Webull REVIEW 2025

Webull has quickly become a favorite for traders who want commission-free stocks, ETFs, options, and crypto. Its advanced desktop and mobile platforms provide real-time data, charting, and alerts, but research and educational content are limited compared to full-service brokers. Whether you’re a beginner, active trader, or looking to build a small portfolio, our in-depth review helps you decide if Webull is right for you in 2025.

Broker Guide's Webull Review in 2025

When I first tried Webull a few years back it felt like a breath of fresh air compared to traditional brokers weighed down by fees and clunky platforms. Fast forward to today and it is clear why Webull has become a major player in commission-free trading.

In this Webull review 2025 I will walk you through what makes it stand out. It offers zero-commission stock and ETF trading, a sleek and powerful mobile app, and even access to options and crypto.

It is no surprise that Webull has grown popular with younger investors, beginners, and active traders like me who want to keep costs low without sacrificing functionality.

That said, no broker is perfect and this is where the Webull pros and cons really come into play. I enjoy the trading tools and smooth app experience, but the platform can feel a little thin on research and education compared to full-service brokers.

So, is Webull good for beginners? In my experience, it is, but it works best for those who want to dive in and learn by doing rather than relying on extensive guidance. This review will break down everything you need to know in 2025 so you can decide if Webull fits your trading style.

About Webull

Webull is a fintech-driven online broker that was founded in 2017 and has quickly made a name for itself in the trading world. Headquartered in Florida, with an additional office in New York,, the company is regulated by the U.S. Securities and Exchange Commission (SEC) and is also a member of the Financial Industry Regulatory Authority (FINRA). On top of that, client assets are protected by the Securities Investor Protection Corporation (SIPC), which helps provide peace of mind for retail investors.

The broker is best known for its commission-free trading model. Investors can trade stocks, ETFs, and options without paying traditional broker fees, and the platform also offers access to cryptocurrencies such as Bitcoin and Ethereum. Fractional shares are available as well, which makes it easier for those with smaller budgets to build diversified portfolios.

Webull is especially appealing to tech-savvy and cost-conscious traders who value a modern, mobile-first experience. Its clean design, real-time market data, and advanced charting tools make it a strong choice for active investors who prefer to manage their portfolios directly.

Compared to traditional brokers like Charles Schwab or Fidelity, Webull stands out for its low-cost structure and sleek technology, although it lacks some of the research depth, financial planning tools, and retirement-focused services that full-service brokers provide.

As a result, Webull has positioned itself as a compelling alternative for traders who want affordability and powerful tools without the extra frills.

My Quick Verdict: Who is Webull Best For?

After spending time with Webull, I can say it remains one of the strongest choices in the commission-free trading space in 2025. Its biggest draw is the ability to trade stocks, ETFs, and options without paying traditional broker commissions, which makes it especially attractive for cost-conscious investors.

The platform also supports fractional shares, allowing traders with smaller budgets to buy into big-name companies without committing large sums. On top of that, Webull’s mobile app is one of the most polished and feature-rich trading apps available, making it a natural fit for investors who prefer managing their portfolios on the go.

That being said, Webull does have some clear limitations. The platform is not built for investors who rely heavily on in-depth market research, analyst reports, or advanced education resources. It also lacks access to mutual funds, and, depending on the region, some retirement account options are missing. This means long-term investors looking for broad wealth management tools may feel underserved.

In my view, Webull is best suited for beginners who want a straightforward way to get started, mobile-first traders who value a clean interface, options traders who want low costs, and those with smaller budgets who benefit from fractional shares. It may not replace a full-service brokerage, but for its target audience, Webull continues to deliver excellent value in 2025.

Pros

- Commission-free trading on stocks, ETFs, and options, keeping costs low for active investors.

- Fractional shares make it easy for beginners and small-budget traders to build diversified portfolios.

- Powerful mobile app with real-time data, customizable charts, and smooth execution.

- Access to cryptocurrency trading alongside traditional assets.

- Paper trading (demo account) available for practice without risking real money.

- No minimum deposit required for a cash account.

Cons

- Limited research tools and analyst insights compared to full-service brokers.

- No access to mutual funds or bonds, which restricts diversification for long-term investors.

- Retirement accounts not available in every region, reducing flexibility for some users.

Why You Should Choose Webull ?

Choosing a broker is about more than just low fees. Investors want a platform that is reliable, easy to use, and flexible enough to fit their style. Webull has built its reputation around commission-free trading and a sleek mobile app, but in 2025 it also stands out for its growing range of assets and continued focus on tech-driven investing. Here is why Webull may be the right choice this year.

Commission-Free Trading That Still Matters

Even though commission-free trading has become the standard, Webull continues to make it worthwhile. Stocks, ETFs, and options can all be traded without paying traditional broker fees, and only a small contract charge applies to options. For active traders, these savings can add up quickly.

Built for Mobile-First Investors

Webull’s mobile app remains one of the most advanced in the market. Its clean interface, customizable charts, and real-time alerts make it a strong choice for investors who want a fast and powerful trading tool in their pocket.

Expanding Access to Assets

Webull supports more than just stocks and ETFs. Options, fractional shares, and cryptocurrencies are also available, allowing traders to diversify without juggling multiple accounts.

Regulated and Backed by Investor Protections

As a broker regulated by the SEC and FINRA, and with SIPC insurance covering up to $500,000 in assets, Webull offers oversight and security that beginners and experienced traders can trust.

Bottomline

Webull is not without limitations, but in 2025 it remains one of the top choices for cost-conscious traders, beginners, and mobile-first investors. If you want commission-free investing combined with modern trading tools, Webull continues to deliver strong value.

Compare to Top Competitors

Webull has carved out a strong place in the trading world, but it is not the only platform attracting attention. Traders often weigh it against other commission-free and tech-focused brokers such as Moomoo, Robinhood, and eToro. Each platform has its own strengths, and the right choice depends on your trading style and goals.

Moomoo

Robinhood

eToro

Exploring Webull's Range of Tradable Instruments

Webull has built its reputation on offering a streamlined yet versatile range of tradable instruments. The platform focuses on the core assets that most cost-conscious and active traders want, while leaving out some of the more traditional investment vehicles found at full-service brokers.

Stocks, ETFs, and ADRs

Traders have commission-free access to a wide selection of U.S.-listed stocks and ETFs, covering everything from blue-chip companies to sector-specific funds. Webull also includes American Depositary Receipts (ADRs), allowing investors to gain exposure to international companies without having to trade directly on foreign exchanges.

Options and Fractional Shares

A standout feature of Webull is its options trading, which comes with no commission beyond a small per-contract fee. This makes it an appealing choice for traders experimenting with options strategies at a lower cost. Another strength is fractional shares, which enable users to buy portions of high-priced stocks. This lowers the entry barrier and allows investors with smaller budgets to diversify more effectively.

Cryptocurrency Trading

Webull also supports trading in popular cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin. While the selection is more limited than what is found on specialized crypto exchanges, having access to digital assets within the same platform as equities and ETFs adds a layer of convenience for traders who want to keep everything in one place.

Interest on Cash Balances

Another attractive feature is that Webull offers interest on uninvested cash balances, giving investors the ability to earn passive income even when their funds are not allocated to trades. This feature has become increasingly important as brokers compete to add more value beyond trading.

Recurring Investments

Webull is also one of the few brokers offering recurring investments for individual stocks and ETFs. Ideal for dollar-cost averaging, users can set automated schedules starting at just $5 and up to $25,000. Recurring investments are supported on any stock or ETF that allows fractional shares, providing a flexible and disciplined way to build positions over time. This feature has made Webull stand out as it reflects a growing trend in the brokerage industry toward helping traders automate consistent investing habits.

What’s Missing

There are some notable gaps in Webull’s offering. The broker does not provide mutual funds or bonds, which can make it less appealing to investors seeking long-term, retirement-focused products. In addition, futures and forex are not available, limiting opportunities for those who want to trade a wider range of global markets.

| Asset | Webull |

|---|---|

| Stock Trading | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Forex Trading | No |

| Social Trading / Copy Trading | No |

| Cryptocurrency Trading | No |

| Fractional Shares (Stocks) | Yes |

| Futures Trading | Yes |

| Traditional IRAs & Roth IRAs | Yes |

Bottom Line

Webull’s range of tradable instruments is best suited for cost-conscious investors who want affordable access to stocks, ETFs, options, fractional shares, recurring investments, and cryptocurrencies. While it lacks the breadth of traditional brokers, it delivers a focused and effective lineup that supports both active trading and consistent long-term investing in 2025.

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $0 |

| Stock Trades | $0 |

Options (Per Contract) | $0 |

Futures (Per Contract) | $1.25 |

Index CFD Fees | Average |

| Deposit Fees | No deposit fee for ACH electronic transfers. $8 fee deposits via domestic wire transfer. $12.5 for incoming international wire deposits. |

| Withdrawal Fees | No withdrawal fees for ACH transfers. $25 for domestic and $45 for international wire withdrawals. |

| Inactivity Fee | $0 |

Webull has built its reputation on offering zero-commission trading, but that doesn’t mean the broker operates for free. Like other modern discount brokers, Webull has a clear revenue model that allows it to keep commissions at $0 while still turning a profit. A major source of income comes from payment for order flow (PFOF), where Webull routes client orders to large High-Frequency Trading Firms (HFTs). These firms earn money from the small spread between buy and sell orders, and in return Webull receives compensation for the order flow.

Beyond PFOF, Webull generates revenue in several other ways. These include fees on short selling, interest charged on margin accounts, and subscription fees paid by users for premium features and market data upgrades. The broker also earns from interest on uninvested cash balances, ensuring it profits even when clients are not actively trading.

Trading Fees

Stocks and ETFs

For stocks and ETFs, Webull charges no commissions or base fees. This mirrors the “zero-commission” model that has become standard in the industry since Robinhood disrupted the market. Traders are still responsible for minimal SEC and FINRA regulatory fees, but these apply across all brokers and are not specific to Webull.

Options Trading

For options trading, Webull also charges no base commission, only a small per-contract fee. This competitive structure makes the platform cost-effective for options traders who might otherwise pay higher rates with legacy brokers.

Crypto Trading

On the cryptocurrency side, Webull applies a spread fee instead of commissions. The spread is built into the buy and sell price, which is standard practice among both brokers and crypto exchanges.

Other Trading Costs and Non-Trading Fees

While Webull advertises itself as a commission-free broker, traders should still be aware of several other costs that may apply depending on how they use the platform. These charges are standard across the brokerage industry but can influence overall profitability for frequent or margin-based traders.

Other Trading Costs

- Regulatory Fees: Like all U.S. brokers, Webull passes on minimal SEC and FINRA regulatory fees to clients. These costs are very small, often fractions of a cent per share or a few dollars per million dollars traded, but they are unavoidable and industry-standard.

- Margin Interest Rates: Webull offers margin trading with tiered interest rates that vary depending on the amount borrowed. Smaller balances typically incur higher interest rates, while larger balances may qualify for reduced rates. This makes margin trading more expensive for casual investors and more competitive for high-volume traders.

- Short Selling Costs: Investors who borrow shares to sell short must also pay stock borrow fees, which vary based on market demand and availability of the security. Hard-to-borrow stocks can carry much higher fees, which may significantly impact short-term trading strategies.

Non-Trading Fees

- Inactivity Fee: Webull does not charge an inactivity fee, making it attractive for casual traders who do not trade on a daily or monthly basis.

- Currency Conversion Fees: Webull accounts are denominated in U.S. dollars, so traders depositing or withdrawing in another currency may face conversion fees. This is worth noting for international clients.

- Withdrawal Fees: While standard ACH transfers are free, wire withdrawals incur fees. Domestic wire transfers carry a modest charge, while international wires are typically more expensive.

Verdict

Webull delivers one of the most cost-effective pricing models in the brokerage industry. With zero commissions on stocks, ETFs, and options, plus simple spread-based crypto pricing, it keeps trading affordable for both beginners and active traders.

While regulatory fees, margin interest, and short selling costs still apply, these are common across all brokers and remain transparent. The absence of inactivity fees adds further appeal, especially for casual investors. Compared to full-service competitors like Fidelity and Schwab, Webull may lack broader asset coverage, but for traders who value low costs, transparency, and straightforward pricing in 2025, it stands as one of the strongest options available.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is Webull Regulated ?

Yes, Webull is a fully regulated U.S. broker, overseen by two of the most trusted financial authorities in the country. It is a registered broker-dealer with the Securities and Exchange Commission (SEC) and a member of the Financial Industry Regulatory Authority (FINRA). This dual oversight ensures that Webull operates under strict guidelines designed to protect retail traders and maintain fair, transparent markets.

Client accounts at Webull are also protected by Securities Investor Protection Corporation (SIPC) coverage, which insures securities and cash up to $500,000 (including a $250,000 limit for cash). It’s important to note that SIPC protection is not the same as FDIC insurance—it does not safeguard against investment losses due to market movements. Instead, it protects traders if the brokerage fails financially, ensuring they can recover their assets up to the stated limits. For everyday investors, this adds a significant layer of confidence in the safety of their funds.

When compared internationally, regulations vary. In the UK and EU, brokers are often regulated by bodies such as the Financial Conduct Authority (FCA) or Cyprus Securities and Exchange Commission (CySEC), with protections like the Financial Services Compensation Scheme (FSCS), which typically covers up to £85,000. In Asia, standards differ by country, with regulators such as the Monetary Authority of Singapore (MAS) or Hong Kong’s SFC providing oversight, though investor compensation schemes may not always be as comprehensive.

Webull’s regulation by the SEC and FINRA, along with SIPC protection, provides strong safeguards for U.S. traders. While international brokers may offer different levels of compensation coverage, Webull meets high U.S. standards, giving investors confidence in the platform’s security and stability.

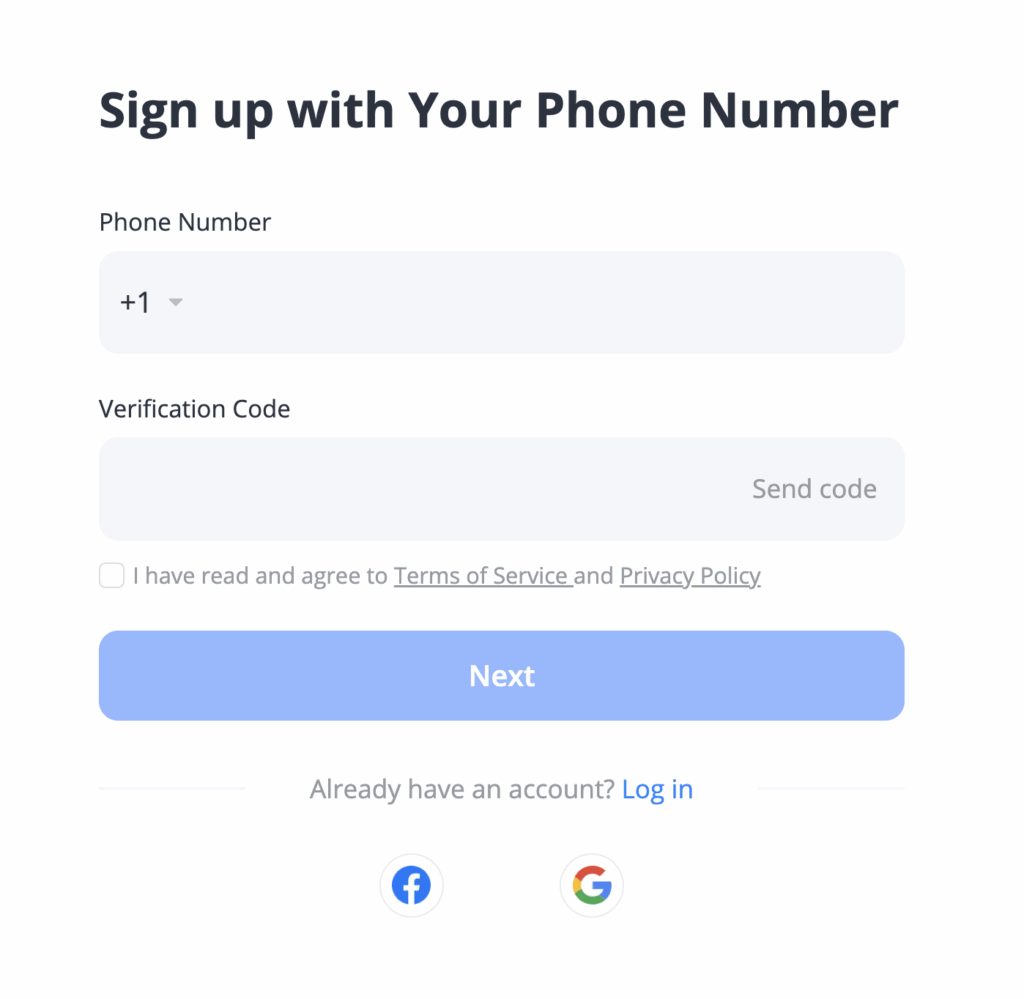

How To Open an Account

Getting started with Webull is straightforward, and the process is designed to be quick and fully digital. If you’re wondering how to open a Webull account, the first step is to head over to Webull’s official signup page.

From there, new users can create an account using an email address or mobile number, followed by identity verification steps required by regulators. This typically includes submitting a photo ID, proof of residency, and answering standard financial background questions.

Once verified, users can link a bank account to fund their profile and begin trading. The platform does not require a minimum deposit, making it accessible for beginners as well as cost-conscious investors who prefer to start small. Account approval is usually fast, often within one business day, which means most traders can move from signup to trading in just a short time.

Overall, Webull’s onboarding is modern, intuitive, and beginner-friendly. The absence of account minimums, combined with the seamless digital application, makes Webull one of the easiest brokers to join in 2025.

Account Types

Webull provides several account types tailored to individual traders and long-term investors. Each account differs in terms of features, requirements, and suitability depending on trading style or investment goals.

Individual Cash Accounts

A cash account lets users trade only with available funds. There is no borrowing involved, which eliminates the risks tied to leverage. This type of account is best suited for beginners and cautious investors who want to avoid the complexities of margin requirements.

Margin Accounts

With a margin account, traders can access leverage, short selling, and day trading opportunities. These accounts come with higher risks but also greater flexibility, making them more appealing to active and experienced traders. Margin accounts require minimum equity levels to comply with regulations.

Retirement Accounts (IRAs)

Webull supports Traditional, Roth, and Rollover IRA accounts for U.S. residents. These retirement accounts provide tax advantages while allowing investors to build long-term portfolios. To open an IRA, users must first have an individual account.

Corporate or Entity Accounts

Webull also offers corporate accounts, though these come with certain restrictions. These accounts may suit small businesses or organizations but are limited compared to full-service brokers.

Unsupported Account Types

Webull does not currently support joint accounts, custodial accounts, or certain corporate structures. Investors looking for family or guardian-managed accounts will need to explore alternative brokers.

Verdict

Webull’s account lineup is focused, simple, and designed for individuals. From active day traders to retirement planners, the available options cover most personal investment needs. However, the lack of joint and custodial accounts may be a drawback for users who want broader family or shared account management.

What is the Minimum Deposit at Webull?

Webull requires no minimum deposit for standard cash accounts, making it easy for new investors to sign up and start trading with whatever amount they can afford. However, if you want to use margin (leverage), you must maintain a $2,000 minimum equity in the margin account, in line with U.S. regulations. Here’s how Webull stacks up against Moomoo, Robinhood, and eToro in terms of minimum deposit:

- Moomoo: No minimum deposit is required to open a standard account.

- Robinhood: Also imposes no minimum for its standard (non-Gold) accounts, though margin or Gold features may have additional requirements.

- eToro: In many jurisdictions, eToro requires an initial deposit of US $50.

Verdict

Webull’s no-minimum standard account requirement lowers the barrier to entry, making it friendly for beginners or small-scale investors. The $2,000 margin minimum is typical among U.S. brokers and allows more advanced trading. Compared to peers, Webull and Moomoo are tied for having the lowest barrier to entry, while eToro’s $50 is modest but might pose a mild hurdle for very small investors.

Deposit and Withdrawal

Funding a Webull account is simple, with multiple options available for both deposits and withdrawals. Understanding the costs and timelines can help traders manage their accounts more effectively.

Deposit Fees & Options

Webull supports ACH bank transfers as the most common way to fund an account. ACH deposits are completely free, which is why most U.S. traders prefer this method. For those who need faster funding or are transferring larger amounts, wire transfers are also available, though they come with fees: typically $8 for domestic wires and $12.50 for international deposits.

Funding via ACH generally takes one to two business days to settle, while wire transfers can be faster, depending on the bank. This makes Webull’s deposit options both cost-effective and relatively quick for most users.

The bad: Deposits and withdrawals via debit/credit cards and e-wallets are not supported.

Withdrawal Fees & Options

When it comes to withdrawals, ACH transfers remain free, making them the most budget-friendly choice. However, Webull charges fees for wire withdrawals: $25 for domestic and $45 for international transfers. Processing times vary by method. ACH withdrawals typically take two to five business days, while wires can arrive sooner, especially for domestic requests.

In conclusion, Webull offers a straightforward and inexpensive funding process for most traders. Using ACH is the best choice since it avoids fees on both deposits and withdrawals. For urgent transfers, wires provide speed at a cost. When considering the Webull withdrawal fee structure and deposit methods, the platform is highly competitive compared to traditional brokers, making it appealing to cost-conscious and active traders in 2025.

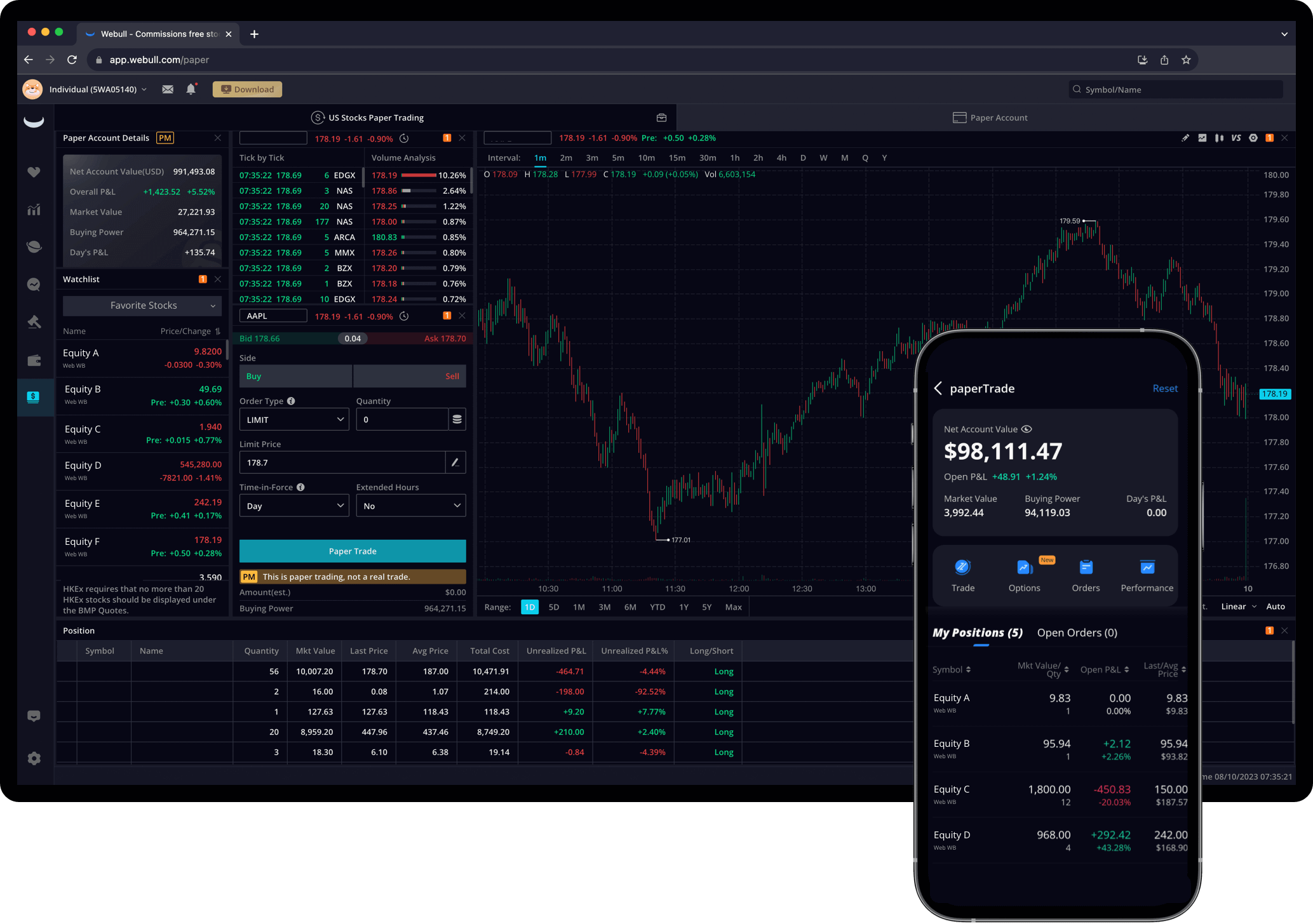

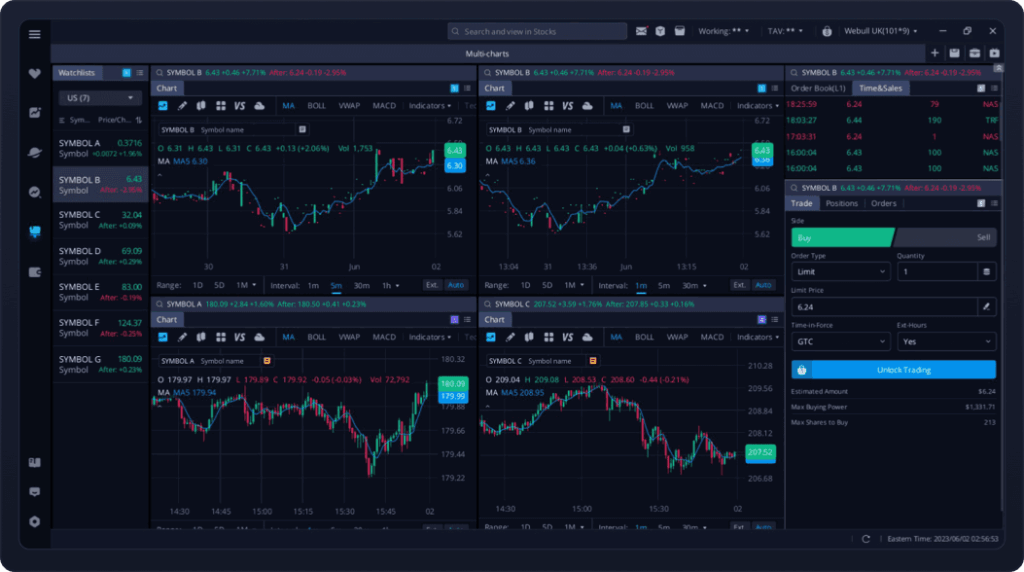

Desktop Trading Platform

Webull offers both a desktop and a web-based trading platform, but the desktop application is the centerpiece of its trading experience. Designed for speed, customization, and professional-level tools, it delivers a powerful yet user-friendly interface that appeals to active traders.

Features and Functionality

Advanced Charting

One of the standout features is its advanced charting. The ability to layer technical indicators, draw trendlines, and switch between multiple timeframes feels smooth and intuitive. In my experience, the charts respond quickly, even when running multiple layouts, which gives it an edge over many “free” platforms.

Market Analysis Tools

Webull’s screeners and watchlists help filter stocks by technical signals, sector, or performance. While not as deep as Thinkorswim’s scanners, I’ve found them more than capable for spotting momentum plays or keeping track of multiple tickers at once without being overwhelmed.

Real-time Information

Streaming real-time data is where the platform shines. Watching the Level 2 order book update in real time feels seamless, and order execution matches the data feed closely. For traders who care about precision, this reliability matters.

Research Integration

Webull integrates basic analyst ratings and market news, but the research side feels light compared to brokers like Interactive Brokers. From my testing, it’s fine for a quick sentiment check, but traders who rely on in-depth reports will probably want to supplement with external research tools.

Educational Content Integration

Educational resources are available directly on the platform, though limited. I noticed that beginners may find the learning curve steep since most of the tools assume some prior trading knowledge. It feels more suited to self-directed traders who enjoy exploring features rather than being guided step by step.

Smart Advisor

Webull’s Smart Advisor offers goal tracking, allowing users to set personalized goals, monitor progress, and work toward specific financial objectives. Managed by State Street Global Advisors, it primarily invests in State Street ETFs. Fees total approximately 0.43% annually, which may be higher than some passive strategies. This feature appeals to users seeking guided investing, although cost-conscious investors may prefer to manage their own portfolios.

Placing Orders

The variety of order types—stop-limit, bracket, trailing stop, and conditional—makes trading strategies flexible. In my own use, placing and adjusting orders felt straightforward, and execution was smooth, even during high-volume market hours.

Alerts & Notifications

Users can set custom price alerts, news alerts, and technical event notifications, which are synced across devices. This ensures traders never miss key opportunities.

Login and Security

Two-factor authentication (2FA) gives peace of mind, and logging in feels secure without being clunky. From experience, it balances speed and safety better than some competitors.

Search Functions

Searching for stocks, ETFs, options, or crypto by ticker or company name is fast. I’ve never had issues pulling up assets instantly, which keeps the workflow efficient.

Pros & Cons of the Web Platform

Pros

- Advanced charting tools with 50+ indicators, drawing features, and multi-timeframe views.

- Customizable layouts that work well across single or multiple monitors.

- Real-time market data with Level 2 access for active traders.

- Flexible order types including stop-limit, bracket, trailing stop, and conditional orders.

- Smooth performance even when running multiple charts or watchlists simultaneously.

- Free to use, delivering professional-grade functionality without extra costs.

- Cross-device syncing of alerts, watchlists, and layouts between desktop and mobile.

Cons

- Research integration is limited compared to Thinkorswim or Interactive Brokers.

- No support for futures or forex, which narrows the appeal for multi-asset traders.

- Learning curve can feel steep for beginners unfamiliar with advanced trading tools.

- Fewer customization options than Thinkorswim’s scripting or Interactive Brokers’ extensive settings.

- Limited educational resources, leaving new traders to learn mostly by exploration.

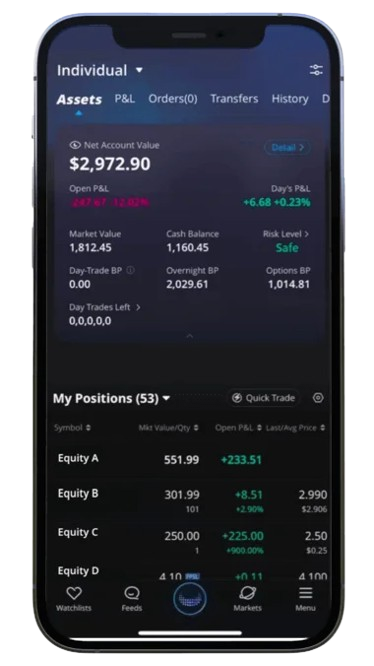

Mobile App

Webull’s mobile app is designed for traders who need flexibility on the go. It mirrors much of the functionality of the desktop platform while optimizing for smaller screens, offering a clean and intuitive interface.

Look & Feel

The app features a modern, sleek interface that’s easy to navigate. Watchlists, charts, and portfolios are organized logically, and customizable layouts allow users to prioritize the information they find most important. Advanced charting is included, with multiple technical indicators, drawing tools, and timeframes, though naturally condensed for mobile screens. Push notifications for price movements, news, and technical alerts keep traders informed in real time.

Login and Security

Security is robust, with two-factor authentication (2FA) and biometric login options such as fingerprint or facial recognition. From experience, logging in is quick and seamless while maintaining strong security standards. Account settings and device management are easy to access, providing control over authentication methods.

Search Functions

Searching for assets is straightforward. Users can quickly find stocks, ETFs, options, and cryptocurrencies by ticker or company name. The search bar supports autocomplete, which reduces errors and saves time when navigating multiple markets.

Placing Orders

Order execution is fast and flexible. The app supports a wide range of order types including market, limit, stop-limit, bracket, and trailing stop orders. Conditional orders can also be placed from mobile, making it possible to implement complex strategies without needing a desktop. Notifications confirm execution, and order modifications are simple and responsive.

Pros & Cons of the Mobile App

Pros

- Intuitive interface with clean, modern design optimized for mobile screens.

- Advanced charting tools including multiple indicators, drawing tools, and timeframes.

- Real-time data and alerts for price movements, news, and technical triggers.

- Wide range of order types supported, including market, limit, stop-limit, bracket, and trailing stops.

- Fast and responsive execution with easy order modifications.

- Secure login options including two-factor authentication and biometrics.

- Cross-device syncing ensures alerts, watchlists, and orders are consistent with desktop.

Cons

- Limited research integration compared to desktop and full-service brokers.

- Screen size constraints make multi-chart analysis less comfortable than on desktop.

- Fewer educational resources, requiring beginners to self-learn many features.

- Advanced order types may be harder to navigate for casual or first-time traders.

Market Research, Tools, and Education

Webull offers a robust suite of market research and trading tools tailored for self-directed traders who prefer to conduct their own analysis. While it may not match the depth of research provided by full-service brokers, its features cover most of the essentials needed for informed decision-making.

Webinars: Users can access live webinars hosted in collaboration with external partners, covering topics from basic investing to advanced trading strategies. These sessions provide regular learning opportunities, though finding them can be tricky since they are not fully integrated into the main educational hub..

Stock, Fund, and Fixed-Income Education: Webull’s stock tutorials generally follow a coherent sequence, but topics are sometimes grouped in ways that feel inconsistent. For instance, introductory lessons on investment types might appear alongside advanced techniques such as Fibonacci retracements. ETF and fund definitions could be clearer, as some explanations may be difficult for novice investors. Fixed-income coverage exists but is less approachable, with explanations that can feel overly technical or dense..

Options and Macro Content: Webull includes detailed guides on options trading, explaining strategies such as covered calls and spreads. The macroeconomic content introduces users to key concepts such as earnings season, Federal Reserve policy, and economic indicators. While informative, some of these materials would benefit from simplified explanations or more structured guidance for easier comprehension.

Customer Support

Webull provides multiple channels for customer support, including live chat, email, and phone, allowing users to choose the method that best suits their needs. The live chat function is integrated into both the mobile app and desktop platform, making it easy to get quick answers during active trading hours. Email support is available for less urgent inquiries, while phone support offers a more direct way to resolve complex issues.

Support is generally available during U.S. business hours, which covers the typical trading day from 9:30 a.m. to 4:00 p.m. ET. While this is sufficient for most U.S.-based traders, users in other time zones may experience delays in receiving responses, particularly outside standard hours.

In terms of user experience, Webull’s support is generally responsive and helpful. Traders often report that live chat provides timely solutions for technical issues or account questions. Phone support is useful for more complicated matters, such as account verification or margin-related queries. However, compared to brokers like TD Ameritrade or Fidelity, Webull lacks 24/7 support and does not offer dedicated account managers, which can be a limitation for high-volume or professional traders.

When compared with peers like Robinhood, Moomoo, and eToro, Webull’s support is competitive in responsiveness but slightly narrower in scope. Robinhood also offers live chat and email, but phone support is limited; Moomoo provides multilingual support and extended hours for international users; eToro has a comprehensive ticketing system but slower response times during peak periods. Overall, Webull strikes a reasonable balance between accessibility and efficiency for retail traders.

Webull’s customer support is reliable for day-to-day trading and account issues, particularly through live chat and email. While it may not match the extended hours or personalized service of full-service brokers, it remains adequate for most U.S.-based self-directed investors in 2025.

FAQ

Is Webull safe and legit?

Yes, Webull is regulated by the SEC and FINRA and provides SIPC coverage up to $500,000. This means customer assets are protected in the event of broker insolvency, making it a legitimate and secure platform for U.S.-based investors.

Does Webull charge fees in 2025?

Webull offers commission-free trading for stocks, ETFs, and options. Options contracts have a small per-contract fee, crypto trading uses a spread, and wire transfers carry fees. There are no hidden commissions for standard trading.

What can I trade on Webull?

Users can trade stocks, ETFs, options, and cryptocurrencies including Bitcoin and Ethereum. Webull does not offer mutual funds, bonds, futures, or forex, so traders needing those instruments will need another broker.

Is Webull good for beginners?

Webull works for beginners who are willing to learn independently. The platform provides tutorials, webinars, and educational content, but the resources assume some prior investing knowledge. Complete beginners may need extra research to navigate advanced features

Does Webull offer crypto trading?

Yes, Webull supports a variety of cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, and more. Crypto trading involves spread fees, and all trades are commission-free beyond the spread.

How do deposits and withdrawals work?

Deposits via ACH transfers are free, while wire deposits incur fees. Withdrawals through ACH are free, and wire withdrawals cost $25 domestically or $45 internationally. Processing typically takes 1–5 business days.

What are Webull’s margin requirements?

A margin account requires a minimum balance of $2,000. Margin interest is tiered based on borrowed amounts, and short selling incurs additional costs.

Does Webull offer retirement accounts?

Yes, U.S. residents can open Traditional, Roth, and Rollover IRAs. An individual account is required before creating an IRA. Corporate or joint retirement accounts are not available.

What are the main downsides of Webull?

Webull lacks mutual funds, bonds, and full retirement account options. Research and educational materials are limited compared to brokers like TD Ameritrade or Fidelity. Additionally, customer support is only available during U.S. business hours.

Webull vs Robinhood

Webull offers more advanced charting, technical indicators, and research tools, while Robinhood is simpler and more beginner-friendly. Traders who value customization, analytics, and active trading may prefer Webull, while casual investors may find Robinhood easier to use.