VT MARKETS REVIEW 2025

Before you trade with VT Markets, read this. We tested the broker’s platforms, fees, and tools to see how it really performs in 2025 — and whether it’s a smart choice for your trading goals. Get the full picture on its regulation, reliability, and how it compares to other top brokers this year.

Broker Guide's VT Markets Review in 2025

VT Markets caught my attention as one of the most talked-about forex and CFD brokers in 2025. It promises fast execution, low spreads, and access to the full MetaTrader suite—features that appeal to both beginners and experienced traders.

I wanted to see if it truly delivers on those claims and how it compares to other top brokers I’ve tested.

In this hands-on VT Markets review, I explore how safe it is to trade with, what its real trading fees look like, how its platforms perform, and whether the overall experience lives up to the hype.

About VT Markets

VT Markets is a global forex and CFD broker established in 2015, with its headquarters located in Sydney, Australia. Over the years, it has grown into a trusted name among traders worldwide, now serving more than 200,000 clients across 150+ countries.

The broker operates under several regulatory entities to ensure compliance and client protection. It is licensed by the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) of South Africa, and the Financial Services Commission (FSC) of Mauritius. This multi-jurisdictional oversight adds an extra layer of trust and stability for traders who value regulated trading environments.

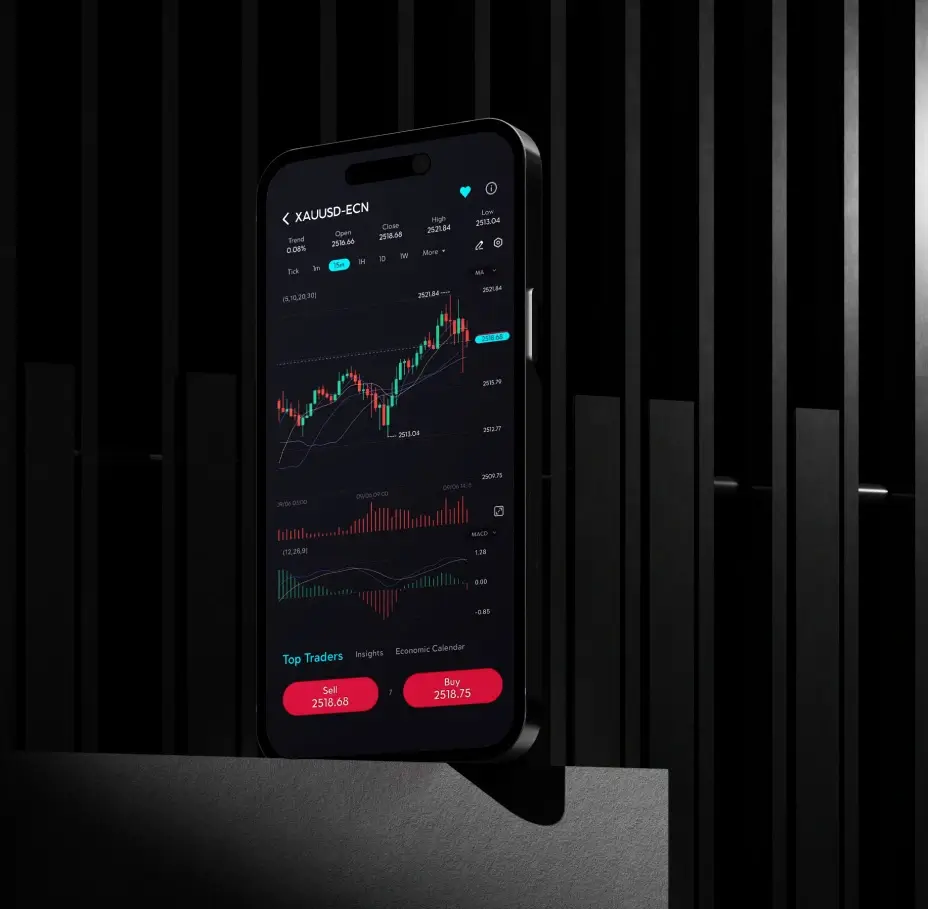

VT Markets offers a wide range of trading instruments through popular platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, and its proprietary VT Markets App. These platforms provide fast execution, advanced charting, and access to both manual and automated trading options, making them suitable for traders of all experience levels.

The broker is part of the Vantage Group, a well-established financial services brand that further enhances its credibility within the global trading community. Beyond trading, VT Markets has built strong brand visibility through high-profile sponsorships, including Newcastle United FC in the Premier League and Maserati MSG Racing in Formula E.

Overall, VT Markets combines regulated reliability, modern trading technology, and global recognition—making it a strong contender for traders seeking a professional, well-rounded brokerage experience.

My Quick Verdict: Who is VT Markets Best For?

Rating: 4.4/5

Best for: Intermediate traders who value fast execution, tight spreads, and professional trading platforms.

Not ideal for: Beginners who rely heavily on in-depth education or traders seeking a broad multi-asset portfolio.

VT Markets earns an overall rating of 4.4 out of 5 in 2025. It stands out for its strong trading conditions, competitive ECN spreads, and low forex fees that appeal to cost-conscious traders. The account setup process is smooth and fast, typically completed within one business day. VT Markets also supports a wide range of payment methods—including cryptocurrency deposits—making funding and withdrawals convenient for global users.

Traders can access the markets using several top-tier platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView, each offering robust tools for technical analysis, automation, and charting. This flexibility makes VT Markets attractive to traders who value both performance and platform choice.

However, the broker still has room for improvement. Its educational materials and market research are limited compared to industry leaders, and its product range is focused mainly on forex and CFDs, with no access to real stocks or ETFs. Additionally, VT Markets’ Trust Score of 70/99 places it slightly below the most trusted brokers in the industry.

Pros

- Full MetaTrader suite with Trading Central tools

- Raw ECN spreads from 0.0 pips

- Fast and easy account opening

- Negative balance protection

- Great mobile app with news, signals, and market updates

Cons

- Limited research and educational resources

- No investor protection scheme

- Withdrawals can take more than three days

- Limited product range (no real stocks or ETFs)

- Requires a $500 deposit to access advanced Trading Central tools

Why You Should Choose VT Markets ?

Flexible Account Types for Every Trading Style

VT Markets gives traders plenty of flexibility when it comes to choosing how they trade. You can pick from Standard, Raw ECN, Cent, or Swap-Free accounts, depending on your experience and strategy. Each account type offers different pricing structures and execution speeds, so whether you’re testing the waters or running a high-volume trading setup, there’s an option that fits your needs.

High Leverage for Experienced Traders

If you’re confident in managing risk, VT Markets offers leverage of up to 1:500, giving you more control over position sizing and capital efficiency. This level of leverage can be powerful when used wisely, making the broker appealing to experienced traders who know how to balance reward and risk.

Bonuses and Loyalty Programs

VT Markets doesn’t just focus on trading—it also rewards loyalty. Through its Club Bleu rewards program, Refer a Friend offer, and ongoing deposit bonuses, traders can earn cashback, gift cards, or trading credits. These extras give active traders more value from their time on the platform and add a sense of community around the brand.

Wide Range of Payment Options

Depositing and withdrawing funds is straightforward with VT Markets. You can use credit or debit cards, cryptocurrencies (BTC, USDT), e-wallets, or local bank transfers—whichever works best for you. The process is quick and secure, and most deposits are processed instantly, so you can start trading without delay.

Active Trader Program with Weekly Rewards

For consistent traders, the Active Trader Program is a standout perk. By maintaining at least $5,000 in equity and meeting certain trading volume targets, clients can earn up to 0.25% in weekly rewards. It’s a small but steady way to boost returns for those who trade regularly.

Bottom Line

VT Markets continues to impress in 2025 with its mix of flexibility, advanced platforms, and reward-driven features. It’s a broker that caters to traders who appreciate competitive spreads, fast execution, and modern payment options. While beginners may want more educational support, active traders will find plenty to like—especially the loyalty perks and smooth overall trading experience.

Compare to Top Competitors

How does VT Markets stack up against other leading brokers in 2025? With so many choices available, it’s important to see how it compares in pricing, platforms, and overall value. Here’s a quick look at how VT Markets measures up against three of its main competitors — IG, IC Markets, and Fusion Markets.

IC Markets

IG

Fusion Markets

Exploring VT Markets’ Range of Tradable Instruments

VT Markets gives traders access to a broad selection of markets, offering over 1,000 tradable CFDs across multiple asset classes. This wide range makes it easy to diversify strategies and trade on global opportunities. Leverage is available up to 1:500, depending on your region and the specific asset class.

Available Asset Classes

VT Markets covers a well-rounded mix of markets suitable for both short-term traders and long-term investors. Here’s what you can trade:

- Forex: 40 major, minor, and exotic currency pairs with ultra-low spreads and fast ECN execution.

- Indices: Global indices, including the S&P 500, NASDAQ 100, FTSE 100, DAX 40, and ASX 200.

- Commodities: 20+ commodities such as gold, silver, crude oil, natural gas, and copper, ideal for hedging or diversification.

- Metals: Spot and CFD trading on gold, silver, and platinum, popular safe-haven assets during volatility.

- Energies: Trade WTI, Brent Oil, and natural gas, all available with competitive margin requirements.

- Cryptocurrencies: 16 crypto CFDs including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) — available under non-UK entities.

- Bonds and ETFs: 50+ instruments providing access to bond markets and exchange-traded funds for broader exposure.

This diverse lineup gives traders the flexibility to explore different market sectors, manage risk, and capitalize on price movements across multiple asset classes.

Copy Trading Options

For those who prefer a more hands-off approach, VT Markets offers copy trading through VTrade and PAMM/MAM accounts. These tools let you automatically replicate the trades of experienced traders or manage multiple client accounts simultaneously. It’s a great option for beginners who want to learn through observation or for professionals managing portfolios for others.

| Asset | VT Markets |

|---|---|

| Tradeable Symbols | 1000 |

| Forex Pairs | 39 |

| Commodity CFDs | 23 |

| Stock CFDs | 800 |

| Cryptocurrencies | 16 |

| Stock Index CFDs | 26 |

| ETF CFDs | 50 |

| Bonds | 7 |

Verdict

With over 1,000 CFDs spanning forex, indices, commodities, metals, energies, crypto, and ETFs, VT Markets provides plenty of opportunities to diversify and trade global markets. Combined with flexible leverage and powerful copy trading tools, it delivers a versatile trading environment suitable for both active traders and investors who prefer an automated strategy.

How VT Market’s Instruments Compare to Competitors

VT Markets holds its own against competitors by covering most major asset classes, including forex, indices, commodities, and crypto. While it doesn’t yet offer real stocks or options trading like IG, its inclusion of ETFs, bonds, and copy trading features makes it a well-rounded choice for CFD traders seeking flexibility and variety.

| Asset | VT Markets | IC Markets | IG | Fusion Markets |

|---|---|---|---|---|

| Forex | ||||

| Indices | ||||

| Commodities | ||||

| Stock CFDs | ||||

| Cryptocurrencies Futures | ||||

| Bonds CFDs | ||||

| ETFs |

Fees and Commission Structure

| Fees | |

|---|---|

| Average spread (EUR/USD) - Standard account | 1.2 pips |

| All-in Cost EUR/USD - Active | 0.8 pips |

Commissions | Cent and Standard Accounts: No commissions Raw Accounts: $6 per operation |

| US CFD Shares | No commissions |

| UK & EU CFD Shares | Shares: 0.1% of contract value per side |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 A fixed fee of $20 will be charged for each subsequent wire withdrawal request. |

| Inactivity Fee | $0 |

VT Markets is known for its competitive and transparent pricing, making it a strong choice for traders who want to minimize costs without sacrificing execution quality. Here’s a breakdown of what to expect when it comes to spreads, commissions, and other trading fees.

Spreads

On average, VT Markets offers a 1.2-pip spread on the EUR/USD pair under its Standard STP account, while the Raw ECN account delivers an effective spread of around 0.83 pips (based on a 0.23-pip average spread plus a $6 round-turn commission).

The Raw ECN account’s pricing is competitive and aligns well with industry standards, whereas the Standard STP account’s spreads are slightly higher compared to what other top brokers offer.

Commissions

VT Markets keeps its fee structure clear and competitive. Cent and Standard accounts charge no commissions, while Raw accounts apply a $6 per-lot commission but offer much tighter spreads — ideal for active traders.

For specific assets, indices cost $1 per base currency of trading volume, soft commodities are $2, US CFD shares are commission-free, UK and EU shares are 0.1% per side, and HK shares are 0.25% per side.

Swaps

VT Markets offers swap-free (Islamic) accounts for traders who cannot receive or pay interest due to religious reasons. Instead of overnight interest, a small “Wakeel” administrative fee may apply in certain regions. This makes the platform accessible and compliant for a wider range of traders.

Other Trading Costs

VT Markets keeps additional trading costs to a minimum. Copy trading fees vary depending on the provider’s performance or the agent structure chosen, which is standard across most brokers offering this feature. For traders using automated systems or running Expert Advisors, the VPS Refund Service is a nice perk — eligible clients can receive up to $50 per month in rebates to help cover virtual private server hosting costs.

When it comes to funding your account, VT Markets doesn’t charge any deposit fees, though certain e-wallet providers may add their own small handling charges. This makes it easy to move funds in and out without worrying about unexpected costs.

Non-Trading Fees

VT Markets also performs well in the non-trading cost category. There’s no inactivity fee, meaning your account won’t be penalized if you take a break from trading. Withdrawals are generally free, though small transactions under $100 (in base currency) are subject to a $20 processing fee. Additionally, a currency conversion fee applies when deposits or withdrawals are made in currencies not supported by the account.

Verdict

VT Markets keeps costs straightforward with tight spreads, low commissions, and no hidden fees. The absence of inactivity charges and flexible funding options makes it budget-friendly, especially for active traders. Overall, it’s a cost-effective broker that competes well with industry leaders in pricing transparency.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is VT Markets Regulated ?

VT Markets operates under a strong regulatory framework, giving traders a reasonable level of trust and protection. The broker is licensed in multiple jurisdictions, which helps ensure that it follows strict financial and operational standards designed to protect client funds and promote transparency.

Licenses

- ASIC (Australia) – Vantage Global Prime Pty Ltd (#516246)

- FSCA (South Africa) – VT Markets Pty Ltd (#50865)

- FSC (Mauritius) – VT Markets Limited (GB23202269)

This multi-license setup allows VT Markets to serve traders globally while complying with regional regulations. The oversight from reputable authorities like ASIC and FSCA adds credibility and accountability to its operations.

Protection

VT Markets provides negative balance protection across all its entities, ensuring traders can’t lose more than their deposited funds. All client money is kept in segregated accounts at the Commonwealth Bank of Australia, separate from the company’s operational funds. This separation helps safeguard client deposits even in the event of financial difficulties.

While VT Markets doesn’t currently offer an investor compensation scheme, it maintains strong operational transparency and risk management measures to protect traders. According to ForexBrokers.com, VT Markets holds a Trust Score of 70/99, placing it in the mid-to-high range for broker reliability and regulatory standing.

Overall, VT Markets can be considered a safe and reputable broker for trading forex and CFDs, particularly for those who value multi-region regulation and fund security.

Understanding Regulatory Protections and Broker Stability

Backed by the Vantage Group

VT Markets operates under the Vantage Group, a well-established financial entity with a solid presence in the global trading industry. Being part of this group adds credibility, financial backing, and access to proven infrastructure—key factors that contribute to the broker’s long-term stability. Traders benefit from the same robust operational standards and technological framework that have supported Vantage’s reputation for over a decade.

Private Company Structure

VT Markets is not a publicly listed company, and it does not publish detailed financial statements. While this limits visibility into its internal financial performance, it’s a common setup among mid-tier brokers. The company instead focuses on maintaining compliance with its regulators, ensuring that all operational practices meet international financial standards.

Proven Track Record and Global Presence

With nearly 10 years of continuous operation, VT Markets has expanded steadily and now operates in more than 10 international offices. This global footprint highlights its commitment to long-term growth and customer support across multiple regions. Its consistent expansion and regulated presence suggest a broker that’s both reliable and well-positioned for continued stability in the competitive forex and CFD space.

Bottom Line

VT Markets’ connection to the Vantage Group, decade-long track record, and international presence all reinforce its credibility as a stable and trustworthy broker. While it’s not publicly traded, its ongoing adherence to regulatory standards and operational transparency give traders confidence in its long-term reliability.

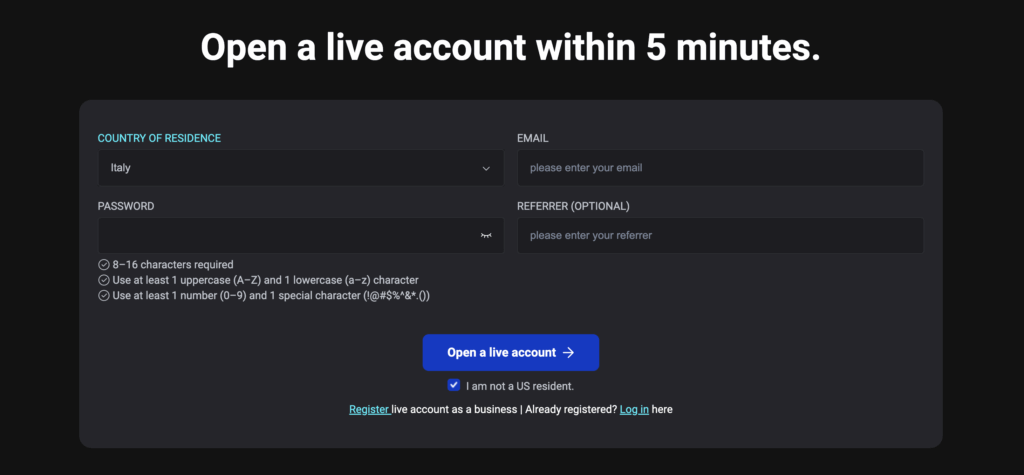

How To Open an Account

Getting started with VT Markets is quick and straightforward. The entire process can be completed online, and most accounts are verified within a day. Here’s a simple step-by-step guide to help you open your trading account and start trading right away.

- Visit vtmarkets.com.

- Click “Trade Now”

- Fill out the registration form with your personal details.

- Upload a valid photo ID and proof of address for verification.

- Choose your account type and base currency.

- Fund your account — the minimum deposit is $50 to $100, depending on the account type.

- Wait for your account to be verified, which usually takes about one business day.

If you’re new to trading or want to test the platform first, you can also open a demo account on MT4 or MT5 to practice before trading live funds.

Account Types

VT Markets offers several account types to suit different trading styles, skill levels, and strategies. Whether you’re a beginner starting small or a professional trader looking for raw spreads and ECN execution, there’s an option that fits your needs.

Standard Account (STP)

The Standard STP Account is ideal for new and intermediate traders who prefer simple pricing with no commissions. It offers stable execution and access to all major trading instruments.

Execution type: STP

Spread: From 1.2 pips

Commission: $0

Base currencies: AUD, USD, HKD, GBP, EUR, CAD

Platform: MT4, MT5

Minimum deposit: $100

Minimum trading size: 0.01 lot

Trading bonus: Available

Standard Swap-Free Account

The Swap-Free STP Account is designed for traders who follow Islamic finance principles or prefer to avoid overnight swap charges.

Execution type: STP (Swap-Free)

Spread: From 1.2 pips

Commission: $0

Leverage: Up to 1:500

Base currencies: AUD, USD, GBP, EUR, CAD

Minimum deposit: $100

Trading bonus: Available

Raw Account (ECN)

The Raw ECN Account is built for experienced traders who want tight spreads and direct access to the interbank market. It combines fast execution with competitive commission-based pricing.

Execution type: ECN

Spread: From 0.0 pips

Commission: $6 per round turn

Base currencies: AUD, USD, HKD, GBP, EUR, CAD

Platform: MT4, MT5

Minimum deposit: $100

Minimum trading size: 0.01 lot

Trading bonus: Available

Raw ECN Swap-Free Account

The Raw ECN Swap-Free Account offers the same ultra-tight spreads as the regular Raw ECN but without overnight swap fees, making it ideal for traders who hold positions longer or need Sharia-compliant trading.

Execution type: ECN (Swap-Free)

Spread: From 0.0 pips

Commission: $6

Leverage: Up to 1:500

Base currencies: AUD, USD, GBP, EUR, CAD

Minimum deposit: $100

Trading bonus: Available

Cent Account (STP)

The Cent Account is perfect for beginners or those testing strategies with smaller amounts. It operates in USC (cents), allowing traders to trade micro-lots with lower risk while still experiencing real market conditions.

Execution type: STP

Spread: From 1.1 pips

Commission: $0 per round turn

Swap-Free: Yes

Base currency: USC

Minimum deposit: $50 (5,000 USC)

Minimum withdrawal: $40 (4,000 USC)

Minimum trading size: 0.01 lot

Applicable instruments: Forex, Gold, Silver, and Oil only

What is the Minimum Deposit at VT Markets?

VT Markets keeps its minimum deposit low, making it accessible for both new and experienced traders. The amount you need depends on the account type you choose.

For most accounts, the minimum deposit is $100, which applies to both Standard STP and Raw ECN accounts. If you’re just starting out or want to test the platform with smaller amounts, the Cent Account only requires a $50 deposit (equivalent to 5,000 USC).

All deposits can be made through a variety of methods, including credit/debit cards, e-wallets, bank transfers, and even cryptocurrencies. This flexibility makes it easy for traders from different regions to fund their accounts quickly and start trading right away.

Overall, VT Markets’ low deposit requirement and multiple funding options make it a convenient and beginner-friendly choice for entering the markets without a large upfront investment.

| Broker | Minimum Deposit |

|---|---|

| VT Markets | $100 |

| IC Markets | $200 |

IG | $5 |

Fusion Markets | $0 |

Deposit and Withdrawal

Funding and withdrawing from your VT Markets account is designed to be quick, flexible, and hassle-free. The broker supports a wide range of global and regional payment methods, allowing traders to choose the option that best fits their location and preferences. Most deposits are processed instantly, while withdrawals typically take a few business days to complete.

Deposit Options

VT Markets offers multiple secure ways to fund your account:

All deposits are free of charge on VT Markets’ end, though your payment provider may apply small transaction fees.

Withdrawal Fees & Options

Withdrawing funds is just as straightforward. VT Markets does not charge any withdrawal fees, except for small withdrawals under $100, which incur a $20 handling fee. E-wallet withdrawals may carry a 0.5–2% fee depending on the provider.

Processing times are generally fast, with most withdrawals completed within 1–3 business days, depending on your chosen payment method and verification status.

Supported Base Currencies

You can open and fund your account in several major currencies, including USD, EUR, GBP, AUD, CAD, HKD, and JPY. Choosing a matching base currency to your funding method can help you avoid conversion charges.

Bottom Line

VT Markets provides a smooth and flexible payment experience with support for cards, e-wallets, crypto, and local transfers. With no hidden deposit fees and quick withdrawal times, it’s well-suited for traders who value fast and reliable account funding.

Desktop Trading Platform

VT Markets delivers a reliable and flexible desktop trading experience built on trusted industry platforms. Traders can choose between MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView WebTrader Plus—each known for stability, speed, and advanced charting. While VT Markets doesn’t have a proprietary desktop platform, it integrates seamlessly with these leading tools and supports useful third-party plugins that enhance analysis and execution.

MT4 – The Classic Choice for Forex Traders

MetaTrader 4 (MT4) remains a go-to for forex traders who want simplicity without sacrificing performance. It offers fast order execution, customizable charts, and hundreds of built-in indicators.

During my testing, MT4 on VT Markets performed smoothly, even during high-volatility sessions, with minimal slippage and quick trade confirmations. It’s especially beginner-friendly and perfect for traders who rely on Expert Advisors (EAs) for automation.

MT5 – The Next-Generation Platform

MetaTrader 5 (MT5) takes things a step further with multi-asset support, faster processing speeds, and more advanced order types. I noticed that MT5 offered a cleaner interface and faster strategy backtesting than MT4.

It also includes built-in economic data and depth-of-market features, which are useful for traders who manage multiple instruments or rely on fundamental insights.

TradingView WebTrader Plus – Intuitive and Visual

For traders who prefer modern design and collaborative analysis, TradingView WebTrader Plus is a great option. It offers beautiful charts, advanced drawing tools, and access to the TradingView community, where thousands of traders share ideas daily.

I found it especially helpful for spotting market setups and comparing different trading perspectives before executing trades on MT5.

Third-Party Tools and Integrations

VT Markets supports several professional third-party integrations, including Trading Central, Acuity, and Autochartist. These plugins enhance the MetaTrader experience with real-time market analysis, news sentiment, and trading signals. They’re ideal for traders who want a data-driven edge without relying solely on manual analysis.

Verdict

From my experience, VT Markets offers a stable, efficient desktop trading platform that caters to both casual and professional traders. The combination of MT4, MT5, and TradingView provides flexibility and reliability, while integrations like Trading Central make it easier to trade confidently with data-backed insights.

Although MetaTrader’s design feels dated, the performance, speed, and range of available tools make VT Markets’ desktop platforms a dependable choice for serious traders in 2025.

Pros & Cons of the Web Platform

Pros

- Reliable and familiar MetaTrader interface

- Full EA and algorithmic trading support

- Access to Trading Central, Acuity, and Autochartist

- Integration with TradingView for advanced charting and community insights

- Smooth, low-latency execution even during peak trading hours

Cons

- Outdated interface on MetaTrader 4 and 5

- Lacks advanced risk management and order grouping tools found in proprietary platforms

- Occasional minor lag when switching between MT4 and TradingView during heavy data loads

Mobile App

The VT Markets App is the broker’s proprietary mobile platform that combines trading, market data, and account management in one easy-to-use interface. During my testing, I found it extremely user-friendly — the layout is clean, and navigating between instruments, charts, and news felt seamless.

One of the standout features is the built-in Pivot Point analysis, which provides quick support and resistance levels for better trade timing. The app also integrates market news, real-time alerts, and watchlists, which made it easy for me to stay on top of market movements even when I was away from my desk.

MT4 and MT5 Mobile – Familiar and Reliable

For traders who prefer a classic setup, VT Markets supports both MetaTrader 4 and MetaTrader 5 mobile apps. These platforms mirror the desktop versions in terms of functionality, offering fast trade execution, customizable charts, and one-tap trading.

In my experience, both MT4 and MT5 performed well on mobile data, executing trades instantly and maintaining a stable connection even during volatile market periods. However, as with most mobile trading apps, charting tools are somewhat limited compared to the desktop platforms.

Charting and Analysis Tools

While the VT Markets App and MetaTrader mobile apps offer essential charting tools, they are best suited for quick analysis rather than in-depth technical studies. The built-in indicators and drawing tools work well for identifying entry and exit points, but customization options are limited.

That said, the real-time data feeds and smooth chart transitions make it easy to monitor trends and react to price changes instantly.

Speed and Performance

Speed is where the VT Markets mobile platforms really shine. During testing, I experienced near-instant order execution and low latency, even while trading during busy sessions.

Switching between accounts, viewing open positions, and making quick adjustments felt effortless. The app also sends timely notifications for margin calls, order executions, and price alerts — helping traders stay informed and in control at all times.

Ease of Use and Customization

All VT Markets mobile platforms prioritize simplicity. The menus are intuitive, and setting up alerts or modifying orders can be done in seconds. However, one area for improvement is chart syncing — your desktop chart layouts don’t automatically carry over to mobile, which means manual reconfiguration if you use multiple devices.

Verdict

Overall, the VT Markets App offers a strong mobile trading experience that balances simplicity with useful features. It’s perfect for traders who want to stay connected to the markets without being tied to a computer.

The MT4 and MT5 mobile apps add reliability and speed for those already familiar with the MetaTrader ecosystem. While more advanced charting features and syncing options would be welcome, the current setup provides a solid and efficient mobile trading solution that works well for managing trades and staying informed on the move.

Pros & Cons of the Mobile App

Pros

- Clean, intuitive interface with integrated news and watchlists

- Built-in Pivot Point analysis for quick market insights

- Fast and reliable order execution

- Real-time price alerts and notifications

Cons

- Limited charting tools and indicators compared to desktop

- No chart or layout syncing between mobile and web/desktop versions

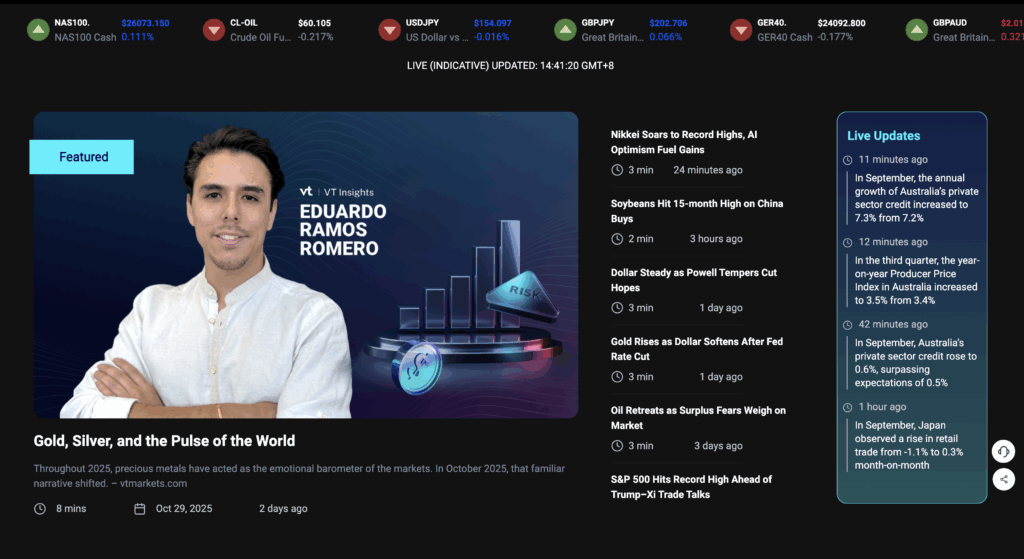

Market Research, Tools, and Education

VT Markets provides traders with a solid selection of research and learning resources designed to support better trading decisions.

While its tools and market insights are helpful for daily analysis, the educational side is still more suited to beginners than advanced professionals. Here’s a closer look at what you can expect from the broker’s research and education offerings.

The broker also includes access to Trading Central, one of the industry’s leading research and analytics providers. Traders with deposits over $500 can use Trading Central’s tools directly within MT4 or MT5, gaining access to technical pattern recognition, analyst commentary, and strategy suggestions. This feature can be particularly valuable for those who rely on data-driven decision-making.

Additionally, VT Markets provides an economic calendar that highlights major global events and a sentiment indicator to gauge market positioning. These tools are integrated into the platform, making it easy to plan trades around upcoming news or volatility.

The platform also includes performance metrics and leaderboards, so you can evaluate and choose traders based on risk level, past performance, and consistency. It’s a helpful learning tool as well — beginners can observe how professional traders approach entries, exits, and risk management.

I found the materials clear and easy to follow — a good fit for newcomers who want to understand the essentials before placing live trades. However, advanced educational content is limited, so experienced traders may need to look elsewhere for in-depth strategy training or advanced analytics.

However, the broker’s educational materials remain fairly basic, and advanced traders might find them lacking. Overall, it’s a well-rounded setup for beginners and intermediate traders who want actionable insights without being overwhelmed by complex data

Customer Support

VT Markets offers dependable and responsive customer support, ensuring traders get assistance whenever they need it. The broker provides 24/7 live chat and email support, covering all major trading hours across different time zones.

During my testing, I found the response time impressive — a live chat agent typically replied within a few minutes, and email inquiries were answered in under a day. The support team was knowledgeable and professional, handling both technical and account-related questions efficiently.

VT Markets supports over 18 languages, including English, Chinese, Spanish, Arabic, and Filipino, making it easy for traders from different regions to get help in their preferred language.

The broker also maintains a detailed Help Center, which includes step-by-step guides, FAQs, and troubleshooting tips for account setup, deposits, platform use, and more. It’s a convenient self-service option for resolving minor issues without waiting for an agent.

Verdict

VT Markets’ customer support is reliable, multilingual, and quick to respond. Whether through live chat, email, or the Help Center, traders can expect clear answers and prompt assistance — an essential feature for anyone trading in fast-moving markets.

FAQ

Is VT Markets safe and regulated?

Yes. VT Markets is regulated by ASIC (Australia), FSCA (South Africa), and FSC (Mauritius). The broker also provides negative balance protection and keeps client funds in segregated bank accounts, adding an extra layer of security.

What platforms does VT Markets support?

VT Markets supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, and its own proprietary VT Markets App, giving traders flexibility across desktop, web, and mobile.

What are VT Markets’ spreads and commissions?

The Raw ECN account offers spreads starting from 0.0 pips with a $6 per lot commission, while the Standard STP account has spreads from 1.2 pips with no commission.

What is the minimum deposit?

The minimum deposit is $50 for Cent Accounts and $100 for other account types like Standard or Raw ECN.

Does VT Markets charge withdrawal or inactivity fees?

No. VT Markets doesn’t charge inactivity fees, and withdrawals are free unless the amount is under $100 or processed via certain e-wallets, which may have small handling charges.

Can I trade crypto on VT Markets?

Yes. VT Markets offers crypto CFDs on popular digital assets like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). However, crypto trading is not available to UK residents due to regional regulations.

Does VT Markets offer negative balance protection?

Yes. All VT Markets clients are protected from losing more than their deposited funds through its negative balance protection policy.

How can I open a VT Markets account?

You can open an account directly on vtmarkets.com by completing the registration form, submitting verification documents, and funding your account. Approval usually takes around one business day.

Is VT Markets good for beginners?

Yes. VT Markets is beginner-friendly thanks to its low minimum deposits, easy onboarding process, and user-friendly platforms. However, the educational content could be more comprehensive for advanced learning.

What countries are restricted?

VT Markets does not accept clients from the USA, Singapore, Russia, and other FATF-listed countries due to regulatory restrictions.