Tickmill REVIEW 2025

If you’re thinking about trading with Tickmill, this review will help you decide. We’ll look at everything that matters in 2025, including fees, spreads, trading platforms, regulation, and overall trustworthiness. The broker has earned a reputation for low costs, fast execution, and strong global regulation, but is it still one of the best brokers to trade with this year? Let’s take a closer look.

Broker Guide's Tickmill Review in 2025

Over the years, Tickmill has earned a solid reputation in the trading world. Many traders, myself included, appreciate its razor-thin spreads, low commissions, and the professional feel of its platforms. It’s a broker that works well for both beginners finding their footing and seasoned traders looking for efficiency.

In this Tickmill review 2025, I’ll walk you through everything you need to know. We’ll go step by step through fees, platforms, regulation, and account options. By the end, you’ll have a clear answer to the big question: is it safe and the right broker for you?

About Tickmill

Tickmill was founded in 2014, and since then it has grown into a truly global forex and CFD broker. Its main base is in the Seychelles, but what really stands out is its strong regulatory footprint. The broker is regulated by the UK’s FCA, CySEC in Cyprus, the FSA in Seychelles, the FSCA in South Africa, and the Labuan FSA in Malaysia. This wide regulatory coverage gives traders a sense of stability and trust that not every broker can offer.

Over the years, they also picked up multiple industry awards, especially for its low-cost trading environment and reliable execution. These recognitions only reinforce its reputation as a broker that takes both pricing and professionalism seriously.

Who is Tickmill best for? In my view, it’s a great fit for a range of traders. Beginners who want a regulated broker with fair costs will find it approachable, while professionals, scalpers, and algorithmic traders will value its tight spreads and fast execution. In short, it’s a broker designed to support you no matter where you are on your trading journey.

My Quick Verdict: Who is Tickmill Best For?

After looking closely at Tickmill, my takeaway is pretty clear. It’s a trustworthy broker backed by strong regulation, and it delivers on what traders value most: low-cost trading with tight spreads and fast execution.

The platforms — MT4 and MT5 — are reliable and packed with tools that work well for both beginners and advanced strategies. That said, the area where the broker falls a little short is in market research and educational resources, which aren’t as deep as some larger brokers.

Overall, if your focus is on fair pricing and professional-grade tools, It is a solid choice in 2025.

Pros

- Low spreads starting from 0.0 pips

- Full MT4/MT5 support

- Strong regulation across multiple regions

- Fast execution, ideal for scalpers and professionals

- Access to copy trading options

Cons

- Limited instruments compared to larger brokers

- No proprietary trading platform

- Education resources are not as strong as competitors

Why You Should Choose Tickmill ?

Choosing the right broker is all about finding the right balance of trust, cost, and tools. Here’s why Tickmill stands out in 2025.

Competitive Pricing That Saves You Money

One of the biggest reasons traders stick with Tickmill is its low-cost trading environment. With spreads starting from 0.0 pips on Pro and VIP accounts, plus very competitive commissions, it’s a broker designed for those who want to keep costs tight. Over time, these savings can make a real difference — especially for high-volume traders.

Strong Regulation for Peace of Mind

When you trade with Tickmill, you’re working with a broker that’s licensed by several top regulators, including the FCA in the UK and CySEC in Europe, along with FSCA South Africa, Labuan FSA Malaysia, and the FSA Seychelles. This mix of Tier-1 and Tier-2 regulators helps build confidence that your funds are handled safely and transparently.

Built for Active Traders

Not every broker caters to fast-moving strategies, but Tickmill does. It’s a strong fit for scalpers, day traders, and algorithmic traders, thanks to its fast execution speeds and support for automated trading on MT4/MT5. If your strategy relies on quick entries and exits, you’ll find the environment here reliable and efficient.

Continuous Improvements in 2025

What’s new this year? In 2025, Tickmill has continued refining its offering with better account management tools, more efficient deposit and withdrawal options, and ongoing platform enhancements. While it still sticks to the trusted MT4 and MT5 platforms, the broker has been investing in smoother user experiences and improving transparency around fees and execution.

Compare to Top Competitors

Traders often compare options before making a choice. To give you the full picture, let’s see how Tickmill stacks up against some of its biggest rivals in 2025. The top names worth comparing are Forex.com, Pepperstone, and XM.

FOREX.com

Pepperstone

XM

Exploring Tickmill's Range of Tradable Instruments

Choosing a broker isn’t just about spreads and platforms. The range of instruments you can trade often determines whether a broker is the right fit for your style. Tickmill offers a focused selection, particularly strong in forex, while still providing CFDs in other popular markets.

Forex Pairs

Their strength lies in forex trading, with 62+ currency pairs available. This includes all the majors, a wide selection of minors, and a smaller set of exotics. For traders who live and breathe currencies, Tickmill delivers the depth and liquidity needed for serious strategies.

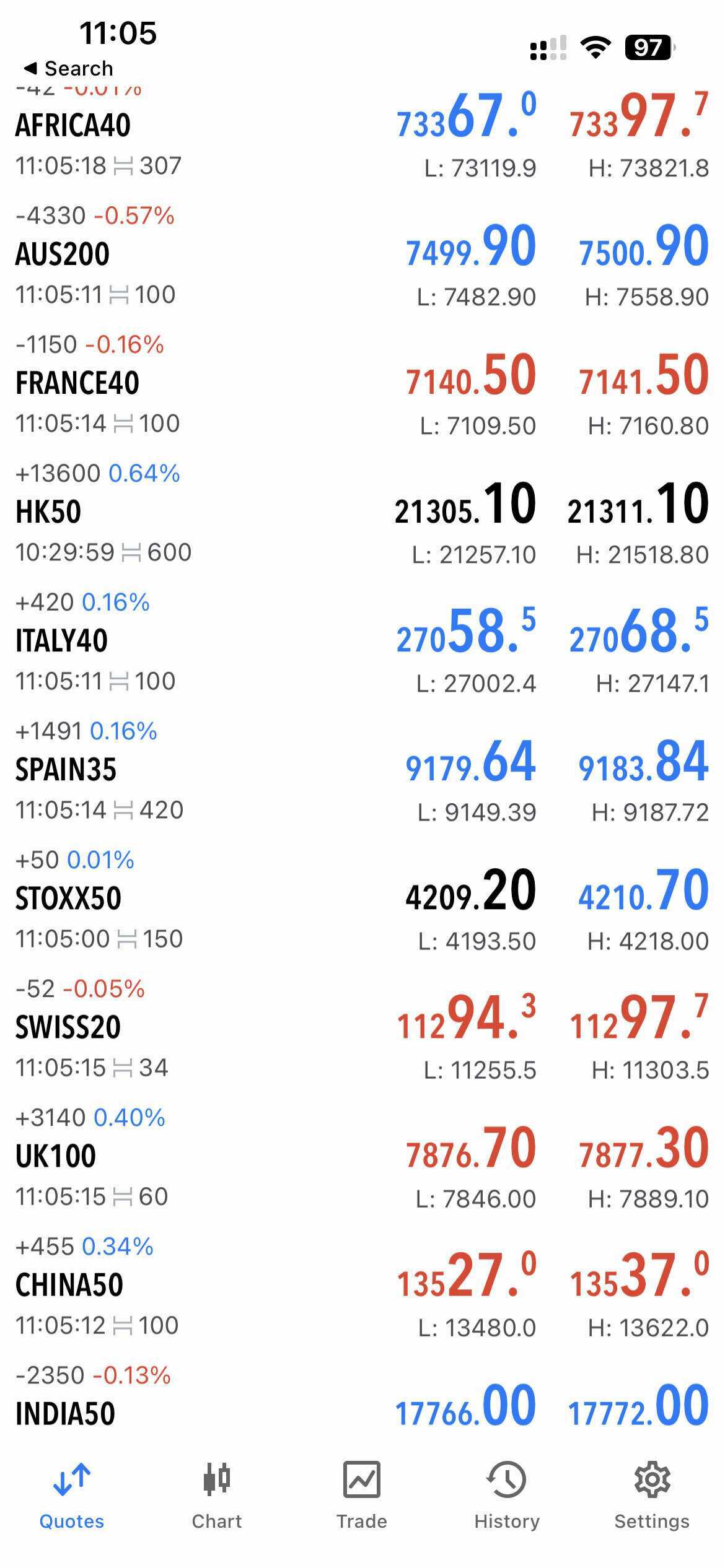

Indices CFDs

Traders get access to 27+ indices CFDs, including well-known benchmarks like the S&P 500, NASDAQ 100, DAX 30, and FTSE 100. These allow you to speculate on the performance of entire markets rather than individual stocks.

Commodities CFDs

The broker also supports trading in 15–19 commodities CFDs. You’ll find the big names like gold, silver, and crude oil, along with some agricultural products. Commodities remain a favorite for diversifying and hedging strategies.

Bonds CFDs

A unique aspect of Tickmill is its 4 government bond CFDs, mainly European bonds. While not as widely used as forex or indices, these instruments appeal to traders interested in interest rate moves and fixed-income markets.

Cryptocurrency CFDs

Depending on your location, you may also trade 8–15 cryptocurrency CFDs. Options include Bitcoin, Ethereum, and Litecoin, though the lineup is smaller compared to multi-asset brokers that specialize in crypto.

Stocks and ETFs

Tickmill rounds out its offering with 490+ stock CFDs and around 25 ETFs. While this selection is far more limited than brokers like XM or Forex.com, it still provides opportunities to trade global companies and sectors.

| Asset | Tickmill |

|---|---|

| Forex Pairs | 63 |

| Tradeable Symbols | 637 |

| Forex Trading | Yes |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency | Physical: No Derivative: Yes |

Instruments vs Competitors

In total, the broker offers around 600+ instruments. This number doesn’t come close to Forex.com or XM, which provide access to thousands of markets including a vast array of stocks and ETFs. Tickmill focuses on quality, liquidity, and execution speed rather than trying to cover every possible asset.

Best for Forex-Focused Traders

If your main priority is forex, it is an excellent choice. Its combination of tight spreads, fast execution, and professional-grade setup makes it ideal for scalpers, day traders, and algo traders.

| Asset | Tickmill | FOREX.com | Pepperstone | XM |

|---|---|---|---|---|

| Forex | ||||

| Indices CFDs | ||||

| Commodities | ||||

| Crypto CFDs | ||||

| Stocks & ETFs |

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $100 |

| Average Spread EUR/USD (Standard) | 1.70 pips |

All-in Cost EUR/USD - Active | .70 pips |

| Forex CFD Fees | Low |

Index CFD Fees | Low |

Options Fees | Average |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $/€/£/CHF 10 or PLN 40 quarterly fee after 12 months |

Trading costs are one of the first things traders look at when choosing a broker. Even small differences in spreads and commissions can add up quickly, especially if you’re scalping or trading large volumes. The broker has built its reputation on keeping costs low, with some of the tightest spreads in the industry and commissions that rival the very best.

Trading Fees

Spreads

Classic account has spreads starting from 1.7 pips with no commission.

Commission per Lot

On RAW accounts, Tickmill charges $3 per side per lot ($6 round-turn).

Other Trading Costs

Beyond spreads and commissions, traders should also factor in a few additional costs that come with active trading.

Overnight Swap / Financing Fees

Like most brokers, Tickmill charges overnight swap fees when you hold positions past market close. The exact amount depends on the instrument and can either be a debit or credit, depending on whether you’re long or short. For forex traders who like to hold positions over several days, these swaps are worth keeping an eye on.

Slippage and Execution Speed

The platform has a reputation for fast execution, with average speeds around 0.20 seconds. While slippage can occur during volatile news events—as with any broker—Tickmill’s execution model is designed to minimize delays. This makes it a reliable option for scalpers and algo traders who need consistency.

Non-Trading Fees

Not all fees come from trading itself. Some charges can appear on the account level, and it’s good to know them in advance.

Inactivity Fee

The broker does charge an inactivity fee of $/€/£/CHF 10 or PLN 40 quarterly fee after 12 months of inactivity.

Currency Conversion Costs

If your trading account is funded in one currency but you’re trading instruments in another, conversion fees apply. These are generally passed through at market rates with a small markup, similar to competitors.

Final Thoughts on Costs

Tickmill’s combination of razor-thin spreads and ultra-low commissions makes it significantly cheaper than Pepperstone and IC Markets, while also more transparent than XM, which builds most of its fees into the spread. For cost-conscious traders—especially scalpers and algo traders—the broker is one of the most competitive choices in 2025.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Tickmill Regulated ?

Yes, Tickmill is a regulated broker and holds licenses with multiple authorities across different regions. This layered regulatory framework adds significant credibility and ensures traders have strong protections no matter where they are located.

Regulators

- Financial Conduct Authority (FCA – UK)

- Cyprus Securities and Exchange Commission (CySEC – EU)

- Financial Sector Conduct Authority (FSCA – South Africa)

- Financial Services Authority (FSA – Seychelles)

- Labuan Financial Services Authority (Labuan FSA – Malaysia)

Why This Matters

Having multiple regulatory licenses means the broker must follow strict rules on client fund protection, financial reporting, and fair dealing. For example, FCA and CySEC regulations require segregation of client funds and participation in investor compensation schemes. Meanwhile, oversight from FSCA, Labuan FSA, and Seychelles FSA broadens it’s global reach while still keeping a framework of accountability.

Bottom line: This multi-regulator setup makes Tickmill a trustworthy and stable broker, giving traders confidence that their funds are handled with transparency and security.

Understanding Regulatory Protections and Broker Stability

Safety is just as important as costs or platforms. With Tickmill, you’re not only getting low trading fees but also strong safeguards that protect your money and ensure the broker operates with transparency.

Segregated Client Funds

The broker keeps client funds fully segregated from its own operating capital. This means your deposits are held in top-tier banks and cannot be used by the broker for business expenses—an important layer of protection if anything goes wrong.

Negative Balance Protection

Like most well-regulated brokers, they offer negative balance protection. Even if markets move sharply against your position, your account cannot go below zero. This prevents you from owing the broker more money than you deposited.

Investor Compensation Schemes

Under its FCA (UK) and CySEC (EU) licenses, Tickmill clients are covered by investor compensation schemes. These provide additional security if the broker were ever to become insolvent. For example, UK clients may be protected up to £85,000 under the Financial Services Compensation Scheme (FSCS), while EU clients under CySEC fall under the Investor Compensation Fund (ICF), with coverage up to €20,000.

Financial Transparency

Being regulated by multiple authorities also means They must meet strict reporting and auditing standards. Regular checks on capital adequacy, liquidity, and fair dealing practices ensure that the broker remains financially stable and trustworthy.

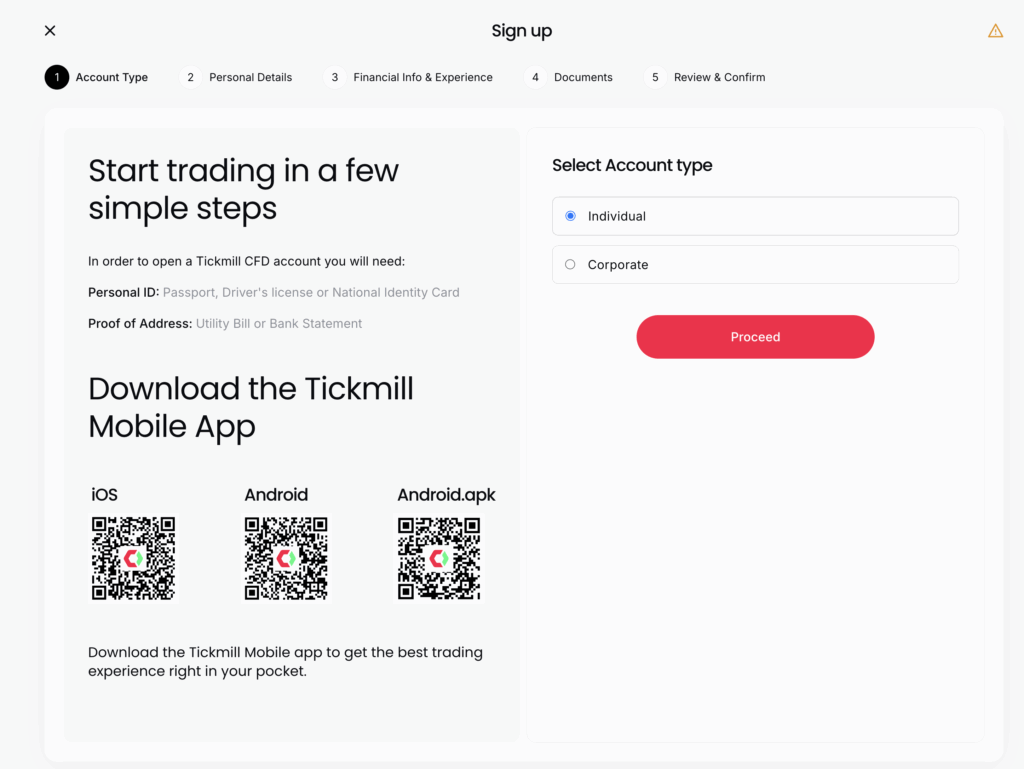

How To Open an Account

Getting started with Tickmill is a straightforward process, and most traders can be up and running within a day. Here’s how it works step by step:

Step-by-Step Walkthrough

Register Online – Visit the Tickmill website and click “Create Account.” Choose an account and you’ll be asked for basic details such as your name, date of birth, email, phone number, and country of residence.

Provide Personal Information – Fill in additional details, including employment status, trading experience, and financial background.

Upload KYC Documents – Submit proof of identity (such as a passport or driver’s license) and proof of address (like a utility bill or bank statement).

Account Verification – Tickmill’s compliance team reviews your documents and approves the account once everything checks out.

Fund Your Account – Once verified, you can deposit funds using bank transfer, card, or e-wallets.

KYC Requirements

Tickmill follows strict Know Your Customer (KYC) procedures in line with global regulations. You’ll need:

A government-issued ID (passport, national ID, or driver’s license).

A recent proof of address (utility bill, bank statement, or government letter, dated within the last 3 months).

Timeframe for Approval

Account approval is typically 24 hours or less, provided documents are clear and valid. In some cases, especially during high volumes, it may take slightly longer, but most traders report fast turnaround times.

Ease of Onboarding Compared to Competitors

Compared to brokers like Pepperstone or Forex.com, Tickmill’s onboarding process is just as smooth, if not quicker. The online registration form is streamlined, and document upload is simple. Many users find the account setup to be fast and hassle-free, with no unnecessary steps.

Verdict

Opening an account with Tickmill is quick and transparent. With fast verification, clear KYC requirements, and an easy signup flow, most traders can start trading within the same day.

Account Types

Tickmill offers a choice of account types designed to suit different styles of traders, from beginners to professionals. Here’s a breakdown of each option:

Classic Account

Classic Account The Classic account has no commissions, with spreads starting from 1.7 pips. It’s simple and easy to understand, making it a good fit for beginners who want a straightforward pricing model without worrying about commission charges.

Raw Account

Tickmill’s Raw account is the broker’s flagship pricing model, replacing the former Pro account after the VIP account was discontinued. It offers the tightest spreads and lowest trading costs across Tickmill’s lineup, making it highly attractive for active traders.

Spreads: Average spread on EUR/USD was just 0.10 pips in August 2025, resulting in an all-in cost of 0.70 pips when factoring in the commission.

Commission: $3 per side ($6 round turn) per standard lot, equivalent to 0.6 pips in cost.

Minimum Deposit: Only $100, keeping it accessible for most traders.

Execution Features: Supports all strategies including scalping, hedging, and algorithmic trading.

Transparency: Tickmill reports typical spreads under normal market conditions, which means actual spreads may vary during high volatility but generally remain very competitive.

This pricing is better than the industry average, and the Raw account is positioned as the best choice for most traders who want low-cost execution without sacrificing flexibility.

Islamic (Swap-Free) Account

Tickmill also offers Islamic accounts that are swap-free, in line with Shariah law. Instead of overnight swap charges, an administration fee may apply on certain instruments. This makes Tickmill accessible to Muslim traders who require swap-free conditions.

Which Account is Best?

Beginners: The Classic account is best for new traders who want simple, commission-free trading.

Experienced traders & scalpers: The Pro account is the sweet spot, offering ultra-tight spreads with reasonable commissions.

High-volume professionals: The VIP account gives the lowest possible costs, ideal for serious traders with larger balances.

What is the Minimum Deposit at Tickmill?

Tickmill keeps its accounts accessible with relatively low entry requirements. The exact minimum deposit depends on the account type:

- Classic Account: $100

- Raw Account: $100

- Islamic (Swap-Free) Account: $100 (available on request for Classic and Raw accounts)

This relatively low barrier makes Tickmill appealing to a wide range of traders. Beginners can test the waters without committing a large sum of money, while experienced traders can open an account to trial strategies or evaluate Tickmill’s execution quality without feeling locked into a heavy deposit.

Vs. Competitors

| Broker | Minimum Deposit |

|---|---|

Tickmill | $100 |

| FOREX.com | $100 |

Pepperstone | $0 |

| XM | $5 |

When you compare this with competitors, the picture becomes clearer: Pepperstone usually recommends around $200, while XM goes the other way with micro accounts that can start as low as $5. Tickmill sits comfortably in the middle — not the absolute cheapest, but still affordable enough to strike a balance between accessibility and professionalism.

In my view, the $100 minimum works well. It’s low enough to make Tickmill beginner-friendly, yet high enough that it attracts serious traders who want reliable execution and support. If you’re looking for a broker where you don’t need thousands to start but still want tight spreads, strong regulation, and professional conditions, Tickmill fits the bill.

Deposit and Withdrawal

Funding and withdrawals are fully digital, quick, and straightforward. There are multiple methods, and the broker does not charge fees for moving money in or out.

Deposit Fees & Options

Tickmill supports a range of deposit methods, including bank transfer, credit and debit cards, and popular e-wallets such as Skrill and Neteller. This makes it convenient for most traders, regardless of where they’re based.

Processing times are generally fast: card and e-wallet deposits are near-instant, while bank transfers can take 1–3 business days depending on the sending bank and country. Importantly, Tickmill does not charge deposit fees, which means the amount you transfer is the amount that shows up in your account.

Withdrawal Fees & Options

Withdrawals are just as straightforward. Traders can use bank transfer, cards, or e-wallets for payouts. Tickmill stands out by offering free withdrawals.

In terms of speed, e-wallet withdrawals are usually processed within one business day, while bank transfers can take 2–5 business days depending on the destination bank. Compared to many competitors, Tickmill’s withdrawal times are above average, especially for e-wallets, which are often completed faster than with brokers like XM or Forex.com.

Verdict

Tickmill keeps deposits and withdrawals simple, transparent, and low-cost. With no hidden fees, a strong choice of payment options, and fast processing for most methods, funding your account or cashing out profits is smooth and reliable. While the bank transfer speed could still be faster, Tickmill remains one of the more trader-friendly brokers when it comes to payments.

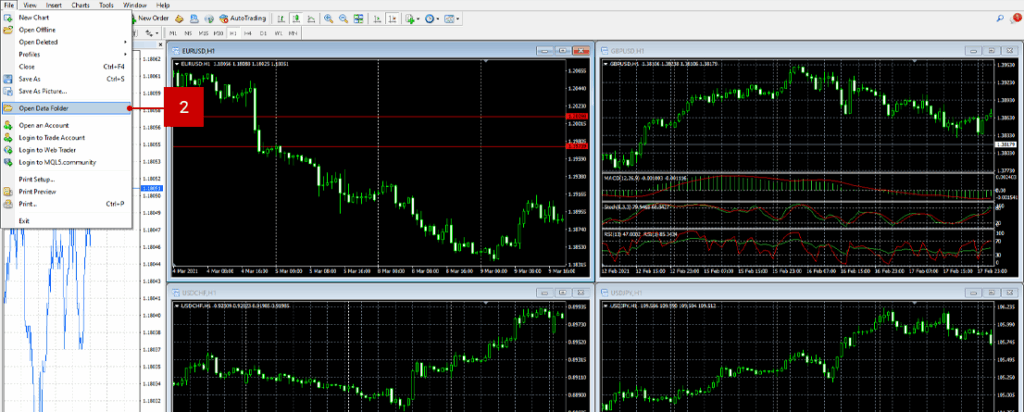

Desktop Trading Platform

Tickmill’s desktop trading environment is built on MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most widely used platforms in the industry. Both are designed for traders who value stability, speed, and flexibility. Additionally, they have Tickmill Trader, a web-based platform powered by DXtrade.

Features and Functionality

Advanced Charting

MT5 comes with 21 timeframes, over 38 built-in indicators, and multiple chart templates, giving traders plenty of tools for technical analysis. MT4, while slightly older, still provides reliable charting features, drawing tools, and full support for custom indicators and Expert Advisors. Together, these platforms allow traders to run in-depth technical analysis and tailor their charts to their own strategies.

Market Analysis Tools

Both platforms support integrated news feeds, economic calendars, and trend analysis tools, making it easier to follow global market events. Tickmill also supports algorithmic trading and custom EAs, which is a major advantage for traders who rely on automated systems.

Real-time Information

Pricing is updated in real time with trades passed directly to liquidity providers. Execution is fast, with an average speed of around 0.20 seconds, and there are minimal requotes under normal market conditions. Traders also get access to depth of market in MT5 and can view full order history for better tracking.

Educational Content Integration

Educational materials such as webinars and trading guides are hosted on Tickmill’s website. They also produce daily articles on its Expert Blog that cover technical and fundamental analysis.

Placing Orders

Order placement is flexible and efficient. Tickmill supports all major order types, including market orders, limit orders, stop orders, and stop-limit orders, with MT5 offering six pending order types. On the Raw account, traders benefit from zero stop/limit distance, which means orders can be placed very close to the market price.

Alerts & Notifications

MT4 and MT5 both support price alerts, e-mail alerts, and push notifications, so you can stay updated on market moves even if you are not at your desk.

Login and Security

Both platforms provide secure login, encrypted data transmission, and the option for two-factor authentication where supported. Tickmill’s compliance with strict regulatory standards adds an additional layer of trust.

Search Functions

Finding instruments is straightforward thanks to symbol search, filtering options, and customizable watchlists. Traders can easily build a list of their favorite instruments for quick access.

Pros & Cons of the Web Platform

Pros

- The desktop platforms (MT4 and MT5) are very stable and reliable — excellent for technical analysis and running Expert Advisors (EAs).

- Charting is advanced: you get many timeframes, a wide selection of built-in indicators, templates, and customizable chart tools.

- Real-time market data and fast execution: MT5 especially offers very low latency, which helps with slippage and trade precision.

- For more advanced users, tools like VPS hosting, API connectivity, and pro-level add-ons are available, enhancing the platform for algo traders.

- Tickmill has been adding its proprietary Tickmill Trader platform (web/desktop) and integrating TradingView, which brings more flexibility in choice of platforms.

Cons

- Platform variety is still limited: although MT4/MT5 are very capable, some traders prefer other platforms like cTrader or more modern proprietary platforms; Tickmill’s offerings are catching up but not yet as broad as some competitors.

- Some advanced features are missing or less polished in the newer proprietary/web platforms (Tickmill Trader). For example, fewer custom indicators, less depth of market in certain jurisdictions.

- Research tools and educational material are not always embedded directly into the desktop platform — you often have to leave the platform or go to the Tickmill website for webinars, market reports, or analytics. This interruption can slow down workflow.

Verdict on Desktop Platform

Overall, Tickmill’s desktop platform setup is strong, especially for traders who focus on forex, technical analysis, and algorithmic trading. If you value speed, reliability, and good charting tools, the MT4/MT5 combo + newer Tickmill Trader / TradingView integrations are very competitive in 2025.

If you need a platform with a wide variety of modern UX features, optional non-MetaTrader platforms, or deeply integrated research/education inside the platform itself, you might find some competitors do slightly better. But for most serious traders, Tickmill’s desktop platforms are more than sufficient.

Mobile App

While it doesn’t completely replace the depth of the desktop platform, it does a good job of covering the most important aspects: account management, secure access, and straightforward trade execution. I’d describe the app as practical and efficient rather than flashy—it focuses on delivering what traders need, without unnecessary complexity.

Look & Feel

Tickmill offers a dedicated mobile app for both iOS and Android, designed to deliver a compact yet powerful trading experience. You can manage your accounts, deposit and withdraw funds, and trade on the go with a clean, intuitive interface. Users report the app as being “better than average” in terms of usability.

Login and Security

The mobile app supports a one-step login. Also, you can't log in using biometric authentication.

Search Functions

Within the app, you can search and filter trading instruments, create watchlists, and quickly jump between markets. The interface is built so that finding pairs or assets is straightforward and responsive.

Placing Orders

You can place market, limit, and stop orders through the mobile app, and adjust exposures on open trades. The app gives you enough control to manage trades on the go, though some advanced features (like custom scripts or EAs) are best left to the desktop platform.

Pros & Cons of the Mobile App

Pros

- Clean, easy-to-use interface suitable for beginners.

- Quick search and watchlist functions make navigation efficient.

- Supports key order types (market, limit, stop).

- Available on both iOS and Android.

- Reliable for managing accounts, deposits, and withdrawals.

Cons

- Lacks advanced charting and analysis tools found on desktop.

- No support for automated trading or custom indicators.

- Feels more functional than innovative compared to leading multi-asset apps.

- Security are limited

Tickmill’s mobile app strikes a balance between simplicity and functionality. It won’t overwhelm beginners, and it offers enough tools for experienced traders to stay active while away from their desk. Still, it’s not designed to replace the desktop platform’s full suite of advanced tools. If you’re looking for a dependable, no-fuss way to keep tabs on the markets and execute trades on the move, the Tickmill app delivers exactly that.

Market Research, Tools, and Education

When I test a broker, one of my key criteria is how well they support traders with research, tools, and learning resources. Tickmill does reasonably well here, though it isn’t perfect. Below is how it stacks up across research tools, platform integrations, and education materials.

Another tool, Acuity Trading, works via MT4/MT5 as a plugin to combine news, sentiment, and trend data in one interface. It analyzes data from news sources and displays bullish vs. bearish sentiment levels to help you spot potential trade ideas.

Tickmill also offers a Signal Centre tool, which blends human and AI-based analysis to provide daily trade ideas (entry, stop-loss, target levels). This tool pushes signals directly into MT4/MT5, making it easier to act.

While these tools are helpful, they’re not as advanced or exhaustive as those offered by dedicated research brokers or platforms providing proprietary indicators, analytics, and deep fundamental data.

This adds flexibility: you can use the platform you love for charting and analysis, while executing trades via Tickmill. That said, execution still relies on the underlying Tickmill / MT4 / MT5 infrastructure, so your experience depends on connectivity, latency, and broker routing.

Education: Webinars, eBooks, Articles, Beginner Guides

Tickmill offers a solid body of educational resources. These include a library of webinars, video tutorials, eBooks, and market insight content.

- Their video tutorials cover topics from crypto trading tools to how stock trading works.

- The Education Hub (on their website) is home to articles and guides that explain basic and intermediate concepts in trading.

- They also host regular webinars and masterclasses, and run a podcast (“The Trader’s Clinic”) to dig deeper into trading topics.

From what reviewers say, Tickmill’s educational offering is on par with industry average — adequate for most traders to get started, but not as deep or structured (with quizzes, progress tracking, etc.) as what top-tier brokers or dedicated learning platforms might provide.It’s worth noting that some critics point out that while the base is good, the diversity and interactivity of content could be improved. Verdict

Tickmill does a competent job in the area of market research and education. Its built-in tools like sentiment analysis, Signal Centre, and its Advanced Trading Toolkit give you real, actionable insight without always needing external platforms. The TradingView integration is a strong plus for technical charting fans.

That said, for traders seeking deep fundamental research, institutional-grade analytics, or a full learning curriculum with assessments and certifications, Tickmill trails behind brokers like IG, Saxo, or specialized research platforms. So in my view: Tickmill’s research and educational ecosystem is suitable for beginners and intermediate traders, but heavy institutional or professional users may find it not the most in-depth available in 2025.

Customer Support

Reliable customer service can make a big difference, especially when you’re trading in fast-moving markets. Tickmill puts effort into supporting its clients with multiple contact options and multilingual assistance, though it doesn’t quite offer the round-the-clock access some competitors provide.

Channels: Live Chat, Email, Phone

Tickmill offers several ways to get help. You can use live chat directly from their website for immediate issues, email (support@tickmill.com) for more detailed questions, or phone support via regional lines (e.g. UK, Seychelles, etc.).

Support Hours and Languages

Customer support is available Monday through Friday, during business hours. The operating hours frequently cited are 7:00 to 16:00 GMT (or equivalent region-based times) for many jurisdictions.

The support team is multilingual. Traders report that Tickmill supports 17+ languages, including English, Arabic, Chinese, German, Indonesian, Thai, Portuguese, Polish, Filipino, Vietnamese, and others.

Responsiveness vs Other Brokers

In tests, Tickmill’s live chat usually connects you to a representative within a few minutes during business hours. Email responses tend to arrive within 24 hours. For more complex queries, or outside peak hours, expect slower replies or referrals to follow-up via email.

Compared to many brokers, Tickmill performs above average in responsiveness during the workweek. However, some competitors provide customer support 24/7, or via more localized phone lines, which Tickmill does not universally match.

Verdict: Efficient but Not 24/7

Tickmill’s support is generally efficient and helpful, especially during weekday business hours. If you have straightforward questions—account setup, funding, platform issues—you’ll likely get what you need quickly.

However, support is not available 24 hours or on weekends, and during off-hours the response can be slower or less comprehensive. If you value round-the-clock support or local phone lines in your country, you might prefer a broker that offers that.

FAQ

Is Tickmill safe and regulated?

Yes. Tickmill is regulated by several top-tier authorities, including the FCA (UK), CySEC (EU), FSCA (South Africa), Labuan FSA (Malaysia), and FSA (Seychelles). Multiple licenses across regions add layers of trust and investor protection.

What can I trade on Tickmill?

Tickmill offers over 600 symbols, including forex pairs (60+), stock indices, commodities, bonds, and in some jurisdictions, cryptocurrency CFDs. The broker is strongest in forex, making it ideal for currency-focused traders.

How much is the minimum deposit at Tickmill?

The minimum deposit is $100 across both Classic and Raw accounts. This makes it accessible for beginners while still offering competitive pricing for experienced traders.

Does Tickmill charge trading fees?

Yes, but they are very competitive. On the Classic account, costs are built into the spread (starting from 1.6 pips). On the Raw account, spreads start from 0.0 pips, with a $3 commission per side per lot.

Are there any non-trading fees?

Tickmill has no deposit and withdrawal fees. However, there may be currency conversion fees if your account currency differs from the base currency of the instrument traded. Importantly, there is a $10 per quarter inactivity fee.

Does Tickmill offer copy trading or social trading?

Yes. Tickmill supports copy trading via third-party platforms like Myfxbook AutoTrade and Pelican Trading, allowing traders to follow and copy strategies from other professionals.

What platforms does Tickmill use?

Tickmill supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5) on desktop, web, and mobile. Both platforms are highly regarded for their charting tools, custom indicators, and support for algorithmic trading.

Can beginners trade with them?

Yes. With a low minimum deposit, user-friendly Classic account, and basic educational resources, Tickmill is accessible to beginners. However, its education library is more limited than brokers like IG or Saxo, so new traders may need to supplement with outside resources.

Does Tickmill offer demo accounts?

Yes. Tickmill provides a free demo account with virtual funds, allowing traders to practice strategies and test the platforms (MT4/MT5) without risking real money.

Is Tickmill suitable for scalping and algorithmic trading?

Absolutely. Tickmill is known for its fast execution speeds, low spreads, and support for Expert Advisors (EAs), making it ideal for scalpers and algo traders.