SAXO REVIEW 2025

If you’re wondering whether Saxo Bank is the right broker for you in 2025, this review breaks it all down. We’ll cover what makes Saxo a trusted name worldwide, from its 60,000+ tradable instruments and powerful platforms to its strong global regulation. You’ll also see where it shines for active traders and professionals, and where beginners might find the fees and account tiers a bit challenging. By the end, you’ll know exactly what to expect if you choose Saxo.

Broker Guide's Saxo Review in 2025

Saxo is a premium, multi-asset broker-bank built for serious trading and investing, not gimmicks or penny pricing. It shines when platform quality, market access, and stability matter more than the absolute lowest fees.

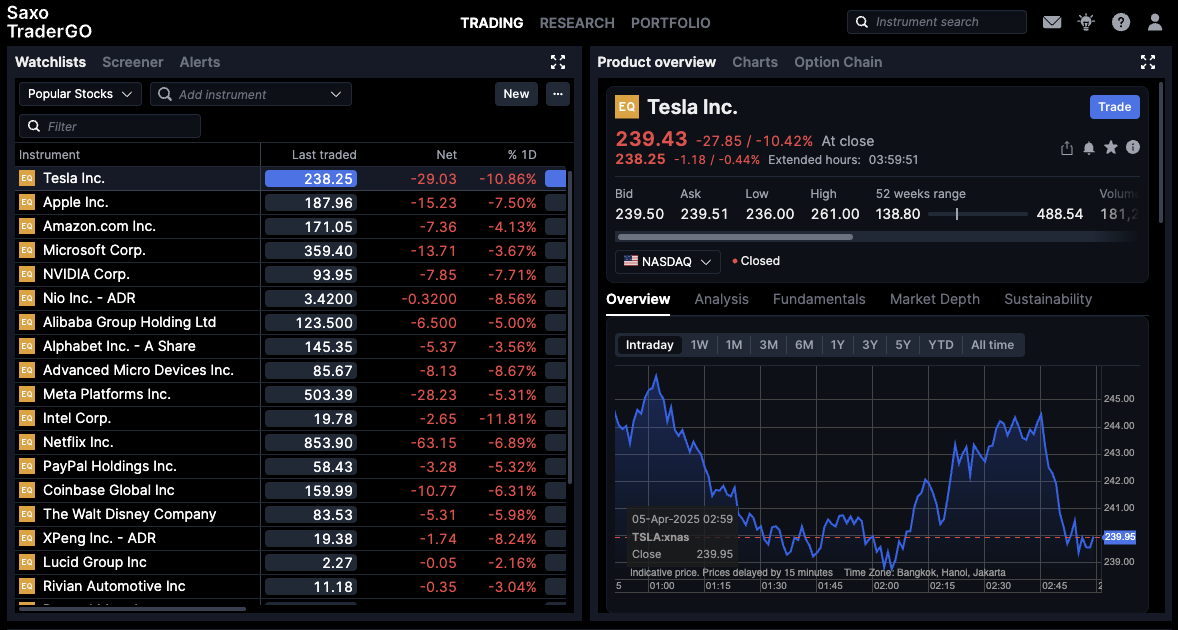

SaxoTraderGO feels fast, clean, and reliable. Orders, watchlists, and layouts sync smoothly across devices. SaxoTraderPRO is heavier but powerful, with deep customization and multi-screen support for complex workflows. The overall stack feels bank-grade and stable, with strong research and tools built in.

About Saxo

Saxo Bank is a Danish pioneer in online trading and fintech brokerage. Founded in 1992 (originally as Midas Fondsmæglerselskab) by Kim Fournais and Lars Seier Christensen, the firm obtained its banking licence in 2001 and rebranded as Saxo Bank.

Over the years, Saxo has transformed from a Scandinavian broker into a global multi-asset trading and investment platform. Its growth has been driven by a blend of innovation, transparency, regulatory compliance, and an ever-expanding product range. It offers clients access to tens of thousands of instruments across asset classes including equities, forex, commodities, bonds, ETFs, options, and more.

Global Presence & Regulation

Saxo Bank operates in multiple jurisdictions worldwide, regulated by top-tier authorities. Its headquarters are in Copenhagen, with key offices in London, Singapore, Zurich, Dubai, and Tokyo. Today, it serves clients across 160+ countries.

Investor-First Model: Transparency & Innovation

Saxo positions itself as more than just a broker—it is a fintech innovator. It emphasises transparent pricing, continuous platform development, and strong investor protection. By 2025, client assets exceeded USD/EUR 118 billion, with over 1.3 million clients worldwide.

Leadership & Ownership

- Kim Fournais — Founder & CEO

- In 2025, J. Safra Sarasin Group agreed to acquire a 70% stake in Saxo Bank, while Kim Fournais retained about 28% ownership.

Key Stats (2024–2025)

- Clients: ~1.3–1.4 million globally

- Client assets under management: ~USD/EUR 118 billion

- Tradable instruments: 70,000+ assets across markets

My Quick Verdict

Saxo Bank is ideally suited for serious traders, active investors, and high-net-worth individuals (HNWIs) who demand institutional-grade tools and global market access. With its advanced platforms—SaxoTraderGO and SaxoTraderPRO—the broker caters to those who need direct market access, powerful charting, and a professional-grade trading environment. For anyone managing larger portfolios or seeking diversified exposure to international markets, Saxo is one of the strongest choices in 2025.

Strengths That Stand Out

Saxo’s biggest strengths are its regulation, market research, and range of instruments. Regulated by top-tier authorities such as the FCA, ASIC, and MAS, and operating as a fully licensed European bank, it gives traders a high level of trust and security. The broker also shines in research, offering world-class analysis through the SaxoStrats team, comprehensive market screeners, and extensive educational resources. On top of that, traders gain access to over 70,000 assets—covering stocks, ETFs, forex, commodities, bonds, options, futures, and crypto ETPs—all through a single account.

Who Saxo May Not Suit

While Saxo Bank is an excellent choice for professionals, it may not be the best fit for casual beginners or small-budget traders. Although there is no formal minimum deposit, Saxo’s tiered account structure means that smaller deposits may limit access to competitive pricing and premium features. In practice, traders with modest balances often face higher commissions and wider spreads compared to those on Platinum or VIP tiers.

Final Word

In short, Saxo Bank is a premium broker for premium traders. If you value strong regulation, advanced platforms, and unrivalled market access, Saxo is a top-tier choice in 2025.

Pros

- Zero-commission stock & ETF trading – ideal for long-term investors looking to keep costs low.

- Fractional shares – start investing with as little as £1, even in high-priced companies.

- Intuitive mobile & desktop platforms – sleek, user-friendly design suited for beginners and casual investors.

- Regulated in the UK & EU – oversight from the FCA and FSC provides strong investor protection.

- Low entry barrier – no minimum deposit required for Invest accounts, making it easy for anyone to get started.

Cons

- No MetaTrader or third-party platforms – limits flexibility for advanced traders who rely on industry-standard tools.

- Limited research tools – less depth compared to competitors like Interactive Brokers or eToro.

- No crypto spot trading – only available through ETPs, and only in certain jurisdictions.

- Currency conversion fees – applied when trading assets in a different currency, which can eat into returns over time.

Why You Should Choose Saxo ?

Choosing the right broker is about more than just fees or flashy marketing—it’s about trust, stability, and access to the markets that matter. In 2025, Saxo Bank continues to stand out as a broker that blends security, innovation, and global reach, making it a compelling choice for serious traders and investors.

Security Backed by Global Regulation

One of the strongest reasons to consider Saxo is its regulatory foundation. The broker is licensed by multiple top-tier financial authorities, including the FCA in the UK, ASIC in Australia, and the MAS in Singapore, alongside its status as a licensed European bank headquartered in Denmark. This means clients benefit from segregated accounts, negative balance protection (where applicable), and investor compensation schemes. For traders who prioritize safety, Saxo’s regulatory pedigree is hard to beat.

A Broker for Serious Traders

Saxo has earned its reputation as a trusted broker for professionals, active investors, and high-net-worth individuals. Its tiered account system—Classic, Platinum, and VIP—caters to different levels of commitment, rewarding larger traders with lower fees and premium services. While anyone can open an account, those who actively trade or maintain larger portfolios get the most out of Saxo’s offering, from reduced pricing to dedicated client support.

Access to International Markets

Where Saxo truly excels is in its breadth of market access. Clients can trade over 70,000 instruments across stocks, ETFs, bonds, commodities, options, futures, forex, and crypto ETPs. Unlike brokers limited to CFDs or a small asset range, Saxo delivers true multi-asset investing from a single account. Whether you want to buy shares on Wall Street, diversify with European bonds, hedge with commodities, or gain exposure to crypto via exchange-traded products, Saxo puts the global markets at your fingertips.

Continuous Platform Innovation

Saxo’s proprietary platforms—SaxoTraderGO and SaxoTraderPRO—are consistently ranked among the best in the industry. In 2025, both platforms continue to receive updates that improve usability, speed, and charting depth. The mobile trading experience, in particular, has become more intuitive, giving traders full functionality on the go without compromising performance.

Investing in the Future: ESG and Thematic Portfolios

Beyond traditional trading, Saxo has positioned itself as a forward-looking broker by offering ESG-focused investments and thematic portfolios. These options allow clients to align their strategies with long-term global trends such as clean energy, technology innovation, or sustainability. It’s an attractive feature for investors who want to combine performance with purpose.

The Bottom Line

In 2025, Saxo Bank remains one of the most secure, innovative, and globally connected brokers available. With its strong regulatory foundation, professional-grade platforms, and access to an unmatched range of assets, Saxo is built for traders and investors who take the markets seriously. If you’re looking for a broker that combines safety, sophistication, and global reach, Saxo should be at the top of your list.

Compare to Top Competitors

When evaluating Saxo against other leading brokers, it’s clear that Saxo positions itself as a premium choice for serious, globally focused traders.

While its strengths lie in deep market access, advanced platforms, and world-class research, it’s worth seeing how it stacks up against other top names in the industry. Below, we compare Saxo with Interactive Brokers, Swissquote, and Forex.com—three well-known competitors that serve different trader profiles.

Interactive Brokers

Swissquote

Forex.com

Exploring Saxo's Range of Tradable Instruments

Saxo Bank offers one of the most diverse product lineups in the online trading industry. With access to more than 60,000 financial instruments, it appeals to investors who want global reach and depth in their portfolios.

Stocks, ETFs, and Bonds

Saxo provides access to equities across 50+ global exchanges, covering both developed and emerging markets. You can trade ETFs across themes, regions, and asset classes, including ESG-focused funds. The broker also offers bonds, from government securities to corporate debt, giving investors fixed-income opportunities.

Mutual Funds

Investors can choose from a wide selection of mutual funds, including active and passive strategies. This makes Saxo appealing for those who prefer long-term investing alongside trading.

Forex and CFDs

Saxo is strong in forex trading, with more than 180 currency pairs available. It also supports CFD trading on indices, equities, and commodities. These products suit active traders looking for leverage and flexibility.

Commodities and Futures

The broker offers commodity trading through futures and options contracts. You can trade energy products, metals, and agricultural goods. Saxo also provides access to a wide range of futures markets for diversification and speculation.

Options Trading

For advanced traders, Saxo delivers a robust options trading platform. It includes global equity options, index options, and FX options. The tools allow for strategic hedging and complex strategies.

Crypto ETPs

Saxo does not allow direct crypto trading. Instead, it offers crypto-linked exchange-traded products (ETPs). These instruments provide exposure to digital assets with the security of regulated exchanges.

A Global Marketplace

With over 60,000 assets available, Saxo positions itself as a multi-asset broker. Few competitors match this level of choice. From traditional markets to innovative products, Saxo gives traders and investors almost every instrument they may need in one account.

| Asset | Saxo |

|---|---|

| Forex Pairs | 190 |

| Tradeable Symbols | 70000 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency | Yes – crypto ETPs only |

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD (Standard) | 1.1 pips |

All-in Cost EUR/USD - Active | 0.9 pips |

| Commissions | Low |

Options Commissions | High |

Stock and ETF Commissions | Low |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $0 |

Saxo Bank follows a transparent, tier-based pricing model, designed to reward more active traders and higher-volume investors. While costs can vary depending on account type, region, and trading activity, the overall structure balances competitiveness with the premium services Saxo provides.

Forex Spreads

Saxo is well-regarded for its tight forex spreads, which start from 0.4 pips on major pairs. The actual spread depends on the account tier—Classic, Platinum, or VIP—with better conditions available to those who maintain larger balances or trade more actively. For example, a Classic account holder may see slightly wider spreads than a VIP client, but all tiers remain competitive compared to the market.

Stocks & ETFs Commissions

For stocks and ETFs, Saxo charges commissions rather than spreads. These are tiered by account type and region, with minimum charges per trade. In many markets, fees start from $1 per trade or 0.05% of trade value, whichever is higher. As clients upgrade to higher tiers, they benefit from discounted commission rates. Active traders who execute larger volumes gain the most from this structure, which scales costs down over time.

Futures & Options

Saxo also provides access to futures and options across global exchanges. Pricing follows an exchange + commission model, with fees typically starting from $1.25–$3 per contract, depending on market and account tier. Professional traders gain from lower costs when trading in higher volumes, making Saxo competitive against other multi-asset brokers.

FX Options

In addition to standard currency pairs, Saxo supports FX options trading. Fees are typically based on a per-contract structure, varying by currency pair and exchange. This product is aimed at advanced traders who require hedging strategies and flexibility beyond spot forex trading.

Rewards for Active Traders

The tiered pricing model is particularly attractive to active and high-net-worth traders. As trading volume grows, Saxo reduces spreads and commissions, making long-term trading more cost-efficient. This approach ensures that serious traders benefit from premium pricing while maintaining access to Saxo’s full suite of products and platforms.

Other Trading Costs

Financing / Overnight Rates

Like most brokers, Saxo charges financing fees (also known as overnight swap rates) for positions held open overnight. These vary by instrument and market conditions. While clearly displayed in the platform, they can impact strategies that rely on leverage or long holding periods in leveraged products.

Exchange Connectivity Fees

Saxo provides access to more than 50 global exchanges, but in some cases, there are connectivity or data fees charged by the exchanges themselves. For example, professional-level access to premium market data may carry additional charges. This cost is generally relevant for active equity and futures traders who need real-time data feeds.

Non-Trading Fees

Inactivity Fee

Saxo does not charge any inactivity fees. Unlike many brokers that penalize clients for leaving accounts dormant, Saxo allows you to keep your account open without extra costs, even if you don’t trade for long periods. This makes it more flexible and cost-effective for casual traders and long-term investors who may trade less frequently.

Currency Conversion Fees

Whenever a trade is executed in a currency different from your account’s base currency, a conversion fee applies. Saxo’s conversion costs no more than plus/minus 0.25 percent. This is important for traders who frequently access international markets across different currencies.

Account Maintenance Details

Saxo does not charge for opening or maintaining an account. Deposits are free in most cases, though withdrawal fees may apply depending on the method and region. The main ongoing non-trading costs for most clients will be currency conversions.

Final Thoughts on Costs

Overall, Saxo’s fees and commission structure reflects its position as a premium broker for serious traders. While casual users may find the costs higher than budget-focused brokers, active investors gain significant value from tiered pricing, transparency, and access to global markets. For those who prioritize market depth, security, and platform quality, Saxo’s costs are aligned with the level of service provided.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Saxo Regulated ?

Saxo Bank is one of the most heavily regulated brokers in the global trading industry. It operates under multiple top-tier licenses, giving clients confidence in the firm’s safety and reliability. The broker is authorized by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Monetary Authority of Singapore (MAS), and the Danish Financial Supervisory Authority (FSA), among others. Its global presence means that traders benefit from strong oversight across several respected jurisdictions.

A key strength of Saxo is its financial stability. The firm maintains robust capital reserves that exceed regulatory requirements, ensuring that it can withstand market shocks and continue to serve clients even during periods of volatility. Saxo also follows strict requirements around segregated client funds, meaning that customer money is kept separate from the company’s operational accounts.

For retail clients in the EU and UK, Saxo provides negative balance protection. This ensures that traders cannot lose more than their deposited capital, an important safeguard when trading leveraged products. Professional and non-EU clients may not have the same level of protection, so understanding your account classification is crucial.

Transparency is another cornerstone of Saxo’s regulatory profile. As a licensed European bank, Saxo publishes regular financial statements and reports, which are open to the public. This level of disclosure is uncommon among many online brokers and underscores Saxo’s commitment to trust and accountability.

In short, Saxo’s multi-jurisdictional regulation, strong balance sheet, and transparent reporting make it one of the safest brokers for serious traders in 2025.

Understanding Regulatory Protections and Broker Stability

For traders, knowing your money is protected is just as important as low fees or a sleek One of Saxo’s defining strengths is the security it provides to clients through regulatory protections and financial stability. As a bank-owned broker, Saxo operates under some of the most rigorous standards in the industry.

Segregated Client Funds

All client deposits are held in segregated accounts, separate from Saxo’s operational funds. This ensures that traders’ money remains protected, even if the broker faces financial difficulties. It is a core safeguard that gives clients peace of mind when trading through Saxo.

Investor Compensation Schemes

Depending on the jurisdiction, clients may also be covered by investor compensation schemes. For example, clients regulated under the UK FCA may be eligible for coverage through the Financial Services Compensation Scheme (FSCS), while those under the Danish FSA fall under Denmark’s investor protection rules. These schemes provide an added layer of protection should the broker default.

Bank-Owned and Stable

Unlike many brokers, Saxo is not just a brokerage firm but also a fully licensed European bank. This distinction reinforces its strong reputation and commitment to long-term stability. Saxo maintains robust capital reserves that exceed regulatory minimums, allowing it to remain resilient even during times of financial stress.

Proven Track Record

With more than three decades of history, Saxo has consistently demonstrated financial strength and operational reliability. The broker has weathered multiple market cycles, further proving its stability and ability to safeguard client assets.

For traders seeking a secure, transparent, and well-capitalized broker, Saxo’s combination of bank-level oversight, compensation protections, and a history of financial resilience makes it one of the most trustworthy choices available.

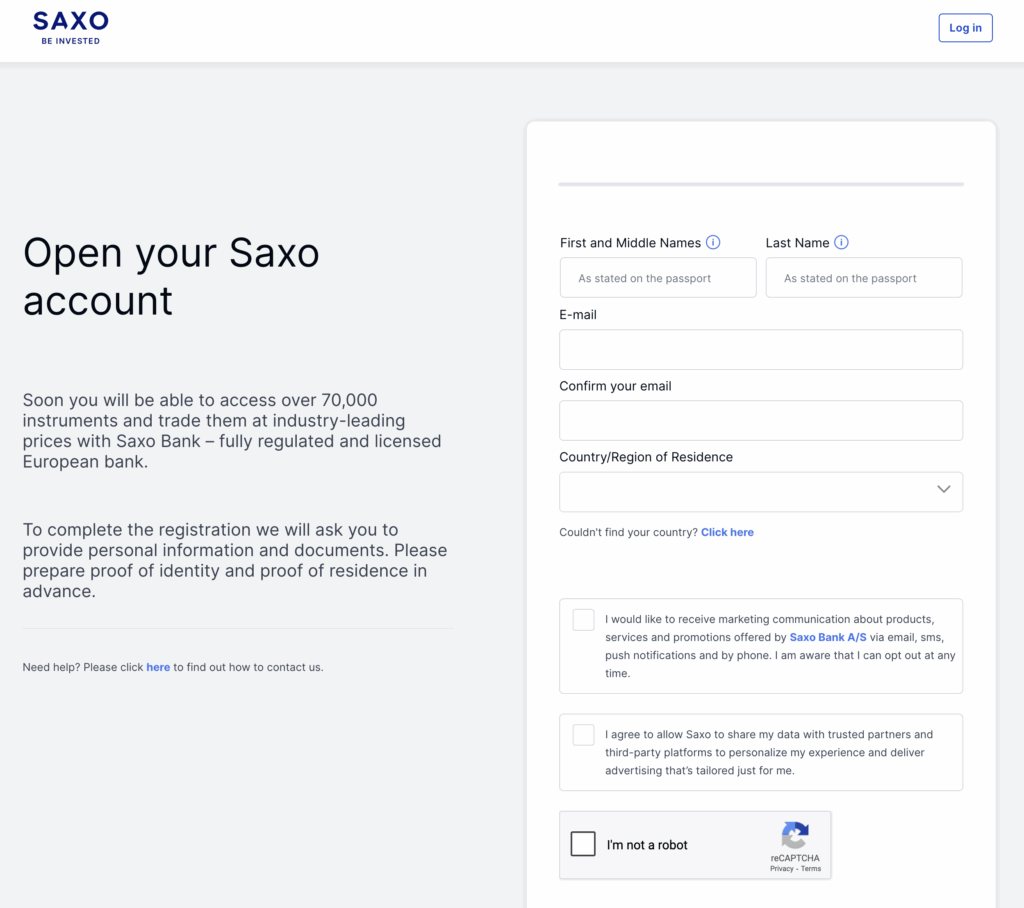

How To Open an Account

Opening an account with Saxo Bank is designed to be straightforward, though it involves more steps than with some lower-tier brokers due to its regulated, bank-level standards. Here’s what to expect:

Step 1: Start Online Application

Visit the official Saxo Bank website and click on Open Account.

Step 2: Provide Personal Details

Fill in basic information such as your name, , email, county/region of residence and phone number. You’ll also need to provide details about your employment status, income, and financial background. This helps Saxo assess your suitability for trading leveraged products.

Step 3: Complete a Trading Experience Questionnaire

As a regulated broker, Saxo must ensure that clients understand the risks of trading. You’ll answer questions about your trading history, knowledge of financial products, and investment goals. This step determines your account classification (e.g., retail or professional).

Step 4: Upload Verification Documents

To comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) rules, you’ll need to upload:

A valid photo ID (passport, national ID card, or driver’s license)

Proof of address (utility bill or bank statement, usually within the last 3 months)

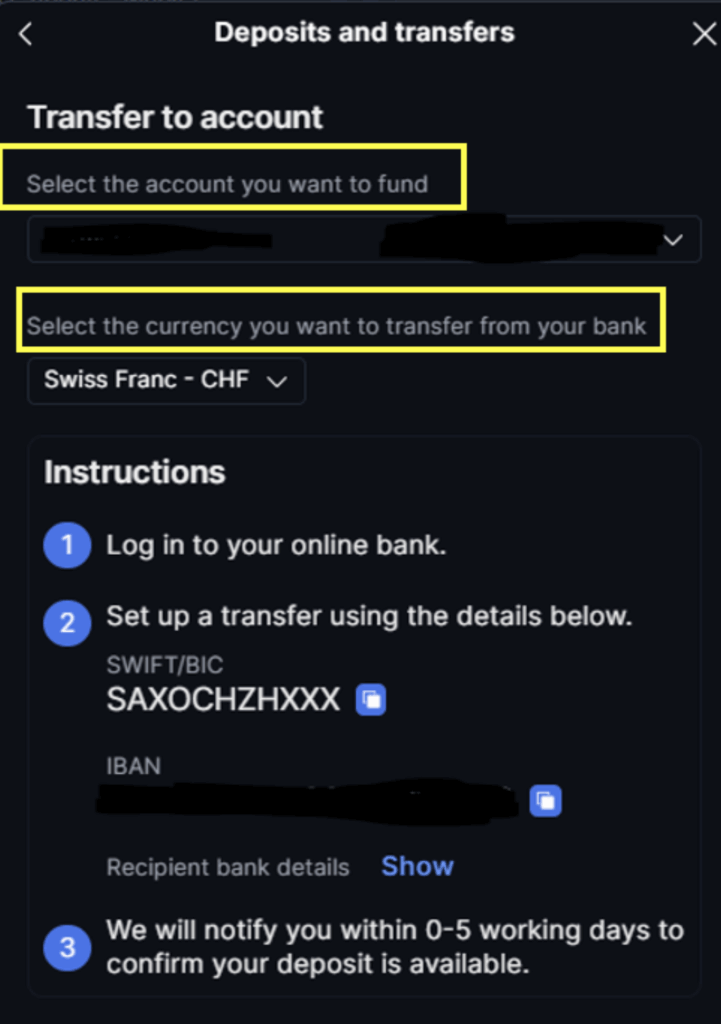

Step 5: Fund Your Account

Once approved, you can deposit funds using bank transfer, credit/debit cards, or other available payment methods (varies by region). Saxo does not require a minimum deposit, making it accessible to traders with different budgets.

Step 6: Start Trading

After funding, you’ll get access to SaxoTraderGO and, if eligible, SaxoTraderPRO. From there, you can explore over 70,000 instruments across global markets.

✅ Tip: Account approval times vary by region but typically take 1–2 business days, provided all documents are correctly submitted.

Account Types

Saxo Bank offers three main account tiers—Classic, Platinum, and VIP—each designed for different levels of trading activity and capital. The tier you qualify for depends on your initial funding or trading volume, though Saxo makes clear that no minimum deposit is required to open a Classic account.

Classic Account

The Classic account is the default level when you open your Saxo account. It requires no minimum funding for access, allowing traders of all budgets to get started. Classic-tier users pay standard pricing on trades and don’t yet benefit from the discounted rates reserved for higher tiers.

Platinum Account

The Platinum account delivers lower spreads and more favorable commissions. To qualify, you need minimum funding of USD 200,000 (or equivalent) or meet certain trading volume criteria. This tier is aimed at active traders who trade frequently and can benefit from improved pricing and enhanced service.

VIP Account

The VIP account is the top tier, offering Saxo’s most aggressive pricing and premium services. Qualification generally requires USD 1,000,000 or more in funding, or sufficiently high trading volume/loyalty program status. VIP clients enjoy maximum discounts, priority support, direct access to analysts, and exclusive event invitations.

What is the Minimum Deposit at Saxo?

One of the standout features of Saxo Bank is its no minimum funding requirement for opening a Classic account. You can open and use a Classic account even with a very modest amount, making Saxo accessible to traders of all capital levels.

However, while the Classic tier has no deposit barrier, higher account tiers do require substantial funding to qualify for their better pricing and perks. For instance:

- To upgrade to Platinum, you typically need to deposit USD 200,000 (or equivalent) or meet the trading volume criteria.

- The VIP tier generally requires USD 1,000,000 (or equivalent) or a high enough trading volume to earn that upgrade.

In short:

- Classic account: No minimum deposit required

- Platinum account: Roughly USD 200,000 required (or volume-based upgrade)

- VIP account: Senior level with approximately USD 1,000,000 required (or qualifying trading volume)

| Broker | Minimum Deposit |

|---|---|

| Saxo | $0 |

Interactive Brokers | $0 |

Swissquote | $0 |

| Forex.com | $100 |

Deposit and Withdrawal

Managing deposits and withdrawals with Saxo is generally straightforward, though the available methods and potential costs can vary by region. As a global broker with clients in more than 170 countries, Saxo provides secure funding processes designed to protect client funds while ensuring regulatory compliance. Still, traders should be aware of currency conversion charges, intermediary bank fees, and processing times that may affect the final amount received.

Deposit Fees & Options

The broker supports a variety of popular deposit methods to ensure convenience for its global client base:

No deposit fees are charged on bank wire transfers.

Debit and credit card deposits may incur operator fees, ranging from 0.51% to 2.24%, depending on the card type, currency, and issuing bank.

In some regions, local bank transfer networks are supported, which can make deposits cheaper and faster.

Withdrawal Fees & Options

Saxo’s withdrawal method is straightforward:

Manual withdrawal forms, if used, may trigger a processing fee (e.g., SGD 50 in some cases).

Additional charges may come from intermediary or correspondent banks, which are outside Saxo’s control.

Processing times usually range from 1–5 business days, depending on region and currency.

Overall Experience

Overall, Saxo offers a reliable and secure funding process. Deposits via bank transfer are cost-effective but may take a few days, while card deposits are faster though sometimes more expensive due to issuer fees. Withdrawals are smooth when handled through the online platform, though manual requests add costs and delays.

The absence of e-wallets and the policy of transferring funds only to accounts in the client’s name enhance security but limit flexibility. Traders should also factor in potential currency conversion fees and bank charges when moving money across different currencies.

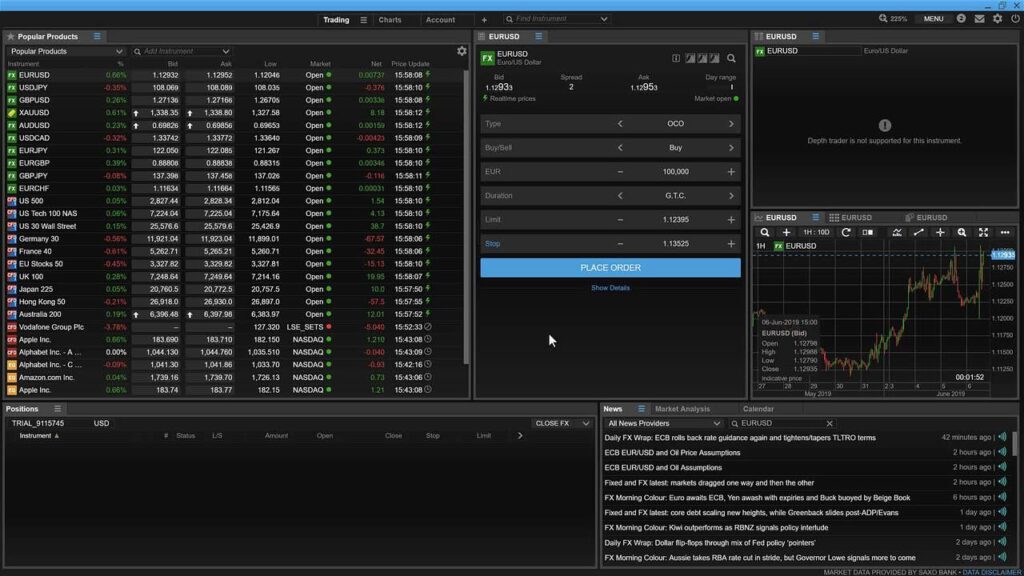

Desktop Trading Platform

Saxo offers two main platforms: the web-based SaxoTraderGO and the more advanced desktop SaxoTraderPRO. Both are excellent in their own right, but for this review, we focused on SaxoTraderPRO because it provides the deepest functionality and the kind of professional-grade features that active traders and serious investors demand.

Features and Functionality

Advanced Charting

The platform provides extensive charting features, with over 50 technical indicators, multiple chart types, and drawing tools. You can layer indicators, save chart layouts, and even trade directly from the chart with one click. For someone who relies heavily on technical analysis, this makes a big difference in speed and precision.

Market Analysis Tools

The integrated market analysis tools go beyond just quotes and charts. You can pull up market depth (Level 2 data), view option chains, and run performance breakdowns across asset classes. It feels like a professional terminal rather than a retail trading app.

Real-time Information

Streaming prices, live news, and real-time corporate actions are all built into the platform. The fact that you don’t need to constantly refresh or rely on external feeds saves time and reduces distractions during trading sessions.

Research Integration

SaxoTraderPRO connects seamlessly with Saxo’s in-house research, including market updates, analyst commentary, and investment themes. Having these insights integrated within the platform means you don’t need to switch between apps or websites while analyzing opportunities.

Educational Content Integration

Educational resources, such as platform tutorials and trading guides, are accessible from within the desktop environment. This is particularly useful when testing new features like options strategies or futures trading.

Placing Orders

Order execution is fast and versatile. You can place market, limit, stop, trailing stop, and OCO orders with ease. I found the ability to customize default order settings particularly helpful, reducing repetitive steps when trading frequently.

Alerts & Notifications

Setting price alerts, margin call notifications, and position updates is straightforward. Notifications can be configured to pop up within the platform or via email, making it easier to track key levels without staying glued to the screen.

Login and Security

Login is secured with two-factor authentication (2FA), which adds an important layer of protection. Sessions remain stable even with heavy data usage, which is reassuring during volatile markets.

Search Functions

The search bar is powerful—type in a stock ticker, currency pair, or even part of a company name, and results appear instantly. It makes navigating Saxo’s huge universe of 70,000+ instruments efficient.

Pros & Cons of the Web Platform

Pros

- Professional-grade tools: SaxoTraderPRO feels like an institutional trading terminal with advanced charting, order types, and market depth.

- Seamless research integration: Saxo’s in-house research and news feed are fully embedded, reducing the need for external sources.

- Customizable layouts: Multiple screens, saved templates, and advanced chart setups make it ideal for power users.

- Fast and reliable execution: Orders go through smoothly with minimal latency, even during volatile market conditions.

- Strong security: Two-factor authentication (2FA) and stable sessions provide peace of mind.

Cons

- Steeper learning curve: Beginners may find SaxoTraderPRO overwhelming compared to SaxoTraderGO.

- High system requirements: Runs best on powerful PCs with multiple monitors; older devices may struggle.

- Not web-based: Requires download and installation, unlike SaxoTraderGO which works from any browser.

- Best features skewed toward active traders: Occasional investors may not fully benefit from its professional features.

Mobile App

Saxo’s SaxoTraderGO mobile app is designed as the portable counterpart to its web and desktop platforms. It brings a professional trading experience to your phone or tablet without feeling cluttered. The interface is sleek, responsive, and well-optimized for both iOS and Android, making it easy to manage trades on the go.

Look & Feel and Features

The app mirrors the clean layout of SaxoTraderGO on desktop. Charts are responsive, and you can switch between timeframes, add indicators, and adjust layouts with a few taps. Watchlists sync across devices, which means any instruments you track on desktop automatically show up on mobile. The app also integrates news, research, and market analysis so you don’t miss updates while away from your computer.

Login and Security

Login is quick and secure with two-factor authentication (2FA) and biometric support like Face ID and fingerprint login. Sessions remain stable, even when switching between Wi-Fi and mobile data, so you don’t lose access mid-trade.

Search Functions

The search tool is efficient—type in a ticker, currency pair, or keyword, and results appear instantly. Given Saxo’s massive 70,000+ instrument offering, the search is crucial, and the mobile app handles it smoothly.

Placing Orders

Placing orders is straightforward. You can choose between market, limit, stop, and OCO orders directly from charts or watchlists. Order confirmation screens are clear, showing margin impact and estimated costs before execution. For active traders, the ability to set alerts and react instantly to price movements makes the mobile platform more than just a backup—it’s a serious trading tool.

Pros & Cons of the Mobile App

Pros

- Clean and intuitive interface: Easy to navigate with a design consistent across desktop and mobile.

- Powerful charting: Offers multiple indicators, drawing tools, and trading directly from charts.

- Biometric security: Face ID and fingerprint login enhance convenience and safety.

- Syncs across devices: Watchlists, alerts, and preferences automatically carry over from desktop.

- Integrated research and news: Keeps traders updated without leaving the app.

Cons

- Limited advanced tools: Some professional features of SaxoTraderPRO (like multi-screen setups or deep market analytics) aren’t available on mobile.

- Heavy data use: Streaming quotes and live charts can consume a lot of mobile data.

- Smaller screen limitations: Complex strategies like options spreads are harder to manage compared to desktop.

- Occasional delays: During high volatility, order confirmation may take a moment longer compared to desktop.

Market Research, Tools, and Education

One of the areas where Saxo really stands out is its commitment to research and educational resources. Whether you trade through SaxoTraderGO or SaxoTraderPRO, the tools feel integrated and designed for traders who want to make informed decisions rather than guesswork.

Customer Support

When trading with a broker as large and globally active as Saxo, having dependable customer support can make a big difference. Whether you’re troubleshooting a platform issue, clarifying fees, or needing help with deposits and withdrawals, the quality and accessibility of support matters. Saxo provides multiple support channels and extensive self-help resources, but the overall experience varies depending on your account tier and location.

Availability and Channels

Saxo offers support through phone, email, and live chat, though availability depends on your region. For example, in major hubs like the UK, Singapore, and Denmark, support hours align closely with local trading times, but in smaller markets, access can be more limited. There isn’t a 24/7 support option, which may be a drawback for traders who operate across multiple time zones.

Response Quality

When I tested Saxo’s support, the live chat was responsive for straightforward questions like funding methods or account setup. For more complex topics such as trading fees or platform features, I was directed to email or phone, where the answers were detailed and accurate, though not always instant.

Self-Help Resources

Saxo compensates for the limited support hours with an extensive Help Centre, packed with FAQs, funding guides, platform tutorials, and troubleshooting content. Most of the time, I found what I needed without contacting support. This self-service approach works well for traders comfortable with navigating resources, but those who prefer hands-on guidance may find it less personal.

Premium Support for Higher Tiers

Platinum and VIP account holders get access to priority service and dedicated managers, which speeds up response times and adds a more personal touch. This tiered model means that while all clients receive solid support, the best service is reserved for higher-value accounts.

Verdict

Overall, Saxo’s customer support is reliable and knowledgeable, though not the most accessible compared to brokers with round-the-clock service. Active traders and professionals will appreciate the accuracy and expertise of responses, while beginners may rely more heavily on the self-help resources before reaching out.

FAQ

Is Saxo a regulated broker?

Yes, Saxo is regulated by top-tier authorities including the FCA (UK), ASIC (Australia), MAS (Singapore), and the FSA (Denmark), among others.

What is the minimum deposit at Saxo?

Saxo has no minimum deposit requirement to open a standard account, but higher-tier accounts like Platinum and VIP have minimum funding thresholds.

What account types does Saxo offer?

There are three main account tiers: Classic, Platinum, and VIP, each offering different pricing, service levels, and perks.

What instruments can I trade on Saxo?

Saxo gives access to over 60,000 tradable instruments, including stocks, ETFs, forex, bonds, commodities, futures, options, and crypto ETPs.

Does Saxo charge an inactivity fee?

No, Saxo does not charge an inactivity fee, unlike many competitors.

What are Saxo’s trading fees like?

Saxo charges tiered commissions on stocks and ETFs, competitive forex spreads starting from 0.4 pips, and transparent fees for futures and options.

Can I trade crypto directly on Saxo?

No, Saxo does not offer direct crypto trading, but it does provide access to crypto ETPs (Exchange-Traded Products).

What trading platforms does Saxo provide?

Saxo offers its web-based platform and the professional-grade SaxoTraderPRO, available on desktop and mobile.

Is Saxo good for beginners?

Saxo is best suited for experienced and active traders. While beginners can use it, the fee structure and advanced tools may feel overwhelming at first.

How do I deposit and withdraw money?

Saxo supports bank transfers and credit/debit card deposits (in some regions). Withdrawals are made to your verified bank account, usually processed within 1–3 business days.