|

| Stocks | ||||

| ETFs | ||||

| Baltic Bonds | ||||

| Money Market Funds | ||||

| Forex | ||||

| Cryptocurrencies | ||||

| CFDs / Derivatives (non-stock) |

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $0 |

| US Stocks | 0.10% (min $0.10, max $1) |

UK Stocks | £1 per trade |

| EU Stocks | €1 per trade |

| ETFs | €0 Lightyear execution fee (ETF trades have no Lightyear commission) |

Baltic Bonds | €1 per trade |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | No |

Transparent pricing is one of Lightyear’s strongest selling points — you’ll see exactly what you pay before you trade.

Other important costs: Lightyear applies a 0.35% currency conversion fee when you convert between currencies, and card deposits are free up to a €500 (or HUF equivalent) threshold after which a 0.5% charge may apply. There are no account opening, custody, inactivity, or withdrawal fees.

Analysis

Lightyear’s fee structure is intentionally simple: small, capped percentage fees for US equities and fixed-euro/GBP fees for European/UK names, with zero execution fees on ETFs. That makes it especially cost-effective for buy-and-hold investors who trade ETFs frequently or who hold multi-currency portfolios and want to minimise surprise FX markups.

Its 0.35% FX fee sits comfortably below many legacy brokers that apply higher markups or poor exchange rates, although some pure “zero commission” challengers will still beat Lightyear on headline trade price — but often at the expense of opaque FX spreads or no interest on idle cash.

Verdict

If you prioritise clarity and overall low all-in costs for cross-border, long-term investing, Lightyear is among the best-value choices in 2025.

For active traders chasing 0-commission execution on single-region trades or users wanting crypto/derivatives, competitors like Trading 212 or eToro may be more feature-rich — but they usually come with trade-offs (less transparent FX, withdrawal or inactivity charges, or asset-type differences). Overall, Lightyear’s balance of low, predictable fees and interest-on-cash makes it a strong pick for cost-conscious investors.

Currency Conversion Fee

Lightyear applies a competitive 0.35% foreign exchange rate whenever you buy or sell assets in a currency different from your account balance. This rate is notably lower than many competing brokers — platforms like eToro or Trading 212 often charge between 0.5% and 1%, meaning Lightyear offers more cost-efficient global investing for those dealing in USD, GBP, or EUR markets.

Deposit Fees

Depositing funds via bank transfer is completely free, keeping the funding process simple and affordable. However, if you prefer using a debit or credit card, Lightyear allows free deposits up to €500 per month (or equivalent in other currencies). Beyond that threshold, a small 0.5% fee applies to card transactions — still far cheaper than most brokers’ card processing fees.

Withdrawal Fees

Withdrawals are free of charge across all supported currencies, with funds typically arriving in 1–2 business days depending on your bank. There are no minimum withdrawal amounts or surprise deductions, reflecting Lightyear’s commitment to transparency.

Custody and Management Fees

Unlike many traditional brokers, Lightyear charges no custody or management fees. You keep 100% of your gains, with no ongoing platform charges or percentage-based maintenance costs.

Non-Trading Fees

Inactivity Fee

Lightyear imposes no inactivity fee, meaning your account remains open and cost-free even if you stop trading for several months. This is a key advantage over legacy brokers that often charge monthly or annual inactivity penalties.

Account Closure Fee

Closing your account is also free, with no processing or transfer-out fees. Whether you withdraw all funds or decide to move to another provider, Lightyear ensures a smooth, penalty-free exit.

ISA Subscription and Management Fees

For UK investors, Lightyear’s Stocks & Shares ISA and Cash ISA come with no subscription or annual management fees. Every pound you invest works directly toward your returns — not toward hidden charges.

A Truly Transparent Cost Structure

Lightyear’s clean fee model stands in sharp contrast to traditional brokers that bury maintenance costs or service charges in small print. There are no “surprise” deductions or complex terms — just straightforward investing backed by transparent pricing. This makes Lightyear one of the most trustworthy and beginner-friendly platforms for cost-conscious investors in 2025.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Lightyear Regulated ?

Yes — Lightyear is a fully regulated investment platform, operating under the oversight of two respected financial authorities. In the UK, it is licensed and supervised by the Financial Conduct Authority (FCA), ensuring compliance with strict rules on transparency, capital requirements, and investor protection. Within the European Union, Lightyear is also authorised by the Estonian Financial Supervision and Resolution Authority (EFSA), allowing it to passport its services securely across multiple EU member states.

All client funds are held in segregated bank accounts, separate from the company’s operational funds. This structure guarantees that your money remains protected even in the unlikely event of company insolvency.

For added safety, UK-based investors benefit from coverage under the Financial Services Compensation Scheme (FSCS), which protects up to £85,000 per person, while EU clients are covered by the Estonian Investor Protection Scheme, providing similar safeguards up to a defined limit.

Lightyear also employs strong digital security protocols, including two-factor authentication (2FA), data encryption, and compliance with EU GDPR standards to ensure privacy and data integrity.

This dual-regulatory framework and robust security design make Lightyear one of the most trusted fintech brokers available in 2025 — combining modern technology with the same level of investor protection expected from established, traditional financial institutions.

Understanding Regulatory Protections and Broker Stability

Lightyear’s regulatory foundation is built on dual oversight — from both the Financial Conduct Authority (FCA) in the UK and the Estonian Financial Supervision and Resolution Authority (EFSA) in the EU. This two-tier regulation ensures that Lightyear meets some of the strictest compliance standards in Europe, strengthening investor confidence and providing consistent safeguards for users across both regions.

Transparent and Fair Operations

Unlike many “zero-commission” brokers, Lightyear does not engage in payment for order flow (PFOF) — a controversial practice where brokers sell trade orders to third parties for profit. By executing trades transparently and directly, Lightyear ensures that clients receive fair pricing and full clarity over how their orders are handled. This reinforces trust and aligns the broker’s interests squarely with those of its investors.

Audits, Compliance, and Financial Stability

Lightyear undergoes regular financial audits and regulatory reporting, maintaining strict solvency ratios and operational transparency. These measures ensure that client assets remain protected and that the company adheres to all capital adequacy and reporting requirements set by the FCA and EFSA.

Credibility Backed by Proven Founders

Founded by ex-Wise (TransferWise) executives and backed by reputable investors, Lightyear benefits from strong fintech expertise and financial discipline. Its leadership’s track record in building regulated, user-focused platforms adds another layer of credibility and confidence in Lightyear’s long-term stability and ethical management.

How To Open an Account

Opening a Lightyear account is quick, paperless, and beginner-friendly — sign-up usually takes just a few minutes, and verification is typically completed within minutes but can take up to 0–2 business days in some cases.

- Download the Lightyear app or visit the web platform and create an account with email and phone.

- Enter your phone number to receive a confirmation code.

- Provide personal details such as your name, date of birth, and email address.

- Provide your tax details.

- Provide information about your source of wealth.

- Complete KYC verification: upload a valid photo ID (passport/driver’s licence) and proof of address — most verifications finish within minutes but may take up to 1–2 business days.

If verification stalls beyond 2 business days, Lightyear’s help centre advises contacting support through the app.

Account Types

Lightyear offers a small but well-designed selection of account types to suit different kinds of investors — from casual savers to businesses managing larger portfolios. Each account maintains the platform’s hallmark simplicity, transparent pricing, and easy setup process.

General Investment Account (GIA)

The GIA is Lightyear’s standard account, open to users across the UK and Europe. It allows you to invest in global stocks, ETFs, and Baltic bonds with no tax advantages but full flexibility — perfect for everyday investing or long-term portfolio building.

Stocks & Shares ISA (UK)

Available to UK residents, the Stocks & Shares ISA enables tax-free investing on returns of up to £20,000 per year. There are no management or subscription fees, and ISA transfers from other providers are supported. This account is ideal for investors who want to grow their wealth while protecting their profits from capital gains and dividend taxes.

Cash ISA

Cash ISA Lightyear also offers a Cash ISA, which earns interest linked to the Bank of England’s base rate. Funds can be withdrawn anytime, making it a flexible option for savers who prefer low-risk returns while keeping their money instantly accessible.

Business Accounts

Business Accounts For corporate clients, Lightyear provides Business Accounts that allow companies to invest surplus funds or earn interest on idle balances through BlackRock Money Market Funds.

At present, Lightyear does not offer a SIPP (Self-Invested Personal Pension) or a demo account, though both are commonly requested features expected in future updates.

What is the Minimum Deposit at Lightyear

Lightyear keeps investing accessible for everyone with a minimum deposit of $0.. This ultra-low entry point makes it ideal for first-time investors who want to start small and build confidence over time. There are no account opening or funding fees, and you can add money via bank transfer, debit card, or Apple/Google Pay.

Combined with fractional investing, this means you can own a piece of major global companies with as little as a single pound or euro, making Lightyear one of the most beginner-friendly brokers in 2025.

| Broker | Minimum Deposit |

|---|---|

| Lightyear | $0 |

Trading 212 | $1 |

| eToro | $100 |

DEGIRO | $0 |

Deposit and Withdrawal

Lightyear makes funding and withdrawing from your account simple, fast, and transparent — with no hidden fees or unnecessary complications. Whether you’re in the UK or mainland Europe, transactions are smooth and supported in multiple major currencies.

Deposit Options

You can fund your account using several convenient methods:

Withdrawal Fees & Options

Withdrawals can only be made to your verified source account (the bank account you originally deposited from). This ensures enhanced security and compliance with anti-money laundering rules. Transfers are typically processed within 1–2 business days, depending on your bank’s network.

Supported Currencies

Lightyear supports multi-currency balances in GBP, EUR, USD, and HUF (Hungarian forints). This allows you to hold, invest, and withdraw in your preferred currency without excessive conversion costs — a major benefit for investors trading across borders.

Fees

Both deposits (within the €500/month card limit) and withdrawals are completely free, with no hidden processing or service fees.

Verdict

Lightyear’s deposit and withdrawal process reflects the platform’s broader commitment to transparency and user control. With multiple payment options, fast processing times, and no withdrawal charges, it’s one of the most straightforward and investor-friendly systems available. Whether you’re topping up your account or cashing out profits, Lightyear ensures your money moves securely, quickly, and without surprises.

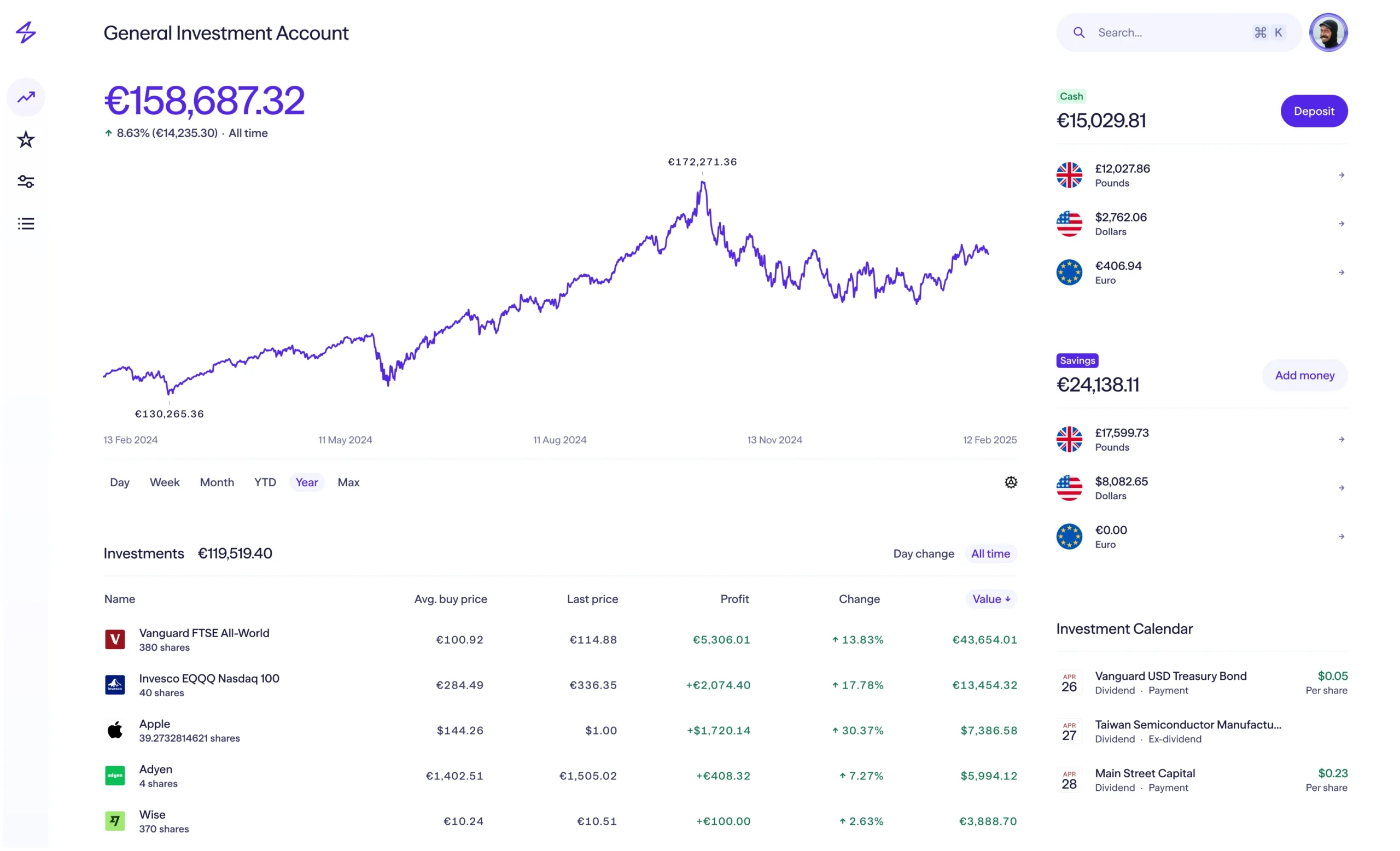

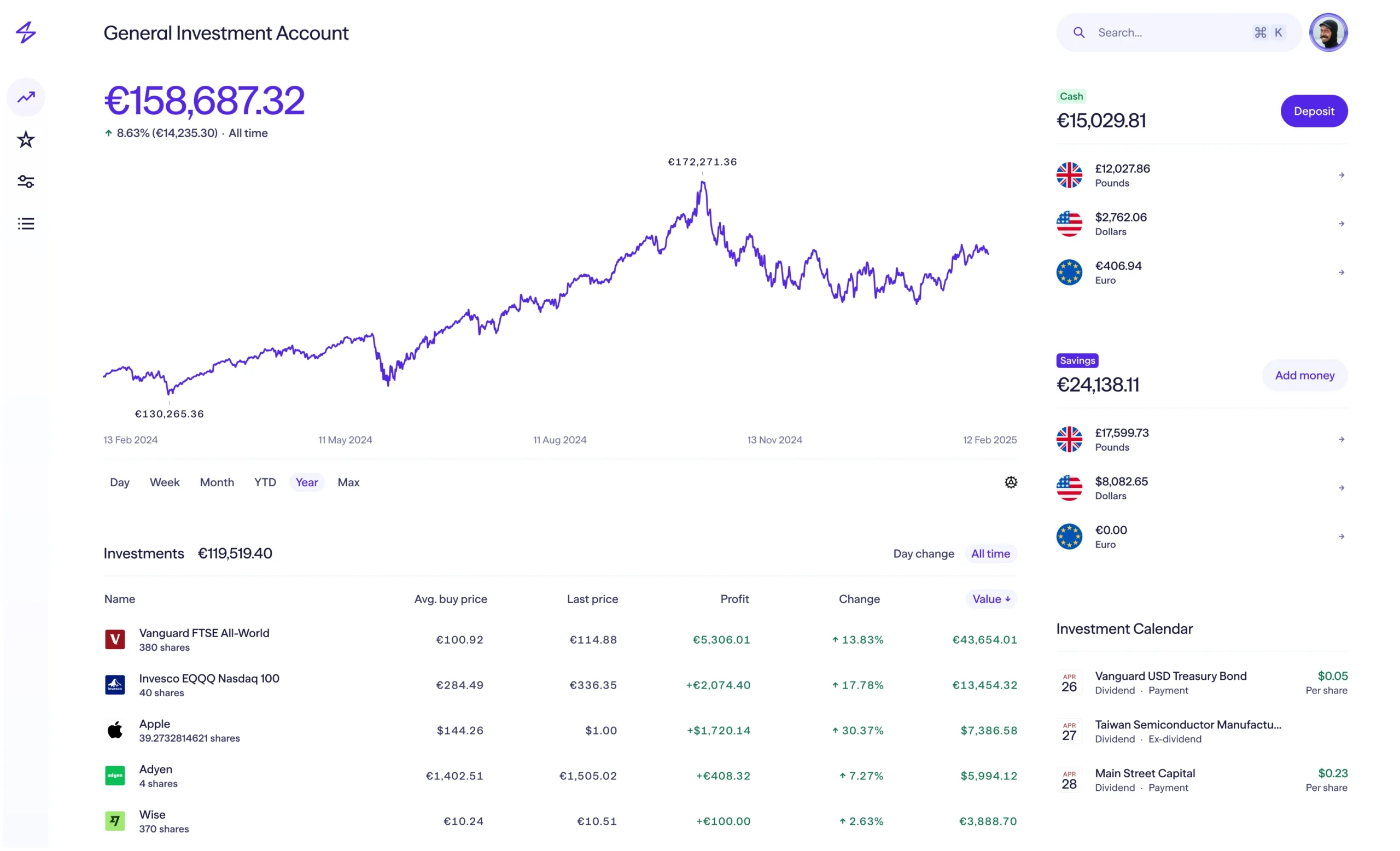

Web Trading Platforms

Lightyear’s web trading platform is designed for clarity and ease of use. With a minimalist layout and responsive design, it allows investors to focus on what matters — managing portfolios and executing trades efficiently. Although still in beta, the platform is improving rapidly, with frequent updates enhancing speed, navigation, and reliability. It’s accessible directly through a browser, requiring no downloads or plugins.

Core Features and Functionality

The web interface features a comprehensive portfolio dashboard that displays asset allocations, performance, and returns.

You can also build a custom watchlist to monitor specific stocks and ETFs and review your full activity history for transparency on trades, dividends, and deposits. Load times are fast, and the layout is neatly organised, ensuring a frictionless experience even for beginners.

Placing Orders

Placing trades on Lightyear’s web platform is simple and intuitive. Users can search any listed stock or ETF, view real-time price data, and execute market or limit orders in just a few clicks.

Orders confirm instantly, with a detailed breakdown of costs before submission — reinforcing Lightyear’s commitment to transparent pricing. Fractional shares can also be purchased easily, allowing users to invest any amount starting from just £1 or €1.

Security and Account Protection

Lightyear employs bank-level security protocols to keep user data and funds safe. All web sessions use end-to-end encryption, and accounts are protected by two-factor authentication (2FA).

In addition, all client funds are held in segregated accounts, ensuring they remain separate from Lightyear’s corporate capital. The platform is fully compliant with FCA and EFSA requirements, providing peace of mind for investors across the UK and EU.

Limitations for Active Traders

While Lightyear’s simplicity is its strength, it lacks advanced charting tools, price alerts, and technical indicators, which may limit its appeal for day traders or technical analysts. The platform focuses on stability and accessibility rather than high-frequency or speculative trading features.

Verdict

Lightyear’s web platform delivers a smooth, transparent, and secure experience for long-term investors. It’s perfect for those who prioritise ease of use, fast execution, and regulatory protection — though active traders may find its analytical tools limited.

Pros & Cons of the Web Platform

Pros:

- Clean, intuitive interface that’s easy to navigate even for beginners

- Fast trade execution and smooth browser performance

- Supports market and limit orders with instant confirmations

- Fractional investing available for low-cost access to global stocks and ETFs

- Multi-currency view (GBP, EUR, USD, HUF) for cross-border investing

- Secure platform with 2FA, encryption, and segregated client funds

- Regular updates and improvements as part of Lightyear’s evolving beta phase

Cons:

- No advanced charting tools or technical indicators

- No customisable dashboards or analytical widgets

- Lacks price alerts and real-time notifications

- Limited research tools compared to full-service brokers

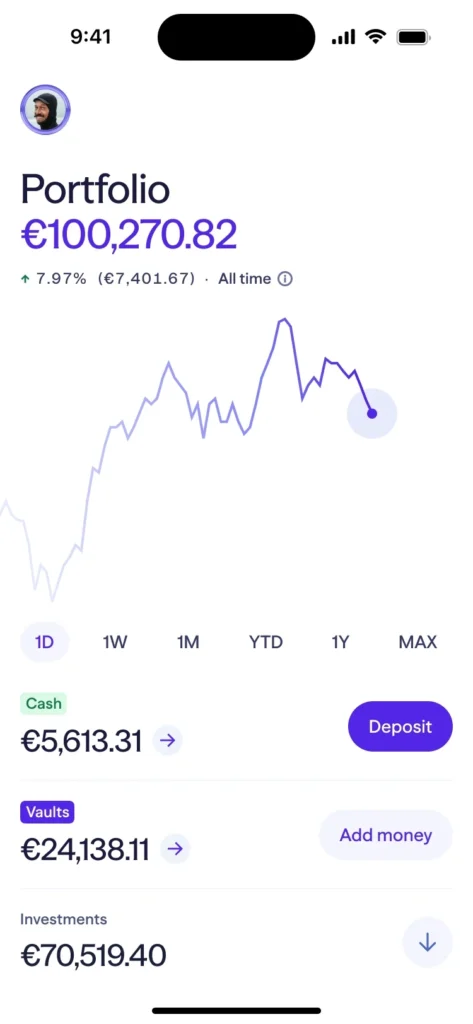

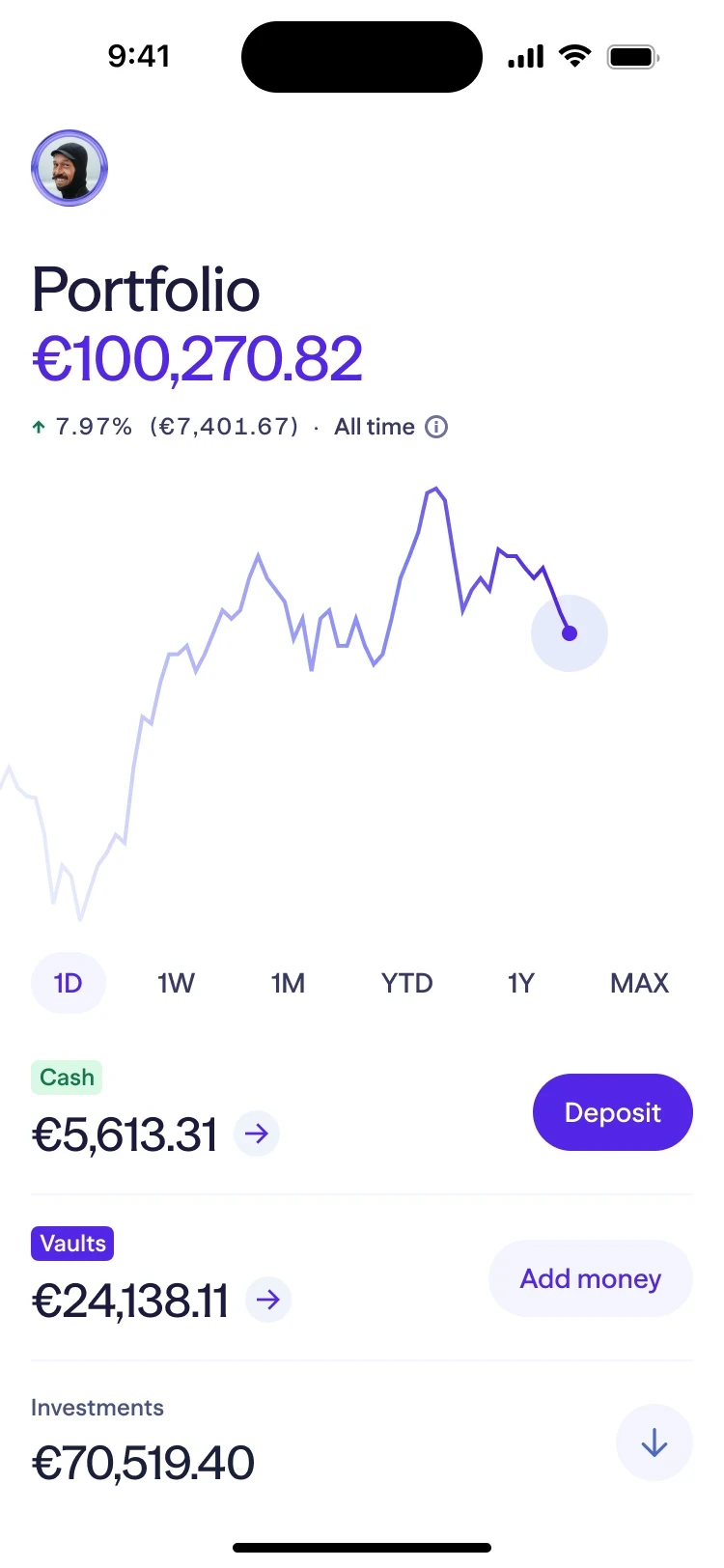

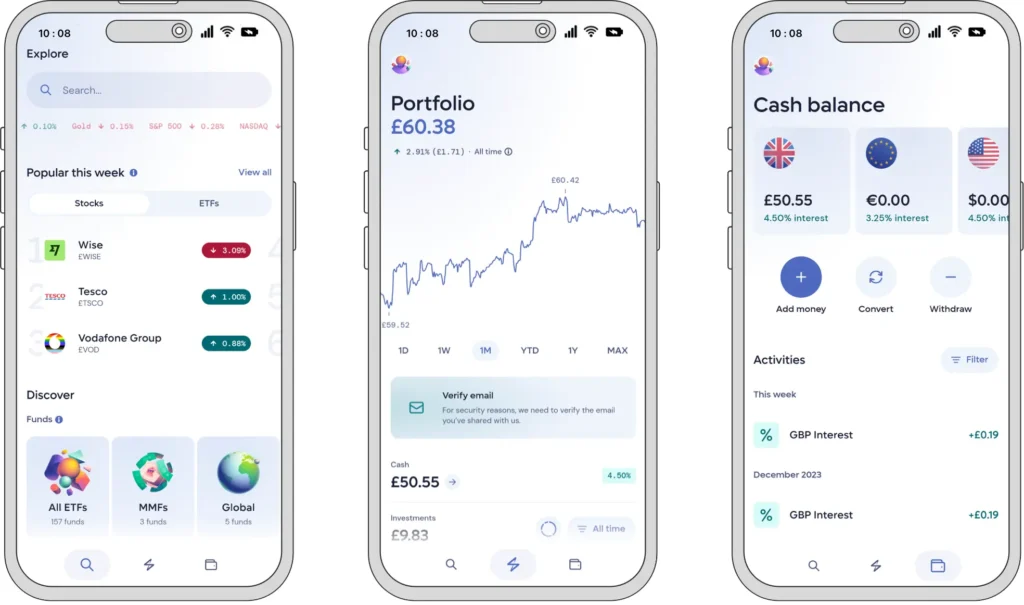

Mobile App

Lightyear’s mobile app has quickly become one of the most popular and well-reviewed investing apps in Europe. With ratings of 4.7 on the App Store and 4.6 on Google Play, it’s clear that users appreciate its blend of simplicity, speed, and reliability. Designed for both iOS and Android, the app offers a seamless way to monitor investments, execute trades, and manage your portfolio — all from the palm of your hand.

Simple, Intuitive Design

The app’s layout is clean, uncluttered, and highly intuitive. Every feature is within easy reach, making it ideal for beginners or investors who prefer a straightforward interface.

The home dashboard provides a clear overview of portfolio performance, recent transactions, and market movements. It’s perfect for daily monitoring and light trading, without overwhelming users with unnecessary tools or data.

Features and Functionality

Lightyear’s mobile app provides access to the platform’s full investment range — including stocks, ETFs, Baltic bonds, and Money Market Funds. Users can view real-time market data, check company fundamentals, and see analyst ratings for informed decision-making. The app also supports fractional investing, letting users buy small portions of high-value shares, and ISA management for UK investors seeking tax-free growth.

Limitations

While the app performs smoothly, it lacks advanced charting tools and live price alerts, which may disappoint active traders or those who rely on technical analysis. However, these omissions help keep the interface minimal and focused on long-term investing.

Security and Reliability

All accounts are protected with two-factor authentication (2FA), data encryption, and secure login protocols. The app’s reliability is strengthened by Lightyear’s FCA and EFSA regulation, ensuring that both user data and funds remain safe.

Verdict

The Lightyear mobile app offers an excellent balance of simplicity, functionality, and security. It’s tailor-made for everyday investors who value clarity, speed, and transparency over complexity.

While professionals may find it lacking in advanced analytical tools, its ease of use and high trust rating make it one of the best mobile investing apps in 2025.

Pros & Cons of the Mobile App

Pros:

- Clean, intuitive interface that’s easy for beginners to navigate

- Supports fractional investing, allowing access to expensive global stocks

- Real-time market data and analyst insights for informed decisions

- Integrated ISA management for UK investors seeking tax-free growth

Cons:

- No advanced charting tools for technical analysis

- Lacks live price alerts or push notifications

- Limited customization options for dashboards or layouts

Market Research, Tools, and Education

Lightyear provides real-time market data across all its supported instruments, ensuring investors always have up-to-date information before making a trade. Each stock or ETF page includes live price quotes, company fundamentals, and analyst ratings — helping users understand key performance metrics at a glance. While the data is accurate and easy to digest, it focuses more on clarity than depth, which aligns with Lightyear’s mission to make investing approachable for everyone.

Watchlists to track your favourite stocks and ETFs.

Portfolio summaries that give a quick snapshot of holdings, diversification, and performance.

Vaults, Lightyear’s unique interest-earning feature, allow users to earn returns on uninvested cash through BlackRock Money Market Funds — offering daily liquidity and competitive yields.

These features make Lightyear particularly appealing to passive investors and savers who want their idle cash to work harder without constant monitoring. The simplicity of the app ensures everything is easy to access, even for first-time investors.

While not as extensive as full-scale learning platforms, the material is well-written and ideal for beginners who are just starting to understand markets.

Room for Improvement

For more advanced investors, Lightyear could benefit from adding: Stock screeners to identify opportunities by sector, performance, or valuation metrics. Interactive charting tools for technical analysis. Deeper market research, such as analyst reports or earnings previews.

While professionals might find the analytics limited, beginners will appreciate its straightforward design, real-time data, and interest-earning Vaults — features that make investing both educational and rewarding.

Customer Support

Lightyear offers customer support through two primary channels: in-app chat and email. While there is no phone support, the digital-first model ensures that users can easily get help without leaving the platform. Support is available during standard business hours (Monday to Friday), and the team typically responds within a few hours — almost always within one business day.

The in-app chat is accessible directly from the Lightyear mobile app and web platform, providing a convenient way to reach support while managing your investments. Email support is best for more complex queries that may require documentation or verification.

Help Centre and Self-Service Resources

Lightyear’s Help Centre is one of the most useful parts of its support ecosystem. It features a wide range of articles and FAQs that cover key topics such as account setup, verification, deposits and withdrawals, fees, ISAs, and tax considerations. The guides are written in plain language, making them easy to understand even for beginners. The platform also regularly updates these resources to reflect new features and regulatory changes.

Response Quality and Professionalism

User feedback across review sites like Trustpilot and the App Store consistently praises Lightyear’s support team for being professional, knowledgeable, and friendly. The responses are clear and tailored rather than automated, which helps build trust with customers. While there’s no 24/7 service yet, the quality of the assistance provided during business hours makes up for the limited schedule.

Room for Improvement

Adding live chat coverage during evenings or weekends and a phone support option could improve accessibility, especially for users in different time zones or those managing larger accounts.

Verdict

Overall, Lightyear’s customer support is efficient, responsive, and beginner-friendly. The combination of fast in-app chat, detailed help articles, and professional staff ensures investors get the guidance they need when it matters most. While not around the clock, its reliability and service quality make it a strong fit for modern, digitally minded investors who value prompt and accurate assistance.

FAQ

Is Lightyear safe and regulated?

Yes. Lightyear is regulated by both the Financial Conduct Authority (FCA) in the UK and the Estonian Financial Supervision and Resolution Authority (EFSA). Client funds are held in segregated accounts, and UK users are protected by the Financial Services Compensation Scheme (FSCS), while EU clients have protection under the Estonian Investor Protection Scheme. Strong security measures, such as two-factor authentication (2FA), data encryption, and compliance with GDPR, are also in place.

What can I trade on Lightyear?

Lightyear allows trading in global stocks (US, UK, EU), ETFs, Baltic bonds, and offers interest via Money Market Funds (MMFs). You can also buy fractional shares of US and EU stocks and ETFs. However, Lightyear does not offer crypto, CFDs, or derivatives.

What are Lightyear’s trading and currency conversion fees?

- Trading fees:

• US stocks: 0.10% (with a cap, e.g. max ~$1)

• UK stocks: £1 per trade

• EU stocks: €1 per trade

• ETFs: Execution through Lightyear is free of commission

• Baltic bonds: €1 per trade - Currency conversion fee: 0.35% when buying foreign assets or converting between currencies.

Other relevant fees: Deposits via card above certain limits may incur a 0.5% fee; withdrawals are generally free.

Does Lightyear offer a demo account?

No. As of 2025, Lightyear does not provide a demo or virtual trading account. Users execute trades with real money.

What is the minimum deposit?

Lightyear has no minimum deposit requirement beyond this small amount, making it very beginner-friendly.

Is Lightyear good for beginners?

Yes. With its simple onboarding, intuitive design, low trading fees, multi-currency support, and transparent fee disclosures, Lightyear is well-suited for new investors. The available educational resources and help-centre articles further support beginners.

Can I invest long-term or set up an ISA?

Yes for UK residents. Lightyear offers Stocks & Shares ISA and Cash ISA accounts, both of which are tax-efficient for long-term investing. For international / EU investors, you can hold general investment accounts for long-term portfolios.

Does Lightyear support fractional shares?

Yes. You can buy fractional shares for US and EU stocks and ETFs. This allows you to invest with small sums into high-priced stocks.

How can I withdraw my funds?

You can withdraw via bank transfer to your verified source account (the bank account you deposited from). Withdrawals are processed in 1–2 business days and are generally free of charge.

Is Lightyear suitable for professional traders?

Lightyear is less ideal for professional, high-frequency traders or technical analysts. The platform lacks advanced charting, real-time alerts, complex derivatives/CFDs, and some research tools that pros often require. It excels for passive, long-term, and cost-conscious investors rather than trade-heavy or analytical-intensive users.