PEPPERSTONE REVIEW 2025

Pepperstone has built a strong reputation for low spreads and reliable platforms like MT4, MT5, and cTrader. In this review, we take a close look at its fees, account types, regulation, and tradable instruments. You’ll see where Pepperstone shines compared to other top forex and CFD brokers, and where it has room to improve. Whether you’re a beginner or an experienced trader, this review gives you the facts you need before opening an account.

Broker Guide's Pepperstone Review in 2025

In this review, I’ll walk you through my personal experience using Pepperstone. Covering everything from fees and platforms to customer support and the range of markets you can trade. I’ll compare it with some of its closest competitors, highlighting where it excels, and pointing out a few areas where it could improve. By the end, you should have a clear sense of whether Pepperstone is the right broker for your trading style and goals.

About Pepperstone

Founded in Melbourne in 2010, Pepperstone has grown from a small Australian start-up into one of the most trusted names in forex and CFD trading worldwide. What drew me to the platform was its transparency—I don’t feel like I’m trading against the broker. Unlike market-makers, Pepperstone runs on an agency/ECN model, which means orders go straight to liquidity providers. The result is consistently fast execution and spreads that can drop as low as 0.0 pips on EUR/USD with Razor accounts, something you notice immediately if you’ve traded with other brokers before.

Over the years, Pepperstone has expanded globally and is now regulated by ASIC, FCA, CySEC, DFSA, SCB, and CMA, covering traders in more than 150 countries. In 2025, they’ve continued to add new products, especially in shares and ETFs, while keeping platforms like MT4, MT5, and cTrader running smoothly. I like that Pepperstone feels professional enough for algorithmic traders but still accessible for beginners—you don’t need a huge deposit to start, yet the technology and pricing are institutional-grade.

My Quick Verdict: Who is Pepperstone Best For?

After spending time on Pepperstone, I can say it’s one of the strongest brokers I’ve used for low-cost, fast, and transparent forex and CFD trading. The biggest strength is execution. Orders go through quickly with little slippage, and spreads on majors like EUR/USD can drop as low as 0.0 pips on the Razor account.

Fees are competitive across the board, and I like that Pepperstone doesn’t act as a market maker, so there’s no sense of trading against the broker. The range of platforms—MT4, MT5, and cTrader—also makes it easy to trade in the way that suits you, whether you’re into automated systems, scalping, or just placing manual trades.

That said, Pepperstone isn’t perfect. Its research and educational content are solid, but not as extensive as some competitors like IG or Saxo. It also doesn’t offer products like futures, bonds, or direct stock investing, so if you’re looking for a full-service investment hub, it may feel limited.

I’d recommend Pepperstone to active forex and CFD traders who want tight spreads and regulation they can trust. Beginners will also find it approachable thanks to low entry costs. But if you’re after deep research tools or broader multi-asset investing, you might be better served elsewhere.

Pros

- Fast and easy account opening – Getting started with Pepperstone was straightforward. My account was verified quickly, and deposits showed up without hassle. Compared to some brokers where KYC drags on for days, Pepperstone made it smooth.

- Competitive forex fees – Spreads on majors are impressively low, especially on the Razor account where EUR/USD can start from 0.0 pips plus commission. In my own trading, I noticed costs stack up far less compared to brokers like OANDA or FXCM.

- Choice of platforms – MT4, MT5, and cTrader are all available. I personally like cTrader’s depth-of-market view, but having MetaTrader for EAs is a big plus. Not every broker gives you this range.

- Regulated in top jurisdictions – Pepperstone is licensed under ASIC, FCA, CySEC, DFSA, SCB, and CMA. That global coverage gives me more peace of mind than some offshore-only brokers.

- Good deposit and withdrawal options – I’ve been able to fund and withdraw using cards, bank transfers, and even PayPal, with no hidden fees from Pepperstone’s side.

- Solid product range for CFDs – Forex is the main draw, but indices, commodities, shares, ETFs, and crypto are all available, which gives decent flexibility for diversifying trades.

Cons

- CFDs only in many markets – You can’t directly invest in stocks or bonds; everything outside of forex is a CFD. If you want real share ownership, Pepperstone isn’t it.

- Higher swap/financing costs – Holding trades overnight can be more expensive than with some competitors like IG. Active day traders won’t feel this as much, but swing traders might.

- Limited in some jurisdictions – Depending on where you’re based, not all instruments are available. For example, crypto CFDs are restricted in the UK.

- Mobile and UX limitations – While the mobile apps (MT4, MT5, cTrader) work fine, Pepperstone doesn’t have a fully polished proprietary app like SaxoTraderGO or IG’s platform. The experience feels more “off-the-shelf.”

Why You Should Choose Pepperstone ?

Pepperstone hasn’t stood still. In 2025, they’ve expanded their range of share CFDs and ETFs, upgraded their servers for faster execution speeds, and introduced tighter spreads on major forex pairs. These upgrades make the platform feel more cost-efficient and responsive, especially during volatile trading hours.

Pricing That Stands Out

One of Pepperstone’s biggest advantages is still its low-cost trading environment. The Razor account delivers spreads from 0.0 pips plus commission, and in my own trading, the total costs often beat competitors like OANDA or FXCM. If you trade frequently, the difference adds up quickly. For me, the cost savings are noticeable when running scalping or high-frequency strategies.

Flexible Trading Styles

Pepperstone caters to a wide range of traders. Algorithmic traders benefit from ultra-low latency execution and VPS hosting support. Social and copy traders can connect with Myfxbook, DupliTrade, or MetaTrader Signals. And for manual traders, the choice between MT4, MT5, and cTrader is a real advantage. I like being able to switch platforms depending on the strategy I want to test.

Strong Regulatory Trust

Trust is a big reason I keep using Pepperstone. It’s licensed under ASIC, FCA, CySEC, DFSA, SCB, and CMA, giving it one of the broadest regulatory footprints in the industry. In a market where some brokers operate offshore with minimal oversight, Pepperstone’s compliance standards make me feel safer keeping funds on the platform.

The Bottom Line

In 2025, Pepperstone is best suited for active forex and CFD traders who want low fees, reliable execution, and multiple trading styles under one roof. The broker has doubled down on what traders actually care about—pricing, speed, copy/algo support, and product variety—while maintaining strong regulation. It’s not ideal if you want direct stock ownership or bonds, but for traders focused on forex and CFDs, Pepperstone remains one of the best choices this year.

Compare to Top Competitors

No broker exists in a vacuum, and Pepperstone is no exception. To really understand its value, I think it’s important to see how it stacks up against other major players in the industry. In this section, I’ll compare Pepperstone with top competitors like Forex.com, FP Markets and IC Markets focusing on key areas traders care about—fees, platforms, product range, and overall trust.

This way, you’ll get a clearer picture of where Pepperstone shines and where another broker might be a better fit for your trading style.

Forex.com

FP Markets

IC Markets

Exploring Pepperstone’s Range of Tradable Instruments

One of the first things I check with any broker is the range of markets I can actually trade. Pepperstone has always been strongest in forex, but over the years they’ve built out a solid lineup of CFDs across multiple asset classes. It’s not the widest offering compared to someone like IG, but it’s more than enough for most active traders.

Forex Pairs

Forex is Pepperstone’s bread and butter. When I traded through their Razor account, I had access to over 60 currency pairs, covering majors, minors, and exotics. The majors (like EUR/USD, GBP/USD, and USD/JPY) consistently had the lowest spreads—sometimes even hitting 0.0 pips during liquid hours. Minors such as AUD/JPY and EUR/GBP were also competitive, though spreads can widen slightly outside peak sessions. Exotics (like USD/TRY or EUR/ZAR) are available too, though with higher spreads and more volatility. For me, Pepperstone feels ideal if forex is your main focus, especially given the ECN-style execution.

Commodities

Beyond currencies, Pepperstone offers a solid range of commodity CFDs. I’ve traded gold and silver spot prices here, which come with tight spreads compared to other brokers. Energy products like crude oil and natural gas are also included, along with soft commodities such as coffee, cocoa, and cotton. It’s not an endless list, but the core markets are there for anyone who wants to hedge or diversify.

Indices

Pepperstone also gives access to popular global indices such as the S&P 500, NASDAQ 100, FTSE 100, DAX 40, Nikkei 225, and ASX 200. I like that you can trade both cash indices and futures CFDs, which gives flexibility depending on whether you’re scalping short moves or holding positions longer term. Execution has been smooth on these products in my experience, with spreads that stack up well against brokers like FP Markets and IC Markets.

Shares and ETFs

In recent years, Pepperstone has expanded into share and ETF CFDs, which I think was a smart move. Depending on your jurisdiction, you can access thousands of shares from the US, UK, Germany, and Australia. This is handy if you want exposure to big tech stocks like Apple or Tesla without leaving the platform. ETFs are also available, letting you trade baskets of assets rather than individual names. One important note: these are all CFDs—you don’t own the underlying asset, so no dividends or voting rights, just price speculation.

Cryptocurrencies

For crypto enthusiasts, Pepperstone supports a selection of crypto CFDs, including Bitcoin, Ethereum, Litecoin, and a few altcoins. The leverage is capped much lower than forex (usually around 2:1 in line with regulation), but that’s expected. Personally, I find crypto spreads a little wider than dedicated crypto exchanges, but having it integrated into the same trading platform as my forex and indices is a big convenience.

| Asset | Pepperstone |

|---|---|

| Forex Pairs | 65 |

| Tradeable Symbols | 1726 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Cryptocurrency (Physical & Derivative) | Physical: No |

| Social Trading / Copy Trading | No |

Availability by Jurisdiction

It’s worth noting that product availability changes depending on where you’re trading from. For example, crypto CFDs are not available to UK clients due to FCA rules, and some share markets may only be accessible under certain Pepperstone entities. When I signed up, I had to check which regulatory branch my account fell under to know exactly which instruments I could access.

Leverage Levels

Leverage also varies by product and regulatory jurisdiction. Under ASIC and FCA regulation, retail traders can access up to 30:1 leverage on forex, 20:1 on indices, 10:1 on commodities, and 2:1 on crypto. If you’re trading under the SCB (Bahamas) or CMA (Kenya) entities, higher leverage up to 500:1 is available for forex, which some professional traders prefer. Personally, I stick to moderate leverage, but it’s good to know the flexibility is there if you qualify.

Final Thoughts

Pepperstone isn’t trying to be the broker with the most products—it’s not offering bonds or futures directly—but the lineup covers the most important markets for active CFD traders. Between forex, indices, commodities, shares, ETFs, and crypto, I’ve never felt limited in terms of trading opportunities. The only caveat is that everything outside forex is offered as CFDs, so if you want physical stock ownership or long-term investing, you’ll need another platform.

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD (Standard) | 1.0 pips |

All-in Cost EUR/USD - Active | 0.70 pips |

Index CFD fees | Low |

Stock CFD fees | Low |

| Deposit Fees | $0 |

| Withdrawal Fees | $0 |

| Inactivity Fee | $15 per month after 12 months of no activity |

When choosing a broker, fees are usually one of the first things I look at. Over time, even a fraction of a pip can add up, especially if you’re trading frequently. With Pepperstone, I’ve found the fee structure to be clear and generally among the lowest I’ve come across in the industry. Let me break down how it works and what I’ve personally experienced.

How Pepperstone Makes Money

Pepperstone makes money in two main ways: spreads and commissions. On the Standard account, spreads are slightly wider, but there are no extra commissions. On the Razor account, spreads can go as low as 0.0 pips on major forex pairs, but you pay a fixed commission per lot traded. I personally prefer the Razor account because I like to see the raw market pricing, even if I’m paying a commission on top—it usually works out cheaper in the long run if you’re an active trader.

Razor vs Standard Accounts

- Razor Account – This is the account I use most. Spreads start from 0.0 pips, and commissions are charged per trade. For forex, the commission is typically $3.50 per side per standard lot on MT4 and MT5, or slightly different on cTrader. It’s built for scalpers, day traders, and algorithmic traders who need the tightest spreads.

- Standard Account – This one has no separate commission. Instead, Pepperstone adds a small markup to the spreads. For example, EUR/USD might start from 1.0 pips instead of 0.0. It’s simpler and easier for beginners who don’t want to calculate commission costs, but if you trade in high volume, it’s usually more expensive overall.

All-In Cost Examples

To give you a concrete example: when I trade EUR/USD on a Razor account, I’ve seen spreads at 0.0 pips during liquid hours. Add the $7 round-trip commission per lot (on MT4/MT5), and the all-in cost is about 0.7 pips. On the Standard account, spreads start around 1.0 pip with no commission, so the cost is roughly the same or slightly higher. For pairs like GBP/USD or AUD/USD, spreads are still tight—often 0.2–0.4 pips on Razor plus commission. Compared to other brokers I’ve tested, Pepperstone consistently ranks near the cheapest.

Commission Differences by Platform

One thing I discovered is that commissions vary depending on the trading platform:

- MT4/MT5 – $3.50 per side per standard lot (so $7 round trip).

- cTrader – Commission is calculated differently, at $3.00 per side per 100,000 units traded, which comes out slightly cheaper for some traders.

If you’re trading large volumes, that small difference between MT4/MT5 and cTrader can add up. Personally, I stick with MT4 for my automated strategies, but I sometimes use cTrader when I want that depth-of-market view and slightly lower commission.

Typical Spreads on Major Pairs

On the Razor account, EUR/USD often comes in at 0.0–0.1 pips during liquid hours, with a $7 round-trip commission per standard lot. That puts the all-in trading cost at around 0.6–0.7 pips, which is extremely competitive.

GBP/USD usually ranges between 0.2–0.4 pips plus commission, while AUD/USD sits around the same. On the Standard account, spreads are higher, with EUR/USD typically at 1.0 pip, GBP/USD around 1.2 pips, and AUD/USD near 1.0 pip—but with no commission added.

How It Compares to Benchmarks

Compared to the wider industry, Pepperstone’s forex pricing consistently ranks near the lowest. Brokers like IC Markets or FP Markets are often very close in cost, with spreads and commissions nearly identical. Larger, more mainstream brokers such as Forex.com, OANDA, or IG tend to be slightly more expensive, particularly on EUR/USD where spreads can sit closer to 1.2–1.5 pips all-in.

Active Trader Program

For high-volume traders, Pepperstone also offers an Active Trader program, which I’ve looked into. The rebate structure basically lowers your trading costs as you increase your monthly trading volume. For example, rebates can start at around $1 per lot and scale higher the more you trade. If you’re moving serious volume (think hundreds of lots per month), this can save you quite a bit. I don’t trade at that scale consistently, but for prop traders or professionals, it’s a strong incentive.

Other Costs

Beyond spreads and commissions, the main extra cost I’ve noticed is overnight financing (swap rates). If you hold trades overnight, especially in forex, these fees can be higher than some competitors like IC Markets. They’re variable depending on the instrument and market conditions, so it’s worth checking in the platform before you commit to holding a position long term. Pepperstone doesn’t charge deposit or withdrawal fees on their side (unless your bank does), which is a nice plus.

Non-Trading Fees

Non-trading fees are often where brokers sneak in extra costs, so I made sure to check these closely with Pepperstone.

Inactivity and Account Maintenance Fees

Unlike some competitors, Pepperstone does not charge inactivity or dormancy fees. Whether you trade daily or leave your account untouched for months, you won’t be penalized. This is a huge plus, especially for casual traders who may take breaks.

Platform Fees

There are no charges for using MT4, MT5, or cTrader. The only costs you’ll encounter are trading-related (spreads, commissions, swaps). Some premium plugins or VPS services may carry a cost, but those are optional and not Pepperstone’s base fees.

Currency Conversion Charges

If you deposit, withdraw, or trade in a currency different from your account base currency, Pepperstone applies a conversion fee. This is fairly standard across the industry and usually falls around 0.5%–1.0% depending on the currency pair.

Deposit and Withdrawal Fees

Pepperstone doesn’t charge fees on deposits or withdrawals on their side, but your bank or payment provider might. The only exception I’ve noticed is international bank transfers, where third-party intermediary banks may apply a charge. In my case, using cards or e-wallets was always free.

Overall, Pepperstone keeps non-trading fees refreshingly low. With no inactivity fee, no account maintenance costs, and no platform fees, it’s one of the most budget-friendly brokers for traders who don’t want to worry about hidden charges outside of trading itself.

My Takeaway on Fees

Overall, Pepperstone delivers one of the most cost-effective trading environments I’ve used. The Razor account especially is hard to beat if you’re serious about keeping costs down. Even when I compared all-in costs on major pairs, Pepperstone came out cheaper or at least on par with IC Markets and FP Markets, and generally ahead of bigger names like Forex.com or OANDA.

The only caveat is for traders who hold positions for long stretches—overnight swaps can eat into profits if you’re not careful. But for active traders, scalpers, or algo users, the low spreads plus commission model is exactly what you want.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Pepperstone Regulated ?

Pepperstone is regulated by several financial authorities worldwide. The Australian Securities and Investments Commission (ASIC) and the UK Financial Conduct Authority (FCA) are considered Tier-1 regulators, offering the highest level of investor protection. The Cyprus Securities and Exchange Commission (CySEC) and the Dubai Financial Services Authority (DFSA) are usually ranked as Tier-2 regulators, providing solid but slightly less stringent oversight. Finally, the Securities Commission of The Bahamas (SCB) is classified as a Tier-3 regulator, offering more flexible trading conditions but with lighter protections.

Safety Features for Clients

In practice, here’s what Pepperstone does to protect traders like me:

- Negative balance protection, so I can’t lose more than my deposit.

- Segregation of client funds, meaning my money is kept separate from the company’s own funds.

- Investor compensation schemes (for UK/EU accounts), which add extra coverage in case of insolvency.

Track Record and Transparency

Pepperstone has been around since 2010 and has built a strong reputation without major scandals. They’re not a publicly listed company, so we don’t see quarterly reports like with IG, but they’ve avoided serious issues. The only notable hiccup was a small data leak in 2020, which was resolved quickly without client losses.

Risks to Consider

If you open an account under SCB (Bahamas), protections are weaker—there’s no compensation scheme if the broker went bust. The tradeoff is usually higher leverage and access to more CFD products. For my own trading, I prefer sticking with FCA or ASIC accounts where oversight is the strongest.

Bottom Line

Yes, Pepperstone is highly regulated, and under ASIC or FCA it offers some of the strongest safeguards in the industry. Clients under offshore entities still benefit from the broker’s reputation and controls, but the protections aren’t as robust.

Understanding Regulatory Protections and Broker Stability

Regulation matters because it determines how safe your money really is with a broker. With Pepperstone, the level of protection depends on which entity you register under. Accounts with the FCA (UK) or ASIC (Australia) get the highest safeguards: funds are kept in segregated bank accounts, negative balance protection applies, and UK/EU clients are covered by compensation schemes in case of insolvency.

In terms of stability, Pepperstone has been around since 2010 and has built a solid reputation through market turbulence and regulatory shifts. The broker isn’t publicly listed, so it doesn’t publish detailed financial statements, but it has avoided the kind of major scandals or liquidity issues that have hurt some competitors. A minor data leak in 2020 was quickly resolved, and client accounts were unaffected—another sign of operational resilience.

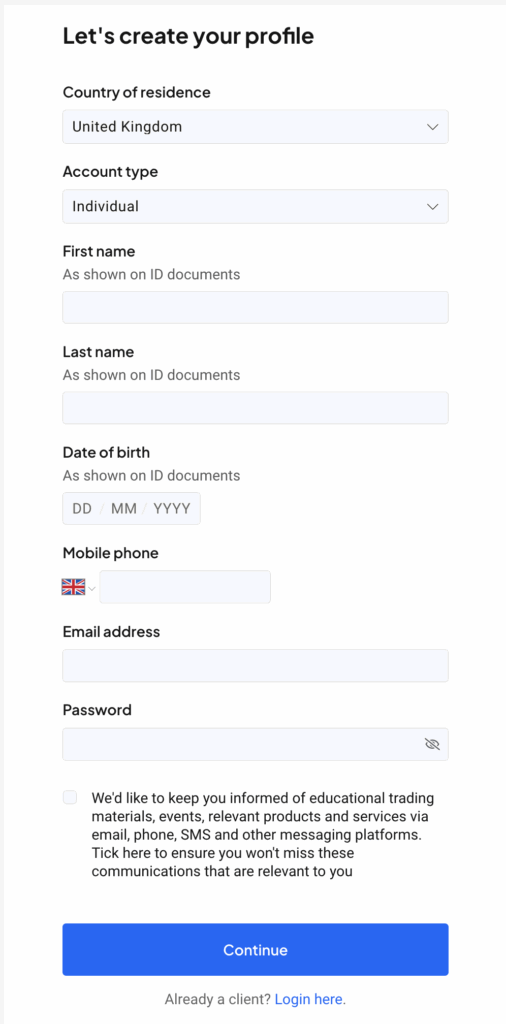

How To Open an Account

Opening an account with Pepperstone is a fairly quick process—I was able to get set up and verified in less than a day. Here’s how it works:

Step 1: Online Registration

Start by heading to the Pepperstone website and clicking “Join Now.” You’ll be asked to provide basic details:

- Country of residence

- Full name, email, date of birth, mobile phone

- Choose a password

- Preferred account type (Standard or Razor)

- Base currency for your account

Step 2: KYC Verification

Like with most regulated brokers, you’ll need to complete KYC (Know Your Customer) checks. Pepperstone asks for two main documents:

Proof of identity (passport, driver’s license, or government-issued ID)

Proof of address (utility bill, bank statement, or government letter no older than 3 months)

I uploaded mine directly through the portal, and the process was straightforward.

Step 3: Account Approval

In my experience, verification was fast—under 24 hours. Some users report approval within just a few hours, though it can take longer if documents need re-checking. Once verified, you can fund your account using bank transfer, card, or e-wallet, and start trading immediately.

Regional Restrictions

Pepperstone accepts clients globally but does not serve U.S. residents due to local regulations. Certain products, like crypto CFDs, may also be unavailable depending on your jurisdiction (for example, they’re banned in the UK under FCA rules).

Demo Accounts

If you’re not ready to go live, Pepperstone offers unlimited demo accounts on MT4, MT5, and cTrader. I found these useful for testing strategies with real-time pricing and execution speed before committing real funds.

Account Types

Pepperstone keeps things simple with just a couple of core account types, plus a few specialized options depending on your trading style or business setup.

Standard Account

The Standard account is commission-free, with costs built into the spread. EUR/USD typically starts around 1.0 pip, making it straightforward for beginners who don’t want to think about commission math. Minimum trade size is 0.01 lots, and there’s no minimum deposit required. I recommend this account if you’re new to trading or prefer a “what you see is what you get” fee model.

Razor Account

The Razor account is Pepperstone’s flagship offering for active traders. Spreads can go as low as 0.0 pips on EUR/USD, but you’ll pay a commission (usually $7 per round lot on MT4/MT5, slightly lower on cTrader). This setup is ideal for scalpers, algo traders, or anyone who wants the tightest pricing possible. Minimum trade size is again 0.01 lots, with no fixed deposit requirement.

Other Account Options

Active Trader Program: High-volume traders can access rebates and lower trading costs through Pepperstone’s tiered rebate program.

Corporate Accounts: Businesses can set up trading accounts under company names.

Managed Accounts: Available in some regions for professional money managers who want to trade on behalf of clients.

| Feature | Standard Account | Razor Account |

|---|---|---|

| Pricing Model | Spread only. No commission | Raw spreads + commission |

| Typical EUR/USD Spread~1.0 pi | ~1.0 pip | 0.0–0.1 pips + $7 per round lot (MT4/MT5) |

| Commission | None | $7 per lot round-turn (slightly lower on cTrader) |

| Minimum Trade Size | 0.01 lots | 0.01 lots |

Minimum Deposit | $0 | $0 |

| Extras | Straightforward cost structure | Access to Pepperstone’s Active Trader rebate program |

Best for | Beginners and casual traders who want simplicity | Active traders, scalpers, algorithmic traders |

Regional Availability

Not every account type is available everywhere. For example, the Razor account is widely offered under ASIC, FCA, and SCB, while European clients under CySEC may face product restrictions (such as no crypto CFDs).

Bottom Line

For most traders, the choice is between Standard (simple, all-in spreads) and Razor (ultra-low spreads + commission). Both are flexible, but the Razor account stands out in 2025 for its competitive pricing and suitability for serious, active traders.

What is the Minimum Deposit at Pepperstone?

One of the things I like about Pepperstone is that there’s no minimum deposit requirement for either the Standard or Razor account. Technically, you can open and fund an account with as little as you like, though in practice most traders start with at least $200–$500 to cover margin and leave room for risk management.

There aren’t major differences across regions—whether you’re signing up under ASIC (Australia), FCA (UK), CySEC (Europe), or SCB (Bahamas), the minimum remains flexible. The only small variations I’ve seen are linked to funding methods: for example, some payment providers may impose their own transfer minimums, usually around $20–$50.

The $0 minimum deposit policy is a big plus for beginners. It means you can start small, test strategies, or even just practice risk management in a live environment without being locked into a large upfront commitment.

| Broker | Minimum Deposit |

|---|---|

Pepperstone | $200 |

| Forex.com | $100 |

| FP Markets | $100 |

IC Markets | $200 |

Deposit and Withdrawal

Funding and withdrawing from Pepperstone is straightforward, though the exact methods you’ll see depend on your region and regulatory entity.

Deposit Methods

When I tested Pepperstone, I had multiple ways to fund my account. Most deposits are fee-free on Pepperstone’s side and are processed instantly if you use cards or e-wallets. Bank transfers can take anywhere from 1–3 business days depending on your bank.

Withdrawal Fees & Options

Withdrawals generally use the same method you deposited with, which keeps things simple but can feel restrictive if you want to switch payout channels. In my case, card and PayPal withdrawals hit my account within 1 business day, while bank transfers took closer to 2–3 business days. Pepperstone doesn’t charge withdrawal fees, but your bank or payment provider might add their own.

Base Currencies and Conversion

Pepperstone supports multiple account base currencies—USD, EUR, GBP, AUD, and several others. Picking the right one matters: if you trade or withdraw in a different currency than your account base, you’ll face a conversion fee (usually around 0.5%–1.0%). To avoid this, I recommend setting your account base to the same currency you’ll use most often for deposits and trading.

Common Pitfalls

A few things I’ve noticed (or seen other traders mention):

- Regional limits: Not all e-wallets are available everywhere. For example, Skrill isn’t always an option in EU-regulated accounts.

- Third-party fees: While Pepperstone doesn’t charge funding fees, banks often do, especially for international transfers.

- Withdrawal matching rule: Since withdrawals typically must be made through the same method you deposited with, it’s smart to plan your funding method from the start.

Bottom Line

Overall, Pepperstone makes deposits and withdrawals fast, flexible, and with no fees on their side. As long as you choose the right account currency and funding method, you shouldn’t run into surprises.

Desktop Trading Platform

After spending time with Pepperstone’s platforms ( MT4, MT5, and cTrader ), I noticed they’re all fast, intuitive, and built for different kinds of traders. While MT4 still feels like the old workhorse, MT5 and cTrader bring more modern features that I found especially useful when testing advanced strategies.

Features and Functionality

Advanced Charting

The first thing I did was play around with the charts. MT5 and cTrader gave me a lot more options than MT4, with extra timeframes, more drawing tools, and the ability to save multiple layouts. I liked how cTrader’s interface felt more modern, while MT5’s charts were smoother when switching between assets.

Market Analysis Tools

Running analysis felt straightforward. MT4 handled basic indicators well, but MT5 and cTrader really stood out with better depth of market and integrated strategy tools. When I tested cTrader Automate, I found it easy to set up custom strategies and backtest them directly.

Real-time Information

I noticed pricing updates instantly — there was no lag when switching between pairs or instruments. Watching tick-by-tick moves on EUR/USD during high volatility confirmed that Pepperstone’s low-latency execution really shows up in the desktop platforms.

Research Integration

I tried out the Autochartist plug-in, and it saved me time by flagging trade setups I might have missed. I also liked being able to pull TradingView charts directly into cTrader — it felt smoother than jumping between windows.

Educational Content Integration

There’s not much built-in on MT4 or MT5 themselves, but when I paired the platform with Pepperstone’s webinars and guides, it was clear they’ve made learning accessible. It’s not baked into the software, but it’s there if you want it.

Placing Orders

Order execution was quick and flexible. I placed limit, stop, and trailing stop orders without any issues, and I liked how cTrader let me partially close trades with one click. On MT5, managing multiple open positions was easier thanks to its expanded order system compared to MT4.

Alerts & Notifications

I set up a few price alerts on MT5, and they pushed straight to my phone through the mobile app — very handy when stepping away. cTrader’s pop-up alerts were also easy to customize.

Login and Security

I tested the login process with two-factor authentication, and it worked smoothly. The platforms use encrypted connections, so I felt confident my account was secure when logging in across different devices.

Search Functions

Searching for instruments was painless. On MT4, I had to dig a little through the symbol list, but MT5’s search bar made it faster, and cTrader’s watchlists were the cleanest to manage.

Pros & Cons of the Web Platform

Pros

- Lightning-fast execution: In my tests, orders executed almost instantly, even during high-volatility news events. Pepperstone’s low-latency infrastructure gives scalpers and day traders a real edge.

- User-friendly interface: cTrader feels modern and intuitive, while MT5 strikes a balance between simplicity and functionality. Even if you’re new, navigating charts and order windows is straightforward.

- Highly reliable platforms: I didn’t experience any platform crashes or disconnects. Feedback from other traders suggests the same — Pepperstone’s systems hold up well even across different regions.

- Rich resources and tools: Autochartist integration, TradingView connections, and expert advisor (EA) support on MT4/MT5 give you multiple ways to analyze and automate trades.

Cons

- MT4 feels dated: While still widely used, MT4’s interface and search functions show their age compared to MT5 and cTrader.

- Platform consistency depends on jurisdiction: Some features — like TradingView integration or certain research tools — aren’t available in every region.

- Learning curve for cTrader: Although powerful, cTrader can feel overwhelming at first, especially for traders used to MetaTrader’s simpler layout.

- Limited built-in education: The platforms themselves don’t have deep tutorials or guides — you’ll need to rely on Pepperstone’s external learning hub.

Mobile App

Pepperstone’s mobile apps — available through MT4, MT5, and cTrader — make it easy to stay connected to the markets while on the go. I tested them across iOS and Android, and while each has its quirks, overall the apps felt stable and reliable.

Look & Feel and Features

The MT4 and MT5 apps are functional but fairly basic, focusing on core trading features rather than polish. Charts are responsive, but limited screen space means analysis isn’t as smooth as on desktop. cTrader’s app, on the other hand, feels more modern, with clean design, customizable layouts, and integrated depth of market — useful if you like scalping from your phone.

Login and Security

Logging in was straightforward, and I was able to enable two-step verification for added security. Connections are SSL-encrypted, so you can trade confidently even on public Wi-Fi. Session timeouts also help protect against unauthorized access if you forget to log out.

Search Functions

Finding instruments was easiest in cTrader, which has an intuitive search bar and neatly organized categories. MT4 and MT5 use a symbol list that works fine but takes a few more taps. Once saved, watchlists sync smoothly, so you can quickly jump back into your preferred markets.

Placing Orders

Placing trades on mobile is fast and responsive. I could easily set market, limit, stop, and trailing stop orders within seconds. cTrader’s one-tap trading felt the most fluid, while MT5 offered the clearest order management when juggling multiple positions. Execution speeds were solid across all apps, with no noticeable lag.

Pros & Cons of the Mobile App

Pros

- Fast execution speeds: Orders went through quickly with no noticeable delays, even on mobile data.

- Clean design on cTrader: The cTrader app feels polished and user-friendly, making it easy to monitor and trade multiple markets.

- Secure logins: Two-step verification and encrypted connections keep your account safe on the go.

- Watchlist sync: Instruments and watchlists update across devices, so you can start on desktop and continue on mobile without friction.

- Full order functionality: Market, limit, stop, and trailing stop orders are all supported.

Cons

- MT4 feels dated: The app still works, but it hasn’t kept up with modern design standards and can feel clunky.

- Limited charting space: Mobile charts aren’t ideal for deep technical analysis — they’re fine for quick checks but lack the detail of desktop.

- Feature gaps by platform: Not every tool (like TradingView integration or Autochartist) is available in mobile form.

- Learning curve on cTrader: While powerful, the extra features can feel overwhelming at first compared to the simplicity of MetaTrader apps.

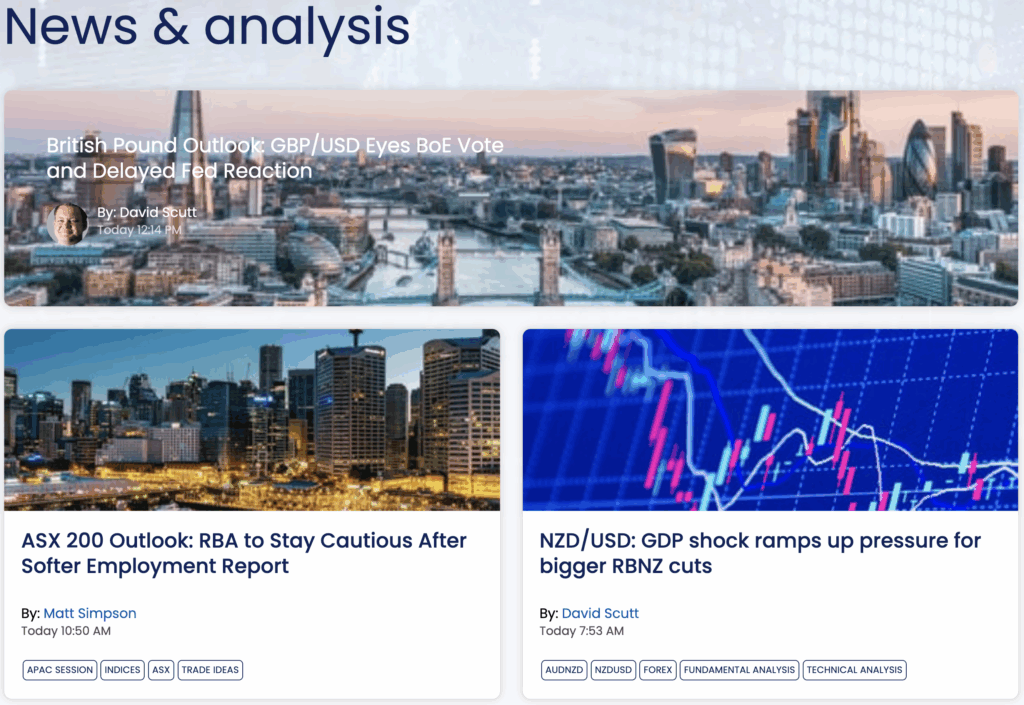

Market Research, Tools, and Education

Forex.com’s strongest edge is research depth, integrated tools, and structured education that connects directly to trading decisions. The in-house global team delivers timely analysis, actionable trade ideas, and event-driven updates that slot neatly into daily prep, while Trading Central adds independent signals and pattern recognition to validate setups from multiple angles.

Together with advanced charts, a rich economic calendar, exclusive performance analytics, and a robust Trading Academy, the stack shortens the path from insight to execution and helps traders improve over time.

Verdict

While OANDA doesn’t have the deepest institutional-grade research compared to brokers like IG or Saxo, it provides enough tools and insights to support most retail traders. Beginners will find the education resources practical, while advanced traders can leverage Algo Labs and API access for a more technical edge.

Customer Support

Availability

Support operates 24 hours a day, 7 days a week, including weekends and market holidays, so help is always reachable regardless of time zone or trading session.

Quality

Service quality is consistently strong, with helpful agents who respond quickly and resolve most platform, funding, and account queries efficiently; complex issues are escalated cleanly with clear follow‑ups.

Channels

- Phone for urgent, trade‑impacting issues that require immediate action

- Live chat for quick troubleshooting, navigation help, and status updates

- Email for detailed requests, document submissions, and a written audit trail

What to expect

Wait times are generally short, identity verification is straightforward, and guidance covers platform features, order tickets, and common funding steps; if an investigation is needed, next actions and timelines are communicated clearly.

Verdict

Customer support is a clear strength: always‑on availability, responsive agents, and multiple channels provide dependable coverage for both routine questions and urgent trade matters.

FAQ

Is Forex.com a trustworthy broker?

Yes. It’s regulated in major jurisdictions, offers segregated client funds, and has a long operating history with strong oversight and transparent policies.

What is the minimum deposit for Forex.com?

$100 to open a Standard or RAW account, though higher deposits help with margin and position sizing.

Does Forex.com charge withdrawal fees?

No. The broker does not charge deposit or withdrawal fees, though banks or payment processors may.

What trading platforms does Forex.com offer?

Advanced Trading Platform (Desktop, Web, Mobile) and MetaTrader, covering discretionary, indicator‑heavy, and EA workflows.

Is Forex.com good for beginners?

Yes. The Standard account is simple, education is strong, and the platforms are intuitive with embedded tips and research.

How does Forex.com make money?

Primarily from spreads and commissions, plus ancillary services like financing and exchange/conversion where applicable.

Can I trade stocks on Forex.com?

Core offering is forex and CFDs; stock access depends on region and product availability via CFDs rather than direct share dealing in many cases.

Does Forex.com have an inactivity fee?

Policies can vary by region; check the entity’s fee schedule in the account documents to confirm current terms.

Is my money safe with Forex.com?

Client funds are held in segregated accounts, with protections depending on the regulator and entity; this reduces counterparty risk.