XTB REVIEW 2025

I personally tested XTB to see how it performs across its range of products, including forex, indices, stocks, and commodities. In this review, I share my experience with the platform, fees, and features to help you decide if it is the right fit for your trading style.

Trading CFDs involves significant risk and may not be suitable for all investors. 70% of accounts lose money when trading CFDs with this provider.

Why You Should Choose XTB in 2025

If you’re looking for a broker that combines low fees, powerful tools, and top-tier regulation, XTB is likely already on your radar. I’ve personally traded with XTB over the past several months, testing everything from their forex spreads and platform functionality to customer support and withdrawals. This isn’t just a theoretical rundown—I’ve placed real trades, analyzed markets through xStation 5, and navigated their mobile app during live market hours.

In this comprehensive XTB review, I’ll walk you through exactly what to expect when trading with XTB in 2025. From their competitive fee structure and wide asset selection to their regulatory credentials and award-winning technology, this guide is designed with you—the trader or investor—in mind.

Whether you’re new to online trading or a seasoned CFD veteran, you’ll get an honest, detailed view of where XTB stands today, how it compares with competitors, and whether it’s the right fit for your trading goals.

About XTB

When I first started exploring online brokers, XTB quickly caught my attention. It began its journey in Poland in 2002 as X-Trade Brokers, but by 2004, it had rebranded to XTB, solidifying its presence as a major player in forex trading and Contracts for Difference (CFDs). Over the years, I’ve watched XTB grow into a truly global entity.

What really impressed me about XTB‘s stability and transparency is its public listing on the Warsaw Stock Exchange (WSE: XTB.PL). This public status means XTB operates under strict financial reporting requirements and public scrutiny, which gives me a lot of confidence.

As of March 31, 2024, XTB boasts a substantial market capitalization of $1.6 billion, further reinforcing its financial health. I’ve seen their global footprint expand significantly, with offices in over a dozen European countries and more than 1 million active users worldwide as of 2025.

My Quick Verdict - Do I Recommend XTB?

After extensively using XTB, I can confidently say I highly recommend it. Leading financial review platforms echo my sentiment. I consistently find myself praising XTB for its competitive fee structure, a wide array of tradable assets, and its clear dedication to investor education.

The platform’s user-friendly interface, combined with attractive commission trading options, makes it an excellent choice for both novice traders, who appreciate a supportive learning environment, and experienced professionals looking for robust tools.

Pros

- Very low fees, including, commission free for ETF and real shares and 0.2% fee for transactions above EUR 100000.

- xStation 5 platform is highly intuitive and feature-rich.

- Offers a wide range of assets (Forex, CFDs on indices, commodities, stocks, ETFs).

- Strongly regulated with high client fund protection.

- Excellent educational resources and market research tools.

Cons

- Limited investment products for long-term strategies (no mutual funds, bonds, options).

- Inactivity fee of €10/£10 per month after 12 months.

- No two-factor authentication on the mobile app.

Why XTB is Right for You in 2025

I choose XTB because it truly stands out in the crowded brokerage market, offering several compelling strengths that cater to my diverse trading and investing needs. Its commitment to low-cost trading is particularly appealing for my active participation; I can invest in stocks and ETFs with minimal trading cost. The commissions are free for ETF and real shares and 0.2% fee for transactions above EUR 100000.

This cost efficiency is a major factor in how I manage my trading capital. I’ve found XTB to be one of the most beginner-friendly platforms available, largely thanks to its extensive and high-quality educational resources.

These resources have significantly eased my learning curve, helping me build confidence and develop my skills. Complementing this, XTB‘s proprietary xStation 5 platform consistently delivers a smooth, intuitive experience, packed with powerful integrated tools for market analysis and trade execution.

Beyond just trading, I appreciate that XTB offers competitive interest rates on uninvested cash balances, providing an additional financial benefit by allowing my idle funds to generate returns Furthermore, the broker’s strong regulatory oversight, especially its regulation by the Financial Conduct Authority (FCA) in the UK, establishes a robust framework for my client safety and compliance, which instills a high degree of trust.

XTB’s public listing on the Warsaw Stock Exchange is a significant factor that contributes to its stability. This public status mandates stringent financial reporting and public scrutiny, which inherently builds my confidence as an investor.

The consistently high Trust Score from independent reviewers further validates this, indicating XTB is not just a broker, but a financially sound and well-vetted institution. This fundamental layer of trust underpins the reliability and attractiveness of all the services XTB offers.

I’ve observed it’s market positioning strategically evolving. While initial assessments suggested XTB aligned more with traders than long-term investors due to a historical lack of ISA/SIPP options, I’ve seen recent developments, such as:

Stocks and Shares ISA

XTB beginning to offer a Stocks and Shares ISA for UK investors. This, combined with their emphasis on low-cost day trading and commission-free stock and ETF investing (free for ETF and real shares and 0.2% fee for transactions above EUR 100000.) up to a specific monthly threshold, suggests a deliberate market focus.

Its historical strength lies in attracting active, short-to-medium term traders, a strategy reinforced by its fee structure and platform capabilities tailored for frequent execution and analysis.

The recent introduction of the Stocks and Shares ISA for UK investors represents a strategic expansion beyond its core trading audience. This indicates XTB is evolving to capture a segment of the long-term, tax-efficient investment market, while still maintaining its strong appeal to active traders.

For me, this evolving strategy means they could become a more versatile option, potentially reducing the need for multiple brokerage accounts if my investment needs expand beyond active trading into long-term, tax-efficient savings.

Exploring XTB's Range of Tradable Instruments

I’ve found XTB provides access to a vast array of financial instruments, offering a comprehensive selection for my active trading strategies. I can access over 8,000 instruments. This extensive range allows me to diversify my portfolios and engage with various market opportunities.

| Asset | XTB | eToro | Capital |

|---|---|---|---|

| Currency Pairs | 70 | 55 | 136 |

| Stock Index CFDs | 33 | 18 | 43 |

| Stock CFDs | 2,022 | 2,000 | 3,989 |

| ETC CFDs | 167 | 264 | 180 |

| Commodity CFDs | 27 | 34 | 54 |

A core component of XTB‘s offering, and something I frequently trade, is its Contracts for Difference (CFDs), which span multiple asset classes:

Beyond CFDs, XTB facilitates trading in traditional asset classes:

Limitations and Exclusions I’ve Noticed

While XTB’s instrument selection is broad, I’ve noticed certain limitations and exclusions within its product portfolio. The platform does not offer popular asset classes such as mutual funds, bonds, options, or futures.

This indicates a strategic focus on instruments primarily suited for active trading and direct equity/ETF investing, rather than aiming to be a universal platform for all investment types, including those favored by long-term, passive investors or those seeking complex derivatives.

I’ve also encountered regional restrictions on certain offerings:

- Cash Equities and ETFs: I’ve learned that direct cash equities and cash ETFs are not available to clients onboarded under XTB‘s Cyprus branch

- Real Stocks and ETFs (General Availability): These instruments are exclusively available for UK and EU customers who are onboarded under XTB‘s Polish entity

The high number of tradable symbols and the wide array of asset classes offered by XTB, contrasted with the explicit omission of certain popular assets like bonds, mutual funds, options, or futures, indicate a strategic specialization rather than a weakness.

XTB is a strong contender for traders whose strategies align with its offered instruments. However, it necessitates that investors with diversified portfolios, or those interested in less volatile assets like bonds or complex derivatives, will need to consider supplementary brokerage accounts. This highlights XTB‘s clear market positioning as a trading-centric platform.

Fees and Commission Structure

| Fees | |

|---|---|

| Minimum Deposit | No minimum deposit required to open an account. For Standard/Pro accounts, minimum deposits start at £250/€250/$250. |

| Inactivity Fee | £10 per month after 12 months of no activity |

| Stock & ETF Trading | Free for ETFs and real shares, and 0.2% fee for transactions above EUR 100000. |

| Forex Trading | EUR/USD spreads vary: from 0.3 pips to 0.6 pips. |

| Withdrawal Fees | Free for withdrawals over £50. |

| Credit/Debit Card Deposit Fees | £0 for most regions, up to 2% for certain countries. |

I’ve found XTB to be widely recognized for its generally low-cost structure, which encompasses both my trading fees and non-trading fees. This competitive pricing model is a significant draw for me, as I aim to maximize my potential returns by minimizing overhead costs.

Stock and ETF Trading Fees

For trading UK and US stocks and exchange-traded funds (ETFs), XTB offers a highly attractive commission-free model. I’ve personally benefited from commission-free trading up to a monthly volume of £100,000. However, it’s important to note that this applies only to real shares and ETFs—once you exceed €100,000 in monthly turnover, a 0.2% commission fee applies.

This generous allowance is particularly beneficial for my active trading with moderate to high volumes.

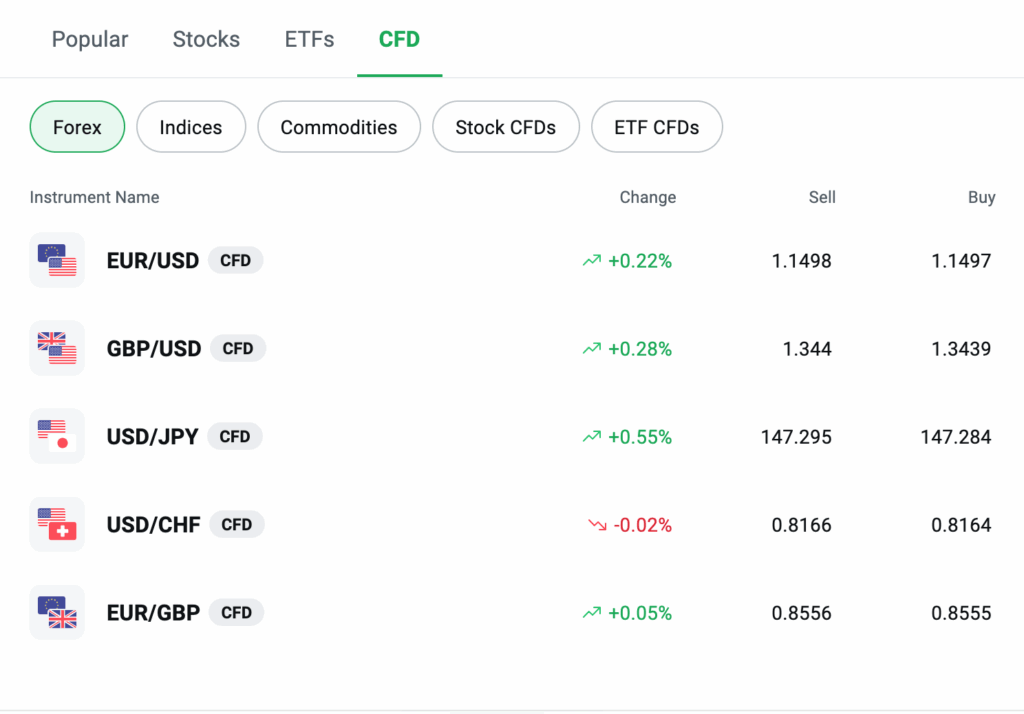

Forex Trading Fees

XTB‘s forex trading fees are entirely spread-based, meaning all costs are integrated into the bid-ask spread, and I don’t pay separate commissions. This simplifies the cost structure for my currency trades, making it easier to calculate my potential expenses. Spreads on major currency pairs, such as EUR/USD, are competitive.

Their platform indicates a typical EUR/USD spread of 0.6 pips for XTB’s Standard account. Do take not that this figure can fluctuate based on market conditions, liquidity, and the specific time of measurement. I always make sure to check real-time spreads on the platform.

Other Trading Costs

Beyond stocks, ETFs, and forex, I’ve noted that XTB applies fees to other instruments:

☑️ Index CFDs: Fees for index CFDs are also built into the spread. For example, the S&P 500 index CFD carries a fee of $0.08.

☑️ Stock CFDs: All stock CFD fees are integrated into the spread. For instance, the Apple stock CFD has a fee of $2.30, and the Vodafone stock CFD is $3.90.

☑️ Leverage Costs: These costs are variable and depend on the specific asset and the account type. Overnight rollover costs, also known as swap fees, apply to leveraged positions I hold overnight. For equity CFDs, an example rate provided is -0.02341%.

Non-Trading Fees: Inactivity Fees, Currency Conversion Fees

I’m also aware that XTB has certain non-trading fees:

Interest on Uninvested Funds

A notable benefit I appreciate from XTB is the interest paid on my uninvested cash balances held in the account. As of my last check, these rates are competitive: 5.2% for GBP, 5% for USD, and 3.8% for EUR.

These rates are subject to change but provide an added value by compensating me for holding idle cash on the platform, reducing the opportunity cost of maintaining liquidity.

IG Review

FP Markets Review

CMC Markets Review

Interactive Brokers Review

Is XTB Regulated ?

I consider XTB a highly trusted and legitimate brokerage firm, a status strongly supported by its extensive regulatory oversight across multiple global jurisdictions. This multi-jurisdictional regulation is a cornerstone of its credibility and gives me confidence.

XTB operates under the authorization of several financial authorities, which I categorize by their tier of trustworthiness:

☑️ Tier-1 Regulators (Highly Trusted): XTB holds licenses from two Tier-1 regulators, which I consider the most stringent and reputable. These include the Financial Conduct Authority (FCA) in the U.K. and the Securities & Exchange Commission (CySEC) in Cyprus.

☑️ Tier-2 Regulators (Trusted): The broker is also authorized by two Tier-2 regulators, further enhancing its credibility.

☑️ Tier-3 Regulators (Average Risk): Notably, XTB holds zero Tier-3 licenses, indicating a preference for higher-tier regulatory environments.

☑️ Tier-4 Regulators (High Risk): XTB is authorized by two Tier-4 regulators, which typically offer lighter oversight.

Beyond these tiers, XTB maintains offices and licenses in over a dozen countries across Europe, including Poland (KNF), Germany (BaFIN), Spain (CNMV), France (AMF), the U.A.E (DFSA), South Africa (FSCA), the FSA of Seychelles, and Belize (FSC). This broad regulatory footprint allows XTB to serve a diverse international client base, including myself.

Understanding Regulatory Protections and Broker Stability

A critical aspect of XTB‘s safety profile, and something I rely on, is its robust client fund protection measures. All client funds are held in segregated accounts, meaning they are kept separate from the company’s operational funds.

This segregation ensures my money cannot be used for XTB’s business expenses and is protected in the event of the company’s insolvency.

For me, as a client in the UK, an additional layer of protection is provided by the Financial Services Compensation Scheme (FSCS), which covers eligible clients up to £85,000 in case of XTB’s failure.

Furthermore, XTB holds indemnity insurance of up to $1 million per client claim, with a total aggregate coverage of up to $5 million through its Belize entity. This insurance provides an extra safeguard for my assets.

They also offer negative balance protection, a crucial feature that ensures I cannot lose more money than I have deposited in my trading account. This protection is particularly important for my leveraged trading, where market movements can quickly lead to significant losses.

All my transactions on the platform are secured with SSL encryption, safeguarding my sensitive data and financial information during transmission.

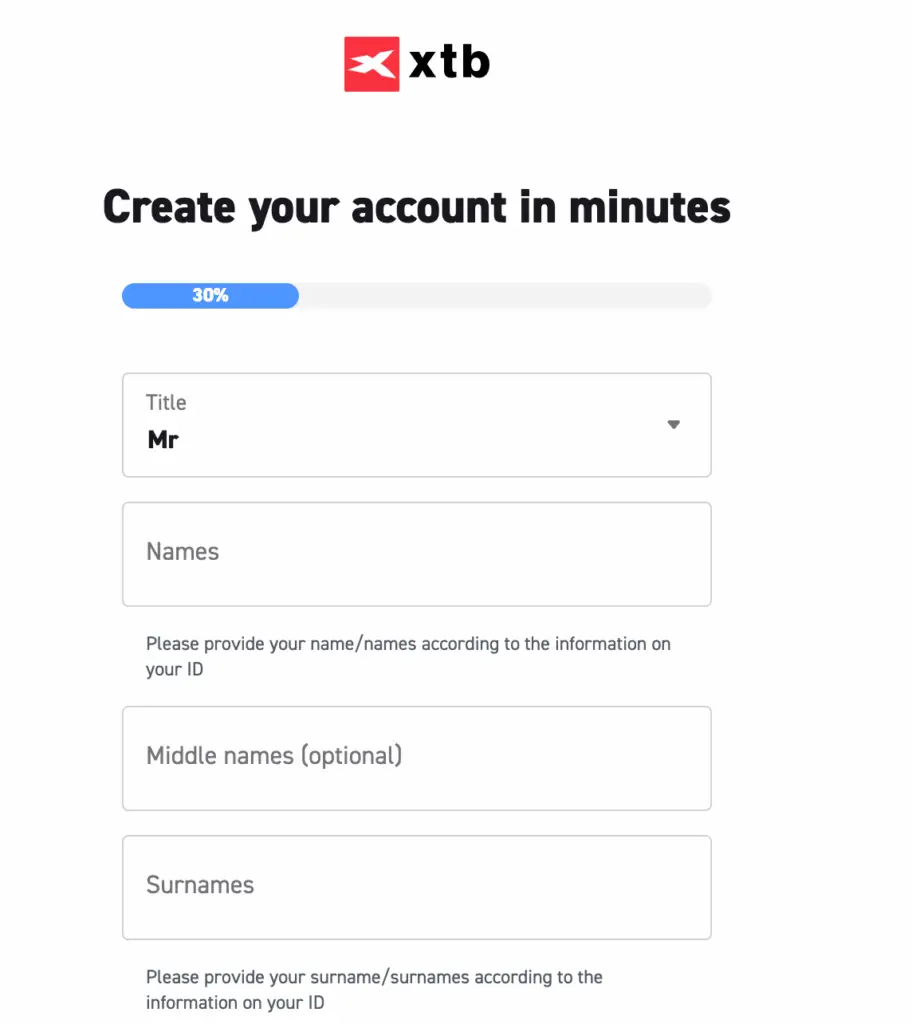

How To Open an Account

Opening my account with XTB was a hassle-free, straightforward, and entirely digital experience. The process was notably fast, and my account was often ready for trading on the same day. This efficiency was a significant advantage for me, as I was eager to begin my trading journey quickly.

Account Types

XTB offers a selection of account types tailored to different client needs and experience levels, and I’ve explored a few:

Standard Account

This is XTB's most popular option, and it's what I started with. It's characterized by its accessibility with no opening or maintenance fees. It's clearly designed to cater to the majority of retail traders.

30-day Demo Account

For individuals looking to gain hands-on experience without risking real capital, XTB provides a 30-day demo account. I found this excellent for exploring the platform's features and practicing my trading strategies in a simulated environment.

Stocks and Shares ISA (UK)

In a move to broaden its appeal, XTB recently introduced a Stocks and Shares ISA for UK investors. This provides a tax-efficient avenue for investing, catering to those focused on long-term savings and growth.

Corporate Account

For businesses or institutions looking to manage company funds or trade under a registered entity, XTB offers corporate accounts.

What is the Minimum Deposit at XTB?

XTB states that there is no minimum deposit required to start trading, allowing me to begin with any amount. This low barrier to entry is frequently highlighted by reviewers. However, I’ve come to understand a nuance: while an account can technically be opened with a $0 minimum deposit, for Standard and Professional accounts, the practical minimum deposit to activate trading typically starts at 250 base currency (£250, €250, or $250).

This distinction implies that while initial registration is highly accessible, a more substantial deposit may be required to fully engage with active trading functionalities.

The promotion of “no minimum deposit” is a marketing strategy to lower the barrier to entry and attract a broad user base. However, the clarification that active Standard and Professional accounts might require a minimum of 250 base currency indicates that while I can register easily, I may need more capital to fully utilize the platform’s trading features.

This highlights the difference between merely opening an account and funding it for active trading. This common industry practice aims to attract users by making the initial step seem effortless, but practical engagement may require a more significant financial commitment.

Deposit and Withdrawal

XTB prides itself on offering fast and largely free deposit and withdrawal processes. This efficiency is crucial for me as a trader who needs to manage my capital dynamically.

Deposit Fees & Options

The broker supports a variety of popular deposit methods to ensure convenience for its global client base:

Withdrawal Fees & Options

XTB’s withdrawal policy is generally favorable, especially for larger amounts, which I appreciate:

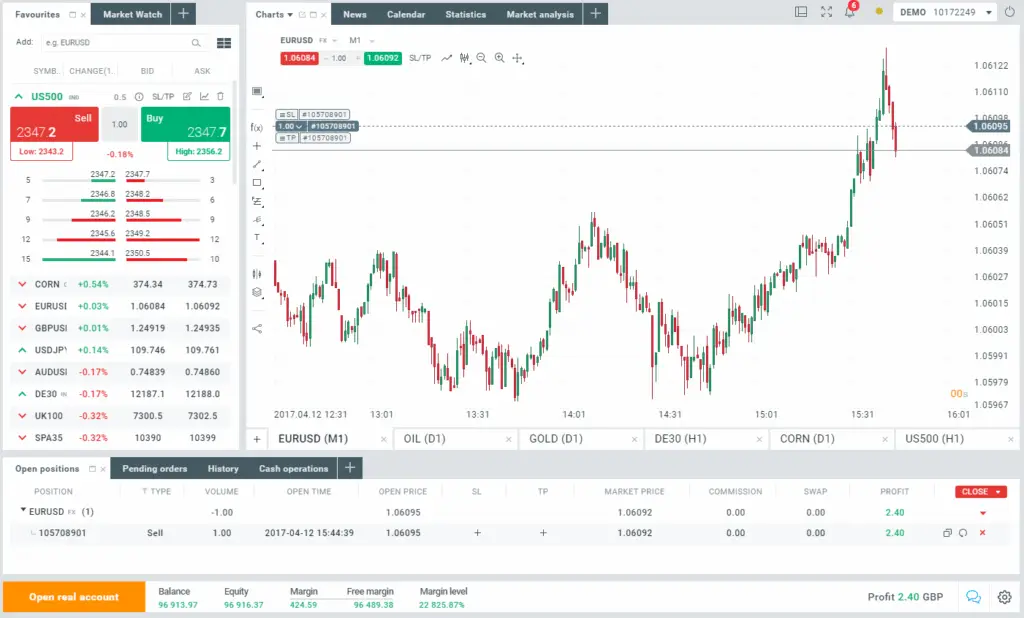

Web Trading Platform (xStation 5)

XTB’s proprietary xStation 5 web trading platform is consistently highlighted as a core strength, and I can attest to its award-winning design, smooth operation, intuitive interface, and comprehensive suite of powerful tools. It truly offers an excellent user experience, catering to both novice and experienced traders like me.

Features and Functionality

Advanced Charting

The platform boasts robust charting capabilities, including 30 drawing tools and 39 technical indicators, which I use for in-depth market analysis.

I particularly love its unique charting features, like the countdown timer displaying the remaining time in each candlestick and the integration of economic news releases directly along the bottom axis of charts, providing real-time context for market-moving events.

Market Analysis Tools

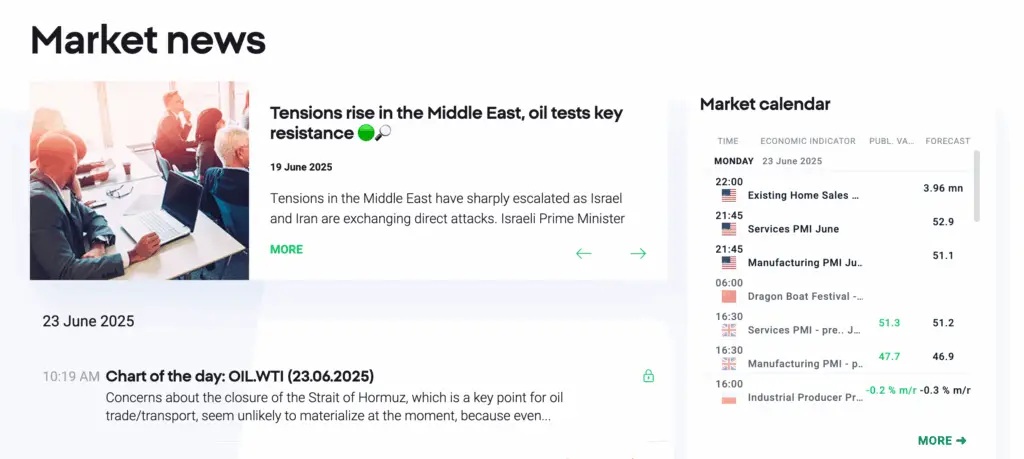

It provides live market sentiment data, risk management features, and an integrated stock scanner Other key trading tools I utilize include color-coded heat mapping for analyzing top movers and a versatile stock screener.

Real-time Information

I have access to real-time news and an economic calendar, which are crucial for staying informed about market-moving events.

Post-Trade Analysis

Real-time Information A valuable post-trade analysis tool is available, which helps me break down my trading performance, identify patterns, and refine my strategies over time.

Research Integration

Market news and analysis from XTB's Market News section stream as headlines directly within the xStation 5 platform. This research encompasses both fundamental and technical analysis, featuring series like "Chart of the day."

Trading signals from reputable providers such as Thomson Reuters, Barclays, and Citi Group are also integrated into the news panel.

News Filtering

A recent enhancement allows me to differentiate between articles written by in-house staff and third-party content, enabling more targeted consumption of news.

Educational Content Integration

Many videos from XTB's Masterclass series are integrated into the Premium section within the xStation 5 web platform, providing convenient access to educational resources.

Placing Orders

The xStation 5 platform offers a comprehensive range of order types to provide traders with flexibility in managing their positions:

☑️ Standard Order Types: Market, Limit, and Stop orders are all available.

☑️ Advanced Order Types: Stop-loss, Take-profit, and Trailing stop orders are also supported, enabling effective risk management and profit-taking strategies.

☑️ Order Time Limits: I can set specific time limits for my orders, including Good 'til' Time (GTT) and Good-til-Canceled (GTC).

Alerts & Notifications

The platform allows me to set up alerts and notifications, which are crucial for staying informed about market movements or specific trading conditions without constant monitoring.

Login and Security

While the xStation 5 platform is robust in features, its login security currently provides only a one-step login process. For enhanced security, I believe the implementation of two-step authentication would be a beneficial improvement, especially for a financial trading platform.

Search Functions

The search functions within the xStation 5 platform are effective; I can efficiently locate products by typing their names in the search bar or by browsing through various categories.

Pros & Cons of the Web Platform

Pros

- I find its usability excellent and its trading tools robust. It’s a

feature-rich platform with a minimalist design. - The unique charting features truly enhance my analysis. I appreciate the comprehensive trading tools, including heat mapping, stock screener, and sentiment data.

- High-quality research content streams directly into the platform. I can

filter news content by source, and educational videos are integrated within the platform. - It’s user-friendly with a clear fee report and good search functions.

Cons

- I’ve noted that XTB has discontinued support for third-party platforms like MetaTrader (MT4 and MT5).

- The custom investment basket tool has been temporarily discontinued from xStation 5.

- The login security currently relies on a one-step login process only, lacking two-step authentication.

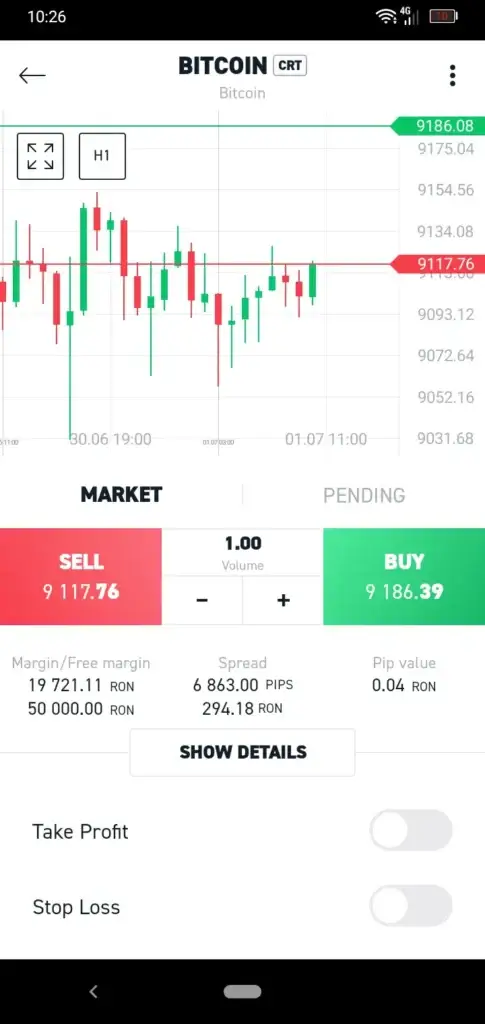

Mobile App (xStation 5)

XTB‘s mobile app, also named xStation 5, I consider superior to the previously supported MetaTrader 4 mobile app, and it’s designed to compete with the best forex mobile platforms available. It truly provides a seamless trading experience on the go.

Look & Feel and Features

The xStation 5 mobile app features a clean and modern design, mirroring many features I find on its web counterpart. These include streaming news, predefined watchlists, an economic calendar, top movers, and client sentiment data.

The app also integrates webinar-style educational videos, some of which are over an hour long, providing learning opportunities directly within the mobile environment. Its user-friendly interface ensures that important features are easily discoverable.

Login and Security

It currently offers only a one-step login process. While biometric authentication is available for convenience, the lack of two-step authentication is a security concern that I believe should be addressed to enhance user protection.

Search Functions

The search functions within the mobile app are effective; I can find products by typing their names or browsing through various categories.

Placing Orders

The mobile trading platform supports a comprehensive set of order types, similar to the web platform: Market, Limit/Stop, Stop-loss/Take-profit, and Trailing stop. I can also set order time limits, specifically Good 'til' Time (GTT) and Good-til-Canceled (GTC).

Key Takeaways

XTB’s heavy reliance on its proprietary xStation 5 platform, both web and mobile, and its decision to discontinue MetaTrader support, represents a strategic cornerstone. By focusing solely on xStation 5, XTB gains full control over its development, user experience, and feature integration. Allowing for unique tools like the candlestick countdown timer and economic news directly on chart axes, fostering a cohesive brand experience.

This strategic choice differentiates XTB in the market. However, it also means that traders accustomed to MetaTrader must adapt to a new environment, and XTB cannot leverage the broad ecosystem of MT4/MT5 plugins and Expert Advisors (EAs).

This could be a barrier for some experienced traders who rely on specific third-party tools. This strategy signals XTB’s confidence in its in-house technology and its commitment to offering a tailored trading environment. It suggests a focus on user experience and integrated tools rather than being a generic platform provider.

For me, it means a potentially richer, more consistent experience, but also a closed ecosystem.

Furthermore, while I praise the mobile app for its design and core features, mirroring the web platform, I’ve noticed specific limitations.

Watchlists do not sync between the mobile and web versions, and the mobile app offers only half the number of indicators (13 vs. 39). Both platforms also lack two-step authentication. The lack of watchlist syncing and fewer indicators on the mobile app create a discontinuity in my user experience.

Traders who rely on consistent watchlists and a full suite of indicators for comprehensive analysis might find the mobile app less powerful for in-depth work, potentially relegating it more to order placement and quick checks rather than detailed analytical tasks.

The absence of two-factor authentication (2FA) across both platforms is a significant security concern in an era of increasing cyber threats, which is paramount for financial platforms.

This suggests that while XTB has invested heavily in its platform, there is a prioritization of “look and feel” and basic trading functionality on mobile over full analytical parity with the web version. It also highlights a critical area for improvement in security.

Pros & Cons of the Mobile App

Pros

- I find the user-friendly interface with a modern design very appealing.

- Offers price alerts for timely notifications.

- I consider it superior to the MetaTrader 4 mobile app.

- Mirrors many features of the web platform, providing a consistent experience.

- It includes integrated educational content.

- Charting offers convenient features like auto-save for trend lines and easy indicator addition/zooming.

Cons

- A significant drawback for me is the absence of two-step authentication for login, which is a critical security enhancement for financial apps.

- Watchlists I create on the mobile app do not sync with the web version of the trading platform, leading to potential inconsistencies when I switch between devices.

- The mobile app offers fewer indicators (13 total) compared to the web platform (39 indicators), which can limit my in-depth technical analysis on the go.

Market Research, Tools, and Education

XTB’s market research content is highly competitive, offering robust analytical resources that rival some of the best in the industry, and I frequently utilize them. This is achieved through a combination of high-quality analysis from its in-house staff and contributions from third-party providers.

Key features of XTB‘s market research and tools that I find valuable include:

Education - Trading Academy, Webinars, Tutorials, Masterclass Series, Progress Tracking

XTB’s educational offering is highly impressive and widely praised for its comprehensive nature and practical utility, catering effectively to both beginners and experienced traders like myself. The broker demonstrates a strong commitment to integrating educational content throughout its trading platform suite and website.

Key educational resources I’ve utilized include:

A minor drawback I’ve noted is the lack of centralized organization for video content, which is currently scattered across the platform and XTB’s YouTube channel rather than being consolidated in one dedicated video library.

Customer Support - Channels, Availability, and Responsiveness

I’ve found XTB to be recognized for providing outstanding customer service. This commitment to client assistance is a crucial factor for me as a trader who may require immediate help with technical issues, account inquiries, or market-related questions.

XTB offers comprehensive support through various channels:

☑️ Live Chat: I’ve used their live chat for real-time assistance.

☑️ Email Support: I can reach out via email, for example, at uksales@xtb.com for UK-specific queries.

☑️ Phone Support: Telephone support is also provided, with a dedicated UK number (+44 2036953085) available.

☑️ Global Reach: XTB’s customer service team provides support in an impressive 18 languages, catering to its diverse international client base.

The availability of customer support is a significant advantage for me: it operates 24 hours a day, five days a week (24/5). This schedule aligns perfectly with the operating hours of global financial markets, which typically run from Monday morning in Asia to Friday evening in New York.

This ensures that I can receive assistance during active trading hours, regardless of my geographical location or the specific market I am trading. This level of support is crucial for active traders who might encounter issues or need immediate assistance outside of traditional business hours. It enhances my overall reliability and confidence in the platform, especially when I’m engaging in time-sensitive trades.

In terms of responsiveness, I’ve found XTB’s support team generally responsive. However, I’ve heard some users report experiencing longer wait times during peak trading hours. It is important to note that XTB explicitly states that clients will be contacted only via email and telephone, and no other means of communication are used.

FAQ

Is XTB regulated?

Yes, XTB is regulated by several top-tier authorities, including the FCA (UK) and CySEC (Cyprus), and is a publicly listed company.

What is the minimum deposit at XTB?

There is no minimum deposit to open an account, but some sources suggest a minimum of £250/€250 might be needed to activate trading.

Can I use a debit card to deposit?

Yes, you can use a debit card. These deposits are usually free, though a small fee (around 1% or less) may apply in some countries.

Does XTB offer real stocks or just CFDs?

They offer both stock CFDs and real cash equities (stocks and ETFs) with commission-free trading up to a monthly limit.

Does XTB have an inactivity fee?

Yes, a €10 (£10) monthly fee is charged after 12 months of no trading activity.

Is XTB good for beginners?

Yes, XTB is considered beginner-friendly due to its intuitive xStation 5 platform, extensive educational content (Trading Academy), and demo account.

What is xStation 5?

xStation 5 is XTB's proprietary trading platform, available on web, desktop, and mobile, known for its advanced charting, fast execution, and integrated market research tools.

How long does it take to open an account at XTB?

The registration takes about 15 minutes. Account approval is usually less than a day after XTB receives your information.

Can I use PayPal to deposit?

Yes, if you're in the European Union. PayPal deposits are instant and usually free.

How do I know if my XTB account is approved?

You'll receive an email notification once your account is active. You can also check the status in your Client Office.