After announcing the expansion of the Main Street Program on Monday, the Federal Reserve started Tuesday its two-day monetary policy meeting, and it will release its decision on interest rates and stimulus on Wednesday. What else can the Fed do? A lot.

The market seems to be listening to the American alternative rock band Pixies singing, “I know the nervous walking, I know the dirty beard hangs, out by the box car waiting, take me away to nowhere plains.”

But the Federal Open Market Committee has other plans answering, “there is a wait so long, you’ll never wait so long,” and then finish telling the markets, “here comes your man!”

And of course, the market dies of happiness.

What to see on Wednesday’s FOMC meeting

First, the Fed will answer the reasons for the Main Street expansion. As commented before, the FOMC announced the broadening of its Main Street program to help both small- and medium-sized businesses.

The American central bank cut the minimum loan by half from $500,000 to $250,000. They also increased the maximum credit allowed to up to $300 million.

Fed’s Chairman Jay Powell said he was confident the Fed changes “will improve the ability of the Main Street Lending Program to support employment during this difficult period.” Long story short, the program was hard to be accessed.

Perhaps the most important topic on Wednesday will be the FOMC economic forecast. It will be the first outlook published by the Fed in 2020 as the central bank avoided the forecast in March due to the COVID-19 pandemic uncertainty.

The dot-plot will provide guidance on how much the US economy has been impacted by the COVID-19, how the country will recover, and how far the effect will last.

Of course, any comment from Powell supporting the economy, rates, and fiscal stimulus would likely give people reasons to be more optimistic. However, any concern about a second wave of the COVID-19 pandemic would hurt the sentiment.

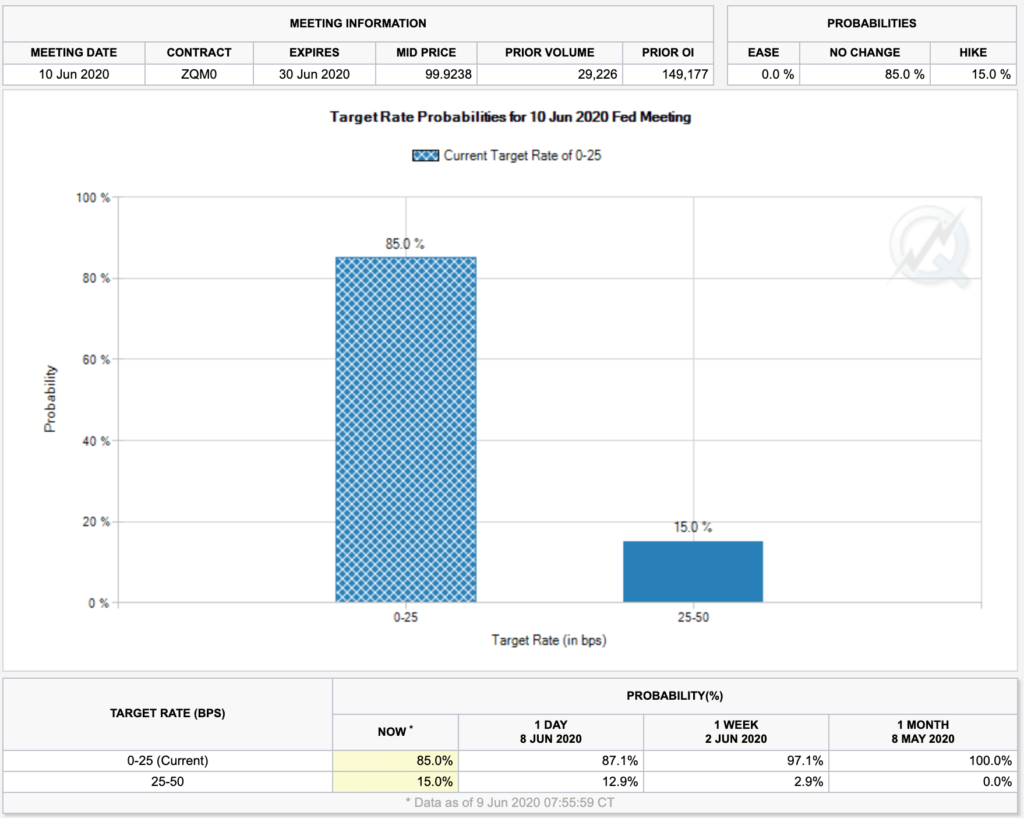

Finally, no changes in interest rates are expected, neither in policies or programs from the FOMC. All flashes will be on Jay Powell’s press conference.

US Dollar outlook

Optimistic or pessimistic forecast? That’s the key to the dollar equation. With a hawkish Fed, markets will rally even more, and it will send the dollar down.

On the other hand, a pessimistic central bank will fuel risk sentiment, giving some short-term relief to the USD. However, that would mean more stimulus from the Fed, so USD would go down at the end.

Currently, DXY is trading at 96.40, third negative day in a row. Be aware of the 95.80 support.