VANTAGE MARKETS REVIEW 2025

Searching for a broker that truly balances speed, transparency, and reliability? In this Vantage Markets review, I share my hands-on experience testing its platforms, pricing, and performance under real market conditions. Whether you’re a beginner with a small budget or a seasoned pro looking for institutional-grade execution, you’ll discover how Vantage Markets measures up in 2025 and 2026 — and whether it’s the right fit for your trading goals.

Broker Guide's Vantage Markets Review in 2025

Choosing the right trading platform can make or break your trading results, and that’s why I decided to personally test Vantage Markets heading into 2025 and 2026. Founded in 2009, Vantage has grown from a small forex broker into a globally recognized multi-asset CFD provider, serving traders in more than 170 countries.

Over the years, it has earned a reputation for transparency, reliability, and lightning-fast ECN execution.

In this Vantage Markets review, I set out to evaluate how the broker performs in the areas that matter most to traders today, including pricing, safety, platforms, account options, and overall reliability.

With markets evolving quickly and technology reshaping the way people trade, it was important to see whether Vantage continues to deliver institutional-grade access and value in 2025 and beyond.

My findings show that Vantage stands out for its strong regulation, competitive Raw ECN pricing, and modern trading platforms that combine MetaTrader, TradingView, and its own proprietary app.

For traders seeking a regulated, low-cost, and high-speed broker built for the next phase of the global market, Vantage Markets remains a top choice going into 2026.

About Vantage Markets

Vantage Markets, originally founded in 2009 in Sydney, Australia, has evolved into one of the world’s most established multi-asset CFD brokers. The company operates globally under strict regulatory oversight, holding licenses from several top-tier authorities including the Australian Securities and Investments Commission (ASIC), the UK Financial Conduct Authority (FCA), the Financial Sector Conduct Authority (FSCA) in South Africa, the Cayman Islands Monetary Authority (CIMA), the Mauritius Financial Services Commission (FSC), and the Vanuatu Financial Services Commission (VFSC).

Vantage gives traders access to over 1,000 tradable instruments across multiple markets, including forex, indices, commodities, shares, ETFs, bonds, and cryptocurrency CFDs. This diverse selection allows clients to diversify portfolios and take advantage of global opportunities from a single trading account.

The company is built around core values of trust, transparency, and execution quality, aiming to provide both retail and professional traders with institutional-grade trading conditions. Its ECN and STP execution model ensures ultra-fast order processing through top-tier liquidity providers, while maintaining fair and transparent pricing.

Over the years, Vantage has earned multiple industry awards, reflecting its consistent performance and innovation. Recent accolades include Best ECN Broker, Best Customer Support, and Best Online Trading Platform APAC 2025 from leading financial award bodies.

To enhance the trading experience, Vantage partners with top-tier technology and research providers such as TradingView, Bloomberg, and Trading Central, integrating professional-grade charting tools, live market analysis, and advanced trading insights into its platform ecosystem.

With more than a decade of experience and a strong regulatory foundation, Vantage Markets continues to bridge the gap between retail and institutional trading, positioning itself as a trusted and forward-looking broker for 2025 and 2026.

My Quick Verdict: Who is Vantage Markets Best For?

Rating: 4.5/5

Best for: Experienced traders, scalpers, algorithmic and professional investors who want transparent costs and ECN-grade execution.

Not ideal for: Absolute beginners or those prioritizing passive investing and fixed-spread accounts.

After testing Vantage Markets across multiple platforms and account types, my overall impression is highly positive. The broker maintains a Trust Score of 90/99, classifying it as Highly Trusted according to some independent brokers.

This strong reputation is backed by multi-jurisdictional regulation, tier-one oversight, and over a decade of consistent performance.

Vantage delivers impressive value for active traders who prioritize raw pricing, ECN access, advanced platforms, and reliable execution speed. Its Raw ECN and Pro ECN accounts offer institutional-level spreads starting from 0.0 pips, while the integration of MetaTrader 4, MetaTrader 5, TradingView, and the proprietary Vantage App provides excellent flexibility for all trading styles.

However, Vantage may not be ideal for complete beginners seeking ultra-low entry costs with fixed spreads or extensive hand-holding. While its educational resources have improved, newer traders might find the range of features and pricing structures a bit overwhelming at first.

Vantage remains a top-tier broker in 2025 and 2026, offering institutional-grade execution, powerful tools, and robust safety oversight — a dependable choice for serious traders worldwide.

Pros:

- Regulated by Tier-1 authorities (ASIC and FCA)

- Low trading and non-trading fees compared to industry averages

- Zero deposit and withdrawal fees for most payment methods

- Fast account setup process, typically under 5 minutes

- Advanced trading platforms including MT4, MT5, TradingView, and the Vantage App

- Negative balance protection for all retail clients

Cons:

- Limited product range beyond CFDs and forex

- Standard account spreads slightly higher than top competitors

- Unavailable to clients in the US, Canada, and Japan

- Research and premium tools are often gated behind higher deposit tiers

Why You Should Choose Vantage Markets ?

As the trading landscape becomes increasingly competitive, Vantage Markets continues to earn global recognition for combining institutional-grade execution, tight ECN pricing, and trusted multi-jurisdiction regulation. Whether you’re an active trader or a seasoned professional, Vantage offers the right mix of technology, safety, and support to help you trade efficiently and confidently.

Lightning-Fast Execution and Institutional Liquidity

Vantage operates through the Equinix Fiber Optic Network, a world-class trading infrastructure used by major financial institutions. This ensures low-latency execution, minimal slippage, and reliable order routing — a crucial advantage for scalpers, algorithmic traders, and high-frequency strategies.

The broker also connects traders directly to deep institutional liquidity pools, providing Raw ECN spreads starting from 0.0 pips. Combined with transparent commission structures, this setup allows for precise, cost-efficient trading across multiple asset classes.

Global Regulation and Trusted Reputation

Founded in 2009, Vantage holds licenses from respected financial regulators, including ASIC (Australia), FCA (UK), FSCA (South Africa), CIMA (Cayman Islands), and FSC (Mauritius). This multi-jurisdictional framework gives traders peace of mind, knowing their funds are protected under strict financial oversight and segregation rules.

Comprehensive Support and Educational Resources

Vantage prioritizes trader success through 24/7 multilingual customer support and a wide range of educational tools, including webinars, tutorials, trading guides, and live market sessions. The broker’s continuous focus on trader development makes it suitable for both emerging and experienced traders looking to enhance their skills.

Advanced Research and Copy Trading Solutions

Vantage partners with Bloomberg and Trading Central to deliver professional-grade research, real-time market insights, and daily analysis directly within its platforms. For traders interested in automation or community-based investing, Vantage also supports social and copy trading via Myfxbook, DupliTrade, and ZuluTrade, enabling users to follow and replicate successful strategies easily.

In summary, Vantage Markets remains a top choice for 2025 and 2026, offering fast execution, global regulation, transparent ECN pricing, and expert-level research tools — all within a secure and trader-focused ecosystem designed for long-term success.

Compare to Top Competitors

When evaluating a broker, it’s important to compare it against leading competitors to understand where it truly excels. In 2025–2026, Vantage Markets continues to compete closely with top-tier names like IG, Fusion Markets, and IC Markets.

Each broker offers distinct advantages in pricing, tools, and trader experience — but Vantage stands out for its balance of regulation, platform variety, and ECN execution power.

IG

Fusion Markets

IC Markets

Exploring Vantage Markets’ Range of Tradable Instruments

Vantage Markets gives traders access to an impressive 1,000+ CFDs across multiple asset classes, making it one of the most versatile brokers in the market. From forex and indices to commodities, shares, ETFs, and crypto, Vantage allows traders to diversify and manage multiple strategies within a single account.

Forex Trading

Vantage offers over 60 forex pairs, including majors, minors, and exotics. With Raw ECN spreads from 0.0 pips and deep liquidity, it’s ideal for scalpers and algorithmic traders who demand precise execution. The broker’s institutional-grade infrastructure ensures fast trade processing and minimal slippage, even during high-volatility periods.

Indices and Commodities

Traders can speculate on global economic performance through major indices such as the S&P 500, NASDAQ, DAX, and FTSE 100. Additionally, commodity CFDs like gold, silver, oil, and natural gas offer safe-haven and inflation-hedging opportunities. Both asset types benefit from competitive leverage and low trading costs.

Shares and ETFs

Vantage provides share CFDs across leading global markets including the US, UK, Europe, and Asia-Pacific. It also supports ETF CFDs, allowing traders to gain exposure to entire industries or market sectors. This range caters to both short-term traders and long-term speculators seeking diversified access.

Crypto CFDs and Perpetual Accounts

Traders can access digital assets via crypto CFDs and Perpetual accounts, featuring popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). Note that crypto CFDs are unavailable to UK retail clients due to FCA regulations. These instruments offer 24/7 market access and flexible margin requirements.

| Asset | Vantage Markets |

|---|---|

| Tradeable Symbols | 1000 |

| Forex Pairs | 60+ |

| Commodity CFDs | 23 |

| Stock CFDs | 1000+ |

| Cryptocurrencies | 60 |

| Futures | 18 |

| ETF CFDs | 57 |

| Bonds | 7 |

Social and Copy Trading Options

For those who prefer collaborative or automated trading, Vantage supports social and copy trading through trusted third-party platforms such as Myfxbook AutoTrade, DupliTrade, and ZuluTrade. These integrations allow users to follow or replicate the strategies of professional traders, helping newcomers learn from experts while maintaining full control over their accounts.

Bottom Line

With 1,000+ CFDs, multi-asset flexibility, and the added benefit of social trading options, Vantage Markets empowers traders to diversify portfolios, explore new strategies, and access global markets with confidence. Whether you trade currencies, commodities, or crypto, Vantage delivers the speed, transparency, and variety needed to thrive in 2025 and 2026.

How Vantage Market’s Instruments Compare to Competitors

The table below compares Vantage Markets to its top competitors — IG Markets, Fusion Markets, and IC Markets — based on the availability of key asset classes:

| Asset | Vantage Markets | IG | Fusion Markets | IC Markets |

|---|---|---|---|---|

| Forex | ||||

| Indices | ||||

| Commodities | ||||

| Stock CFDs | ||||

| Cryptocurrencies Futures | ||||

| Bonds | ||||

| ETFs |

Fees and Commission Structure

| Fees | |

|---|---|

| Average spread (EUR/USD) - Standard account | 1.3 pips |

| All-in Cost EUR/USD - Active | 0.75 pips |

Commissions | Standard STP Account – Spreads start from 1.1 pips with no commissions. Raw ECN Account – Start from 0.0 pips and a commission of $6.0 per round turn. Pro ECN Account – spreads start from 0.0 pips and a commission of $3.0 per round turn. |

Forex CFD fees | Low |

Index CFD fees | Average |

Stock CFD fees | High |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | $0 |

Trading costs and transparency are among the most important factors for traders. Vantage Markets has built a strong reputation for offering competitive spreads, clear commissions, and zero hidden fees, appealing to both new and professional traders. Its pricing model is straightforward and aligned with leading ECN brokers such as Fusion Markets and IC Markets.

Trading Fees

Vantage offers three main account types with different pricing structures to suit varying trading styles: Standard STP, Raw ECN, and Pro ECN.

Spreads & Commissions

Standard STP Account: Average spreads start from 1.1 pips on EUR/USD. This account type charges no commission, as costs are included in the spread. It’s ideal for beginners or casual traders who prefer simple pricing.

Raw ECN Account: Offers spreads from 0.0 pips, with a $6 round-turn commission per lot. This account provides direct access to liquidity providers for tighter pricing and faster execution, making it suitable for scalpers and algorithmic traders.

Pro ECN Account: Designed for high-volume and professional traders, spreads also start from 0.0 pips, but commissions are reduced to $3 per round turn. The minimum deposit is higher, but the overall cost per trade is among the lowest in the industry.

Swaps

Overnight financing (swap) rates at Vantage are industry-standard, varying based on the instrument and position size. Traders can also opt for swap-free (Islamic) accounts, which comply with Sharia principles and replace interest with fixed administrative fees.

Non-Trading Fees

Deposit and Withdrawal Fees

Vantage does not charge fees on deposits or withdrawals made via credit/debit cards or e-wallets. Traders using international bank transfers are entitled to one free withdrawal per month, after which standard bank charges may apply.

Inactivity Fees

There are no inactivity fees, allowing traders to pause or take breaks without incurring penalties — a notable advantage over brokers that charge dormant account fees after several months.

Currency Conversion Fees

A small conversion fee applies when trading instruments denominated in a currency different from your account’s base currency. Vantage helps mitigate this by supporting 15 base currencies, reducing the need for unnecessary conversions.

Verdict

Overall, Vantage Markets offers a transparent and cost-effective fee structure that appeals to both casual and professional traders. The Raw ECN and Pro ECN accounts provide some of the tightest spreads in the market, supported by institutional-grade liquidity and rapid execution. With no deposit, withdrawal, or inactivity fees, and the flexibility of multiple base currencies, Vantage remains one of the most competitively priced and trader-friendly brokers in 2025 and 2026.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Vantage Markets Regulated ?

Vantage Markets stands out as a highly trusted global broker, operating under multiple reputable regulatory authorities that ensure transparency, client protection, and compliance with strict financial standards.

Global Regulation and Licensing

Founded in 2009, Vantage Markets operates through several entities regulated across multiple jurisdictions, making it one of the most widely supervised brokers in the industry. The company holds licenses from:

- ASIC (Australian Securities and Investments Commission) – Australia

- FCA (Financial Conduct Authority) – United Kingdom

- FSCA (Financial Sector Conduct Authority) – South Africa

- FSC (Financial Services Commission) – Mauritius

- CIMA (Cayman Islands Monetary Authority) – Cayman Islands

- VFSC (Vanuatu Financial Services Commission) – Vanuatu

These regulators, particularly ASIC and FCA, are regarded as Tier-1 authorities, ensuring that Vantage adheres to the highest levels of financial integrity, operational transparency, and client fund protection.

Client Fund Protection and Financial Security

Under its Tier-1 licenses, Vantage is required to segregate client funds from company operating capital, meaning client money is held securely in top-tier banks and cannot be used for internal operations. Both ASIC and FCA regulations also enforce leverage caps to minimize trader risk, typically limiting retail leverage to 1:30 in the UK and Australia.

For UK clients, deposits are protected under the Financial Services Compensation Scheme (FSCS), which provides coverage of up to £85,000 per person if the broker becomes insolvent. Additionally, Vantage extends coverage further through Lloyd’s of London insurance, protecting eligible clients for up to $1 million per claimant.

Negative Balance Protection and Risk Controls

All Vantage retail accounts include negative balance protection, ensuring that clients can never lose more than their deposited funds, even during extreme market volatility. This safeguard, along with tight execution policies and margin alerts, helps reduce the risk of catastrophic losses.

Vantage also maintains a strong internal risk management framework and regularly undergoes third-party audits to ensure compliance with international financial standards.

Trust Rating and Reputation

While Vantage Markets is not a publicly traded company, it has earned a strong reputation for reliability and client transparency. Independent reviewers consistently rate it as “Highly Trusted”, giving it an overall Trust Score of 90/99, comparable to other top-tier brokers.

Bottom Line

With oversight from multiple global regulators, segregated client funds, insurance protection, and negative balance safeguards, Vantage Markets provides a secure and transparent trading environment. Its Tier-1 regulation under ASIC and FCA, coupled with comprehensive risk controls and a proven 15-year track record, firmly establishes it as one of the safest and most trustworthy brokers to trade with in 2025 and 2026.

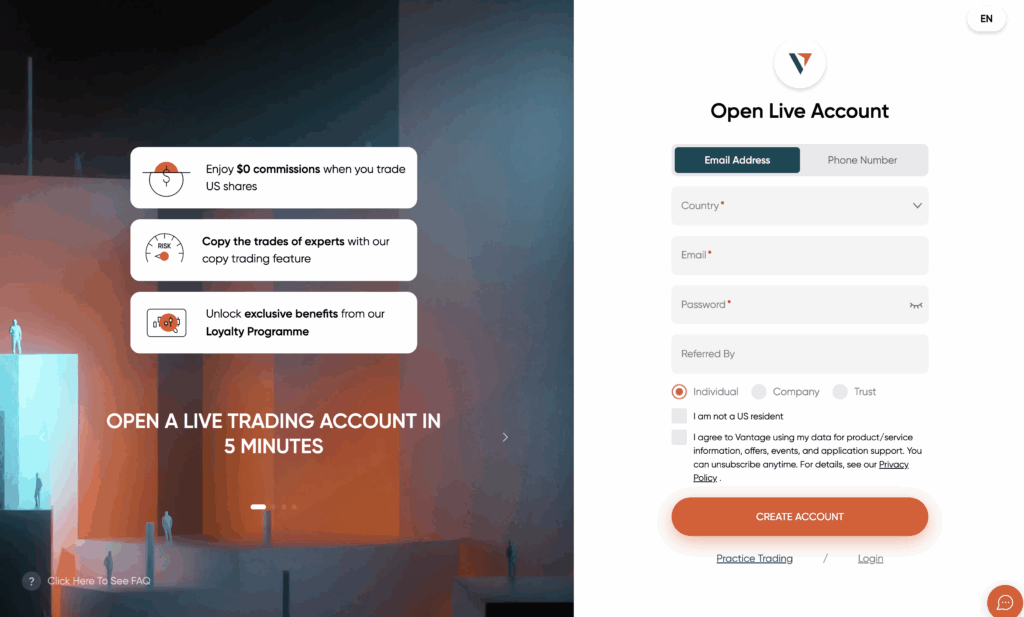

How To Open an Account

In today’s fast-paced trading world, traders expect a broker that makes account setup quick, secure, and hassle-free. Vantage Markets delivers exactly that with a fully digital registration process that can be completed in about five minutes. The platform’s intuitive onboarding system and automated verification ensure you can start trading within 24 hours — no paperwork or long waiting times required.

Step-by-Step Account Setup

- Register – Visit the official Vantage Markets website and click “Register.” Enter your personal details such as name, email address, country of residence, and preferred base currency.

- Verify Your Identity – Upload a valid government-issued ID (passport or driver’s license) and a recent proof of address, such as a utility bill or bank statement. Verification is typically completed within one business day.

- Choose Your Account Type – Pick between Standard STP, Raw ECN, or Pro ECN accounts based on your trading style. Each offers unique spreads, commissions, and minimum deposit requirements.

- Fund Your Account – Add funds using your preferred method — debit/credit card, bank transfer, or e-wallets like PayPal, Skrill, or Neteller.

- Start Trading – Once verified and funded, access MT4, MT5, TradingView, or the Vantage App and begin trading instantly.

Vantage supports 15 base currencies, including USD, EUR, GBP, AUD, CAD, BTC, and ETH, helping traders avoid unnecessary conversion fees. Its fast, seamless onboarding process makes it one of the most efficient and beginner-friendly brokers to get started with.

Account Types

Choosing the right trading account can make a big difference in how you experience the markets. Whether you’re just getting started or already trading professionally, Vantage Markets offers a range of accounts tailored to different skill levels, strategies, and budgets. Each account type is built to provide transparent pricing, flexible leverage, and access to the broker’s full lineup of trading platforms — MT4, MT5, TradingView, and the Vantage App.

In this section, we’ll break down each Vantage account type, explain who it’s best suited for, and highlight what makes it stand out. From commission-free beginner accounts to professional-grade ECN setups, Vantage gives traders the flexibility to grow, adapt, and trade their way in 2025 and 2026.

Standard STP Account

The Standard STP account is Vantage’s most beginner-friendly option. It features commission-free trading with spreads starting from 1.1 pips, offering a simple and transparent structure.

All costs are included in the spread, making it easy for new traders to understand their expenses. With a minimum deposit of just $50, this account is best suited for casual or beginner traders who want straightforward access to global markets without complex fee structures.

Raw ECN Account

The Raw ECN account caters to more experienced traders who demand tight spreads and faster execution. Spreads start from 0.0 pips, with a $6 round-turn commission per lot. This account connects directly to Vantage’s institutional liquidity pool, providing deep liquidity and precise pricing. It’s particularly ideal for scalpers, algorithmic traders, and intraday professionals who rely on speed and accuracy.

Pro ECN Account

Built for professional and high-volume traders, the Pro ECN account offers Vantage’s most competitive pricing — spreads from 0.0 pips with a reduced $3 round-turn commission. The minimum deposit is $10,000, reflecting its professional-grade structure.

This account provides premium trading conditions, including priority execution and personalized support, making it suitable for hedge fund managers, money managers, and seasoned professionals.

Islamic (Swap-Free) Account

Vantage offers Sharia-compliant Islamic accounts on both the Standard STP and Raw ECN tiers. Instead of overnight swap fees, these accounts charge a fixed administrative fee, allowing traders to stay aligned with Islamic financial principles.

Cent Account

Designed for beginners and those testing smaller strategies, the Cent Account allows trading in micro-lots with balances displayed in cents. This structure helps new traders manage risk effectively while gaining live market experience with minimal exposure.

Perpetual Account

Tailored for crypto-focused traders, the Perpetual Account provides access to cryptocurrency CFDs with a minimum deposit of only $5. It supports popular digital assets like Bitcoin and Ethereum, with 24/7 trading availability and no expiration dates on contracts.

Premium Account

Available in selected Asian regions, the Premium Account offers enhanced leverage of up to 1:2000, giving active traders additional flexibility and margin efficiency.

Demo Account

Vantage also provides a free Demo Account with up to $100,000 in virtual funds, ideal for testing strategies, exploring platforms, or learning the ropes without financial risk.

What is the Minimum Deposit at Forex.com?

Vantage Markets keeps its minimum deposit requirements straightforward and accessible, allowing traders to start with as little as $50 USD. This low entry point makes the broker suitable for both beginners testing the waters and experienced traders looking for cost-efficient access to ECN-style trading conditions.

Here’s a breakdown of the minimum deposits across Vantage’s main account types:

Standard STP Account

Minimum Deposit: $50

Best For: Beginners and casual traders

Raw ECN Account

Minimum Deposit: $50

Best For: Active traders and scalpers

Pro ECN Account

Minimum Deposit: $10,000

Best For: Professional and institutional traders

Cent Account

Minimum Deposit: $1 (varies by region)

Best For: New traders or strategy testers

Perpetual Account

Minimum Deposit: $5

Best For: Crypto CFD traders

Premium Account

Minimum Deposit: $200 (region-specific)

Best For: Traders in selected Asian markets

Deposits can be made in 15 base currencies, including USD, EUR, GBP, AUD, CAD, BTC, and ETH, allowing traders to reduce conversion fees and avoid funding delays.

| Broker | Minimum Deposit |

|---|---|

| Vantage Markets | $50 |

IG | $5 |

| IC Markets | $200 |

Fusion Markets | $0 |

Deposit and Withdrawal

Funding your account and accessing your profits should always be simple, fast, and cost-effective — and Vantage Markets delivers just that. The broker provides a wide range of deposit and withdrawal options, most of which are fee-free and processed almost instantly, making it easy for traders to manage their funds without unnecessary delays or charges.

Deposit Options

Vantage supports multiple secure and convenient funding methods to accommodate traders worldwide. You can deposit funds using:

Most deposits made via cards and e-wallets are processed instantly, allowing traders to start trading right away. Bank transfers, depending on your country and bank, usually take 2–5 business days to clear.

Withdrawal Fees & Options

Withdrawals are just as straightforward. Traders can request payouts through the same methods used for deposits, ensuring security and compliance with anti-fraud regulations. Vantage provides one free international bank withdrawal per month, while additional withdrawals may incur small banking fees depending on your financial institution.

The broker’s internal processing time is within 24 hours, and withdrawals via e-wallets are typically completed the same day once approved.

Supported Base Currencies

Vantage offers 15 supported base currencies, including USD, EUR, GBP, AUD, CAD, NZD, SGD, JPY, BTC, and ETH, among others. Having multiple base currency options helps minimize conversion fees, especially for traders operating in different markets or using cryptocurrency-based accounts.

Final Thoughts

With zero deposit fees, instant funding options, and fast withdrawals, Vantage ensures a smooth and transparent money management experience. Whether you prefer traditional payment methods or crypto wallets, the platform’s flexibility and efficiency make it easy to move funds in and out of your account securely. This commitment to convenience and fairness solidifies Vantage Markets as one of the most user-friendly brokers for funding and withdrawals in 2025 and 2026.

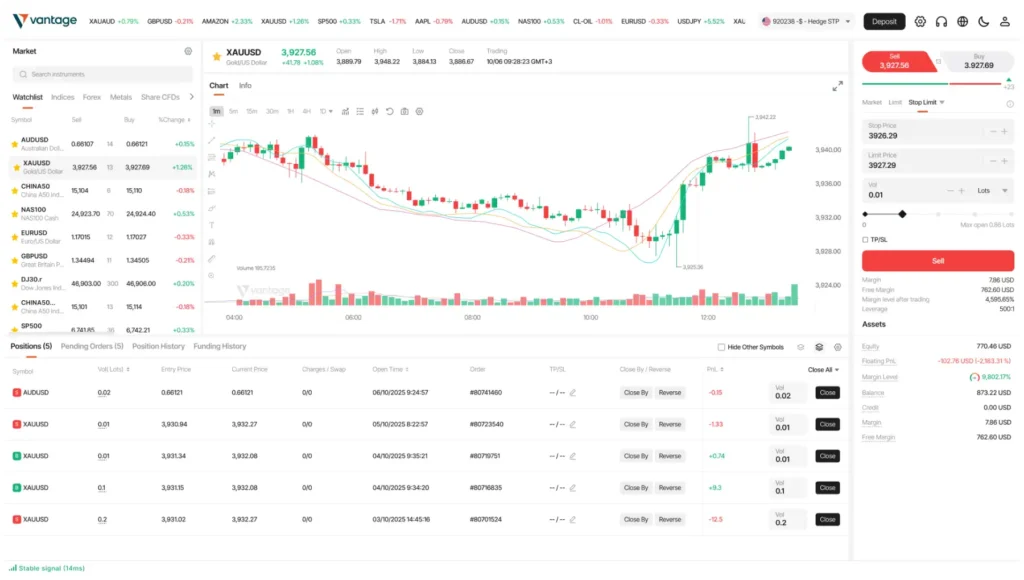

Desktop Trading Platform

During my testing of Vantage Markets’ trading platforms, I found the broker delivers a solid blend of speed, functionality, and flexibility across all devices. Whether you prefer desktop trading, web access, or mobile convenience, Vantage provides multiple platform options that cater to different trading styles — from manual chart trading to automated strategies and social trading integrations.

The main platforms offered are MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, and the Vantage proprietary app, all designed to deliver institutional-grade execution and market analysis tools.

MetaTrader 4 and MetaTrader 5: The Industry Standards

Vantage’s MT4 and MT5 platforms remain the cornerstone of its trading ecosystem. Both versions are available for desktop, web, and mobile, and during testing, I found the execution speed to be consistently fast with minimal latency — ideal for high-frequency and algorithmic traders.

- Expert Advisor (EA) support allows users to automate their strategies with ease.

- Advanced charting tools include 30+ built-in indicators, customizable templates, and multiple chart types.

- Order flexibility enables traders to use multiple order types, set stop/limit parameters, and manage risk directly from the chart.

The MetaTrader 5 platform also adds more technical indicators, built-in economic calendars, and improved order management, making it a strong choice for advanced traders.

TradingView Integration: Web Trading Made Powerful

A standout feature I appreciated during testing is Vantage’s TradingView integration, which allows traders to connect their Vantage accounts directly to TradingView’s web-based charting platform.

This gives users access to real-time data, advanced drawing tools, and one of the most intuitive charting interfaces on the market.

With this integration, I was able to analyze, plan, and execute trades directly from TradingView, syncing seamlessly with my Vantage account. It’s a modern, browser-based option that combines technical precision with user-friendly design — perfect for traders who prefer web access without installing extra software.

TradingView — Smart Charting and Social Insights

TradingView integration brings the power of community-driven analysis to Fusion Markets. Traders can access real-time charts, create custom indicators, and use Pine Script to automate strategies.

The platform also allows sharing ideas and insights with millions of users worldwide, making it a favorite for traders who value both advanced charting and market collaboration.

SmartTrader Tools: Professional Add-Ons for MetaTrader

Vantage enhances the traditional MetaTrader experience with its SmartTrader Tools suite, powered by FX Blue. These professional-grade add-ons are designed to help traders analyze performance, manage positions, and make more informed decisions.

Some of the most useful tools I tested include:

Alarm Manager – to set automated alerts and trade notifications.

Sentiment Trader – to gauge market sentiment and trader positioning.

Mini Terminal and Trade Terminal – for one-click trade execution and quick order management.

Correlation Matrix – to identify correlated markets and manage exposure.

These add-ons transform MetaTrader into a more data-driven, customizable workspace suitable for active traders.

Performance Overview

Throughout my testing, order execution was swift and reliable, with negligible slippage even during volatile market conditions. Charting responsiveness and platform stability were also excellent, both on desktop and web interfaces.

However, it’s worth noting that MT4 and MT5 still carry a somewhat dated interface, which may feel less modern compared to newer web platforms like cTrader or proprietary solutions.

Verdict: A Reliable, Professional Platform Suite

After testing all available options, I found Vantage Markets’ platform lineup to be robust, fast, and trader-focused. The combination of MetaTrader, TradingView, and SmartTrader Tools offers flexibility for every type of trader — from beginners experimenting with indicators to professionals running automated systems.

While the MetaTrader interface could benefit from a design refresh, the underlying performance, execution speed, and customization options are top-tier. Overall, Vantage’s trading platforms deliver a dependable and professional trading experience, perfectly suited for 2025 and 2026’s fast-moving markets.

Pros & Cons of the Web Platform

Pros:

- Fast and stable execution speeds

- Full EA and algorithmic trading support

- Advanced charting and one-click trading

- Extensive SmartTrader add-ons via FX Blue

- Customizable layouts and multi-screen compatibility

Cons:

- Interface feels outdated compared to newer platforms

- Learning curve can be steep for absolute beginners

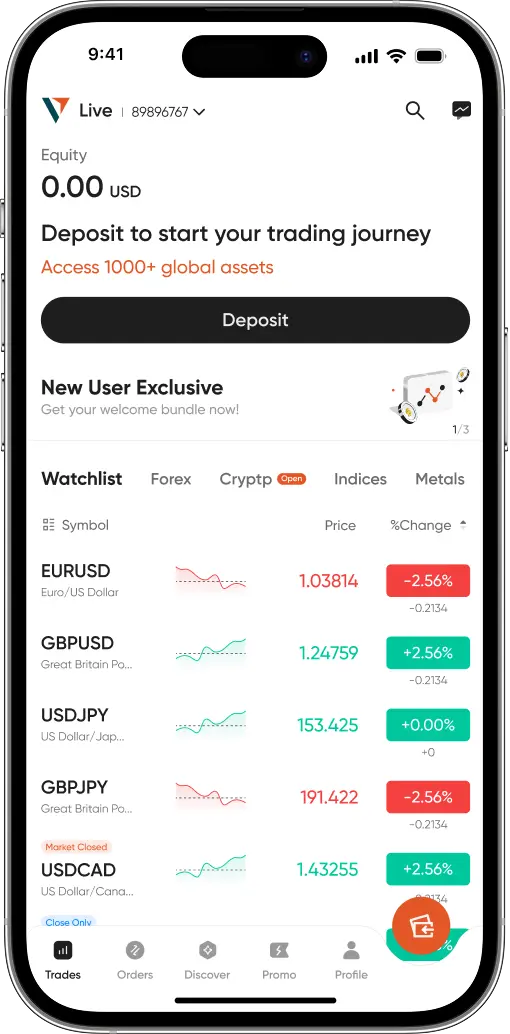

Mobile App

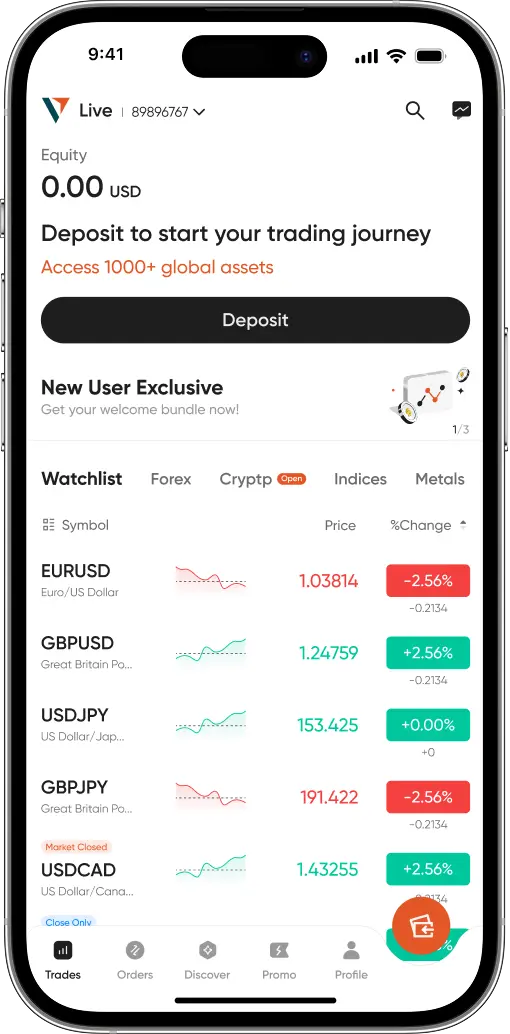

During my testing, the Vantage mobile app impressed me with its clean design, speed, and functionality. Available on both iOS and Android, it lets traders monitor markets, execute trades, and manage accounts with ease — whether at home, in transit, or traveling abroad.

Vantage App Overview

The Vantage App is the broker’s proprietary mobile trading platform and serves as a powerful all-in-one solution. It combines real-time market data, integrated trading signals, and social trading features in a single, easy-to-navigate interface.

Key features include:

- Social feed with insights and discussions from other traders

- Built-in trading signals and market alerts for timely decisions

- Live financial news and updates

- Push notifications for trades, price levels, and account events

- In-app deposits, withdrawals, and customer support access

Execution is fast and reliable, matching the performance of Vantage’s desktop platforms, while the interface feels modern and responsive.

Compatibility with Other Mobile Platforms

In addition to its own app, Vantage Markets supports MetaTrader 4, MetaTrader 5, and TradingView mobile apps, giving users the flexibility to trade on familiar interfaces. During testing, these apps performed smoothly and synced well with existing Vantage accounts, ensuring traders can switch between desktop and mobile without losing continuity.

User Experience and Design

The app is clean, modern, and easy to navigate — especially for new traders. Charts load quickly, and executing trades or adjusting positions takes just a few taps. However, there are some limitations. The charting tools and indicators are fewer than on the desktop version, and the inclusion of occasional in-app ads can interrupt the otherwise streamlined experience.

Security and Account Management

Vantage places a strong emphasis on security, integrating two-factor authentication (2FA) and encrypted connections to protect user accounts. During my tests, all account functions — from deposits and withdrawals to live support — were handled directly through the app without issues. The ability to manage funds, verify identity, and trade from one mobile interface is a major convenience for active traders.

Verdict

After hands-on testing, the Vantage mobile app stands out as a robust, intuitive, and well-rounded trading companion for modern traders. While it doesn’t completely replace desktop-level analysis, its blend of speed, usability, and convenience makes it ideal for trading on the go. For traders in 2025 and 2026 who value flexibility without compromising performance, Vantage’s mobile ecosystem is one of the best in its class.

Pros & Cons of the Mobile App

Pros

- Sleek and intuitive design with fast trade execution

- Available on both iOS and Android

- Integrated news, signals, and social feed

- Instant deposits and withdrawals within the app

- Works seamlessly with MT4, MT5, and TradingView mobile

Cons

- Limited chart types and technical indicators

- In-app ads can occasionally distract from trading

Market Research, Tools, and Education

When it comes to market insights and trader education, Vantage Markets has made noticeable progress in recent years. During my testing, I found the broker’s research and learning ecosystem to be well-structured, engaging, and accessible across its platforms.

While it doesn’t yet match the depth of research offered by industry giants like IG or Saxo, it provides more than enough high-quality content for retail and intermediate-level traders to stay informed and sharpen their skills.

A major highlight is the broker’s collaboration with Bloomberg, which brings video market analysis and financial commentary directly to the platform. This partnership gives traders access to professional-grade insights, a rare feature among retail brokers. News flow is timely, relevant, and neatly integrated into the trading dashboard, allowing users to stay updated without leaving the platform.

Additionally, daily newsletters summarize major market events, giving traders a quick digest of what’s driving price movements. Combined with tools like the SmartTrader suite and sentiment indicators, Vantage creates a data-rich environment ideal for both discretionary and automated trading approaches.

- Webinars and livestreams hosted by market professionals

- eBooks covering forex strategies, technical analysis, and risk management

- Step-by-step trading guides and blog tutorials

- Introductory courses for beginners looking to build foundational skills

These resources are well-organized and updated regularly, though some advanced topics remain less comprehensive compared to top-tier brokers.

While there’s still room for more depth in advanced analytics, Vantage Markets now offers one of the most balanced and professional research environments in its class — making it a solid choice for traders who want both actionable insights and practical education.

Customer Support

Responsive and reliable customer support is crucial when trading live markets, and during my testing, Vantage Markets delivered a generally positive experience. The broker offers 24/7 multilingual support via live chat, along with 24/5 assistance via email and phone, ensuring traders can access prompt, reliable help whenever they need it, no matter where they are in the world.

Support Availability and Channels

The live chat function, accessible directly through the website and the Vantage App, is the fastest and most convenient way to reach support. I tested it multiple times during both market and off-hours, and responses typically came within 30–60 seconds, with agents providing clear and professional answers. The live chat also includes built-in translation features, allowing non-English speakers to communicate easily.

For less urgent matters, email support is available and handled by regional teams. While helpful, email replies can sometimes take a few hours to a full business day, depending on query complexity and time zones. Vantage also offers phone support in several key regions, giving traders direct access to human assistance when needed.

In-App and Platform Support Integration

One standout feature is that Vantage’s support channels are fully integrated within the Vantage App. Traders can chat with agents, check FAQs, or request account assistance without leaving the trading interface — a useful touch for mobile users managing trades on the go.

Verdict

Overall, Vantage Markets provides responsive and professional customer service, particularly through live chat and app-based support. While email turnaround times could improve, the broker’s multilingual assistance and 24/7 availability make it dependable for traders seeking quick and knowledgeable help in 2025 and 2026.

FAQ

Is Vantage Markets safe and regulated?

Yes. Vantage Markets is a fully regulated global broker licensed by ASIC (Australia), FCA (UK), FSCA (South Africa), FSC (Mauritius), CIMA (Cayman Islands), and VFSC (Vanuatu). Client funds are held in segregated Tier-1 bank accounts, and retail traders are protected by negative balance protection and FSCS coverage up to £85,000 for UK clients.

What is the minimum deposit to start trading?

You can open a Standard STP or Raw ECN account with just $50. Vantage also offers a Cent Account starting from $1 (depending on region), making it suitable for traders with smaller budgets or those testing strategies before scaling up.

Is Vantage good for beginners?

Yes. Vantage’s Standard STP account is beginner-friendly with no commissions and a simple pricing structure. The broker also provides free webinars, tutorials, eBooks, and demo accounts, helping new traders build confidence before going live.

Does Vantage Markets charge any hidden fees?

No. Vantage is transparent with its fee structure. There are no deposit, withdrawal, or inactivity fees, though currency conversion costs may apply when trading in a different base currency.

Can professional traders use Vantage?

Absolutely. The Pro ECN account is designed for high-volume or institutional traders, offering 0.0 pip spreads, $3 round-turn commissions, and priority execution. Professionals also benefit from VPS hosting, API access, and SmartTrader Tools for advanced analytics.

Can I trade cryptocurrencies on Vantage?

Yes. Vantage offers crypto CFDs and Perpetual Accounts covering assets like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). However, crypto CFDs are not available to UK retail traders due to local FCA regulations.

Does Vantage offer copy trading or automated strategies?

Yes. Traders can connect to popular platforms like Myfxbook AutoTrade, DupliTrade, and ZuluTrade for social and copy trading. Both MT4 and MT5 also support Expert Advisors (EAs) for automated strategy execution.

How are taxes handled when trading with Vantage?

Vantage does not deduct or file taxes on behalf of clients. Traders are responsible for reporting and paying taxes in their country of residence based on local laws. The broker provides account statements and trade histories to help with tax reporting.

Does Vantage support demo trading?

Yes. You can open a free demo account with up to $100,000 in virtual funds. It’s perfect for practicing strategies, exploring platforms, or testing automated systems without risking real capital.

Which countries can and cannot open a Vantage account?

Vantage accepts clients from over 170 countries, but accounts cannot be opened by residents of the United States, Canada, North Korea, Japan, or certain restricted regions due to regulatory limitations.