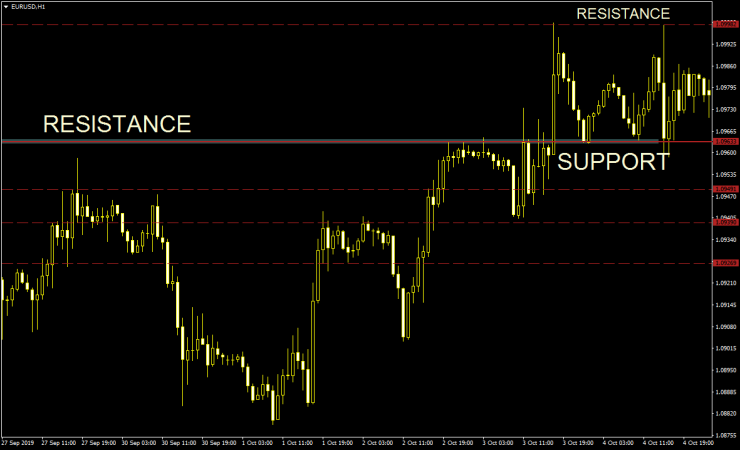

The concepts of support and resistance are probably the most popular and the most basic techniques that technical analysis offers. Despite their simplicity, they are very powerful tools. Their concept is related to the “market’s memory.” They are levels that the price touched several times without crossing (breaking) above (resistance) or below (support).

When the price of the asset approaches a resistance level, it is expected that more sellers will show up and price will bounce to the downside. On the flip side, when price is falling toward a support level, it will likely attract buyers, favoring a rebound. If the price breaks the support (resistance), it could create a signal as it suggests that it will continue to fall (rise) toward the next support (resistance) after having cleared clustered demand (supply).

Traders use support and resistance in combination with other indicators to enrich the analysis. When a signal emerges from an indicator, if the price is trading near a resistance level, for example, the trader might wait for the breakout of the resistance to add confidence to the signal.

Support and resistance levels not only refer to recent levels. An old support level could reemerge later and if it has been broken, it could turn into a potential resistance area and vice versa. There are also some natural levels, like round numbers, that also could act as support and resistance points. The “levels” of support and resistance should be seen as areas, not only the exact number. Support and resistance areas can also be identified using trendlines and moving averages.