Trading 212 REVIEW 2025

Trading 212 is known for zero-commission stock trading and a sleek mobile app. But does it truly deliver for beginners and active traders in 2025? We tested the platform to uncover its strengths and hidden drawbacks

Broker Guide's Trading 212 Review in 2025

When I first downloaded Trading 212 and set up my account, I wanted to see if all the hype around commission-free trading really lived up to its promise. Within minutes, I was buying fractional shares of big-name companies straight from my phone—something that used to feel complicated suddenly became almost effortless.

But as I dug deeper, testing everything from its CFD platform to withdrawals and customer support, I found that Trading 212 isn’t quite the same experience for every type of trader.

This Trading 212 review is the result of my hands-on testing, where I’ll share what works brilliantly, what falls short, and whether this broker is the right fit for you this year.

About Trading 212

History & Background

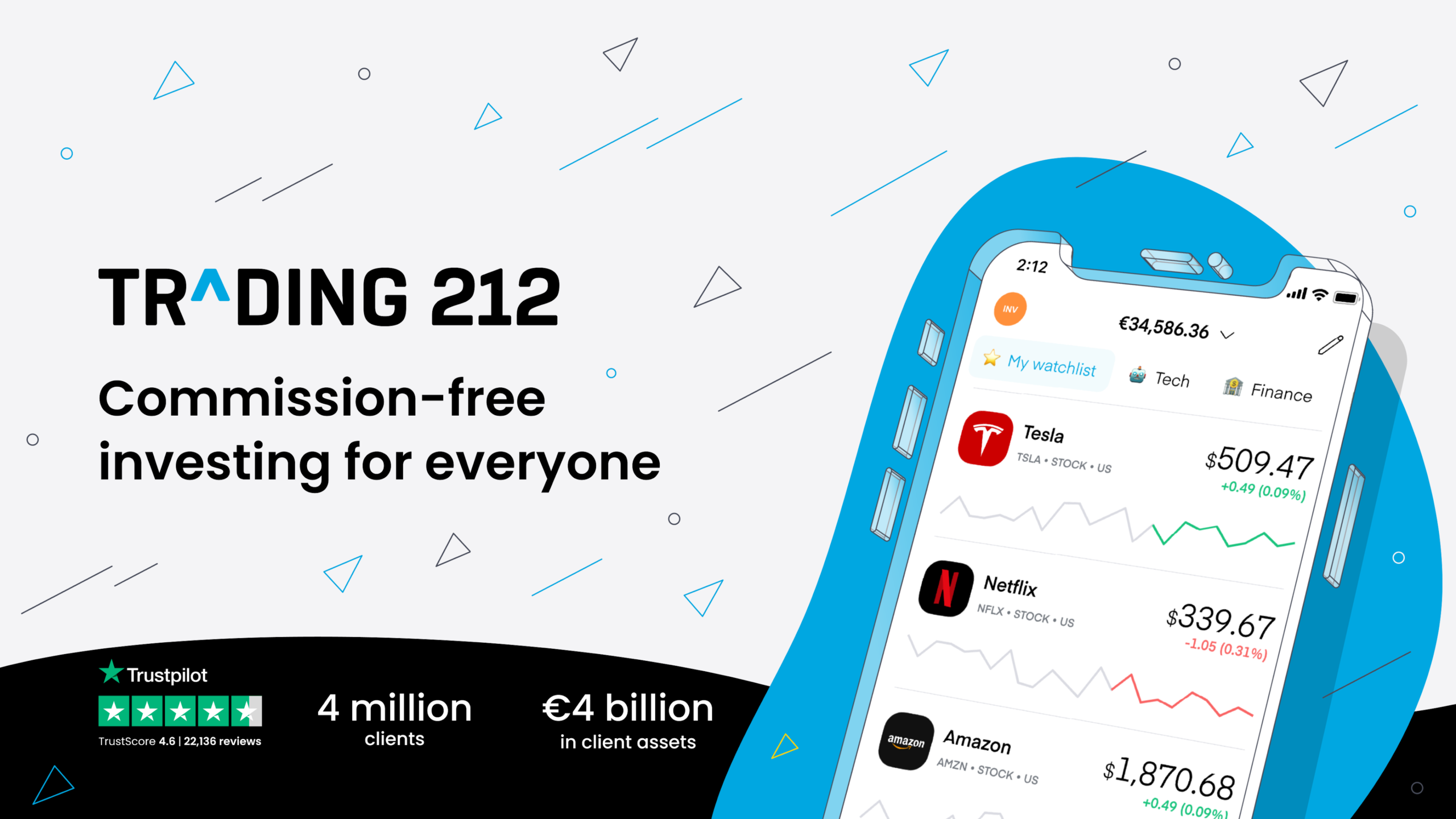

Trading 212 was founded in 2004 and is headquartered in London, UK. What began as a small fintech venture has since grown into one of Europe’s most widely used trading platforms, with millions of users across the UK and EU. From the start, its mission has been to make investing more accessible, and its mobile-first approach has helped it stand out in a competitive market. Today, Trading 212 UK is regarded as a reliable entry point for everyday investors.

What They Offer

The broker provides two main avenues for clients:

- Trading 212 Invest – commission-free access to stocks and ETFs, including fractional shares.

- Trading 212 CFD – contracts for difference on forex, indices, commodities, and crypto CFDs (availability depends on jurisdiction).

- Trading 212 ISA – available for UK residents, allowing tax-efficient investing.

- Practice Account – a demo environment with virtual funds to practice risk-free.

This mix of products makes Trading 212 attractive to both beginners and more active traders.

Unique Selling Points

Trading 212’s biggest draw is commission-free stock and ETF trading. Combined with fractional investing, it allows users to own shares of major companies with as little as £1. The platform’s sleek mobile and desktop apps are designed for ease of use, while the practice account makes it beginner-friendly. Accessibility and simplicity are the core of its value proposition.

Business Model

While investors enjoy commission-free stock and ETF trades, Trading 212 generates revenue in other ways:

- Spreads on CFD trades

- Currency conversion fees on foreign transactions

- Overnight financing charges for leveraged CFD positions

- Premium services

This model enables the broker to sustain its no-commission offer while maintaining long-term financial stability.

My Quick Verdict: Who is Trading 212 Best For?

After testing Trading 212 across both its Invest and CFD accounts, my impression is clear: this platform is designed with accessibility in mind. For beginners or anyone who wants to invest in stocks and ETFs commission-free, Trading 212 delivers exactly what it promises. The ability to buy fractional shares makes it easy to start small, and the user-friendly interface ensures that even first-time investors can navigate the platform with confidence.

The mobile app is where it truly shines. Its intuitive design, clean layout, and quick execution make it one of the most seamless investing apps I’ve used. It feels less intimidating than traditional platforms and lowers the barrier for everyday users to enter the markets.

That said, advanced CFD traders may find Trading 212 less appealing. The lack of MetaTrader support, fewer advanced tools, and spreads that aren’t always the most competitive can be limiting if you’re focused on high-volume or algorithmic strategies.

In 2025, it remains a solid choice for retail investors, particularly beginners who value simplicity, commission-free trading, and a smooth mobile experience.

Pros

- Zero-commission stock & ETF trading – ideal for long-term investors looking to keep costs low.

- Fractional shares – start investing with as little as £1, even in high-priced companies.

- Intuitive mobile & desktop platforms – sleek, user-friendly design suited for beginners and casual investors.

- Regulated in the UK & EU – oversight from the FCA and FSC provides strong investor protection.

- Low entry barrier – no minimum deposit required for Invest accounts, making it easy for anyone to get started.

Cons

- No MetaTrader or third-party platforms – limits flexibility for advanced traders who rely on industry-standard tools.

- Limited research tools – less depth compared to competitors like Interactive Brokers or eToro.

- No crypto spot trading – only available through CFDs, and only in certain jurisdictions.

- Currency conversion fees – applied when trading assets in a different currency, which can eat into returns over time.

Why You Should Choose Trading 212 ?

With so many brokers on the market, deciding where to invest can feel overwhelming. Some focus on advanced tools for professionals, while others target casual traders. Trading 212 in 2025 positions itself right in the sweet spot for beginners and everyday investors by combining zero-commission trading, a sleek mobile experience, and strong regulatory backing. Here’s why it continues to be one of the best brokers for beginners in the UK and Europe.

Accessibility and Low-Cost Entry

Trading 212 was built around accessibility. There’s no minimum deposit for Invest accounts, and the ability to buy fractional shares means you can start with just £1. This lowers the barrier to entry and makes investing possible for anyone, regardless of budget.

Commission-Free Stock Investing

As a zero-commission broker, Trading 212 ensures that more of your money goes into your portfolio rather than into fees. Over the long run, avoiding commission charges can make a significant difference, especially for investors building wealth gradually.

Mobile-First Convenience

Trading 212’s mobile app is one of the most user-friendly platforms available. Designed with everyday investors in mind, it makes buying, selling, and tracking your investments feel effortless. The desktop platform offers the same smooth experience, ensuring flexibility across devices.

Trusted by Millions in the UK & Europe

With millions of active users and regulation under both the FCA (UK) and FSC (EU), Trading 212 has established itself as a trustworthy brand. Investor protection schemes and client fund safeguards add to its credibility.

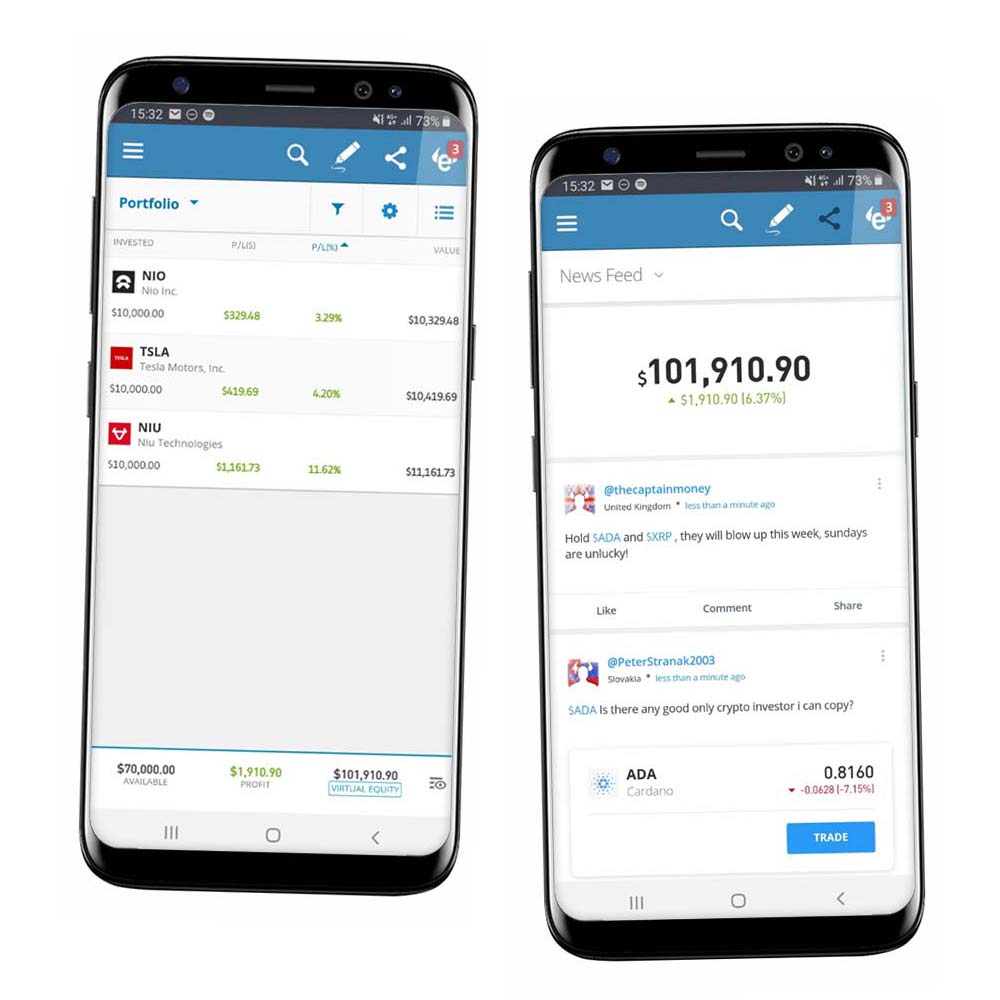

Free Demo Account for Practice

For anyone still hesitant, Trading 212 offers a practice account with virtual funds. This is an excellent way to test strategies or simply learn how the platform works before investing real money.

Verdict

If you’re a long-term investor or casual trader who values simplicity, affordability, and trust, Trading 212 in 2025 remains one of the strongest choices on the market.

Compare to Top Competitors

While Trading 212 has carved out a strong reputation as a commission-free, mobile-first broker, it’s not the only choice available. Competitors like eToro, XTB, and Pepperstone also attract millions of traders worldwide, each with their own strengths and drawbacks. Here’s how they stack up side by side.

eToro

Pepperstone

XTB

Exploring Trading 212's Range of Tradable Instruments

One of the biggest advantages of Trading 212 is the variety of markets and instruments it offers, giving investors flexibility in how they want to trade or invest. From commission-free stocks and ETFs to leveraged CFD products, the platform covers most major asset classes that retail investors look for.

Stocks and ETFs

Through the Trading 212 Invest account, users can access thousands of stocks and exchange-traded funds (ETFs) from major global exchanges, including the London Stock Exchange, NYSE, and NASDAQ. With the option to buy fractional shares, even expensive companies like Amazon or Tesla are within reach for everyday investors. The ability to diversify easily across multiple Trading 212 markets makes it attractive to long-term investors building portfolios.

CFDs on Indices, Forex, and Commodities

For those seeking more active trading opportunities, Trading 212 CFD provides exposure to a broad range of leveraged products. These include:

Indices – such as the S&P 500, FTSE 100, and DAX.

Forex – access to major, minor, and exotic currency pairs.

Commodities – including gold, oil, and agricultural products.

These instruments allow traders to speculate on price movements without owning the underlying asset, though they come with higher risk due to leverage.

Crypto CFDs

While Trading 212 does not currently offer crypto spot trading, it provides access to crypto CFDs in certain jurisdictions. This lets traders speculate on the price of popular cryptocurrencies like Bitcoin and Ethereum. However, UK retail clients cannot trade crypto derivatives due to FCA restrictions.

Jurisdictional Restrictions

The exact range of Trading 212 instruments depends on your location. For example, UK clients have access to Invest, CFD, and ISA accounts, but crypto CFDs are restricted. EU clients can typically trade CFDs on crypto, forex, and commodities, alongside stocks and ETFs.

Bottom Line

With thousands of stocks, ETFs, and CFDs available, Trading 212 provides broad access to global markets. Whether you’re a beginner looking to invest commission-free in shares or an active trader seeking exposure to forex and indices, the platform offers a wide enough selection to cover most retail trading needs.

| Asset | Trading 212 |

|---|---|

| Forex Pairs | 184 |

| Tradeable Symbols | 7800+ |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | No |

How Trading 212’s Instruments Compare to Competitors

| Features | Trading 212 | eToro | XTB | Pepperstone |

|---|---|---|---|---|

| Stocks & ETFs | ✅ Yes (real, commission-free, fractional shares) | ✅ Yes (real, commission-free, fractional shares) | ✅ Yes | ❌ No real stock/ETF trading |

| Forex | ✅ Yes | ✅ Yes | ✅ Strong selection, many pairs | ✅ Strong selection, ultra-tight spreads |

| Commodities & Indices | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Crypto | ❌ Not Available | Spot crypto + crypto CFDs (region-dependent) | ⚠️ Limited crypto CFDs | ⚠️ Limited crypto CFDs |

| Platform Choice | Proprietary Trading 212 app (mobile + web) | Proprietary eToro app (social features) | xStation 5 (desktop + mobile) | MT4, MT5, cTrader, TradingView |

| Best for | Long-term investors & beginners | Social & crypto traders | Active CFD & forex traders | Professional/algorithmic forex & CFD traders |

Trading 212 vs eToro

Both brokers give access to stocks, ETFs, and CFDs, but eToro has a strong edge in crypto spot trading, which Trading 212 lacks. On the other hand, Trading 212 stands out for fractional shares and commission-free investing, making it more cost-effective for stock investors. eToro leans more toward social and community trading, while Trading 212 focuses on straightforward market access.

Trading 212 vs XTB

XTB shines in forex and CFD trading, offering a wide selection of currency pairs, commodities, and indices with fast execution. However, it doesn’t provide commission-free real stock or ETF investing in the same way Trading 212 does. If your focus is long-term equity investing, Trading 212 wins; if you’re a dedicated forex trader, XTB may be the stronger choice.

Trading 212 vs Pepperstone

Pepperstone specializes in forex and CFDs with very tight spreads and professional-grade platforms like MT4, MT5, and cTrader. It’s designed for active and algorithmic traders who value execution speed. Trading 212, by contrast, appeals more to retail investors building stock and ETF portfolios commission-free, though it lacks the advanced platform flexibility Pepperstone provides.

Fees and Commission Structure - Trading 212 Review

| Fees | |

|---|---|

| Minimum Deposit | €1 |

| Average Spread EUR/USD (Standard) | 2.7 pips |

All-in Cost EUR/USD - Active | 2.7 pips |

| Commissions | $0 |

Forex CFD fees | Average |

Stock CFD fees | Average |

| Deposit Fees | $0, until you deposit 2,000 GBP/EUR in total; after that, a 0.7% fee applies.

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $0 |

When evaluating a broker, fees and costs are often just as important as platform features or market access. Even small differences in spreads, commissions, or conversion charges can add up significantly over time, especially for active traders. Trading 212 fees are designed to appeal to beginners and long-term investors through commission-free stock and ETF investing, but CFD traders should pay closer attention to spreads, overnight financing, and currency conversion charges. Below, we break down trading fees, other costs, and non-trading fees to give you a clear picture of what to expect in 2025.

Trading Fees

Commission-Free Investing

Trading 212 offers zero commission on stocks and ETFs through its Invest/ISA accounts. This means you don’t pay per-trade fees when buying or selling shares—your main cost is related to currency conversion when trading outside your base currency.

Spreads on CFD Trading

For CFD and forex trading, spreads are the key cost. These are the fees that Trading 212 charges instead of commissions on these instruments. A few data points:

The average EUR/USD spread is around 2.7 pips on CFD accounts (industry average is tighter).

Some reports show spreads near 1.8 pips under normal conditions.

At peak liquidity, spreads can tighten further, but they are still not as competitive as brokers like Pepperstone.

Currency Conversion Fees

Swap fees (overnight financing) are slightly higher than the industry average. For example, holding a long position in gold may incur a swap cost of around $54 per lot.

These fees vary depending on the instrument, position type, and market interest rates. Despite this, swap rates are clearly listed on the platform, helping traders manage long-term costs.

Non-Trading Fees

Deposit & Withdrawal Fees

Trading 212 does not charge fees for withdrawals but charges 0.7% deposit fee if you deposit more than €2,000 in total to your Invest account using credit/debit cards or electronic wallets.

Inactivity Fee

As of 2025, no inactivity fee is charged. This is particularly appealing for casual investors who don’t trade regularly.

Verdict

Trading 212’s fee model is one of its biggest advantages for casual investors. The zero-commission stock and ETF trading, coupled with fractional shares and no deposit/withdrawal charges, makes it one of the most accessible brokers in the UK and Europe. For beginners and long-term investors, this keeps costs simple, predictable, and very low.

However, the picture shifts when it comes to CFD and forex trading. With an average EUR/USD spread of about 2.7 pips, Trading 212 is noticeably more expensive than brokers like Pepperstone or XTB, who cater to active CFD traders with tighter spreads and raw pricing options. The 0.15%–0.5% currency conversion fee also adds up for those trading in non-base currencies.

On the positive side, no inactivity fees and transparent overnight financing charges keep the broker’s costs straightforward compared to competitors that tack on hidden non-trading fees.

Trading 212 offers a low-cost, commission-free environment for investors, but active CFD and forex traders will likely find better value elsewhere.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Trading 212 Regulated - Trading 212 Review

Trading 212 is regulated by several key authorities: the Financial Conduct Authority (FCA) in the UK, Australian Securities & Investment Commission (ASIC) and the Financial Supervision Commission (FSC) in Bulgaria. This dual oversight ensures that the broker complies with both UK financial rules and European regulations, giving investors confidence in its operations.

MiFID II Compliance

As a European broker, Trading 212 is also subject to MiFID II (Markets in Financial Instruments Directive II). This EU framework sets strict standards for transparency, client protection, and risk disclosure—ensuring that Trading 212 clients receive clear, fair, and regulated service.

Investor Confidence

Being regulated by the FCA—widely regarded as one of the toughest financial regulators globally—makes Trading 212 a trusted name for UK traders. Combined with EU regulation through the FSC, the broker operates under a robust regulatory umbrella, making it a safe and reliable option for retail investors.

In summary, Trading 212 regulated status under the FCA and FSC, plus compliance with MiFID II, ensures strong investor protections and reinforces its reputation as a safe broker in 2025.

Understanding Regulatory Protections and Broker Stability

For traders, knowing your money is protected is just as important as low fees or a sleek platform. Trading 212’s regulatory safeguards and financial stability give investors peace of mind, ensuring a secure environment for both beginners and experienced traders in 2025.

Investor Protection Schemes

Trading 212 clients benefit from compensation schemes in case of broker insolvency:

- In the UK, eligible clients are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000.

- In the EU, clients are protected by the Investor Compensation Fund (ICF), which covers up to €20,000.

Segregated Client Funds

As required by regulation, Trading 212 keeps client funds segregated from company operational funds. This means your deposits are held in separate bank accounts, reducing the risk of misuse and protecting traders if the company encounters financial difficulties.

Clean Record and Transparency

Unlike some high-risk offshore brokers, Trading 212 has no history of major scandals or regulatory breaches. The firm has built a reputation for transparency and reliability, key factors for traders looking for long-term safety.

Financial Health and Stability

Trading 212 has grown to serve millions of clients across Europe and the UK, a sign of its strong financial foundation. Its commission-free business model is supported by spreads, FX conversions, and CFD services, ensuring diverse revenue streams. Combined with strict oversight, this makes Trading 212 a stable and sustainable broker in 2025.

With FCA and EU regulation, segregated client accounts, and investor protection schemes, Trading 212 provides a secure trading environment. Its financial stability and clean track record further strengthen confidence for both beginners and experienced traders.

How To Open an Account

Opening an account with Trading 212 is a quick and fully online process, designed to make it easy for beginners to get started. The sign-up flow is straightforward and can be completed in just a few steps from your desktop or mobile device.

Online Application

You’ll begin by filling out a short application form on the Trading 212 website or app. This includes providing your name, email address, and country of residence, along with selecting which type of account you’d like to open—Invest, ISA, or CFD.

Note: You can’t open an account if you are from US or Canada.

Identity Verification (KYC)

To comply with regulatory requirements, Trading 212 requires Know Your Customer (KYC) checks. You’ll need to upload a valid form of ID (passport, driver’s license, or national ID card) and provide proof of address, such as a recent utility bill or bank statement. The verification system is automated, so in most cases, documents are approved quickly.

Account Approval

Once your documents are submitted, approval typically takes just a few hours, though in some cases it may take up to one business day. After approval, you can fund your account instantly using your preferred payment method and start trading or investing right away.

How Long Does It Take?

The Trading 212 account approval process is usually very quick compared to traditional brokers. Most users are verified and ready to trade within a few hours of submitting their documents.

In cases where extra checks are required—such as unclear ID scans or address proof—the process may take up to one business day. Once approved, you can fund your account instantly via card, bank transfer, or e-wallet and start investing right away.

For the majority of retail clients, Trading 212 offers one of the fastest onboarding experiences in 2025, making it highly convenient for beginners.

Overall, the Trading 212 account opening process is simple, secure, and much faster than traditional brokers, making it ideal for first-time traders in 2025.

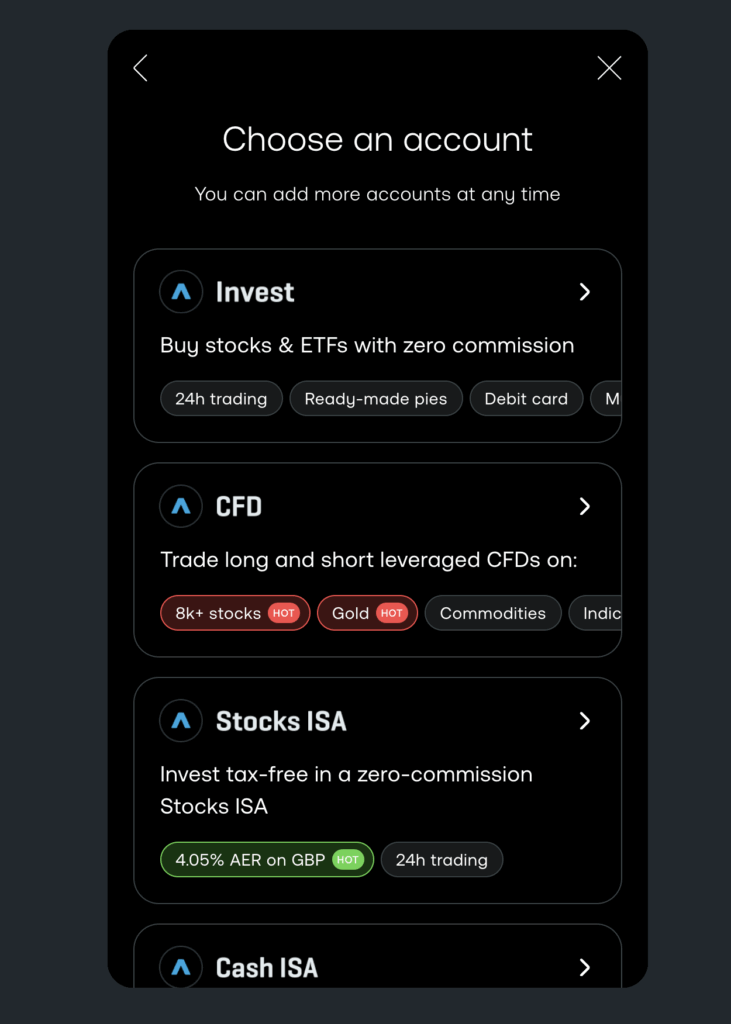

Account Types

Trading 212 offers several account types designed to meet the needs of different kinds of traders and investors. Whether you’re a long-term investor, a short-term CFD trader, or just getting started, there’s an option to fit your goals.

Trading 212 Invest

The Invest account allows you to trade stocks and ETFs with zero commission. It’s ideal for long-term investors who want to build portfolios without worrying about transaction costs. Fractional shares are supported, so you can start investing in big-name companies with small amounts.

Trading 212 CFD

The CFD account gives access to forex, indices, commodities, and crypto CFDs (availability varies by region). This account is better suited to active traders who want to speculate on short-term price movements using leverage. However, CFDs come with higher risk and involve spreads, overnight fees, and conversion costs.

Trading 212 ISA (UK Only)

For UK residents, Trading 212 also offers a Stocks & Shares ISA, letting investors grow their wealth tax-efficiently. You can invest in thousands of global stocks and ETFs, all sheltered under the ISA allowance.

Practice Account

Every user gets access to a practice account with virtual funds, which mirrors live market conditions. This is perfect for beginners to learn the platform or for experienced traders to test new strategies risk-free.

What is the Minimum Deposit at Trading 212?

One of Trading 212’s strengths is its accessibility. For an Invest account, there is €1 / £1minimum deposit requirement, making it easy for beginners to start investing with as little or as much as they like. This flexibility is especially appealing to new investors in the UK and Europe who want to test the waters before committing larger sums.

For the CFD account, Trading 212 does require a €10 / £10 minimum deposit. This low entry barrier makes the platform far more approachable than many traditional brokers, while still offering access to a wide range of markets.

| Broker | Minimum Deposit |

|---|---|

| Trading 212 | €1 |

eToro | $50 |

XTB | $0 |

| Pepperstone | $0 |

Deposit and Withdrawal - Trading 212 Review

Managing your money efficiently is crucial, and Trading 212 makes deposits and withdrawals straightforward, fast, and cost-effective. With multiple funding methods, zero deposit and withdrawal fees, and quick processing times, the platform stands out as a user-friendly choice for both beginners and experienced traders.

Deposit Fees & Options

You can fund your account through several convenient methods:

Withdrawal Fees & Options

Withdrawals can be made using the same methods as deposits:

For comparison, eToro charges a $5 withdrawal fee, which makes Trading 212 the cheaper choice for frequent withdrawals.

Overall Experience

With no deposit until you reach €2,000 or withdrawal fees and a wide range of payment methods, Trading 212 offers one of the most cost-friendly funding experiences in the retail trading space. Fast processing and flexible options make it especially convenient for both beginners and active traders looking for hassle-free account management.

Desktop Trading Platform - Trading 212 Review

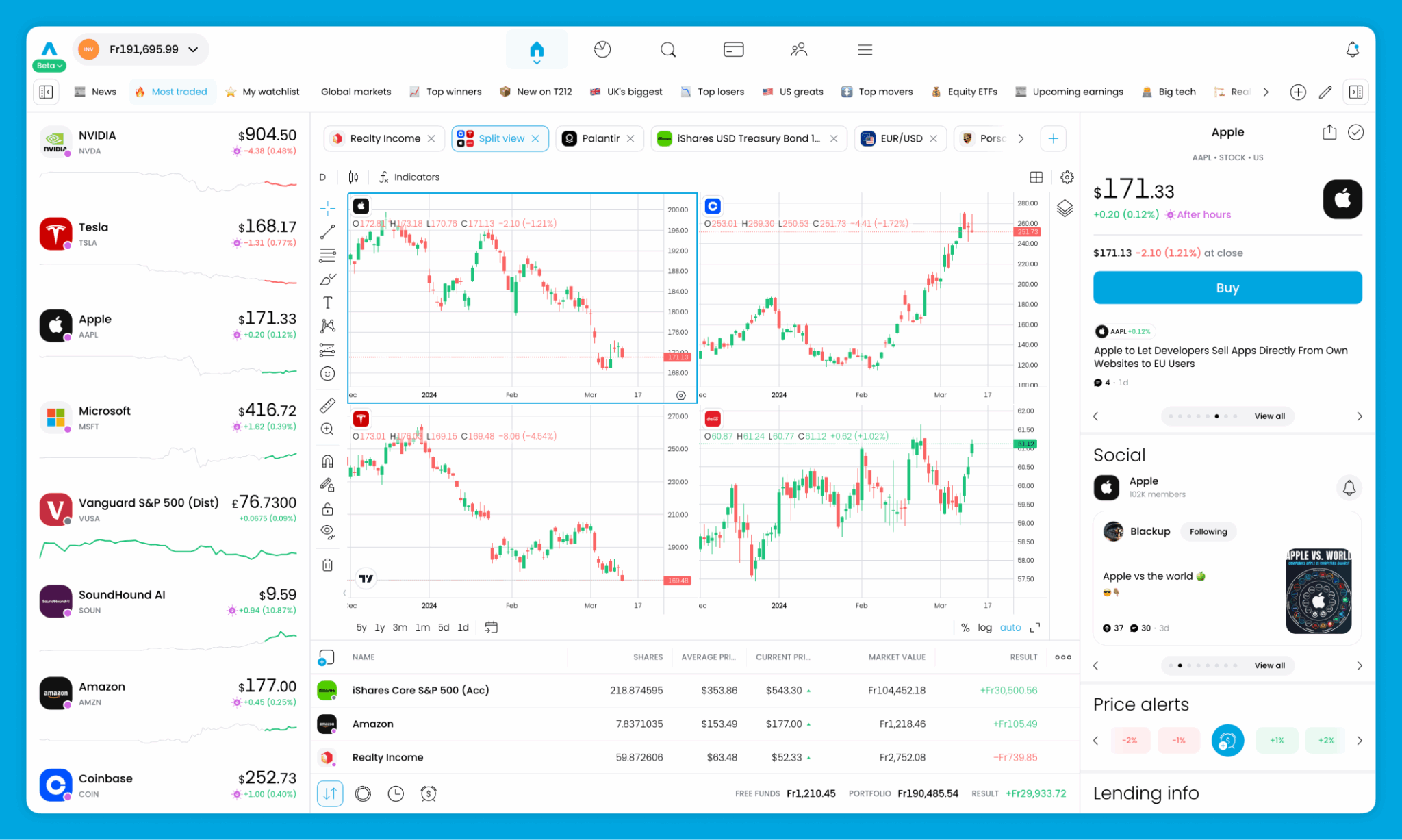

When I tested the Trading 212 desktop platform, my first impression was its clean, modern design and how quickly I could navigate between charts, order windows, and watchlists.

Unlike some platforms that feel overwhelming with endless menus, Trading 212 strikes a balance between simplicity for beginners and enough functionality for casual traders. It’s not the most advanced workstation on the market, but for stock investors and light CFD users, the experience felt smooth, fast, and refreshingly intuitive.

Advanced Charting

Trading 212’s desktop platform offers a solid range of chart types, including line, bar, candlestick, and area charts. You can apply technical indicators such as moving averages, RSI, MACD, and Bollinger Bands. While it covers most retail needs, it does not match the depth of charting found on MetaTrader 4/5 or TradingView, which advanced CFD traders may miss.

Market Analysis Tools

Users can access built-in screeners and market heat maps to identify trends. The analysis tools are intuitive but remain more basic compared to professional-grade platforms.

Real-time Information

Price feeds are updated in real time across stocks, ETFs, and CFDs, ensuring fast execution and accurate market snapshots. This was reliable during testing, with minimal delays even during volatile sessions.

Research Integration

Unlike platforms such as XTB’s xStation or Pepperstone’s TradingView integration, Trading 212’s desktop app has limited third-party research integration. News updates are available, but traders who rely heavily on in-depth reports may find them lacking.

Educational Content Integration

Trading 212 integrates basic educational resources directly into the platform, helping beginners understand how to place trades and read charts. However, advanced educational content is primarily accessed via the website or mobile app.

Placing Orders

Order placement is straightforward, with options for market, limit, stop, and stop-limit orders. Execution was smooth in testing, and the interface is simple enough for beginners to use without confusion.

Alerts & Notifications

Traders can set price alerts and notifications for key assets. Alerts can be delivered in-app or via push notifications (if linked with the mobile platform), making it easy to stay updated.

Login and Security

The platform uses secure login protocols, including two-factor authentication (2FA) for added protection. Client funds and data are safeguarded by Trading 212’s regulatory compliance standards.

Search Functions

The search bar is fast and responsive, allowing you to quickly locate stocks, ETFs, or CFDs by name or ticker. It also suggests related assets, which is convenient for portfolio building.

Pros & Cons of the Web Platform

Pros

- Clean, modern design that is easy to navigate

- Multiple chart types (candlestick, line, bar, area) with common indicators

- Real-time price updates for fast execution

- Straightforward order placement with different order types (market, limit, stop, stop-limit)

- Responsive search function with ticker and asset suggestions

- Secure login with 2FA and strong compliance standards

Cons

- No MetaTrader 4/5 or TradingView support, limiting appeal for advanced CFD traders

- Limited research integration compared to brokers like XTB or Pepperstone

- Basic educational tools within the platform, with most advanced resources outside

- Fewer advanced technical indicators compared to dedicated charting platforms

- Less customizable workspace than professional-grade trading platforms

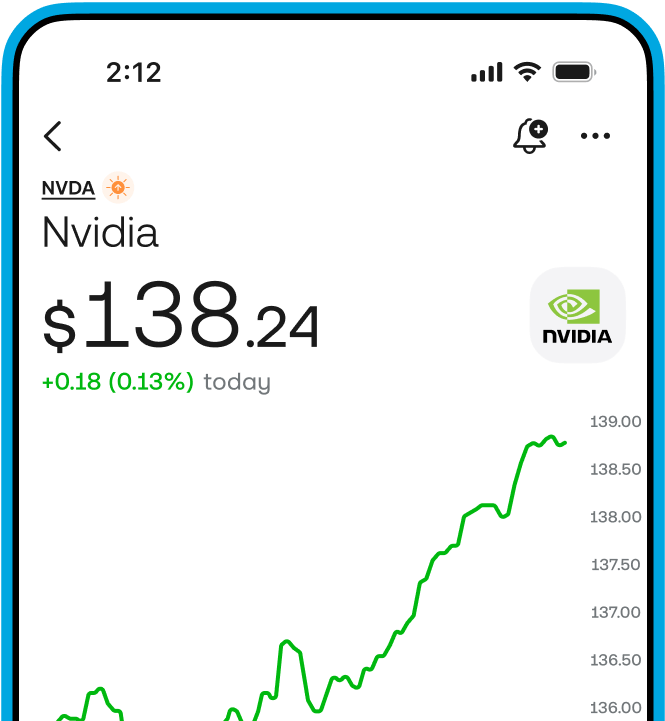

Mobile App - Trading 212 Review

During my tests, the Trading 212 mobile app stood out as one of the most polished trading apps available today. It’s designed with a mobile-first focus, delivering fast execution, clean navigation, and an intuitive layout that makes trading on the go effortless.

For beginners and casual investors, the app provides everything needed in a simple package, while more advanced CFD traders may find the lack of MetaTrader-style tools a limitation.

Look & Feel

The Trading 212 mobile app has a sleek, modern interface designed with simplicity in mind. Navigation between watchlists, charts, and portfolios is smooth, and the app loads quickly even during volatile market conditions.

Features like fractional shares, price alerts, and instant deposits make it practical for everyday investors, while charts and indicators are well-suited for casual analysis and trading.

Login and Security

Security is handled with two-factor authentication (2FA) and biometric login options such as fingerprint or Face ID. This ensures both convenience and protection for traders accessing their accounts on mobile devices.

Search Functions

The search bar is fast and intuitive, allowing you to find stocks, ETFs, or CFDs by ticker symbol or company name. It also suggests related assets, making it easy to discover new opportunities without leaving the app.

Placing Orders

Placing trades is straightforward, with options for market, limit, stop, and stop-limit orders.

The order ticket is clean and easy to understand, which is great for beginners who don’t want to be overwhelmed by complex options. Execution speed during testing was reliable, with minimal lag.

Pros & Cons of the Mobile App

Pros

- Clean, modern interface with smooth navigation

- Mobile-first design makes it easy for beginners and casual traders

- Fast search function with ticker and asset suggestions

- Secure login with 2FA and biometric options (Face ID, fingerprint)

- Fractional shares and instant deposits available directly in the app

- Reliable trade execution with simple order placement

Cons

- Limited advanced charting tools compared to MetaTrader or TradingView

- Basic research integration, with most in-depth insights available outside the app

- Workspace customization is minimal

- Better suited for long-term investors and casual CFD traders, not advanced professionals

Market Research, Tools, and Education

A broker’s research and educational offering can make a big difference in how traders grow and make informed decisions.

Trading 212 provides the essentials but keeps things simple, which works well for beginners, though advanced traders may find the tools limited compared to research-heavy platforms.

The platform offers a basic newsfeed, economic calendar, and some fundamental data, enough to support everyday trading. Educational resources are primarily delivered through Trading 212’s YouTube channel, tutorials, and in-app guides, making it accessible for those just starting out.

However, the lack of in-depth analysis, premium research reports, or third-party integrations means experienced traders may need to rely on external sources.

Overall, the offering is functional and beginner-friendly but not designed for advanced research needs.

Customer Support - Trading 212 Review

Strong customer support can make a big difference when traders need quick answers or face account issues. Trading 212 offers multiple support channels, but its service quality receives mixed reviews from users.

Support Channels

Customers can reach Trading 212 via:

- In-app live chat – the fastest way to connect with a support agent

- Email support – for more detailed inquiries

Notably, Trading 212 does not provide 24/7 phone support, which may be a drawback for those who prefer speaking to a representative directly.

Response Times

User feedback suggests that live chat response times vary. Some traders report getting quick answers within minutes, while others mention longer waiting times during busy market hours. Email responses typically arrive within 24–48 hours, depending on the complexity of the issue.

User Experience

Reviews on platforms like Trustpilot reflect a mixed experience. Many users appreciate the convenience of in-app support, while others feel frustrated by slow response times or the lack of immediate phone assistance.

Overall Impression

Trading 212’s customer support works well for basic inquiries and general troubleshooting, especially via live chat. However, the absence of round-the-clock phone support and the inconsistent response times make it less robust compared to brokers with fully staffed 24/7 help desks. For beginners and casual investors, the support is usually sufficient, but advanced traders may prefer brokers with faster and more comprehensive service.

FAQ

Is Trading 212 safe?

Yes, Trading 212 is regulated by the FCA in the UK and the FSC in Bulgaria, offering investor protection schemes such as the FSCS (up to £85,000) and ICF (up to €20,000) depending on your region.

What markets can I trade on Trading 212?

You can trade stocks, ETFs, forex, indices, commodities, and crypto CFDs (crypto availability depends on jurisdiction).

Does Trading 212 charge commission?

No, Trading 212 offers zero-commission trading on stocks and ETFs. However, CFD trading involves spreads and overnight fees.

What is the minimum deposit on Trading 212?

There is no minimum deposit for Invest or ISA accounts. CFD accounts usually require a small minimum deposit of around €10 / £10.

How do I fund my account?

Deposits can be made via bank transfer, debit/credit card, or e-wallets like PayPal, Google Pay, and Apple Pay.

Are there deposit or withdrawal fees?

No, Trading 212 does not charge fees for deposits or withdrawals. However, currency conversion fees (0.15%–0.5%) may apply if trading in a non-base currency.

Does Trading 212 offer a demo account?

Yes, Trading 212 provides a free demo account with virtual funds, ideal for practice or testing strategies.

Can I trade crypto on Trading 212?

Crypto is available only through CFDs and only in regions where regulations permit. Trading 212 does not currently offer direct crypto spot trading.

Is Trading 212 good for beginners?

Yes, Trading 212 is considered one of the best brokers for beginners in the UK and Europe thanks to its zero-commission stock trading, fractional shares, intuitive mobile app, and demo account.