Swissquote REVIEW 2025

Wondering if Swissquote is the right broker for you in 2025? This review takes you inside one of Switzerland’s most trusted financial institutions to see how it performs in today’s fast-moving markets. With a strong regulatory foundation, advanced trading platforms, and access to millions of global assets, we’ll explore whether Swissquote truly lives up to its reputation for safety, innovation, and reliability.

Broker Guide's Swissquote Review in 2025

In this Swissquote Review 2025, I take a closer look at one of the most established and trusted brokers in global trading. Swissquote is not just a broker but a fully licensed Swiss bank that has been connecting traders to international markets since 1996.

I wanted to review Swissquote because it offers a rare combination of bank-grade security, advanced trading platforms, and a wide selection of assets, appealing to both new and experienced traders. Here, you’ll find a clear breakdown of what to expect in 2025, from its fees and platforms to account types, regulation, and customer service, so you can decide if Swissquote is the right place to grow your trading journey.

About Swissquote

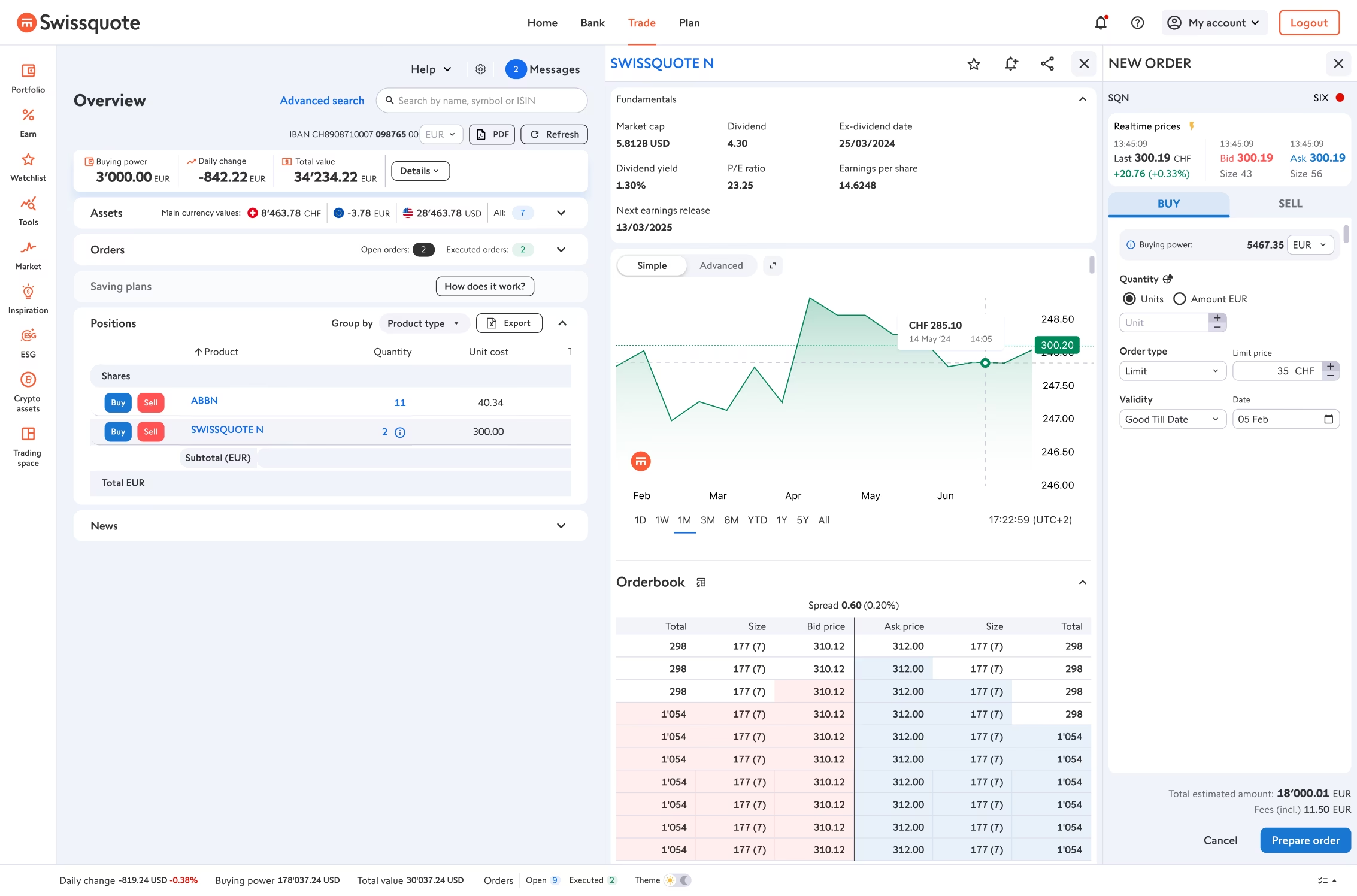

Founded in 1996 and headquartered in Gland, Switzerland, Swissquote has evolved from a local financial services firm into a globally recognized online bank and brokerage. The company is publicly listed on the SIX Swiss Exchange (SQN), which highlights its transparency, financial strength, and long-standing credibility in the trading industry.

Global Presence

Swissquote now serves over 700,000 clients worldwide, with offices in key financial centers including the United Kingdom, Dubai, Luxembourg, Hong Kong, Singapore, and Cyprus. This international footprint allows it to provide region-specific services while maintaining Swiss banking standards of reliability and security.

Services and Markets

As both a bank and investment broker, Swissquote offers an extensive range of financial products. Clients can trade forex, CFDs, cryptocurrencies, ETFs, bonds, options, and global stocks, giving them access to both traditional and modern markets from a single account.

Brand Partnerships

Adding to its global visibility, Swissquote is an official partner of ZSC Lions and the UEFA Europa League, partnerships that reinforce its reputation for performance, innovation, and trust across the financial and sporting worlds.

Swissquote stands out as a broker that bridges traditional banking security with modern trading innovation. It’s a solid choice for those who value regulation, credibility, and a broad market offering, even if it comes at a slightly higher cost than some of its lower-tier competitors.

My Quick Verdict: Who is Swissquote Best For?

Overall Rating: 4.4/5

Best For: Traders and investors who prioritize safety, diverse market access, and the reliability of a Swiss banking institution.

Not Ideal For: Those looking for ultra-low spreads, commission-free trading, or 24/7 customer support.

Swissquote delivers a premium trading experience backed by Swiss banking security and Tier-1 regulation. It offers a vast selection of markets, ranging from forex and stocks to cryptocurrencies and ETFs, all supported by powerful platforms such as MetaTrader and its proprietary CFXD.

The broker stands out for its research tools, educational resources, and transparent operations as a publicly listed company. However, traders should be aware that Swissquote’s pricing structure—while fair—tends to be higher than the industry average. Overall, it’s an excellent choice for those who prefer long-term stability, trust, and professional-grade trading over budget-friendly costs.

Pros

- Tier-1 regulation across multiple jurisdictions, including FINMA, FCA, MAS, SFC, DFSA, CySEC, MFSA, and CSSF

- Banking license ensures top-level safety and strong client fund protection

- Access to a wide range of over 3 million instruments, covering forex, stocks, ETFs, bonds, options, and crypto

- No inactivity fee for accounts under the Swiss (CH) entity

- Offers MetaTrader 4 & 5 alongside proprietary platforms like CFXD and TradingView integration

- Excellent educational resources and professional-grade market research tools

- Supports cryptocurrency trading and staking, including 50+ digital assets

Cons

- High minimum deposit starting from $1,000

- Higher spreads compared to industry averages

- No fixed-spread accounts available

- Research tools are split between platforms, limiting convenience

- Not available to U.S. or Canadian residents due to regulatory restrictions

Why You Should Choose Swissquote ?

One of the main reasons traders choose Swissquote is its foundation as a fully licensed Swiss bank. Unlike most online brokers, Swissquote combines banking and brokerage services under one roof, giving clients the security of holding funds within a regulated Swiss financial institution. Each client also receives a personal IBAN, allowing for smooth integration between trading and everyday banking. This unique setup brings an extra layer of confidence to investors who prioritize safety and stability in uncertain markets.

Proven Trust and Transparency

Swissquote holds a Trust Score of 99/99 according to some independent reviewers, reflecting its outstanding reputation for compliance, security, and reliability. Being publicly listed on the SIX Swiss Exchange further enhances its transparency, as the company regularly publishes audited financial reports and meets strict capital requirements. Clients know exactly where their money is and how the company operates.

Innovation That Keeps Evolving

Beyond safety, Swissquote continues to innovate. It offers cutting-edge trading tools like Autochartist for market analysis and TradingView charts for better visualization. The broker’s proprietary CXFD platform has been consistently upgraded for speed and usability, while the SQX crypto exchange expands opportunities for digital asset traders. Together, these tools position Swissquote as a modern, forward-thinking broker that doesn’t just rely on its banking heritage—it builds on it.

The Bottom Line

Swissquote’s appeal in 2025 lies in its blend of trust, technology, and transparency. It provides a stable, bank-backed environment for traders who value both security and innovation, making it a top choice for those seeking long-term reliability in their financial journey.

Compare to Top Competitors

When evaluating Swissquote, it’s worth seeing how it stacks up against some of the biggest names in the trading industry. While Swissquote’s strength lies in its bank-level safety, transparency, and range of services, its pricing and platform structure cater more to serious traders and investors than casual users. Here’s how it compares with Interactive Brokers, Saxo Bank, and Pepperstone in 2025.

Saxo

IG

Interactive Brokers

Exploring Swissquote’s Range of Tradable Instruments

One of Swissquote’s biggest strengths lies in the breadth and diversity of its tradable instruments. With access to more than 3 million financial products, the broker offers one of the largest selections available in the retail trading space.

Whether you’re an active day trader, a long-term investor, or someone looking to diversify across asset classes, Swissquote provides a unified platform that combines traditional investing, modern trading, and digital assets.

Extensive Market Coverage

Swissquote clients can trade across multiple global markets, including Forex and CFDs (472 symbols), stocks, ETFs, options, futures, and bonds. This wide coverage allows traders to build portfolios that span from blue-chip equities and commodities to index futures and fixed-income products.

Such variety makes Swissquote comparable to full-service brokers like Saxo Bank and IG, which also cater to professional investors seeking access to multi-asset opportunities.

Expanding into Cryptocurrencies

In addition to traditional instruments, Swissquote has become a pioneer in cryptocurrency trading among regulated brokers. It offers 52 physical cryptocurrencies—including Bitcoin, Ethereum, and Cardano—along with staking services that allow users to earn passive rewards on supported coins.

All crypto assets are securely custodied under Swiss banking protection, providing extra confidence for digital investors. However, it’s worth noting that crypto CFDs are not available to UK retail clients due to FCA regulations, in line with industry standards.

Thematic Investing and Robo-Advisory

Beyond manual trading, Swissquote also supports thematic investing and robo-advisory services. These automated solutions make it easier for investors to gain exposure to curated portfolios based on specific trends—such as clean energy, AI, or technology—without needing to select individual securities.

The Robo-Advisor automatically rebalances portfolios to match a user’s risk tolerance, ideal for those who prefer a hands-off approach.

eTrading vs eForex Accounts

Swissquote offers two main account structures: eTrading and eForex. The eTrading account focuses on shares, funds, ETFs, and bonds, while the eForex account is dedicated to forex and CFD trading. This separation ensures traders have the right tools, pricing, and platform setup for their preferred market type.

Final Thoughts

Compared to competitors like Saxo Bank, CMC Markets, and IG, Swissquote holds its own with an impressive range of markets and innovative investment features. Its mix of bank-grade security, crypto integration, and multi-asset access makes it a top choice for those seeking a complete trading and investing ecosystem.

| Asset | Swissquote |

|---|---|

| Forex Pairs | 55 |

| Forex Trading | CFDs: Yes Spot: Yes |

| Tradeable Symbols (Swissquote’s eForex) | 472 |

| Stocks and ETFs | 20,000 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency | Physical: Yes Derivative: Yes |

How Swissquote’s Instruments Compare to Competitors

| Asset | Swissquote | Interactive Brokers | Saxo | IG |

|---|---|---|---|---|

| Forex | ||||

| CFDs | ||||

| Stocks & ETFs | ||||

| Options | ||||

| Futures | ||||

| Bonds | ||||

| Cryptocurrency (Physical) | ||||

| Crypto CFDs | ||||

| Thematic Investing | ||||

| Commodities |

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $1000 |

| Average Spread EUR/USD | 1.6 pips |

Average GBP/USD Spread | 1.9 |

| Forex CFD Fees | Low |

Options Commissions | High |

| Custody Fees | 0.025% of total assets per quarter, with a CHF 15 minimum and a CHF 50 maximum |

Mutual Fund Commissions | Average |

| Futures Fees | High |

| Index CFD fees | Low |

Spot Crypto Fees | High |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 fees internally for bank transfers within SEPA, $10 for other cases |

| Inactivity Fee | The fee is set at a maximum of 10 units of your base currency (CHF, USD, EUR, or GBP) after 6 months of no activity |

Swissquote’s pricing model reflects its reputation as a secure, bank-regulated broker. The fees are slightly higher than the industry average, but the added cost comes with greater transparency, safety, and quality of service. Traders know exactly what they are paying for—professional-grade execution, Swiss regulation, and reliable fund protection.

Trading Fees

Spreads:

Standard account: 1.7 pips

Premium account: 1.4 pips

Prime account: 0.6 pips

These spreads are competitive but not the lowest. They cater to traders who value stability and execution speed over raw cost savings.

Commissions

Forex and CFDs:

No separate commission; costs are built into the spread.

Stocks: Between 0.03% and 0.15%, depending on region and exchange.

ETFs: Charged similarly to stock trades.

Crypto Trading Fees

A 1% fee per trade applies to most transactions. This drops to 0.5% for larger trades or higher-volume clients.

Example:

A 1.7-pip EUR/USD spread equals about $34 for a round-turn trade.

Swissquote’s spreads are higher than some competitors, but its execution quality and transparency make it reliable for consistent trading results.

Other Trading Costs

Overnight swaps: Vary depending on currency pair and are tripled on Wednesdays to cover weekend positions.

Deposit fees:

Free via bank transfer.

2.2–2.5% fee for credit/debit card deposits.

Withdrawal fees:

Around $10 / €10 per transaction, depending on currency and region.

Swissquote’s deposit and withdrawal policies are straightforward, with no hidden costs. However, card deposits can be expensive for frequent traders.

Non-Trading Fees

Inactivity fee:

- None under Swissquote Bank (CH).

- €100 per quarter for Swissquote Europe (LUX) accounts.

Currency conversion fee:

- Applies when trading or transferring across different base currencies.

Custody fee:

- 0.025% per quarter, with a CHF 15 minimum and CHF 50 maximum.

While the custody fee is standard for a bank, it’s higher than what most online-only brokers charge.

Final Verdict

Swissquote’s fees are transparent, fair, and well-justified by the safety it offers. While it’s not the cheapest broker, it provides exceptional fund protection, advanced platforms, and professional-grade reliability. For traders who value trust, regulation, and a seamless banking-trading experience, Swissquote remains a premium choice in 2025.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Swissquote Regulated ?

Yes, Swissquote is one of the most heavily regulated brokers in the world, operating under the oversight of eight major financial authorities. These include FINMA (Switzerland), FCA (UK), DFSA (Dubai), CySEC (Cyprus), MFSA (Malta), MAS (Singapore), SFC (Hong Kong), and CSSF (Luxembourg) (BestBrokers, Swissquote Review 2025 – BrokerChooser). Such broad regulatory coverage ensures that Swissquote adheres to strict financial, operational, and client protection standards across multiple jurisdictions.

The company is also a publicly listed institution, operating under Swissquote Group Holding Ltd (SIX: SQN) on the SIX Swiss Exchange. This listing adds an extra layer of transparency, as Swissquote must publish regular audited financial statements and meet rigorous capital adequacy requirements.

As a licensed Swiss bank, Swissquote follows Swiss banking laws and maintains strong capital reserves, offering additional protection for client funds. Investor protection levels vary by region:

- Switzerland (FINMA): Up to CHF 100,000 per client

- United Kingdom (FCA/FSCS): Up to £85,000

- Luxembourg (CSSF): Up to €100,000 for cash deposits and €20,000 for securities

These protections, combined with the broker’s long-standing reputation and multi-jurisdictional regulation, make Swissquote one of the safest and most transparent brokers available in 2025.

Understanding Regulatory Protections and Broker Stability

Swissquote’s reputation for reliability is rooted in its strong regulatory framework and banking-grade financial stability. As both a licensed bank and a global broker, it follows some of the most stringent compliance and operational standards in the financial industry.

All client funds are fully segregated from the company’s operational accounts and held in Tier-1 banks, ensuring that customer assets remain protected even in the unlikely event of insolvency. In addition, EU retail clients benefit from negative balance protection, which means traders can never lose more money than they deposit—an important safeguard for volatile market conditions.

Swissquote’s transparency is another key strength. The company publishes quarterly and annual financial reports, providing detailed insights into its financial health, liquidity, and risk management practices. Its public listing on the SIX Swiss Exchange adds another layer of accountability, as it must adhere to continuous disclosure obligations and undergo regular audits.

As a licensed Swiss bank, Swissquote is required to maintain capital reserves that exceed MiFID and EU regulatory requirements, reinforcing its financial strength and ability to absorb market shocks. It is also a member of the Swiss Bankers Association and is audited annually by independent authorities to verify compliance, governance, and client protection standards.

Together, these measures ensure that Swissquote remains one of the most stable and trustworthy trading institutions, providing clients worldwide with a secure and transparent environment for investing and trading.

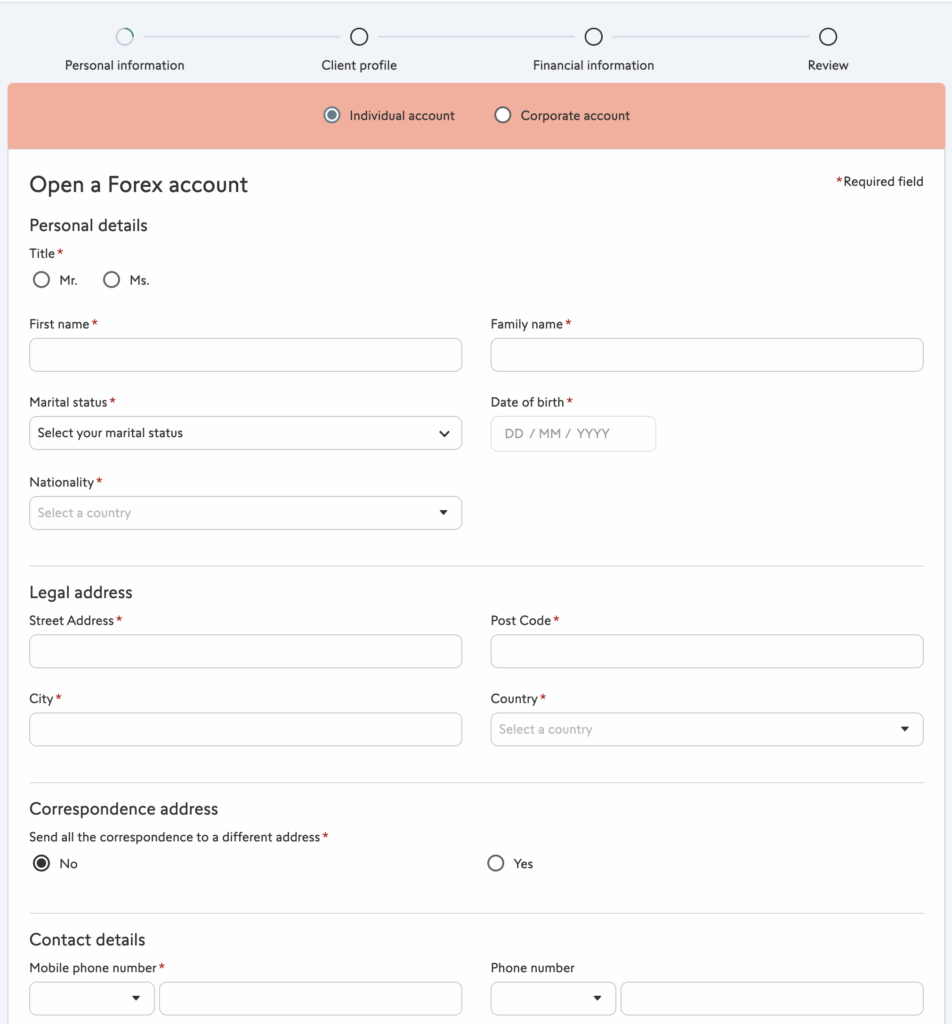

How To Open an Account

Opening an account with Swissquote is a simple, fully online process that takes only about 10–15 minutes. The broker has designed the registration flow to be fast, intuitive, and compliant with international regulations, making it suitable for both new and professional traders.

Here’s how to get started:

Step 1: Begin Online Registration

- Visit the Swissquote website and click “Open Your Account.”

- Fill out basic personal information such as name, country, and contact details.

- Provide your financial background and trading experience to help Swissquote determine suitability.

Step 2: Identity Verification

- Upload a valid government-issued ID (passport, driver’s license, or national ID card).

- Upload a proof of address, such as a recent utility bill or bank statement (issued within the last 3 months).

The verification process is typically completed within 24 hours, allowing you to start trading the next business day.

Once approved, you’ll receive your account credentials and can make your first deposit. The process is secure, efficient, and designed to help you start trading global markets quickly and confidently.

Account Types

The broker offers a variety of account types designed to suit different trader profiles—from beginners to institutional investors. Each account comes with its own minimum deposit requirement, spread structure, and trading benefits, allowing clients to choose the setup that best matches their goals and experience level.

Standard

Minimum deposit: $1,000

Spread: From 1.7 pips

Commission: None

Best for: Beginners

Premium

Minimum deposit: $10,000

Spread: From 1.4 pips

Commission: None

Best for: Active traders

Prime

Minimum deposit: $50,000

Spread: From 1.1 pips

Commission: None

Best for: High-Volume Traders

Professional

Minimum deposit: Custom

Spread: Negotiated

Commission: Negotiated

Best for: Institutional / Expert Traders

Key Features

- Negative Balance Protection:

Every account type includes negative balance protection, ensuring that traders cannot lose more than their deposited funds—even in volatile markets. - Automated Trading Support:

Swissquote fully supports Expert Advisors (EAs) and other forms of automated trading, allowing users to implement algorithmic or strategy-based systems on MetaTrader and other supported platforms. - Variable Contract Sizes:

Traders can adjust position sizes to match their strategies and risk preferences, providing flexibility for both conservative and aggressive trading styles.

Additional Account Options

- Joint Accounts:

Ideal for partners or family members who wish to share access and manage a portfolio together. - Corporate Accounts:

Designed for companies and institutional clients that trade under a legal business entity. - Islamic (Swap-Free) Accounts:

Available for traders following Sharia-compliant principles. These accounts do not accumulate swap or interest charges on overnight positions.

Summary

Swissquote’s account structure is simple and transparent, with no hidden fees or commissions on forex and CFD trades. While the minimum deposits are higher than some competitors, the broker compensates with Swiss banking security, powerful platforms, and professional-grade execution. Each account type caters to a different level of experience, ensuring traders—from beginners to institutions—can find the right fit for their trading needs.

What is the Minimum Deposit at Swissquote?

Swissquote requires a minimum deposit of $1,000 to open a Standard account, while more advanced tiers have higher requirements—$10,000 for Premium and $50,000 for Prime. These amounts reflect Swissquote’s position as a premium, bank-regulated broker focused on serious traders and investors. Compared to competitors like Interactive Brokers ($0) or IG ($0), Swissquote clearly targets mid- to high-level traders who value reliability, strong regulation, and access to a wide range of markets. While the entry cost is higher, clients benefit from Swissquote’s banking-grade security, institutional infrastructure, and professional trading environment.

| Broker | Minimum Deposit |

|---|---|

| Swissquote | $1000 |

| Saxo | $0 |

IG | $0 |

Interactive Brokers | $0 |

Deposit and Withdrawal

Swissquote makes funding and withdrawing from your trading account straightforward, with clear policies and no hidden charges. The broker offers several payment methods depending on your location and the Swissquote entity you’re registered with.

Deposit Fees & Options

The broker supports a variety of popular deposit methods to ensure convenience for its global client base:

Supported Currencies

Swissquote supports 21 base currencies, providing flexibility for international traders who wish to fund their accounts in their preferred currency.

Local Methods

Depending on the entity, local payment systems are also supported—for example, SEPA transfers within the EU and local clearing options for accounts under Swissquote Europe.

Swissquote ensures all deposits are processed securely and credited to the correct trading account. Funds are always held in segregated accounts under Tier-1 Swiss banking protection.

Withdrawal Fees & Options

Bank Transfer Only

Withdrawals are processed exclusively via bank transfer, ensuring security and compliance with anti-money laundering regulations.

Fees

Withdrawal fees range between $2 and $10, depending on the destination and currency.

SEPA Transfers

Within the EU, SEPA withdrawals are typically faster and cheaper, often taking 1–2 business days.

Verdict

Swissquote’s deposit and withdrawal process is transparent, fast, and reliable. While the lack of e-wallet options or card withdrawals may be limiting for some traders, the security and efficiency of Swissquote’s banking system make it a dependable choice for funding and managing your trading account.

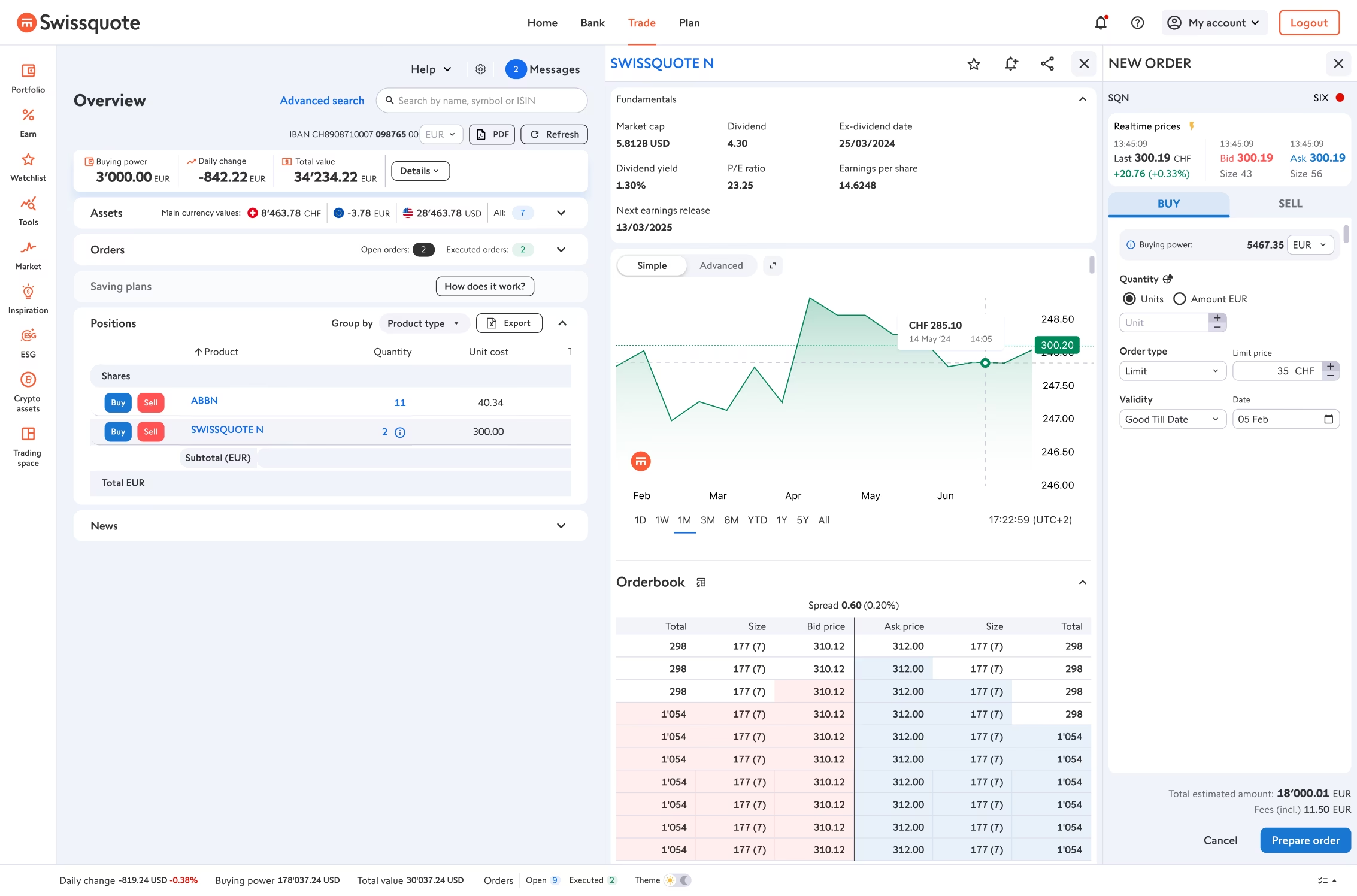

Web Trading Platform

Swissquote delivers a complete desktop trading experience that combines professional performance, flexibility, and security. Traders can choose between the broker’s proprietary CFXD platform or the widely used MetaTrader 4 and MetaTrader 5 suites. Both platforms provide access to global markets, advanced analysis tools, and stable execution environments built for precision and control.

The CFXD Platform

Swissquote’s CFXD platform is its next-generation proprietary trading software, developed to replace the older Advanced Trader desktop version. CFXD features a clean, modern interface with customizable layouts, making it ideal for both new and experienced traders.

Key Features:

TradingView integration for advanced charting with hundreds of indicators and drawing tools.

Autochartist signals that identify trading patterns and entry opportunities in real time.

Multi-window setup for monitoring multiple markets simultaneously.

While CFXD offers powerful charting and execution tools, it lacks a built-in news feed (ForexBrokers), meaning users may need to access external sources for live market updates.

MetaTrader 4 and MetaTrader 5

The broker also supports MT4 and MT5, the industry’s most popular trading platforms. These platforms provide:

Access to 333+ CFD products, including forex, indices, and commodities.

Automated trading through Expert Advisors (EAs).

Advanced charting and technical indicators.

Custom add-ons and third-party plug-ins for deeper functionality.

Placing Orders

Both CFXD and MetaTrader allow fast and intuitive order placement. Traders can execute market, limit, stop, and trailing stop orders directly from the chart. The platforms also support one-click trading and customizable order types to suit different strategies and risk levels.

Security

As a Swiss-regulated bank, Swissquote’s platforms maintain bank-grade encryption and authentication protocols. All transactions are protected using SSL encryption and two-factor authentication (2FA) to ensure maximum account safety.

Research and Education

Its web trading platforms include integrated access to Autochartist for technical insights, plus regular market analysis and webinars from in-house experts. Traders can also access Swissquote’s Learning Center, which offers tutorials and video guides designed to help users get the most out of the platforms.

Verdict

Swissquote’s desktop trading platforms combine innovation, stability, and professional tools. The CFXD platform is ideal for modern traders seeking advanced features and seamless execution, while MT4 and MT5 cater to those who prefer automation and familiarity. Both deliver the reliability and security that define Swissquote’s reputation as a trusted global broker.

Pros & Cons of the Web Platform

Pros

- Multi-chart layout for monitoring several instruments and timeframes at once.

- Autochartist signals integrated into the platform to identify trading opportunities automatically.

- Seamless execution with fast order processing and minimal slippage.

Cons:

- No integrated news or headlines, requiring traders to check external sources for market updates.

Limited in-platform research tools, as most analysis and educational content are accessed through Swissquote’s website rather than directly within the platform.

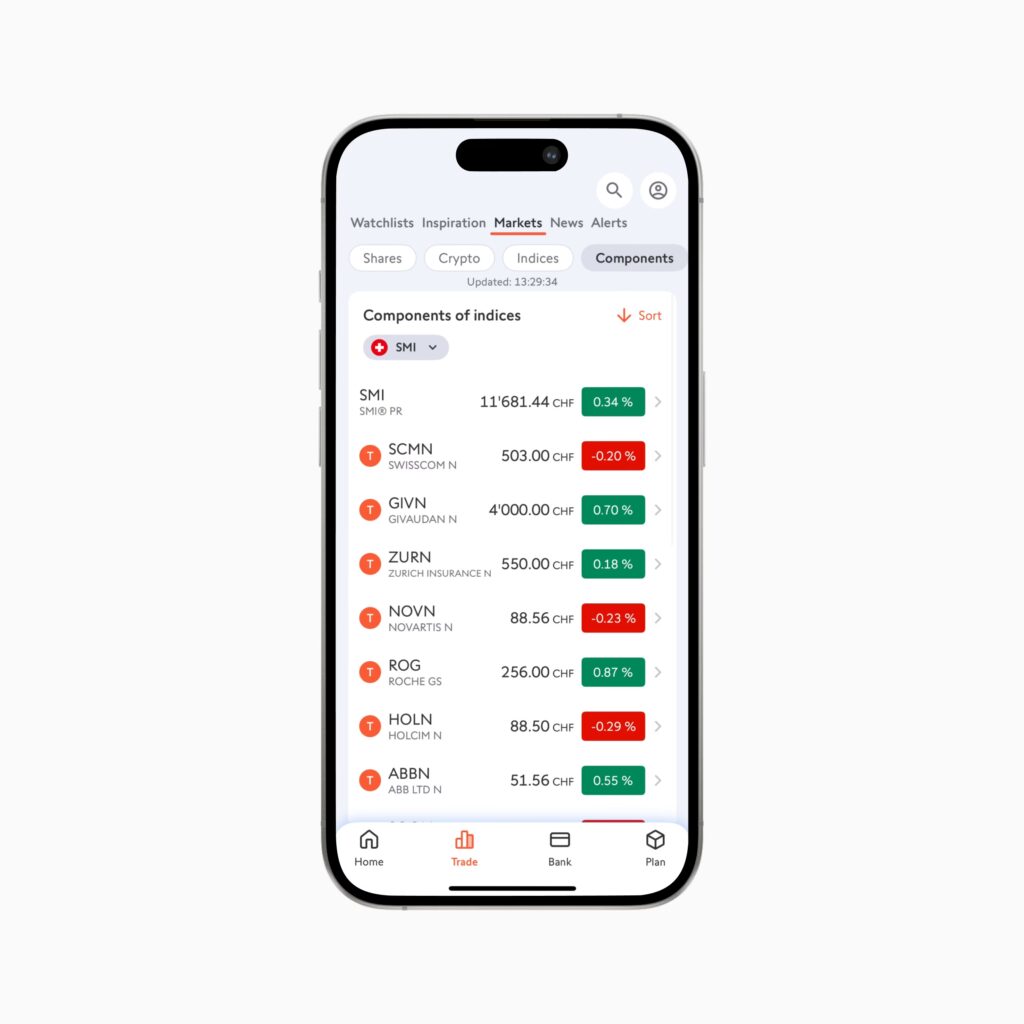

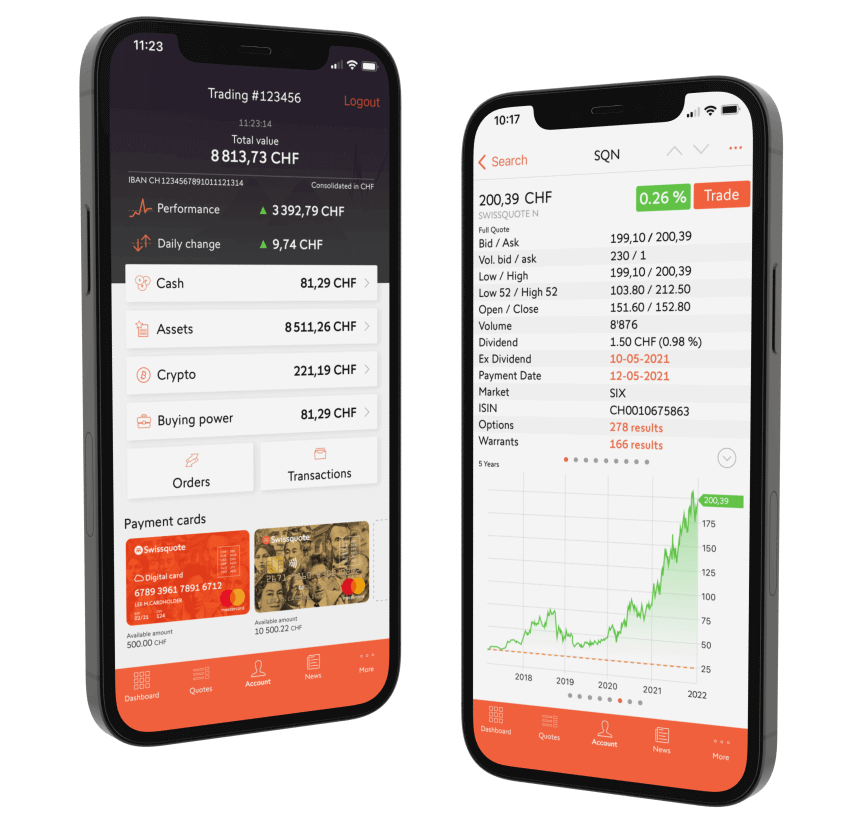

Mobile App

Swissquote’s mobile trading app combines convenience, security, and professional functionality in one sleek package. Designed for traders who prefer flexibility, it provides access to global markets directly from your smartphone or tablet. Available for both iOS and Android, the app ensures a smooth and secure trading experience anytime, anywhere.

Platform Availability and Compatibility

The Swissquote mobile app is available for iOS, Android, and Huawei devices, and is compatible with both phones and tablets. Traders can choose between the Swissquote CFXD app or the MetaTrader 4 and MetaTrader 5 mobile platforms, depending on their trading preferences. Each offers responsive layouts, intuitive navigation, and quick access to order management and charting tools.

User Experience and Features

The mobile app delivers a clean, user-friendly interface packed with essential trading functions:

Real-time market data and price quotes.

Interactive charts with multiple timeframes and indicators.

Built-in Autochartist integration for trading signals and pattern recognition.

Custom alerts and push notifications for price changes and trade updates.

Access to educational videos and research materials for continued learning.

The layout is designed to be intuitive, allowing even new traders to navigate and trade confidently.

Placing Orders

Order placement on the Swissquote mobile app is simple and efficient:

One-tap trading directly from charts or order screens.

Choose between market, limit, stop, and trailing stop orders.

Modify or close positions instantly with real-time synchronization to the desktop platform.

Preview order details before execution for added accuracy.

Performance and Reliability

The app is optimized for speed, stability, and security, even during volatile market conditions. It features bank-grade encryption, two-factor authentication (2FA), and biometric login options for maximum protection. Execution speed is consistent, and account data syncs seamlessly across all platforms.

Verdict

Swissquote’s mobile app offers a strong balance between simplicity and functionality. It’s ideal for traders who want a dependable way to manage their trades on the go. While it lacks some of the advanced charting tools found on the desktop version, its speed, usability, and security make it one of the most reliable mobile trading solutions in the market.

Pros & Cons of the Mobile App

Pros

- Easy onboarding process with quick account setup and verification.

- Secure login options, including biometric access and two-factor authentication (2FA).

- Custom alerts and push notifications to stay updated on market movements.

- Smooth and responsive interface for effortless navigation and order placement.

Cons:

- Charting tools are less advanced compared to competitors such as IBKR and Saxo Bank.

- Limited access to in-depth research and analysis features directly within the app.

Market Research, Tools, and Education

Traders and investors have access to an impressive range of research tools and educational resources that make it easier to understand the markets and make informed decisions. The broker’s ecosystem blends automated insights, economic analysis, and investor education, appealing to both short-term traders and long-term portfolio builders.

Autochartist: Automatically scans markets to identify chart patterns and emerging trade opportunities in real time.

Economic Calendar: Lists upcoming global events, central bank decisions, and key data releases—essential for planning trades around volatility.

Market Sentiment Indicators: Show how traders are positioned across major assets, helping users interpret overall market confidence or caution.

Trading Central (available on MT4/MT5): Provides professional-grade analysis, trading signals, and technical forecasts directly inside the MetaTrader platform.

These tools combine automation and expert research, allowing users to track both technical setups and broader macroeconomic shifts.

Video Tutorials: More than 25 built-in videos guide traders through platforms, tools, and trading strategies.

Live Webinars: Regular sessions led by market analysts cover current events, trading psychology, and technical insights.

Market Insights: In-depth articles and reports keep traders informed about economic trends and market drivers.

Robo-Advisory & Thematic Investing: Educational support extends into investing themes like AI, green energy, and healthcare, helping long-term investors diversify intelligently.

The content is practical, clear, and focused on building real trading competence.

However, real-time news integration within the platform is limited, which may leave day traders looking for external news feeds. Still, the available tools and educational content create a well-rounded learning and research environment for any trading approach.

Customer Support

Customer service is a key part of the overall trading experience, and this broker delivers reliable, multilingual support to assist traders worldwide. Whether you’re a beginner setting up your first account or an experienced investor troubleshooting a technical issue, help is readily available through several direct contact channels.

Availability and Contact Options

Support operates 24 hours a day, five days a week, through live chat, email, and phone. Traders can reach out in multiple languages, including English, French, German, Arabic, Italian, and Spanish, depending on their region and account entity.

- Live Chat: The quickest way to get help for platform, account, or technical questions.

- Email Support: Ideal for document verification, deposits, or follow-up inquiries.

- Phone Lines: Regional contact numbers are available for faster service during market hours.

Each regional office—Switzerland (CH), the UK, the EU, and the Middle East (MEA)—manages its own support channels, ensuring clients connect with representatives familiar with local regulations and services.

Response Quality

Support agents are knowledgeable, professional, and efficient. Most inquiries are resolved on the first contact, with clear explanations and friendly communication. Live chat responses are typically provided within minutes, while email replies are handled within one business day.

The only noticeable drawback is the absence of 24/7 availability, meaning assistance isn’t provided during weekends when markets are closed.

Verdict

Customer support quality is excellent overall, combining fast response times, professional staff, and multilingual accessibility. Although it lacks weekend coverage, the team’s expertise and commitment to clear communication make it a dependable support system for traders across all experience levels. For weekday trading hours, the service is among the most responsive and well-trained in the industry.

FAQ

Is Swissquote safe and legit?

Yes, it is. Swissquote is one of the most secure and trusted brokers globally. It operates as a fully licensed Swiss bank regulated by FINMA, and is also authorized by several other Tier-1 regulators including the FCA in the UK, MAS in Singapore, CySEC in Cyprus, and DFSA in Dubai. Client funds are held in segregated Tier-1 bank accounts and protected up to CHF 100,000 under Swiss depositor insurance. Additionally, Swissquote is publicly listed on the SIX Swiss Exchange (SQN), which ensures regular auditing, full transparency, and financial accountability.

What can I trade with Swissquote?

Clients can trade across more than three million financial instruments, offering one of the most diverse selections in the industry. Available markets include forex and CFDs, stocks, ETFs, bonds, commodities, indices, and options. It also provides access to 52 physical cryptocurrencies with staking options, along with thematic portfolios and robo-advisory services for investors who prefer automated or long-term investing strategies.

How much is the minimum deposit?

The minimum deposit depends on the account type. The Standard account requires $1,000, the Premium account $10,000, and the Prime account $50,000. These requirements are higher than average, reflecting Swissquote’s focus on mid- to high-level traders who value banking-grade security and institutional infrastructure.

Does Swissquote charge inactivity fees?

There is no inactivity fee under Swissquote Bank Switzerland. However, accounts registered under Swissquote Europe in Luxembourg are charged €100 per quarter after a period of inactivity. The broker makes this clear in advance, ensuring full transparency before clients fund their accounts.

What trading platforms are available?

Traders can choose between the proprietary CFXD platform, MetaTrader 4 and 5, or the TradingView integration. Each platform offers a distinct experience: CFXD provides a modern interface with integrated charting and order management, while MT4 and MT5 are ideal for automated and algorithmic trading. TradingView integration adds advanced technical charting and community features.

Does Swissquote offer crypto trading?

Yes. Clients can trade and own 52 physical cryptocurrencies including Bitcoin, Ethereum, and Solana. Staking services are also available for earning passive income. The standard trading fee is 1%, which drops to 0.5% for larger-volume traders. However, due to FCA regulations, crypto CFDs are not available to retail clients in the UK.

Is Swissquote good for beginners?

It’s a solid choice for beginners who want a regulated, trustworthy broker. The platforms are intuitive, and there are educational resources like tutorials, webinars, and a demo account for practice. Support is professional and responsive, making it easy to get help when needed. The only limitation for new traders is the $1,000 minimum deposit, which might be higher than some entry-level alternatives.

Can I use Swissquote with a small budget?

Yes, but it is better suited to traders with moderate or larger capital. While the $1,000 minimum is manageable for many, smaller accounts might find the trading costs relatively high compared to discount brokers. That said, the added safety, transparent fees, and Swiss banking standards provide real value for those looking to trade responsibly and securely.

Swissquote vs Saxo Bank — which is better in 2025?

Both are leading European brokers, but they cater to slightly different types of traders. Swissquote is more accessible, offering crypto trading, lower account maintenance costs, and an easier-to-use platform. Saxo Bank, on the other hand, provides tighter spreads, a more advanced suite of tools, and deeper customization options. In 2025, Swissquote stands out for safety, transparency, and accessibility, while Saxo is preferred by highly active or institutional traders who require advanced market infrastructure.