XM REVIEW 2025

Curious if XM really lives up to its reputation? In this hands-on 2025 review, I tested everything — from spreads and platforms to customer support and education. Find out whether its $5 minimum deposit, powerful MetaTrader and TradingView tools, and strong global regulation make it the smart choice for your next trading move.

Broker Guide's XM Review in 2025

When a broker claims to be trusted by millions, offers ultra-low spreads, and wins global awards for education, you have to put it to the test. That’s exactly why I reviewed XM, one of the world’s most recognized forex and CFD brokers. Founded in 2009, XM has built a reputation for reliability, regulation, and reach, serving traders in over 190 countries.

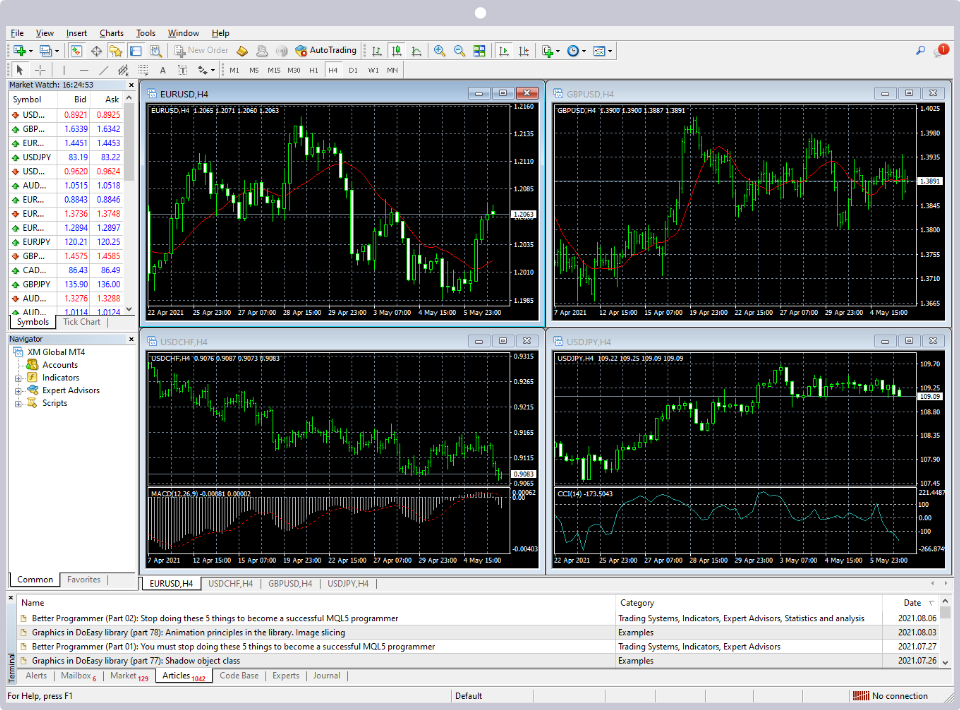

It runs on industry-leading platforms — MetaTrader 4, MetaTrader 5, and TradingView — and is regulated by Tier-1 authorities including ASIC, CySEC, and the FCA. With an impressive Trust Score of 92/99, XM stands out in 2025 as a broker that blends accessibility with professional-grade features.

About XM

Founded in 2009 under Trading Point Holdings Ltd., XM Group has grown into one of the most globally recognized names in online forex and CFD trading. Headquartered in Cyprus, the company operates multiple regulated entities, including Trading Point of Financial Instruments Ltd. (licensed by CySEC), Trading Point of Financial Instruments Pty Ltd. (regulated by ASIC in Australia), XM Global Limited (regulated by the IFSC in Belize), and Trading Point MENA Limited (supervised by the DFSA in Dubai). This multi-jurisdictional structure gives XM a strong regulatory backbone and global credibility.

XM offers an extensive selection of more than 1,400 CFDs across forex, indices, commodities, metals, and shares, including 55 currency pairs for traders of all levels. With access to platforms like MetaTrader 4, MetaTrader 5, and TradingView, clients can enjoy both flexibility and advanced analytical tools. Whether you’re a day trader, investor, or algorithmic trader, XM provides the infrastructure and support to match your trading style.

Now available in over 180 countries, XM continues to expand its global footprint by focusing on accessibility and education. The broker’s vision is simple yet powerful: to make trading transparent, fair, and accessible for everyone, regardless of experience or location. Through multilingual customer service, zero hidden fees on deposits or withdrawals, and rich learning materials, XM Group embodies its mission to bridge the gap between beginners and professionals in global markets.

My Quick Verdict: Who is XM Best For?

After testing XM across platforms, fees, and trading tools, my verdict is clear — XM is a trusted, beginner-friendly broker that delivers on education, research, and ease of use. It’s one of the few brokers that truly balances accessibility with professional-grade features, making it ideal for new traders who want to grow with a reputable platform.

XM shines in areas that matter most to everyday traders: a $5 minimum deposit, no hidden fees on deposits or withdrawals, and a robust lineup of educational webinars, tutorials, and market insights. The addition of TradingView alongside MetaTrader 4 and 5 also strengthens its appeal to both visual and technical traders.

However, it’s not without drawbacks. XM’s standard account spreads are only average, and while it offers over 1,400 CFDs, its product range is narrower than top-tier multi-asset brokers that include ETFs or bonds. Still, with a Trust Score of 92/99, regulation from ASIC, CySEC, and FCA, and award-winning research tools, XM remains one of the most reliable and transparent choices for traders in 2025.

Pros

- $5 minimum deposit

- 1,400+ instruments

- Excellent education and market research

- Regulated in multiple top-tier jurisdictions

- User-friendly deposit/withdrawal

Cons

- Higher spreads on standard accounts

- Limited real stock and ETF access

- No proprietary trading platform

Why You Should Choose XM ?

With over 10 million clients in more than 180 countries, XM Group has earned its place among the world’s most reputable forex and CFD brokers. Its long-standing presence since 2009 and regulation under multiple Tier-1 authorities — including ASIC, CySEC, and the FCA — give traders confidence that their funds are handled securely and transparently. XM also maintains segregated client accounts and offers negative balance protection, ensuring an additional layer of safety during volatile market conditions.

Cutting-Edge Trading Technology

In 2025, XM continues to evolve with the times. The broker’s integration of TradingView adds a powerful, visually rich charting experience alongside its classic MetaTrader 4 and 5 platforms. Traders can now combine XM’s tight execution speeds with TradingView’s advanced analytics, social chart sharing, and customizable layouts — making technical analysis more intuitive than ever.

Accessible, Low-Cost Trading

XM’s philosophy of “no hidden fees” remains unchanged. The broker charges no deposit or withdrawal fees, supports instant funding, and allows beginners to start with as little as $5. Combined with fast execution and multiple account types, XM makes trading easy and affordable for all experience levels.

Award-Winning Education and Research

Named Best in Class for Education 2025 by other independent reviewers, XM offers daily webinars, live market analysis, and multilingual learning materials that empower traders to build real skills. Whether you’re a beginner, copy trader, or a seasoned MetaTrader user, XM’s blend of technology, transparency, and teaching makes it a top choice for 2025.

Compare to Top Competitors

To get a clearer picture of where XM stands in 2025, let’s compare it with three other leading brokers: XTB, Tickmill, and FP Markets. We’ll focus on regulatory strength, pricing/spreads, product offerings, and beginner-friendliness, so you can see whether XM is the best fit for your trading style.

XTB

Tickmill

FP Markets

Exploring XM's Range of Tradable Instruments

XM offers a very broad selection of tradable assets, making it suitable for a wide range of traders — from beginners to more advanced CFD-users. According to XM’s own instrument listings, there are 55 forex pairs and around 1,387 CFDs spanning precious metals, equity indices, energies, commodities, stock CFDs, and cryptocurrencies. In total, the number of instruments is about 1,442 under many XM entities.

Forex

XM provides 55 currency pairs including majors, minors, and a selection of exotic pairs. This gives traders decent exposure to global fiat currencies.

Stock CFDs & Shares

There are over 1,400 stock-CFD instruments from global markets (US, Europe, Asia). Real stock ownership (actual shares) is only possible under XM’s Shares Account, which is offered via its IFSC-regulated entity (usually with a much higher minimum deposit and no leverage) for clients outside certain regulated jurisdictions.

Commodities, Indices, Metals & Energies

XM supports CFDs on precious metals (gold, silver, etc.), energy products (oil, natural gas), and a variety of indices (US, UK, European, Asian). The number of indices and commodity instruments is solid, though not as expansive as some multi-asset brokers.

Cryptocurrencies

Through XM Global (and some non-EU entities), XM offers a selection of crypto CFDs (e.g. Bitcoin, Ethereum, Litecoin, Ripple) with 24/7 trading hours in certain jurisdictions. However, in many EU-regulated branches, crypto offerings are restricted or not available due to regulation.

| Asset | XM |

|---|---|

| Forex Pairs | 55 |

| Tradeable Symbols | 1400+ |

| Forex Trading | Yes |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency | Physical: No Derivative: Yes |

Limitations and Exclusions I’ve Noticed

- There are no ETFs, bonds, or options available under any XM regulatory entity for retail clients.

- Real share trading is limited to specific jurisdictions (IFSC ones) and comes with high minimums. In regulated areas like the EU/UK, you generally only get CFDs, not actual ownership of the underlying shares.

- The product availability (especially cryptos) depends heavily on your region and the regulatory arm of XM you’re under. Some jurisdictions impose restrictions.

Copy Trading & Social Features

XM also supports copy trading / trade-following functions, and periodic trading competitions, which appeal to social traders or those who prefer more guided or communal learning/trading experiences.

Verdict

XM’s tradable instrument range is broad enough to cover most retail trader needs: plenty of currency pairs, stock CFDs, indices, metals, commodities, and a crypto offering under certain entities. But compared to full multi-asset brokers that offer ETFs, bonds, options, or direct asset ownership more widely, XM is less diversified. For those whose priority is having access to a huge variety of financial products, there may be brokers with a wider asset spectrum. For everyone else, especially CFD and forex-focused traders, XM’s lineup is competitive, solid, and reliable.

How XM’s Instruments Compare to Competitors

To help you quickly see how XM stacks up against other brokers in terms of tradable assets, here’s a side-by-side comparison with XTB, Tickmill, and FP Markets. This gives a clearer view of what you gain or miss out on depending on broker choice.

| Asset | XM | XTB | Tickmill | FP Markets |

|---|---|---|---|---|

| Forex | ||||

| Stocks CFDs | ||||

| Real Stocks | ||||

| Indices CFDs | ||||

| Commodities | ||||

| Crypto CFDs | ||||

| ETFs | ||||

| Bonds |

Notes on the Comparison

- Real Stocks / Shares under “✔️” for XM: actual share ownership (not just CFD) is only available via its IFSC-regulated entity, and availability depends heavily on your jurisdiction.

- †Cryptocurrencies: XTB, Tickmill, FP Markets offer crypto CFDs; XM offers crypto via certain entities (not uniformly across all regulatory jurisdictions).

- For ETFs and Bonds: XM’s EU / CySEC / ASIC branches generally do not offer these; XTB has broader ETF access, including real ETFs or ETF-CFDs, depending on entity. Tickmill offers some ETF CFDs. FP Markets has very limited or no ETF / bond availability in many cases.

Bottom Line

XM delivers a very solid set of major CFDs and forex instruments, plus crypto in certain jurisdictions, making it appealing for CFD-focused and forex traders. However, compared to brokers like XTB, XM is less diversified in terms of real stocks, ETFs and bonds — especially for EU-based clients. If your priority is access to a wide range of asset classes beyond CFDs or ownership of real assets, brokers like XTB may offer more flexibility.

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | $5 |

| Average Spread EUR/USD (Standard) | 1.6 pips |

All-in Cost EUR/USD - Active | 0.8 pips |

| Forex CFD Fees | Low |

Index CFD Fees | Low |

Options Fees | Average |

Stock CFD fees | Average |

| Deposit Fees | $0

|

| Withdrawal Fees | $0 |

| Inactivity Fee | A one-time $15 maintenance fee is charged after 1 year of inactivity, followed by a $5 monthly fee for as long as the account remains inactive. |

When it comes to costs, XM maintains one of the more transparent and balanced fee structures among major forex and CFD brokers. Whether you’re trading on the Standard, Micro, or XM Zero account, pricing is designed to suit different experience levels and trading volumes while keeping overall costs reasonable.

Trading Fees

XM’s trading costs depend on your chosen account type. On the XM Zero Account, spreads start from as low as 0.2 pips, with a $3.50 commission per lot per side added to each trade. This structure is ideal for active or high-volume traders who prefer tighter spreads and clear commission pricing.

For Standard and Micro Accounts, XM does not charge commissions; instead, fees are built into the spread. The average spread on EUR/USD is about 1.6 pips, which is competitive but slightly higher than the industry’s lowest-cost brokers.

XM also offers a wide range of CFDs with built-in pricing:

Index CFDs have relatively low spreads — for example, the S&P 500 averages 0.6 points.

Stock CFDs include the trading cost within the spread, such as Apple at approximately 0.7 points.

Other Trading Costs

One of XM’s biggest advantages is its no deposit or withdrawal fees policy. The broker absorbs most third-party transaction costs, allowing you to fund or withdraw without worrying about hidden charges. For those who trade overnight, swap fees (overnight financing) apply depending on the instrument and trade direction. XM also provides swap-free Islamic accounts, which replace overnight swaps with a fixed administrative charge for compliance with Sharia principles.

Non-Trading Fees

XM keeps its non-trading fees moderate and easy to understand.

Inactivity fee

An inactivity fee of $15 is charged after one year of no activity, followed by $5 per month if the account remains idle. This ensures that long-term dormant accounts are maintained efficiently.

Additionally, currency conversion fees apply when you deposit or withdraw in a currency different from your account’s base currency — a common practice across most brokers.

Verdict

Overall, XM offers a clear and competitive cost structure, particularly for users of the XM Zero account, who benefit from tight spreads and transparent commissions. The absence of deposit and withdrawal fees, plus the availability of swap-free options, makes XM attractive for both active traders and long-term investors. While standard spreads are not the lowest in the industry, the broker’s reliability, transparency, and fair pricing give it a strong edge in 2025.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is XM Regulated ?

Yes — XM is a fully regulated and multi-licensed broker, operating under several reputable financial authorities across multiple regions. The brand is part of the Trading Point Group, a well-established financial services company that oversees all XM entities globally. This structure allows XM to cater to traders in different jurisdictions while ensuring compliance with the highest regulatory standards.

XM operates under four main regulatory bodies:

- CySEC (Cyprus Securities and Exchange Commission) – covers clients in the European Union, ensuring compliance with MiFID II and providing an Investor Compensation Fund of up to €20,000 per eligible client.

- ASIC (Australian Securities and Investments Commission) – one of the world’s most respected Tier-1 regulators, known for strict supervision and robust client protection rules.

- IFSC (International Financial Services Commission, Belize) – oversees XM Global Limited, allowing the broker to serve international clients with flexible leverage and broader product access.

- DFSA (Dubai Financial Services Authority) – regulates XM’s MENA operations through Trading Point MENA Limited, ensuring strong oversight for traders in the UAE and surrounding regions.

XM earned a Trust Score of 92/99, placing it among the most secure brokers in the global forex and CFD industry. This strong score reflects its regulatory diversity, long operational history, and transparent business practices.

In addition, XM applies key client protection measures that go beyond minimum standards. The broker uses segregated client funds, meaning traders’ money is held separately from company capital, reducing risk in the event of insolvency. It also provides negative balance protection, ensuring that clients can never lose more than their deposited funds — a crucial safeguard in volatile markets.

While XM is not publicly listed and does not operate a bank, its multi-jurisdictional regulation, 15-year track record, and consistent compliance history make it a highly trusted broker for 2025.

Understanding Regulatory Protections and Broker Stability

One of XM’s strongest qualities is its long-standing transparency and proven stability in the global trading industry. With over 15 years of operation since its founding in 2009, XM has successfully navigated multiple financial cycles and global market disruptions — including the COVID-19 crisis and major currency events — without compromising client security or service quality. This consistent performance highlights the broker’s operational resilience and strong internal risk management.

Although XM is not bank-owned, it remains a financially independent and profitable company, backed by the reputable Trading Point Group. This independence allows XM to maintain flexibility in its operations while adhering to strict financial oversight imposed by its regulators.

XM’s risk disclosure and investor protection mechanisms vary by region, ensuring compliance with local laws. For instance, under CySEC regulation, European clients are covered by the Investor Compensation Fund, which protects eligible traders up to €20,000 in case of broker default. Similarly, XM’s ASIC, DFSA, and IFSC entities enforce capital adequacy and financial reporting standards to safeguard client funds.

Importantly, XM offers negative balance protection across all accounts, ensuring that traders cannot lose more than their deposited capital — even during periods of extreme volatility. Combined with segregated client accounts and multi-tier regulatory oversight, these measures make XM one of the most secure and transparent brokers operating in 2025

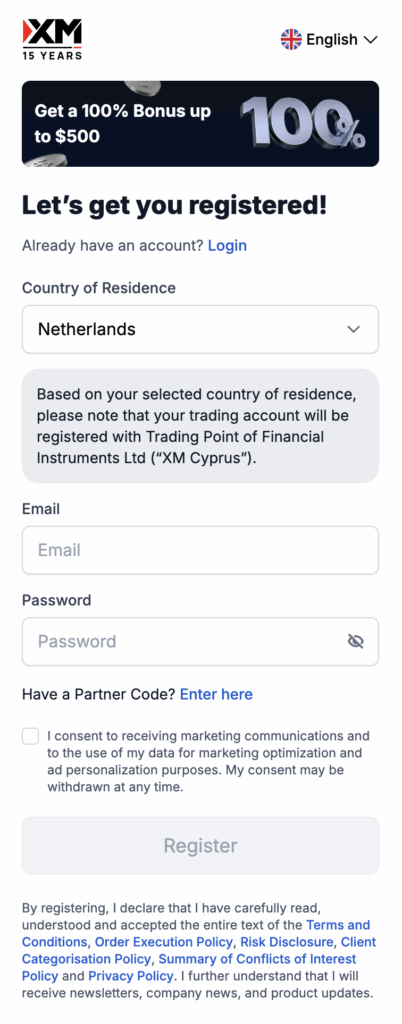

How To Open an Account

Opening an account with XM is quick, convenient, and entirely digital — designed to get you trading in as little as one business day. The registration process is straightforward and beginner-friendly, requiring just a few simple steps from start to finish.

Here’s how it works:

- Sign Up: Visit XM’s official website and click “Get Started.” You’ll be asked to provide basic personal details, country of residence, email and password.

- Provide your personal and financial information and answer questions about your financial knowledge.

- Upload valid identification and proof of address to comply with regulatory Know Your Customer (KYC) requirements. XM typically reviews and approves documents within 24 hours.

- Select your account type (Micro, Standard, or XM Zero), trading platform, base currency, and desired leverage level.

- Make Your First Deposit: Fund your account using any of XM’s secure payment methods — including credit/debit cards, bank transfers, Skrill, or Neteller — all with no deposit fees.

XM supports over 20 languages, including Chinese, Filipino, Russian, and Spanish, ensuring accessibility for traders worldwide. The broker also provides detailed video guides and multilingual customer support to assist you through each step.

However, XM’s services are not available to residents of the USA, Canada, Japan, or Israel due to regulatory restrictions.

Overall, the XM account setup process is fast, secure, and user-friendly, making it ideal for both beginners and experienced traders looking for a seamless start.

Account Types

XM offers a diverse selection of account types designed to meet the needs of every trader — from absolute beginners to seasoned professionals. Each account type differs in terms of contract size, spreads, and commission structure, giving you the flexibility to choose the setup that best fits your trading goals and risk tolerance.

Micro Account

The Micro Account is ideal for beginners and those who want to trade with smaller amounts of capital. Here, 1 lot equals 1,000 units, allowing traders to practice risk management with minimal exposure. The minimum deposit is just $5, and there are no commissions, as trading costs are included within the spread. This account is a perfect entry point for new traders learning the ropes of the forex and CFD markets.

Lot size: 1 lot = 1,000 units

Minimum deposit: $5

Commission: None (spread-only pricing)

Spreads: From 1.6 pips on major pairs

Leverage: Up to 1:1000 (varies by region)

Best for: Beginners and low-risk traders

Standard Account

The Standard Account is XM’s most popular option, offering standard lot sizes where 1 lot equals 100,000 units. Like the Micro Account, it carries no commission fees, and spreads remain competitive — around 1.6 pips on major pairs such as EUR/USD. With the same $5 minimum deposit, this account suits traders who are ready to scale up while keeping simplicity and transparency.

Lot size: 1 lot = 100,000 units

Minimum deposit: $5

Commission: None

Spreads: From 1.6 pips (EUR/USD typical)

Leverage: Up to 1:1000 (regional limits apply)

Best for: Intermediate traders seeking flexibility

XM Zero Account

Designed for active and professional traders, the XM Zero Account combines tight spreads starting from 0.0–0.2 pips with a commission of $3.50 per lot per side. The minimum deposit requirement is $100, and execution is ultra-fast, making it a preferred choice for scalpers and algorithmic traders. This account provides maximum pricing transparency and precision for those who value raw spreads.

Lot size: 1 lot = 100,000 units

Minimum deposit: $100

Commission: $3.50 per lot per side

Spreads: As low as 0.0–0.2 pips

Leverage: Up to 1:500 (varies by jurisdiction)

Best for: Scalpers, algorithmic, and high-volume traders

Shares Account

The Shares Account offers access to real stock trading — not CFDs — and is available under XM’s IFSC-regulated entity. It requires a $10,000 minimum deposit and does not provide leverage. This account is geared toward investors who want to hold physical shares rather than speculate on short-term price movements.

Instruments: Real shares (not CFDs)

Minimum deposit: $10,000

Commission: Variable (per share basis)

Leverage: None (1:1 only)

Availability: Under IFSC-regulated entity

Best for: Long-term investors trading real equities

Islamic (Swap-Free) Accounts

XM also provides Islamic accounts that comply with Sharia principles. These accounts charge no overnight swap or interest fees, replacing them with a fixed administrative cost on applicable instruments.

Available for: Micro, Standard, and XM Zero accounts

Overnight fees: No swaps (fixed administrative charge instead)

Compliance: Fully Sharia-compliant

Best for: Traders following Islamic finance principles

What is the Minimum Deposit at XM?

XM keeps trading accessible with a low minimum deposit requirement, making it one of the most beginner-friendly brokers in the industry. You can open a Micro or Standard Account with just $5, allowing new traders to start small and gradually build confidence.

For those who prefer tighter spreads and professional-grade execution, the XM Zero Account requires a $100 minimum deposit, which is still modest compared to many competitors. This flexible deposit structure ensures that traders at all levels — from first-timers to seasoned professionals — can find an account that fits their budget and trading goals.

| Broker | Minimum Deposit |

|---|---|

| XM | $5 |

| XTB | $0 |

Tickmill | $100 |

FP Markets | $100 |

Deposit and Withdrawal

Funding and withdrawals are seamless, transparent, and cost-efficient — a key strength that helps traders focus more on their strategies rather than the logistics of moving money. The process is designed to be fast, intuitive, and free of unnecessary charges, making it one of the most user-friendly funding systems in the industry.

Deposit Fees & Options

There are no deposit fees charged on any payment method, and the broker covers transaction costs on its end so that the full amount reaches your account. Traders can fund using several secure and convenient channels, including:

Deposits made via cards or e-wallets are usually processed instantly, while bank transfers can take two to five business days depending on the financial institution. Accounts can be opened in any of 10 base currencies, including USD, EUR, GBP, AUD, and JPY, reducing conversion costs and simplifying account management for international clients.

The secure client portal makes funding straightforward, with clear transaction tracking and multilingual support for over 20 languages — ensuring that traders around the world can deposit with confidence.

Withdrawal Fees & Options

Withdrawals follow the same frictionless structure. There are no fees for most payment methods, and requests are typically processed within the same business day for verified users. The only exception applies to bank wire transfers below $200, where a $15 charge may be applied to cover intermediary bank costs.

All withdrawals must be made via the same method used for deposit, in line with anti–money laundering regulations. Once the initial deposit is returned to its source, profits are usually paid out via bank transfer for added security.

Verdict

Overall, XM’s funding process stands out for its speed, transparency, and reliability. With no hidden fees, fast turnaround times, and broad currency support, depositing and withdrawing funds feels smooth and stress-free. It’s a dependable system that suits everyone — from first-time traders funding $5 to professionals managing larger balances — ensuring transactions are handled efficiently and securely every time.

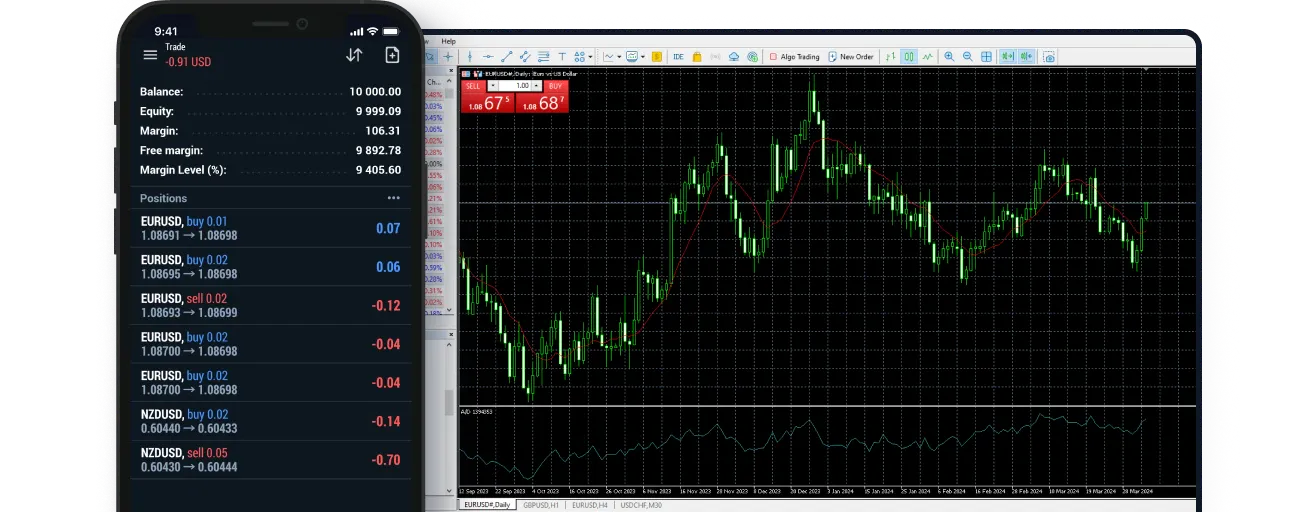

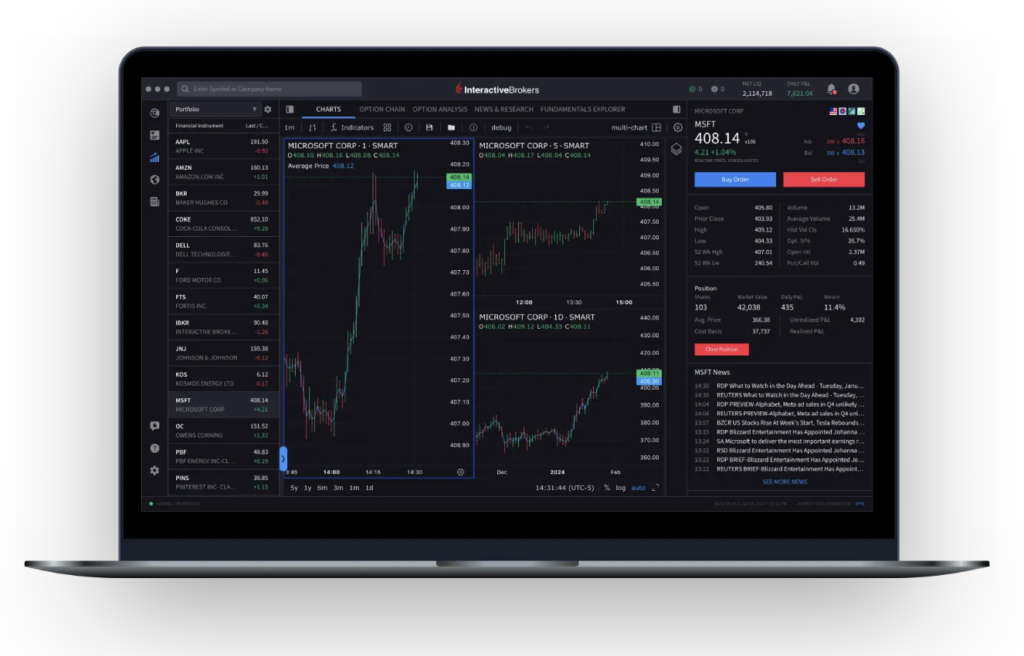

Desktop Trading Platform

After personally testing the broker’s desktop platforms, I found the experience fast, stable, and feature-rich — though it still relies on industry-standard software rather than proprietary innovation. Traders can choose between MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the new TradingView integration, giving flexibility whether you prefer classic functionality or modern visual design.

Features and Functionality

Platform Options and User Experience

The MT4 and MT5 platforms remain the core of the desktop trading environment. MT4 is lightweight and dependable, making it ideal for straightforward forex trading. MT5, on the other hand, introduces additional timeframes, depth-of-market data, and more pending order types, giving advanced traders more control. During my testing, order execution was nearly instantaneous, with no freezing or slippage issues — even during volatile sessions.

The newly added TradingView integration stands out for its sleek, browser-like interface and powerful charting capabilities. Compared to MetaTrader’s older design, TradingView feels more intuitive and visually appealing, especially for traders who rely heavily on chart-based decision-making.

Charting, Tools, and Automation

The platforms offer excellent charting tools with over 80 technical indicators, multiple drawing options, and the ability to create and save templates. The responsiveness and chart clarity make technical analysis effortless. Both MT4 and MT5 support Expert Advisors (EAs) for algorithmic trading, while copy-trading options are available for those who prefer to follow professional strategies instead of building their own.

Traders can also set custom price alerts, access live market feeds, and manage multiple charts simultaneously — features that help streamline trading for both beginners and experienced users.

Security and Interface Limitations

While the platforms are reliable, they do show their age. The MetaTrader interface feels dated compared to brokers that have developed proprietary platforms. Another limitation is the absence of two-factor authentication (2FA) on the desktop version, which could strengthen account security.

Verdict

The overall desktop trading experience is robust, fast, and highly customizable. You get professional-grade tools, stable performance, and support for both manual and automated strategies. However, the lack of modern design elements and 2FA security keeps it from feeling as polished as newer trading platforms.

Pros & Cons of the Web Platform

Pros

- Access to MT4, MT5, and TradingView, offering flexibility for all trading styles

- Fast and reliable execution with minimal slippage during high market volatility

- Excellent charting tools with 80+ indicators and full customization options

- Supports algorithmic trading (EAs) and copy trading strategies

- Customizable workspace with price alerts, templates, and multi-chart layouts

- Lightweight and stable software suitable for both low and high-performance systems

Cons

- No proprietary platform, relying solely on third-party software

- Outdated interface design on MetaTrader platforms

- Occasional learning curve for beginners unfamiliar with MetaTrader

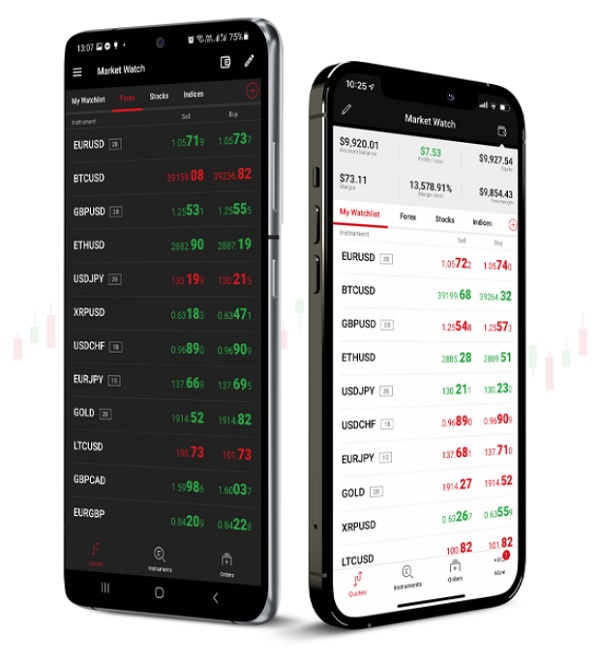

Mobile App

Trading on the go is effortless thanks to the broker’s mobile platforms, which combine accessibility with a strong set of trading tools. Whether you prefer the MetaTrader 4 app, MetaTrader 5 app, or the proprietary XM App, the mobile experience is designed to offer flexibility, fast execution, and smooth performance across all major devices.

Platform Availability and Compatibility

The mobile platforms are available on both Android and iOS, ensuring full access for traders using smartphones or tablets. The MT4 and MT5 apps mirror much of the functionality of their desktop counterparts — including live price feeds, one-click trading, and customizable charts — while the XM App simplifies the experience even further with a clean layout and intuitive navigation.

The proprietary app integrates account management and trading in one place, making it easy to switch between deposits, withdrawals, and live trades. It supports real-time market updates, quick order execution, and detailed instrument search, which are essential for traders who need to react swiftly to market movements.

User Experience and Features

During testing, the app performed impressively with minimal lag and stable connectivity, even during volatile market sessions. It’s also multilingual, supporting over 20 languages, including English, Spanish, Arabic, and Filipino — making it accessible to a global user base.

Charting tools are simplified but efficient, with multiple timeframes, basic drawing tools, and smooth zooming for technical analysis. Traders can set price alerts through MetaTrader’s push notifications, although the XM App currently lacks built-in in-app alerts and Touch/Face ID login, which would enhance convenience and security.

Performance and Reliability

Execution speed on mobile is on par with the desktop versions, and trades sync seamlessly between devices. You can monitor open positions, access account balance information, and modify or close trades within seconds.

Verdict

Overall, the mobile trading experience is fast, user-friendly, and reliable, offering everything most traders need to manage positions while away from their desk. While the design could benefit from biometric login and native alert integration, the combination of MetaTrader functionality and XM’s proprietary app ensures a smooth and efficient mobile trading experience in 2025.

Pros & Cons of the Mobile App

Pros

- Available on MetaTrader 4, MetaTrader 5, and XM App for both Android and iOS

- User-friendly interface suitable for beginners and experienced traders alike

- Fast execution speeds and smooth performance, even during volatile markets

- Access to real-time quotes, live charts, and multiple order types

- Multilingual support (20+ languages including Filipino, Arabic, and Spanish)

- Seamless synchronization between mobile, web, and desktop platforms

- Integrated account management features in the XM App for deposits and withdrawals

Cons

No Touch ID or Face ID login, limiting quick yet secure access

Lacks built-in in-app price alerts (relying on MetaTrader notifications instead)

Charting tools are simplified compared to desktop versions

The proprietary XM App offers fewer technical indicators than MT4/MT5

Market Research, Tools, and Education

A standout strength of XM is its comprehensive educational and research ecosystem — one of the critical reasons I chose to test it. In fact, XM was rated “Best in Class for Education 2025” by some independent reviewers, largely because of the depth, accessibility, and quality of its learning offerings.

I tuned into several sessions myself — the pacing and clarity were excellent, with real-time Q&A to keep it interactive. XM also publishes daily market analysis videos, featuring commentary on forex, indices, and macroeconomic developments. Because these are integrated into the platform and shared widely, traders gain timely ideas without needing to hop between sites.

Trading Central Integration – Available to account holders, this tool blends AI and expert frameworks to highlight key support/resistance zones, technical signals, and trend analysis.

Economic Calendar – Tracks global economic releases, central bank decisions, and macro data with event impact levels.

Market Sentiment Tracker / Indicators – Highlighting trader positioning or directional bias, these help you see whether markets are overbought or oversold.

Strategy Tools & Calculators – Includes pip calculators, margin calculators, and other utilities to manage risk and plan trades.

In my hands-on testing, I found the combination of these tools plus live analysis compelling — I could spot trade setups faster and verify them against multiple sources without leaving the XM interface.

Video tutorials / platform walkthroughs covering all levels, from “What is a pip?” to advanced charting strategies

Live training rooms where analysts trade in real time, explaining entries, stops, and exits

Free demo accounts with virtual funds, allowing you to practice strategies safely, without risking real capital

The structured courses cover fundamental analysis, technical analysis, risk management, and strategy development — all key building blocks for serious traders.

Customer Support

Having tested XM’s customer service across multiple channels, I found the support experience to be efficient, professional, and genuinely helpful. Assistance is available through live chat, email, and phone, ensuring that traders can reach an agent using their preferred communication method. The support team operates 24 hours a day, 7 days a week, which covers all major trading sessions from the Asian open to the U.S. close.

Availability and Accessibility

The support team is multilingual, serving clients in more than 20 languages, including English, Spanish, Arabic and Chinese — a huge advantage for traders across different regions. During my tests, live chat proved to be the fastest and most effective way to get help. Average wait time was under a minute, and responses were clear, accurate, and professional. Email support, while slower, typically provided complete answers within a few hours.

Phone assistance is also available for more urgent inquiries, offering a direct line to knowledgeable representatives who understand both platform operations and market-related issues. The tone was friendly and patient, especially when I asked technical questions about account verification and funding.

Service Quality Compared to Competitors

When compared with other brokers like XTB and Tickmill, this support team stands out for accuracy and problem resolution. Many brokers now operate around the clock. XM’s official website also offers a detailed FAQ and Help Center, where many basic questions can be resolved instantly without needing to contact support.

Verdict

Overall, customer service feels genuinely client-focused, with quick responses and a professional, multilingual team that knows the platform inside and out. The speed, clarity, and reliability of support during market hours make it one of the most dependable in the forex and CFD trading space.

FAQ

Is XM safe and reliable?

Yes, XM is a highly regulated broker operating under multiple authorities, including ASIC (Australia), CySEC (Cyprus), DFSA (Dubai), and IFSC (Belize). It maintains segregated client funds and offers negative balance protection, ensuring you can never lose more than your deposited capital. With a Trust Score of 92/99 , it’s considered one of the most secure brokers for retail traders in 2025.

Is XM a good choice for beginners?

Absolutely. XM is beginner-friendly, with a $5 minimum deposit, a free demo account, and a massive library of video tutorials and webinars. Its clear pricing, easy account setup, and multilingual support make it an excellent starting point for anyone new to forex or CFD trading.

Is the broker suitable for advanced or professional traders?

Yes. Experienced traders often prefer the XM Zero Account, which offers spreads from 0.0 pips plus a small commission for maximum pricing transparency. It also supports algorithmic trading (EAs), VPS hosting, and access to TradingView for advanced charting and strategy testing.

What is the minimum deposit to start trading?

You can begin trading with as little as $5 on the Micro or Standard accounts, while the XM Zero Account requires $100. This low entry threshold makes it accessible for traders with a limited budget who still want access to a reputable, fully regulated broker.

What can I trade on XM?

Traders have access to over 1,400 instruments, including 55 forex pairs, indices, commodities, precious metals, stock CFDs, and cryptocurrencies (available under XM Global). Real share trading is also offered under the IFSC-regulated entity.

Does XM charge any hidden fees?

No. The broker is transparent about its pricing. There are no deposit or withdrawal fees, and spreads are clearly displayed. The only potential extra costs include inactivity fees ($15 after one year, then $5/month) and currency conversion charges when trading in a non-base currency.

How can I deposit and withdraw funds?

You can fund or withdraw using bank transfer, debit/credit cards, Skrill, Neteller, or SticPay (depending on your region). Most transactions are processed the same day, and there are no internal fees, except for bank wires under $200, which may incur a small charge.

Does XM provide educational support for new traders?

Yes. The broker is known for its award-winning education, including XM TV, daily market updates, live webinars, and video tutorials for all skill levels. This makes it a top choice for traders who want to learn while they trade.

How are profits and taxes handled when trading with XM?

XM does not withhold or report taxes on behalf of traders. You’re responsible for declaring profits to your local tax authority based on your country’s regulations. The platform provides detailed account statements to help with record-keeping and tax filing.

What are the main downsides of XM?

While it’s reliable and beginner-friendly, XM’s main limitations include no proprietary trading platform, no 24/7 customer support, and restricted access to ETFs or bonds for EU clients. However, for forex and CFD traders seeking a trusted, low-cost, and educationally rich broker, XM remains an excellent overall choice.