Robinhood REVIEW 2025

Is Robinhood still worth using in 2025? In this comprehensive review, we break down everything you need to know—from fees, safety, and regulation to its new Robinhood Legend desktop platform, 24-hour trading, and 3% IRA match.

Whether you’re a beginner or an active investor, find out if Robinhood remains one of the best trading apps of 2025 for low-cost, flexible investing.

Broker Guide's Robinhood Review in 2025

As part of our 2025 Broker Testing Series, I opened and funded a live Robinhood account to see if it still lives up to its promise of “democratizing finance for all.” Once the pioneer of zero-commission trading, Robinhood remains one of the most popular investing platforms in the U.S., especially among beginners and mobile-first investors.

In this Robinhood review 2025, I’ll share my hands-on experience with its evolving ecosystem — from the new Robinhood Legend desktop platform to its 24-hour market access and IRAs that now offer up to a 3% match.

We’ll take an in-depth look at Robinhood fees, features, safety, and overall usability to help you decide whether it’s still worth your trust in 2025.

This Robinhood app review covers all the key pros and cons investors should know before opening an account.

About Robinhood

Founded in 2013 and headquartered in Menlo Park, California, Robinhood has grown from a startup challenging Wall Street norms into one of the most recognizable investing platforms in the United States.

It is regulated by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), while its parent company, Robinhood Markets Inc., is publicly listed on the NASDAQ exchange. Today, the platform serves more than 20 million users, most of whom are retail investors attracted by its commission-free trading and intuitive mobile experience.

Robinhood’s mission has always been to make investing accessible to everyone, not just seasoned traders or high-net-worth individuals. The platform continues to expand its ecosystem with innovative features designed to simplify finance and empower self-directed investors.

In 2025, Robinhood introduced several major updates, including the Robinhood Legend desktop platform for active traders, a 3% IRA match for Gold members, and a Robinhood Credit Card that offers up to 3% cash back on everyday spending.

It also expanded its product lineup with futures trading, crypto transfers, and 24-hour market access, allowing investors to trade U.S. stocks around the clock from Sunday evening through Friday evening.

Whether accessed through mobile or desktop, the Robinhood investing platform blends ease of use with an ever-growing list of financial tools. These advancements reflect the company’s ongoing effort to evolve from a beginner-friendly stock app into a comprehensive, tech-driven brokerage that supports both new and experienced investors.

My Quick Verdict: Who is Robinhood Best For?

Rating: 4.4/5 |

Best for: Beginners and retirement savers

After testing Robinhood with a live account, I found it to be an excellent choice for beginners and mobile-first traders who value simplicity, speed, and low costs. The platform’s commission-free trading on stocks, ETFs, options, and cryptocurrencies, along with its $0 account minimum, makes it one of the most accessible brokers in the market.

Its cash management features, including high interest on uninvested funds and the 3% IRA match for Gold members, add real value for long-term investors.

However, Robinhood still has clear limitations. It lacks mutual funds and individual bonds, which restricts diversification options, and its research tools remain basic compared to full-service brokers.

Advanced traders may find the platform too limited for in-depth analysis or sophisticated trading strategies.

Overall, Robinhood earns a 4.6 out of 5 rating for its strong usability, cost efficiency, and investor-friendly design. It is best suited for new investors, mobile users, and retirement savers who want to start building their portfolios quickly and affordably while enjoying a modern investing experience.

Pros:

- $0 commission on stocks, ETFs, options, and crypto.

- Seamless mobile and web platforms.

- Instant deposits and fractional shares.

- 1–3% IRA match and interest on uninvested cash.

- 24-hour stock trading (Mon–Fri).

Cons:

- No mutual funds or individual bonds.

- Limited market research and analytical tools.

- $75 outgoing transfer fee.

- Customer support could be faster.

Why You Should Choose Robinhood ?

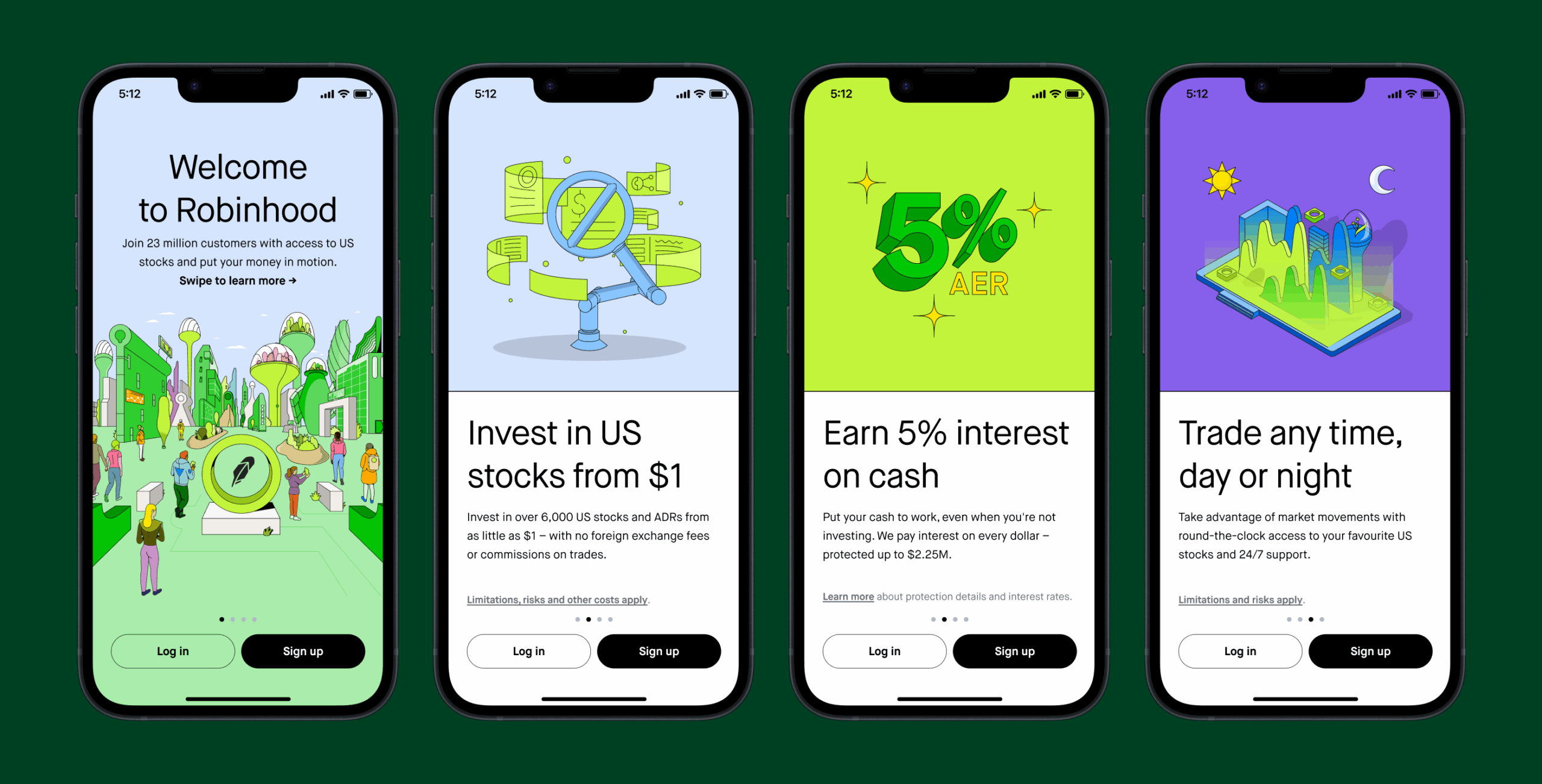

Robinhood remains one of the best stock apps in 2025 thanks to its continued focus on accessibility, simplicity, and innovation. The platform’s mobile-first design ensures a smooth user experience for both new and returning investors, while the onboarding process is fast, fully digital, and requires no minimum deposit. Whether you are buying your first stock or managing an IRA, Robinhood makes investing easy to start and simple to maintain.

Trade Anytime with the 24-Hour Market

One of the biggest upgrades in 2025 is Robinhood’s 24-Hour Market, which allows users to trade U.S. stocks and ETFs anytime between Sunday evening and Friday evening. This feature gives investors more control over timing their trades and responding to global market events outside traditional hours—something few competitors like Webull or SoFi Invest offer at this scale.

Robinhood Gold: Enhanced Earnings and Premium Data

The Robinhood Gold subscription continues to add value with higher APY on uninvested cash (4.65%), access to Morningstar research and Nasdaq Level II market data, and an unmatched 3% IRA contribution match. These benefits make it a strong option for investors looking to grow wealth passively while staying informed with professional-grade insights.

Cash Card and Credit Card Rewards

Robinhood’s Cash Card and Credit Card programs now provide up to 3% daily cash back on eligible purchases, adding a practical, real-world benefit for everyday users who want to earn rewards while they spend.

Robinhood Legend: A Major Step Forward for Active Traders

The newly launched Robinhood Legend desktop platform delivers a more robust trading experience with customizable charts, improved order management, and a sleek interface. It bridges the gap between mobile convenience and desktop capability, making it easier for traders to scale their strategies as their skills evolve.

Bottom Line

If you are looking for a low-cost, easy-to-use investing platform with round-the-clock trading, integrated rewards, and reliable tools for long-term growth, Robinhood remains one of the top choices in 2025. It’s an ideal fit for investors who value flexibility, simplicity, and continuous innovation without the burden of high fees.

Compare to Top Competitors

Before choosing a trading platform, it’s important to see how Robinhood measures up against its major competitors. While Robinhood excels in accessibility and zero-commission trading, other brokers stand out in areas like research tools, asset diversity, and professional-grade platforms. Here’s how Interactive Brokers, Webull, and Fidelity compare to Robinhood in 2025.

Interactive Brokers

Webull

Fidelity

Exploring Robinhood’s Range of Tradable Instruments

Robinhood offers a streamlined selection of assets designed to meet the needs of most retail investors while keeping trading costs at zero. Its focus remains on simplicity and accessibility rather than an overwhelming number of investment choices.

While this makes Robinhood an excellent entry point for beginners, it also limits the platform’s appeal to those seeking advanced diversification options such as mutual funds, bonds, or forex trading.

Stocks and ETFs

Robinhood built its reputation on commission-free trading, and that legacy continues in 2025. Investors can buy and sell U.S. stocks and ETFs without any fees, making it one of the most affordable ways to build a portfolio.

The platform also supports fractional shares, allowing users to invest with as little as $1. This feature is especially beneficial for those who want exposure to high-priced stocks without committing large amounts of capital.

Additionally, Robinhood gives investors access to IPOs, enabling them to participate in new public offerings before shares hit the broader market.

Options Trading

For traders looking to expand their strategies, Robinhood offers options trading with no commissions. Each contract carries a small $0.50 fee, and Gold members enjoy reduced pricing.

The trading interface is clean and beginner-friendly, though it lacks some of the deeper analytical tools found on platforms like Webull or Interactive Brokers. Still, the ability to trade options affordably and directly from mobile or desktop makes it appealing for users testing more advanced trading strategies.

Cryptocurrency

Robinhood continues to lead among traditional brokers in crypto trading, supporting more than 20 coins, including Bitcoin, Ethereum, and Dogecoin. There are no markups or trading spreads for market-maker routing, meaning you trade at transparent prices.

Users can also transfer crypto in and out of the platform, a feature not always available with similar stock brokerages.

Futures and IRAs

New in 2025, futures trading is available with competitive pricing—$0.75 per contract for standard users or $0.50 for Gold members.

Robinhood also offers Traditional and Roth IRAs with a 1–3% contribution match, a unique benefit for retirement savers.

Bottomline

Robinhood’s streamlined offering may lack certain asset classes, but its low-cost structure and growing product range make it a compelling choice for everyday investors seeking straightforward access to major markets.

| Asset | Robinhood |

|---|---|

| Stock Trading | Yes |

| Options Trading | Yes |

| Futures Trading | Yes |

| Forex Trading | No |

| Crypto Trading | Yes |

| Traditional and Roth IRAs | Yes |

| Fractional Shares (Stocks) | Yes |

How Robinhood’s Instruments Compare to Competitors

Before choosing a broker, it’s helpful to understand how Robinhood’s available instruments stack up against other major platforms. While Robinhood excels in commission-free trading and simplicity, competitors like Interactive Brokers, Webull, and Fidelity offer broader asset coverage and more advanced trading tools. The table below highlights which instruments are available on each platform as of 2025.

| Asset | Robinhood | Interactive Brokers | Webull | Fidelity |

|---|---|---|---|---|

| Stocks | ||||

| ETFs | ||||

| Fractional Shares | ||||

| Options | ||||

| Futures | ||||

| Forex | ||||

| Cryptocurrencies | ||||

| Mutual Funds |

Bottomline

Robinhood stands out for its free trading, fractional shares, and round-the-clock stock trading, features designed for retail investors who prioritize simplicity and flexibility. Interactive Brokers dominates in global access and product diversity, offering everything from bonds to forex. Webull sits in the middle ground with strong crypto and stock offerings but fewer retirement or fund options. Fidelity, meanwhile, remains the go-to for long-term investors who value mutual funds, retirement planning, and deep research tools.

For those seeking an easy entry into investing with a modern, mobile experience, Robinhood remains the most accessible option — while IBKR and Fidelity cater to investors who need full diversification and research depth.

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $0 |

| Stock & ETF Commissions | $0 |

Options (Per Contract) | $0 |

| Futures Trading | $0.75 per contract |

| Margin Interest Rate | 5.75% |

ACAT Transfer Out Fee | $100 |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | No |

Understanding how much it costs to trade and maintain your account is essential when choosing a broker. Robinhood remains one of the most affordable platforms in 2025, continuing its zero-commission model for U.S. securities while keeping non-trading fees minimal. Below is a quick overview of Robinhood’s pricing compared to industry norms.

Trading Fees

Robinhood continues to be a pioneer in commission-free trading. All stocks, ETFs, and options can be traded without paying any commissions or platform fees. This has become the platform’s defining feature and remains one of the biggest advantages for beginners and cost-conscious investors.

Crypto traders also benefit from low crypto trading fees, with no additional spreads or markups beyond minor execution differences depending on market liquidity. The newly introduced futures trading feature in 2025 comes at a $0.75 per contract rate, which is competitive compared to larger multi-asset brokers.

Robinhood Gold members enjoy a lower rate of $0.50 per contract, making futures trading more affordable for active users.

For margin traders, Robinhood applies a 6.75% standard interest rate, reduced to 5.75% for balances up to $50,000. This rate is below average for U.S. brokers, especially when paired with the benefits of the Gold plan.

Other Trading Costs

While the core trading features remain free, there are optional premium tools available through Robinhood Gold. For $5 per month or $50 per year, subscribers gain access to Morningstar research, Nasdaq Level II data, and a 4.65% APY on uninvested cash. Gold members also enjoy larger instant deposits (up to $50,000) and enhanced IRA contribution matches of up to 3%.

Transferring your account out of Robinhood through the Automated Customer Account Transfer Service (ACAT) incurs a $75 fee, which is standard across the industry. There are no other hidden costs related to trading, charting, or market data beyond this.

Non-Trading Fees

Robinhood keeps non-trading fees extremely low, reinforcing its position as a cost-effective platform for both casual and long-term investors.

- Inactivity Fee: None. You can leave your account idle without penalties.

- Withdrawal Fees: ACH withdrawals are completely free, while domestic wires cost $25 and international wires cost $50.

- Instant Withdrawals: A small 1.75% fee applies for users who choose immediate fund transfers instead of standard processing times.

- Currency Conversion: Robinhood operates exclusively in USD, so conversion costs may apply when funding your account from a non-USD currency.

Verdict

In 2025, Robinhood remains one of the lowest-cost brokers available. Its commission-free trading model, combined with transparent pricing and no inactivity fees, makes it ideal for both new and cost-conscious investors. The optional Robinhood Gold plan adds meaningful benefits like premium data, higher cash APY, and IRA matches that enhance long-term returns.

While some fees like ACAT transfers and instant withdrawals still apply, Robinhood’s pricing structure remains simple, predictable, and highly competitive in the modern brokerage landscape.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Robinhood Regulated ?

Yes, Robinhood is a fully regulated and publicly listed brokerage that operates under strict U.S. and international financial oversight. In the United States, Robinhood Financial LLC is regulated by the Securities and Exchange Commission (SEC) and is a registered member of the Financial Industry Regulatory Authority (FINRA). Its UK operations are supervised by the Financial Conduct Authority (FCA), ensuring compliance with investor protection standards in both jurisdictions.

Robinhood’s parent company, Robinhood Markets, Inc., is publicly traded on the NASDAQ under the ticker symbol HOOD, which adds another layer of transparency and accountability. As a listed entity, it publishes regular financial statements, undergoes independent audits, and is required to meet strict disclosure and capital adequacy rules.

For investor protection, customer securities are covered by the Securities Investor Protection Corporation (SIPC), which insures up to $500,000 per customer, including a $250,000 limit for cash balances. This protection ensures that if the brokerage fails, customers’ securities and cash deposits are safeguarded within SIPC limits.

It is important to note, however, that Robinhood Crypto LLC, which handles digital asset trading, is not covered by SIPC insurance. Like other U.S. crypto exchanges, it holds users’ cryptocurrency in segregated accounts but does not provide the same level of protection as traditional securities accounts.

Overall, Robinhood’s adherence to SEC, FINRA, and FCA regulations, combined with its public company status and transparent financial reporting, makes it a safe and legitimate broker for most investors.

Understanding Regulatory Protections and Broker Stability

Robinhood offers strong layers of investor protection to safeguard client assets. All brokerage accounts are protected by the Securities Investor Protection Corporation (SIPC), covering up to $500,000 per customer, including $250,000 for cash holdings. Additionally, uninvested cash in Robinhood Cash Management accounts is FDIC-insured through a network of partner banks, providing up to $2.25 million in aggregate coverage. These protections ensure that investors’ cash and securities remain safe even in the unlikely event of broker insolvency.

No Negative Balance Protection

Unlike some international brokers, Robinhood does not provide negative balance protection. This means that under rare circumstances, especially during extreme market swings, margin traders could lose more than their initial investment. While such cases are uncommon, it’s important for investors using leverage to understand this potential risk and manage their exposure responsibly.

Commitment to Transparency and Compliance

Robinhood faced regulatory fines in 2020 and 2021 related to platform outages, risk disclosure issues, and payment-for-order-flow practices. In response, the company significantly improved its compliance framework, system stability, and disclosure standards. It has since strengthened its internal controls, enhanced customer communication, and invested heavily in technology to prevent future disruptions.

Public Listing as a Trust Signal

Being publicly listed on the NASDAQ (ticker: HOOD) reinforces Robinhood’s financial transparency and stability. As a listed company, it must publish regular financial statements, undergo independent audits, and comply with strict SEC reporting requirements. This public accountability gives investors confidence that Robinhood operates with a higher standard of oversight and long-term sustainability.

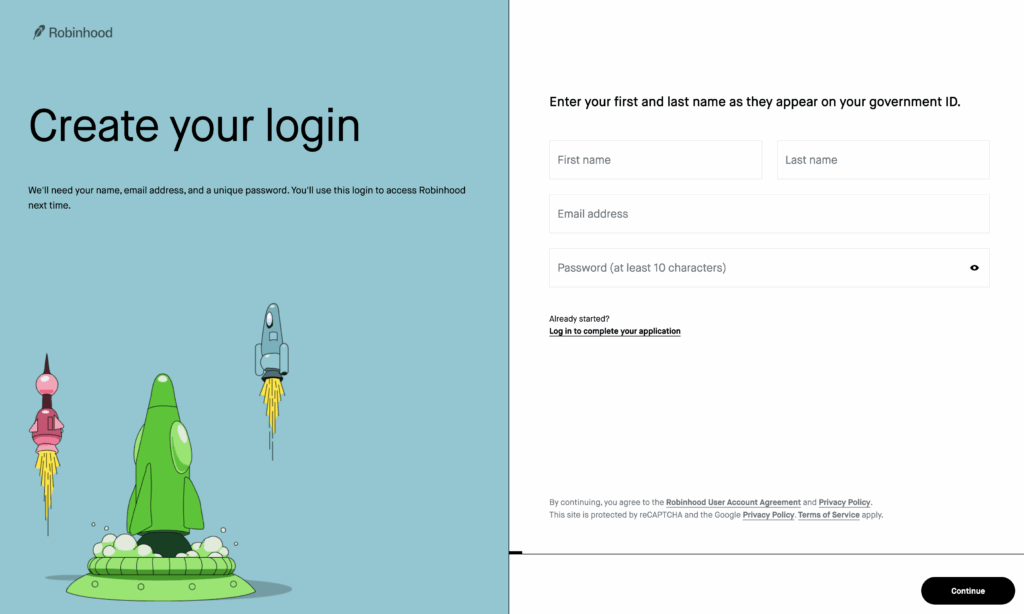

How To Open an Account

Opening an account with Robinhood is quick, straightforward, and fully digital. The streamlined onboarding is designed for first-time investors, and most users complete the Robinhood sign-up process in under an hour. There is no minimum deposit, so you can start investing immediately after funding.

- Download the Robinhood app or visit robinhood.com and tap Sign Up.

- Enter your name, email, and create a password.

- Provide personal details: date of birth, address, and Social Security Number.

- Answer short questions relating to your trading experience

- Upload a government-issued photo ID and verify your identity.

Account Requirements

To sign up you must be at least 18 years old and a U.S. resident with a valid Social Security Number and government-issued photo ID. Robinhood currently serves U.S. customers only, so a U.S. address is required for verification.

Fast Approval and Verification

After submitting your application and ID, many users receive approval within minutes. Robinhood supports instant bank verification with most major U.S. banks, which speeds up funding and gives new accounts instant buying power—typically up to $1,000 for standard accounts and higher limits for Gold members. If additional review is needed, approval may take up to 24 hours.

Account Types

Robinhood offers a focused yet flexible range of account types designed to support different investing goals—from casual trading to retirement savings. Each account tier emphasizes simplicity, cost efficiency, and accessibility for investors at all levels.

Individual Brokerage Accounts

The Individual Brokerage Account is Robinhood’s main account type and comes in three tiers: Standard, Instant, and Gold.

Standard accounts include commission-free trading, fractional shares, and access to U.S. stocks, ETFs, options, and crypto.

Instant accounts provide instant deposits up to $1,000, letting you trade without waiting for funds to clear.

Gold, Robinhood’s premium tier, costs $5 per month or $50 per year and offers enhanced features like Morningstar research, Nasdaq Level II data, margin trading, higher instant deposits (up to $50,000), and 4.65% APY on uninvested cash.

IRA Accounts

Robinhood’s Traditional and Roth IRAs give investors tax-advantaged options for retirement savings. The standout feature is the IRA Match, where Robinhood contributes 1% for standard users and up to 3% for Gold members for every eligible deposit—an incentive rarely offered by other U.S. brokers.

Cash Management

Through Robinhood Cash Management, investors can earn competitive interest on idle funds. Deposits are FDIC-insured up to $2.25 million via a network of partner banks, and users can easily access funds with a linked debit card or bank transfer.

Verdict

Robinhood’s account lineup is simple yet powerful, offering flexibility for both active traders and long-term investors. The Gold tier adds tangible value with its higher interest, premium tools, and IRA match, while Cash Management enhances liquidity and convenience.

Overall, Robinhood’s account structure strikes an excellent balance between ease of use, affordability, and meaningful financial benefits.

What is the Minimum Deposit at Robinhood?

Robinhood has a $0 minimum deposit requirement, making it one of the most accessible brokers for new investors. You can open an account and start trading without needing to meet any funding threshold.

Once your bank is linked, Instant accounts receive up to $1,000 in instant deposit availability, allowing you to trade immediately while funds settle. Robinhood Gold members enjoy significantly higher limits, with instant deposits up to $50,000.

Larger bank transfers that exceed the instant limit may take 4–5 business days to fully process, depending on your bank’s transfer speed and verification status.

| Broker | Minimum Deposit |

|---|---|

| Robinhood | $0 |

Interactive Brokers | $0 |

| Webull | $0 |

Fidelity | $0 |

Deposit and Withdrawal

Funding and withdrawing from your Robinhood account is simple, transparent, and designed for convenience. The platform offers multiple methods to move money securely, with clear limits and minimal fees, making it one of the easiest brokers to manage daily cash flow.

Deposit Methods

Robinhood currently supports two main deposit options:

There are no deposit fees, and your funds are usually available for trading immediately through Instant Deposit. Standard users can access up to $1,000 instantly, while Robinhood Gold members enjoy instant deposits of up to $50,000. Larger deposits beyond these limits may take 4–5 business days to fully settle.

Withdrawal Fees & Options

Withdrawals from Robinhood are straightforward and flexible:

Users can withdraw up to $50,000 per business day, ensuring easy access to funds without unnecessary restrictions.

Cash Management Features

Robinhood’s Cash Management account adds extra convenience by allowing users to earn interest on uninvested cash. Gold members earn a competitive 4.65% APY, while all cash balances are FDIC-insured up to $2.25 million through a network of partner banks. The account also includes debit card access, enabling easy spending or transfers directly from your brokerage balance.

Verdict

Robinhood’s deposit and withdrawal system is one of the smoothest in the industry. With instant deposits, no funding fees, and high-interest cash management, it balances speed, safety, and efficiency. For everyday investors, these features make managing cash as effortless as trading.

Web Trading Platform

In 2025, Robinhood made a significant leap forward for desktop traders with the launch of Robinhood Legend—its upgraded, web-based trading platform built for both casual and active investors. Legend enhances the trading experience with improved tools, faster performance, and a sleek, user-friendly interface that makes analysis and execution effortless.

Key Features and Design

The Robinhood web platform has evolved into a more capable system without losing its hallmark simplicity. Legend introduces customizable charts, real-time quotes, and integrated financial news from reputable sources.

Traders can adjust layouts, track watchlists, and view earnings reports directly within the platform. The dashboard’s intuitive design allows users to focus on market movements while maintaining easy access to their portfolio, research tools, and trade history.

Tools and Analysis

Robinhood Legend expands the toolkit for traders seeking more control. The platform now includes technical indicators, multiple chart types, and price alerts, helping users perform better-informed analyses.

While it remains simpler than advanced tools from brokers like Interactive Brokers or ThinkorSwim, Legend’s charting tools are responsive and ideal for light to moderate technical analysis. Integration with Morningstar research (via Gold membership) further strengthens the platform’s analytical capabilities.

Placing Orders and Execution

Order placement on Legend is straightforward and efficient. The trade ticket is cleanly designed, offering options for market, limit, and stop orders. Traders can buy and sell stocks, ETFs, options, crypto, and futures from a unified dashboard.

Execution is quick, and real-time confirmations keep users updated on order status. However, advanced order types—such as hotkeys, bracket orders, or conditional orders—are not yet available, which limits flexibility for high-frequency or professional traders.

Security and Reliability

Robinhood maintains strong security standards across all platforms. Legend uses two-factor authentication (2FA), encryption protocols, and biometric login options to protect user accounts.

As a web-based platform, it benefits from Robinhood’s ongoing infrastructure upgrades, which have improved reliability and minimized downtime since earlier years. The company also monitors trading activity in real time to detect suspicious behavior and ensure account safety.

Verdict

Robinhood Legend represents a polished step forward for desktop trading. It blends speed, modern design, and cross-device synchronization with a simple layout that appeals to casual and semi-active traders.

While it lacks the depth and customization of professional trading suites, it’s fast, secure, and intuitive—making it one of the best desktop platforms for users who value a clean, efficient, and accessible trading experience.

Pros & Cons of the Web Platform

Pros

- Fast and intuitive interface ideal for beginner to intermediate traders.

- Customizable charts and integrated market news in one workspace.

- Seamless syncing with the Robinhood mobile app.

- Visually clean and modern design with minimal clutter.

Cons

- Lacks advanced order types such as hotkeys, bracket orders, or trailing stops.

- Limited in-depth analytics compared to professional-grade platforms like Interactive Brokers or ThinkorSwim.

- Still missing multi-screen support for power users.

Mobile App

The Robinhood mobile app remains the centerpiece of the platform and one of the most highly rated trading apps on both iOS and Android. Designed with accessibility in mind, it continues to define the standard for intuitive mobile investing in 2025. Its clean interface, smooth navigation, and minimal learning curve make it ideal for beginners and casual traders. The app combines sleek design with powerful functionality, allowing users to trade, manage portfolios, and access market data from anywhere.

User Interface and Experience

The user experience (UX) is where Robinhood truly shines. The app offers real-time quotes, watchlists, and a customizable home screen that displays portfolio performance at a glance.

Its visual design focuses on clarity and ease of use, allowing even first-time investors to navigate seamlessly. Users can listen to live earnings calls, track market news, and receive push notifications for major price changes or portfolio updates—all within a few taps.

Trading Features and Charting Tools

Robinhood’s mobile app provides commission-free trading for stocks, ETFs, options, and cryptocurrencies, with the ability to execute trades quickly and efficiently. Traders can also take advantage of 24-hour market access directly through the app, a feature that remains rare among competitors.

When it comes to charting, the app offers basic technical indicators like moving averages and volume overlays but lacks advanced customization tools such as drawing functions, pattern recognition, or backtesting capabilities. This makes it best suited for light to moderate analysis rather than deep technical studies.

Integrated News and Insights

Robinhood integrates news updates, market briefings, and earnings summaries directly into the trading interface.

Gold members also gain access to Morningstar research and Nasdaq Level II data, enhancing the informational value of the app. These features help investors stay informed without leaving the platform, streamlining the decision-making process.

Verdict

The Robinhood mobile app remains one of the most accessible and user-friendly investing platforms on the market. Its simplicity, design, and round-the-clock access make it ideal for new and everyday traders who value speed and convenience over deep analytics.

While advanced users may prefer more powerful charting tools, Robinhood’s app continues to deliver a fast, modern, and engaging trading experience that’s hard to beat on mobile.

Pros & Cons of the Mobile App

Pros:

- Clean, intuitive interface suitable for all experience levels.

- Real-time quotes, alerts, and personalized watchlists.

- Seamless syncing with the web and desktop platforms.

- 24-hour trading access and fractional share support.

Cons:

- Lacks advanced charting and order types.

- Limited customization for technical analysis.

Market Research, Tools, and Education

Robinhood offers a growing suite of research tools that enable investors to make informed decisions without leaving the platform.

While its base version offers access to fundamental company data, price charts, analyst ratings, and dividend information, premium users who subscribe to Robinhood Gold gain access to two major upgrades: Morningstar research reports and Nasdaq Level II market data.

Morningstar’s reports provide investors with professional insights into company performance, valuation metrics, and analyst opinions—ideal for users who want credible third-party analysis before making a buying or selling decision. Meanwhile, Nasdaq Level II provides deeper visibility into market depth, allowing traders to see real-time bid and ask activity from multiple market makers.

This feature, while not essential for beginners, gives more active traders a better understanding of short-term market sentiment.

However, its charting tools remain basic, with only limited technical indicators available. Investors who rely on advanced analytics, stock screeners, or pattern recognition tools may find Robinhood’s research suite too minimal for in-depth analysis.

The topics range from basic investing concepts—like diversification and risk tolerance—to more advanced subjects such as options strategies and retirement planning. The educational materials are engaging and well-organized, making them ideal for beginners who want to build confidence in their financial knowledge.

Customer Support

Robinhood has significantly improved its customer service over the past few years, expanding its support options and availability to better meet investor needs. The platform now offers 24/7 live chat support, allowing users to connect with representatives directly from the app or desktop site at any time. Additionally, phone support is available during business hours—7 a.m. to 9 p.m. ET on weekdays—for more complex account or trading inquiries.

For less urgent matters, users can reach out via email support, though response times tend to be slower, typically taking one to two business days. While Robinhood continues to enhance its responsiveness, its email and callback system can still lag behind top-tier brokers like Fidelity or Charles Schwab in terms of resolution speed and personalized service.

In-App Help Center and AI Assistance

The in-app help center is one of Robinhood’s strongest support features. It’s well-organized and easy to navigate, providing hundreds of articles on topics like account setup, funding, trading, and tax documents. The platform also uses AI-powered chat assistance, which helps guide users to relevant resources or escalate issues to live agents when needed. This hybrid approach saves time for common questions and makes finding answers more convenient for self-directed investors.

Customer Experience and Improvements

Over the years, Robinhood has worked to rebuild trust following past criticism over slow response times and system outages. The company has since invested heavily in customer care infrastructure and support training, ensuring that agents can handle technical and financial inquiries more efficiently. Despite these improvements, Robinhood’s support still trails top competitors in personalization and depth of service, especially for high-volume or professional traders.

Verdict

Overall, Robinhood’s customer support has evolved into a dependable and accessible system that meets the needs of most retail investors. While it doesn’t yet match the sophistication of full-service brokers, the addition of 24/7 live chat, in-app AI assistance, and a well-structured knowledge base makes support faster, simpler, and far more user-friendly than in previous years.

FAQ

Is Robinhood safe and regulated in 2025?

Yes. Robinhood is a fully regulated U.S. broker overseen by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). It is also publicly listed on the NASDAQ under the ticker HOOD, adding an extra layer of transparency. Client securities are protected by the Securities Investor Protection Corporation (SIPC) for up to $500,000, including $250,000 for cash, while uninvested funds in cash management accounts are FDIC-insured up to $2.25 million.

What can I trade on Robinhood?

Robinhood offers a diverse yet streamlined selection of tradable assets, including stocks, ETFs, options, cryptocurrencies, futures, and IRAs. Investors can also access fractional shares and IPO allocations, making it easy to build a portfolio across multiple asset types. However, Robinhood does not currently support mutual funds, bonds, or forex.

Does Robinhood charge any hidden fees?

No. Robinhood is known for its transparent, zero-commission model. There are no hidden fees for trading stocks, ETFs, or crypto. Optional services, such as Robinhood Gold, cost $5 per month or $50 per year, while outgoing account transfers carry a $75 ACAT fee. Standard ACH withdrawals are free, but instant withdrawals incur a 1.75% fee.

What is the minimum deposit to start investing?

Robinhood has no minimum deposit requirement. You can open and fund an account with any amount. Standard users get up to $1,000 in instant deposit availability, while Gold members can access up to $50,000 instantly.

Can I trade crypto and futures on Robinhood?

Yes. Robinhood supports crypto trading on more than 20 coins, including Bitcoin and Ethereum, with no trading commission or markup. In 2025, the platform also launched futures trading, priced at $0.75 per contract (or $0.50 for Gold members), expanding access to more active trading strategies.

Is Robinhood good for beginners?

Absolutely. Robinhood’s user-friendly design, zero-commission trading, and educational tools make it one of the best brokers for beginners. The app’s intuitive interface and built-in resources like Robinhood Learn help new investors gain confidence quickly without feeling overwhelmed.

Can I invest long-term with Robinhood IRAs?

Yes. Robinhood offers both Traditional and Roth IRAs, ideal for long-term retirement investing. A unique feature is the IRA Match, where Robinhood contributes 1% for standard users and 3% for Gold members on every eligible deposit—an uncommon perk among online brokers.

Does Robinhood support fractional shares?

Yes. Robinhood allows users to buy fractional shares starting from just $1, making it easier to invest in high-priced stocks like Tesla or Amazon without committing large sums. This feature helps diversify portfolios, even on a smaller budget.

How can I withdraw funds from Robinhood?

Funds can be withdrawn via free ACH transfers to your linked bank account. The process typically takes 1–3 business days. For faster access, you can use instant withdrawals for a 1.75% fee. Robinhood also offers wire transfers—$25 for domestic and $50 for international.

Is Robinhood suitable for professional traders?

Robinhood is best suited for beginners and casual investors, though its new Robinhood Legend desktop platform and futures trading make it more appealing to semi-active traders. However, it still lacks the advanced analytics, order types, and global markets that professional traders often require.